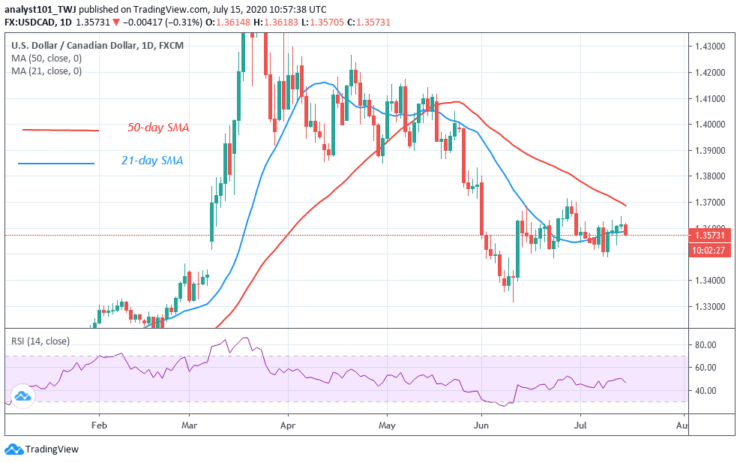

Key Resistance Levels: 1.42000, 1.44000, 1.46000

Key Support Levels: 1.34000, 1.32000, 1.30000

USD/CAD Price Long-term Trend: Ranging

The Loonie is in a sideways move in June. The market is fluctuating between levels 1.3500 and 1.3700. The price has risen above the 21-day SMA to move upward. The pair is likely to rise if the 21-day SMA support holds. The USD/CAD will rise and reach level 1.3700 if the uptrend resumes.

Daily Chart Indicators Reading:

The 50-day SMA and the 21-day SMA are sloping downward indicating the sideways trend. The Loonie has fallen to level 49 of the Relative Strength Index. This indicates that the pair is in the downtrend zone and below the center line 50.

USD/CAD Medium-term Trend: Ranging

On the 4-hour chart, the pair is fluctuating between levels 1.3500 and 1.3700. The current upward move is facing resistance at level 1.3650 as market moves downward. The pair will find support above level 1.3550 if the selling pressure persists.

4-hour Chart Indicators Reading

Presently, the SMAs are sloping horizontally indicating the sideways trend. The Loonie is below 80% range of the daily stochastic. It implies that the market is in a bearish momentum,.

General Outlook for USD/CAD

The USD/CAD pair is in the middle of levels 1.3500 and 1.3700. Presently, the market is in a bearish momentum. However, the price action indicates a bearish signal.

Source: https://learn2.trade