As filed with the Securities and Exchange Commission on April 19,

2018

Registration

No. 333- _______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMAGEWARE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

33-0224167

|

|

(State or Other Jurisdiction of

|

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Identification No.)

|

10815 Rancho Bernardo Road, Suite 310

San Diego, California 92127

(Address of Principal Executive Offices)

Amended and Restated 1999 Stock Award Plan

(Full title of the plan)

Wayne Wetherell

ImageWare Systems, Inc.

10815 Rancho Bernardo Road, Suite 310

San Diego, California 92127

(Name and address of agent for service)

(858) 673-8600

(Telephone number, including area code, of agent for

service)

Copies to:

Daniel W. Rumsey, Esq.

Jessica R. Sudweeks, Esq.

Disclosure Law Group,

a Professional Corporation

600 West Broadway, Suite 700

San Diego, California 92101

Tel: (619) 272-7050

Fax: (619) 330-2101

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2

of the Exchange Act.

|

Large

accelerated filer [ ]

|

Accelerated

filer [X]

|

|

Non-accelerated

filer [ ]

|

Smaller

reporting company [ ]

|

|

|

Emerging

growth company [ ]

|

(Do not check if a smaller reporting company)

If

an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided Section 7(a)(2)(B) of the Securities Act.

[ ]

CALCULATION OF REGISTRATION FEE

|

Title

of Securities to be Registered

|

Amount

to be

Registered

(1)

|

Proposed

Maximum Offering Price

per

Share

(2)

|

Proposed

Maximum

Aggregate

Offering

Price

(2)

|

Amount

of

Registration

Fee

|

|

Common Stock, par

value $0.01 per share: To be issued under the Amended and Restated

1999 Stock Award Plan

|

631,046

|

$

1.75

|

$

1,104,330.50

|

$

137.49

|

|

Common Stock, par

value $0.01 per share: Outstanding options issued by the Registrant

under the Amended and Restated 1999 Stock Award Plan

|

4,368,954

(3)

|

$

1.75

|

$

7,645,669.50

|

$

951.89

|

|

Total

|

5,000,000

|

|

$

8,750,000

|

$

1,089.38

|

|

(1)

|

Shares available for issuance under our Amended and Restated 1999

Stock Award Plan (the “

Plan

”)

were previously registered on registration statements on

Form S-8 filed with the Securities and Exchange Commission

(“

SEC

”)

on April 18, 2012 (Registration No. 333-180809), January 11, 2008

(Registration No. 333-148615), November 27, 2001 (Registration

No. 333-74016) and December 6, 2000 (Registration

No. 333-51310). This Registration Statement on Form S-8 is

being filed to register an additional 5,000,000 shares of our

common stock, par value $0.01 per share (“

Common

Stock

”), underlying

options that may be issued or are currently outstanding under the

Plan.

In accordance with Rule

416 under the Securities Act of 1933, as amended, this Registration

Statement shall also be deemed to cover any additional securities

that may from time to time be offered or issued to prevent dilution

resulting from stock splits, stock dividends or similar

transactions.

|

|

(2)

|

Pursuant

to General Instruction E to Form S-8, a filing fee is only being

paid with respect to the registration of additional securities

under the Plan. Estimated solely for the purpose of

calculating the amount of the registration fee pursuant to Rules

457(c) and (h) under the Securities Act of 1933, as amended,

on the basis of the average of the high and low selling prices per

share of Common Stock of the Registrant on April 10, 2018, as

reported by the OTCQB Market.

|

|

(3)

|

Represents

4,368,954

shares of Common Stock

issuable upon exercise of outstanding options previously issued

under the Plan.

|

EXPLANATORY NOTE

ImageWare Systems, Inc.

(the “

Company

”) has prepared this Registration Statement

in accordance with the requirements of Form S-8 under the

Securities Act of 1933, as amended

(the “

Securities

Act

”), to register an additional 5,000,000

shares of the Company’s common stock, par value $0.01 per

share (“

Common

Stock

”), issuable

pursuant to the Company’s Amended and Restated 1999 Stock

Award Plan (the “

Plan

”). The Plan provides for the grant of

incentive stock options, non-qualified stock options, shares of our

Common Stock, restricted shares of Common Stock, restricted stock

units, stock appreciation rights, dividend equivalent rights and

other stock-based awards (collectively, “

Awards

”). Awards, other than incentive stock

options, may be granted to the Company’s employees, officers,

directors and independent contractors.

The Company previously

registered shares available for issuance under the Plan on

registration statements on Form S-8 filed with the SEC on

April 18, 2012 (Registration No. 333-180809), January 11, 2008

(Registration No. 333-148615), November 27, 2001 (Registration

No. 333-74016) and December 6, 2000 (Registration

No. 333-51310).

Pursuant

to General Instruction E to Form S-8, the contents of the Prior

Registration Statements relating to the Plan, and all periodic

reports filed by the Company after the Prior Registration

Statements to maintain current information about the Company are

hereby incorporated by reference.

Part I of this Registration Statement includes a

reoffer prospectus (the “

Reoffer

Prospectus

”). The names

of certain persons who may, from time to time in the future, sell

shares under the Reoffer Prospectus and the amount of such shares

are set forth below under the caption “

Selling

Stockholders

.” In

addition, other affiliate selling stockholders may elect to sell

shares under the Reoffer Prospectus as they receive them from time

to time in the future in which case, as their names and amounts of

shares to be reoffered become known, we will supplement the Reoffer

Prospectus with that information. Any securities covered by the

Reoffer Prospectus which qualify for sale pursuant to Rule 144 may

be sold under Rule 144 rather than pursuant to the Reoffer

Prospectus.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

The

document(s) containing the information concerning the Plan

specified in Part I will be sent or given to participants of the

Plan as specified by Rule 428(b)(1). Such documents are not filed

as part of this Registration Statement in accordance with the Note

to Part I of the Form S-8 Registration Statement.

REOFFER PROSPECTUS

IMAGEWARE SYSTEMS, INC.

4,368,954

Shares of Common

Stock

This Reoffer Prospectus relates to the sale of up

to

4,368,954

shares of our

common stock, par value $0.01 per share (“

Common

Stock

”), that may be

offered and resold from time to time in the future by existing

stockholders of the Company (the “

Selling

Stockholders

”) identified

in this Reoffer Prospectus for his or her own account issuable

pursuant to the Company’s Amended and Restated 1999 Stock

Award Plan (the “

Plan

”). The Plan provides for the grant of

incentive stock options, non-qualified stock options, shares of our

Common Stock, restricted shares of Common Stock, restricted stock

units, stock appreciation rights, dividend equivalent rights and

other stock-based awards (collectively, “

Awards

”). Awards, other than incentive stock

options, may be granted to the Company’s employees, officers,

directors and independent contractors. It is anticipated that

the Selling Stockholders will offer Common Stock for sale at

prevailing prices, as reported by the OTCQB Market on the date of

sale. We will receive no part of the proceeds from sales made under

this Reoffer Prospectus. The Selling Stockholders will bear all

sales commissions and similar expenses. Any other expenses incurred

in connection with the registration and offering of the shares will

be borne by the Company.

The

shares of Common Stock will be issued pursuant to stock options

previously granted under the Plan or granted in the future under

the Plan. This Reoffer Prospectus has been prepared for the

purposes of registering the Common Stock under the Securities Act

of 1933, as amended, to allow for future sales by the Selling

Stockholders on a continuous or delayed basis to the public without

restriction.

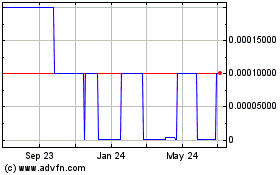

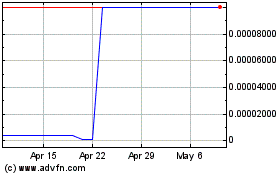

Our Common Stock currently listed for quotation on the OTCQB Market

under the symbol “IWSY.” The closing sales price for

our Common Stock on April 10, 2018 was $1.84 per

share.

Investing in our Common Stock

involves risks. See “

Risk

Factors

” on page

4

of this Reoffer

Prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE

SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

DETERMINED

IF THIS REOFFER PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY

REPRESENTATION TO

THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Reoffer Prospectus is April

19

, 2018

IMAGEWA

R

E SYSTEMS, INC.

|

|

|

PAGE NO.

|

|

|

|

1

|

|

|

|

4

|

|

|

|

4

|

|

|

|

4

|

|

|

|

5

|

|

|

|

6

|

|

|

|

6

|

|

|

|

9

|

|

|

|

11

|

|

|

|

11

|

|

|

|

11

|

|

|

|

12

|

You should rely only on the information contained in this Reoffer

Prospectus or any related prospectus supplement. We have not

authorized anyone to provide you with different information. If

anyone provides you with different or inconsistent information, you

should not rely on it. The information contained in this Reoffer

Prospectus or incorporated by reference herein is accurate only on

the date of this Reoffer Prospectus. Our business, financial

condition, results of operations and prospects may have changed

since such date. Other than as required under the federal

securities laws, we undertake no obligation to publicly update or

revise such information, whether as a result of new information,

future events or any other reason.

This Reoffer Prospectus is not an offer to sell, nor is it an offer

to buy, these securities in any jurisdiction where the offer or

sale is not permitted.

This summary highlights certain information that we present more

fully in the rest of this Reoffer Prospectus. This summary does not

contain all of the information you should consider before investing

in the securities offered pursuant to this Reoffer Prospectus. You

should read the entire prospectus carefully, including the section

titled “Risk Factors,” before making an investment

decision.

Except where the context otherwise requires and for purposes of

this Reoffer Prospectus only, “we,” “us,”

“our,” “Company,” “our

Company,” “ImageWare,” and “ImageWare

Systems” refer to ImageWare Systems, Inc., a Delaware

corporation, and its consolidated subsidiaries.

Overview

ImageWare Systems, Inc., a Delaware corporation

since 2005 and previously incorporated in California in 1987 as a

Utah corporation, has its principal place of business at 10815

Rancho Bernardo Road, Suite 310, San Diego, California 92127. Our

telephone number is (858) 673-8600. We maintain a corporate website

at

http://www.iwsinc.com

.

Our common stock, par value $0.01 per share

(“

Common

Stock

”), is currently

listed for quotation on the OTCQB Market under the symbol

“IWSY.” Unless the context otherwise requires, the

words “

we

,” “

us

,” “

our

,” “

ImageWare

,” “

ImageWare

Systems

,”

“

Company

” or “

our Company

” refers to ImageWare Systems, Inc. and all

of its subsidiaries.

We are a pioneer and leader in

the emerging market for biometrically enabled software-based

identity management solutions. Using those human characteristics

that are unique to us all, we create software that provides a

highly reliable indication of a person’s identity.

We develop mobile and

cloud-based identity management solutions providing biometric,

secure credential and law enforcement technologies. Our patented

biometric product line includes our flagship product, the IWS

Biometric Engine®, a hardware and algorithm independent

multi-biometric engine that enables the enrollment and management

of unlimited population sizes. Our identification products are

used to manage and issue secure credentials, including national

IDs, passports, driver licenses and access control credentials. Our

digital booking products provide law enforcement with integrated

mug shots, fingerprint LiveScan and investigative

capabilities. We also provide comprehensive authentication

security software using biometrics to secure physical and logical

access to facilities or computer networks or internet sites.

We are headquartered

in San Diego, California, with offices in Portland, Oregon, Mexico,

and Ottawa, Ontario.

We are also a leading developer of mobile and

cloud-based identity management solutions providing patented

biometric authentication solutions for the enterprise. We deliver

next-generation biometrics as an interactive and scalable

cloud-based solution. We bring together cloud and mobile technology

to offer multi-factor authentication for smartphone users, for the

enterprise, and across industries. We have introduced a set of

mobile and cloud solutions to provide biometric user

authentication, including the GoVerifyID® mobile application

and cloud-based SaaS solutions. These solutions include GoMobile

Interactive (“

GMI

”), which provides patented, secure, dynamic

messaging. More recently we have introduced GoVerifyID®

Enterprise Suite, which provides turnkey integration with Microsoft

Windows, Microsoft Active Directory, and security products from CA,

HPE, IBM, and SAP. These solutions are marketed and sold to

businesses across many industries. For the healthcare industry, we

also developed and market a patented, FDA-Cleared,

biometrically-secured, enterprise-level platform for patient

engagement and medication adherence.

Historically,

we have marketed our products to government entities at the

federal, state and local levels; however, the emergence of cloud

based computing, a mobile market that demands increased security

and interoperable systems, and the proven success of our products

in the government markets, has enabled us to enlarge our target

market focus to include the emerging consumer and non-government

enterprise marketplace.

Our biometric technology is a core software

component of an organization’s security infrastructure and

includes a multi-biometric identity management solution for

enrolling, managing, identifying and verifying the identities of

people by the physical characteristics of the human body. We

develop, sell and support various identity management capabilities

within government (federal, state and local), law enforcement,

commercial enterprises, and transportation and aviation markets for

identification and verification purposes. Our IWS Biometric Engine

is a patented biometric identity management software platform for

multi-biometric enrollment, management and authentication, managing

population databases of virtually unlimited sizes. It is hardware

agnostic and can utilize different types of biometric

algorithms. It allows different types of biometrics to be

operated at the same time on a seamlessly integrated

platform. It is also offered as a Software Development Kit

(“

SKD

”) based search engine, enabling developers

and system integrators to implement a biometric solution or

integrate biometric capabilities into existing applications without

having to derive biometric functionality from pre-existing

applications. The IWS Biometric Engine combined with our

secure credential platform, IWS EPI Builder, provides a

comprehensive, integrated biometric and secure credential solution

that can be leveraged for high-end applications such as passports,

driver licenses, national IDs, and other secure

documents.

Our

law enforcement solutions enable agencies to quickly capture,

archive, search, retrieve, and share digital images, fingerprints

and other biometrics as well as criminal history records on a

stand-alone, networked, wireless or web-based platform. We develop,

sell and support a suite of modular software products used by law

enforcement and public safety agencies to create and manage

criminal history records and to investigate crime. Our IWS Law

Enforcement solution consists of five software modules: Capture and

Investigative modules, which provide a criminal booking system with

related databases as well as the ability to create and print mug

photo/SMT image lineups and electronic mug-books; a Facial

Recognition module, which uses biometric facial recognition to

identify suspects; a Web module, which provides access to centrally

stored records over the Internet in a connected or wireless

fashion; and a LiveScan module, which incorporates LiveScan

capabilities into IWS Law Enforcement providing integrated

fingerprint and palm print biometric management for civil and law

enforcement use. The IWS Biometric Engine is also available to

our law enforcement clients and allows them to capture and search

using other biometrics such as iris or DNA.

Our

secure credential solutions empower customers to create secure and

smart digital identification documents with complete ID systems. We

develop, sell and support software and design systems which utilize

digital imaging and biometrics in the production of photo

identification cards, credentials and identification systems. Our

products in this market consist of IWS EPI Suite and IWS EPI

Builder. These products allow for production of digital

identification cards and related databases and records and can be

used by, among others, schools, airports, hospitals, corporations

or governments. We have added the ability to incorporate multiple

biometrics into the ID systems with the integration of IWS

Biometric Engine to our secure credential product

line.

Our GoVerifyID products support multi-modal

biometric authentication including, but not limited to, face,

voice, fingerprint, iris, palm, and more. All the biometrics can be

combined with or used as replacements for authentication and access

control tools, including tokens, digital certificates, passwords,

and PINS, to provide the ultimate level of assurance,

accountability, and ease of use for corporate networks, web

applications, mobile devices, and PC desktop environments.

GoVerifyID provides patented multi-modal biometric identity

authentication that can be used in place of passwords or as a

strong second factor authentication method. GoVerifyID is provided

as a cloud-based Software-as-a-Service (“

SaaS

”) solution; thereby, eliminating complex IT

deployment of biometric software and eliminating startup costs.

GoVerifyID works with existing mobile devices, eliminating the need

for specialized biometric scanning devices typically used with most

biometric solutions.

GoVerifyID

was built to work seamlessly with our patented technology

portfolio, including GoMobile Interactive®, the secure dynamic

messaging system, and the ultra-scalable IWS Biometric Engine that

provides anonymous biometric matching and storage. GoVerifyID is

secure, simple to use, and designed to provide instant identity

authentication by engaging with the biometric capture capabilities

of each user’s mobile device. GoVerifyID also provides a

fully open SDK for organizations that require the utmost in

flexibility.

Our

GoVerifyID Enterprise Suite for Windows easily and seamlessly

integrates with a user’s existing Microsoft

ecosystem/infrastructure to support the user’s extended

workforce. GoVerifyID Enterprise Suite secures corporate networks

from end-to-end – both applications and data – on

client, server, and cloud systems with flexible user login policies

to address varied trust requirements. Our GoVerifyID Enterprise

Suite works with the smart devices that the workforce already uses,

including iOS/Android smartphones and tablets.

Our GoVerifyID Enterprise Suite for Windows

provides biometric authentication for the Microsoft ecosystem that

secures enterprise security without compromising agility,

productivity, or user experience. Its comprehensive architecture

offers biometric authentication for the complete range of

enterprise stakeholders, delivering secure enterprise applications

and workspaces to internal employees, partners, suppliers and

vendors, even customers. Out-of-band authentication is provided via

universally available devices, such as smartphones and tablets.

In-band authentication can be enabled via fingerprint readers, iris

scanners, and any Windows Biometric Framework compatible device.

The server component provides easy centralized management of

biometric authentication policies for all users, using a standard

Snap-In to the Microsoft Management Console. It provides greater

user assurance and Single Sign-On (“

SSO

”) convenience for all corporate systems and

cloud applications. There is no compromise in agility or user

experience.

GoVerifyID Enterprise Suite also provides options

for seamless integration with leading Enterprise Identity and

Access Management (“

IAM

”) solutions including CA SSO, IBM Security

Access Manager (“

ISAM

”), SAP Cloud Platform, and HPE’s

Aruba ClearPass. These turnkey integrations provide multi-modal

biometric authentication to replace or augment passwords for use

with enterprise and consumer class systems.

Our

pillphone® Platform:

●

Improves

medication adherence and manages chronic conditions by enriching

the relationship between the care team and the patient via its

enterprise level, mobile communication platform;

●

Digitally

connects healthcare providers with patients and provides support

when the patients are outside of the medical facility;

●

Streamlines

workflows and improves care team communication and collaboration

with the patient by offering personalized, two-way interactive,

secure messaging and real-time remote medication monitoring;

and

●

Enhances

the human connection of the care team that is essential for quality

patient-centered care.

Selected Risks Associated with an Investment in Shares of Our

Common Stock

Our business is subject to substantial risk.

Please carefully consider the section titled

“

Risk

Factors

” on page 4

of this Reoffer Prospectus for a

discussion of the factors you should carefully consider before

deciding to purchase the securities offered by this Reoffer

Prospectus. These risks include, among others:

●

available

cash resource may be insufficient to provide for our working

capital needs, including repaying borrowings under our lines of

credit due on or before December 31, 2018, for the next twelve

months;

●

we have a history of significant recurring losses, and we expect

that we will continue to incur substantial operating losses for the

foreseeable future;

●

we

depend upon a small number of large system sales, and if we fail to

achieve one or more large system sales in the future, our business

could be significantly harmed;

●

one

customer accounts for a significant percent of our total revenues,

and loss of such customer could adversely affect our results of

operations and financial condition;

●

a

significant number of our customers and potential customers are

government agencies that are subject to unique political and

budgetary constraints and have special contracting requirements,

which may affect our ability to obtain new and retain current

government customers;

●

Our

lengthy sales cycle may cause us to expend significant resources

for one year or more in anticipation of a sale to certain

customers, yet we still may fail to complete the sale;

●

we face significant competition from companies with greater

resources, and if we are unable to compete effectively, we may not

be able to achieve or maintain significant market penetration or

improve our results of operations;

●

we

operate in foreign countries and are exposed to risks associated

with foreign political, economic and legal environments and with

foreign currency exchange rates;

●

our

Common Stock is subject to “penny stock rules, which may make

it more difficult for holders to sell shares of our Common Stock in

the secondary market; and

●

our

stock has been volatile, and your investment in our Common Stock

could suffer a decline in value.

Additional risks and uncertainties not presently known to us or

that we currently deem immaterial may also impair our business

operations. You should be able to bear a complete loss of your

investment.

By this Reoffer Prospectus, the Selling

Stockholders are offering up to

4,368,954

shares of our Common Stock, which are

issuable pursuant to our Plan. The Selling Stockholders are not

required to sell their shares, and any future sales of Common Stock

by the Selling Stockholders are entirely at the discretion of the

Selling Stockholders. We will receive no proceeds from any future

sale of the shares of Common Stock in this offering. However, upon

any exercise of outstanding stock options granted under the Plan

and any stock options granted in the future under the Plan, we will

receive proceeds associated with such

exercises.

|

Securities Registered:

|

|

4,368,954

shares of common stock, par value $0.01 per share

|

|

|

|

|

|

Shares of Common Stock Outstanding Prior to Completion of the

Offering:

|

|

95,114,871

|

|

|

|

|

|

OTCQB Symbol:

|

|

IWSY

|

|

|

|

|

|

Transfer Agent:

|

|

Our transfer agent is ComputerShare. The transfer agent’s

address is 250 Royal Street, Canton, MA 02021

.

|

|

|

|

|

|

Risk Factors:

|

|

Our

business operations are subject to numerous risks. See

“

Risk Factors

”

beginning on page 4 of this Reoffer Prospectus for a discussion of

factors you should carefully consider before investing in our

securities.

|

|

|

|

|

|

Use of Proceeds:

|

|

We will

not receive any proceeds from the sale of the shares of Common

Stock registered pursuant to this Reoffer Prospectus. However, upon

exercise of outstanding stock options granted under the Plan and

any stock options granted in the future under the Plan, we will

receive proceeds associated with such exercises. To the extent that

we receive any funds from the exercise of options or other awards

issued to the Selling Stockholders under the Plans, such funds will

be used for

general corporate purposes

including, but not limited to capital expenditures, repayment of

indebtedness, and additions to working capital

.

|

|

|

|

|

|

Sales by Affiliates and Sales of Restricted Securities

|

|

Selling

Stockholders who are considered “affiliates” of the

Company, as defined in Rule 405 under the Securities Act, or who

are selling “restricted securities,” as defined in Rule

144(a)(3) under the Securities Act, may not sell an amount of

shares pursuant to this Reoffer Prospectus which exceeds in any

three month period the amount specified in Rule 144(e) under the

Securities Act.

|

An investment in our

securities involves a high degree of risk. You should consider the

risks, uncertainties and assumptions described under Item 1A,

“

Risk

Factors

,” in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2017,

which risk factors are incorporated herein by reference, and may be

amended, supplemented or superseded from time to time by other

reports we file with the SEC in the future. The risks and

uncertainties we have described in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2017 are not the only ones

we face. Additional risks and uncertainties not presently known to

us or that we currently deem immaterial may also affect our

operations. The occurrence of any of these known or unknown risks

might cause you to lose all or part of your

investment.

CAUTIONARY

NOTES

REGARDING

FORWARD-LOOKING

STATEMENTS

This

Reoffer Prospectus contains forward-looking statements that involve

substantial risks and uncertainties. All statements contained in

this Reoffer Prospectus other than statements of historical facts,

including statements regarding our strategy, future operations,

future financial position, future revenue, projected costs,

prospects, plans, objectives of management and expected market

growth, are forward-looking statements. These statements involve

known and unknown risks, uncertainties and other important factors

that may cause our actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

The

words “anticipate,” “believe,”

“estimate,” “expect,” “intend,”

“may,” “plan,” “predict,”

“project,” “target,”

“potential,” “will,” “would,”

“could,” “should,” “continue,”

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. These forward-looking statements include,

among other things, statements about:

●

the

availability of capital to satisfy our working capital

requirements;

●

the

accuracy of our estimates regarding expenses, future revenues and

capital requirements;

●

anticipated

trends and challenges in our business and the markets in which we

operate;

●

our ability to

implement our business strategy;

●

our

ability to anticipate market needs or develop new or enhanced

products to meet those needs;

●

our

expectations regarding market acceptance of our

products;

●

the

success of competing products by others that are or become

available in the market in which we sell our products;

●

our

ability to protect our confidential information and intellectual

property rights;

●

our

ability to manage expansion into international

markets;

●

our ability to

maintain or broaden our business relationships and develop new

relationships with strategic alliances, suppliers, customers,

distributors or otherwise;

●

developments

in the U.S. and foreign countries; and

●

other risks and uncertainties, including

those

described under Item

1A, “

Risk

Factors

,” in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2017,

which risk factors are incorporated herein by

reference

.

These

forward-looking statements are only predictions and we may not

actually achieve the plans, intentions or expectations disclosed in

our forward-looking statements, so you should not place undue

reliance on our forward-looking statements. Actual results or

events could differ materially from the plans, intentions and

expectations disclosed in the forward-looking statements we make.

We have based these forward-looking statements largely on our

current expectations and projections about future events and trends

that we believe may affect our business, financial condition and

operating results. We have included important factors in the

cautionary statements included in this Reoffer Prospectus, as well

as certain information incorporated by reference into this Reoffer

Prospectus, that could cause actual future results or events to

differ materially from the forward-looking statements that we make.

Our forward-looking statements do not reflect the potential impact

of any future acquisitions, mergers, dispositions, joint ventures

or investments we may make.

You

should read this Reoffer Prospectus with the understanding that our

actual future results may be materially different from what we

expect. We do not assume any obligation to update any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required by applicable

law.

USE OF PRO

CEEDS

This Reoffer Prospectus relates to shares of our

Common Stock that may be offered and sold from time to time in the

future by the Selling Stockholders. We will not receive any

proceeds from the sale of the shares of Common Stock registered

pursuant to this Reoffer Prospectus. However, upon any

exercise of outstanding stock options granted under the Plan and

any stock options granted in the future under the Plan, we will

receive proceeds associated with such exercises. To the extent

that we receive any funds from the exercise of options or other

awards issued to the Selling Stockholders under the Plan, such

funds will be used

for

general

corporate purposes including, but not limited to capital

expenditures, repayment of indebtedness, and additions to working

capital.

DETERMINATI

O

N OF OF

FERING PRICE

The

Selling Stockholders may, from time-to-time in the future, sell the

Common Stock issued to them from time-to-time upon exercise of

stock options granted to them under the Plan at prices and on terms

then prevailing or at prices related to the then current market

price, or in negotiated transactions.

The Selling Stockholders named in this Reoffer

Prospectus are offering up to

4,368,954

shares of our Common Stock, issuable

upon exercise of stock options granted to the Selling Stockholders

pursuant to the Plan.

The

following table provides, as of April 10, 2018, information

regarding the beneficial ownership of our Common Stock held by each

of the Selling Stockholders, including:

|

1.

|

the

number of shares of Common Stock beneficially owned by each Selling

Stockholder prior to this offering;

|

|

2.

|

the

total number of shares of Common Stock that are to be offered by

each Selling Stockholder;

|

|

3.

|

the

total number of shares of Common Stock that will be beneficially

owned by each Selling Stockholder upon completion of the offering;

and

|

|

4.

|

the

percentage beneficially owned by each Selling

Stockholder.

|

Information with respect to beneficial ownership is largely based

upon Company records, as well as information obtained from the

Selling Stockholders. Information with respect to “Shares

Beneficially Owned Prior to this Offering” includes the

shares issued pursuant to the Plan. Information with respect to

“Shares Beneficially Owned Upon Completion of this

Offering” assumes the sale of all shares of the Common Stock

offered by this Reoffer Prospectus and no other purchases or sales

of our Common Stock by the Selling Stockholders. Except as

described below and to our knowledge, each named Selling

Stockholder beneficially owns and has sole voting and investment

power over all Common Stock or rights to these shares of Common

Stock.

|

|

Position with the Company

|

Shares Beneficially Owned

Prior

to this Offering

(1)

|

Number of Shares Being

Offered

(2)

|

Shares Beneficially Owned

Upon

Completion of this Offering

|

|

|

|

|

|

|

|

|

|

James

Miller

|

Chief

Executive Officer, Chairman

|

2,417,062

|

2.5

%

|

700,000

|

1,717,062

|

1.8

%

|

|

Wayne

Wetherell

|

Senior

Vice President of Administration, Chief Financial Officer,

Secretary and Treasurer

|

658,794

|

*

|

210,000

|

448,794

|

*

|

|

David

Harding

|

Senior

Vice President, Chief Technical Officer

|

1,039,168

|

1.1

%

|

575,000

|

464,168

|

*

|

|

Robert

Brown

|

Vice

President, Sales and Business Development

|

312,500

|

*

|

450,000

|

-

|

*

|

|

David

Somerville

|

Senior

Vice President, Sales and Marketing

|

-

|

*

|

300,000

|

-

|

*

|

|

Charles

Crocker

|

Director

|

1,132,741

|

1.2

%

|

139,686

|

933,055

|

1.0

%

|

|

Charles

Frischer

|

Director

|

3,029,057

|

3.2

%

|

53,000

|

2,976,057

|

3.1

%

|

|

Dana

Kammersgard

|

Director

|

178,838

|

*

|

146,000

|

32,838

|

*

|

|

David

Carey

|

Director

|

235,522

|

*

|

129,686

|

105,836

|

*

|

|

David

Loesch

|

Director

|

263,730

|

*

|

129,686

|

134,044

|

*

|

|

Guy

Steve Hamm

|

Director

|

235,608

|

*

|

139,686

|

95,922

|

*

|

|

John

Cronin

|

Director

|

196,022

|

*

|

139,686

|

56,336

|

*

|

|

Neal

Goldman

|

Director

|

41,882,559

|

40.7

%

|

139,686

|

41,742,873

|

40.7

%

|

|

Robert

Clutterbuck

|

Director

|

2,142,348

|

2.3

%

|

53,000

|

2,089,348

|

2.2

%

|

|

Aaron

Pantuch

|

Employee

|

44,329

|

*

|

10,000

|

34,329

|

*

|

|

Adam

Robertson

|

Employee

|

7,500

|

*

|

3,000

|

4,500

|

*

|

|

Ali

Sheikh

|

Employee

|

13,336

|

*

|

21,500

|

-

|

*

|

|

Anand

Srinivasan

|

Employee

|

-

|

*

|

30,000

|

-

|

*

|

|

Anna

Brzozowski

|

Employee

|

10,000

|

*

|

10,000

|

-

|

*

|

|

Brenda

Wenger

|

Employee

|

-

|

*

|

5,000

|

-

|

*

|

|

Brett

Sullivan

|

Employee

|

4,250

|

*

|

3,000

|

1,250

|

*

|

|

Brian

Foott

|

Employee

|

67,668

|

*

|

45,000

|

22,668

|

*

|

|

Christopher

Stage

|

Employee

|

-

|

*

|

10,000

|

-

|

*

|

|

Cristina

Vasquez

|

Employee

|

4,584

|

*

|

7,000

|

-

|

*

|

|

Dale

Peek

|

Employee

|

41,168

|

*

|

45,000

|

-

|

*

|

|

Daniel

Scriber

|

Employee

|

5,002

|

*

|

12,000

|

-

|

*

|

|

Darren

Semmel

|

Employee

|

39,168

|

*

|

85,000

|

-

|

*

|

|

David

Mann

|

Employee

|

13,000

|

*

|

5,500

|

7,500

|

*

|

|

David

Tutt

|

Former

Employee

|

2,088

|

*

|

2,088

|

-

|

*

|

|

Eden

Celeste

|

Employee

|

10,500

|

*

|

5,000

|

5,500

|

*

|

|

Gavin

Jung

|

Employee

|

32,000

|

*

|

9,500

|

22,500

|

*

|

|

Gregg

Curry

|

Employee

|

4,052

|

*

|

3,000

|

1,052

|

*

|

|

Henry

Chan

|

Employee

|

10,000

|

*

|

15,000

|

-

|

*

|

|

Jackie

Williford

|

Employee

|

8,500

|

*

|

5,000

|

3,500

|

*

|

|

Jeffrey

Hotze

|

Employee

|

143,417

|

*

|

65,000

|

78,417

|

*

|

|

Jesse

Gomez

|

Employee

|

5,500

|

*

|

3,000

|

2,500

|

*

|

|

Jie

Feng Chen

|

Employee

|

4,168

|

*

|

7,000

|

-

|

*

|

|

John

Zetterberg

|

Employee

|

14,332

|

*

|

17,000

|

-

|

*

|

|

Jonathan

Nichols

|

Employee

|

90,834

|

*

|

55,000

|

35,834

|

*

|

|

Kevin

Cordel

|

Independent

Contractor

|

56,250

|

*

|

50,000

|

6,250

|

*

|

|

Laura

Frease

|

Employee

|

-

|

*

|

20,000

|

-

|

*

|

|

Lisa

Caccamese

|

Employee

|

14,500

|

*

|

3,000

|

11,500

|

*

|

|

Mark

Virnig

|

Employee

|

36,668

|

*

|

75,000

|

-

|

*

|

|

Matthew

Klep

|

Employee

|

61,064

|

*

|

39,000

|

22,064

|

*

|

|

Matthew

Saporito

|

Employee

|

-

|

*

|

2,500

|

-

|

*

|

|

Michael

Campbell

|

Employee

|

7,500

|

*

|

9,500

|

-

|

*

|

|

Mike

Rerick

|

Employee

|

13,000

|

*

|

3,000

|

10,000

|

*

|

|

Patrick

Anderson

|

Employee

|

10,000

|

*

|

7,500

|

2,500

|

*

|

|

Paul

Curry

|

Employee

|

8,000

|

*

|

5,000

|

3,000

|

*

|

|

Peter

Storli

|

Employee

|

-

|

*

|

2,500

|

-

|

*

|

|

Phillip

Brown

|

Employee

|

8,000

|

*

|

5,000

|

3,000

|

*

|

|

Phillipp

Debus

|

Employee

|

7,000

|

*

|

3,500

|

3,500

|

*

|

|

Quang

Vu

|

Employee

|

21,000

|

*

|

7,500

|

13,500

|

*

|

|

Raisa

Pantuch

|

Employee

|

76,903

|

*

|

50,000

|

26,903

|

*

|

|

Randy

Singh

|

Employee

|

5,500

|

*

|

3,000

|

2,500

|

*

|

|

Rebekah

Folsom

|

Employee

|

10,500

|

*

|

12,500

|

-

|

*

|

|

Richard

Johnson

|

Employee

|

15,002

|

*

|

21,500

|

-

|

*

|

|

Robb

Wijnhausen

|

Employee

|

26,000

|

*

|

14,500

|

11,500

|

*

|

|

Robert

Nies

|

Employee

|

13,336

|

*

|

30,000

|

-

|

*

|

|

Scott

Wallace

|

Employee

|

15,500

|

*

|

2,500

|

13,000

|

*

|

|

Sharon

Hall

|

Employee

|

3,586

|

*

|

3,000

|

586

|

*

|

|

Sheryl

Edward

|

Employee

|

112,500

|

*

|

60,000

|

52,500

|

*

|

|

Steve

Timm

|

Employee

|

75,000

|

*

|

54,000

|

21,000

|

*

|

|

Svetla

Iovtcheva

|

Employee

|

27,168

|

*

|

8,000

|

19,168

|

*

|

|

Tom

Evangelisti

|

Employee

|

125,185

|

*

|

25,000

|

100,185

|

*

|

|

Tom

Leinberger

|

Former

Employee

|

62,500

|

*

|

56,250

|

6,250

|

*

|

|

William

Moore

|

Employee

|

-

|

*

|

9,500

|

-

|

*

|

|

Yang

Zhang

|

Employee

|

3,000

|

*

|

2,500

|

500

|

*

|

* less than 1%

(1)

The

number and percentage of shares beneficially owned is determined in

accordance with Rule 13d-3 of the Securities Exchange Act of 1934,

as amended, and the information is not necessarily indicative of

beneficial ownership for any other purpose. Under such rule,

beneficial ownership includes any shares as to which the Selling

Stockholder has sole or shared voting power or investment power and

also any shares, which the Selling Stockholder has the right to

acquire within 60 days from April 10, 2018. “

Shares Beneficially Owned Upon Completion of

this Offering

” assumes the sale of all of the Common

Stock offered by this Reoffer Prospectus and no other purchases or

sales of our Common Stock by the Selling stockholders.

(2)

Includes shares

that are issuable upon exercise of stock options issued pursuant to

the Plans, some of which are not, and will not become vested within

60 days from April 10, 2018, and are not included in the

calculation of “

Shares

Beneficially Owned Prior to this Offering

.”

(3)

Applicable

percentage ownership is based on 95,114,871 shares of Common Stock

outstanding as of April 10, 2018, together with securities

exercisable or convertible into shares of Common Stock within 60

days of April 10, 2018 for each stockholder, including, for

purposes of the shares beneficially owned prior to the Offering,

the shares offered for resale pursuant to this Reoffer

Prospectus.

Beneficial

ownership is determined in accordance with the rules of the SEC and

generally includes voting or investment power with respect to

securities. Shares of Common Stock that are currently exercisable

or exercisable within 60 days of April 10, 2018, are deemed to be

beneficially owned by the person holding such securities for the

purpose of computing the percentage of ownership of such person,

but are not treated as outstanding for the purpose of computing the

percentage ownership of any other person.

Timing of Sales

Subject

to the foregoing, the Selling Stockholders may elect to offer and

sell the shares covered by this Reoffer Prospectus at various times

in the future. The Selling Stockholders will act independently of

our Company in making decisions with respect to the timing, manner

and size of each sale.

No Known Agreements to Resell the Shares

To

our knowledge, no Selling Stockholder has any agreement or

understanding, directly or indirectly, with any person to resell

the Common Stock covered by this Reoffer Prospectus.

Offering Price

The

sales price offered by the Selling Stockholders to the public may

be:

|

1.

|

the

market price prevailing at the time of sale;

|

|

2.

|

a price

related to such prevailing market price; or

|

|

3.

|

such

other price as the selling stockholders determine from time to

time.

|

Manner of Sale

To the extent permissible, the shares of Common Stock may be sold

by means of one or more of the following methods:

|

1.

|

a block

trade in which the broker-dealer so engaged will attempt to sell

the Common Stock as agent, but may position and resell a portion of

the block as principal to facilitate the transaction;

|

|

2.

|

purchases

by a broker-dealer as principal and resale by that broker-dealer

for its account pursuant to this Reoffer Prospectus;

|

|

3.

|

ordinary

brokerage transactions in which the broker solicits

purchasers;

|

|

4.

|

through

options, swaps or derivatives;

|

|

5.

|

in

transactions to cover short sales;

|

|

6.

|

privately

negotiated transactions; or

|

|

7.

|

in a

combination of any of the above methods.

|

The

Selling Stockholders may, from time-to-time in the future, sell

their Common Stock directly to purchasers or may use brokers,

dealers, underwriters or agents to sell their Common Stock. Brokers

or dealers engaged by the selling stockholders may arrange for

other brokers or dealers to participate. Brokers or dealers may

receive commissions, discounts or concessions from the selling

stockholders, or, if any such broker-dealer acts as agent for the

purchaser of Common Stock, from the purchaser in amounts to be

negotiated immediately prior to the sale. The compensation received

by brokers or dealers may, but is not expected to, exceed that

which is customary for the types of transactions

involved.

Broker-dealers

may agree with a Selling Stockholder to sell a specified number of

Common Stock at a stipulated price per share, and, to the extent

the broker-dealer is unable to do so acting as agent for a selling

stockholder, to purchase as principal any unsold Common Stock at

the price required to fulfill the broker-dealer commitment to the

selling stockholder.

Broker-dealers

who acquire Common Stock as principal may thereafter resell the

Common Stock from time to time in transactions, which may involve

block transactions and sales to and through other broker-dealers,

including transactions of the nature described above, in the

over-the-counter market or otherwise at prices and on terms then

prevailing at the time of sale, at prices then related to the

then-current market price or in negotiated transactions. In

connection with resales of the Common Stock, broker-dealers may pay

to or receive from the purchasers of shares commissions as

described above.

If

the Selling Stockholders enter into arrangements with brokers or

dealers, as described above, we are obligated to file a

post-effective amendment to this registration statement disclosing

such arrangements, including the names of any broker-dealers acting

as underwriters.

The

Selling Stockholders and any broker-dealers or agents that

participate with the Selling Stockholders in the sale of the Common

Stock may be deemed to be “underwriters” within the

meaning of the Securities Act. In that event, any commissions

received by broker-dealers or agents and any profit on the resale

of the Common Stock purchased by them may be deemed to be

underwriting commissions or discounts under the Securities

Act.

Sales by Affiliates and Sales of Restricted Securities

Selling

Stockholders who are considered “affiliates” of the

Company, as defined in Rule 405 under the Securities Act, or who

are selling “restricted securities”, as defined in Rule

144(a)(3) under the Securities Act, may not sell an amount of

shares pursuant to this Reoffer Prospectus which exceeds in any

three month period the amount specified in Rule 144(e) under the

Securities Act.

Sales Pursuant to Rule 144

Any

shares of Common Stock covered by this Reoffer Prospectus which

qualify for sale pursuant to Rule 144 under the Securities Act may

be sold under Rule 144 rather than pursuant to this Reoffer

Prospectus.

Accordingly,

during such times as a Selling Stockholder may be deemed to be

engaged in a distribution of the Common Stock, and therefore be

considered to be an underwriter, the selling stockholder must

comply with applicable law and, among other things:

|

1.

|

may not

engage in any stabilization activities in connection with our

Common Stock;

|

|

2.

|

may not

cover short sales by purchasing shares while the distribution is

taking place; and

|

|

3.

|

may not

bid for or purchase any of our securities or attempt to induce any

person to purchase any of our securities other than as permitted

under the Exchange Act.

|

In

addition, we will make copies of this Reoffer Prospectus available

to the Selling Stockholders for the purpose of satisfying the

prospectus delivery requirements of the Securities

Act.

State Securities Laws

Under

the securities laws of some states, the Common Stock may be sold in

such states only through registered or licensed brokers or dealers.

In addition, in some states the Common Stock may not be sold unless

the stock has been registered or qualified for sale in the state or

an exemption from registration or qualification is available and is

complied with.

Expenses of Registration

We are bearing all costs relating to the registration of the Common

Stock which may be sold from time-to-time in the future by the

Selling Stockholders. These expenses are estimated to include, but

are not limited to, legal, accounting, printing and mailing fees.

The Selling Stockholders, however, will pay any commissions or

other fees payable to brokers or dealers in connection with any

future sale of their Common Stock pursuant to this Reoffer

Prospectus.

The validity of the Common Stock offered by this

Reoffer Prospectus will be passed upon by Disclosure Law Group, a

Professional Corporation, of San Diego, California

(“

DLG

”).

The consolidated

financial statements of ImageWare Systems, Inc. appearing in our

Annual Report on Form 10-K for the year ended December 31,

2017, and the effectiveness of ImageWare Systems, Inc.’s

internal control over financial reporting as of December 31,

2017, have been audited by Mayer Hoffman McCann

P.C.

of San Diego,

California

, an independent

registered public accounting firm, as set forth in their reports

thereon, included therein, and incorporated herein by reference.

Such consolidated financial statements are incorporated herein by

reference in reliance upon such reports given on the authority of

such firm as experts in accounting and

auditing.

INCORPORATION OF CER

T

AIN DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” into this

Reoffer Prospectus the information that we file with the SEC. This

means that we can disclose important information to you by

referring you to those documents. Information incorporated by

reference is part of this Reoffer Prospectus. Until such time that

a post-effective amendment to this Reoffer Prospectus has been

filed which indicates that all securities offered hereby have been

sold or which deregisters all securities remaining unsold at the

time of such amendment, all documents subsequently filed by the

Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Securities Exchange Act of 1934, as amended, shall be deemed to be

incorporated by reference in this Reoffer Prospectus and to be a

part hereof from the date of filing of such documents. Information

that we file at a future date with the SEC will update and

supersede this information. For further information about the

Company and our Common Stock, please read the documents

incorporated by reference below.

|

(a)

|

The

Registrant’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2017, as filed with the SEC on March 19,

2018;

|

|

(b)

(c)

|

The

Registrant’s Current Report on Form 8-K, as filed with the

SEC on February 13, 2018; and

The description of our Common Stock contained in the Registration

Statement on Form 8-A filed pursuant to Section 12(b) of the

Exchange Act on March 21, 2000, including any amendment or report

filed with the SEC for the purpose of updating this

description

.

|

WHERE YOU

C

AN FIND

ADDITIONAL INFORMATION

This

Reoffer Prospectus is part of a registration statement on Form S-8

that we filed with the SEC. Certain information in the registration

statement has been omitted from this Reoffer Prospectus in

accordance with the rules of the SEC. We file annual, quarterly and

special reports, proxy statements and other information with the

SEC. You can inspect and copy the registration statement as well as

reports, proxy statements and other information we have filed with

the SEC at the public reference room maintained by the SEC at 100 F

Street N.E. Washington, D.C. 20549, You can obtain copies from the

public reference room of the SEC at 100 F Street N.E. Washington,

D.C. 20549, upon payment of certain fees. You can call the SEC at

1-800-732-0330 for further information about the public reference

room. We are also required to file electronic versions of these

documents with the SEC, which may be accessed through the

SEC’s website at http://www.sec.gov.

No

dealer, salesperson or other person is authorized to give any

information or to make any representations other than those

contained in this Reoffer Prospectus, and, if given or made, such

information or representations must not be relied upon as having

been authorized by us. This Reoffer Prospectus does not constitute

an offer to buy any security other than the securities offered by

this Reoffer Prospectus, or an offer to sell or a solicitation of

an offer to buy any securities by any person in any jurisdiction

where such offer or solicitation is not authorized or is unlawful.

Neither delivery of this Reoffer Prospectus nor any sale hereunder

shall, under any circumstances, create any implication that there

has been no change in the affairs of our company since the date

hereof.

DISCLOSURE OF COMMISS

I

ON POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Insofar

as indemnification for liabilities arising under the Securities Act

may be permitted to our directors, officers or persons controlling

us pursuant to the foregoing provisions, we have been informed that

in the opinion of the SEC such indemnification is against public

policy as expressed in the Securities Act and is therefore

unenforceable. In addition, indemnification may be limited by state

securities laws.

IMAGEWARE SYSTEMS, INC.

4,368,954

shares of Common

Stock

Reoffer Prospectus

Dated, April 19, 2018

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item

3.

Incorporation

of Documents by Reference

The following

documents, which have been previously filed by the Registrant with

the Securities and Exchange Commission (the

“

SEC

”),

are hereby incorporated by reference in this Registration

Statement:

|

(a)

|

The

Registrant’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2017, as filed with the SEC on March 19,

2018;

|

|

(b)

(c)

|

The

Registrant’s Current Report on Form 8-K, as filed with the

SEC on February 13, 2018; and

The description of our Common Stock contained in the Registration

Statement on Form 8-A filed pursuant to Section 12(b) of the

Exchange Act on March 21, 2000, including any amendment or report

filed with the SEC for the purpose of updating this

description

.

|

Until

such time that a post-effective amendment to this Registration

Statement has been filed which indicates that all securities

offered hereby have been sold or which deregisters all securities

remaining unsold at the time of such amendment, all documents

subsequently filed by the Registrant pursuant to Sections 13(a),

13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as

amended, shall be deemed to be incorporated by reference in this

Registration Statement and to be a part hereof from the date of

filing of such documents. Any statement contained herein or in a

document incorporated or deemed to be incorporated by reference

herein shall be deemed to be modified or superseded for purposes of

this Registration Statement to the extent that a statement

contained herein or in any subsequently filed document which is

also deemed to be incorporated by reference herein modifies or

supersedes such statement. Any such statement so modified or

superseded shall not be deemed, except as so modified or

superseded, to constitute a part of this Registration

Statement.

Item 4.

Description of Securities

Not

applicable.

Item 5.

Interests of Named Experts and Counsel

Not

applicable.

Item 6.

Indemnification of Directors and Officers

Our

certificate of incorporation and bylaws contain provisions relating

to the limitation of liability and indemnification of directors and

officers. Our certificate of incorporation provides that a director

will not be personally liable to us or our stockholders for

monetary damages for breach of fiduciary duty as a director, except

for liability:

|

●

|

for any

breach of the director’s duty of loyalty to us or our

stockholders;

|

|

●

|

for

acts or omissions not in good faith or that involve intentional

misconduct or a knowing violation of law;

|

|

●

|

under

Section 174 of the Delaware General Corporation Law (the

“

DGCL

”);

or

|

|

●

|

for any

transaction from which the director derived any improper personal

benefit.

|

Our

certificate of incorporation also provides that if the DGCL is

amended to authorize corporate action further eliminating or

limiting the personal liability of directors, then the liability of

our directors will be eliminated or limited to the fullest extent

permitted by the DGCL.

Our bylaws provide that we will

indemnify our directors and officers to the fullest extent not

prohibited by the DGCL;

provided, however,

that we may limit the extent of such

indemnification by individual contracts with our directors and

executive officers; and provided, further, that we are not required

to indemnify any director or executive officer in connection with

any proceeding (or part thereof) initiated by such person or any

proceeding by such person against us or our directors, officers,

employees or other agents unless:

|

●

|

such

indemnification is expressly required to be made by

law;

|

|

●

|

the

proceeding was authorized by the Board of Directors;

or

|

|

●

|

such

indemnification is provided by us, in our sole discretion, pursuant

to the powers vested in us under the DGCL.

|

Our

bylaws provide that we shall advance, prior to the final

disposition of any proceeding, promptly following request therefor,

all expenses by any director or executive officer in connection

with any such proceeding upon receipt of any undertaking by or on

behalf of such person to repay said amounts if it should be

determined ultimately that such person is not entitled to be

indemnified under Article XIII of our bylaws or otherwise.

Notwithstanding the foregoing, unless otherwise determined, no

advance shall be made by us if a determination is reasonably and

promptly made by the Board of Directors by a majority vote of a

quorum of directors who were not parties to the proceeding, or if

such a quorum is not obtainable, or even if obtainable, a quorum of

disinterested directors so directs, by independent legal counsel in

a written opinion, that the facts known to the decision-making

party at the time such determination is made demonstrate clearly

and convincingly that such person acted in bad faith or in a manner

that such person did not believe to be in or not opposed to our

best interests.

Our

bylaws also authorize us to purchase insurance on behalf of any

person required or permitted to be indemnified pursuant to Article

XIII of our bylaws.

Section

145(a) of the DGCL authorizes a corporation to indemnify any person

who was or is a party, or is threatened to be made a party, to a

threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative (other

than an action by or in the right of the corporation), by reason of

the fact that the person is or was a director, officer, employee or

agent of the corporation, or is or was serving at the request of

the corporation as a director, officer, employee or agent of

another corporation, partnership, joint venture, trust or other

enterprise, against expenses (including attorneys’ fees),

judgments, fines and amounts paid in settlement actually and

reasonably incurred by the person in connection with such action,

suit or proceeding, if the person acted in good faith and in a

manner the person reasonably believed to be in, or not opposed to,

the best interests of the corporation and, with respect to any

criminal action or proceeding, had no reasonable cause to believe

the person’s conduct was unlawful.

Section

145(b) of the DGCL provides in relevant part that a corporation may

indemnify any person who was or is a party or is threatened to be

made a party to any threatened, pending or completed action or suit

by or in the right of the corporation to procure a judgment in its

favor by reason of the fact that the person is or was a director,

officer, employee or agent of the corporation, or is or was serving

at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust

or other enterprise against expenses (including attorneys’

fees) actually and reasonably incurred by the person in connection

with the defense or settlement of such action or suit if the person

acted in good faith and in a manner the person reasonably believed

to be in or not opposed to the best interests of the corporation

and except that no indemnification shall be made in respect of any

claim, issue or matter as to which such person shall have been

adjudged to be liable to the corporation unless and only to the

extent that the Court of Chancery or the court in which such action

or suit was brought shall determine upon application that, despite

the adjudication of liability but in view of all the circumstances

of the case, such person is fairly and reasonably entitled to

indemnity for such expenses which the Court of Chancery or such

other court shall deem proper.

The

DGCL also provides that indemnification under Section 145(d) can

only be made upon a determination that indemnification of the

present or former director, officer or employee or agent is proper

in the circumstances because such person has met the applicable

standard of conduct set forth in Section 145(a) and

(b).

Section

145(g) of the DGCL also empowers a corporation to purchase and

maintain insurance on behalf of any person who is or was a

director, officer, employee or agent of the corporation, or is or

was serving at the request of the corporation as a director,

officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise against any liability

asserted against such person and incurred by such person in any

such capacity, or arising out of such person’s status as

such, whether or not the corporation would have the power to

indemnify such person against such liability under Section 145 of

the DGCL.

Section

102(b)(7) of the DGCL permits a corporation to provide for

eliminating or limiting the personal liability of one of its

directors for any monetary damages related to a breach of fiduciary

duty as a director, as long as the corporation does not eliminate

or limit the liability of a director for acts or omissions which

(1) which breached the director’s duty of loyalty to the

corporation or its stockholders, (2) which were not in good faith

or which involve intentional misconduct or knowing violation of

law, (3) under Section 174 of the DGCL; or (4) from which the

director derived an improper personal benefit.

We

have obtained directors’ and officers’ insurance to

cover our directors and officers for certain

liabilities.

Item 7.

Exemption from Registration Claimed

Not

applicable.

Item 8.

Exhibits

|

Exhibit

No.

|

|

Document Description

|

|

Incorporation by Reference

|

|

|

|

Opinion

and Consent of Disclosure Law Group

|

|

Filed

herewith.

|