U.S. Stocks Climb, Following Surge in Chinese Markets

July 06 2020 - 4:48PM

Dow Jones News

By Anna Isaac and Akane Otani

U.S. stocks jumped Monday following the holiday weekend, lifted

by shares of everything from medical technology companies to

banks.

Global stocks have rallied to start the week, with China's

Shanghai Composite Index soaring 5.7% to its highest level since

early 2018. That was even as data continued to point to a rise in

coronavirus cases in the U.S., which some investors have worried

might force officials to further delay reopening plans across the

country.

At least part of stocks' recent gains appear to stem from bets

that the U.S. will be able to avoid having to reinstate widespread

restrictions on business.

"Very few people think that there will be as draconian lockdowns

again," said James Athey, a senior investment manager at Aberdeen

Standard Investments. Mr. Athey added that investors are also

keeping hopes pinned on news related to vaccine and treatment

developments.

The Dow Jones Industrial Average climbed 459.67 points, or 1.8%,

to 26287.03. The S&P 500 added 49.71 points, or 1.6%, to

3179.72 and the Nasdaq Composite advanced 226.02 points, or 2.2%,

to 10433.65.

Shares of Becton Dickinson rose $5.44, or 2.2%, to $250.47 after

the company said it was launching a rapid diagnostic test for the

new coronavirus.

Meanwhile, Uber Technologies added $1.84, or 6%, to $32.52 after

it said that it would buy Postmates for about $2.65 billion in an

all-stock transaction.

Bank shares also bounced higher, with Bank of America rising 37

cents, or 1.6%, to $23.66 and Goldman Sachs up $9.96, or 5%, to

$207.36. Many bank stocks are down substantially for the year, hurt

by prospects of a drop in lending and consumer activity due to the

pandemic.

Some analysts cautioned that the market's recent surge could run

out of momentum in the coming months, given the potential for

economic data to disappoint at a time when stocks look expensive

relative to expected earnings. Although reports have shown swaths

of the economy rebounding, many measures of consumer spending

remain far below prepandemic levels.

"Quite frankly, we're not that optimistic about markets for the

second half of the year," said John Vail, chief global strategist

at Nikko Asset Management, who added that the firm is expecting

middling returns for U.S. stocks for the year.

Elsewhere, the Stoxx Europe 600 rose 1.6% after data showed

German factory orders rebounded 10.4% in May after falling sharply

during the lockdown in April. The increase was driven by both

domestic and foreign orders, as economies around the world began to

reopen. Data also showed eurozone retail sales were stronger than

expected in May.

Signs that economic activity is rebounding from

coronavirus-related lockdowns have helped lift global markets,

analysts say.

"In recent weeks, the data has looked very positive from China.

Its economy is back in motion, and that should lift global equities

a bit," said Seema Shah, chief strategist at Principal Global

Investors.

China market analysts said it was hard to pinpoint a single

clear driver for Monday's surge, though some pointed to a

front-page editorial in state-owned China Securities Journal. It

said fostering a "healthy bull market" was important, given China's

increasingly complicated international relations, intense financial

and technological competition, and the challenge of controlling

internal financial risks.

Investors compared the leap in Chinese financial markets to a

wave of optimism that drove a historic bull run in 2014 and 2015

that eventually ended in a ruinous market crash.

"The article was a clear indication that China's government is

determined to support the rally in local stocks. They're capable of

doing that. They've proved that in the past by using state-owned

entities to purchase local stocks," said Piotr Matys, foreign

exchange strategist at Rabobank.

Xie Yu contributed to this article.

Write to Anna Isaac at anna.isaac@wsj.com and Akane Otani at

akane.otani@wsj.com

(END) Dow Jones Newswires

July 06, 2020 16:33 ET (20:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

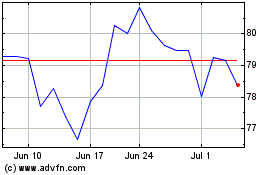

Principal Financial (NASDAQ:PFG)

Historical Stock Chart

From Aug 2024 to Sep 2024

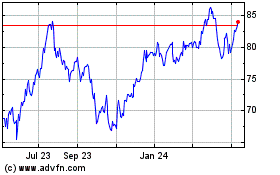

Principal Financial (NASDAQ:PFG)

Historical Stock Chart

From Sep 2023 to Sep 2024