Drink Makers Combat Soda Slump -- WSJ

February 12 2018 - 3:02AM

Dow Jones News

By Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 12, 2018).

Coca-Cola Co., PepsiCo Inc. and Dr Pepper Snapple Group Inc.

have been remaking themselves for the past decade, adding products

like kombucha tea and coconut water as consumers migrate to less

sugary drinks.

But the three drink giants, set to report their fourth-quarter

earnings this week, have recently embraced different strategies to

combat the long slide in soda sales.

PepsiCo said Thursday it is launching a colorful seltzer water

brand called Bubly, making it the latest drink company to go after

a larger piece of the flavored sparkling water market. The market

grew by more than 15% last year to $2.4 billion, according to

research firm Euromonitor International, led by National Beverage

Corp.'s La Croix.

PepsiCo will need Bubly and more to reinvigorate its North

American beverage unit, its largest, whose profit dropped 10% last

quarter. The company blamed disappointing results on cooler summer

weather and too much marketing focus on healthier brands. Analysts

polled by Thomson Reuters expect the segment to report

fourth-quarter revenue of $5.9 billion, down from $6.3 billion a

year ago.

To offset the drop, PepsiCo has leaned on its snack business,

which includes brands such as Doritos and Sun Chips, and a

companywide cost-cutting initiative that has yielded annual savings

of around $1 billion. But analysts worry the Purchase, N.Y.-company

is making things worse for itself by not keeping drink prices in

line with those of competitors.

Dr Pepper, the smallest of the three drink rivals, revealed

plans last month to merge with Keurig Green Mountain, a company

best known for its single-serve coffee pods, in a $19 billion

tie-up that has industry-watchers both stumped and intrigued.

Executives from the two companies say the deal will allow Keurig

and its owner, the European investment firm JAB, to add their

coffees to Dr Pepper's distribution network and strengthen Dr

Pepper's e-commerce capabilities.

While it could give Keurig's sales a needed boost, implications

are less clear for Dr Pepper's faltering soda business, which

includes brands like A&W Root Beer and 7UP. When Dr Pepper

reports earnings Wednesday, its investors will want to know what to

expect, beyond a $103.75 per share special cash dividend.

"I'm not sure anything they say will matter for the stock, given

the M&A, " Bernstein analyst Ali Dibadj said. "But I think we'd

like to see if there's any sign explaining why this sudden

sale."

Coca-Cola is betting four new flavors of Diet Coke in sleeker

cans with names like "Zesty Blood Orange" will help it hold on to

soda drinkers a little longer.

The Atlanta-based company's Diet Coke sales have dropped every

year since 2006, though Coca-Cola managed to keep its soda volumes

flat last quarter. The results were helped by Coca-Cola Zero Sugar,

which like Diet Coke is artificially sweetened and

calorie-free.

While Diet Coke is still the third-largest carbonated soft drink

brand in the country, according to industry publication

Beverage-Digest, the new flavors are competing with a

larger-than-ever bevy of alternatives including fizzy waters and

other flavored no-calorie and low-calorie drinks.

The new drinks hit shelves after the fourth-quarter ended, but

Coca-Cola might hint at early results when it reports earnings

Friday. Investors will also want to see how much refranchising

bottling operations boosted the company's operating profit margin

last quarter.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

February 12, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

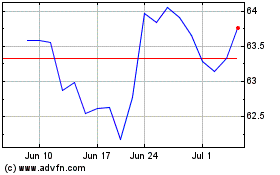

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024