Current Report Filing (8-k)

August 26 2019 - 4:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

_______________________

Date of Report: August 22, 2019 (Date of

earliest event reported)

CAPSTONE THERAPEUTICS CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-21214

|

|

86-0585310

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1275 West

Washington Street, Suite 104, Tempe, Arizona

|

|

85281

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code:

(602) 286-5520

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

CAPS

|

OTCQB

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

[ ] Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company: ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 –

Registrant’s Business and Operations

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

CONTINGENT VALUE RIGHTS

To allow stockholders

as of the Record Date (July 10, 2019) to participate in the value, if any, of the development efforts of the Company’s approximately

60% owned subsidiary, LipimetiX Development, Inc. (the “JV”), the Board approved the issuance of certain contingent

value rights (“CVR”) pursuant to the terms of a Contingent Value Rights Agreement (the “CVR Agreement”).

The issuance of the CVRs and the CVR Agreement were contingent upon the approval of the Reverse Stock Split (Proposal 2) at the

Annual Meeting held on August 22, 2019. The intent of the CVRs is to provide payment to the stockholders, option holders and warrant

holders as of the Record Date of the future value realized, if any, and subject to various costs and expenses, from the Company’s

ownership interest in the JV.

The Board of the

Company approved the issuance of a Contingent Value Right (“CVR”) as described in our Proxy Statement filed on

Form DEF 14A with the Securities and Exchange Commission on July 10, 2019. The CVR will be effective August 23, 2019. The

issuance of the CVR will result in deconsolidation of LipimetiX Development, Inc. (“LDI”) from the

Company’s consolidated financial statements and the treatment in the Company’s financial statements of

the Company’s investment in LDI as if it was a dividend to the shareholders. Subsequent to August 23, 2019 the Company

will have no economic interest in LDI, as per the CVR, the net proceeds from the Company’s investment in LDI will be

distributed to the shareholders of record on the Record Date, July 10, 2019. In conjunction with issuance of the CVR, the

Company and Buyer (Lender) on August 23, 2019 entered into the Third Amendment to the Securities Purchase, Loan and Security

Agreement , attached as exhibit 10.2 this Current report on Form 8-K, to release LDI from Collateral and release Buyers

security interest in the Company’s investment in LDI under the Securities Purchase, Loan and Securities Agreement .

Section 3 – Securities and Trading

Markets

|

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

The information included

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

Section 5 - Corporate Governance and Management

|

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal

Year.

|

In connection with

the approval by our shareholders at the Annual Meeting held on August 22, 2019 of the reverse stock split, as described in this

Current Report on Form 8-K, the Company filed a Certificate of Amendment to the Restated Certificate of Incorporation with the

Secretary of State of the State of Delaware. The Certificate of Amendment to the Restated Certificate of Incorporation provides

for each 1,000 shares of the Company’s Common Stock issued and outstanding on the Effective Date (12:01AM Eastern August

31, 2019) to be combined into one share. The Certificate of Amendment to the Restated Certificate of Incorporation is included

as Exhibit 3.1 to this Current Report on Form 8-K.

|

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

Annual Meeting of Stockholders

(a) Our Annual Meeting of stockholders was held on August 22,

2019 with a quorum in attendance.

(b) At our Annual Meeting, stockholders elected our nominees

for Directors; approved a reverse stock split of 1,000 to 1 shares, gave an advisory vote on executive compensation and the frequency

of future advisory votes on executive compensation, and ratified the appointment of Eide Bailly LLP as our independent registered

public accounting firm for the fiscal year ending December 31, 2019. The certified results of the matters voted upon at our Annual

Meeting, which are more fully described in our definitive proxy statement filed with the SEC on July 10, 2019, are as follows:

Proposal 1: Proposal to elect one

Class I Director, two Class II Directors and two Class III Directors, to serve until the Annual Meeting of Stockholders to be held

in the year 2022, 2020 and 2021:

|

Number of Shares

|

|

Director Nominee

|

FOR

|

WITHHELD

|

BROKER

NON-VOTES

|

|

Fredric J. Feldman, PhD. (Class I)

|

28,145,868

|

10,084,472

|

12,855,785

|

|

Number of Shares

|

|

Director Nominee

|

FOR

|

WITHHELD

|

BROKER

NON-VOTES

|

|

John M. Holliman, III (Class II)

|

28,165,243

|

10,065,097

|

12,855,785

|

|

Number of Shares

|

|

Director Nominee

|

FOR

|

WITHHELD

|

BROKER

NON-VOTES

|

|

Matthew E. Lipman (Class II)

|

28,147,048

|

10,083,292

|

12,855,785

|

|

Number of Shares

|

|

Director Nominee

|

FOR

|

WITHHELD

|

BROKER

NON-VOTES

|

|

Elwood D. Howse, Jr. (Class III)

|

28,161,215

|

10,069,125

|

12,855,785

|

|

Number of Shares

|

|

Director Nominee

|

FOR

|

WITHHELD

|

BROKER

NON-VOTES

|

|

Michael M. Toporek (Class III)

|

28,153,135

|

10,077,205

|

12,855,785

|

Proposal 2: Approval to amend the Company’s Restated

Certificate of Incorporation, to effect a reverse split of the common stock, par value $0.0005 per share, of the Company (the “Common

Stock”) in a ratio of 1-for-1,000 (the “Reverse Stock Split”), which would result in (i) holdings prior to such

split of fewer than 1,000 shares of Common Stock being converted into a fractional share, which will then be immediately cancelled

and converted into a right to receive the cash consideration described in our definitive proxy statement, and (ii) the Company

having fewer than 300 stockholders of record, allowing the Company to deregister its Common Stock under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), and avoid the costs associated with being a public reporting company:

|

Number of Shares

|

|

FOR

|

AGAINST

|

ABSTAIN

|

BROKER

NON-VOTES

|

|

36,128,668

|

14,875,186

|

82,271

|

0

|

Proposal 3: An advisory vote to

approve the compensation of our named executive officers (“say-on-pay”):

|

Number of Shares

|

|

FOR

|

AGAINST

|

ABSTAIN

|

BROKER

NON-VOTES

|

|

29,333,583

|

8,867,070

|

29,687

|

N/A

|

Proposal 4: Advisory

Vote on Frequency of Holding Future Votes on Executive Compensation:

|

Number of Shares

|

|

ONE YEAR

|

TWO YEARS

|

THREE YEARS

|

ABSTAIN

|

BROKER

NON-VOTES

|

|

3,548,561

|

22,576

|

26,916,709

|

7,742,494

|

12,855,785

|

Proposal 5: Proposal to Ratify the

Appointment of Eide Bailly LLP as our Independent Registered Public Accounting Firm for Fiscal Year 2019

|

Number of Shares

|

|

FOR

|

AGAINST

|

ABSTAIN

|

|

42,746,459

|

8,117,816

|

221,850

|

Section 9 - Financial

Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Dated: August 26, 2019

|

CAPSTONE THERAPEUTICS CORP.

|

|

|

|

|

|

|

/s/ John M. Holliman, III

|

|

|

|

John M. Holliman, III

|

|

|

|

Executive Chairman

|

|

Exhibit Index

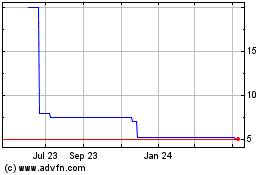

Capstone Therapeutics (QB) (USOTC:CAPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

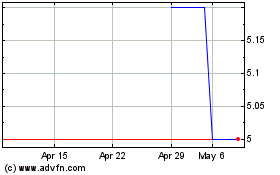

Capstone Therapeutics (QB) (USOTC:CAPS)

Historical Stock Chart

From Apr 2023 to Apr 2024