false

--12-31

0001559998

0001559998

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

May

21, 2024

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

| State |

|

Commission |

|

IRS

Employer |

| of Incorporation |

|

File

Number |

|

Identification

No. |

112

NE 41st Street, Suite 106

Miami,

FL 33137

Address

of principal executive offices

212-739-7700

Telephone

number, including area code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

VINO |

|

The

Nasdaq Stock Market LLC |

Item

3.03 Material Modification to Rights of Security Holders.

The

disclosure set forth in Item 5.03 below is incorporated herein by reference.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Effective

May 21, 2024, Gaucho Group Holdings, Inc. (the “Company”) filed a Certificate of Designation of Senior Convertible Preferred

Stock (the “Certificate of Designation”) with the Delaware Secretary of State, designating 100,000 shares of preferred stock

of the Company, par value $0.01, as Senior Convertible Preferred Stock (the “Senior Convertible Preferred Stock”). No shares

of Senior Convertible Preferred Stock are currently outstanding. If and when issued (of which there can be no assurance), holders of

Senior Convertible Preferred Stock will be subject to the following rights, preferences and powers:

| ● | The

Senior Convertible Preferred Stock will be entitled to an 8.5% annual dividend, payable when,

as and if declared by the Company’s Board of Directors. |

| ● | The

Series Convertible Preferred Stock will be entitled to a liquidation preference to be paid

ahead of shares of common stock or any other class or series of capital stock of the Company

designated to be junior to the Senior Convertible Preferred Stock. |

| ● | The

Senior Convertible Preferred Stock will not be entitled to vote, except in limited circumstances

enumerated in the Certificate of Designation or as otherwise required by law. |

| ● | If,

on the date that is 18 months following the termination of the offering whereby the Senior

Convertible Preferred Stock is issued, the Minimum Price (as defined by Nasdaq 5635(d)) of

the Company’s common stock has increased by more the 60% since the date of the initial

purchase of the Senior Convertible Preferred Stock by a stockholder, then all shares of Senior

Convertible Preferred Stock held by such stockholder shall be automatically converted into

shares of common stock. If a stockholder’s Senior Convertible Preferred Stock is not

eligible for automatic conversion pursuant to the foregoing, then on such date, all shares

of Senior Convertible Preferred Stock held by such stockholder shall be redeemed by the Company.

|

| ● | At

any time following the date that is six months following the termination of the offering

whereby the Senior Convertible Preferred Stock is issued, each stockholder holding Senior

Convertible Preferred Stock may, upon approval of the Company, convert his, her or its shares

of Senior Convertible Preferred Stock into shares of common stock. |

The

foregoing description of the Certificate of Designation and the Senior Convertible Preferred Stock is qualified in its entirety

by reference to the full text of the Certificate of Designation, a copy of which is filed hereto as Exhibit 3.1 and incorporated

herein by reference.

This

current report on Form 8-K is issued in accordance with Rule 135c under the Securities Act, and is neither an offer to sell any securities,

nor a solicitation of an offer to buy, nor shall there be any sale of any such securities in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 22nd day of May 2024.

| |

Gaucho

Group Holdings, Inc. |

| |

|

|

| |

By: |

/s/

Scott L. Mathis |

| |

|

Scott

L. Mathis, President & CEO |

Exhibit 3.1

CERTIFICATE

OF DESIGNATION OF SENIOR

CONVERTIBLE PREFERRED STOCK OF

gaucho group holdings, INC.

PURSUANT

TO SECTION 151 OF THE

DELAWARE GENERAL CORPORATION LAW

Gaucho

Group Holdings, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (hereinafter called

the “Corporation”), DOES HEREBY CERTIFY:

That

pursuant to resolutions adopted by unanimous consent of the Board of Directors of the Corporation, the Certificate of Designation for

the Senior Convertible Preferred Stock, $0.01 par value per share, dated May 21, 2024, is as follows:

Senior

Convertible Preferred Stock

1.

Designation. A total of 100,000 shares of the Corporation’s Preferred Stock shall be designated as “Senior Convertible

Preferred Stock.” As used herein, the term “Preferred Stock” means the shares of Senior Convertible Preferred

Stock except as the context otherwise requires.

2.

Dividends. Subject to provisions of law, from and after the date of issuance, the holders of record of shares of the Preferred

Stock shall be entitled to receive dividends at an annual rate of 8.5% of the Liquidation Value (as defined below) per share of Preferred

Stock (which amount shall be subject to equitable adjustment whenever there shall occur a stock dividend, stock split, combination, reorganization,

recapitalization, reclassification or other similar event). Such dividends shall accrue from day to day (without compounding), whether

or not declared, and shall be cumulative; provided, however, that except as otherwise provided herein, dividends, including any special

dividends declared by the Board of Directors as well as ordinary dividends, shall be payable only when, as and if declared by the Board

of Directors, out of assets which are legally available therefor. Dividends may be paid in cash or in shares of Common Stock based on

the Minimum Price as defined by Nasdaq Rule 5635(d) (provided that such issuance of Common Stock is in accordance with all applicable

Nasdaq Rules) at the option of the holder of Preferred Stock.

Such

dividends shall also be paid upon a liquidation or redemption of the Preferred Stock in accordance with the provisions of Section 3 or

Section 6. Dividends payable on the Preferred Stock for any period less than a full year shall be computed on the basis of the actual

number of days elapsed and a 365-day year. All accrued and accumulated dividends on the Preferred Stock shall be prior and in preference

to any dividend on Common Stock of the Corporation and shall be fully declared and paid before any dividends are declared and paid, or

any other distributions or redemptions are made, on any shares of Common Stock.

3.

Liquidation, Dissolution or Winding Up.

(a)

Treatment at Sale, Liquidation, Dissolution or Winding Up. In the event of any liquidation, dissolution or winding up of the Corporation,

whether voluntary or involuntary, before any distribution or payment is made to any holders of any shares of Common Stock or any other

class or series of capital stock of the Corporation designated to be junior to the Preferred Stock, and subject to the liquidation rights

and preferences of any class or series of Preferred Stock designated to be senior to, or on a parity with, the Preferred Stock, the holders

of shares of Preferred Stock shall be entitled to be paid first out of the assets of the Corporation available for distribution to holders

of the Corporation’s capital stock whether such assets are capital, surplus or earnings, an amount equal to $100.00 per share of

Preferred Stock (which amount shall be subject to equitable adjustment whenever there shall occur a stock dividend, stock split, combination,

reorganization, recapitalization, reclassification or other similar event) (such amount, as so determined, is referred to herein as the

“Liquidation Value” with respect to such shares) plus any dividends accrued or declared but unpaid on such shares.

(b)

Insufficient Funds. If upon such liquidation, dissolution or winding up the assets or surplus funds of the Corporation to be distributed

to the holders of shares of Preferred Stock and any other then-outstanding shares of the Corporation’s capital stock ranking on

a parity with respect to payment on liquidation with the Preferred Stock (such shares being referred to herein as the “Parity

Stock”) shall be insufficient to permit payment to such respective holders of the full Liquidation Value and all other preferential

amounts payable with respect to the Preferred Stock and such Parity Stock, then the assets available for payment or distribution to such

holders shall be allocated among the holders of the Preferred Stock and such Parity Stock, pro rata, in proportion to the full respective

preferential amounts to which the Preferred Stock and such Parity Stock are each entitled.

(c)

Certain Transactions Treated as Liquidation. For purposes of this Section 3, (i) any acquisition of the Corporation by means of

merger or other form of corporate reorganization or consolidation with or into another corporation in which outstanding shares of this

Corporation, including shares of Preferred Stock, are exchanged for securities or other consideration issued, or caused to be issued,

by the other corporation or its subsidiary and, as a result of which transaction, the stockholders of this Corporation own 50% or less

of the voting power of the surviving entity (other than a mere re-incorporation transaction), or (ii) a sale, transfer or lease (other

than a pledge or grant of a security interest to a bona fide lender) of all or substantially all of the assets of the Corporation, shall

be treated as a liquidation, dissolution or winding up of the Corporation and shall entitle the holders of Preferred Stock to receive

the amount that would be received in a liquidation, dissolution or winding up pursuant to Section 3(a) hereof.

(d)

Distributions of Property. Whenever the distribution provided for in this Section 3 shall be payable in property other than cash

or shares of Common Stock, the value of such distribution shall be the fair market value of such property as determined in good faith

by the Board of Directors, unless the holders of 50% or more of the then outstanding shares of Preferred Stock request, in writing, that

an independent appraiser perform such valuation, then by an independent appraiser selected by the Board of Directors and reasonably acceptable

to the holders of 50% or more of Preferred Stock. The cost of the independent appraiser shall be borne by the holders of the Preferred

Stock unless such valuation is 15% (or more) greater than the initial valuation as determined by the Board of Directors.

4.

Voting Power. Except as otherwise expressly provided in this Certificate of Designation or as otherwise required by law, no holder

of Preferred Stock shall be entitled to vote on any matters.

5.

Conversion Rights; Automatic Conversion; Optional Conversion. The holders of the Preferred Stock shall have the following rights

and obligations with respect to the conversion of such shares into shares of Common Stock:

(a)

Automatic Conversion. Notwithstanding Section 6, but subject to and in compliance with the provisions of this Section 5, if, on

the date that is 18 months from the termination date of the offering whereby the Corporation offered and sold Preferred Stock (the “Termination

Date”), the Minimum Price, as defined by Nasdaq Rule 5635(d), per Common Share increases by more than 60% of the Minimum Price

per Common Share as of the date of the initial purchase price of the Preferred Stock by each stockholder, then all shares of Preferred

Stock held by such stockholder shall be converted automatically into the number of shares of Common Stock determined by multiplying the

total number of shares of Preferred Stock held by such stockholder by the Applicable Conversion Rate, without any further action by the

holders of such shares and whether or not the certificates representing such shares are surrendered to the Corporation or its transfer

agent (the “Automatic Conversion”).

(b)

Optional Conversion. Notwithstanding Section 6, but subject to and in compliance with the provisions of this Section 5, at any

time on or after 6 months and 1 day from the Termination Date, each stockholder holding Preferred Stock, upon approval of the Corporation,

which shall not be unreasonably withheld, will have the option to convert their shares of Preferred Stock into the number of shares of

Common Stock determined by multiplying the total number of shares of Preferred Stock held by such stockholder by the Applicable Conversion

Rate, without any further action by the holders of such shares and whether or not the certificates representing such shares are surrendered

to the Corporation or its transfer agent (the “Optional Conversion”).

(c)

Applicable Conversion Rate. The conversion rate in effect at any time for the Preferred Stock (the “Applicable Conversion

Rate”) shall be the quotient obtained by dividing $25.00 by the Applicable Conversion Value, as defined in Section 5(d). The

initial Applicable Conversion Rate shall be twenty-five (25), and each share of Preferred Stock shall be convertible into twenty-five

(25) shares of Common Stock.

(d)

Applicable Conversion Value. The Applicable Conversion Value in effect from time to time, except as adjusted in accordance with

Section 5(e) hereof, shall be $1.00 with respect to the Preferred Stock (the “Applicable Conversion Value”).

(e)

Adjustment to Applicable Conversion Value.

(i)

Upon Extraordinary Common Stock Event. Upon the happening of an Extraordinary Common Stock Event (as hereinafter defined), the

Applicable Conversion Value shall, simultaneously with the happening of such Extraordinary Common Stock Event, be adjusted by multiplying

the Applicable Conversion Value by a fraction, the numerator of which shall be the number of shares of Common Stock outstanding immediately

prior to such Extraordinary Common Stock Event and the denominator of which shall be the number of shares of Common Stock outstanding

immediately after such Extraordinary Common Stock Event, and the product so obtained shall thereafter be the Applicable Conversion Value.

The Applicable Conversion Value, as so adjusted, shall be readjusted in the same manner upon the happening of any successive Extraordinary

Common Stock Event or Events. An “Extraordinary Common Stock Event” shall mean (A) the issuance of additional shares

of Common Stock as a dividend or other distribution on outstanding shares of Common Stock, (B) a subdivision of outstanding shares of

Common Stock into a greater number of shares of Common Stock, or (C) a combination or reverse stock split of outstanding shares of Common

Stock into a smaller number of shares of Common Stock.

(ii)

Waiver of Adjustment to Applicable Conversion Value. Notwithstanding anything herein to the contrary, the operation of, and any

adjustment of the Applicable Conversion Value pursuant to, this Section 5(e) may be waived with respect to any specific share or shares

of Preferred Stock, either prospectively or retroactively and either generally or in a particular instance, by a writing executed by

the registered holder of such share or shares. Any waiver pursuant to this Section 5(e)(ii) shall bind all future holders of shares of

Preferred Stock for which such rights have been waived. In the event that a waiver of adjustment of Applicable Conversion Value under

this Section 5(e)(ii) results in different Applicable Conversion Values for shares of Preferred Stock, the Secretary of the Corporation

shall maintain a written ledger identifying the Applicable Conversion Value for each share of Preferred Stock. Such information shall

be made available to any person upon request.

(f)

Dividends. In the event the Corporation shall make or issue, or shall fix a record date for the determination of holders of Common

Stock entitled to receive a dividend or other distribution (other than a distribution in liquidation or other distribution otherwise

provided for herein) with respect to the Common Stock payable in (i) securities of the Corporation other than shares of Common Stock,

or (ii) other assets (excluding cash dividends or distributions), then and in each such event the Corporation shall declare and pay a

dividend on the Preferred Stock on a pro rata basis with the Common Stock determined on an as-converted basis assuming all Shares had

been converted pursuant to Section 5 as of immediately prior to the record date of the applicable dividend (or if no record date is fixed,

the date as of which the record holders of Common Stock entitled to such dividends are to be determined).

(g)

Certificate as to Adjustments; Notice by Corporation. In each case of an adjustment or readjustment of the Applicable Conversion

Rate, the Corporation at its expense will furnish each holder of Preferred Stock with a certificate prepared by the Treasurer or Chief

Financial Officer of the Corporation, showing such adjustment or readjustment, and stating in detail the facts upon which such adjustment

or readjustment is based.

(h)

No Issuance of Fractional Shares. No fractional shares of Common Stock or scrip representing fractional shares shall be issued

upon the conversion of shares of Preferred Stock. Instead of any fractional shares of Common Stock which would otherwise be issuable

upon conversion of Preferred Stock, the Corporation shall round up to the next whole share of Common Stock issuable upon the conversion

of shares of Preferred Stock. The determination as to whether any fractional shares of Common Stock shall be rounded up shall be made

with respect to the aggregate number of shares of Preferred Stock being converted at any one time by any holder thereof, not with respect

to each share of Preferred Stock being converted.

(i)

Reservation of Common Stock. The Corporation shall at all times reserve and keep available out of its authorized but unissued

shares of Common Stock, solely for the purpose of effecting the conversion of the shares of the Preferred Stock, such number of its shares

of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of the Preferred Stock (including

any shares of Preferred Stock represented by any warrants, options, subscription or purchase rights for Preferred Stock), and if at any

time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding

shares of the Preferred Stock (including any shares of Preferred Stock represented by any warrants, options, subscriptions or purchase

rights for such Preferred Stock), the Corporation shall take such action as may be necessary to increase its authorized but unissued

shares of Common Stock to such number of shares as shall be sufficient for such purpose.

(j)

No Reissuance of Preferred Stock. No share or shares of Preferred Stock acquired by the Corporation by reason of redemption, purchase,

conversion or otherwise shall be reissued as a share or shares of Preferred Stock, however, all such shares shall be made available as

preferred shares which the Corporation shall be authorized to issue. The Corporation shall from time to time take such appropriate corporate

action as may be necessary to reduce the authorized number of shares of the Preferred Stock.

6.

Redemption.

(a)

Redemption of Preferred Stock. Unless the Preferred Stock is subject to Automatic Conversion pursuant to Section 5(a) or the holder

of Preferred Stock agrees to an Optional Conversion, 18 months from the Termination Date (the “Redemption Date”),

the Corporation shall redeem all then-outstanding shares of Preferred Stock (“Preferred Redemption”) for a price per

Share equal to the Liquidation Value for such Share, plus all unpaid accrued and accumulated dividends on such Share (whether or not

declared) (the “Preferred Redemption Price,” for all holders collectively, the “Aggregate Redemption Price”).

The Aggregate Redemption Price shall be payable in immediately available funds to the respective holders of the Preferred Stock within

sixty (60) days following the Redemption Date and the Corporation shall contribute all of its assets to the payment of the Aggregate

Redemption Price, and to no other corporate purpose, except to the extent prohibited by applicable Delaware law.

(b)

Insufficient Funds; Remedies for Nonpayment.

(i)

Insufficient Funds. If the assets of the Corporation legally available are insufficient to pay the Aggregate Redemption Price,

the Corporation shall (i) take all appropriate action reasonably within its means to maximize the assets legally available for paying

the Aggregate Redemption Price, (ii) redeem out of all such assets legally available therefor the maximum possible number of Shares that

it can redeem on such date, pro rata among the holders of such Shares, and (iii) thereafter at any time and from time to time when additional

assets of the Corporation become legally available to redeem the remaining Shares, the Corporation shall immediately use such assets

to pay the remaining balance of the Aggregate Redemption Price.

(ii)

Remedies for Nonpayment. If within sixty (60) days of the Redemption Date all shares of the Preferred Stock are not redeemed in

full, until such Shares are fully redeemed and the Aggregate Redemption Price paid in full, (a) all of the unredeemed Shares shall remain

outstanding and continue to have the rights, preferences and privileges expressed herein, including the accrual and accumulation of dividends

thereon as provided in Section 4, and (b) interest on the portion of the aggregate Redemption Price applicable to the unredeemed Shares

shall accrue daily in arrears at an annual rate equal to 10%.

(c)

Rights Subsequent to Redemption. At such time that the Redemption Price is paid (or payment is tendered) for any of the Shares

to be redeemed, on such date all rights of the holder in the Shares so redeemed and paid or tendered, including any rights to dividends

on such Shares, shall cease, and such Shares shall no longer be deemed issued and outstanding.

7.

Registration of Transfer. The Corporation will keep at its principal office a register for the registration of shares of Preferred

Stock. Upon the surrender of any certificate representing shares of Preferred Stock at such place, the Corporation will, at the request

of the record holders of such certificate, execute and deliver (at the Corporation’s expense) a new certificate or certificates

in exchange therefore representing the aggregate number of shares of Preferred Stock represented by the surrendered certificate. Each

such new certificate will be registered in such name and will represent such number of shares of Preferred Stock as is required by the

holder of the surrendered certificate and will be substantially identical in form to the surrendered certificate.

8.

Replacement. Upon receipt of evidence reasonably satisfactory to the Corporation (an affidavit of the registered holder will be

satisfactory) of the ownership and the loss, theft, destruction or mutilation of any certificate evidencing shares of Preferred Stock,

and in the case of any such loss, theft or destruction, upon receipt of an unsecured indemnity from the holder reasonably satisfactory

to the Corporation or, in the case of such mutilation upon surrender of such certificate, the Corporation will (at its expense) execute

and deliver in lieu of such certificate a new certificate of like kind representing the number of shares of Preferred Stock represented

by such lost, stolen, destroyed or mutilated certificate and dated the date of such lost, stolen, destroyed or mutilated certificate.

9.

Restrictions and Limitations on Corporate Action and Amendments to Charter. The Corporation shall not take any corporate action

or otherwise amend its Certificate of Incorporation without the approval of at least 50.01% of the then outstanding shares of Preferred

Stock, either in writing without a meeting or at an annual or a special meeting of such holders, voting separately as a single class

with one vote per Share, in person or by proxy, if such corporate action or amendment would:

(a)

amend any of the rights, preferences, privileges of or limitations provided for herein for the benefit of any shares of Preferred Stock;

(b)

authorize or issue, or obligate the Corporation to authorize or issue, (i) additional shares (beyond the amount authorized herein) of

Preferred Stock, (ii) Parity Stock (as defined in Section 3(b)) or (iii) shares of Preferred Stock senior to the Preferred Stock with

respect to liquidation preferences, dividend rights or redemption rights;

(c)

decrease the authorized number of shares of Preferred Stock;

(d)

other than as set forth in Section 6, cause the Corporation to redeem, purchase or otherwise acquire for value (or pay into or set aside

for a sinking fund for such purpose), any securities of the Corporation, pursuant to a redemption, purchase or other acquisition for

cash of shares of Preferred Stock, which is effected pro rata with the holders thereof, in proportion to the full respective preferential

amounts to which such holders are entitled;

(e)

declare bankruptcy, dissolve, liquidate, or wind up the affairs of the Corporation; or

(f)

amend any provisions of this Section 9.

10.

No Dilution or Impairment. The Corporation will not, by amendment of its Certificate of Incorporation or through any reorganization,

transfer of capital stock or assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid

or seek to avoid the observance or performance of any of the terms of the Preferred Stock set forth herein, but will at all times in

good faith assist in the carrying out of all such terms and in the taking of all such action as may be necessary or appropriate in order

to protect the rights of the holders of the Preferred Stock against dilution or other impairment. Without limiting the generality of

the foregoing, the Corporation (a) will not increase the par value of any shares of stock receivable on the conversion of the Preferred

Stock above the amount payable therefor on such conversion, and (b) will take all such action as may be necessary or appropriate in order

that the Corporation may validly and legally issue fully paid and nonassessable shares of stock on the conversion of all Preferred Stock

from time to time outstanding.

11.

Notices of Record Date. In the event of:

(a)

any taking by the Corporation of a record of the holders of any class of securities for the purpose of determining the holders thereof

who are entitled to receive any dividend or other distribution, or any right to subscribe for, purchase or otherwise acquire any shares

of capital stock of any class or any other securities or property, or to receive any other right; or

(b)

any capital reorganization of the Corporation, any reclassification or recapitalization of the capital stock of the Corporation, any

merger or consolidation of the Corporation, or any transfer of all or substantially all of the assets of the Corporation to any other

corporation, or any other entity or person; or

(c)

any voluntary or involuntary dissolution, liquidation or winding up of the Corporation;

then

and in each such event the Corporation shall mail or cause to be mailed to each holder of Preferred Stock a notice specifying (i) the

date on which any such record is to be taken for the purpose of such dividend, distribution or right and a description of such dividend,

distribution or right, (ii) the date on which any such reorganization, reclassification, recapitalization, transfer, consolidation, merger,

dissolution, liquidation or winding up is expected to become effective, and (iii) the time, if any, that is to be fixed, as to when the

holders of record of Common Stock (or other securities) shall be entitled to exchange their shares of Common Stock (or other securities)

for securities or other property deliverable upon such reorganization, reclassification, recapitalization, transfer, consolidation, merger,

dissolution, liquidation or winding up. Such notice shall be mailed by first class mail, postage prepaid, at least ten (10) days prior

to the earlier of (A) the date specified in such notice on which such record is to be taken and (B) the date on which such action is

to be taken.

12.

Notices. Except as otherwise expressly provided, all notices referred to herein will be in writing and will be delivered by registered

or certified mail, return receipt requested, postage prepaid and will be deemed to have been given when so mailed (a) to the Corporation,

at its principal executive offices and (b) to any stockholder, at such stockholder’s address as it appears in the stock records

of the Corporation (unless otherwise indicated in writing by any such stockholder).

IN

WITNESS WHEREOF, this Certificate of Designation has been executed on behalf of the Corporation by its Chief Executive Officer, and

attested by its Secretary, this 21st day of May 2024.

| | Gaucho Group Holdings, Inc. |

| | |

|

| | By: |

/s/ Scott L. Mathis |

| | Name: |

Scott L. Mathis |

| | Title: |

Chief Executive Officer |

| Attest: |

|

| |

|

/s/ Maria Echevarria

|

|

| Maria Echevarria, Secretary |

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

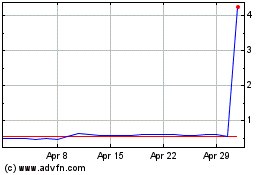

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From May 2024 to Jun 2024

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Jun 2023 to Jun 2024