SDX Business System - Recommended Cash Offer-Part 2

June 08 1998 - 4:13AM

UK Regulatory

RNS No 5495j

SDX BUSINESS SYSTEMS PLC

8th June 1998

PART 2

APPENDIX II

Particulars of the Loan Notes

The #100,000,000 Floating Rate Guaranteed Unsecured

Loan Notes 2002 of the Offeror will be created by a

resolution of the Board of the Offeror or a duly authorised

committee thereof and will be constituted by a Loan Note

Instrument (the "Loan Note Instrument") executed as a deed

by the Offeror and Lucent. The issue of the Loan Notes is

conditional on the Offer becoming or being declared

unconditional in all respects. The Loan Note Instrument will

contain provisions, inter alia, to the following effect:

1. The Loan Notes will be issued by the Offeror in

amount and integral multiples of #1 in nominal

amount and will constitute unsecured obligations of

the Offeror. The Loan Note Instrument will not

contain any restrictions on borrowing, disposals or

charging of assets by the Offeror. If valid

elections for the Loan Note Alternative would not

result in at least #1 million in nominal value of

Loan Notes being issued, no Loan Notes will be

issued unless the Board of the Offeror otherwise

determines.

2. Payment of principal and interest on the Loan Notes

and all obligations of the Offeror under the Loan

Note Instrument will be unconditionally guaranteed

by Lucent (the "Guarantor") as provided in the Loan

Note Instrument.

3. Interest on the Loan Notes will be payable (subject

to any requirement to deduct tax therefrom)

semi-annually in arrears on 30 June and 31 December

in each year or, if such a day is not a business

day, on the immediately preceding business day

("Interest Payment Dates") except that the first

payment of interest on the Loan Notes will be made

on 31 December, 1998, in respect of the period from

and including the date of issue of the relevant

Loan Notes up to but excluding 31 December, 1998.

The period from and including the date of first

issue of the Loan Notes up to but excluding 31

December, 1998 and the period from and including

that or any subsequent Interest Payment Date up to

but excluding the next following Interest Payment

Date is herein called an Interest Period.

4. (a) The rate of interest on the Loan Notes for

each Interest Period will be the rate per

annum which is one half of one per cent.

below LIBOR. For these purposes, LIBOR

means:

(i) the rate per annum of the offered

quotation for six-month sterling

deposits which appears on Telerate

Page 3750 soon after 11.00am on the

first business day of the relevant

Interest Period; or

(ii) if no such offered quotation appears

on Telerate Page 3750 at or about

such time (or there is then no such

Telerate Page 3750), the arithmetic

mean (rounded upwards, if necessary,

to four decimal places) of the

offered quotations for six-month

sterling deposits which appear on

the Reuters Screen "LIBO" page (or

such other page(s) as may replace

the "LIBO" page for the purpose of

displaying offered rates of leading

reference banks in London for

inter-bank sterling deposits) soon

after 11.00am providing the rate as

at 11.00am on the first business

day of the relevant Interest Period;

or

(iii) if no such offered quotation

appears on the Telerate Page 3750

(or there is then no such Telerate

Page 3750) and no such offered

quotations appear on the Reuters

Screen "LIBO" page or such

replacement page(s) as aforesaid

(or there is then no such "LIBO"

page nor any replacement therefor),

such rate at which National

Westminster Bank plc (or, failing

which, such other London clearing

bank as the Offeror may select for

this purpose) is offering six-month

sterling deposits to prime banks in

the London inter-bank market at or

about 11.00am on the first business

day of the relevant Interest Period.

For the purposes of this definition, "Telerate Page

3750" means the display designated as "Page 3750"

on the Telerate Service (or such other page as may

replace Page 3750 on that service or such other

service as may be nominated by the British Bankers'

Association as the information vendor for the

purpose of displaying British Bankers' Association

Interest Settlement Rates for sterling deposits).

(b) If a rate of interest cannot be established

in accordance with the provisions of

sub-paragraph (a) above for any Interest

Period, the rate of interest on the Loan

Notes for that Interest Period shall be the

same as that applicable to the Loan Notes

during the previous Interest Period, unless

such prime bank in the London inter-bank

market as the Offeror shall reasonably

select for the purpose shall have been

prepared to offer a rate as aforesaid, in

which case the rate of interest for the

relevant Interest Period shall be

determined on the basis of the rate so

offered.

5. Each instalment of interest shall be calculated on

the basis of a 365 day year and the number of days

elapsed in the relevant Interest Period.

6. A holder of Loan Notes (a "Noteholder") may require

the Offeror to repay the whole or any part (being

#500 nominal or any integral multiple thereof) of

the principal amount of his/her holding of Loan

Notes at par, together with accrued interest

(subject to any requirement to deduct tax

therefrom) up to but excluding the date of

repayment, on any Interest Payment Date, from and

including 31 December, 1998 and thereafter on any

Interest Payment Date falling prior to 30 June,

2002 by giving not less than 30 days' prior notice

in writing to the Offeror accompanied by the

certificate(s) for all the Loan Notes to be repaid

and a notice of redemption.

7. If, at any time, the principal amount of all Loan

Notes outstanding equals or is less than #500,000

or 10 per cent, of the total nominal amount of Loan

Notes issued in connection with the Offer, the

Offeror shall be entitled on giving the remaining

Noteholders not less than 30 days' notice in

writing expiring on any Interest Payment Date

after 30 June, 2000 to redeem all (but not some

only) of the Loan Notes at par together with

accrued interest (subject to any requirement to

deduct tax) up to but excluding the date of

redemption.

8. The Offeror will have the right to redeem the Loan

Notes at par on any Interest Payment Date after 30

June, 2000 on 30 days' written notice if interest

payable under the Loan Notes is reasonably expected

by the Offeror to fall to be treated as a

distribution for corporation tax purposes.

9. Any Loan Notes not previously repaid, redeemed or

purchased will be repaid in full at par on 30 June,

2002, together with accrued interest (subject to

any requirement to deduct tax) up to but excluding

that date.

10. Each Noteholder will be entitled to require all or

part of the Loan Notes held by that Noteholder to

be repaid at par together with accrued interest

(subject to any requirement to deduct any tax) if:

(a) any principal or interest on any of the

Loan Notes held by that Noteholder is not

paid in full within 30 days after the due

date for payment; or

(b) an order is made or an effective resolution

is passed for the winding-up or dissolution

of the Offeror or the Guarantor (other than

for the purposes of a reconstruction,

amalgamation, merger or members' voluntary

winding-up in the case of the Offeror, on

terms previously approved by extraordinary

resolution (as defined in the Loan Note

Instrument) and, in the case of the

Guarantor, not involving insolvency); or

(c) an encumbrancer takes possession of, or a

trustee, receiver, administrator or similar

officer is appointed or an administration

order is made in respect of, the whole or

substantially the whole of the undertaking

or property of the Offeror or the

Guarantor and such person has not been paid

out or discharged within 30 days.

11. The Offeror may at any time purchase any Loan Notes

at any price by tender (available to all

Noteholders alike), private treaty or otherwise by

agreement with the relevant Noteholder(s).

12. Any Loan Notes repaid, redeemed or purchased by the

Offeror, the Guarantor or any subsidiary of the

Guarantor will be cancelled and will not be

available for re-issue.

13. The Loan Notes will be evidenced by certificates

and will be registered and transferable in amounts

or integral multiples of #500, provided that

transfers of Loan Notes will not be registered

during the 14 days immediately preceding an

Interest Payment Date or while the register of

Noteholders is closed.

14. The Noteholders will have power by extraordinary

resolution of the Noteholders passed in accordance

with the provisions of the Loan Note Instrument or

by resolution in writing signed by holders of not

less than 75 per cent. by value of the outstanding

Loan Notes, inter alia, to sanction any abrogation,

modification or compromise or arrangement in respect

of their rights against the Offeror and/or the

Guarantor and to assent to any amendment of the

provisions of the Loan Note Instrument. The Offeror

may, with the consent of its financial advisers,

amend the provisions of the Loan Note Instrument,

without such sanction or consent, if such amendment

is of a formal, minor or technical nature or to

correct a manifest error. Any wholly owned UK

subsidiary of the Guarantor may be substituted for

the Offeror as principal obligor in respect of the

Loan Notes without the sanction or consent of the

Noteholders provided that the Notes continue to be

guaranteed on an unconditional basis by the

Guarantor and provided that to the extent that such

substitution results in a disposal by any

Noteholders for the purposes of UK taxation, the

Offeror will hold such Noteholders indemnified in

respect of any UK taxation suffered in consequence

of such disposal.

15. No application has been made or is intended to be

made to any stock exchange for the Loan Notes to be

listed or otherwise traded.

16. The Loan Notes and the Loan Note Instrument will be

governed by and construed in accordance with English

law.

APPENDIX III

Financial and Other Information on the Offer

1. Bases and Sources

(i) Unless otherwise stated, financial

information concerning Lucent and SDX has

been derived from the published annual

report and accounts and interim and

quarterly statements of the relevant

company for the relevant periods.

(ii) The value of the Offer is based on

approximately 35.5 million SDX shares in

issue, together with approximately 2.6

million SDX shares subject to options under

the SDX Share Option Schemes.

(iii) The closing middle market price of SDX

shares is derived from the London Stock

Exchange Daily Official List for the

relevant date.

2. Financial Effects of Acceptance of the Offer

The following tables show, for illustrative purposes only

and on the bases and assumptions set out in the notes

below, the financial effects of acceptance on capital value

and income for a holder of one SDX share if the Offer

becomes or is declared unconditional in all respects.

A. Increase in Capital Value

As at 7 May 98 As at 2 January 98

(p) (p)

Cash consideration (i) 326.0 326.0

Market value of (ii) 295.5 (iii) 202.5

one SDX share __________ __________

Increase in 30.5 123.5

capital value

This represents an 10.3% 61.0%

increase of

B. Effect on Income

As at 5 June 98

(p)

Income from (iv) 18.55

cash consideration

Dividend income from (v) 3.25

one SDX share ________

Increase in income 15.30

This represents an 470.8%

increase of

Notes:

(i) Cash consideration inclusive of 1.0p (net)

interim dividend for the financial year

ending 31 October, 1998.

(ii) Based on the middle market quotation of an

SDX share of 295.5p as derived from the

London Stock Exchange Daily Official List at

the close of business on 7 May, 1998, the

last business day prior to the announcement

on 8 May, 1998 that SDX had received an

approach which might or might not develop

into an offer being made for SDX.

(iii) Based on the middle market quotation of an

SDX share of 202.5p as derived from the

London Stock Exchange Daily Official List at

the close of business on 2 January, 1998.

(iv) The income from the cash consideration has

been calculated on the assumption that the

cash including the 1.0 p (net) interim

dividend for the financial year ending 31

October, 1998 is re-invested to yield 5.69

per cent. per annum, being the gross yield

shown by the FTSE Actuaries average gross

redemption yield for medium coupon British

Government securities of five to fifteen

years on 5 June, 1998, the last business

day prior to this announcement, as

published in the Financial Times on 6 June,

1998.

(v) The gross dividend income from one SDX

share is based on the aggregate dividends

of 2.6p (net) per SDX share being the total

of the 1.6p (net) final dividend for the

financial year ended 31 October, 1997 and

the 1.0p (net) interim dividend for the

financial year ending 31 October, 1998,

together, in each case, with an associated

tax credit at 20/80th of the amount paid.

(vi) No account has been taken of the Loan Note

Alternative or of any liability to

taxation.

APPENDIX IV

Definitions

The following definitions apply throughout this

announcement unless the context requires otherwise:

"Board" or "Boards" the Boards of Lucent and/or

the Offeror and/or SDX as

the context requires.

"City Code" The City Code on Takeovers

and Mergers.

"Companies Act" the Companies Act 1985 (as

amended).

"Dresdner Kleinwort Benson" Kleinwort Benson Securities

Limited.

"Form of Acceptance" the Form of Acceptance and

authority relating to the

Offer accompanying the

Offer Document.

"LIBOR" London Interbank Offered

Rate for six month sterling

deposits as more

particularly defined in

paragraph 4 (a) of Appendix

II.

"Loan Note Alternative" the alternative whereby SDX

shareholders (other than

certain overseas

shareholders) validly

accepting the Offer may

elect to receive Loan Notes

in lieu of all or part of

the cash consideration to

which they would otherwise

have been entitled under

the Offer.

"Loan Notes" the floating rate

guaranteed unsecured loan

notes 2002 of the Offeror.

"Lucent" Lucent Technologies Inc.

"Lucent Group" Lucent and its subsidiaries

and subsidiary

undertakings.

"Morgan Stanley" Morgan Stanley & Co.

Limited.

"NYSE" The New York Stock

Exchange.

"Offer" the recommended offer to

be made by Morgan Stanley

on behalf of Lucent or one

of its wholly owned

subsidiaries to acquire all

of the SDX shares,

including where the context

so requires, any subsequent

revision, variation,

extension or renewal of such

offer, and subject to the

conditions set out herein.

"Offer Document" the document to be

dispatched to SDX

shareholders containing the

full terms and conditions

of the Offer.

"Offeror" Lucent or the wholly owned

subsidiary of Lucent on

whose behalf the Offer is

made.

"Panel" The Panel on Takeovers and

Mergers.

"SDX" SDX Business Systems plc.

"SDX Group" SDX and its subsidiaries

and subsidiary undertakings.

"SDX Share Option Schemes" the existing share option

schemes of SDX, comprising

the SDX Business Systems

Discretionary Share Option

Scheme, the SDX Business

Systems Savings Related

Share Option Scheme and

the outstanding options

granted between 1995 and

1996 to certain employees

of the SDX Group to

subscribe SDX shares.

"SDX shares" the ordinary shares of

nominal value of 5p each in

the capital of SDX on the

date hereof and any further

such shares which are

unconditionally allotted or

issued prior to the date on

which the Offer closes (or

such earlier date, not

being earlier than the date

on which the Offer becomes

or is declared unconditional

as to acceptances or, if

later, the first closing

date of the Offer, as

Lucent may, subject to the

provisions of the City

Code, decide).

"UK" or "United Kingdom" the United Kingdom of Great

Britain and Northern

Ireland.

"US" the United States of

America, its territories

and possessions, any state

of the United States and

the District of Columbia.

"Wider Lucent Group" the Lucent Group and any

company, joint venture or

partnership or firm in

which any member of the

Lucent Group may be

interested, directly or

indirectly, in 20 per cent.

or more of the equity

capital.

"Wider SDX Group" the SDX Group and any

company, joint venture or

partnership or firm in

which any member of the SDX

Group may be interested,

directly or indirectly, in

20 per cent. or more of the

equity capital.

For the purposes of this announcement, "subsidiary" and

"subsidiary undertaking" have the respective meanings given

by the Companies Act.

END

OFFUBUAWQBGRUMR

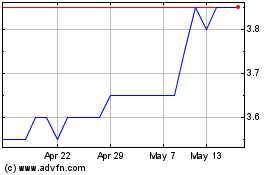

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jul 2023 to Jul 2024