Report of Foreign Issuer (6-k)

September 11 2020 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of, September 2020

Commission

File Number: 001-35722

TAOPING

INC.

(Translation

of registrant’s name in English)

21st

Floor, Everbright Bank Building

Zhuzilin,

Futian District

Shenzhen,

Guangdong, 518040

People’s

Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F [X] Form 40-F [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Entry

into a Material Definitive Agreement.

On September 10, 2020, Taoping Inc. (the “Company”)

and an individual investor (the “Investor”) entered into a securities purchase agreement (the “Purchase Agreement”),

pursuant to which the Company agreed to sell to the Investor 222,222 ordinary shares, no par value (the “Ordinary Shares”)

at a purchase price of $2.70 per share, in a registered direct offering. In a concurrent private placement, pursuant to the Purchase

Agreement, for a purchase price of $1,400,000, the Company will sell and issue to the Investor a Convertible Promissory Note (the

“Note”) in a principal amount of $1,480,000 and a warrant to purchase 53,333 ordinary shares at $9.00 per share

within three years following the issue date (the “Warrant”). The Note carries an original issue discount of $80,000

matures in 12 months from the issue date, bearing interest at a rate of 5.0% per annum. At any time prior to the maturity, the

Note, at the Investor’s option, may be convertible into fully paid Ordinary Shares of the Company at a conversion price

of $9.00 per share. At any time after the occurrence of an event of default (as defined in the Note), the Investor may convert

all of the outstanding balance of the Note into Ordinary Shares in an aggregate amount not exceeding 1.0 million shares. At the

maturity, the Investors may also covert all of the outstanding balance of the Notes into Ordinary Shares at a price no less than

$2.40 per share. In addition, if the Note remains outstanding and due in each of the months of March and June 2021, the Investor

has a one-time option during the first three weeks in each of March and June 2021, respectively, to convert no more than

one half of the then outstanding balance of the Note into Ordinary Shares at a price no less than $2.40 per share.

The

total aggregate gross proceeds of the above financing are $2.0 million. The Company intends to use the net proceeds from the financing

for working capital and general corporate purposes. The financing is expected to close on or about September 14, 2020, subject

to satisfaction of customary closing conditions.

A

copy of form of the Purchase Agreement, the Note and the Warrant are attached hereto as Exhibits 10.1, 4.1 and 4.2, respectively,

and are incorporated herein by reference. The foregoing summaries of the terms of the Purchase Agreement, the Note and the Warrant

are subject to, and qualified in their entirety by, such documents.

The sale and offering of Ordinary Shares pursuant

to the Purchase Agreement was effected as a takedown off the Company’s shelf registration statement on Form F-3 (File No.

333-229323), which became effective on February 11, 2019, pursuant to a prospectus supplement filed with the Securities and

Exchange Commission (the “Registration Statement”). The Note, the Warrant and Ordinary Shares underlying the Note

and Warrant were not offered pursuant to the Registration Statement and were offered pursuant to an exemption from the registration

requirements of Section 5 of the Securities Act of 1933, as amended, contained in Section 4(a)(2) thereof and/or Regulation D

promulgated thereunder.

The information contained in this report

on Form 6-K is hereby incorporated by reference into the Company’s registration statement on Form F-3 (File No. 333-229323) that

was filed with the SEC and became effective on February 11, 2019.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

TAOPING INC.

|

|

|

|

|

|

September

11, 2020

|

By:

|

/s/

Jianghuai Lin

|

|

|

|

Jianghuai

Lin

|

|

|

|

Chief

Executive Officer

|

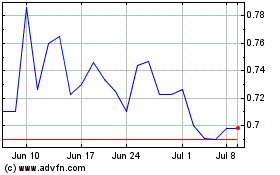

Taoping Inc BVI (NASDAQ:TAOP)

Historical Stock Chart

From Aug 2024 to Sep 2024

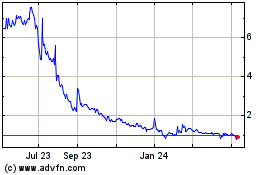

Taoping Inc BVI (NASDAQ:TAOP)

Historical Stock Chart

From Sep 2023 to Sep 2024