By Peter Loftus and Melanie Evans

Intensified manufacturing efforts aren't moving fast enough to

meet the rising U.S. need for ventilators that can keep critical

coronavirus patients breathing, hospital and medical-device company

officials say.

A frantic global effort is under way to manufacture more of the

breathing machines. Traditional ventilator makers including

Medtronic PLC and Hamilton Medical AG are more than doubling their

weekly output. New entrants Ford Motor Co. and General Motors Co.

have promised a few thousand ventilators as early as this month

before sharply ramping up manufacturing.

The federal government has also taken steps to find and

distribute ventilators, shipping ventilators from its strategic

stockpile and the Federal Emergency Management Agency.

Yet the reinforcements aren't likely to arrive soon enough and

in sufficient numbers for U.S. hospitals confronting a surge of

cases or gearing up for the next wave, hospital and medical-device

industry officials say.

Hospitals in the U.S., which have about 60,000 ventilators on

hand, will be about 25,000 short of what they need when the surge

in coronavirus patients peaks around the middle of this month,

estimated Neil Carpenter, who consults for hospitals at Array

Advisors.

"I really need them now," said Chris Van Gorder, chief executive

of Scripps Health, which operates five hospitals in San Diego

County, Calif.

Scripps placed a roughly $1 million order for 30 ventilators in

early March, Mr. Van Gorder said. Yet delivery is scheduled in

eight to 10 weeks, which is likely too late, Mr. Van Gorder said.

Without the new orders, doctors are preparing to use one ventilator

for two patients.

Scripps also hopes to secure more ventilators from San Diego

County, which placed its own order. The county hasn't yet received

a delivery date, according to its procurement office.

Hospitals outside the U.S. are also struggling with an

insufficient number of ventilators on hand and being delivered.

Ventilators, complicated machines often the size of a desktop

printer, have emerged as a crucial weapon in hospital coronavirus

treatment. They are used to aid critically ill coronavirus

patients, whose infections have all but overwhelmed their lungs and

choked off breathing. Many don't survive even after being hooked up

to one.

Hospitals, which typically use the devices on premature babies

and pneumonia patients, didn't have enough of the machines to cope

with the influx of coronavirus patients. As their demand jumped,

facilities said they searched frantically for ventilators to fill

mounting needs.

Northwell Health, in New York City and the surrounding region,

is converting up to roughly 270 anesthesia machines and outfitting

about 350 other devices with 3-D printed parts so they can function

as ventilators, a spokesman said. It is waiting on an order for

more than 500 ventilators placed weeks ago to be totally fulfilled,

said Phyllis McCready, who oversees the health system's supply

chain.

On Friday, New York Gov. Andrew Cuomo signed an executive order

allowing the National Guard to take ventilators from hospitals in

areas of the state that don't have a lot of cases, and redistribute

to hospitals in need.

Manufacturers are ratcheting up production. Yet companies say it

takes time to move employees around, add production lines and

arrange a supply chain for the hundreds of components in each

machine.

Altogether, medical-device manufacturers are making on average

2,000 to 3,000 ventilators per week, compared with 700 per week

before the crisis, said the Advanced Medical Technology Association

industry group. It expects production to increase to 5,000 to 7,000

ventilators a week in the coming weeks.

"We could double or triple capacity and still not be able to

meet global demand," said Eric Honroth, head of North America for

Getinge AB, a Sweden-based maker of ventilators that is moving to

increase production by 60% to make 16,000 ventilators this

year.

General Motors is working with ventilator maker Ventec Life

Systems to make 10,000 machines a month, and possibly up to 20,000,

but it would take till late spring or summer to reach full

capacity.

General Electric recruited about 100 current employees and

retirees in the region to raise production at its Madison, Wis.,

plant. It has been training the new plant workers before giving

them jobs like quality inspection, material handling or filling a

spot on the manufacturing line.

Medtronic, which is transferring employees from a pacemaker

plant to its nearby ventilator factory in Galway, Ireland, plans to

double production by the end of this month and make an estimated

30,000 ventilators in the next six months, said Bob White, head of

the company's minimally invasive therapies unit.

The company also took the unusual step of sharing online the

designs for one of its ventilator models, so other companies could

make the model. By Thursday, the designs had been downloaded more

than 84,000 times, a spokeswoman said, though the company wasn't

aware of any firm plans by others to make the machines.

Florida-based hospital operator AdventHealth, which projects the

pandemic will peak across its markets in starting in May, is

exploring whether it would be able to get excess ventilators from

hospitals after they have passed their peak needs, officials at the

operator said. Meantime, it struck deals Thursday with three

ventilator manufacturers who pledge to deliver equipment starting

this month and into May, said Marisa Farabaugh, the system's supply

chain chief.

--Thomas Gryta, Denise Roland and Mike Colias contributed to

this article.

(END) Dow Jones Newswires

April 04, 2020 12:42 ET (16:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

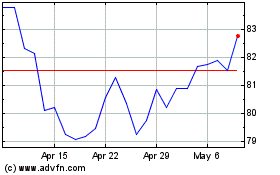

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

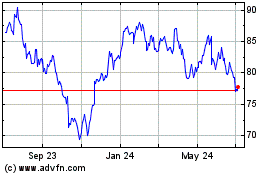

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024