TSX: TNX NYSE AMERICAN: TRX Successful Explorer To Emergent Miner TANZANIAN GOLD CORPORATION Filed pursuant to Rule 433 Issuer Free Writing Prospectus dated January 17, 2020 Registration Statement No. 333 - 226949

Tanzanian Gold Corporation “Tanzanian Gold”, has taken all reasonable care in producing and publishing information contained in this presentation. Tanzanian Gold does not warrant or make any representations regarding the use, validity, accuracy, completeness or reliability of any claims, statements or information in this presentat ion . The information is not a substitute for independent professional advice before making any investment decisions. Furthermore, you may not modify or reproduce in any form, electronic or otherwise any information in th is presentation. Peter Zizhou, P.Geo is the Qualified Person as defined by the NI 43 - 101 who has reviewed and assumes responsibility for the technical content of this presentation. Certain information contained in th e presentation has been obtain from the Amended National Instrument 43 - 101 Independent Technical Report Mineral Reserves Estimate and Pre - Feasibility Study on the Buckreef Gold Mine Project, Tanzania, Ea st Africa as filed with the SEC and on Sedar and the information contained in this presentation is qualified in its entirety to the Technical Report. The Toronto Stock Exchange and NYSE American have not reviewed the information on our website and do not accept responsibilit y f or the adequacy or accuracy of it. Forward - Looking Statements This presentation contains certain forward - looking statements as defined in the applicable securities laws. All statements, othe r than statements of historical facts, are forward - looking statements. Forward - looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “hopes”, “intend s”, “estimated”, “potential”, “possible” and similar expressions, or statements that events, conditions or results “will”, “may”, “could” or “should” occur or be achieved. Forward - looking statements relate to future event s or future performance and reflect Tanzanian Gold management’s expectations or beliefs regarding future events and include, but are not limited to, statements with respect to the estimation of mineral reserves an d r esources, success of mining operations, the timing and amount of estimated future production, and capital expenditure. Although Tanzanian Gold believes the expectations expressed in such forward - looking statements are based on reasonable assumpti ons, such statements are not guarantees of future performance. The actual achievements of Tanzanian Gold or other future events or conditions may differ materially from those reflected in the forward - lo oking statements due to a variety of risks, uncertainties and other factors. These risks, uncertainties and factors include general business, legal, economic, competitive, political, regulatory and social uncertaint ies ; actual results of exploration activities and economic evaluations; fluctuations in currency exchange rates; changes in costs; future prices of gold and other minerals; mining method, production profile and mine plan; del ays in exploration, development and construction activities; changes in government legislation and regulation; the ability to obtain financing on acceptable terms and in a timely manner or at all; contests ov er title to properties; employee relations and shortages of skilled personnel and contractors; the speculative nature of, and the risks involved in, the exploration, development and mining business. These risks are set for th under Item 3.D in Tanzanian Gold’s Form 20 - F for the year ended August 31, 2019, as amended, as filed with the SEC. The information contained in this presentation is as of the date of the presentation and Tanzanian Gold assumes not duty to u pd ate such information. Cautionary note to U.S. Investors US Investors are cautioned that the reserve estimates disclosed in this presentation have been calculated pursuant to Canadia n s tandards, and may not be considered “reserves” by the U.S. Securities and Exchange Commission (“SEC”). The SEC permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral depo sit s that a company can economically and legally extract or produce. Tanzanian Gold uses certain terms in this presentation, such as “inferred” or “indicated” resources which the SEC guidelines prohibit U.S. r egi stered companies from including in their filings with the SEC. U.S. investors are cautioned not to assume that any part or all of the mineral deposits identified as an “indicated mineral r eso urce”, “measured mineral resource” or “inferred mineral resource” will ever be converted to reserves as defined in NI 43 - 101 or SEC Industry Guide 7. For clarification, we do not own nor control properties that contain “Proven (Measured) Reserves” or “Probable (Indicated) Re ser ves” as defined by SEC securities regulations.

000 oz Measured…. 815 Indicated….. 1837 M&I.. 2652 Inferred…… 1003 Total.. 3655 • BUCKREEF: Has global mineral resource of 33.93Mt @ 1.51g/t Au (1.547MOz) • BUZIBA: Has global mineral resource of 29.434Mt @ 1.05g/t Au (0.990MOz) • KIGOSI: Has global mineral resource of 21.79Mt @ 0.84 g/t Au (0.586MOz). • ITETEMIA: Has global mineral resource of 4.48Mt @ 2.96 g/t Au (0.427MOz). • LUHALA: Has global mineral resource of 1.85Mt @1.87 g/t Au (0.112MOz) . 3 79% Of Total Is M & I

June 2018 Pre - Feasibility Study (43 - 101 Compliant). Mineable open pit with just under 1.0M oz 4

5 $/oz Sensitivity Base Case @ $1,300 At $1,500 IRR = 132%

New surface map shows 1,200 m (3,937 feet) of continuous mineralization at surface (Shear Zone Hosted) Data for Buckreef Project model from approx. 892 holes that drilled 137,509 meters . New Geology - Resource Model 95% complete. Red Zone is wireframe @ 0.4g/t Au 6

7 In Holes Meters drilled DD 8 8,042.34 RC PRECOLLAR 15 2,713.00 RC 43 6,733.00 MET (DD) 1 162.10 Total Phase I & II 52 17,650.44 Grade Control (RC) 79 1,975.00 19,625.44 » The 2019 drilling program is the largest drilling program in the Company’s history. » Total drilled for Phase I and Phase II amounts to 17,650m. This is 57,906 ft or approximately 11 miles. » In addition, the Company started a grade control drilling program

8 15 infill holes will facilitate converting Inferred Reserves to M&I Reserves and could add in - pit mineable oz

9 Some areas below northern part of open pit bottom, like L19 - 5 show robust continuous mineralization

10

11 Pit Bottom 400m From Surface 450m From Surface

12 Hole L25 - 1 is one of the most northerly holes and extends the Shear Zone over 200m along strike Results from this hole indicate that the Northeast Extension could still be open . From 650m to 681m : - 31.0m @ 2.5 g/t - 2.0m @ 6.9 g/t - 1.0m 11.9 g/t - 7.0m @ 4.0 g/t - 1.0m @ 15.5 g/t - 2.0m @ 4.4 g/t - 1.0m @ 6.8 g/t

13 From 360 - 421.9m: 13m @ 4.6 g/t - 2.5m @ 21.7g/t - 1m @ 50.5 g/t From 464.3 – 503m: 38.7m @ 5.2 g/t - 3m @ 7.8 g/t - 8m @ 11.5 g/t - 4m @ 18.1 g/t - 3m @ 9.2 g/t Phase III will test the continuity of mineralized structures from surface – through the open pit – below the pit bottom – and below below drilling from Phase III.

14 Screen shots from rotating 3D image showing minor dislocation of mineralization by a late dyke and confirming that deeper extensions of mineralized zones are still intact as well as best location for a Phase III hole below the dyke .

In pit and below pit sampled at various depths. Tests will provide data for open pit design and for conceptual stope design for below pit bottom 15 Samples ready for shipment

Focus of current metallurgical testing is on final feasibility plant design to treat primary resources in pit, and below pit bottom. Basis of plant design is double capacity of plant in PFS. Drilling has started on these holes.

17 Oxide resources at or close to surface contain less than 1% of the gold in the PFS open pit. More suitable to be treated by a separate smaller plant. PFS open pit with main oxide mineralized structures

18 Grade control drilling has started. Topsoil & waste removal started. Pit can supply +3yrs to plant ; another +2yrs supply available from stockpiles. Project has upside. Grade Control Drilling

19 Oxide plant will treat approx.15 tph ore. Flow sheet will be conventional Gravity - Cyanide Leaching CIL with cyclones and centrifuges. Metallurgical testing has indicated potential for high recoveries. Plant could incorporate parts from earlier test plant. Stockpiles of oxide ore. Previous plant site in background

20 The Company will soon be facing two choices for the path ahead. » Make the current project better, or » Change the scope to include open pit and underground mining Make It Better Change Scope

21

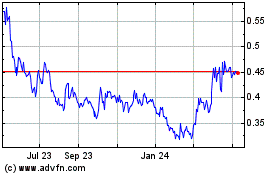

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Aug 2024 to Sep 2024

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Sep 2023 to Sep 2024