TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end investment company incorporated with limited liability under the

laws of Guernsey with registered number 48761)

INTERIM RESULTS FOR THE SIX-MONTH PERIODED

31 AUGUST 2019

LEI: 549300TZCK08Q16HHU44

(Classified Regulated Information, under DTR 6 Annex 1 section 1.2)

27 November 2019

JZ Capital Partners, the London listed fund that invests in US and European

micro-cap companies and US real estate, announces its interim results for the

six-month period ended 31 August 2019.

Results and Portfolio Highlights

* NAV of $748.2 million (FYE 28/02/19: $810.2 million)

* NAV per share of $9.66 (FYE 28/02/19: $10.04)

* Total realisations and refinancings of $121.2 million, including: the sale

of JZCP's 80% stake in Avante & Orizon for gross proceeds of approximately

$65.5 million, and the sale of Waterline Renewal for gross proceeds of

approximately $24.6 million (including escrows).

* JZCP made one post-period realisation (October 2019), selling Priority

Express for $18.8 million in gross proceeds (including escrows and a

potential earn-out), a 60% uplift to NAV.

* As of 31 August 2019, the portfolio comprised:

* US micro-cap: 23 businesses, which includes four 'verticals' and 14

co-investments, across nine industries.

* European micro-cap: 17 companies across six industries and seven countries.

* US real estate: 61 properties across five major assemblages in New York and

South Florida all in various stages of (re)/development.

Appraisal of Real Estate Portfolio

* Further to the announcement of 30 October 2019, the Company asked its

independent third-party appraiser to accelerate the annual appraisal

process and update its valuations for the real estate portfolio.

* The reports received indicate minimal differences from the appraiser's

year-end values as at 28 February 2019; however, the fair value of JZCP's

real estate investments at 31 August 2019 decreased to $422.7 million from

$443.1 million at 28 February 2019. The net movement in unrealised losses

between the fair value and cost of JZCP's real estate investment between 28

February 2019 and 31 August 2019 totalled $64 million, largely due to the

carrying costs of the portfolio.

* The Board believes that significant uncertainty remains as to whether the

real estate portfolio could be realised at these values. Due to financing

constraints and the requirement to generate liquidity in line with the

Company's recently approved investment policy, this will likely require

assets to be realised on an accelerated basis.

Strategic Initiatives

* On 24 October 2019 (post-period), the Board received shareholder approval

for the adoption of a revised investment policy, whereby JZCP will look to

realise investments and materially reduce commitments to new investments in

order to return a substantial amount of capital to shareholders and pay

down a substantial amount of debt.

* The Company's focus continues to be its revised investment policy; however,

potential impairment to the value of the real estate portfolio dictates

that the Company must protect its balance sheet in the near term by

prioritizing debt repayment over the return of capital to shareholders.

* In the past eighteen months, the Company has returned approximately $50

million to shareholders in a combination of open market purchases and a

tender offer at close to NAV.

* JZCP is currently in the market with a portfolio of certain US microcap

assets and expects to realise $150-170 million in gross proceeds from this

transaction before 29 February 2020.

Outlook

* Strong pipeline of realisations and refinancings in JZCP's overall

portfolio.

* JZCP expects to pay down a significant amount of debt in the near term upon

completion of the secondary sale of a portfolio of certain US microcap

assets.

David Macfarlane, Chairman of JZCP, said: "The Board regrets the delay in

publication of the Company's results as well as the uncertainty regarding the

value of the real estate portfolio.

The Company remains focused on implementing its revised investment policy;

however, due to potential provisions against the real estate portfolio, the

Company must protect its balance sheet in the near term by prioritizing debt

repayment over the return of capital to shareholders. Consequently, new capital

allocations will be largely limited to follow-on investments in existing

portfolio companies as well as other existing obligations.

The Board is confident in the Investment Adviser's ability to execute on the

strategic initiatives announced today, which have been designed to maximise

value for JZCP's shareholders."

Presentation details:

There will be an audiocast presentation for investors and analysts at 3.30pm

London time / 10.30am New York time on 27 November 2019. The presentation can

be accessed here and by dialing +44 (0)330 336 9411 (UK) or +1 323-994-2093

(US) with the participant access code 2869534.

__________________________________________________________________________________

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this announcement, this

inside information is now considered to be in the public domain. The person

responsible for arranging the release of this announcement on behalf of the

Company is David Macfarlane, Chairman.

For further information:

Ed Berry / Kit Dunford

+44 (0)20 3727 1143

FTI Consulting

David Zalaznick

+1 212

485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden

+44 (0)

1481 745385

Northern Trust International Fund

Administration Services (Guernsey) Limited

About JZ Capital Partners

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of micro-cap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

About JZ Capital Partners

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of micro-cap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

Chairman's Statement

I am now able to report the results of JZ Capital Partners ("JZCP" or the

"Company") for the six-month period ended 31 August 2019. The Board regrets the

delay in publication of JZCP's results as well as the uncertainty created by

the announcement of the delay made on 30 October 2019. As described further in

that announcement, discussions in the ordinary course of business between the

Company's Investment Adviser and certain third-party real estate brokers gave

rise to questions as to whether the Company's real estate portfolio was

overvalued. The Board therefore came to the view that a delay in publication of

the results and an announcement to the market were necessary while the

situation was further assessed.

Immediately, the Company asked its independent third-party appraiser to

accelerate the annual appraisal process and update its valuations as at 31

August 2019. The reports received were in accordance with the Company's

accounting policies as per the financial statements at 28 February 2019 and

indicate minimal differences from the appraiser's year-end values at 28

February 2019; however, the fair value of JZCP's real estate investments at 31

August 2019 decreased to $422.7 million from $443.1 million at 28 February

2019. The net movement in unrealised losses between the fair value and cost of

JZCP's real estate investment between 28 February 2019 and 31 August 2019

totalled $64 million. Notwithstanding the revised appraisals, the Board

believes that significant uncertainty remains as to whether the real estate

portfolio could be realised at these values. This uncertainty results from both

financing constraints at the underlying property level and the requirement to

generate liquidity in line with the Company's recently approved investment

policy, which will likely require assets to be realised on an accelerated

basis. As disclosed in the Company's published financial statements

historically, due to the inherent uncertainties of real estate valuation, the

values reflected in the financial statements may differ significantly from the

values that would be determined by negotiation between parties in a sale

transaction and those differences could be material.

Not publishing the Company's interim results by 30 November 2019 would have

resulted in the temporary suspension of the listing of JZCP's securities (until

the actual date of publication). In the short period between the availability

of the appraiser's report and the deadline for publication it would not have

been possible for the Company's auditors to have been able to complete their

customary review of the interim results and related report. While best practice

for the publication of interim results contemplates an interim auditor review,

it is not a regulatory requirement; under these unusual circumstances, the

Board has determined that shareholders would be better served by avoiding a

temporary suspension and accordingly did not ask the auditors to review these

interim results.

Strategic Initiatives

On 24 October 2019 (post-period), the Board received shareholder approval for

the adoption of a revised investment policy, whereby JZCP will look to realise

investments and materially reduce commitments to new investments in order to

return a substantial amount of capital to shareholders and pay down a

substantial amount of debt.

As part of this strategy, the Company announced that it planned to raise

approximately $400-500 million in liquidity by the end of the fiscal year

ending February 2023, through realisations, the secondary sale of certain asset

portfolios, the formation of joint venture partnerships and the US Side-Car

Fund, in which the Company would be an initial investor.

Return of capital

In the past eighteen months, the Company has returned approximately $50 million

to shareholders in a combination of open market purchases and a tender offer at

close to NAV. Subject to the achievement of liquidity objectives, the Company

expects to continue to return capital to shareholders; however, the near term

priority is debt repayment.

Realisations

In August 2019, JZCP finalized the sale of 80% of its interest in portfolio

companies Orizon and Avante for $65.5 million in gross proceeds, a 23% uplift

to the July 2019 NAV of those assets. In October 2019 (post-period), JZCP

closed the sale of its portfolio company Priority Express for $18.8 million in

gross proceeds (including escrows and a potential earn out), a 60% uplift to

the July 2019 NAV.

These transactions, together with others, bring total gross proceeds realised

this fiscal year through November 2019 to more than $135 million. A process is

currently underway for the sale of a portfolio of US microcap assets, which is

expected to generate between $150-170 million in gross proceeds to JZCP by 29

February 2020.

Alterations to the investment policy

The Company's focus continues to be its revised investment policy; however,

potential impairment to the value of the real estate portfolio dictates that

the Company must protect its balance sheet in the near term by prioritizing

debt repayment over the return of capital to shareholders. Consequently, new

capital allocations will be largely limited to follow-on investments in

existing portfolio companies as well as other existing obligations.

As part of curtailing new investments, the Company will not proceed to make a

commitment to the recently announced US Side-Car Fund, which was approved by

shareholders to be up to $25 million. Furthermore, JZCP's commitment to JZI

Fund IV, L.P. ("Fund IV"), which shareholders previously approved at up to EUR64

million, is intended to be limited to a maximum of EUR15 million. The Board

expects this contribution to be made over a period of five years. Because of

JZCP's commitment reduction, Jay Jordan and David Zalaznick expect to increase

their aggregate commitment to Fund IV by up to approximately EUR10 million.

Additionally, the Board has requested that the Investment Adviser relieve the

Company of its future subscription obligations to certain managed funds where

the Company has current and projected future commitments of approximately up to

$44 million. In consultation with the Board, Jay Jordan and David Zalaznick

have agreed in principle to provide for or replace these commitments to certain

managed funds in an amount of up to approximately $50-60 million, including the

increased commitment to Fund IV.

Over time, the Board believes that the above measures will conserve cash of up

to approximately $100 million.

In addition, the Investment Adviser has volunteered to forego payment of the

remainder of its currently earned capital incentive fee on the basis that (i)

$3.9 million of it can be immediately paid to the members of the JZAI team

other than Jay Jordan and David Zalaznick and (ii) the net gains underpinning

the realised incentive fee are rolled forward and netted against future losses.

Additionally, the Investment Adviser has volunteered to forego future capital

incentive fees until the Company and the Investment Adviser mutually agree to

reinstate such payments.

Following the implementation of the above strategic initiatives, the Board will

consider the Company's strategy in light of the circumstances prevailing at

that time. The Board believes that a continuation of the aforementioned policy

changes will likely be adopted, involving further realisations, limited

investment activity, remaining debt repayments and the return of further

capital to shareholders.

Shareholders owning more than 50% of the Company's ordinary shares have

confirmed to the Board that they support continuance based on the repayment of

debt and capital detailed above.

Portfolio Update

At the end of the period, the Company's portfolio consisted of 24 US microcap

businesses (including four 'verticals' and 15 co-investments) across nine

industries, 17 European microcap companies across six industries and seven

countries, and five major real estate assemblages (61 properties in total)

located across Brooklyn, New York and South Florida.

US and European Microcap

The US microcap portfolio performed very well during the period, delivering a

net increase in NAV per share of 63 cents, primarily due to net accrued income

of 11 cents per share and increased earnings at the Company's co-investments

Peaceable Street Capital (11 cents), New Vitality (3 cents) and K2 Towers II (3

cents) as well as writing the Orizon, Avante and Logistics investments up to

their respective sale values (18, 7 and 6 cents per share, respectively).

The European microcap portfolio (via JZI Fund III, L.P. or "Fund III")

delivered a net increase of 9 cents per share during the period, due to

write-ups at S.A.C, My Lender, Treee, Eliantus, Factor Energia, BlueSites,

Luxida and Karium. However, these gains were offset by a write-down on the

Company's direct loan to Ombuds (16 cents).

As of 31 August 2019, Fund III held 12 investments: four in Spain, two in

Scandinavia, two in Italy, two in the UK and one each in Portugal and

Luxembourg. JZCP held direct loans to a further four companies in Spain:

Ombuds, Docout, Xacom and Toro Finance.

Real Estate

The real estate portfolio experienced a net decrease of 82 cents during the

period, primarily due to operating expenses and debt service at the property

level. As of 31 August 2019, the Company has approximately $416 million

invested in a portfolio of retail, office and residential properties in

Brooklyn, New York, and South Florida, alongside its real estate partner,

RedSky Capital. The total portfolio is comprised of 61 properties, which,

following the newly received appraisals mentioned above, is valued at $422.7

million, subject to the reservations of the Board and Investment Adviser

regarding the realisable value of the portfolio as discussed above. During the

period, JZCP made follow-on investments and paid expenses totalling

approximately $43 million.

As part of its focus on liquidity, the Company does not expect to make any new

investments in the real estate sector other than in its existing portfolio,

primarily where additional capital is required for debt service payments,

accretive pre-development expenditures or the acquisition of a remaining

property to complete an assemblage. The Board, Investment Adviser and RedSky

Capital are working closely to establish the best course of action

(development, sale or joint venture) to maximise value and liquidity from each

real estate asset. The Investment Adviser has taken a much more direct role in

the day-to-day management of both Redsky Capital and the real estate portfolio.

Spruceview Capital Partners

Spruceview Capital Partners ("Spruceview"), the Company's asset management

business in the US, continues to make progress. Spruceview looks to address the

growing demand from corporate pensions, endowments, family offices and

foundations for fiduciary management services through an Outsourced Chief

Investment Officer ("OCIO") model as well as customized products/solutions per

asset class.

After successfully deploying an initial committed amount of $300 million for a

portfolio of alternative investments for a Mexican trust (or "CERPI"),

Spruceview's mandate was extended in August by an additional commitment of $400

million, with the potential remaining to increase the size of the CERPI to up

to $1.0 billion over the coming years. Spruceview continues to have a healthy

pipeline of potential client opportunities.

The Board

As previously announced, the Board intends to seek new appointments and this

process has begun. I must report, however, that Chris Waldron has indicated his

wish to step down. He does so with our thanks for his contribution and our best

wishes for the future.

Outlook

The Board regrets the uncertainty regarding the realisable value of the real

estate portfolio but can reaffirm that the Investment Adviser is committed to

the strategy of maximising value for JZCP's shareholders by realising assets,

paying down a substantial amount of debt and continuing to return capital to

shareholders.

David Macfarlane

Chairman

26 November 2019

Investment Adviser's Report

Dear Fellow Shareholders,

On 24 October 2019, shareholders voted to approve a revised investment policy,

whereby JZCP will look to realise investments and materially reduce commitments

to new investments in order to return capital to shareholders and pay down

debt. We have achieved several realisations and are making progress on many

more.

In August 2019, JZCP finalized the sale of 80% of its interest in portfolio

companies Orizon and Avante for $65.5 million in gross proceeds, a 23% uplift

to the July 2019 NAV of those assets. In October 2019 (post- period), JZCP

closed the sale of its portfolio company Priority Express for $18.8 million in

gross proceeds (including escrows and a potential earn out), a 60% uplift to

the July 2019 NAV of that asset. These transactions bring total gross proceeds

realised this fiscal year through November 2019 to more than $135 million.

In addition to realisations, we plan to raise liquidity for JZCP from secondary

sales of certain asset portfolios and joint venture partnerships. We are

currently in the market with a portfolio of select US microcap assets and

expect to realise between $150-170 million in gross proceeds prior to 29

February 2020 from these transactions.

As of 31 August 2019, our US micro-cap portfolio consisted of 23 businesses,

which includes four 'verticals' and 14 co-investments, across nine industries;

this portfolio was valued at 8.2x EBITDA, after applying an average 23%

marketability discount to public comparables. The average underlying leverage

senior to JZCP's position in our US micro-cap portfolio is 4.4x EBITDA.

Consistent with our value-oriented investment strategy, we have acquired our

current US micro-cap portfolio at an average 6.0x EBITDA.

Our European micro-cap portfolio consisted of 17 companies across six

industries and seven countries. The European micro-cap portfolio has low

leverage senior to JZCP's position, of under 2.0x EBITDA.

As of the same date, our US real estate portfolio consisted of 61 properties

and can be grouped primarily into five major 'assemblages', located in the

Williamsburg, Greenpoint and Downtown/Fulton Mall neighbourhoods of Brooklyn,

New York, and the Wynwood and Design District neighbourhoods of Miami, Florida.

Our assemblages are comprised of adjacent or concentrated groupings of

properties that can be developed, financed and/or sold together at a higher

valuation than on a stand-alone basis.

Net Asset Value ("NAV")

JZCP's NAV per share decreased 38 cents, or 3.8%, during the six-month period

from 28 February 2019 to 31 August 2019.

NAV per Ordinary share as of 28 February 2019 $10.04

Change in NAV due to capital gains and accrued

income

+ US Micro-cap 0.63

- European Micro-cap (0.07)

- Real estate (0.82)

Other increases/(decreases) in NAV

+ Net foreign exchange effect 0.08

- Finance costs (0.13)

- Expenses and taxation (0.09)

+ Appreciation from share buybacks 0.02

NAV per Ordinary share as of 31 August 2019 $9.66

The US micro-cap portfolio performed well during the period, delivering a net

increase of 63 cents per share. This was primarily due to net accrued income of

11 cents, increased earnings at co-investments Peaceable Street Capital (11

cents), New Vitality (3 cents) and K2 Towers II (3 cents) as well as writing

our Orizon, Avante and Logistics investments up to their respective sale values

(18, 7 and 6 cents, respectively). We also received 4 cents of escrow payments

during the period.

Our JZI Fund III, L.P. ("Fund III") portfolio performed very well during the

period, posting a net increase of 9 cents, primarily due to write-ups at Fund

III portfolio companies S.A.C, My Lender, Treee, Eliantus, Factor Energia,

BlueSites, Luxida and Karium. Gains at our Fund III portfolio companies were

offset by a write-down on our direct loan to Ombuds (16 cents).

The real estate portfolio experienced a net decrease of 82 cents, primarily due

to operating expenses and debt service at the property level.

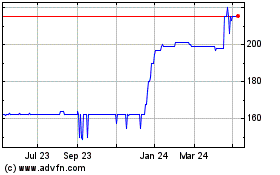

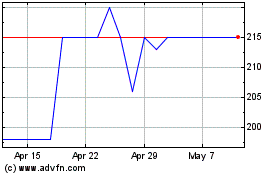

Returns

The chart below summarises cumulative total shareholder returns and total NAV

returns for the most recent six-month, one-year, three-year and five-year

periods.

31.8.2019 28.2.2019 31.8.2018 31.8.2016 31.8.2014

Share price (in GBP) GBP4.82 GBP4.35 GBP4.44 GBP4.53 GBP4.34

NAV per share (in USD) $9.66 $10.04 $9.82 $10.40 $10.11

NAV to market price discount 39.2% 42.4% 41.2% 43.0% 28.7%

6 month 1 year 3 year 5 year

return return return return

Dividends paid (in USD) $0.155 $0.790

- -

Total Shareholders' return 10.8% 8.6% 9.1% 25.8%

(GBP)1

Total NAV return per share (USD)1 -3.8% -1.6% -5.7% 3.3%

Total Adjusted NAV return per share (USD) 0.2% 1.3% -3.4% 16.7%

1,2

1 Total returns are cumulative and assume that dividends were reinvested.

2 Adjusted NAV returns reflect the return per share before (i) the dilution

resulting from the issue of 18,888,909 ordinary shares at a discount to NAV on

30 September 2015 and (ii) subsequent appreciation from the buyback of ordinary

shares at a discount.

Portfolio Summary

Our portfolio is well-diversified by asset type and geography, with 40 US and

European micro-cap investments across eleven industries and five primary real

estate 'assemblages' (61 total properties) located in Brooklyn, New York and

South Florida. The portfolio continues to become more diversified

geographically across Western Europe with investments in Spain, Italy,

Portugal, Luxembourg, Scandinavia and the UK.

Below is a summary of JZCP's assets and liabilities at 31 August 2019 as

compared to 28 February 2019. An explanation of the changes in the portfolio

follows:

31.8.2019 28.2.2019

US$'000 US$'000

US microcap 424,913 478,970

portfolio

European microcap portfolio 104,863 128,698

Real estate 422,656 443,044

portfolio

Other investments 20,916 18,302

Total investments 973,348 1,069,014

Treasury bills 3,323 3,314

Cash 71,686 50,994

Total cash 75,009 54,308

equivalents

Other assets 623 1,286

Total assets 1,048,980 1,124,608

Zero Dividend Preference shares 59,946 63,838

Convertible Unsecured Loan Stock 50,167 54,274

Loans payable 149,490 149,227

Other liabilities 41,151 47,007

Total liabilities 300,754 314,346

Net Asset Value 748,226 810,262

JZCP's loan facility with Guggenheim Partners may be repaid, in whole or in

part, at any time, without any prepayment penalties.

US microcap

portfolio

As you know from previous reports, our US portfolio is grouped into industry

'verticals' and co-investments. Our 'verticals' strategy focuses on

consolidating businesses under industry executives who can add value via

organic growth and cross company synergies. Our co-investments strategy allows

for greater diversification of our portfolio by investing in larger companies

alongside well-known private equity groups.

The US micro-cap portfolio performed well during the period, delivering a net

increase of 63 cents per share. This was primarily due to net accrued income of

11 cents, increased earnings at co-investments Peaceable Street Capital (11

cents), New Vitality (3 cents) and K2 Towers II (3 cents) as well as writing

our Orizon, Avante and Logistics investments up to their respective sale values

(18, 7 and 6 cents, respectively). We also received 4 cents of escrow

payments during the period.

European microcap

portfolio

Our Fund III portfolio performed very well during the period, posting a net

increase of 9 cents, primarily due to write- ups at Fund III portfolio

companies S.A.C, My Lender, Treee, Eliantus, Factor Energia, BlueSites, Luxida

and Karium. Gains at our Fund III portfolio companies were offset by a

write-down on our direct loan to Ombuds (16 cents).

JZCP invests in the European micro-cap sector through its approximately 18.8%

ownership of Fund III. As of 31 August 2019, Fund III held 12 investments: four

in Spain, two in Scandinavia, two in Italy, two in the UK and one each in

Portugal and Luxembourg. JZCP held direct loans to a further four companies in

Spain: Ombuds, Docout, Xacom and Toro Finance.

JZAI has offices in London and Madrid and an outstanding team with over fifteen

years of experience investing together in European micro-cap deals.

During the period, JZCP received distributions totaling approximately EUR12.5

million (approximately $14.1 million) from its investments in: (i)

Petrocorner, a network of petrol stations throughout Spain; (ii) Collingwood, a

niche auto insurance business in the UK; and (iii) Fincontinuo, a niche

consumer lender in Italy.

The proceeds included above from Petrocorner represent the first tranche of

proceeds from the sale of Petrocorner by Fund III to British Petroleum.

Headquartered in Madrid, Petrocorner is a strategic build-up in the Spanish

retail petrol station market, comprised of 65 petrol stations located across

Spain with annualized sales volume of approximately 250 million litres of

petrol. JZCP expects to receive cumulative gross proceeds of EUR12.1 million

from the sale (including interim proceeds and escrows), which represents a

gross multiple of invested capital ("MOIC") of approximately 2.0x and a gross

internal rate of return ("IRR") of approximately 23.0%.

Real estate

portfolio

As discussed in the Chairman's Statement and below in the Outlook section, we

believe the valuations are high for several of our real estate sites and

assemblages. Accordingly, we expect to see lower valuations for the fiscal year

ending 29 February 2020 beyond the approximately $64 million that the NAV has

been marked down to reflect the carrying costs for the six months ending 31

August 2019.

As of 31 August 2019, JZCP had approximately $416 million invested in a

portfolio of retail, office and residential properties in Brooklyn, New York,

and South Florida, which is valued at $422.7 million as of that date. We have

made these investments alongside our real estate partner, RedSky Capital.

Since we began investing in real estate in April 2012, we have acquired a total

of 61 properties, all currently in various stages of development and

re-development.

JZCP Investment

Follow-on real estate ($ millions)

investments

Follow-ons and expenses 43.6

Other

investments

Our asset management business in the US, Spruceview Capital Partners, has

continued to make encouraging progress since we last reported to you.

Spruceview addresses the growing demand from corporate pensions, endowments,

family offices and foundations for fiduciary management services through an

Outsourced Chief Investment Officer ("OCIO") model as well as customized

products/solutions per asset class.

After the successful deployment during the period of an initial committed

amount of $300 million for a portfolio of alternative investments for a Mexican

trust (or "CERPI"), Spruceview's mandate was extended in August by an

additional commitment of $400 million, with the potential remaining to increase

the size of the CERPI to up to $1.0 billion over the coming years.

During the period, Spruceview maintained a pipeline of potential client

opportunities and continued to provide investment oversight to the pension

funds of the Mexican and Canadian subsidiaries of an international packaged

foods company, as well as a European private credit fund-of-funds, a US middle

market private equity fund-of-funds, and portfolios for family office clients.

As previously reported, Richard Sabo, former Chief Investment Officer of Global

Pension and Retirement Plans at JPMorgan and a member of that firm's executive

committee, is leading a team of 14 investment, business development, legal and

operations professionals.

Realisations

Asset Portfolio Proceeds

($millions)

Avante - Sale of 80% of JZCP's stake US microcap 37.5

Orizon - Sale of 80% of JZCP's stake US microcap 28.0

Waterine Renewal -Sale US microcap 23.3

Fund III - Proceeds from Sale of European 14.5

Petrocorner / Refinancing of Collingwood & microcap

Fincontinuo

Felix Storch - Refinancing US microcap 14.0

Receipt of Escrow Balances US microcap 3.9

121.2

Avante &

Orizon

In August 2019, JZCP sold 80% of its stake in US micro-cap investments Avante

and Orizon to Edgewater Growth Capital Partners for $65.5 million in gross

proceeds, a 23% uplift to July 2019 NAV of those assets.

Avante is a single source provider of medical, surgical, diagnostic imaging and

radiation oncology equipment, including sales, service, repair, parts,

refurbishing and installation in over 150 countries. Orizon is a manufacturer

of integral aerospace assemblies for original equipment manufacturers and tier

one suppliers to original equipment manufacturers.

Waterline

Renewal

In April 2019, Waterline Renewal was acquired by Behrman Capital, a private

equity investment firm based in New York and San Francisco.

Waterline Renewal is a leading provider of engineered products used in the

trenchless rehabilitation of wastewater infrastructure for municipal,

commercial, industrial, and residential applications. The company's patented

line of products and technologies allows its customers to deliver long-lasting

solutions that repair sewer systems and wastewater lines without the need for

excavation or property damage, and prevent overflow created by excess inflow

and infiltration of ground water into the wastewater system.

JZCP expects to realise approximately $24.6 million in gross proceeds

(including escrows) from the sale.

Felix

Storch

In March 2019, JZCP refinanced Felix Storch, its manufacturer of small and

custom refrigeration appliances. This refinancing resulted in gross proceeds to

JZCP of approximately $14.0 million, which returned JZCP's entire March 2017

investment in Felix Storch of $12.0 million. Felix Storch has continued to

exhibit strong growth and we expect it to return more capital in the future.

Priority

Express

In October 2019 (post-period), Priority Express was acquired by Capstone

Logistics, a leading North American supply chain solutions partner.

Priority Express was founded in 2005 and provides over 500 customers in the

healthcare and e-commerce end markets with expedited freight and distribution

services, scheduled routed delivery services and on-demand delivery services.

JZCP expects to realise approximately $18.8 million in gross proceeds

(including escrows and a potential earn-out) from the sale, a 60% uplift to

July 2019 NAV.

Outlook

As discussed in the Chairman's Statement, we as the Investment Adviser have

been working with the Board to alleviate many of JZCP's commitments which would

require considerable cash resources. We are taking on the responsibility to

provide or procure these commitments, either through increased personal

investment or other avenues. Most importantly, JZCP will have up to

approximately $100 million less in cash requirements to fulfill these existing

commitments, which will be money that can be dedicated to debt repayment and

return of capital to shareholders.

Subject to achieving our liquidity objectives, our near and medium term

priority is debt repayment, including the Zero Dividend Preference Shares and

Convertible Unsecured Loan Stock. After that, we will endeavor to continue

to return capital to shareholders.

One near term initiative to achieve liquidity is through the secondary sale of

certain of our US micro-cap assets. Hopefully, this will yield prices at or

above our NAV, similar to our realisations already achieved this year. At the

same time, we are minimizing the amount of capital JZCP invests in new

acquisitions to preserve cash for near and medium term debt repayment and,

ultimately, return of capital to shareholders.

Realising liquidity for our real estate portfolio is also an objective. We are

currently evaluating the best course of action (development, sale or joint

venture) to maximize value. Toward that end, we will be putting several of our

properties up for sale in the next 60-90 days. It is important to note that we

must support the business plan for certain of our respective assemblages and

build-outs in order to complete the job and maximize value. These are the only

new investments we will be making in real estate; we expect it will take 24 to

36 months to maximize the value of our current portfolio.

With regard to valuation of our real estate portfolio, we believe the

valuations are high for several of the sites and assemblages. Accordingly, we

expect to see lower valuations for the fiscal year ending 29 February 2020

beyond the approximately $64 million that the NAV has been marked down to

reflect the carrying costs for the six months ending 31 August 2019.

We thank the Board and shareholders for their support of the revised investment

strategy and we are confident that we can execute the strategy. In the coming

months, we will be reporting to you how we are progressing with realisations to

raise cash for debt repayment. We anticipate the next event will be the pay

down of a significant amount of debt upon the successful completion of the

secondary sale.

Yours faithfully,

Jordan/Zalaznick Advisers, Inc.

26 November 2019

Board of Directors

David Macfarlane (Chairman)

1

Mr Macfarlane was appointed to the Board of JZCP in 2008 as Chairman and a

non-executive Director. Until 2002 he was a Senior Corporate Partner at

Ashurst. He was a non-executive director of the Platinum Investment Trust Plc

from 2002 until January 2007.

James

Jordan

Mr Jordan is a private investor who was appointed to the Board of JZCP in 2008.

He is a director of the First Eagle family of mutual funds, and of Alpha

Andromeda Investment Trust Company, S.A. Until 30 June 2005, he was the

managing director of Arnhold and S. Bleichroeder Advisers, LLC, a privately

owned investment bank and asset management firm; and until 25 July 2013, he was

a non-executive director of Leucadia National Corporation. He is an Overseer of

the Gennadius Library of the American School of Classical Studies in Athens,

and as Director of Pro Natura de Yucatan.

Sharon

Parr2

Mrs Parr was appointed to the Board of JZCP in 2018. In 2003 she completed a

private equity backed MBO of the trust and fund administration division of

Deloitte and Touche, called Walbrook, selling it to Barclays Wealth in 2007. As

a Managing Director of Barclays, she ultimately became global head of their

trust and fund administration businesses, comprising over 450 staff in 10

countries. She stepped down from her executive roles in 2011 to focus on other

areas and interests but has maintained directorships in several companies. She

is a Fellow of the Institute of Chartered Accountants in England and Wales and

a member of the Society of Trust and Estate Practitioners, and is a resident of

Guernsey.

Tanja

Tibaldi

Ms Tibaldi was appointed to the Board of JZCP in 2008. She was on the board of

JZ Equity Partners Plc from January 2005 until the company's liquidation on 1

July 2008. She was managing director at Fairway Investment Partners, a Swiss

asset management company where she was responsible for the Group's marketing

and co- managed two fund of funds. Previously she was an executive at the Swiss

Stock Exchange and currently serves on the board of several private companies.

Christopher Waldron3,

4

Mr Waldron was appointed to the Board of JZCP in 2013. He has more than thirty

years' experience as an asset manager and director of investment funds. He is

Chairman of UK Mortgages Limited and Crystal Amber Fund Limited. He began his

career with James Capel and subsequently held investment management positions

with Bank of Bermuda, the Jardine Matheson Group and Fortis prior to joining

the Edmond de Rothschild Group in Guernsey as Investment Director in 1999. He

was appointed Managing Director of the Edmond de Rothschild companies in

Guernsey in 2008, a position he held until 2013, when he stepped down to

concentrate on non- executive work and investment consultancy. He is a member

of the States of Guernsey's Investment and Bond Management Sub-Committee and a

Fellow of the Chartered Institute for Securities and Investment. He is a

resident of Guernsey.

Patrick Firth

Mr Firth resigned from the Board and as Chairman of the Audit Committee in June

2019.

1Chairman of the nominations committee of which all Directors are members.

2Mrs Parr was appointed Chairman of the Audit Committee in June 2019. All

Directors are members of the Audit Committee.

3Chairman of the management engagement committee of which all Directors are

members. Mr Waldron was appointed as Senior Independent Director in May 2019.

4Mr Waldron proposed to resign from the Board on 26 November 2019.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Interim Report and Unaudited

Condensed Interim Financial Statements (the "Interim Report and Financial

Statements") in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

- the Unaudited and Condensed Interim Financial Statements (the "Interim

Financial Statements") have been prepared in accordance with IFRS and give a

true and fair view of the assets, liabilities, financial position and profit or

loss of the Company; and

- the Chairman's Statement and Investment Adviser's Report include a fair

review of the information required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six months

of the financial year and their impact on the Interim Financial Statements; and

a description of the principal risks and uncertainties for the remaining six

months of the year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being

related party transactions that have taken place in the first six months of

the financial year and that have materially affected the financial position or

the performance of the entity during that period; and any changes in the

related party transactions described in the 2019 Annual Report and Financial

Statements that could do so.

Going concern and principal risks and

uncertainties

As an investment fund, the Company's principal risks are those that are

associated with its investment portfolio. Given the nature of the portfolio,

the principal risks are associated with the financial and operating performance

of the underlying investments.

The Directors do not consider that the principal risks and uncertainties have

changed since the publication of the Annual Report and Financial Statements for

the year ended 28 February 2019 (as explained annual report). The Directors

continue to monitor the risks to the Company.

The Directors consider the Company has adequate financial resources, in view of

its holding in cash and cash equivalents and liquid investments, and the income

streams deriving from its investments and believe that the Company is well

placed to manage its business risks successfully to continue in operational

existence for the foreseeable future and that it is appropriate to prepare the

interim financial statements on the going concern basis.

Approved by the Board of Directors and agreed on behalf of the Board on 26

November 2019.

David Macfarlane

Chairman

Sharon Parr

Director

Investment Portfolio

31 August 2019 Percentage

of

Portfolio

Cost1 Value

US$'000 US$'000 %

US Microcap portfolio

US Microcap (Verticals)

Industrial Services Solutions2

INDUSTRIAL SERVICES SOLUTIONS ("ISS")

Provider of aftermarket maintenance, repair, and field services for critical

process equipment throughout the US

Total Industrial Services Solutions valuation 48,250 95,893 9.8

Testing Services Holdings2

TECHNICAL SOLUTIONS AND SERVICES

Provider of safety focused solutions for the industrial, environmental and life

science related markets

CONTAMINATION CONTROL & CERTIFICATION

Provider of testing, certification and validation services for cleanroom,

critical environments and containment systems

Total Technical Solutions and Services Vertical valuation 23,731 23,210 2.4

Flexible Packaging Vertical

ACW FLEX PACK, LLC

Provider of a variety of custom flexible packaging solutions to converters and

end-users

Total Flexible Packaging Vertical valuation 10,033 11,064 1.1

Flow Controls

FLOW CONTROL, LLC

Manufacturer and distributor of high-performance, mission-critical flow

handling products and components utilized to connect processing line equipment

Total Flow Control Vertical valuation 14,040 14,924 1.5

Total US Microcap (Verticals) 96,054 145,091 14.8

US Microcap (Co-investments) 8,760 8,760 0.9

ABTB

Acquirer of franchises within the fast-casual eateries and quick-service

restaurants sector

DEFLECTO 40,112 44,334 4.5

Deflecto designs, manufactures and sells innovative plastic products to

multiple industry segments

EXER URGENT CARE 2,400 2,400 0.3

Emergency Room alternative that combines clinical expertise, care & convenience

GEORGE INDUSTRIES 12,683 12,681 1.3

Manufacturer of highly engineered, complex and high tolerance products for the

aerospace, transportation, military and other industrial markets

IGLOO2 6,572 6,450 0.7

Designer, manufacturer and marketer of coolers and outdoor products

K2 TOWERS II 8,463 10,963 1.1

Acquirer of wireless communication towers

NEW VITALITY2 3,431 6,303 0.7

Direct-toconsumer provider of nutritional supplements and personal care

products

ORIZON 4,127 7,000 0.7

Manufacturer of high precision machine parts and tools for aerospace and

defence industries

PEACEABLE STREET CAPITAL 28,041 36,541 3.8

Specialty finance platform focused on commercial real estate

SALTER LABS2 16,762 21,717 2.2

Developer and manufacturer of respiratory medical products and equipment for

the homecare, hospital, and sleep disorder markets

SLOAN LED2 6,030 452 0.0

Designer and manufacturer of LED lights and lighting systems

SUZO HAPP 2,572 11,700 1.2

GROUP2

Designer, manufacturer and distributor of components for the global gaming,

amusement and industrial markets

TIERPOINT2 44,313 46,813 4.8

Provider of cloud computing and collocation data centre services

VITALYST2 9,020 8,192 0.8

Provider of outsourced IT support and training services

Total US Microcap (Co-investments) 193,286 224,306 23.0

US Microcap (Other)

AVANTE HEALTH SOLUTIONS 7,178 9,375 1.0

Provider of new and professionally refurbished healthcare equipment

FELIX STORCH 50 24,500 2.5

Supplier of specialty, professional, commercial, and medical refrigerators and

freezers, and cooking appliances

HEALTHCARE PRODUCTS HOLDINGS3 17,636 - 0.0

Designer and manufacturer of motorised vehicles

NATIONWIDE STUDIOS 26,324 5,000 0.5

Processor of digital photos for pre-schoolers

PRIORITY EXPRESS2 13,200 16,641 1.7

Provider of same day express courier services to various companies located in

north-eastern USA. Priority Express is a subsidiary of US Logistics

Total US Microcap (Other) 64,388 55,516 5.7

Total US Microcap portfolio 353,728 424,913 43.5

European Microcap portfolio

EUROMICROCAP FUND 2010, L.P. - 3,854 0.4

Invested in European Microcap entities

JZI FUND III, L.P. 35,200 57,010 5.8

At 31 August 2019, was invested in twelve companies in the European microcap

sector: Fincontinuo, S.A.C, Collingwood, My Lender, Alianzas en Aceros, ERSI,

Treee, Eliantus, Factor Energia, BlueSites, Luxida and Karium

Total European Microcap (measured at Fair Value) 35,200 60,864 6.2

Direct Investments

DOCOUT4 2,777 3,836 0.4

Provider of digitalisation, document processing and storage services

OMBUDS4 17,198 13,650 1.4

Provider of personal security, asset protection and facilities management

services

TORO FINANCE4 21,619 22,436 2.3

Provides short term receivables finance to the suppliers of major Spanish

companies

XACOM4 2,055 4,077 0.4

Supplier of telecom products and technologies

Total European Microcap (Direct Investments) 43,649 43,999 4.5

Total European Microcap portfolio 78,849 104,863 10.7

Real Estate portfolio

JZCP REALTY5 437,577 422,656 43.3

Facilitates JZCP's investment in US real estate

Total Real Estate portfolio 437,577 422,656 43.3

Other investments

BSM ENGENHARIA2 6,115 459 0.0

Brazilian-based provider of supply chain logistics, infrastructure services and

equipment rental

CERPI 619 619 0.1

Spruceview managed investment product

JZ INTERNATIONAL3 - 750 0.1

Fund of European LBO investments

SPRUCEVIEW CAPITAL 30,005 19,088 2.0

Asset management company focusing primarily on managing endowments and pension

funds

Total Other investments 36,739 20,916 2.2

Listed investments

U.S. Treasury Bill 0.00% Maturity 6th-February-2020 3,321 3,323 0.3

Total Listed investments 3,321 3,323 0.3

Total - portfolio 910,214 976,671 100.0

1Original book cost incurred by JZCP adjusted for subsequent transactions. The

book cost represents cash outflows and excludes PIK investments.

2Co-investment with Fund A, a Related Party (Note 19) .

3Legacy Investments. Legacy investments are excluded from the calculation of

capital and income incentive fees.

4Classified as Loans at Amortised Cost .

5JZCP invests in real estate indirectly through its investments in JZCP Realty

Ltd. JZCP owns 100% of the shares and voting rights of JZCP Realty, Ltd.

Statement of Comprehensive Income (Unaudited)

For the Period from 1 March 2019 to 31 August 2019

Six Month Six Month

Period Ended Period Ended

31 August 2019 31 August 2018

Note US$'000 US$'000

Income

Realisations from investments held in escrow 21 3,923 2,085

accounts

Net foreign currency exchange gains 3,765 1,045

Gain on financial liabilities at fair value through 4,107 5,925

profit or loss

Investment Income 8 19,984 14,300

Bank and deposit interest 225

289

32,004

23,644

Expenses

Net loss on investments at fair value through profit 6

or loss (31,575) (25,720)

Expected credit losses 7 (14,727) -

Investment Adviser's base fee 10 (8,301) (8,498)

Investment Adviser's incentive fee 10 2,895 3,843

Administrative expenses (1,660)

(1,423)

Directors' remuneration (219)

(230)

(53,598) (32,017)

Operating loss (21,594) (8,373)

Finance costs 9 (10,463) (9,126)

Loss for the period (32,057) (17,499)

Weighted average number of Ordinary shares in issue 20 80,614,784 83,456,487

during the period

Basic loss per Ordinary share 20 (39.77)c (20.97)c

Diluted loss per Ordinary share 20 (39.84)c (24.27)c

The format of the Statement of Comprehensive Income (Unaudited) has changed

from prior periods in that it now presents income in one column format rather

than a split between capital and revenue.

The accompanying notes form an integral part of the Interim Financial

Statements.

Statement of Financial Position (Unaudited)

As at 31 August 2019

31 August 28 February

2019 2019

Note US$'000 US$'000

Assets

Investments at fair value through profit or loss 11 932,672 1,014,316

Loans at amortised cost 11 43,999 58,012

Other receivables 12 623 1,286

Cash at bank 71,686 50,994

Total assets 1,048,980 1,124,608

Liabilities

Zero Dividend Preference shares 13 59,946 63,838

Convertible Unsecured Loan Stock 14 50,167 54,274

Loan payable 15 149,490 149,227

Investment Adviser's incentive fee 10 36,876 42,771

Investment Adviser's base fee 10 2,079 2,102

Other payables 16 2,196 2,134

Total liabilities 300,754 314,346

Equity

Share capital 216,625 246,604

Other reserve 353,528 353,528

Retained earnings 178,073 210,130

Total equity 748,226 810,262

Total liabilities and equity 1,048,980 1,124,608

Number of Ordinary shares in issue at period/year end 17 77,474,175 80,666,838

Net asset value per Ordinary share $9.66 $10.04

These Interim Financial Statements were approved by the Board of Directors and

authorised for issue on 26 November 2019. They were signed on its behalf by:

David Macfarlane

Chairman

Sharon Parr

Director

The accompanying notes form an integral part of the interim financial

statements.

Statement of Changes in Equity (Unaudited)

For the Period from 1 March 2019 to 31 August 2019

Share Other Retained

Capital Reserve Earnings Total

Note US$'000 US$'000 US$'000 US$'000

Balance as at 1 March 2019 246,604 353,528 210,130 810,262

Loss for the period - (32,057) (32,057)

-

Buy back of Ordinary shares 17 (29,979) - (29,979)

-

Balance at 31 August 2019 216,625 353,528 178,073 748,226

Comparative for the period from 1 March 2018 to 31 August 2018

Share Other Retained

Capital Reserve Earnings Total

US$'000 US$'000 US$'000 US$'000

Balance at 1 March 2018 265,685 353,528 218,360 837,573

Impact of adoption of IFRS 9 - - (1,395) (1,395)

Adjusted Balance at 1 March 2018 265,685 353,528 216,965 836,178

Loss for the period (17,499) (17,499)

- -

Buy back of Ordinary shares (6,707) (6,707)

- -

Balance at 31 August 2018 258,978 353,528 199,466 811,972

The accompanying notes form an integral part of the Interim Financial

Statements.

The format of the Statement of Changes in Equity has changed from prior periods

in that it now reflects the one column income presentation in the Statement of

Comprehensive Income format. The Company's profit/loss are now posted to

retained earnings rather than individual revenue/capital reserves.

Statement of Cashflows (Unaudited)

For the Period from 1 March 2019 to 31 August 2019

Six Month Six Month

Period Ended Period Ended

31 August 2019 31 August 2018

Note US$'000 US$'000

Cash flows from operating activities

Cash inflows

Realisation of investments1 11 117,341 159,385

Maturity of treasury bills2 11 3,350 49,845

Escrow receipts received 21 3,923 2,085

Interest received from unlisted investments 677 1,103

Income distributions received from investments 1,192 -

Bank Interest received 225 289

Cash outflows

Direct investments and capital calls3 11 (51,228) (131,482)

Purchase of treasury bills 11 (3,321) (3,267)

Investment Adviser's base fee paid 10 (8,324) (8,513)

Investment Adviser's incentive fee paid 10 (3,000) (996)

Other operating expenses paid (1,865) (1,641)

Foreign exchange (loss)/gain realised (306) 17

Net cash inflow before financing activities 58,664 66,825

Financing activities

Finance costs paid:

- Convertible Unsecured Loan Stock (1,515) (1,631)

- Loan Payable (6,453) (5,720)

Payments to buy back Company's Ordinary shares (29,979) (6,707)

Net cash outflow from financing activities (37,947) (14,058)

Increase in cash at bank 20,717 52,767

Reconciliation of net cash flow to movements in cash

at bank

US$'000 US$'000

Cash and cash equivalents at 1 March

50,994 9,000

Increase in cash at bank

20,717 52,767

Unrealised foreign exchange movements on cash at

bank (25) (213)

Cash and cash equivalents at period end

71,686 61,554

1Total realisations quoted in the interim report of $121.2 million, include

escrow receipts of $3.9 million and income distributions received of $1.2

million and exclude a short term debt repayment of $1.2 million.

2Includes $38,000 of treasury bill interest received on maturity.

3Total investments in period include $0.7 million of deposits held at 28

February 2019.

The accompanying notes form an integral part of the Interim Financial

Statements.

Notes to the Interim Financial Statements (Unaudited)

1. General Information

JZ Capital Partners Limited ("JZCP" or the "Company") is a Guernsey domiciled

closed-ended investment company which was incorporated in Guernsey on 14 April

2008 under the Companies (Guernsey) Law, 2008 (as amended). The Company is

classed as an authorised fund under the Protection of Investors (Bailiwick of

Guernsey) Law 1987. The Company's Capital consists of Ordinary shares, Zero

Dividend Preference ("ZDP") shares and Convertible Unsecured Loan Stock

("CULS"). The Company's shares trade on the London Stock Exchange's Specialist

Fund Segment.

The Company's Investment Policy is to target predominantly private investments,

seeking to back management teams to deliver on attractive investment

propositions. In executing its strategy, the Company takes a long term view.

The Company seeks to invest directly in its target investments, although it may

also invest through other collective investment vehicles. The Company may also

invest in listed investments, whether arising on the listing of its private

investments or directly. The Investment Adviser is able to invest globally but

with a particular focus on opportunities in the United States and Europe.

The Company is currently mainly focused on investing in the following areas:

(a) small or micro-cap buyouts in the form of debt and equity and preferred

stock in both the US and Europe; and

(b) real estate.

Jordan/Zalaznick Advisers, Inc. (the "Investment Adviser") takes a dynamic

approach to asset allocation and, though it doesn't expect to, in the event

that the Company were to invest 100% of gross assets in one area, the Company

will, nevertheless, always seek to maintain a broad spread of investment risk.

Exposures are monitored and managed by the Investment Adviser under the

supervision of the Board.

The Company has no direct employees. For its services the Investment Adviser

receives a management fee and is also entitled to performance related fees

(Note 10). The Company has no ownership interest in the Investment Adviser.

During the period under review the Company was administered by Northern Trust

International Fund Administration Services (Guernsey) Limited.

The Unaudited Condensed Interim Financial Statements (the "Interim Financial

Statements") are presented in US$'000 except where otherwise indicated.

2. Significant Accounting Policies

The accounting policies adopted in the preparation of these Interim Financial

Statements have been consistently applied during the period, unless otherwise

stated.

Statement of Compliance

The Interim Financial Statements of the Company for the period 1 March 2019 to

31 August 2019 have been prepared in accordance with IAS 34, "Interim Financial

Reporting" as adopted in the European Union, together with applicable legal and

regulatory requirements of the Companies (Guernsey) Law, 2008 and the

Disclosure Guidance and Transparency Rules. The Interim Financial Statements do

not include all the information and disclosure required in the Annual Audited

Financial Statements and should be read in conjunction with the Annual Report

and Financial Statements for the year ended 28 February 2019.

Independent Review of Interim Financial Statements

These Interim Financial Statements and information in the accompanying Interim

Report have not been audited or reviewed by the Company's Auditor.

Basis of Preparation

The interim financial statements have been prepared under the historical cost

basis, modified by the revaluation of financial instruments designated at fair

value through profit or loss ("FVTPL") upon initial recognition. The principal

accounting policies adopted in the preparation of these Interim Financial

Statements are consistent with the accounting policies stated in Note 2 of the

Annual Financial Statements for the year ended 28 February 2019. The

preparation of these Interim Financial Statements are in conformity with IAS

34, "Interim Financial Reporting" as adopted in the European Union, and

requires the Company to make estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the interim financial

statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could materially differ from those estimates.

The Statement of Comprehensive Income is now presented in a one column format

rather than AIC SORP recommended presentation which allocated profit/loss

between capital and revenue.

New standards, interpretations and amendments adopted by the Company

The accounting policies adopted in the preparation of the interim financial

statements are consistent with those followed in the preparation of the

Company's annual financial statements for the year ended 28 February 2019. The

has been no early adoption, by the Company, of any other standard,

interpretation or amendment that has been issued but is not yet effective.

Several amendments and interpretations to standards apply for the first time in

2019, but do not have an impact on the interim financial statements of the

Company.

3. Estimates and Judgements

The estimates and judgements made by the Board of Directors are consistent with

those made in the Audited Financial Statements for the year ended 28 February

2019.

4. Segment Information

The Investment Manager is responsible for allocating resources available to the

Company in accordance with the overall business strategies as set out in the

Investment Guidelines of the Company. The Company is organised into the

following segments:

* Portfolio of US micro-cap investments

* Portfolio of European micro-cap investments

* Portfolio of Real estate investments

* Portfolio of Other investments - (not falling into above categories)

Investments in treasury bills are not considered as part of the investment

strategy and are therefore excluded from this segmental analysis.

The investment objective of each segment is to achieve consistent medium-term

returns from the investments in each segment while safeguarding capital by

investing in a diversified portfolio.

Segmental operating profit/(loss)

For the period from 1 March 2019 to 31 August 2019

US European Real Other

Micro-Cap Micro-Cap Estate Investments Total

US$ '000 US$ '000 US$ '000 US$ '000 US$ '000

Interest 15,980 2,742 32 - 18,754

revenue

Dividend revenue - 1,192 - - 1,192

Total segmental revenue 15,980 3,934 32 - 19,946

Net gain/(loss) on investments at 29,331 3,097 (64,003) - (31,575)

FVTPL

Expected credit losses - (14,727) - - (14,727)

Realisations from investments held in 3,923 - - - 3,923

Escrow

Investment Adviser's base (3,420) (827) (3,379) (147) (7,773)

fee

Investment Adviser's capital (10,074) 240 12,729 - 2,895

incentive fee1

Total segmental operating profit/ 35,740 (8,283) (54,621) (147) (27,311)

(loss)

For the period from 1 March 2018 to 31 August 2018

US European Real Other

Micro-Cap Micro-Cap Estate Investments Total

US$ '000 US$ '000 US$ '000 US$ '000 US$ '000

Interest 10,649 3,565 59 - 14,273

revenue

Total segmental revenue 10,649 3,565 59 - 14,273

Realisations from investments held in 2,085 - - - 2,085

Escrow

Net gain/(loss) on investments at 8,152 2,778 (36,650) - (25,720)

FVTPL

Investment Adviser's base (3,311) (859) (3,501) (122) (7,793)

fee

Investment Adviser's capital (3,922) 435 7,330 - 3,843

incentive fee1

Total segmental operating profit/ 13,653 5,919 32,762) (122) (13,312)

(loss)

1The capital incentive fee is allocated across segments where a realised or

unrealised gain or loss has occurred. Segments with realised or unrealised

losses are allocated a credit pro rata to the size of the loss and segments

with realised or unrealised gains are allocated a charge pro rata to the size

of the gain.

Certain income and expenditure is not considered part of the performance of an

individual segment. This includes net foreign exchange gains, interest on

cash, finance costs, management fees, custodian and administration fees,

directors' fees and other general expenses.

The following table provides a reconciliation between total segmental operating

profit/(loss) and operating profit/(loss):.

Period ended Period ended

31.8.2019 31.8.2018

US$ '000 US$ '000

Total segmental operating loss (27,311) (13,312)

Gain on financial liabilities at fair value through profit or

loss 4,107 5,925

Net foreign exchange gain

3,765 1,045

Bank and deposit interest

225 289

Expenses not attributable to segments (1,642)

(1,890)

Fees payable to investment adviser based on non-segmental assets

(528) (705)

Interest on US treasury bills

38 27

Operating loss (21,594) (8,373)

The following table provides a reconciliation between total segmental revenue

and Company revenue:

Period ended Period ended

31.8.2019 31.8.2018

US$ '000 US$ '000

Total segmental revenue 19,946 14,273

Non-segmental revenue

Bank and deposit interest

225 289

Interest on US treasury bills

38 27

Total revenue 20,209 14,589

Segmental Net Assets

At 31 August 2019

US European Real Other

Micro-Cap Micro-Cap Estate Investments Total

US$ '000 US$ '000 US$ '000 US$ '000 US$ '000

Segmental assets

Investments at FVTPL 424,913 60,864 422,656 20,916 929,349

Loans at amortised cost 43,999 43,999

- - -

Other receivables 495 495

- - -

Total segmental assets 424,913 104,863 423,151 20,916 973,843

Segmental liabilities

Payables and accrued expenses (45,805) 1,594 2,146 3,259 (38,806)

Total segmental liabilities (45,805) 1,594 2,146 3,259

(38,806)

Total segmental net assets 379,108 106,457 425,297 24,175 935,037

At 28 February 2019

US European Real Other

Micro-Cap Micro-Cap Estate Investments Total

US$ '000 US$ '000 US$ '000 US$ '000 US$ '000

Segmental assets

Investments at FVTPL 478,970 70,686 43,044 18,302 1,011,002

Loans at amortised cost 58,012

- - - 58,012

Other receivables 1,275

- - - 1,275

Total segmental assets 478,970 128,698 444,319 18,302 1,070,289

Segmental liabilities

Payables and accrued expenses (38,768) 1,321 (10,573) 1,850

(46,170)

Total segmental liabilities 1,321 (10,573) 1,850

(38,768) (46,170)

Total segmental net assets 440,202 130,019 433,746 20,152 1,024,119

The following table provides a reconciliation between total segmental assets

and total assets and total segmental liabilities and total liabilities:

31.8.2019 28.2.2019

US$ '000 US$ '000

Total segmental assets 973,843 1,070,289

Non segmental assets

Treasury

Bills 3,323 3,314

Cash at bank

71,686 50,994

Other receivables

128 11

Total assets 1,048,980 1,124,608

Total segmental (38,806) (46,170)

liabilities

Non segmental liabilities

Zero Dividend Preference shares (59,946)

(63,838)

Convertible Unsecured Loan Stock (50,167) (54,274)

Loans payable (149,490) (149,227)

Other payables (2,345)

(837)

Total liabilities (300,754) (314,346)

Total net assets 748,226 810,262

5. Fair Value of Financial Instruments

The Company classifies fair value measurements of its financial instruments at

FVTPL using a fair value hierarchy that reflects the significance of the

inputs used in making the measurements. The financial instruments valued at

FVTPL are analysed in a fair value hierarchy based on the following levels:

Level 1

Quoted prices (unadjusted) in active markets for identical assets or

liabilities.

Level 2

Those involving inputs other than quoted prices included within level 1 that

are observable for the asset or liability, either directly (that is, as prices)

or indirectly (that is, derived from prices). For example, investments which

are valued based on quotes from brokers (intermediary market participants) are

generally indicative of Level 2 when the quotes are executable and do not

contain any waiver notices indicating that they are not necessarily tradeable.

Another example would be when assets/liabilities with quoted prices, that would

normally meet the criteria of Level 1, do not meet the definition of being

traded on an active market. At the period end, the Company had assessed that

the liabilities valued at FVTPL being the CULS and valued using the quoted ask

price, would be classified as level 2 within the valuation method as they are

not regularly traded.

Level 3

Those involving inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs). Investments in JZCP's

portfolio valued using unobservable inputs such as multiples, capitalisation

rates, discount rates fall within Level 3.

Differentiating between Level 2 and Level 3 fair value measurements i.e.,

assessing whether inputs are observable and whether the unobservable inputs are

significant, may require judgement and a careful analysis of the inputs used to

measure fair value including consideration of factors specific to the asset or

liability.

The following table shows financial instruments recognised at fair value,

analysed between those whose fair value is based on:

Financial assets at 31 August 2019

Level 1 Level 2 Level 3 Total

US$ '000 US$'000 US$ '000 US$ '000

US micro-cap 424,913 424,913

- -

European micro-cap 60,864 60,864

- -

Real estate 422,656 422,656

- -

Other investments 20,916 20,916

- -

Listed investments 3,323 3,323

- -

3,323 929,349 932,672

-

Financial assets at 28 February

2019

Level 1 Level 2 Level 3 Total

US$ '000 US$'000 US$ '000 US$ '000

US micro-cap - 478,970 478,970

-

European micro-cap 70,686 70,686

- -

Real estate 443,044 443,044

- -

Other investments 18,302 18,302

- -

Listed investments 3,314 3,314

- -

3,314 1,011,002 1,014,316

-

Financial liabilities designated at fair value through profit or loss at

inception

Financial liabilities at 31 August 2019 Level 1 Level 2 Level 3 Total

US$ '000 US$'000 US$ '000 US$ '000

CULS 50,167

- - 50,167

50,167

- - 50,167

Financial liabilities at 28 February 2019 Level 1 Level 2 Level 3 Total

US$ '000 US$'000 US$ '000 US$ '000

CULS 54,274

- - 54,274

54,274 -

- 54,274

Transfers between levels

Transactions for the CULS do not take place with sufficient frequency and

volume to provide adequate pricing information on an ongoing basis, as defined

by IFRS. Therefore, it is considered the CULS' are not traded in an active

market and are therefore categorised at level 2.

Valuation techniques

The same valuation methodology and process was deployed as for the year ended

28 February 2019.

Quantitative information of significant unobservable inputs and sensitivity

analysis to significant changes in unobservable inputs within Level 3 hierarchy

The significant unobservable inputs used in fair value measurement categorised

within Level 3 of the fair value hierarchy together with a quantitative

sensitivity as at 31 August 2019 and 28 February 2019 are shown below:

Value Valuation Unobservable Range Sensitivity Approx. Impact on

31.8.2019 (weighted Fair Value

average)

US$'000 Technique input used 1 US$'000

US micro-cap EBITDA Average EBITDA 6.0x - -0.5x /

investments 424,913 Multiple Multiple of Peers 12.6x +0.5x (32,697) 34,114

(8.4x)

Discount to 15% - 35% +5% / -5%

Average Multiple (22.5%) (43,856) 42,066

European EBITDA Average EBITDA 6.0x-13.8x -0.5x /

micro-cap 60,864 Multiple Multiple of Peers (9.7x) +0.5x (4,143) 4,131

investments

Discount to -31.4% - +5% / -5%

Average Multiple 33.9% (3,910) 3,910

(-0.7%)

Real estate2 Comparable Market Value Per $324 - -5% / +5%

273,538 Sales Square Foot $3,113 per (30,902) 30,902

sq ft

($1,598)

DCF Model / Discount Rate 5.5% - +25bps /

42,313 Income 6.5% -25bps (3,544) 3,544

Approach3 (6.15%)

Cap Rate/ Capitalisation 3.25 - +25bps /

106,805 Income Rate 5.5% -25bps (20,292) 20,292

Approach (3.9%)

Other AUM AUM $3.0 Bn - +10%/-10%

investments 19,088 Approach $3.7 Bn 4,503 (4,234)

% Applied to 2.3% +10%/-10%

AUM 1,921 (1,921)

Value Valuation Unobservable Range Sensitivity Approx. Impact on

28.2.2019 (weighted Fair Value

average)

US$'000 Technique input used 1 US$'000

US micro-cap EBITDA Average EBITDA 6.0x - -0.5x /

investments 478,970 Multiple Multiple of Peers 16.3x +0.5x (37,624) 39,780

(8.5x)

Discount to 15% - 35% +5% / -5%

Average Multiple (23%) (47,352) 49,662

European EBITDA Average EBITDA 5.2x - -0.5x /

micro-cap 70,686 Multiple Multiple of Peers 12.1x +0.5x (8,934) 8,934

investments (8.7x)

Discount to 0% - 29% +5% / -5%

Average Multiple (19%) (7,316) 7,316

Real estate2 Comparable Market Value Per $324 - -5% / +5%

271,863 Sales Square Foot $3,113 (30,902) 30,902

($1,441)

per sq ft

DCF Model / Discount Rate 5.5% - +25bps /

43,954 Income 6.5% -25bps (3,544) 3,544

Approach3 (6.2%)

Cap Rate/ Capitalisation 3.25 - +25bps /

127,226 Income Rate 5.5% -25bps (20,292) 20,292

Approach (4.5%)

Other AUM AUM $2.0 Bn - +10%/-10%

investments 17,093 Approach $2.6 Bn 3,294 3,112

% Applied to 2.5% +10%/-10%

AUM 1,727 (1,727)

1The sensitivity analysis refers to a percentage amount added or deducted from

the average input and the effect this has on the fair value.

2The Fair Value of JZCP's investment in financial interests in real estate, is

measured as JZCP's percentage interest in the value of the underlying

properties.

3Certain investments in the Roebling, Williamsburg and Wynwood real estate

portfolios are valued using an income capitalisation approach.

The following table shows a reconciliation of all movements in the fair value

of financial instruments categorised within Level 3 between the beginning and

the end of the reporting period.

Period ended 31 August 2019

US European Real Other

Micro-Cap Micro-Cap Estate Investments Total

US$ '000 US$ '000 US$ '000 US$ '000 US$ '000