Current Report Filing (8-k)

March 23 2018 - 5:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 23, 2018

_____________________________

Medtronic Public Limited Company

(Exact name of Registrant as Specified in its Charter)

_____________________________

|

|

|

|

|

|

|

|

|

Ireland

|

|

1-36820

|

|

98-1183488

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

20 On Hatch, Lower Hatch Street

Dublin 2, Ireland

|

|

(Address of principal executive offices)

|

(Registrant’s telephone number, including area code):

+353 1 438-1700

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

On March 23, 2018, Medtronic plc (the “Company”) announced that it intends to redeem approximately $1.2 billion of Medtronic, Inc.’s Senior Notes, consisting of all of Medtronic, Inc.’s $400.0 million aggregate principal amount of 5.600% Senior Notes due 2019 (the “2019 Notes”) and $765.6 million aggregate principal amount of 4.450% Senior Notes due 2020 (the “2020 Notes” and together with the 2019 Notes, the “Notes”), in each case at a redemption price equal to the outstanding principal amount of the Notes and a make-whole premium as specified in the applicable indenture, plus accrued and unpaid interest. The redemption date for the Notes will be April 27, 2018. The Company believes the redemption represents an attractive opportunity to deploy its capital efficiently, given the economic benefit of lower net interest expense and lower average cost of debt outstanding.

On March 23, 2018, the Company further announced that it intends to repurchase a minimum of $1.2 billion of its ordinary shares over the course of its 2019 fiscal year, which will be in addition to the Company’s planned share repurchases to offset employee compensation dilution. These repurchases will be made pursuant to the Company’s existing $5.0 billion share repurchase program previously authorized by the Company’s Board of Directors. The Company may repurchase any such shares from time to time, at the discretion of management of the Company, in open market or privately negotiated transactions, in each case subject to market conditions and other factors.

The Company intends to fund the redemption of the Notes and the repurchase of its ordinary shares with cash and cash equivalents on hand.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements regarding future events and the company's future results that are subject to the safe harbor created under Private Securities Litigation Reform Act of 1995 and other safe harbors under the Securities Act and the Securities Exchange Act of 1934. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but without limitation, statements relating to the redemption of the Notes and the repurchase of ordinary shares. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified in the risk factors and cautionary statements described in the Company’s filings with the United States Securities and Exchange Commission, including the risk factors contained in the Company’ most recent Annual Report on Form 10-K. The Company does not undertake to update its forward-looking statements or any of the information contained in this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDTRONIC PUBLIC LIMITED COMPANY

|

|

|

|

|

|

|

|

|

|

|

By

|

|

/s/ Karen L. Parkhill

|

|

Date: March 23, 2018

|

|

|

|

|

|

Karen L. Parkhill

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

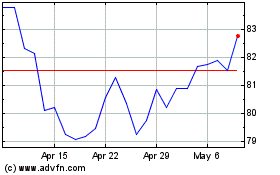

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

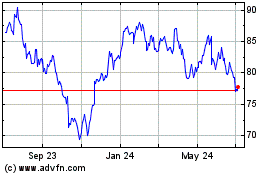

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024