AIM Sch 1 - Camellia Plc (6572P)

August 20 2014 - 10:15AM

UK Regulatory

TIDMCAM

RNS Number : 6572P

AIM

20 August 2014

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

-------------------------------------------------------------------------

COMPANY NAME:

-------------------------------------------------------------------------

Camellia Plc (the "Company")

-------------------------------------------------------------------------

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

-------------------------------------------------------------------------

Linton Park

Linton

Maidstone

Kent

ME17 4AB

-------------------------------------------------------------------------

COUNTRY OF INCORPORATION:

-------------------------------------------------------------------------

England and Wales

-------------------------------------------------------------------------

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

-------------------------------------------------------------------------

www.camellia.plc.uk

-------------------------------------------------------------------------

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

-------------------------------------------------------------------------

The Company and its subsidiaries (the "Group") operates in

four divisions, comprising (i) agriculture and horticulture

(predominantly tea production), (ii) engineering, (iii) food

storage and distribution and (iv) private banking and financial

services. The Group employs approximately 75,000 people globally.

The Group also holds investments comprising listed and unlisted

securities, fine art, philately, documents, manuscripts, land

and property.

The agriculture and horticulture division is engaged in the

production of tea, edible nuts (macadamias, pistachios and

almonds), citrus fruits, avocado, rubber, forestry, viticulture,

cattle, other horticultural produce and general farming (maize

and soya). The Group is one of the largest private tea producers

world-wide with a total of 65 tea estates and 60 tea factories.

It also manufactures instant tea and distributes packet tea

in India. The Group's main operations are in India, Bangladesh,

Malawi and Kenya, where the tea is grown and produced. It also

has notable agricultural operations, other than tea, in Brazil,

California, Kenya and South Africa.

The engineering division is engaged in precision engineering,

cutting and grinding, fabrication, heat treatment, galvanising,

powder coating and manufacture of stables, etch inspection

and catalysts. These businesses are predominately UK based

and serve customers in a number of sectors including the offshore

oil and gas and aerospace sectors.

The food storage and distribution division is involved in frozen,

chilled and ambient temperature food supply chain management

providing cold storage, refrigerated transport and production

support to several leading UK food manufacturers. It also specialises

in frozen imports and distributes seafood products in Europe

and supplies food service customers in the Netherlands with

fresh, frozen and ready-made fish.

The banking and financial services division comprises Duncan

Lawrie, which provides an integrated suite of banking services,

financial planning, investment management and trust and estate

advice. The head office of Duncan Lawrie private bank is in

London, with offices in the Isle of Man, Bristol and Wrotham.

-------------------------------------------------------------------------

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

-------------------------------------------------------------------------

2,824,500 ordinary shares of 10 pence each

-------------------------------------------------------------------------

CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE) AND ANTICIPATED

MARKET CAPITALISATION ON ADMISSION:

-------------------------------------------------------------------------

No capital to be raised on admission

Estimated market capitalisation: GBP265 million

-------------------------------------------------------------------------

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

-------------------------------------------------------------------------

52.80 per cent.

-------------------------------------------------------------------------

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM COMPANY HAS APPLIED OR AGREED TO HAVE ANY OF ITS SECURITIES

(INCLUDING ITS AIM SECURITIES) ADMITTED OR TRADED:

-------------------------------------------------------------------------

The Company's listing on the Luxembourg Stock Exchange will

be cancelled with effect from 1 September 2014, as announced

on 14 August 2014.

-------------------------------------------------------------------------

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

-------------------------------------------------------------------------

Malcolm Courtney Perkins (Chairman)

Christopher John Relleen (Deputy Chairman, Independent Non-Executive

Director and Senior Independent Director)

Christopher John Ames (Joint Managing Director)

Martin Dünki (Non-Executive Director)

Peter John Field (Joint Managing Director)

Anil Kumar Mathur (Finance Director)

Frédéric Vuilleumier (Independent Non-Executive Director)

Proposed

William Knatchbull Gibson (Independent Non-Executive Director)

joining the Board on 1 September 2014

Thomas (Tom) Kenric Franks (Deputy Chief Executive) joining

the Board on 1 October 2014

Graham Harold Mclean (Executive Director) joining the Board

on 1 October 2014

Susan Ann Walker (Finance Director Designate) joined the Group

on 1 July 2014 and will join the Board as Finance Director

in June 2015

-------------------------------------------------------------------------

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

-------------------------------------------------------------------------

Name of Shareholder % pre-Admission % post-Admission

Camellia Holdings AG 50.52 50.52

Alcatel Bell Pensioenfonds VZW 9.81 9.81

Taube Hodson Stonex & Partners 3.11 3.11

Argos Argonaut Fund 3.05 3.05

In addition, Assam-Dooars Holdings Limited, a subsidiary

of the Company, holds (and will continue to hold following

Admission) 62,500 ordinary shares representing 2.21 per cent.

of the Company's issued ordinary share capital. These ordinary

shares are part of the total issued share capital of the

Company but, in accordance with the Companies Act 2006, no

voting rights are exercisable in respect of these shares

while they remain so held.

-------------------------------------------------------------------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

-------------------------------------------------------------------------

None

-------------------------------------------------------------------------

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

-------------------------------------------------------------------------

(i) 31 December

(ii) N/A - Existing issuer moving from Official List

(iii) Half Yearly Report to 30 June 2014 - by 30 September

2014

Final Results for the Financial Year Ending 31 December 2014

- by 30 June 2015

Half Yearly Report to 30 June 2015 - by 30 September 2015

-------------------------------------------------------------------------

EXPECTED ADMISSION DATE:

-------------------------------------------------------------------------

19 September 2014

-------------------------------------------------------------------------

NAME AND ADDRESS OF NOMINATED ADVISER:

-------------------------------------------------------------------------

Charles Stanley Securities

131 Finsbury Pavement

London

EC2A 1NT

-------------------------------------------------------------------------

NAME AND ADDRESS OF BROKER:

-------------------------------------------------------------------------

Charles Stanley Securities

131 Finsbury Pavement

London

EC2A 1NT

-------------------------------------------------------------------------

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

-------------------------------------------------------------------------

N/A - Quoted Applicant

-------------------------------------------------------------------------

DATE OF NOTIFICATION:

-------------------------------------------------------------------------

20 August 2014

-------------------------------------------------------------------------

NEW/ UPDATE:

-------------------------------------------------------------------------

NEW

-------------------------------------------------------------------------

QUOTED APPLICANTS MUST ALSO COMPLETE THE FOLLOWING:

-------------------------------------------------------------------------

THE NAME OF THE AIM DESIGNATED MARKET UPON WHICH THE APPLICANT'S

SECURITIES HAVE BEEN TRADED:

-------------------------------------------------------------------------

The Main Market for Officially Listed securities operated by

the London Stock Exchange plc.

-------------------------------------------------------------------------

THE DATE FROM WHICH THE APPLICANT'S SECURITIES HAVE BEEN SO

TRADED:

-------------------------------------------------------------------------

6 May 1949

-------------------------------------------------------------------------

CONFIRMATION THAT, FOLLOWING DUE AND CAREFUL ENQUIRY, THE APPLICANT

HAS ADHERED TO ANY LEGAL AND REGULATORY REQUIREMENTS INVOLVED

IN HAVING ITS SECURITIES TRADED UPON SUCH A MARKET OR DETAILS

OF WHERE THERE HAS BEEN ANY BREACH:

-------------------------------------------------------------------------

Confirmed

-------------------------------------------------------------------------

AN ADDRESS OR WEB-SITE ADDRESS WHERE ANY DOCUMENTS OR ANNOUNCEMENTS

WHICH THE APPLICANT HAS MADE PUBLIC OVER THE LAST TWO YEARS

(IN CONSEQUENCE OF HAVING ITS SECURITIES SO TRADED) ARE AVAILABLE:

-------------------------------------------------------------------------

www.camellia.plc.uk

-------------------------------------------------------------------------

DETAILS OF THE APPLICANT'S STRATEGY FOLLOWING ADMISSION INCLUDING,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY:

-------------------------------------------------------------------------

The Board's strategy for the Group is:

* to develop a worldwide group of businesses requiring

management to take a long term view;

* the achievement of long term shareholder returns

through sustained and targeted investment;

* investing in sustainability, the environment and the

communities in which it does business;

* ensuring that the quality and safety of its products

and services meet the highest international

standards; and

* the continuous refinement and improvement of the

Group's existing businesses using its internal

expertise and financial strength.

Where opportunities arise to make complementary acquisitions

and divestments in order to generate accelerated returns to

shareholders, this will be considered by the Directors.

-------------------------------------------------------------------------

A DESCRIPTION OF ANY SIGNIFICANT CHANGE IN FINANCIAL OR TRADING

POSITION OF THE APPLICANT, WHICH HAS OCCURRED SINCE THE END

OF THE LAST FINANCIAL PERIOD FOR WHICH AUDITED STATEMENTS HAVE

BEEN PUBLISHED:

-------------------------------------------------------------------------

Save as announced by the Company in announcements made in accordance

with the Disclosure and Transparency Rules and the Listing

Rules (including the trading update announcement made on 5

August 2014), there have been no significant changes in the

financial or trading position of Camellia Plc since 31 December

2013, being the end of the last financial period for which

audited financial statements have been published.

-------------------------------------------------------------------------

A STATEMENT THAT THE DIRECTORS OF THE APPLICANT HAVE NO REASON

TO BELIEVE THAT THE WORKING CAPITAL AVAILABLE TO IT OR ITS

GROUP WILL BE INSUFFICIENT FOR AT LEAST TWELVE MONTHS FROM

THE DATE OF ITS ADMISSION:

-------------------------------------------------------------------------

The Directors have no reason to believe that the working capital

available to the Company or its Group will be insufficient

for at least 12 months from the date of its admission.

-------------------------------------------------------------------------

DETAILS OF ANY LOCK-IN ARRANGEMENTS PURSUANT TO RULE 7 OF THE

AIM RULES:

-------------------------------------------------------------------------

N/A

-------------------------------------------------------------------------

A BRIEF DESCRIPTION OF THE ARRANGEMENTS FOR SETTLING THE APPLICANT'S

SECURITIES:

-------------------------------------------------------------------------

Settlement will be through the CREST system for uncertificated

shares. Shareholders can also deal based on share certificates.

-------------------------------------------------------------------------

A WEBSITE ADDRESS DETAILING THE RIGHTS ATTACHING TO THE APPLICANT'S

SECURITIES:

-------------------------------------------------------------------------

www.camellia.plc.uk

-------------------------------------------------------------------------

INFORMATION EQUIVALENT TO THAT REQUIRED FOR AN ADMISSION DOCUMENT

WHICH IS NOT CURRENTLY PUBLIC:

-------------------------------------------------------------------------

See the appendix to this Schedule One announcement which is

available on the Company's website at: www.camellia.plc.uk

-------------------------------------------------------------------------

A WEBSITE ADDRESS OF A PAGE CONTAINING THE APPLICANT'S LATEST

ANNUAL REPORT AND ACCOUNTS WHICH MUST HAVE A FINANCIAL YEAR

END NOT MORE THEN NINE MONTHS PRIOR TO ADMISSION AND INTERIM

RESULTS WHERE APPLICABLE. THE ACCOUNTS MUST BE PREPARED IN

ACCORDANCE WITH ACCOUNTING STANDARDS PERMISSIBLE UNDER AIM

RULE 19:

-------------------------------------------------------------------------

www.camellia.plc.uk

-------------------------------------------------------------------------

THE NUMBER OF EACH CLASS OF SECURITIES HELD IN TREASURY:

-------------------------------------------------------------------------

N/A

-------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

PAASEFFLSFLSESA

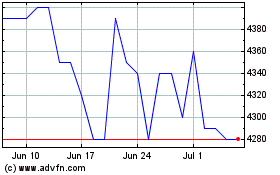

Camellia (LSE:CAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

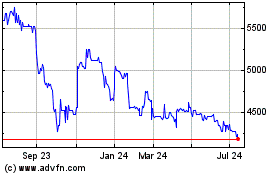

Camellia (LSE:CAM)

Historical Stock Chart

From Jul 2023 to Jul 2024