BP Swings to a Loss On Weaker Oil Prices -- WSJ

October 30 2019 - 3:02AM

Dow Jones News

By Sarah McFarlane and Giulia Petroni

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 30, 2019).

BP PLC said it swung to a loss in third-quarter earnings

resulting from a divestment-related charge and lower earnings in

its exploration and production business.

The London-based energy giant Tuesday posted a replacement-cost

loss -- a metric similar to the net income figure that U.S. oil

companies report -- of $351 million for the three months ended

Sept. 30, compared with a profit of $3.09 billion in the

year-earlier period.

Stripping out the one-off items, BP's results exceeded analyst

expectations, with the underlying replacement-cost profit at $2.25

billion, above a company-compiled consensus of 24 brokers'

estimates forecasting $1.73 billion. Still, the result was well

below the same period last year when its underlying

replacement-cost profit was $3.84 billion.

BP's results exceeded market expectations as a result of

better-than-expected downstream and Rosneft contributions, said

Bernstein analyst Oswald Clint. BP holds around a 20% stake in

Russia's Rosneft.

Looking ahead, the oil giant said it expects fourth-quarter

production to be higher following the completion of seasonal

maintenance and turnaround activities.

Oil companies' earnings have been hit by weaker oil and gas

prices. Last week, Norway's Equinor ASA and Italy's Eni SpA

announced declines in their third-quarter earnings, citing lower

energy prices.

BP shares closed down 3.8% in London on Tuesday.

BP's production was also hobbled by maintenance activities in

some of the company's highest-margin regions. Hurricane Barry in

the Gulf of Mexico shut down some of its facilities for about 14

days, it said.

The company had flagged its impairment charge of $2.6 billion

related to divestments earlier this month, having sold U.S. assets

at lower prices than expected. In the quarter, BP sold its Alaska

assets to privately held Hilcorp Energy Co. for $5.6 billion. The

sale accounted for about $1 billion of the impairment charge.

The impairment also increased gearing -- the ratio of BP's

market cap to debt -- to 36% including leases. It is above the

company's target range of 20-30%, but BP said it should be

temporary and gearing should fall to the middle of that range in

2020 as the company reduces debt.

The company said it expects to complete its $10 billion

divestment program ahead of schedule -- by the end of this year

instead of 2020. Divestments made this year totaled $7.2 billion by

the end of the third quarter.

Total revenue for the third quarter was $62.29 billion, compared

with $80.80 billion the previous year, BP said. The company

reported a net loss of $749 million.

Underlying replacement-cost profit before interest and tax in

the upstream business -- which produces oil and gas -- fell to

$2.14 billion from $4 billion for the same period a year ago. The

contribution from Rosneft Oil Co. was more resilient however, at

$802 million, down from $872 million a year ago.

Operating cash flow, excluding payments relating to the 2010

Deepwater Horizon oil spill, was $6.5 billion, while net debt rose

to $46.5 billion, BP said. The company paid roughly $400 million in

connection to the oil spill in the Gulf of Mexico as part of a $20

billion settlement with the U.S. government in 2015.

BP maintained its quarterly dividend at 10.25 cents a share.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

October 30, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

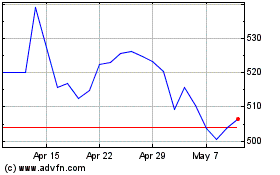

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

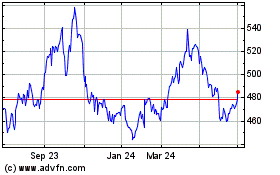

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024