TIDMRNO

RNS Number : 4586T

Renold PLC

15 November 2023

Renold plc

Interim results for the half year ended 30 September 2023

("Renold", the "Company" or, together with its subsidiaries, the

"Group")

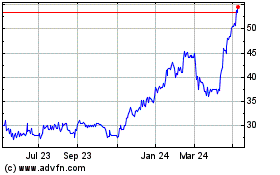

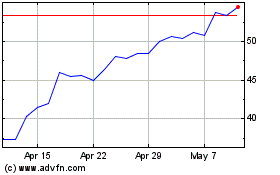

Strategic and operational progress driving record earnings

growth

Renold (AIM: RNO), a leading international supplier of

industrial chains and related power transmission products,

announces its interim results for the six month period ended 30

September 2023.

Financial summary Half year ended

Change %

(Constant

30 September 30 September

GBPm 2023 2022 Change % currency)(1)

Revenue 125.3 116.3 +7.7% +10.7%

Adjusted operating profit(2) 15.0 9.6 +56.3% +59.4%

Return on sales(2) 12.0% 8.3% +370bps +360bps

Adjusted profit before tax(2) 11.3 7.3 +54.8%

Net debt(3) 28.3 34.0

Adjusted earnings per share(2) 3.8p 2.7p +40.7%

Additional statutory measures

Operating profit 16.2 8.8 +84.1%

Profit before tax 12.5 6.5 +92.3%

Basic earnings per share 4.4p 2.3p +91.3%

Financial highlights

-- Revenue up 7.7% (10.7% at constant exchange rates) to GBP125.3m

(2022: GBP116.3m) driven by strong improvement in Torque Transmission

("TT") activity levels and continued growth in Chain.

-- Adjusted operating profit up 56.3% (59.4% at constant exchange

rates) to GBP15.0m (2022: GBP9.6m).

-- Return on sales increased by 370bps, (360bps at constant exchange

rates) to 12.0% (2022: 8.3%).

-- Net debt as at 30 September 2023 of GBP28.3m (31 March 2023: GBP29.8m),

despite acquisition of Davidson Chain Pty ("Davidson") for GBP3.1m

in the period and deferred payment of GBP1.7m for Industrias YUK

S.A. ("YUK"). Net debt represented 0.7x rolling 12 months adjusted

EBITDA.

-- Adjusted EPS up 40.7% to 3.8p (2022: 2.7p).

-- IAS 19 pension deficit reduced by 15.3% to GBP52.7m (31 March

2023: GBP62.2m).

Business highlights

-- Good progress on productivity improvements, cost reduction programmes

and capital investment projects, accelerating the integration

of Group-wide supply chain and increasing operational capabilities.

-- Strong first half sales performance, despite normalisation in

order intake to GBP109.7m when compared to the prior H1 record

order intake of GBP124.1m.

-- Order book at 30 September 2023 of GBP83.6m, compared to prior

year's record high (30 September 2022: GBP99.0m) as the duration

of the order book shortened following normalisation of supply

chains this year.

-- Acquisition of Davidson for AU$6.0m, increasing the Group's access

to the Australian conveyor and adapted transmission chain markets.

The integration process is progressing well and the business is

performing in line with expectations.

-- GBP2.2m exceptional profit from the assignment of a lease for

a closed legacy site, resulting in a GBP0.7m per annum reduction

in ongoing leased property costs.

(1) See below for reconciliation of actual rate, constant

exchange rate and adjusted figures.

(2) See Note 12 for definitions of adjusted measures and the

differences to statutory measures.

(3) See Note 8 for a reconciliation of net debt which excludes

lease liabilities.

Robert Purcell, Chief Executive of Renold, said:

" I'm pleased to report continued progress which builds on the

momentum the Group has enjoyed in recent periods, delivering a

record half year result. Sales, margins, profits and cash

generation have all progressed well. Global markets continue to be

uncertain and we remain vigilant for changes in patterns of demand

beyond the current order book shortening. We are delighted with the

purchase of Davidson in Australia, which further builds our

inorganic growth strategy and we remain well positioned to continue

developing through acquisition. There remains uncertainty over the

implication of global economic pressures in the medium term,

however the Board is increasingly confident in delivering a result

for the current year ahead of previous market expectations."

Reconciliation of reported, constant exchange rate and adjusted

results

Revenue Operating profit Earnings per

share

--------------------- --------------------- ---------------------

H1 H1 H1 H1 H1 H1

2023/24 2022/23 2023/24 2022/23 2023/24 2022/23

GBPm GBPm GBPm GBPm pence pence

-------------------------------- ---------- --------- ---------- --------- ---------- ---------

Statutory at actual

exchange rates 125.3 116.3 16.2 8.8 4.4 2.3

Adjust for non-recurring

items:

Assignment of lease of

closed site - - (2.2) -

Acquisition and reorganisation

costs - - 0.5 0.6

Amortisation of acquired

intangible assets - - 0.5 0.2

-------------------------------- ---------- --------- ---------- --------- ---------- ---------

Adjusted at actual exchange

rates 125.3 116.3 15.0 9.6 3.8 2.7

Exchange impact 3.4 - 0.3 -

-------------------------------- ---------- --------- ---------- ---------

Adjusted at constant

exchange rates 128.7 116.3 15.3 9.6

-------------------------------- ---------- --------- ---------- ---------

Investor Presentation

The Company will conduct a live presentation and Q&A session

for investors at 5:30 pm GMT today, 15 November 2023. The

presentation is open to all existing and potential shareholders.

Those wishing to attend should register via the following link and

they will be provided with log in details:

https://us02web.zoom.us/webinar/register/WN_DwsvKoYLQumb8x1YZg-klw

There will be the opportunity for participants to ask questions

at the end of the presentation. Questions can also be emailed to

renold@investor-focus.co.uk ahead of the presentation.

ENQUIRIES:

Renold plc IFC Advisory Limited

Robert Purcell, Chief Executive Tim Metcalfe

Jim Haughey, Group Finance Director Graham Herring

renold@investor-focus.co.uk

0161 498 4500 020 3934 6630

Nominated Adviser and Joint Broker Joint Broker

Peel Hunt LLP Cavendish Capital Markets Limited

Mike Bell Ed Frisby (Corporate Finance)

Ed Allsopp Andrew Burdis / Harriet Ward

(ECM)

020 7418 8900 020 7220 0500

Cautionary statement regarding forward-looking statements

Some of the information in this document may contain projections

or other forward-looking statements regarding future events or the

future financial performance of Renold plc and its subsidiaries.

You can identify forward-looking statements by terms such as

"expect", "believe", "anticipate", "estimate", "intend", "will",

"could", "may" or "might", the negative of such terms or other

similar expressions. Renold plc (the Company) wishes to caution you

that these statements are only predictions and that actual events

or results may differ materially. The Company does not intend to

update these statements to reflect events and circumstances

occurring after the date hereof or to reflect the occurrence of

unanticipated events. Many factors could cause the actual results

to differ materially from those contained in projections or

forward-looking statements of the Group, including among others,

general economic conditions, the competitive environment as well as

many other risks specifically related to the Group and its

operations. Past performance of the Group cannot be relied on as a

guide to future performance.

NOTES FOR EDITORS

Renold is a global leader in the manufacture of industrial

chains and also manufactures a range of torque transmission

products which are sold throughout the world to a broad range of

original equipment manufacturers, distributors and end-users. The

Company has a reputation for quality that is recognised worldwide.

Its products are used in a wide variety of industries including

manufacturing, transportation, energy, metals and mining.

Further information about Renold can be found at:

www.renold.com

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014), as it forms part of domestic law by

virtue of the European Union (Withdrawal) Act 2018) ("MAR") prior

to its release as part of this announcement and is disclosed in

accordance with the Company's obligations under Article 17 of those

Regulations.

Chief Executive's statement

The Group's performance in the first six months of the year

continued to be strong, delivering an increase in revenues of 7.7%

to GBP125.3m (2022: GBP116.3m). At constant exchange rates,

revenues increased 10.7%. The TT division, which saw revenue

increase by 25.2%, has had an especially positive start to the

year, as the benefit of the long-term military contracts within

Couplings, along with increased capacity investments in Westfield,

our North American TT operation, has allowed the business to

capitalise on the current strong North American market.

Group adjusted operating profit increased by 56.3% to GBP15.0m

(2022: GBP9.6m) as the benefits of increased sales and prior year

productivity improvements translated into better financial results.

Return on sales increased by 370bps, to 12.0% (2022: 8.3%), a

record high for the Group, driven by increasing levels of

productivity investments and projects, benefits of increased sales

volumes both organic and through acquisition, passing on cost

inflation and acquisition integration synergies. Statutory

operating profit increased to GBP16.2m (2022: GBP8.8m), as an

exceptional profit of GBP2.2m was recorded on the assignment of the

lease of the closed Bredbury site, offset by costs associated with

the acquisition of Davidson, with the statutory operating profit

margin for the period increasing to 12.9% (2022: 7.6%).

Net debt reduced during the period by GBP1.5m to GBP28.3m (31

March 2023: GBP29.8m) despite the Group acquiring the trade and

assets of Davidson for GBP3.1m, making a deferred consideration

payment for the YUK acquisition of GBP1.7m, and bringing forward a

UK pension scheme payment of GBP2.6m that was originally scheduled

for the second half of the year. The accelerated pension payment

will enable efficiencies in the evolution of the scheme's

investment portfolio.

Order intake for the period was GBP109.7m, a decrease of 11.6%

(2022: GBP124.1m), or a 9.0% decrease at constant exchange rates.

YUK contributed GBP6.9m to order intake in the period. The order

book as at 30 September 2023 of GBP83.6m remains higher than

historic levels. However, there has been a normalisation of order

intake following an improvement in global supply chains, with

improvements to delivery times, allowing customers to reduce

forward order placement as certainty of lead times increase. The

order book at 30 September 2023 of GBP83.6m represents a constant

currency decrease of 11.1% over the record high position at the end

of the previous financial year.

The Group has continued to successfully manage a period of

sustained cost inflation and changes to the supply chain, pursued

efficiency gains and projects and passed on cost adjustments both

up and down. The Group expects to experience further cost pressures

through the second half of the year but the Board is confident that

these will continue to be managed successfully.

Renold continues to focus efforts on driving and optimising

performance through identified projects, some of which require

capital investment, targeting better operational efficiency,

improved design and standardisation of products, better asset

utilisation, more flexible working practices, and leveraging

improved procurement strategies.

Acquisitions

On 1 September 2023, the Group acquired the trading assets of

Davidson, based in Melbourne, Australia, for a cash consideration

of AU$6.0 million, enlarging the already established Australian

Chain business by 26%. The Davidson acquisition demonstrates

further strategic momentum, supplementing organic growth through

high quality bolt-on acquisitions which can expand our geographic

presence, grow our product offering and strengthen our market

position in key end markets.

The Board is pleased with the performance of Davidson in the

period since completion of the acquisition and remains excited by

the opportunities beginning to emerge. Davidson has traded in line

with the Board's expectations made at the time of the

acquisition.

There remains an active pipeline of acquisition opportunities

which the Group continues to review as part of its growth strategy.

The Board adopts a disciplined approach to its acquisition

strategy, with investments focussed on complementary industrial

chain businesses, to supplement organic growth. Acquisitions are

expected to be earnings accretive whilst leverage is maintained at

conservative levels.

Business and financial review

Adjusted operating

Revenue profit Return on sales

----------------------- ------------------- --------------------- -------------------

2023/24 2022/23 2023/24 2022/23 2023/24 2022/23

Six month period GBPm GBPm GBPm GBPm % %

Chain 101.5 95.1 16.0 12.5 15.8 13.1

Torque Transmission 29.8 23.0 4.7 1.5 15.8 6.5

Head office costs/

Inter segment sales

elimination (2.6) (1.8) (5.4) (4.4) - -

----------------------- --------- -------- ----------- -------- --------- --------

Total Adjusted at

constant rates 128.7 116.3 15.3 9.6 11.9 8.3

Impact of foreign

exchange (3.4) - (0.3) - 0.1

----------------------- --------- -------- ----------- -------- --------- --------

Total Adjusted at

actual rates 125.3 116.3 15.0 9.6 12.0 8.3

Adjusting items:

Assignment of lease

of closed site - - 2.2 -

Amortisation of

acquired intangible

assets - - (0.5) (0.2)

Acquisition and

reorganisation costs - - (0.5) (0.6)

----------------------- --------- -------- ----------- -------- --------- --------

Statutory 125.3 116.3 16.2 8.8 12.9 7.6

----------------------- --------- -------- ----------- -------- --------- --------

Chain

The Chain division's revenue at constant exchange rates

increased by 6.7% to GBP101.5m, and stayed above the

psychologically important GBP100m milestone.

Chain Performance

--------------------------------------- -------- -------- -------- --------

2023/24 2022/23 2023/24 2022/23

GBPm GBPm ROS % ROS %

--------------------------------------- -------- -------- -------- --------

External revenue 98.4 94.7

Inter-segment revenue 0.5 0.4

--------------------------------------- -------- -------- -------- --------

Total revenue 98.9 95.1

Foreign exchange 2.6 -

--------------------------------------- -------- -------- -------- --------

Revenue at constant exchange rates 101.5 95.1

--------------------------------------- -------- -------- -------- --------

Operating profit 17.0 12.3 17.2 12.9

Assignment of lease of closed site (2.2) -

Amortisation of acquired intangible

assets 0.5 -

Acquisition and reorganisation

costs 0.5 0.2

--------------------------------------- -------- -------- -------- --------

Adjusted operating profit 15.8 12.5 16.0 13.1

--------------------------------------- -------- -------- -------- --------

Foreign exchange 0.2 -

--------------------------------------- -------- -------- -------- --------

Adjusted operating profit at constant

exchange rates 16.0 12.5 15.8 13.1

--------------------------------------- -------- -------- -------- --------

Revenue increased across all regions:

-- Europe increased external revenue by 7.6% at constant currency

rates. Excluding the impact of the YUK acquisition external revenue

fell by 5.8%, as the impact of the Ukraine war, and cost inflation,

was felt through the broader European economy. The integration

of the YUK business has proceeded as planned with GBP7.2m of additional

external revenue recorded, as the Group saw the benefits of substituting

externally sourced products, increasing conveyor chain ("CVC")

product sales (manufactured by YUK in Spain) throughout Europe,

and increasing transmission chain ("TRC") sales in Spain.

-- The Americas increased constant currency revenues by 6.9%, with

sales of Engineering chain remaining buoyant, and demand for transmission

chain and leaf chain (used in Forklift trucks) remaining strong.

New opportunities with distributors and strong demand was seen

from end users especially for capital equipment in the food processing,

ethanol and mining industries.

-- Australasian revenues increased by 6.7% at constant exchange rates,

as the business continued to benefit from execution of its growth

strategy, sales increased by double digit growth rates in New Zealand,

and Malaysia, with Thailand also growing strongly. Sales to Indonesia

were adversely impacted by continued import restrictions imposed

by the Indonesian government, whilst Australia also saw the impact

of a slowdown in activity.

-- External revenues in India fell in the first half of the year as

the impact of slow agricultural sales were experienced, and there

was an increase in competition from other local manufacturers.

Capacity was utilised in supporting Group sales, especially increased

demand within the US market, for larger sized Engineering chain

products. Additional investment to support productivity and capacity

improvements in India, have recently been initiated, and activities

aimed at the expansion of the domestic dealer network and an increase

in the number of local warehouses is underway, to enhance geographic

coverage and service.

-- External revenues in China were up 50.1% (at constant exchange

rates) as efforts aimed at growing domestic Chinese sales continue

to bear fruit, the sales increase going someway to offset the softening

in demand seen as a result of slower intra group demand from Europe.

The transfer of externally purchased product volumes from the YUK

acquisition to the Jintan factory continued with an increase in

sales seen to the YUK business during the period. Significant progress

has once again been made in enhancing the performance of the factory

in Jintan, through a programme of standardisation and improvement

projects, including the commissioning of new equipment, so the

factory is increasingly able to manufacture higher specification

products.

Divisional adjusted operating profit at constant exchange rates

was GBP16.0m, GBP3.5m higher than the prior year. Return on sales

increased by 270bps to 15.8% (2022: 13.1%).

Order intake at constant exchange rates decreased by 11.2% to

GBP91.2m, resulting in a book to bill (ratio of orders to sales)

for the first half of the year of 90.3% (2022: 105.0%).

Torque Transmission ("TT")

TT Performance

----------------------------------------- -------- -------- -------- --------

2023/24 2022/23 2023/24 2022/23

GBPm GBPm ROS % ROS %

----------------------------------------- -------- -------- -------- --------

External revenue 26.9 21.6

Inter-segment revenue 1.9 1.4

----------------------------------------- -------- -------- -------- --------

Total revenue 28.8 23.0

Foreign exchange 1.0 -

----------------------------------------- -------- -------- -------- --------

Revenue at constant exchange rates 29.8 23.0

----------------------------------------- -------- -------- -------- --------

Operating profit (and adjusted operating

profit) 4.6 1.5 16.0 6.5

----------------------------------------- -------- -------- -------- --------

Foreign exchange 0.1 -

----------------------------------------- -------- -------- -------- --------

Adjusted operating profit at constant

exchange rates 4.7 1.5 15.8 6.5

----------------------------------------- -------- -------- -------- --------

Divisional revenues at constant exchange rates of GBP29.8m were

GBP6.8m (30%) higher than in the prior year, which continued the

trend seen in the second half of the last financial year. This was

due to increased demand for Military Couplings in the Cardiff

business, and a further strengthening in demand in North America.

Additionally, the division benefited from a significant increase in

capacity primarily driven by capital investments in automated

machines, and efficiency improvements driven by greater visibility

following the implementation of M3.

As a result of the increased sales activity, selling price rises

and improved operational output, as well as a normalisation in

product mix, divisional operating profit at constant currency

increased by GBP3.2m to GBP4.7m.

Return on sales increased in the period to 16.0% (2022: 6.5%).

This is now beyond pre COVID pandemic level rates of return.

The closing order book for the division of GBP34.1m should

ensure that momentum will continue into the second half of the year

at similar rates, however, second half comparators are

significantly stronger than those in H1.

Cash flow and net debt

2023/24 2022/23

Half year to 30 September GBPm GBPm

------------------------------------------------ -------- --------

Adjusted operating profit 15.0 9.6

Add back: Depreciation and amortisation 4.9 4.9

Share-based payments 0.7 0.5

------------------------------------------------ -------- --------

Adjusted EBITDA 20.6 15.0

Movement in working capital (1.4) (7.6)

Net capital expenditure (2.1) (2.2)

Operating cash flow 17.1 5.2

Income taxes (1.3) (1.3)

Pensions cash costs (6.0) (3.1)

Repayment of principal under lease liabilities (1.4) (1.2)

Financing costs paid (2.2) (1.3)

Consideration paid for acquisitions(1) (4.9) (17.8)

Other movements 0.2 (0.7)

------------------------------------------------ -------- --------

Change in net debt 1.5 (20.2)

Closing net debt (28.3) (34.0)

------------------------------------------------ -------- --------

(1) Includes GBP1.7m deferred consideration in relation to the

acquisition of Industrias YUK S.A in the prior year and GBP0.2m of

acquisition costs for Davidson Chain Pty.

Net Debt reduced from the prior financial year end by GBP1.5m in

the period to GBP28.3m. Cash collections were strong, especially in

North America, where receipts from significant orders shipped at

the end of the last financial year were collected in the period.

Offsetting this inflow, the Group paid GBP3.1m in cash

consideration for the Davidson acquisition, and made the initial

deferred payment of GBP1.7m for the YUK acquisition, along with

associated acquisition and reorganisation costs of GBP0.5m.

Working capital increased during the period, with the Group

increasing inventory levels especially in North America where

demand continues to be strong, particularly in the Engineered chain

segment.

Net capital expenditure of GBP2.1m remained broadly in line with

prior years. Strategic investments in production capabilities,

especially in our Chinese and Indian facilities continue apace,

including expansion of press capabilities, improved heat treatment

and continuing the roll-out of the group's standard business

systems.

Corporation tax payments on account of GBP1.3m were at similar

levels to the first half of last year.

Interest cash costs increased relative to the first half of last

year reflecting the increase in market interest rates over the

intervening period.

Pensions

The Group has a number of closed defined benefit pension schemes

(accounted for in accordance with IAS 19 'Employee Benefits').

During the Covid-19 pandemic, the Group negotiated a GBP2.8m

one-off deferral of contributions with the UK pension scheme

trustees. Contributions have now returned to normal levels, with

the second of five annual deferred payments of c.GBP0.6m being

made. Additionally, the Group had a longstanding agreement with the

UK scheme to pay an additional GBP1.0m of annual cash

contributions, to the extent that the Group's adjusted operating

profit exceeds GBP16.0m; the additional cash contributions

commenced in the half year. The Group took the opportunity to bring

forward GBP2.6m of contributions to the UK pension scheme from the

second half of the year, in order to increase efficiency in the

evolution of the investment portfolio. Excluding these amounts,

underlying pension contributions reduced following the closure of

the New Zealand pension scheme in FY23, and a reduction in

administration costs. The cash contributions into the UK Scheme are

known and stable, though increasing with RPI capped at 5%. In FY24

this cost is expected to be GBP5.3m. In addition there are

administration and actuarial costs, including the PPF levy, which

may vary. The cost of pensions in payment in Germany (there is no

scheme or fund) are expected to be GBP1.2m in FY24. This amount

will rise with inflation but the total will fall gradually over

time.

The Group's IAS 19 deficit decreased from GBP61.3m at 30

September 2022 to GBP52.7m at 30 September 2023.

At 30 September 2023 At 31 March 2023

Overseas Overseas

UK schemes schemes Total UK schemes schemes Total

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----------- --------- -------- ----------- --------- ----------

IAS 19 retirement benefit

obligations (36.6) (16.1) (52.7) (44.2) (18.0) (62.2)

Net deferred tax asset 1.6 1.4 3.0 3.3 1.8 5.1

-------------------------------- ----------- --------- -------- ----------- --------- ----------

Retirement benefit obligations

net of deferred tax asset (35.0) (14.7) (49.7) (40.9) (16.2) (57.1)

-------------------------------- ----------- --------- -------- ----------- --------- ----------

The yield on corporate bonds increased further during the

period. Consequently the discount rates used for the UK scheme rose

from 4.85% to 5.70%, and resulted in a net reduction in UK pension

liabilities of GBP7.6m, and overseas pension liabilities of

GBP1.9m. The long term expectation for CPI inflation remained

broadly stable at 3.35% (3.30% at September 2022). Asset values

were impacted as both the value of gilts and equities fell during

the period. The scheme has insurance assets linked directly to the

benefits of certain scheme members. As the liability to these

members reduces, for example with an increase in discount rate, so

does the value of the corresponding insurance asset.

Pension liabilities in overseas schemes reduced by GBP1.9m to

GBP16.1m, again due in the main to an increase in discount

rates.

The net pension financing expense (a non-cash item) was GBP1.4m

(2022: GBP1.0m).

Borrowing Facilities

The Group refinanced its borrowing facilities in May 2023. The

new facilities consist of a GBP85.0m multi-currency revolving

credit facility and a GBP20.0m accordion option which will provide

the Company access to additional funding in support of its

acquisition programme. The principal facility term, being the Net

Debt / Adjusted EBITDA covenant, was also improved from the

previous level of 2.5 times Adjusted EBITDA to 3.0 times Adjusted

EBITDA, with other key terms remaining unchanged.

Dividend

In line with recent policy based on enhancing Group performance

through focussed investment in new equipment and earnings enhancing

acquisitions the Board has decided not to declare an interim

ordinary dividend. The dividend policy will remain under review as

margin and cash flow performance continues to develop.

Summary

Sales in the first half remained strong. Margins rose markedly

as better volumes, good cost management, complementary acquisitions

and strong execution of productivity and efficiency programmes,

aided by a consistent and coherent strategy all came together. The

robust Renold business with a strengthening balance sheet and

growing cash generation is positioned well for tackling whatever

global economic headwinds may transpire in the upcoming period.

Going concern

The interim condensed consolidated financial statements have

been prepared on a going concern basis. In determining the

appropriate basis of preparation of the financial statements, the

Directors are required to consider whether the Group can continue

in operational existence for the foreseeable future.

The ongoing macro-economic uncertainty, and inflationary

environment, together with the impact of the war in Ukraine

alongside the continued improvement in the half year trading

performance of the Group have been considered as part of the

adoption of the going concern basis. The Group continues to closely

monitor operating costs, and capital expenditure and other cash

demands are being managed carefully.

As part of its assessment, the Board has considered downside

scenarios that reflect the current uncertainty in the global

economy, including significant material and energy supply issues

and continuing inflationary pressures.

The Directors believe that the Group is well placed to manage

its business risks and, after making enquiries including a review

of forecasts and predictions, taking account of reasonably possible

changes in trading performances and considering the existing

banking facilities, including the available liquidity and covenant

structure, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the 12

months following the date of approval of the interim financial

statements. Accordingly, they continue to adopt the going concern

basis in preparing the consolidated financial statements.

Risks and uncertainties

The Directors have reviewed the principal risks and

uncertainties of the Group. The Directors consider that the

principal risks and uncertainties of the Group published in the

Annual Report for the year ended 31 March 2023 remain appropriate.

The risks and associated mitigation processes can be found on pages

50-57 of the 2023 Annual Report, which is available at

www.renold.com.

The risks referred to and which could have a material impact on

the Group's performance for the remainder of the current financial

year relate to:

-- Macroeconomic and geopolitical volatility, including continuing

uncertainty over energy supply inflation and disruption, together

with a weakening in the broader European economy;

-- Strategy execution;

-- Product liability;

-- Health and safety in the workplace;

-- Security and effective deployment and utilisation of IT systems;

-- Prolonged loss of a major manufacturing site;

-- People and change;

-- Liquidity, foreign exchange and banking arrangements;

-- Pension deficit; and

-- Legal, financial and regulatory compliance.

Responsibility statement

The Directors confirm that to the best of their knowledge:

-- the condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting;

-- the interim management report includes a fair review of the information

required by DTR 4.2.7R (indication of important events and their

impact during the first six months of the financial year and description

of principal risks and uncertainties for the remaining six months

of the financial year); and

-- the interim management report includes a fair review of the information

required by DTR 4.2.8R (disclosure of related parties' transactions

and changes therein).

The Directors of Renold plc are listed in the Annual Report for

the year ended 31 March 2023. A list of current Directors is

maintained on the Group website at www.renold.com.

By order of the Board

Robert Purcell Jim Haughey

Chief Executive Group Finance Director

15 November 2023 15 November 2023

Condensed consolidated income statement

for the six months ended 30 September 2023

First half Full year

2022/23 2022/23

First

half 2023/24

(unaudited) (unaudited) (audited)

Note GBPm GBPm GBPm

---------------------------------------- ----- -------------- ------------- -----------

Revenue 3 125.3 116.3 247.1

Operating costs (109.1) (107.5) (224.2)

---------------------------------------- ----- -------------- ------------- -----------

Operating profit 3 16.2 8.8 22.9

---------------------------------------- ----- -------------- ------------- -----------

Finance costs 4 (3.7) (2.3) (5.6)

---------------------------------------- ----- -------------- ------------- -----------

Profit before tax 12.5 6.5 17.3

Taxation 5 (3.4) (1.7) (5.5)

---------------------------------------- ----- -------------- ------------- -----------

Profit for the period 9.1 4.8 11.8

---------------------------------------- ----- -------------- ------------- -----------

Earnings per share 6

Basic earnings per share 4.4p 2.3p 5.7p

Diluted earnings per share 3.8p 2.1p 5.1p

Basic adjusted earnings per share(1) 3.8p 2.7p 6.5p

Diluted adjusted earnings per share(1) 3.3p 2.4p 5.9p

---------------------------------------- ----- -------------- ------------- -----------

(1) Adjusted: In addition to statutory reporting, the Group

reports certain financial metrics on an adjusted basis. Definitions

of adjusted measures and reconciliations to statutory metrics are

provided in Note 12 to the financial statements.

All results are from continuing operations.

Condensed consolidated statement of comprehensive income

for the six months ended 30 September 2023

First half Full year

2022/23 2022/23

First

half 2023/24

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

--------------------------------------------- --- -------------- ------------- -----------

Profit for the period 9.1 4.8 11.8

Items that may be reclassified to

the income statement in subsequent

periods:

Exchange differences on translation

of foreign operations (0.3) 9.3 2.7

Gain/(loss) on hedges of the net investment

in foreign operations 0.2 (1.2) (0.8)

Cash flow hedges:

(Loss)/gain arising on cash flow hedges

during the period (0.3) (1.4) 0.3

Cumulative (loss)/gain arising on

cash flow hedges reclassified

to profit and loss (0.4) 0.7 0.6

Income tax relating to items that

may be reclassified subsequently to

profit or loss 0.1 0.2 (0.2)

-------------------------------------------------- -------------- ------------- -----------

(0.7) 7.6 2.6

------------------------------------------------- -------------- ------------- -----------

Items not to be reclassified to the

income statement in subsequent periods:

Remeasurement gains/(losses) on retirement

benefit obligations 4.7 24.7 22.2

Tax on remeasurement gains on retirement

benefit obligations (1.1) (6.4) (5.8)

3.6 18.3 16.4

------------------------------------------------- -------------- ------------- -----------

Other comprehensive income for the

period, net of tax 2.9 25.9 19.0

-------------------------------------------------- -------------- ------------- -----------

Total comprehensive income for the

period, net of tax 12.0 30.7 30.8

-------------------------------------------------- -------------- ------------- -----------

Condensed consolidated balance sheet

as at 30 September 2023

Restated(1) 31 March

30 September 30 September

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBPm GBPm GBPm

---------------------------------- ----- -------------- -------------- -----------

Assets

Non-current assets

Goodwill 30.1 30.0 28.2

Intangible assets 11.9 10.3 10.9

Property, plant and equipment 54.4 57.3 56.8

Right-of-use assets 15.7 17.6 16.5

Deferred tax assets 9.7 15.8 11.8

121.8 131.0 124.2

---------------------------------- ----- -------------- -------------- -----------

Current assets

Inventories 65.2 70.8 61.8

Trade and other receivables 41.3 43.5 43.5

Current tax 0.6 0.1 0.6

Derivative financial assets - 0.1 0.3

Cash and cash equivalents 8 19.5 15.7 19.3

---------------------------------- ----- -------------- -------------- -----------

126.6 130.2 125.5

---------------------------------- ----- -------------- -------------- -----------

Total assets 248.4 261.2 249.7

---------------------------------- ----- -------------- -------------- -----------

Liabilities

Current liabilities

Borrowings 8 (3.5) (2.9) (47.3)

Trade and other payables (56.2) (63.7) (57.2)

Lease liabilities (2.1) (2.6) (2.7)

Current tax (9.4) (4.5) (6.6)

Derivative financial liabilities (0.3) (1.5) -

Provisions (0.8) - (0.9)

---------------------------------- ----- -------------- -------------- -----------

(72.3) (75.2) (114.7)

---------------------------------- ----- -------------- -------------- -----------

Net current assets 54.3 55.0 10.8

---------------------------------- ----- -------------- -------------- -----------

Non-current liabilities

Borrowings 8 (43.8) (46.3) (1.3)

Preference stock 8 (0.5) (0.5) (0.5)

Trade and other payables (2.5) (6.8) (2.5)

Lease liabilities (13.5) (18.8) (17.5)

Deferred tax liabilities (6.5) (10.1) (7.8)

Retirement benefit obligations 7 (52.7) (61.3) (62.2)

Provisions (4.8) (4.0) (4.1)

(124.3) (147.8) (95.9)

---------------------------------- ----- -------------- -------------- -----------

Total liabilities (196.6) (223.0) (210.6)

---------------------------------- ----- -------------- -------------- -----------

Net assets 51.8 38.2 39.1

---------------------------------- ----- -------------- -------------- -----------

Equity

Issued share capital 9 11.3 11.3 11.3

Currency translation reserve 11.5 18.1 11.5

Other reserves (5.2) (6.1) (4.5)

Retained earnings 34.2 14.9 20.8

---------------------------------- ----- -------------- -------------- -----------

Total shareholders' funds 51.8 38.2 39.1

---------------------------------- ----- -------------- -------------- -----------

(1) See Note 11 for details of the prior period

restatements.

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2023

Share Restated(1) Restated(1)

capital Share Retained Currency Capital Total

(Note premium earnings translation redemption Other shareholders'

9) account /(deficit) reserve reserve reserves funds

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

At 1 April 2022 11.3 - (8.7) 9.8 - (5.4) 7.0

Profit for the year - - 11.8 - - - 11.8

Other comprehensive

income - - 16.4 1.7 - 0.9 19.0

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

Total comprehensive

income for the

year - - 28.2 1.7 - 0.9 30.8

Share-based

payments - - 1.3 - - - 1.3

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

At 31 March 2023 11.3 - 20.8 11.5 - (4.5) 39.1

Profit for the

period - - 9.1 - - - 9.1

Other comprehensive

income/(expense) - - 3.6 - - (0.7) 2.9

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

Total comprehensive

income/(expense)

for the period - - 12.7 - - (0.7) 12.0

Share-based

payments - - 0.7 - - - 0.7

At 30 September

2023 11.3 - 34.2 11.5 - (5.2) 51.8

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

At 1 April 2022 11.3 - (8.7) 9.8 - (5.4) 7.0

Profit for the

period - - 4.8 - - - 4.8

Other comprehensive

income/(expense) - - 18.3 8.3 - (0.7) 25.9

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

Total comprehensive

income/(expense)

for the period - - 23.1 8.3 - (0.7) 30.7

Share-based

payments - - 0.5 - - - 0.5

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

At 30 September

2022 (Restated)(1) 11.3 - 14.9 18.1 - (6.1) 38.2

-------------------- --------- --------- ------------ ------------- ------------ ---------- -------------------

(1) See Note 11 for details of the prior period

restatements.

Included in retained earnings is GBP3.3m (31 March 2023:

GBP2.7m) relating to a share option reserve.

The other reserves include Renold shares held by the Renold plc

Employee Benefit Trust. The Renold Employee Benefit Trust holds

Renold plc shares and satisfies awards made under various employee

incentive schemes when issuance of new shares is not

appropriate.

At 30 September 2023 the Renold Employee Benefit Trust held

16,265,023 (31 March 2023: 16,888,938) ordinary shares of 5p each

and, following recommendations by the employer, are provisionally

allocated to satisfy awards under employee incentive schemes. At 30

September 2023 the market value of these shares was GBP5.0m (31

March 2023: GBP4.3m).

Condensed consolidated statement of cash flows

for the six months ended 30 September 2023

First

half First half

Full year

2023/24 2022/23 2022/23

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

------------------------------------------- -------------- ------------- -----------

Cash flows from operating activities

Cash generated by operations (Note

8) 13.0 3.7 19.4

Income taxes paid (1.3) (1.3) (2.7)

------------------------------------------- -------------- ------------- -----------

Net cash flows from operating activities 11.7 2.4 16.7

------------------------------------------- -------------- ------------- -----------

Cash flows from investing activities

Proceeds from property disposals - 0.3 -

Cash outflow on disposal of right-of-use

assets (0.3) - -

Purchase of property, plant and equipment (1.2) (1.9) (7.0)

Purchase of intangible assets (0.6) (0.6) (1.4)

Consideration paid for acquisitions (4.7) (14.5) (14.5)

------------------------------------------- -------------- ------------- -----------

Net cash flows from investing activities (6.8) (16.7) (22.9)

------------------------------------------- -------------- ------------- -----------

Cash flows from financing activities

Repayment of principal under lease

liabilities (1.4) (1.2) (2.9)

Financing costs paid (3.1) (1.1) (3.0)

Proceeds from borrowings 83.5 23.3 28.3

Repayment of borrowings (84.0) (3.9) (8.3)

------------------------------------------- -------------- ------------- -----------

Net cash flows from financing activities (5.0) 17.1 14.1

------------------------------------------- -------------- ------------- -----------

Net (decrease)/increase in cash

and cash equivalents (0.1) 2.8 7.9

Net cash and cash equivalents at

beginning of period 17.5 9.5 9.5

Effects of exchange rate changes - 0.5 0.1

------------------------------------------- -------------- ------------- -----------

Net cash and cash equivalents at

end of period 17.4 12.8 17.5

------------------------------------------- -------------- ------------- -----------

Notes to the interim condensed consolidated financial

statements

1. Corporate information

The interim condensed consolidated financial statements for the

six months ended 30 September 2023 were approved by the Board on 15

November 2023. These statements have not been audited or reviewed

by the Group's auditor pursuant to the Auditing Practices Board

guidance on the Review of Interim Financial Information.

Renold plc is a limited liability company, incorporated and

registered under the laws of England and Wales, whose shares are

publicly traded. The principal activities of the Company and its

subsidiaries are described in Note 3.

These interim condensed consolidated financial statements do not

constitute statutory accounts of the Group within the meaning of

Section 434 of the Companies Act 2006. The statutory accounts for

the year ended 31 March 2023 have been filed with the Registrar of

Companies. The auditor's report on those accounts was unqualified,

did not contain an emphasis of matter paragraph and did not contain

any statement under Section 498(2) or Section 498(3) of the

Companies Act 2006.

2. Accounting policies

Basis of preparation

The interim condensed consolidated financial statements for the

six months ended 30 September 2023 have been prepared in accordance

with the UK adopted International Accounting Standard 34, 'Interim

financial reporting' and the Disclosure Guidance and Transparency

Rules sourcebook of the UK's Financial Conduct Authority (FCA).

These condensed consolidated financial statements should be read

in conjunction with the consolidated financial statements for the

year ended 31 March 2023, which were prepared in accordance with

UK-adopted international accounting standards and with the

requirements of the Companies Act 2006 as applicable to companies

reporting under these standards.

The accounting policies, presentation and methods of computation

applied by the Group in these interim condensed consolidated

financial statements are the same as those applied in the Group's

latest audited annual consolidated financial statements for the

year ended 31 March 2023, except as noted below.

The excess of the consideration transferred, the amount of any

non-controlling interest and the acquisition date fair value of any

previously held equity interest in the acquired entity as compared

with the Group's share of the identifiable net assets are

recognised as goodwill. Where the Group's share of identifiable net

assets acquired exceeds the total consideration transferred, a gain

from a bargain purchase is recognised immediately in the income

statement after the fair values initially determined have been

reassessed.

New and revised accounting standards adopted by the Group

During the period, the International Accounting Standards Board

and International Financial Reporting Interpretations Committee

have issued the following standards, amendments and

interpretations, which are considered relevant to the Group. Their

adoption has not had any significant impact on the amounts or

disclosures reported in these financial statements.

-- IFRS 17 'Insurance Contracts'

-- Amendments to IAS 1 and IFRS Practice Statement 2 (Disclosure of accounting policies)

-- Amendments to IAS 18 Definition of accounting estimates

-- Amendments to IAS 12 (Deferred Tax related to Assets and

Liabilities arising from a single transaction)

New and revised accounting standards and interpretations which

were in issue but were not yet effective and have not been adopted

early by the Group

The IASB published a number of amendments to IFRSs, new

standards and interpretations which are not yet effective, and of

which some have been endorsed for use in the EU. An impact

assessment has been performed for each of these, with no

significant financial impact being identified for the consolidated

financial statements of the Group and the separate financial

statements of Renold plc. The amendments, new standards and

interpretations will be adopted in accordance with their effective

dates.

-- Amendments to IFRS 16 Lease Liability in a Sale and Leaseback

-- Amendments to IAS 1 (Classification of Liabilities as Current or Non-Current)

-- Amendments to IAS 1 (Non-current Liabilities with covenants)

-- IAS 7 Statement of cash flows and IFRS 7 Financial Instrument Disclosures

Significant accounting judgements, estimates and assumptions

In the course of preparing these interim condensed consolidated

financial statements, no judgements have been made in the process

of applying the Group's accounting policies that have had a

significant effect on the amounts recognised in the financial

statements, other than those involving estimation uncertainty. The

key sources of estimation uncertainty are mostly those which

applied in the annual consolidated financial statements for the

year ended 31 March 2023, namely:

-- Taxation

-- Retirement benefit obligations

-- Right-of-use assets

-- Inventory valuation; with the addition of:

-- Revenue and profit recognition over time

Financial risk management

The Group's financial risk management objectives and policies

are consistent with those disclosed in the consolidated financial

statements for the year ended 31 March 2023.

3. Segmental information

For management purposes, the Group is organised into two

operating segments according to the nature of their products and

services and these are considered by the Directors to be the

reportable operating segments of Renold plc as shown below:

-- The Chain segment manufactures and sells power transmission and

conveyor chain and also includes sales of torque transmission products

through Chain National Sales Companies (NSCs); and

-- The Torque Transmission segment manufactures and sells torque transmission

products, such as gearboxes and couplings .

No operating segments have been aggregated to form the above

reportable segments.

The Chief Operating Decision Maker (CODM) for the purposes of

IFRS 8 'Operating Segments' is considered to be the Board of

Directors of Renold plc. Management monitor the results of the

separate reportable operating segments based on operating profit

and loss which is measured consistently with operating profit and

loss in the consolidated financial statements. The same segmental

basis applies to decisions about resource allocation. Disclosure

has been included in respect of working capital as opposed to

operating assets of each segment as this is the measure reported to

the CODM on a regular basis. However, Group finance costs,

retirement benefit obligations and income taxes are managed on a

Group basis and therefore are not allocated to operating segments.

Transfer prices between operating segments are on an arm's length

basis in a manner similar to transactions with third parties.

The segment results for the period ended 30 September 2023 were

as follows:

Head

office

Torque costs

Period ended 30 September Chain(1) Transmission and eliminations Consolidated

2023 GBPm GBPm GBPm GBPm

------------------------------------- --------- -------------- ------------------ -------------

Revenue

External customer - transferred

at a point in time 98.4 24.1 - 122.5

External customer - transferred

over time - 2.8 - 2.8

Inter-segment 0.5 1.9 (2.4) -

------------------------------------- --------- -------------- ------------------ -------------

Total revenue 98.9 28.8 (2.4) 125.3

------------------------------------- --------- -------------- ------------------ -------------

Operating profit/(loss) 17.0 4.6 (5.4) 16.2

Finance costs (3.7)

------------------------------------- --------- -------------- ------------------ -------------

Profit before tax 12.5

Taxation (3.4)

Profit after tax 9.1

------------------------------------- --------- -------------- ------------------ -------------

Other disclosures

Working capital 47.5 11.2 (8.4) 50.3

Capital expenditure 1.2 0.2 0.6 2.0

Total depreciation and amortisation 3.6 0.8 1.0 5.4

------------------------------------- --------- -------------- ------------------ -------------

(1) Chain operating profit includes non-recurring costs of

GBP0.5m relating to the acquisition and reorganisation costs of the

Davidson business, GBP0.5m relating to amortisation of acquired

intangible assets and GBP2.2m of profit on assignment of lease of

closed site.

The segment results for the period ended 30 September 2022 were

as follows:

Head office

Torque costs

Period ended 30 September Chain Transmission and eliminations Consolidated

2022 GBPm GBPm GBPm GBPm

------------------------------------- -------- -------------- ------------------ --------------

Revenue

External customer- transferred

at a point in time 94.7 21.0 - 115.7

External customer - transferred

over time - 0.6 - 0.6

Inter-segment 0.4 1.4 (1.8) -

------------------------------------- -------- -------------- ------------------ --------------

Total revenue 95.1 23.0 (1.8) 116.3

------------------------------------- -------- -------------- ------------------ --------------

Operating profit/(loss) 12.3 1.5 (5.0) 8.8

Finance costs (2.3)

------------------------------------- -------- -------------- ------------------ --------------

Profit before tax 6.5

Taxation (1.7)

Profit after tax 4.8

------------------------------------- -------- -------------- ------------------ --------------

Other disclosures

Working capital 49.7 10.4 (9.5) 50.6

Capital expenditure 0.9 1.6 0.5 3.0

Total depreciation and amortisation 3.3 0.8 1.0 5.1

------------------------------------- -------- -------------- ------------------ --------------

In addition to statutory reporting, the Group reports certain

financial metrics on an adjusted basis (alternative performance

measures, APMs). Definitions of adjusted measures, and information

about the differences to statutory metrics are provided in Note 12

to the interim condensed consolidated financial statements.

Constant exchange rate results are current period results

retranslated using prior year exchange rates. A reconciliation is

provided below and in Note 12.

Head office

Torque costs

Period ended 30 September Chain Transmission and eliminations Consolidated

2023 GBPm GBPm GBPm GBPm

-------------------------------- ------ -------------- ------------------ -------------

Total revenue 98.9 28.8 (2.4) 125.3

Foreign exchange retranslation 2.6 1.0 (0.2) 3.4

-------------------------------- ------ -------------- ------------------ -------------

Total revenue at constant

exchange rates 101.5 29.8 (2.6) 128.7

-------------------------------- ------ -------------- ------------------ -------------

Operating profit/(loss) 17.0 4.6 (5.4) 16.2

Foreign exchange retranslation 0.2 0.1 - 0.3

-------------------------------- ------ -------------- ------------------ -------------

Operating profit/(loss)

at constant exchange rates 17.2 4.7 (5.4) 16.5

-------------------------------- ------ -------------- ------------------ -------------

The segment results for the year ended 31 March 2023 were as

follows:

Head office

Torque costs

Chain Transmission and eliminations Consolidated

Year ended 31 March 2023 GBPm GBPm GBPm GBPm

------------------------------------- ------ -------------- ------------------ -------------

Revenue

External customer - transferred

at a point in time 201.5 43.4 - 244.9

External customer - transferred

over time - 2.2 - 2.2

Inter-segment 0.9 3.2 (4.1) -

------------------------------------- ------ -------------- ------------------ -------------

Total revenue 202.4 48.8 (4.1) 247.1

------------------------------------- ------ -------------- ------------------ -------------

Operating profit/(loss) 26.5 5.4 (9.0) 22.9

Finance costs (5.6)

------------------------------------- ------ -------------- ------------------ -------------

Profit before tax 17.3

Taxation (5.5)

Profit after tax 11.8

------------------------------------- ------ -------------- ------------------ -------------

Other disclosures

Working capital 44.0 10.9 (6.8) 48.1

Capital expenditure 5.6 2.2 1.2 9.0

Total depreciation and amortisation 6.9 1.6 2.6 11.1

------------------------------------- ------ -------------- ------------------ -------------

4. Finance costs

First half Full year

2023/24 2022/23 2022/23

GBPm GBPm GBPm

--------------------------------------- -------- -------- ----------

Finance costs:

Interest payable on bank loans and

overdrafts 1.8 0.9 2.3

Interest expense on lease liabilities 0.4 0.2 0.7

Amortised financing costs 0.1 0.2 0.3

Loan finance costs 2.3 1.3 3.3

--------------------------------------- -------- -------- ----------

Net IAS 19 finance costs 1.4 1.0 2.1

Discount unwind on non-current trade

and other payables - - 0.2

Finance costs 3.7 2.3 5.6

--------------------------------------- -------- -------- ----------

5. Taxation

Analysis of tax charge in the year

First half Full year

2023/24 2022/23 2022/23

GBPm GBPm GBPm

----------------------------------- -------- -------- ----------

Current tax:

- UK - - (0.1)

- Overseas 1.3 1.5 3.6

- Adjustments in respect of prior

periods 1.8 (0.3) 0.7

----------------------------------- -------- -------- ----------

Current income tax charge 3.1 1.2 4.2

----------------------------------- -------- -------- ----------

Deferred tax:

- UK 0.9 - 0.2

- Overseas (0.6) 0.5 1.5

- Adjustments in respect of prior

periods - - (0.4)

Total deferred tax charge 0.3 0.5 1.3

----------------------------------- -------- -------- ----------

Tax charge on profit on ordinary

activities 3.4 1.7 5.5

----------------------------------- -------- -------- ----------

Factors affecting current and future tax charges

The increase in the current tax charge for the period is

attributable to increased taxable profits in jurisdictions for

which the corporation tax rate is higher than the prevailing UK

rate, currently 25%. The deferred tax charge is primarily

attributable to the half year unwind of the deferred tax asset held

in respect of the defined benefit pension scheme, partially offset

by a recognition of additional deferred tax in overseas

jurisdictions as supported by forecast taxable profits.

The Group's tax charge in future years will be affected by the

profit mix, effective tax rates in the different countries where

the Group operates, and utilisation of tax losses. No deferred tax

is recognised on the unremitted earnings of overseas subsidiaries

in accordance with IAS 12.39.

6. Earnings per share

Earnings per share (EPS) is calculated by reference to the

earnings for the period and the weighted average number of shares

in issue during the period as follows:

First half Full year

2023/24 2022/23 2022/23

Per Per Per

share share share

Earnings amount Earnings amount Earnings amount

GBPm (pence) GBPm (pence) GBPm (pence)

-------------------------------- --------- -------- --------- -------- --------- --------

Basic EPS - Profit attributed

to ordinary shareholders 9.1 4.4 4.8 2.3 11.8 5.7

Effect of adjusting items,

after tax:

Amortisation of acquired

intangible assets 0.5 0.2 0.2 0.1 0.7 0.3

Acquisition and reorganisation

costs 0.5 0.2 0.6 0.3 0.6 0.3

Assignment of lease of

closed site (2.2) (1.0) - - - -

Tax adjustments relating

to prior year - - - - 0.4 0.2

Adjusted EPS 7.9 3.8 5.6 2.7 13.5 6.5

-------------------------------- --------- -------- --------- -------- --------- --------

First half Full year

2023/24 2022/23 2022/23

Thousands Thousands Thousands

------------------------------------------- ----------- ----------- -----------

Weighted average number of ordinary

shares:

For the purpose of calculating basic

earnings per share 208,980 206,995 207,242

Effect of dilutive potential ordinary

shares:

Shares subject to performance conditions 28,546 23,737 23,003

------------------------------------------- ----------- ----------- -----------

For the purpose of calculating diluted

earnings per share 237,526 230,732 230,245

------------------------------------------- ----------- ----------- -----------

First half Full year

2023/24 2022/23 2022/23

(pence) (pence) (pence)

---------------------- ---------- --------- ----------

Diluted EPS 3.8 2.1 5.1

Diluted adjusted EPS 3.3 2.4 5.9

---------------------- ---------- --------- ----------

The adjusted EPS numbers have been provided to give a useful

indication of underlying performance by the exclusion of adjusting

items. Due to the existence of unrecognised deferred tax assets

there were no associated tax credits on some of the adjusting items

and in these instances adjusting items are added back in full.

7. Retirement benefit obligations

The Group's retirement benefit obligations are summarised as

follows:

At 30 At 30 At 31

September September March

2023 2022 2023

GBPm GBPm GBPm

-------------------------------------- ----------- ------------ --------

Funded plan obligations (145.3) (160.7) (158.8)

Funded plan assets 109.6 118.8 114.5

-------------------------------------- ----------- ------------ --------

Net funded plan obligations (35.7) (41.9) (44.3)

Unfunded obligations (17.0) (19.4) (17.9)

-------------------------------------- ----------- ------------ --------

Total retirement benefit obligations (52.7) (61.3) (62.2)

-------------------------------------- ----------- ------------ --------

Analysed as:

At 30 At 30 At 31

September September March

2023 2022 2023

GBPm GBPm GBPm

------------------------------ ----------- ------------ -------

Net funded plan obligations:

UK (36.6) (41.2) (44.2)

Other 0.9 (0.7) (0.1)

------------------------------ ----------- ------------ -------

(35.7) (41.9) (44.3)

------------------------------ ----------- ------------ -------

Unfunded obligations:

Germany (16.8) (19.3) (17.7)

Other (0.2) (0.1) (0.2)

(17.0) (19.4) (17.9)

------------------------------ ----------- ------------ -------

The decrease in the Group's net pre-tax deficit from GBP62.2m at

31 March 2023 to GBP52.7m at 30 September 2023 primarily reflects

changes in the underlying assumptions, such as the discount rate,

plus employer contributions made in the period.

8. Additional cash flow information

Reconciliation of operating profit to net cash flows from

operations:

First half Full year

2023/24 2022/23 2022/23

GBPm GBPm GBPm

------------------------------------------ -------- -------- ----------

Cash generated from operations:

Operating profit 16.2 8.8 22.9

Depreciation of property, plant and

equipment - owned assets 3.1 2.9 6.1

Depreciation of property, plant and

equipment - right-of-use-assets 1.3 1.2 2.5

Amortisation of intangible assets 1.0 1.0 2.5

Loss on disposals of plant and equipment - - 0.3

Profit on disposal of right-of-use-asset (2.2) - -

Equity share plans 0.7 0.5 1.3

Increase in inventories (3.3) (10.9) (4.5)

Decrease/(increase) in receivables 2.3 (0.9) (2.8)

(Decrease)/increase in payables (0.3) 4.2 (4.2)

Increase in provisions 0.2 - 1.0

Cash contribution to pension schemes (6.0) (3.1) (5.8)

Pension current service cost (non-cash) - - 0.1

Cash generated from operations 13.0 3.7 19.4

------------------------------------------ -------- -------- ------------

Reconciliation of net change in cash and cash equivalents to

movement in net debt:

First half Full year

2023/24 2022/23 2022/23

GBPm GBPm GBPm

------------------------------------------- -------- -------- ----------

(Decrease)/increase in cash and cash

equivalents (0.1) 2.8 7.9

Change in net debt resulting from

cash flows

- Proceeds from borrowings (83.5) (23.3) (28.3)

- Repayment of borrowings 84.0 1.2 8.3

Foreign currency translation differences 0.2 (0.7) (0.7)

Non-cash movement on capitalised finance

costs 0.9 (0.2) (0.3)

Net debt acquired as part of the business

combination - - (2.9)

Change in net debt during the period 1.5 (20.2) (16.0)

Net debt at start of period (29.8) (13.8) (13.8)

------------------------------------------- -------- -------- ----------

Net debt at end of period (28.3) (34.0) (29.8)

------------------------------------------- -------- -------- ----------

Net debt comprises:

At 30 At 30 September

September 2022 At 31 March

2023 GBPm 2023

GBPm GBPm

--------------------------- ----------- ---------------- --------------

Cash and cash equivalents 19.5 15.7 19.3

Total debt (47.8) (49.7) (49.1)

Net debt (28.3) (34.0) (29.8)

--------------------------- ----------- ---------------- --------------

At 30 At 30 September

September 2022 At 31 March

2023 2023

Net cash and cash equivalents GBPm GBPm GBPm

------------------------------- ----------- ---------------- --------------

Cash and cash equivalents 19.5 15.7 19.3

Less: Overdrafts (2.1) (2.9) (1.8)

Net cash and cash equivalents 17.4 12.8 17.5

------------------------------- ----------- ---------------- --------------

At 30 At 30 September

September 2022 At 31 March

2023 2023

Total debt GBPm GBPm GBPm

------------------------ ----------- ---------------- --------------

Borrowings:

Overdrafts (2.1) (2.9) (1.8)

Bank Loans (1.7) - (45.5)

Capitalised costs 0.3 - -

------------------------ ----------- ---------------- --------------

Current borrowings (3.5) (2.9) (47.3)

------------------------ ----------- ---------------- --------------

Bank Loans (44.4) (46.3) (1.3)

Capitalised costs 0.6 - -

------------------------ ----------- ---------------- --------------

Non-current borrowings (43.8) (46.3) (1.3)

------------------------ ----------- ---------------- --------------

Total borrowings (47.3) (49.2) (48.6)

Preference stock (0.5) (0.5) (0.5)

Total debt (47.8) (49.7) (49.1)

------------------------ ----------- ---------------- --------------

9. Called up share capital

At 30 At 30 At 31

September September March

2023 2022 2023

GBPm GBPm GBPm

------------------------------------- ----------- ----------- -------

Ordinary shares of 5p each - issued

and fully paid 11.3 11.3 11.3

------------------------------------- ----------- ----------- -------

At 30 September 2023, the issued ordinary share capital

comprised 225,417,740 ordinary shares of 5p each (30 September

2022: 225,417,740 shares).

10. Acquisition of businesses

During the period the Group completed the acquisition of the

trading assets of Davidson Chain Pty ("Davidson") for the total

consideration of AU$6.0m (GBP3.1m), of which AU$5.7m (GBP3.0m) was

paid on the date of the acquisition and the remaining AU$0.3m

(GBP0.1m) being deferred, to be paid in September 2024. Davidson is

based in Melbourne, Australia, and is a manufacturer and

distributor of high quality conveyor chain ("CVC").

The transaction has been accounted for as a business combination

under IFRS 3 and is summarised below:

Provisional

as at 30

September

2023

GBPm

--------------------------------------------------- ------------

Fair value of net assets acquired:

Intangible assets 1.4

Property, plant and equipment 0.1

Inventories 0.4

Trade and other receivables 0.3

Trade and other payables (0.4)

Deferred tax liabilities (0.4)

Net identifiable assets and liabilities 1.4

Goodwill 1.7

--------------------------------------------------- ------------

Total consideration 3.1

--------------------------------------------------- ------------

Consideration

Cash consideration 3.0

Deferred consideration 0.1

--------------------------------------------------- ------------

Total consideration transferred/to be transferred 3.1

--------------------------------------------------- ------------

Net cash outflow arising on acquisition:

Cash consideration paid (3.0)

Add: Cash and cash equivalents acquired -

--------------------------------------------------- ------------

(3.0)

--------------------------------------------------- ------------

Increase in net debt arising on acquisition:

Net cash outflow arising on acquisition (3.0)

Less: Acquisition costs (0.2)

--------------------------------------------------- ------------

(3.2)

--------------------------------------------------- ------------

Acquisition related costs amounted to GBP0.2m and have been

included in the condensed consolidated income statement.

The gross contractual value of the trade and other receivables

was GBP0.3m. The best estimate at the acquisition date of the

contractual cash flows not expected to be collected was GBPnil.

Deferred consideration of GBP0.1m is payable within one

year.

The goodwill arising on acquisition has been allocated to the

Australia CGU and is expected to be deductible for tax purposes.

The goodwill is attributable to:

-- the anticipated profitability of the distribution of the

Group's services in new markets; and

-- the synergies that can be achieved in the business

combination including management, processes and maximising site

capacities.

The business was acquired on 1 September 2023 and contributed

GBP0.2m revenue and GBP0.0m adjusted operating profit for the

period between the date of acquisition and the balance sheet

date.

If the acquisition had been completed on the first day of the

financial period, the acquisition would have contributed GBP1.2m to

Group revenue, GBP0.2m to Group operating profit and GBP0.4m

adjusted operating profit (after adding back GBP0.2m for

acquisition costs).

During the year deferred consideration of EUR2.0m (GBP1.7m) was

also paid in relation to the acquisition of the conveyor chain

business of Industrias YUK S.A. in the prior year.

Total net cash outflow arising on acquisitions:

Davidson Chain Pty (3.0)

Industrias YUK S.A. (1.7)

----------------------------------------------------- ------

(4.7)

----------------------------------------------------- ------

Total increase in net debt arising on acquisitions:

Davidson Chain Pty (3.2)

Industrias YUK S.A. (1.7)

----------------------------------------------------- ------

(4.9)

----------------------------------------------------- ------

11. Prior period adjustments

Following a review of complex tax judgements looking back over a

number of years undertaken at the last financial year end, a prior

year adjustment of GBP1.3m was identified relating to errors in the

recognition of deferred tax on certain intragroup and stock

consolidation adjustments. Included in this amount is the

recognition of deferred tax for losses following errors identified

in the profitability forecasts for which increased deferred tax can

be ascribed. The prior year adjustment to deferred tax is offset by

an equal and opposite adjustment to current tax arising in respect

of an error identified in the Group's historic transfer pricing

calculation. A final adjustment has been identified in relation to

a deferred tax asset in respect of interest restriction of GBP1.2m

which should have been recognised historically to the extent it

offsets the deferred tax liability in the respective tax

jurisdiction. The adjustment recognises this deferred tax asset in

the opening balance and opening reserves of the Group.

The impact, on a line item basis for those affected, on the

Condensed balance sheet as at 30 September 2022 is as follows:

Condensed consolidated Deferred

balance sheet as at 30 As previously / Current

September 2022 reported tax recognition Restated

GBPm GBPm GBPm

--------------------------- -------------- ----------------- -----------

Assets

Non-current assets

Deferred tax assets 13.3 2.5 15.8

--------------------------------- -------------- ----------------- -----------

13.3 2.5 15.8

------------------------------ -------------- ----------------- -----------

Total assets 258.7 2.5 261.2

--------------------------------- -------------- ----------------- -----------

Liabilities

Current liabilities

Current tax (3.2) (1.3) (4.5)

--------------------------------- -------------- ----------------- -----------

(3.2) (1.3) (4.5)

------------------------------ -------------- ----------------- -----------

Total Liabilities (221.7) (1.3) (223.0)

--------------------------------- -------------- ----------------- -----------

Net assets 37.0 1.2 38.2

--------------------------------- -------------- ----------------- -----------

Equity

Retained earnings 13.7 1.2 14.9

--------------------------------- -------------- ----------------- -----------

Total shareholders' funds 37.0 1.2 38.2

--------------------------------- -------------- ----------------- -----------

12. Alternative performance measures

In order to provide users of the accounts with a clear and

consistent presentation of the performance of the Group's ongoing

trading activity, the Group uses various alternative performance

measures (APMs). Amortisation of acquired intangible assets,

restructuring costs, discontinued operations and material one-off

items or remeasurements are added back / (deducted) as adjusting

items as management seek to present a measure of performance which

is not impacted by material non-recurring items or items considered

non-operational. Performance measures for the Group's ongoing

trading activity are described as 'Adjusted' and are used to

measure and monitor performance as management believe these

measures enable users of the financial statements to better assess

the trading performance of the business. In addition, the Group

reports sales and profit measures at constant exchange rates.

Constant exchange rate metrics exclude the impact of foreign

exchange translation, by retranslating the current year results

using prior year exchange rates.

The APMs used by the Group include:

APM Reference Explanation of APM

----------------------------------- ---------- -------------------------------------

-- adjusted operating profit A Adjusted measures are used

by the Group as a measure

of underlying business performance,

adding back items that do

not relate to underlying