Ether fluctuates above $450 support

The coin has a target price of $488 high

Ethereum (ETH) Current Statistics

The current price: $458.89

Market Capitalization: $52,029,363,330

Trading Volume: $14,108,917,588

Major supply zones: $280, $320, $360

Major demand zones: $160, $140, $100

Ethereum (ETH) Price Analysis November 11, 2020

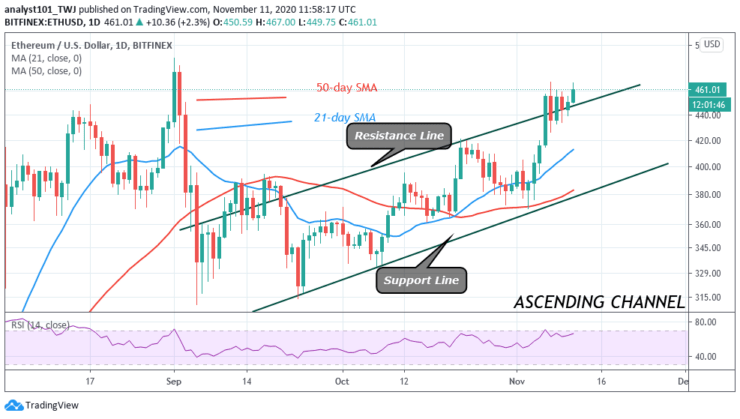

On November 10, the altcoin rebounded but could not break the $470 resistance. The upward move was repelled as price retraced to the $455 low. The upside momentum will always resume as long as price finds support above $450 support.

Presently, the coin is trading at $462 at the time of writing. On the upside, a strong bounce above $460 will propel price to break the $470 resistance. Ether will rally above $488 once the $470 resistance is breached. The upside momentum will be invalidated if the bears break the $450 and the $430 support level.

ETH Technical Indicators Reading

Ethereum is trading above the resistance line of the ascending channel. The biggest altcoin will continue to trend higher as long as price is sustained above the resistance line. The coin will resume a downward move if the price breaks below the resistance line.

Conclusion

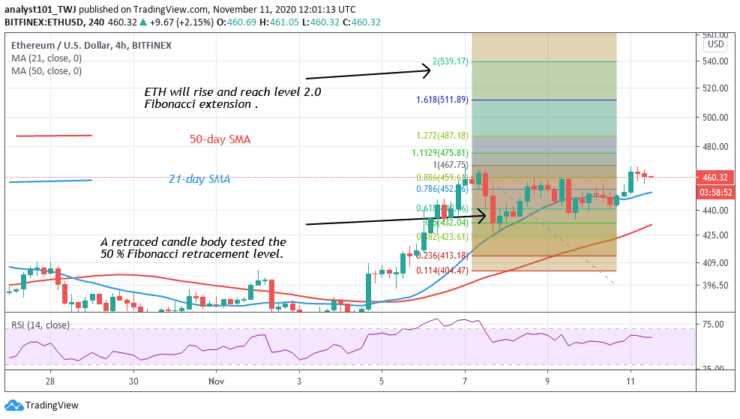

Ethereum bulls are close to breaking the resistance at $470. Once the resistance is broken the Fibonacci tool analysis will hold. When the coin was resisted on November 7 uptrend, the retraced candle body tested the 50% Fibonacci retracement level. This explains that the coin is likely to move up to level 2.0 Fibonacci extension which is $539.17 high.

Source: https://learn2.trade