As filed with the Securities and Exchange

Commission on January 12 , 2018

File

No. 333- 222360

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT NO. 1

TO

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

DUO

WORLD, INC.

(Exact

name of registrant as specified in its charter)

|

NEVADA

|

|

35-2517572

|

|

(State

of Incorporation)

|

|

(I.R.S.

Employer Identification No.)

|

c/o

Duo Software (Pvt.) Ltd, No. 403 Galle Road, Colombo 03, Sri Lanka

(Address

of Principal Executive Offices)

Duo

World, Inc. 2017 Employee Stock Ownership Plan

(Full

title of the plan)

Muhunthan

Canagasooryam

President

and CEO

c/o

Duo Software (Pvt.) Ltd.

No.

403 Galle Road

Colombo

03, Sri Lanka

(Name

and address of agent for service)

(870)

505-6540

(Telephone

number, including area code, of agent for service)

With

a copy to:

David

E. Wise, Esq.

The

Colonnade

9901

IH-10 West, Suite 800

San

Antonio, Texas 78230

(210)

323-6074

Email:

wiselaw@verizon.net

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting

company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act

|

Large

accelerated filer

|

[ ]

|

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated

filer

|

[ ]

|

|

Smaller

reporting company

|

[X]

|

|

(Do

not check if a smaller reporting company)

|

Emerging

Growth Company

|

[X]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

[X]

CALCULATION

OF REGISTRATION FEE

|

Title

of each class of

securities

to be registered

|

|

Amount to be

registered

|

|

Proposed maximum

offering price

per unit (1)

|

|

|

Proposed maximum aggregate

offering price

|

|

|

Amount of

registration fee

|

|

|

Common Stock, $0.001 par value

|

|

9,611,665 Shares

|

|

$

|

.465

|

|

|

$

|

4,469,424

|

|

|

$

|

556.44

|

(1)

|

|

Total

|

|

9,611,665 Shares

|

|

$

|

.465

|

|

|

$

|

4,469,424

|

|

|

$

|

556.44

|

(1)

|

|

|

(1)

|

Pursuant

to Rule 457 (c) of the Securities Act of 1933, as amended, the registration fee is calculated on the basis of the average

of the closing bid and ask prices for the Common Stock as quoted on OTC Bulletin Board at the close of trading on December

28, 2017.

|

EXPLANATORY

NOTE

This

Registration Statement on Form S-8 of Duo World, Inc. (“we,” “us,” “our,” the “Company”

or the “Registrant”) has been prepared in accordance with the requirements of Form S-8 under the Securities Act of

1933, as amended, to 9,611,665 shares of Common Stock reserved for issuance under the Duo World, Inc. 2017 Employee Stock Ownership

Plan.

This

Registration Statement also includes a prospectus (which we refer to as the “reoffer prospectus”) prepared in accordance

with General Instruction C of Form S-8 and in accordance with Part I of Form S-3. The reoffer prospectus may be used for reofferings

and resales of certain of the shares of our Common Stock listed above that may be deemed to be “control securities”

and/or “restricted securities” under the Securities Act of 1933, as amended, and the rules and regulations promulgated

thereunder. These are the shares that will be acquired by our officers and directors, or that will be acquired by our employees,

under an employee benefit plan. Such officer, directors and employees are the selling shareholders identified in the reoffer prospectus.

We are filing this

Amendment No. 1 to our Registration Statement to add additional “Selling Shareholders” and to correct minor discrepancies

in the information provided under the section entitled “Selling Shareholders.”

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

documents containing the information specified in Part I of this Registration Statement will be sent or given to employees as

specified under Rule 428(b)(1) of the Securities Act of 1933, as amended (“Securities Act”). Such documents are not

being filed with the Securities and Exchange Commission (“Commission”) either as part of this Registration Statement

or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated

by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item

1. Plan Information.

Not

applicable.

Item

2. Registrant Information and Employee Plan Annual Information.

We

will provide to each participant in our 2017 Employee Stock Ownership Plan a written statement advising them of the availability

of documents incorporated by reference in Item 3 of Part II of this Registration Statement and of documents required to be delivered

pursuant to Rule 424(b) of the Securities Act without charge and upon written or oral notice by contacting:

Jennifer

Perera

Chief

Financial Officer

Duo

World, Inc.

No.

403 Galle Road

Colombo

03, Sri Lanka

Telephone No.+94 777 764405

REOFFER

PROSPECTUS

DUO

WORLD, INC.

9,611,665

Shares of Common Stock

This

reoffer prospectus relates to shares of Common Stock of Duo World, Inc. that may be reoffered or resold from time to time by the

shareholders identified in this reoffer prospectus (“Selling Shareholders”) and that have been acquired or that may

be acquired under our 2017 Employee Stock Ownership Plan (“2017 Plan”). This reoffer prospectus covers 6,542,500

shares of Common Stock to be acquired by our officers, directors and employees, who are the named Selling Shareholders in

this reoffer prospectus, plus an additional 3,069,165 shares issuable under the 2017 Plan to other employees not named

as Selling Shareholders in this reoffer prospectus.

The Selling Shareholders

may sell shares of Common Stock from time to time in the principal market on which our Common Stock is traded at the prevailing

market price or in privately negotiated transactions. Our Common Stock is quoted on the OTC Bulletin Board, which is maintained

by the Financial Institutions National Regulatory Authority. See “Plan of Distribution” which begins on page 10.

We

will not receive any of the proceeds from the sale of Common Stock by the Selling Shareholders. While we will pay the expenses

of registering these shares, the Selling Shareholders will bear all sales commissions and similar expenses.

We

may amend or supplement this reoffer prospectus from time to time by filing amendments or supplements as required. You should

read the entire prospectus, the information incorporated by reference herein and any amendments or supplements carefully before

you make an investment decision.

Investing in our Common

Stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties in the

section entitled “Risk Factors” beginning on page 7 of this reoffer prospectus before making a decision to

purchase our stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this reoffer prospectus is January 12, 2018

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information in this prospectus or incorporated by reference in this prospectus and in any applicable prospectus

supplement. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information. We and the

Selling Shareholders take no responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. The information contained in this prospectus, any applicable prospectus supplement and the documents

incorporated by reference herein or therein are accurate only as of the date such information is presented. Our business, financial

condition, results of operations and prospects may have changed since that date. You should also read this prospectus together

with the additional information described under the headings “Incorporation of Certain Information by Reference” and

“Where You Can Find More Information.” This prospectus may be supplemented from time to time to add, update or change

information in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for the

purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such

statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement

so superseded will be deemed not to constitute a part of this prospectus.

The

Selling Shareholders are offering the Common Stock only in jurisdictions where such issuances are permitted. The distribution

of this prospectus and the issuance of the Common Stock in certain jurisdictions may be restricted by law. Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the issuance of the Common stock and the distribution of this prospectus outside the United States. This prospectus does not

constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the Common Stock offered

by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the securities offered under this prospectus. The registration statement, including exhibits, can be read on the

Securities and Exchange Commission’s website or at the Securities and Exchange Commission’s offices mentioned under

the heading “Where You Can Find More Information.”

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does

not contain all of the information you should consider before investing in our Common Stock. You should carefully review the prospectus,

the information incorporated by reference and the registration statement of which this prospectus is a part in their entirety

before investing in our Common Stock, including information discussed under “Risk Factors” in this prospectus and

the documents incorporated by reference and our financial statements and notes thereto that are incorporated by reference in this

prospectus. As used in this prospectus, unless the context otherwise indicates, references to “Duo World,” “company,”

“we,” “our,” “ours” and “us” refer to Duo World, Inc., a Nevada corporation, and

our subsidiaries, unless the context otherwise requires. In addition, any references to “financial statements” are

to our financial statements contained herein or incorporated by reference herein, except as the context otherwise requires and

any references to “fiscal year” refers to our fiscal year ending March 31. Unless otherwise indicated, the terms “Common

Stock,” “common stock” and “shares” refer to shares of our $.001 par value, common stock.

Overview

Duo

World, Inc. is an information technology and software solutions company, focused on bringing value to its clients through every

customer interaction. Duo World specializes in subscription management and billing solutions, and customer lifecycle management

solutions. Duo World’s business model allows us to deliver consistent, quality service, at a scale and in the geographies

that meet our clients’ business needs. We leverage our breadth and depth of capabilities to help companies create quality

customer experiences across multiple channels, while increasing revenue and reducing their cost to serve their customers.

Duo

World was formed as a Nevada corporation in 2014 for the purpose of acquiring (i) Duo Software (Pvt.) Limited, a Sri Lankan company,

from Mr. Muhunthan Canagasooryam, Duo World’s President and founder, in exchange for 28,000,000 shares of our Common Stock

and 5,000,000 shares of our Series A Preferred Stock; and (ii) Duo Software (Pte.) Limited, a Singaporean company, from Ms. Koshala

Nishaharan, in exchange for 2,000,000 shares of our Common Stock. The acquisition of Duo Software (Pte.) Limited also included

that company’s wholly-owned subsidiary, Duo Software India (Private) Limited, an Indian company. These acquisitions were

accomplished as of December 3, 2014.

RISK

FACTORS

Investing

in our Common Stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below

and all of the information contained or incorporated by reference in this prospectus, including the risks and uncertainties discussed

under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2017, and

in our Quarterly Reports on Form 10-Q for the fiscal quarters ended June 30, 2017, and September 30, 2017, as updated

or superseded by the risks and uncertainties described under similar headings in the other documents filed after the date hereof

and incorporated by reference into this prospectus. All of these “Risk Factors” are incorporated by reference herein

in their entirety. These risks and uncertainties are not the only ones facing us. Additional risks of which we are not presently

aware or that we currently believe are immaterial may also harm our business and results of operations. The trading price of our

Common Stock could decline due to the occurrence of any of these risks, and investors could lose all or part of their investment

in our Common Stock. In assessing these risks, investors should also refer to the information contained or incorporated by reference

in our other filings with the Securities and Exchange Commission.

CAUTIONARY

STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the information incorporated by reference contain forward-looking statements. These statements relate to future

events or future financial performance and involve known and unknown risks, uncertainties and other factors that may cause Duo

World’s or our industry’s actual results, levels of activity, performance or achievements to be materially different

from any future results, levels of activity, performance or achievements expressed or implied by the forward- looking statements.

In

some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“potential,” or the negative of these terms or other comparable terminology. These statements are only predictions.

Actual events or results may differ materially. Although we believe that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update

any of the forward-looking statements after the date of this prospectus to confirm our prior statements to actual results.

Further,

this prospectus contains forward-looking statements that involve substantial risks and uncertainties. Such statements include,

without limitation, all statements as to expectation or belief and statements as to our future results of operations, the progress

of any product development, the need for, and timing of, additional capital and capital expenditures, partnering prospects, the

protection of and the need for additional intellectual property rights, effects of regulations, the need for additional facilities

and potential market opportunities.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of the Common Stock offered through this prospectus by the Selling Shareholders. We

have agreed to bear the expenses relating to the registration of the Common Stock for the Selling Shareholders.

SELLING

SHAREHOLDERS

This

reoffer prospectus relates to the reoffer and resale of shares issued or that may be issued to the Selling Shareholders listed

below or future Selling Shareholders under the 2017 Plan. Each of the transactions by which the Selling Shareholders acquired

or will acquire the securities covered by this prospectus was exempt or excluded under the registration provisions of the Securities

Act of 1933, as amended, by virtue of Regulation S promulgated thereunder.

The

following table sets forth the number of shares of Common Stock beneficially owned, or to be beneficially owned when issued, by

each current Selling Shareholder. The number of shares in the column “Shares Owned Prior to the Offering” represents

the total number of shares that a Selling Shareholder currently owns or has a right to acquire within sixty (60) days of January

10, 2018. The number of shares in the column “Shares to be Offered for Selling Shareholder Account” represents

all of the shares that a Selling Shareholder may offer under this reoffer prospectus. The table and footnotes assume that the

Selling Shareholders will sell all of the shares listed in the column “Shares Which May Be Offered.” However, because

the Selling Shareholders may sell all or some of their shares under this reoffer prospectus from time to time, or in another permitted

manner, we cannot assure you as to the actual number of shares that will be sold by the Selling Shareholders or that will be held

by the Selling Shareholders after completion of any sales. We do not know how long the Selling Shareholders will hold the shares

before selling them. Beneficial ownership is determined in accordance with Rule13d-3 promulgated by the Securities and Exchange

Commission under the Securities Exchange Act of 1934, as amended. The Selling Shareholders are all officers, directors and/or

employees of the Company. See footnotes below for information related to the Selling Shareholders’ positions or relationships

with the Company. We are also registering 3,069,165 shares under the 2017 Plan which have not been allocated or

awarded to our employees. If, subsequent to the date of this reoffer prospectus, we grant any of these unallocated shares under

the 2017 Plan to our employees, we intend to supplement this reoffer prospectus to reflect such additional awards and the names

of such persons and the amounts of securities to be reoffered by them.

The

Company will file a prospectus supplement to name successors to any named Selling Shareholders who are able to use this prospectus

to resell their securities.

|

Name

|

|

Shares Owned

Prior to This

Offering

|

|

|

Shares to be

Offered for

Selling

Shareholder

Account

|

|

|

Total Shares to

be Owned After

This Offering

|

|

|

Percentage Owned

upon Completion

of This Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shehan Sharmith Tissera (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

H.M. Sukitha Chanaka Jayasinghe (1)

|

|

|

500,000

|

|

|

|

500,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Dinusha Charinda Kannangara (1)

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Dulan Achintha Udukumburage (1)

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Rajinda Waruna Hewagamage (1)

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Heshan Indika Kaluthanthri (1)

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Chinthaka Thiyambarawaththa (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Sudharshan Balakrishnan (1)

|

|

|

17,500

|

|

|

|

17,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Kasun Eranga Wijeratna (1)

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Kasun Gayan Piyomal (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Eshwaran Veerabahu (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Ronnie Marlon Abeykoon (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

M.D. Surani Lakshima Arachchige (1)

|

|

|

2,500

|

|

|

|

2,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

D.Iroshan Harshana Kumarasinghe (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mohamed Wadood Ahzan Mohamed (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Gihan Ranil De Silva (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sineth Uthpala Chandrasekara (1)

|

|

|

17,500

|

|

|

|

17,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Mohamed Buhari Mohamed Rizan (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Ishan Sandeepa Munasinghe (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Dasun Priyashan Hettiarachchi (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Hewamannage Sampath Niroshana (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Rusiru Dulan Stefan Peiris (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Kasun Dilhara Dehigaspitiyage (1)

|

|

|

17,500

|

|

|

|

17,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Anjana Nilupul Chandratilake (1)

|

|

|

500,000

|

|

|

|

500,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Rangika Malintha Pio Perera (1)

|

|

|

500,000

|

|

|

|

500,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Gagani Harshani Tilakaratne (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

|

|

|

|

|

|

|

Champaka Samiilaa Wijayawardhana (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Ajeewan Arumugam (1)

|

|

|

500,000

|

|

|

|

500,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Khangesh Yamuna Dheeran (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Christine Emenda Amithapkumar (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

S.K. Nadun Kanishka (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Rajith Sanjaya Dias (1)

|

|

|

17,500

|

|

|

|

17,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ranasinghage Shashika Ruwani (1)

|

|

|

17,500

|

|

|

|

17,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Mohamed Ali Safras Mohamed (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Dinusha Priyadarshani De Alwis (1)

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Siddhartha Guha Thakurta (1)

|

|

|

215,000

|

|

|

|

215,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Sudarshini Rajaratnam (1)

|

|

|

500,000

|

|

|

|

500,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.Lakmini Nilrukshi Senevirathna (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

W.A.Prasad Jayashanka (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

P.M.A.Binara Gunawardana (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Pamidu Jayaranga Ruhunage (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

V.Malith Kalana De Mel (1)

|

|

|

5,000

|

|

|

|

5,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

A.Pawan Sasanka Sumanasena (1)

|

|

|

20,000

|

|

|

|

20,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

E.Ruchira Himal Perera (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Ishara Indimal Gunathilaka (1)

|

|

|

1,500

|

|

|

|

1,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Nanthakumar Suvethan (1)

|

|

|

1,500

|

|

|

|

1,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

H.M.Gihan Nilangana Herath (1)

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

A.E.Divani Iranga (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Sachitra Dilshan Kaluarachchi (1)

|

|

|

1,500

|

|

|

|

1,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

S.R.A.Sajith Dushmantha Samarathunga (1)

|

|

|

1,500

|

|

|

|

1,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Gee Kiyanage Chamila Dilhani (1)

|

|

|

2,500

|

|

|

|

2,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

K.M.G.Amila Samaranayaka (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

P.D.Gayan Lalantha (1)

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Dhanushan Chanaka Jayakody (1)

|

|

|

1,500

|

|

|

|

1,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

J.P.Sajith Dananjaya Thilakarathna (1)

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Pium Visitha Galhena (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

T.M.Z.Mohamed Hakib (1)

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

B.A.Hasitha Udaya Kumarasiri Gunawardana (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

D.Thushan Lakmantha Wijayasuriya (1)

|

|

|

2,500

|

|

|

|

2,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

M.Z.Waseem Ahamed (1)

|

|

|

1,500

|

|

|

|

1,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Z.H.Mohamed Usama (1)

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

L.A.Patali Prabuddhika Jayawardhana (1)

|

|

|

1,000

|

|

|

|

1,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

H.A.Samira Sulakshana Perera (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

B.Nilakshini Marina Chrisanthika R.W.Goonawardena (1)

|

|

|

15,000

|

|

|

|

15,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

K.A.Hasini Chathurangika De Costa (1)

|

|

|

2,500

|

|

|

|

2,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Subtotal

|

|

|

4,792,500

|

|

|

|

4,792,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Suzannah Jennifer Samuel Perera (2)

|

|

|

1,500,000

|

|

|

|

1,500,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Mahmud Riad Ameen (3)

|

|

|

250,000

|

|

|

|

250,000

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

Total

|

|

|

6,542,000

|

|

|

|

6,542,500

|

|

|

|

-0-

|

|

|

|

0

|

%

|

|

|

(1)

|

This

Selling Shareholder is a non-executive employee of the Company. In addition, the shares being registered in the name of this

Selling Shareholder are being issued in the name of, and held of record by, but not “beneficially owned” (as defined

in Rule 13d-3, by, Mr. Vishal Bakshani, as Trustee for this Selling Shareholder, among other Selling Shareholders. Mr. Bakshani

disclaims any beneficial ownership in these shares. See “Plan of Distribution – Special Note.”

|

|

|

(2)

|

This

Selling Shareholder is the Chief Financial Officer and a Director of the Company.

|

|

|

(3

)

|

This

Selling Shareholder is the Director Legal and a Director of the Company.

|

See “Special Note” and “Special Restrictions

of the Resale of Common Stock” in the section entitled “Plan of Distribution.”

PLAN

OF DISTRIBUTION

Each

Selling Shareholder of the securities and any of their transferees, distributes, pledgees or donees or their successors may, from

time to time, sell any or all of their securities covered hereby on the OTC Bulletin Board or any stock exchange, market or trading

facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling

Shareholder may use any one or more of the following methods when selling the securities covered by this reoffer prospectus:

|

|

●

|

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

●

|

block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block

as principal to facilitate the transaction;

|

|

|

●

|

purchase

by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

●

|

privately

negotiated transactions;

|

|

|

●

|

a

combination of any of the foregoing methods of sale; or

|

|

|

●

|

any

other method permitted pursuant to applicable law.

|

If

the Selling Shareholder effects such transactions by selling shares of our Common Stock to or through underwriters, broker-dealers

or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions

from the Selling Shareholder or commissions from purchasers of our Common Stock for whom they may act as agent or to whom they

may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may

be in excess of those customary in the types of transactions involved).

From

time to time, one or more of the Selling Shareholders may distribute, devise, gift, pledge, hypothecate or grant a security interest

in some or all of the shares of Common Stock owned by them. Any such distributes, devisees or donees will be deemed to be the

Selling Shareholders. Any such pledgees, secured parties or persons to whom the securities have been hypothecated will, upon foreclosure

in the event of default, be deemed to be Selling Shareholders.

A

Selling Shareholder may choose not to sell any or may choose to sell less than all of our Common Stock registered for such person

pursuant to the registration statement, of which this reoffer prospectus forms a part.

Selling

Shareholders and any broker-dealer participating in the distribution of our Common Stock may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933, as amended, and any commission paid, or any discounts or concessions allowed

to, any broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act of 1933, as amended.

At the time a particular offering of the securities is made, a prospectus supplement, if required, will be distributed which will

set forth the aggregate amount of securities being offered and the terms of the offering, including the name or names of any broker-dealers

or agents, any discounts, commissions and other terms constituting compensation from the Selling Shareholder and any discounts,

commissions or concessions allowed, reallowed or paid to broker-dealers.

The

Selling Shareholders and any other person participating in such distribution will be subject to applicable provisions of the Securities

Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, Regulation M, which

may limit the timing of purchases and sales of any of the shares of Common Stock by the Selling Shareholder and any other participating

person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of Common Stock to

engage in market-making activities with respect to the shares of Common Stock. All of the foregoing may affect the marketability

of the Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of

our Common Stock.

We

will pay the expenses of the registration of our Common Stock sold by the Selling Shareholders, including, without limitation,

Securities and Exchange Commission filing fees, compliance with state securities or “blue sky” laws; provided, however,

that the Selling Shareholders will pay all underwriting discounts and selling commissions, if any.

Once

sold under the registration statement, of which this reoffer prospectus forms a part, the shares of our Common Stock sold pursuant

hereto will be freely tradable in the hands of persons other than our affiliates. We have notified the Selling Shareholders of

the need to deliver a copy of this reoffer prospectus in connection with any sale of their shares hereunder.

In

order to comply with certain state securities laws, if applicable, the shares may be sold in such jurisdictions only through registered

or licensed brokers or dealers. In certain states, the shares may not be sold unless the shares have been registered or qualified

for sale in such state or an exemption from regulation or qualification is available and is complied with. Sales of shares must

also be made by the Selling Shareholders in compliance withal other applicable state securities laws and regulations.

In

addition to any shares sold hereunder, Selling Shareholders may, at the same time, sell any shares of Common Stock owned by them

in compliance with all of the requirements of Rule 144, regardless of whether such shares are covered by this reoffer prospectus.

Special

Note

It

is highly probable that at least 4,792,500 of the shares covered by this reoffer prospectus will be issued to and held

of record by Mr. Vishal Bakshani, as trustee, for the benefit of the Selling Shareholders. However, Mr. Bakshani will not be deemed

to be the “beneficial owner” (as defined in Rule 13d-3 of the Securities Exchange Act of 1934, as amended) of the

shares because Mr. Bakshani will only sell and/or vote the shares allocated to the Selling Shareholders upon specific written

instructions from the Selling Shareholders. All proceeds from the sales of shares by trustee will be remitted to the Selling Shareholders

without deduction.

The reason behind

the use of a trustee to be the holder of record of the shares is to make it easier and more economical for the Selling

Shareholders to sell their shares, as the fees charged by broker-dealers are extremely high and could cause a hardship on those

Selling Shareholders desiring to sell a small number of shares in the stock market. The 1,500,000 shares of Common Stock issued

to Suzannah Jennifer Samuel Perera will be issued directly to her and will not be issued to the trustee. The 250,000 shares of

Common Stock issued to Mahmud Riad Ameen will be issued directly to him and will not be issued to the trustee.

Special

Restrictions on Resale of the Common Stock

As a condition to the

award of shares of our Common Stock under our 2017 Plan, each employee, officer and director receiving shares shall agree not

to sell any of the shares awarded under the 2017 Plan for at least twelve months and such persons may only sell 33 1/3% of the

shares awarded to them under the 2017 Plan during any 12 month period. In addition, each such employee, officer and director

shall agree to comply with the Company’s Insider Trading Policy.

In

addition, our Chief Financial Officer and Legal Director shall comply with volume limitations of Rule 144(e) in connection with

any sale of their shares of our Common Stock.

LEGAL

MATTERS

WiseLaw,

P.C., San Antonio, Texas, has passed upon the validity of the shares of our Common Stock offered by the Selling Shareholders under

this prospectus.

EXPERTS

Our

financial statements as of March 31, 2017 and 2016, and for the fiscal years ended March 31, 2017 and 2016, included in this prospectus

have been audited by independent registered public accountants and have been so included in reliance upon the report of Manohar

Chowdhry & Associates given on the authority of such firm as experts in accounting and auditing.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

Securities and Exchange Commission allows us to “incorporate by reference” the information we have filed with it,

which means that we can disclose important information to you by referring you to those documents. The information we incorporate

by reference is an important part of this prospectus, and later information that we file with the Securities and Exchange Commission

will automatically update and supersede this information. We incorporate by reference the documents listed below and any future

documents we file with the Securities and Exchange Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934, as amended, subsequent to the date of this prospectus and prior to the termination of the offering (excluding,

in either case, information furnished pursuant to Items 2.02 and 7.01 of Form 8-K):

|

|

(1)

|

Our

Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the Securities and Exchange Commission on

June 30, 2017;

|

|

|

(2)

|

Our

Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2017, filed with the Securities and Exchange Commission

on August 14, 2017; and

|

|

|

(3)

|

Our

Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2017, filed with the Securities and Exchange Commission

on November 13, 2017.

|

|

|

(4)

|

Our

Definitive Schedule 14C filed with the Securities and Exchange Commission on December

28, 2017.

|

|

|

(5)

|

Our Form 8-K Current Report filed

with the Securities and Exchange Commission on January 12, 2018.

|

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith,

we file annual, quarterly and current reports, proxy and information statements and other information with the Securities and

Exchange Commission. Such reports, proxy statements and other information can be read and copied at the Securities and Exchange

Commission’s public reference facilities at 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. Please call

the Securities and Exchange Commission at 1-800-732-0330 for further information on the operation of the public reference facilities.

In addition, the Securities and Exchange Commission maintains a website that contains reports, proxy and information statements

and other information regarding registrants that file electronically with the Securities and Exchange Commission. The address

of the Securities and Exchange Commission’s website is www.sec.gov.

We make available free

of charge on or through our website at

www.duoworld.com

, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities

Exchange act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with or otherwise

furnish it to the Securities and Exchange Commission. Information on our website is not incorporated by reference in this

prospectus and is not a part of this prospectus.

PROSPECTUS

9,611,665

Shares of Common Stock

DUO

WORLD, INC.

January 12, 2018

PART

II.

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference

The

Securities and Exchange Commission allows us to “incorporate by reference” the information we have filed with it,

which means that we can disclose important information to you by referring you to those documents. The information we incorporate

by reference is an important part of this prospectus, and later information that we file with the Securities and Exchange Commission

will automatically update and supersede this information. We incorporate by reference the documents listed below and any future

documents we file with the Securities and Exchange Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934, as amended, subsequent to the date of this prospectus and prior to the termination of the offering (excluding,

in either case, information furnished pursuant to Items 2.02 and 7.01 of Form 8-K):

|

|

(1)

|

Our

Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the Securities and Exchange Commission on

June 30, 2017;

|

|

|

(2)

|

Our

Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2017, filed with the Securities and Exchange Commission

on August 14, 2017; and

|

|

|

(3)

|

Our

Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2017, filed with the Securities and Exchange Commission

on November 13, 2017.

|

|

|

(4)

|

Our

Definitive Schedule 14C filed with the Securities and Exchange Commission on December

28, 2017.

|

|

|

(5)

|

Our Form 8-K Current Report filed

with the Securities and Exchange Commission on January 12, 2018.

|

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

Liability

of Directors and Officers

Article

9 of the Company’s amended Articles of Incorporation provides that our directors and officers shall not be personally liable

to the Company or our shareholders for damages for breach of fiduciary duty. However, Article 9 does not eliminate or limit a

director or officer for (i) acts or omissions which involve intentional misconduct or a knowing violation of law, or (ii) the

unlawful payment of dividends.

Indemnification

of Directors and Officers.

Article

VII, Section 7 of the Company’s Bylaws provide that the Company shall indemnify its officers, directors, employees and agents

to the fullest extent permitted by the laws of Nevada. Article 10 of our amended Articles of Incorporation provides indemnification

for our officers, directors, employees and agents in accordance with the Nevada Revised Statutes.

The

Nevada Revised Statutes allow us to indemnify our officers, directors, employees, and agents from any threatened, pending, or

completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, except under certain circumstances,

except an action by or in the right of the corporation, by reason of the fact that such person is or was a director, officer,

employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’

fees, judgments, fines and amounts paid in settlement, actually and reasonably incurred by such person in connection with the

action, suit or proceeding, if such person acted in good faith and in a manner, which such person reasonably believed to be in

or not opposed to the best interests of the corporation, or that, with respect to any criminal action or proceeding, such person

had reasonable cause to believe that the conduct was unlawful.

NRS

78.751 of the Nevada Revised Statutes allows a corporation to authorize discretionary indemnification under certain circumstances.

A corporation shall have discretion to indemnify only as authorized in the specific case upon a determination made (i) by the

shareholders; (ii) by the board of directors by majority vote of a quorum consisting of directors who were not parties to the

action, suit, or proceeding; (iii) if a majority vote of a quorum consisting of directors who were not parties to the action,

suit or proceeding so orders, by independent legal counsel in a written opinion; or (iv) if a quorum consisting of directors who

were not parties to the action, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion.

Item

7. Exemption from Registration Claimed.

The

restricted securities that may be reoffered or resold by the Selling Shareholders pursuant to the reoffer prospectus included

herein were stock awards granted under the 2017 Plan and were not registered under the Securities Act of 1933, as amended, or

the securities laws of any state, in reliance on the exclusion from the registration requirements under the Securities Act of

1933, as amended, provided by Regulation S, as none of the award recipients are U.S. persons or citizens.

Item

8. Exhibits.

*Incorporated

by reference to the Company’s Form S-1 Registration Statement (File No. 333-211460) declared effective by the SEC on September

26, 2016.

**

Filed herewith.

Item

9. Undertakings.

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

to include any prospectus required by Section 10(a) (3) of the Securities Act of 1933, as amended;

(ii)

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high

end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule

424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate

offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in this registration statement

or any material change to such information in the registration statement.

PROVIDED,

HOWEVER, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is on Form S-8, and the information

required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the

Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated

by reference in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, as amended, each such post-effective amendment

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at the time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and,

where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange

Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (“1933 Act”), may

be permitted to directors, officers or controlling persons of the Company pursuant to the foregoing provisions or otherwise, the

Company has been advised that, in the opinion of the Securities and Exchange Commission, such indemnification is against public

policy as expressed in the 1933 Act and is, therefore, unenforceable. In the event that a claim for indemnification against such

liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of

the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has

been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification

by it is against public policy as expressed in the 1933 Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this amended Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Colombo, Sri Lanka on the 12

th

day of January 2018 .

|

Duo

World, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Muhunthan Canagasooryam

|

|

|

|

Muhunthan

Canagasooryam

|

|

|

|

President

and

|

|

|

|

Chief

Executive Officer

|

|

Pursuant to the requirements

of the Securities Act of 1933, this amended Registration Statement on Form S-8 has been signed by the following persons

in the capacities and on the dates indicated below.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Muhunthan Canagasooryam

|

|

President, Chief Executive Officer, Principal

|

|

January

12, 2018

|

|

Muhunthan Canagasooryam

|

|

Executive Officer and Director

|

|

|

|

|

|

|

|

|

|

/s/ Suzannah Jennifer Samuel Perera

|

|

Chief Financial Officer, Principal Financial Officer, Principal Accounting Officer, Secretary,

|

|

January

12, 2018

|

|

Suzannah Jennifer Samuel Perera

|

|

Treasurer and Director

|

|

|

|

|

|

|

|

|

|

/s/ Mahmud R. Ameen

|

|

Director Legal

|

|

January 12, 2018

|

|

Mahmud R. Ameen

|

|

and Director

|

|

|

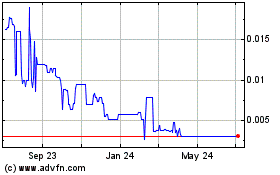

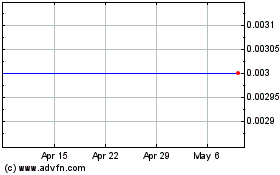

Duo World (CE) (USOTC:DUUO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Duo World (CE) (USOTC:DUUO)

Historical Stock Chart

From Apr 2023 to Apr 2024