Volex PLC Trading Update (5159V)

April 15 2021 - 2:00AM

UK Regulatory

TIDMVLX

RNS Number : 5159V

Volex PLC

15 April 2021

15 April 2021

Volex plc

Trading update

Volex plc (AIM:VLX), the global supplier of integrated

manufacturing services and power products, is pleased to provide

the following update on trading ahead of the scheduled announcement

of the Group's full year results for the 52 weeks ended 4 April

2021(1) on 17 June 2021.

Financial and operational performance

The Group delivered a robust performance in the second half of

the financial year, underpinned by strong demand from customers in

the consumer electronics and electric vehicle markets.

The performance for the period includes over $52 million of

revenue from electric vehicle customers, a significant increase of

187% compared to the previous year, as we expanded our customer

base and product offering in this market.

There has also been an overall stabilisation in demand from our

core medical and industrial markets as well as healthy year-on-year

growth from data centre customers as the trend towards home-working

continues.

As a result, revenue for the full year will be ahead of market

expectations and be at least $440 million while underlying

operating profit is expected to be at least $41 million, ahead of

the most recently guided range.

Margins benefited from foreign exchange movements and favourable

commodity pricing in the first half of the financial year and,

although these unwound in the second half as anticipated, the Group

delivered strong year-on-year margin growth. The underlying

operating margin achieved for the full year represents a

satisfactory balance between revenue growth and profitability.

Although the business and operational challenges posed by

Covid-19 have not abated, all sites have remained fully operational

even as our local teams have prioritised keeping our employees

safe.

Acquisition activity and balance sheet

The acquisition of De-Ka Elektroteknik Sanayi ve Ticaret Anonim

irketi ("DE-KA") completed on 18 February 2021 and its integration

into the wider Volex business is progressing as planned,

accelerating our strategy of creating the most efficient and lowest

cost global producer in the industry.

DE-KA's sales and profits are currently significantly ahead of

the previous year and the business continues to enjoy very strong

demand in its core, white goods markets.

Following the acquisition of DE-KA, Group net debt (excluding

lease liabilities) will be approximately $6 million. Having

completed a successful refinancing in November 2020, Volex retains

a high degree of financial flexibility and management continues to

advance targeted investment opportunities, whilst maintaining its

highly disciplined approach to potential acquisitions.

The Group expects to announce a recommended dividend for FY2021

that is no less than 2.2 pence per share.

Executive Chairman, Nat Rothschild commented:

"Volex delivered a particularly strong end to the period with

our resilient business model meeting the challenges posed by the

Covid-19 pandemic head-on. Robust demand in the electric vehicle

and consumer electronics markets underpinned our performance in the

second half and, thanks to our diverse customer base and global

footprint, we are well placed to deliver on the next stage of our

development as we look to increase investment and grow our

business. Whilst we are now entering a more challenging

inflationary environment, we aim to defend the significant margin

gains we have made. Unless future lockdown measures severely

disrupt our customers or operations, we are confident of further

revenue and profit progression in FY2022."

This announcement, released by Volex plc, contains inside

information for the purposes of Article 7 of the Market Abuse

Regulation (EU) 596/2014 (MAR), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please contact:

Volex plc +44 (0) 7747 488 785

Nat Rothschild, Executive Chairman

Jon Boaden, Chief Financial Officer

Powerscourt - Media Enquiries +44 (0)20 7250 1446

James White

Jack Holden

N+1 Singer - Nominated Adviser and Joint Broker +44 (0)20 7496

3000

Shaun Dobson

Iqra Amin

HSBC Bank Plc - Joint Broker

+44 (0)20 7991 8888

Simon Alexander

Joe Weaving

Notes:

1. All figures in this trading update are unaudited. Audited

amounts will be included in our full year results announcement on

17 June 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFFISFISLIL

(END) Dow Jones Newswires

April 15, 2021 02:00 ET (06:00 GMT)

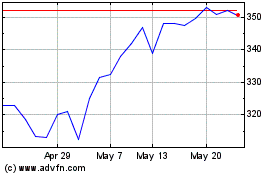

Volex (LSE:VLX)

Historical Stock Chart

From Oct 2024 to Nov 2024

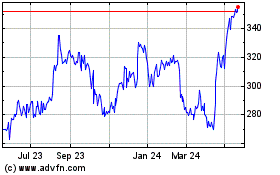

Volex (LSE:VLX)

Historical Stock Chart

From Nov 2023 to Nov 2024