Current Report Filing (8-k)

December 12 2017 - 8:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): December 6, 2017

EDGEWELL PERSONAL CARE COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Missouri

|

1-15401

|

43-1863181

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1350 Timberlake Manor Parkway, Chesterfield, Missouri 63017

(Address of principal executive offices)

314-594-1900

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

Emerging growth company

|

o

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Edgewell Personal Care Company (the “Company”) announced on December 12, 2017 that Sandra J. Sheldon, the Company’s Chief Financial Officer, will be leaving the Company.

Ms. Sheldon will remain employed with the Company through January 2018 and will assist with the transition of her responsibilities. Ms. Sheldon’s departure is not related to any issues regarding the integrity of the Company’s financial statements or accounting policies and practices. The Company has retained a nationally recognized executive search firm to identify a permanent successor to Ms. Sheldon. The search will be national in scope.

On December 6, 2017, the Company appointed Elizabeth Dreyer, Vice President, Controller and Chief Accounting Officer, to serve as the Company’s interim Chief Financial Officer, effective immediately. Ms. Dreyer, age 55, has served as Vice President, Controller and Chief Accounting Officer of the Company since July 2015 and in the same position for the Personal Care division since she joined the Company in January 2015. Prior to joining the Company, Ms. Dreyer was Vice President, Controller and Chief Accounting Officer of Hillenbrand Inc. from 2010 to 2014, and served as Interim Chief Financial Officer during 2014. She previously held positions as Vice President of Finance with Zimmer Corp., Chief Financial Officer of Createc Corporation, and Vice President of Organizational Effectiveness of ADESA. Ms. Dreyer began her career with Deloitte and is a Certified Public Accountant.

In connection with her appointment, Ms. Dreyer and the Company have entered into an Interim CFO Incentive Agreement under which Ms. Dreyer will receive additional compensation totaling approximately $300,000, subject to, among other things, her remaining employed with the Company through November 30, 2018 and her satisfactory performance. The additional compensation is comprised of $100,000 in cash (to be paid in equal installments on or around December 31, 2017 and November 30, 2018), and a grant of time-based restricted stock equivalents (“RSEs”) with an approximate value of $200,000. The RSEs will be granted under the Company’s Second Amended and Restated 2009 Incentive Stock Plan on or about January 2, 2018, will be pursuant to the terms of the Company’s standard RSE agreement, and will have annual pro-rata vesting over a 2-year period. The foregoing is qualified in its entirety by reference to the full text of the Interim CFO Incentive Agreement, attached hereto as Exhibit 10.1 and incorporated herein by reference.

The Company issued a press release on December 12, 2017, related to the above matters. A copy of this press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

10.1

|

Interim CFO Incentive Agreement between the Company and Elizabeth Dreyer.

|

99.1 Press Release of Edgewell Personal Care Company issued on December 12, 2017.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on From 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

EDGEWELL PERSONAL CARE COMPANY

By:

/s/ Manish R. Shanbhag

Manish R. Shanbhag

Chief Legal Officer, Chief Compliance Officer and Secretary

Dated: December 12, 2017

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

|

|

|

|

|

99.1

|

|

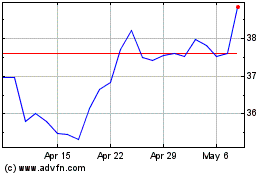

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

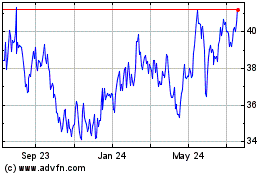

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Apr 2023 to Apr 2024