BioDelivery Sciences International (NASDAQ: BDSI) is a specialty pharmaceutical company focused on the development and commercialization of pain and addiction management therapies by utilizing their novel and proprietary BioErodible MucoAdhesive (BEMA) drug delivery technology. Both current product candidates use the opioid Buprenorphine administered via a small patch that adheres to the inside of the mouth with the drug being absorbed through the cheek. BEMA Buprenorphine/Naloxone (Bunavail) is being developed for the treatment of opioid dependence and we believe it could be a $100M product 2015. BDSI’s second compound is BEMA Buprenorphine

for moderate to severe chronic pain partnered with one of the seminal names in pain

medicine Endo Health Solutions (ENDP) and in 2 phase 3 trials with data expected year

end 2013. Well capitalized and on the cusp of turning from a drug development story

into a drug launches story, the company seems to be at an inflection point.

BioErodible MucoAdhesive Technology:

There are several ways to deliver a drug to a patient, each with their own advantages and disadvantages. For example, intravenous delivery is the most rapid, but also can be the most toxic because the drug is delivered throughout the entire body. BEMA technology delivers its drug across the mucous membrane, which can be more effective than oral pill form. BEMA technology is very valuable in situations where intravenous, subcutaneous, or oral forms of drug delivery are ineffective. Delivery through the mucous membrane is effective because it dissolves and enters the body quickly, but also can be less toxic. The drug dissolves across the mucosal membrane in about 15 minutes and patients testify that it is easy to use and leaves little to no aftertaste. Since patient compliance and reduced toxicity has recently become of the utmost important to the FDA, Bio Delivery Sciences International has used its BEMA technology to develop several products.

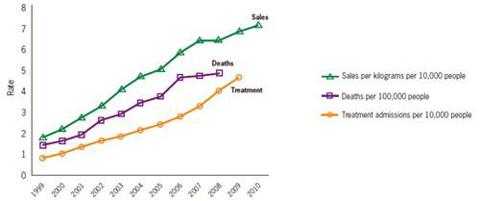

The company’s website shows some interesting information concerning the rates of prescription painkiller sales, deaths and substance abuse treatment admissions (1999-2010).

*National Vital Statistics System, 1999-2008; ARCOS, Drug Enforcement Administration (DEA), 1999-2010; Treatment Episode Data Set, 1999-2009.

The website further states:

“Opioid dependence is a medical diagnosis that is characterized by the inability of an individual to stop using opioids, both prescription opioids such as morphine, hydrocodone and oxycodone, as well as illicit opioids such as heroin, even when it is in the best interest of the individual to do so. Opioid dependence is a complex medical condition that often requires long-term treatment and care. The treatment of opioid dependence is important to reduce both the associated health and social consequences and to improve the well-being and social functioning of people affected.

The main goals of treating persons with opioid dependence are to reduce dependence on illicit drugs, reduce morbidity and mortality, improve physical and psychological health, reduce criminal behavior, and facilitate reintegration into the workforce and education system and to improve social functioning. The ultimate achievement of a drug free-state is the ideal and ultimate objective, but this may not be feasible for all individuals with opioid dependence, especially in the short term. As no single treatment is effective for all individuals with opioid dependence, diverse treatment options are needed, including psychosocial approaches and pharmacological treatment.”

BioDelivery Sciences International is combining its BEMA technology with a molecule called buprenorphine to create two market opportunities. Buprenorphine is currently marketed as Subxone and Subutex, with buprenorphine products used for the treatment of opioid dependence exceeding $1.5 billion in 2012. Its delivery with a low dose formulation can be used for treatment of chronic pain, while the high dose formulation with naloxone can be used for treatment of opioid pain. With only one drug on soluble film currently on the market, which is sold by Reckitt Benckiser in the U.K., there is room for a company like BioDelivery Sciences to grab market share. With the potential to capture a portion of the $1.5 million opioid dependence market and between $300-$500 million of the Buprenorphine Schedule II drug market, BioDelivery Sciences International is currently under spec-valued with a market cap of only $182 Million.

- BUNAVAIL

As noted above, opioid dependence has become a significant problem in the U.S. According to the 2010 National Survey on Drug Use and Healthy, nearly 2 million people are dependent on prescription opioids. Additionally, the National Institute of Drug Abuse states that there are over 200 million opioid prescriptions dispensed per year. Each year, the amount of people using opioids for non-medical needs is growing.

BioDelivery Sciences International is developing Bunavail as a therapy for patients with opioid depencence. The company combines buprenorphine and naloxone with its BEMA technology to develop a therapy potentially better than the current drug on the market, Suboxone.

So far, clinical studies have shown that Bunavail is equivalent or better than Suboxone in several ways. Bunavail has shown a lower incidence of side effects such as headache, constipation, nausea, agitation, and anxiety. Additionally, Bunavail shows better efficacy and less toxicity due to a better bioavailability and less buprenorphine needed to deliver the desired effects. In recent studies, surveyed patients have stated that BEMA technology was easy to use and had a pleasant taste. Bunavail’s ease of use should lead to better patient compliance, which has also become an important factor in determining approval by the FDA.

Even though Bunavail contains the same drug components as Suboxone, BEMA technology makes the drug a better therapy for opioid dependence. If eventually approved by the FDA, BioDelivery Sciences International can capture a large part of Suboxone sales, which exceeded $1.5 Billion in 2012. Furthermore, this market grew greater than 20% in 2012 and there continues to be a desperate need for viable treatments.

- BEMA Buprenorphine

BioDelivery Sciences International is also developing a low dose version of buprenorphine using BEMA technology for the treatment of chronic pain. BEMA Buprenorphine offers several advantages over current treatments. It is classified as a Class III opioid, meaning that patients are less likely to become addicted, while offering pain relief similar to a Class II opioid like morphine. Additionally, BEMA Buprenorphine has the potential for fewer side effects such as respiratory depression, constipation, and cognitive function. Since patients with chronic pain have to use these treatments daily for a long period of time, it is important that side effects be kept to a minimum.

BioDelivery Sciences International partnered with Endo Pharmaceuticals (NASDAQ: ENDP) in January 2012 for BEMA Buprenorphine for the treatment of chronic pain. Currently in Phase III clinical trials, the company is eligible receive up to $180 Million in milestone payments, with $30 Million to be received for completion of the trial. The company will also receive an additional $50 Million for FDA approval and even more in potential sale milestones. The estimated market potential for its BEMA technology is $300 million according to Dr. Mark Sirgo, CEO of BioDelivery Sciences. There is considerable political pressure mounting for these types of drugs to be more readily available on the market, since there are a plethora of addictive pain drugs on the market being abused.

- Onsolis

Onsolis is an FDA approved drug that also utilizes the BEMA drug delivery technology, which consists of a small, bioerodible polymer film for application to the buccal mucosa (inner lining of the cheek). Onsolis is an opioid analgesic indicated only for the management of breakthrough pain in patients with cancer, 18 years of age and older, who are already receiving and who are tolerant to opioid therapy for their underlying persistent cancer pain.

Near Term Catalyst:

BioDelivery Sciences International is expecting to submit a New Drug Application for BUNAVAIL in mid-summer 2013. In its 2012 10K, the company states:

“Additionally, we completed a $40 million registered financing which will assist in funding the clinical trial programs for both BEMA Buprenorphine and BUNAVAIL, while also providing a strong balance sheet as we continue BUNAVAIL licensing discussions in the U.S. and abroad and consider commercializing BUNAVAIL ourselves. We look forward to an exciting 2013 and working to achieve a number of key milestones, including the anticipated mid-year filing of our NDA for BUNAVAIL and moving the Phase 3 studies for BEMA Buprenorphine for chronic pain toward completion. We will also be determining whether to move forward with commercializing BUNAVAIL on our own or through a commercial partnership here in the U.S.

Continued progress was made in the development of BioDelivery’s two buprenorphine-containing products with the completion in January 2013 of the safety study for BUNAVAIL for the treatment of opioid dependence. The study, which included 249 patients who were switched from Suboxone to BUNAVAIL, demonstrated the ease of use and tolerability of BUNAVAIL.”

Future Catalysts:

BioDelivery Sciences International has several upcoming milestones in 2013 that can drive shareholder value. The company is focusing its resources on achievement of the following key milestones:

- BUNAVAIL commercialization opportunities. BDSI will continue to evaluate its strategic options for the commercialization of BUNAVAIL, which include partnership, internal approaches or a combination of these. BDSI expects to finalize its strategy in the second half of 2013.

- Recruitment of two Phase 3 studies for BEMA Buprenorphine. BDSI and Endo expect to continue recruitment in the two Phase 3 efficacy studies for BEMA Buprenorphine for chronic pain, one in opioid experienced and one in opioid naïve patient groups. The trials are expected to complete in late 2013 or early 2014. Upon completion of study enrollment and database lock for each trial, and the acceptance of filing of the NDA with the FDA, BDSI is expected to receive milestone payments from Endo totaling $30 million.

- Commence Confirmatory Study for Clonidine Topical Gel. BDSI plans to prepare for a confirmatory study in the latter part of 2013 which could lead to data availability by the end of 2014.

- Re-introduction of ONSOLIS in the U.S. In March 2013, BDSI and its commercial partner Meda submitted a proposal to FDA to reintroduce ONSOLIS for the treatment of breakthrough cancer pain into the U.S. marketplace following previously reported appearance issues with the product. If approved by FDA, the original ONSOLIS formulation may be on the market during the second-half of 2013 while stability data is collected on a newly formulated version of ONSOLIS. These data may be submitted to FDA before the end of the year, and if approved, could allow introduction of the new formulation sometime in 2014.

- Exploration of potential new products and technologies. In addition to advancing its lead products in development, BDSI is also, as in the past, exploring the application of its BEMA drug delivery technology to additional pharmaceuticals. In addition, BDSI continues to investigate potential new products and technologies to complement and diversify its existing portfolio.

Strong Management:

As mentioned, this appears to be the right time politically for these kinds of drugs to be developed and marketed. In my opinion, the right companies with good products, and more importantly, good management stand to benefit the most.

I found this interesting video interview with Dr. Mark Sirgo who explains what BDSI is currently engaged in. In the video, Dr. Sirgo gives his opinion stating the $300M potential of BEMA. Some other highlights from the video include the following quotes from Sirgo:

“The two products in our pipeline have much greater value than our first product, explains Dr. Sirgo. We’ve demonstrated the ability to move products through the regulatory hurdles. Investors need to take a closer look at our pipeline and the value that we plan to create there.

We have one marketed product that uses the same technology that products in our pipeline are using. It’s approved. It’s been through the FDA and it serves as a great proof-of-concept for our ability to not only take our product through the regulatory pathway, but also partner and get through commercialization.”

BEMA Buprenorphine is a unique opioide, it’s a class three. It’s the only standalone class three. The classifications are by the DEA (Drug Enforcement Administration), the higher the number, the less abuse and addiction potential of the opioid. So, class two’s for instance are fentanyl, morphine, and oxycodone. BEMA Buprenorphine doesn’t lose any of the efficacies of the C2 narcotics, but it has a much better safety profile.”

Dr. Mark Sirgo is a very good CEO, one of the best there is for among small cap biotech companies. He has consistently avoided turning to capital markets for financing, instead choosing to partner various products along with registered offerings to support the company’s proprietary pipeline. For those of you who listen to my online show and follow me on twitter, I constantly reiterate how important it is for a company to have good management. One of my favorite sayings is, “always bet on the jockey, not so much the horse.” A company can have great product potential, yet if its management is not good, problems can arise.

KEY VALUE DRIVERS:

• Transitioning from drug development to drug launches.

In 2013 BDSI will file an NDA for Bunavail (for opioid dependence) with an anticipated FDA

approval/launch in mid-2014. Bunavail will compete in the $1.5B Suboxone market

with an improved delivery method, which we model could capture ~15% of the

branded Suboxone market and generate $150M in sales to BDSI by 2016. In 2012

BDSI could launch its second drug BEMA Buprenorphine in partnership with Endo

Health Solutions (ENDP).

• Bunavail targets a significant market with an improved drug delivery.

While the $1.5B Suboxone market should contract with the dual launches of generic

Suboxone tablets in 1Q13, approximately 81% of the market is branded Suboxone

film strips (launched in 2010) and we anticipate a $1B market opportunity for

Bunavail through at least 2022. In pain management improved delivery wins, and

Bunavail should take share through a combination of better taste and lower side

effects than Suboxone film strips.

• ENDP partnership validates follow-on BEMA Buprenorphine for chronic pain.

ENDP partnered for this drug in 1Q12 and it remains the most exciting compound in

ENDP’s pipeline, in our opinion, so they are likely motivated to get the drug

approved & launched. The first BEMA Buprenorphine trial failed phase 3 in 2010,

but with a new trial design and a motivated, pain focused partner in ENDP we

believe it has a better chance for positive top-line results in 4Q13/1Q14.

• Well capitalized through FDA approval & launch.

BDSI raised ~$40M in 4Q12 giving the company ample cash to get through Bunavail launch in 2014, and it is in-line to receive up to $80M in additional development & regulatory milestones

through FDA approval of BEMA Buprenorphine.

Chart Technicals:

The above chart is very bullish, showing the recent price correction is done, and accumulation is underway. The last wave started at near $4 a share and ran almost to $6. I expect the new wave to move to a pivot price of $5.25 or so. Where it goes from that point will remain to be seen.

Conclusion:

The company’s current market cap of $169.84M is just way to low in my strong opinion, as BioDelivery Sciences is poised to take a substantial share of the multi-Billion dollar pain management and opioid dependence market. Its BEMA platform allows for its drugs to have lessened side effects, better patient compliance, and less of a propensity for patients to develop dependence through long time use. The FDA has been in favor of approving drugs that reduce the chance of abusing prescription medicine. These factors, along with BioDelivery Sciences’ strong management team, puts the company in a prime position to capitalize on this opportunity.

Based on the chart and the company’s near-term NDA filing, My short term price target opinion is $5.25. My long term 1 year price target is $9, if management executes and progresses on its goals by the middle of 2014.

Disclosure: I am long BDSI.

Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky — always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.