Current Report Filing (8-k)

January 08 2018 - 2:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 29, 2017

|

Viking Energy Group, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-29219

|

|

98-0199508

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

1330 Avenue of the Americas, Suite 23 A,

New York, NY

|

|

10019

|

|

(Address of principal executive offices)

|

|

(zip code)

|

|

(212) 653-0946

|

|

(Registrant’s telephone number, including area code)

|

|

_____________________________________________

|

|

(former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On December 29, 2017, Viking Energy Group, Inc. (the “Company”) entered into a Purchase and Sale Agreement (the “Agreement”), with Woodway Oil & Gas – KS–I, LLC, a Delaware limited liability company (the “Seller”), to acquire (the “Acquisition”) working interests in approximately 41 oil leases in Ellis and Rooks Counties in Kansas, comprising several thousand acres. The working interests in the leases range from 84 to 100%, with an average of approximately 96%, and the net revenue interests range from 72 to 85%, with an average of approximately 81%. While the Agreement was dated December 22, 2017, the parties did not release their signature pages until December 29, 2017, and the effective time of the Acquisition was January 1, 2018, at 7:00 a.m. CDT (the “Effective Time”). The assets acquired in the Acquisition (the “Acquired Assets”) also include an undivided interest in all oil and gas wells, equipment, fixtures and other personal property located upon the leased properties and used in connection with oil and gas operations upon the leases attributable to the working interests purchased in the Acquisition.

The Acquisition purchase price was $2,200,000. The Company paid $200,000 on December 29, 2017, and the balance is due on January 15, 2018. Haas Petroleum LLC (http://www.haaspetroleum.com/), a fourth-generation oil and gas company, will operate these assets on behalf of the Company.

In connection with the Acquisition, on December 29, 2017, the Seller and the Company executed an Assignment and Bill of Sale (the “Assignment”) to transfer the Acquired Assets to a newly formed, wholly-owned subsidiary of the Company, Mid-Con Development, LLC, effective as of the Effective Time.

The foregoing descriptions of the Agreement and Assignment and the terms of the Acquisition are qualified in their entirety by the full text of the Agreement and the Assignment, filed as Exhibit 10.1 and 10.2, respectively, and incorporated by reference in, this report.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

The disclosure in Item 1.01 above is incorporated by reference herein.

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES.

In consideration for services rendered, on December 29, 2017, the Company issued to FWB Consulting, Inc., a Company controlled by Frank Barker, Jr., warrants to purchase 5,000,000 shares of the Company’s common stock at $0.25 per share, exercisable for 120 months.

In consideration for services rendered and several personal guarantees provided to the Company’s lenders, on December 29, 2017, the Company issued to James A. Doris, warrants to purchase 15,000,000 shares of the Company’s common stock, 4,000,000 at $0.25 per share, and 11,000,000 at $0.30 per share, exercisable for 120 months.

The issuances of these Warrants was made in reliance on an exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), as there was no general solicitation and the issuances did not involve a public offering.

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On December 29, 2017, Frank Barker, Jr. was appointed as a member of the Company’s Board of Directors and as the Company’s Chief Financial Officer.

Mr. Barker is a Certified Public Accountant licensed to practice in the State of Florida, and has been in practice since 1978. He was co-founder of the accounting firm of Peel, Barker, Schatzel & Wells, PA in 1979. Mr. Barker left the firm in 1993, and went on to form the accounting firm of Frank W. Barker, Jr., CPA PA, and the independent consulting firm of FWB Consulting, Inc. to facilitate the provision of strategic, financial, accounting and tax-related services in various capacities to both Public and Private entities. These services have included Compliance Reporting with the Securities and Exchange Commission, the planning, preparation and oversight of annual audit functions, presentation of financial data to Public Company Boards, turn-around management, bankruptcy and asset recovery, Strategic planning for survival of troubled companies, financial forecasting and cash flow management, litigation support and forensic analysis, mergers and acquisitions and reverse mergers. During the last five years, Mr. Barker has worked exclusively on a contract basis through these two firms. Prior to that, Mr. Barker, in addition to contractual services, has also served as Chief Financial Officer of several Public Companies with Revenues in excess of $40 million, in the fields of Defense Contracting, Manufacturing, Alternative Energy, Electrical Contracting, Healthcare Research and Construction. Additionally, Mr. Barker’s other industry experience include Oil and Gas, Health Care Services and Administration, Not for Profit, Retail, Distribution, Gaming, Real Estate, Professional Services, Internet Technologies, Media Communications, Web Based Technologies, Banking, Investments, Insurance, Private Equity, Municipal and County Governments, Treasure Exploration, etc. Mr. Barker has been providing professional services to the Company as an independent consultant since the first quarter of 2015. Mr. Barker received a B.A. in Accounting and Finance from the University of South Florida, Tampa, Florida in 1978.

The terms of Mr. Barker's appointment have not yet been determined.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

The exhibits listed in the following Exhibit Index are filed as part of this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Viking Energy Group, Inc.

|

|

|

|

|

|

|

Dated: January 3, 2018

|

By:

|

/s/ James Doris

|

|

|

|

|

James Doris

|

|

|

|

|

CEO & Director

|

|

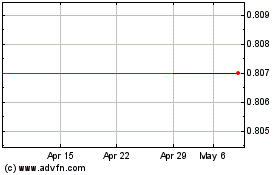

Viking Energy (QB) (USOTC:VKIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

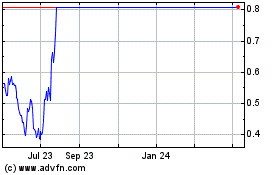

Viking Energy (QB) (USOTC:VKIN)

Historical Stock Chart

From Apr 2023 to Apr 2024