Home Depot Sets $1.2 Billion Supply-Chain Overhaul

June 11 2018 - 2:14PM

Dow Jones News

By Jennifer Smith

Home Depot Inc. plans to spend $1.2 billion over the next five

years to speed up delivery of goods to homes and job sites as the

rise of online shopping resets consumer expectations.

The home improvement retailer will add 170 distribution

facilities across the U.S. so that it can reach 90% of the U.S.

population in one day or less, said Mark Holifield, the company's

executive vice president of supply chain and product development.

The new sites will include dozens of direct fulfillment centers for

next-day or same-day delivery of commonly ordered products, as well

as 100 local hubs where bulky items like patio furniture and

appliances will be consolidated for direct shipment to

customers.

Mr. Holifield told a logistics industry conference last week

that the retailer is realigning its supply chain to a changing

retail landscape.

Customers "expect delivery to be free, they expect it to be

timely," he said. "Sometimes they want it fast, and are willing to

pay for that. Sometimes they want it free, and they're willing to

wait for it. We need to have the right options there."

The push comes as Home Depot is trying to tamp down

transportation costs and improve inventory management as it tries

to more closely integrate its growing online business with its

network of about 2,280 brick-and-mortar stores.

"This is part of an $11 billion overall plan to re-engineer our

company to ensure that we are prepared for the future in retail,"

Mr. Holifield said.

Online orders accounted for 6.7% of the retailer's $100.9

billion in sales last year, but the digital revenues expanded 21%

from the year before. About 45% of online orders are picked up

inside stores, and the company is rolling out self-service lockers

at the front of some stores to speed up order retrieval.

Shoppers accustomed to two-day delivery from online retailers

like Amazon.com Inc. are increasingly making buying decisions based

on convenience factors, experts say, such as speed of delivery or

availability of a wide range of products.

That's pushing retailers to reshape distribution networks that

were originally designed to ship pallet-loads of goods from

warehouses to stores. They are turning to tactics such as

drop-shipping, where suppliers ship online orders directly to

customers, and opening warehouses closer to customers.

Over the next five years Home Depot plans to build around seven

e-commerce fulfillment centers that stock hundreds of thousands of

products for shipment to consumers' homes or job sites.

The company is also testing the use of cars and vans for

lower-cost delivery of smaller orders in some markets, and

expanding its network of flatbed trucks that can deliver loads of

concrete and other building materials to professional customers,

who account for about 40% of the retailer's sales.

"We expect to build 40 flatbed distribution centers in the 40

largest markets, so that we can bring those products to customers

on a next-day, same-day basis," Mr. Holifield said.

Home Depot sales rose 4.2% in the first quarter, lower than

analysts had expected. Gardening-supply sales took a hit from

unseasonably cool weather in March and April, but the rest of the

retailer's business performed ahead of expectations during the

quarter and growth is "double-digit over last year," Carol Tomé,

finance chief of the Atlanta-based company, said last month.

Higher freight costs also weighed on margins as Home Depot, like

other retailers, grappled with tight trucking capacity.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

June 11, 2018 13:59 ET (17:59 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

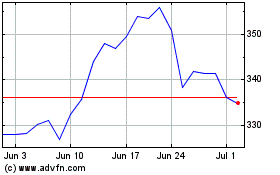

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2024 to May 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From May 2023 to May 2024