Sixty Percent of Retail Investors Feel Better off Financially Compared to a Year Ago According to the Latest Schwab Wealth Ma...

January 31 2018 - 11:30AM

Business Wire

Charles Schwab today released its latest retail client behavior

and sentiment report covering the second half of 2017.

This press release features multimedia. View

the full release here:

http://www.businesswire.com/news/home/20180131005375/en/

Terri Kallsen, Executive Vice President

and head of Schwab Investor Services (Photo: Business Wire)

Key highlights from the “Schwab Wealth Management Monitor”

include:

- Schwab retail clients overall were net

buyers during the second half of 2017.

- Average cash allocation across all

retail clients decreased to 18.5% (from 21.1% a year ago).

- Nearly 60% of Schwab clients feel

better off financially compared to a year ago – the highest rating

in five years.

- Client outlook for the U.S. stock

market is down slightly with 40% feeling bullish compared to 42% a

year ago; 41% now feel bearish – a 10% increase from a year

ago.

- The political landscape in Washington

and the possibility of a stock market correction are the top

investor concerns.

“There are signs of continued positivity from retail investors

with an increasing number of clients feeling better off compared to

a year ago,” said Charles Schwab Executive Vice President and head

of Investor Services Terri Kallsen. “But we’re also seeing some

bears come out of hibernation due to concerns about a possible

stock market correction and uncertainty in Washington D.C.”

The Q3/Q4 2017 Schwab Wealth Management Monitor report

represents more than seven million retail client accounts and more

than $1.2 trillion in assets.

The full report is available here.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

Disclosures

Sentiment findings based on an online internal survey of 1,067

Schwab Investor Services clients between December 4-14, 2017. Data

analyzed by Koski Research.

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE: SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. Koski Research is not

affiliated with the Charles Schwab Corporation or its affiliates.

More information is available at www.schwab.com and

www.aboutschwab.com.

Investment Products: Not FDIC Insured • No Bank Guarantee •

May Lose Value.

(0118-8MFL)

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180131005375/en/

Charles SchwabMichael Cianfrocca,

415-667-0344michael.cianfrocca@schwab.com

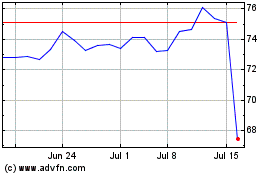

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

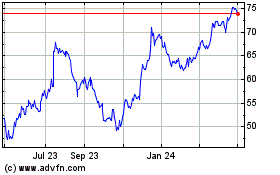

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024