Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

May 17 2019 - 5:02PM

Edgar (US Regulatory)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant

o

Filed

by a Party other than the Registrant

x

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Under Rule 14a-12

|

HomeStreet, Inc.

(Name of Registrant as Specified In Its

Charter)

Roaring

Blue Lion Capital Management, L.P.

Blue

Lion Opportunity Master Fund, L.P.

BLOF

II LP

Charles

W. Griege, Jr.

Ronald

K. Tanemura

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

|

x

|

No fee required.

|

|

|

|

|

o

|

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

|

|

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the

|

|

filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4)

|

Date Filed:

|

On

May 17, 2019,

Roaring Blue Lion Capital Management,

L.P.

(“Blue Lion”) launched a website (located at www.FixHMST.com) (the “Website”)

to communicate with shareholders of HomeStreet, Inc. (“HomeStreet”) related to Blue Lion’s solicitation of proxies

in connection with the 2019 annual meeting of shareholders of HomeStreet. Materials posted to the Website are filed herewith

as

Exhibit 1

.

Exhibit 1

Financial

Company Charged With Improper Accounting and Impeding Whistleblowers

FOR IMMEDIATE RELEASE

2017-24

Washington D.C., Jan. 19, 2017 —

The Securities and Exchange Commission today announced that Seattle-based financial services company HomeStreet Inc. has agreed

to pay a $500,000 penalty to settle charges that it conducted improper hedge accounting and later took steps to impede potential

whistleblowers.

HomeStreet’s treasurer Darrell

van Amen agreed to pay a $20,000 penalty to settle charges that he caused the accounting violations.

According to the SEC’s order,

HomeStreet originated approximately 20 fixed rate commercial loans and entered into interest rate swaps to hedge the exposure.

The company elected to designate the loans and the swaps in fair value hedging relationships, which can reduce income statement

volatility that might exist absent hedge accounting treatment. Companies are required to periodically assess the hedging

relationship and must discontinue the use of hedge accounting if the effectiveness ratio falls outside a certain range.

The SEC’s order finds that

in certain instances from 2011 to 2014, van Amen saw to it that unsupported adjustments were made in HomeStreet’s hedge effectiveness

testing to ensure the company could continue using the favorable accounting treatment. The test results with altered inputs

to influence the effectiveness ratio were provided to HomeStreet’s accounting department, which resulted in inaccurate accounting

entries.

“HomeStreet disregarded its

internal accounting policies and procedures to come up with different testing results to enable its use of hedge accounting,”

said Erin Schneider, Associate Director of the SEC’s San Francisco Regional Office. “Companies must follow the

rules rather than create their own.”

The SEC’s order further finds

that after HomeStreet employees reported concerns about accounting errors to management, the company concluded the adjustments

to its hedge effectiveness tests were incorrect. When the SEC contacted the company in April 2015 seeking documents related

to hedge accounting, HomeStreet presumed it was in response to a whistleblower complaint and began taking actions to determine

the identity of the “whistleblower.” It was suggested to one individual considered to be a whistleblower that

the terms of an indemnification agreement could allow HomeStreet to deny payment for legal costs during the SEC’s investigation.

HomeStreet also required former employees to sign severance agreements waiving potential whistleblower awards or risk losing their

severance payments and other post-employment benefits.

“Companies that focus on finding

a whistleblower rather than determining whether illegal conduct occurred are severely missing the point,” said Jina Choi,

Director of the SEC’s San Francisco Regional Office.

Jane Norberg, Chief of the SEC's

Office of the Whistleblower, added, “This is the second case this week against a company that took steps to impede former

employees from sharing information with the SEC. Companies simply cannot disrupt the lines of communications between the

SEC and potential whistleblowers.”

HomeStreet and van Amen consented

to the SEC’s order without admitting or denying the findings that they violated internal accounting controls and books and

records provisions of the federal securities laws. HomeStreet also violated Rule 21F-17, which prohibits taking actions to

impede communication with the SEC.

The SEC’s investigation was

conducted by Rebecca Lubens and John Roscigno, and the case was supervised by Tracy Davis in the San Francisco office.

###

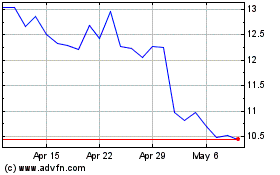

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Aug 2024 to Sep 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Sep 2023 to Sep 2024