Litecoin slumps to $121 low and resumes upward

The altcoin will further decline to $73 if the support at $120 cracks

Litecoin (LTC) Current Statistics

The current price: $144.63

Market Capitalization: $9,613,048,370

Trading Volume: $12,189,426,086

Major supply zones: $120, $140, $160

Major demand zones: $90, $70, $50

Litecoin (LTC) Price Analysis January 12, 2021

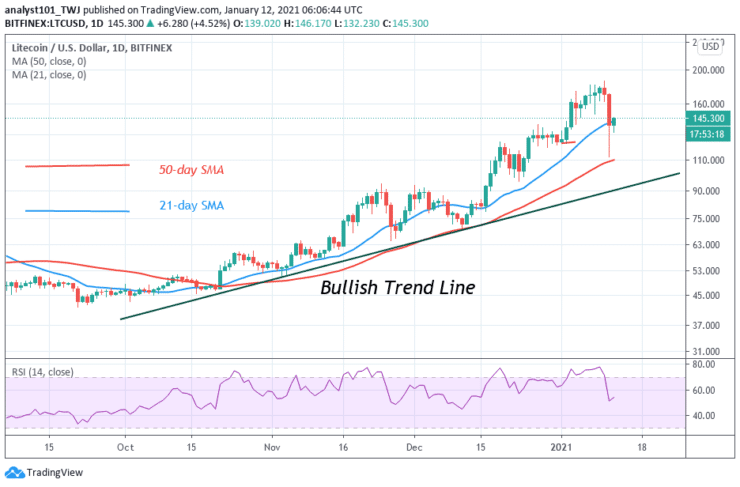

Litecoin has fallen to $120 low as the coin resumed its upward move. The crypto has fallen into the previous range bound zone of $120 and $140. LTC will retest the $180 resistance if the bulls clear the $140 and $170 minor resistance levels. On January 10, Litecoin was repelled as the bulls attempt to break the $180 resistance level. Meanwhile, the crypto has resumed upside momentum as the market reaches the high of $146.

Litecoin (LTC) Technical Indicators Reading

After the breakdown, the LTC price broke above the SMAs which suggested an upward movement of the coin. The crypto is at level 51 of the Relative Strength Index period 14. It indicates that there is a balance between supply and demand.

Conclusion

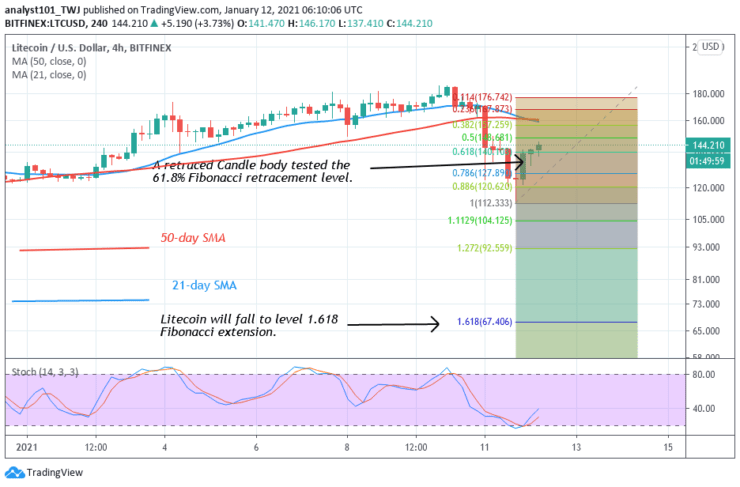

Litecoin has fallen to $120 low as the current support holds. This has propelled the price to rise on the upside. However, if the $120 support fails to hold, the Fibonacci tool price prediction will hold. On January 11 downtrend; a retraced candle body tested the 61.8%Fibonacci retracement level. The retracement indicates that the crypto will reach level 1.618 Fibonacci extensions or the high of $67.40.

Source: https://learn2.trade