Comcast Cuts Price of Its Streaming Hardware From $5 a Month to $0

September 18 2019 - 5:55PM

Dow Jones News

By Lillian Rizzo

Comcast Corp. is making its streaming device available free of

charge to its internet-only customers, in an effort to capitalize

on its expanding broadband customer base as the battle for

streaming customers ramps up.

The nation's largest cable operator launched Flex, its answer to

other streaming hardware such as Roku, Amazon.com Inc.'s Fire TV

Stick and Apple Inc.'s Apple TV, earlier this year. The device,

which originally could be leased for $5 a month, will now be free

to all broadband customers during the duration of their contract,

the company said Wednesday. Comcast declined to say how many of its

customers had opted to lease the Flex since its inception.

Another competitor to Flex was launched Wednesday: Facebook Inc.

introduced a new Portal device that has television chat and

video-streaming capabilities, becoming the latest company to enter

the streaming-hardware field.

Comcast's decision to make Flex free to customers comes one day

after the company's NBCUniversal unit unveiled its new

direct-to-consumer streaming service, Peacock, a nod to NBC's logo.

Peacock will launch in April 2020 and will be available for free to

Comcast's more than 21 million U.S. cable subscribers.

The company has yet to disclose pricing for the app outside of

its customer base. While Peacock will be available on Flex, Comcast

declined to say whether it would be free as well for internet

customers, or what the price point will be.

CEO Brian Roberts on Wednesday said Peacock would lean heavily

on advertising. Mr. Roberts added the company is exploring how to

work with other distributors to extend Peacock to non-Comcast cable

customers at no additional cost to them.

Like its peers, Comcast has been bleeding pay-TV subscribers as

people abandon traditional pay-TV packages in favor of streaming

apps like Netflix Inc., Amazon's Prime TV, and Hulu Inc. Mr.

Roberts on Wednesday said Comcast has 55 million customers across

its business, but the company has lost cable-TV customers for the

past nine consecutive quarters.

Mr. Roberts, who was speaking at Goldman Sachs Group Inc.'s

Communacopia conference in New York, acknowledged the cord-cutting

trend is here to stay, and said providing Flex as an option to

broadband-only customers is a way for the company to remain a

video-content provider.

"Not all video customers are profitable to us anymore, and

programming costs can be lumpy," Mr. Roberts said, adding it isn't

always worth fighting the cord-cutting trend for those reasons.

Comcast said Flex is able to stream videos in 4K resolution and

comes with a voice-activated remote control. The technology behind

the Flex platform and remote control stems from Comcast's cable

system, Xfinity X1, which gives cable subscribers access to their

pay-TV package and streaming apps through Comcast's set-top box. A

majority of Comcast's cable customers use the X1 platform and its

voice remote.

The company said Flex would provide a "digital dashboard,

"similar to X1 and Xfinity's xFi internet service, so that

customers can manage their related internet-home products, and use

other functions similar to a smartphone.

Comcast said there wouldn't be any advertising on Flex. It

declined to say whether it would take a cut of subscriptions

purchased through its platform. As with other streaming devices,

apps from rivals including Hulu and Netflix are available on the

platform.

Peacock will be added to Flex once the service is live. Skinny

bundles, such as Dish Network Corp. 's Sling TV or Alphabet Inc. 's

YouTube TV -- which provide access to a limited selection of live

TV channels -- aren't available on Flex yet, although Sling

International, which provides international TV shows, is.

The company will reach out to its current internet-only

customers, with and without Flex, to notify them that Flex is now

available free of charge. (Customers will still have to pay $5 a

month if they want a second device.).

Flex is currently only offered to Comcast customers. Matt

Strauss, Comcast Cable's executive vice president of Xfinity

Services, on Wednesday said the company was exploring whether

license Flex to rivals -- similar to the X1 cable platform that is

licensed to Cox Communications, among others.

While Comcast has focused on speed upgrades to improve broadband

customers' experience, offering Flex at no cost is meant to improve

the internet-only customers' experience, a spokeswoman said.

Write to Lillian Rizzo at Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

September 18, 2019 17:40 ET (21:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

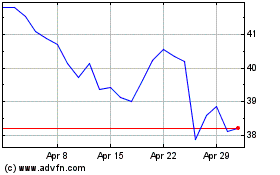

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024