RNS Number:8464T

Braemar Shipping Services PLC

07 May 2008

This announcement replaces in its entirety the incorrect announcement posted

at 7.00am today under RNS number 8245T.

BRAEMAR SHIPPING SERVICES PLC

PRESS RELEASE

For immediate release 7 May 2008

Unaudited Results - Year ended 29 February 2008

Braemar Shipping Services plc (the "Group"), a leading international provider of

broking, consultancy, technical and other services to the shipping and energy

industries, today announced full year unaudited results for the year ended 29

February 2008.

HIGHLIGHTS

*Pre-tax profit up 47% to #14.7m (2007: #10.0m). On an adjusted basis this

represents an increase of 34%*.

*Basic EPS from continuing operations up 53% to 48.99p (2007: 32.08p). On

an adjusted basis this represents an increase of 33%*.

*Net cash generated from operating activities #17.0m (2007: #6.6m)

*Net cash at 29 February 2008: #21.6m (28 Feb 2007: #14.6m)

*Final dividend 15.00p per share (up 22%), full year 23.00p (2007:19.00p)

up 21%

*Strategy of broadening the business into shipping and energy services is

developing well.

*Adjusted profits exclude an impairment charge of #950,000 taken in 2006/7,

representing an adjustment to earnings per share of 4.82p.

Commenting on the results and outlook, Sir Graham Hearne, Chairman, said:

"Shipbroking has thrived in shipping markets which have been both volatile and

buoyant. The demand for oil and raw materials has continued unabated attracting

further new investment in shipping."

"Our other shipping services businesses have also made good progress, the most

notable performance coming from our Environmental business, DV Howells. We have

continued to invest part of our operating cash flows in these businesses."

"Market conditions remain favourable for our businesses and the financial year

has begun well, so far with no adverse effect from the global credit squeeze.

Freight rates and vessel values are both firm and there is strong demand for our

services, all of which bodes well for the new year."

For further information, contact:

Braemar Shipping Services plc

Alan Marsh Tel +44 (0) 20 7535 2650

James Kidwell Tel +44 (0) 20 7535 2881

Aquila Financial

Peter Reilly Tel +44 (0) 118 979 4100

Elaborate Communications

Sean Moloney Tel +44 (0)1296 682356

Charles Stanley Securities

Philip Davies Tel +44 (0) 20 7149 6457

Notes

Braemar Shipping Services plc is a leading international provider of broking,

consultancy, technical and other services to the shipping and energy industries.

Its principal businesses are as follows:

Braemar Seascope

Specialised shipbroking and consultancy services to international ship owners

and charterers in the sale & purchase, tanker, gas, chemicals, offshore,

container and dry bulk markets.

www.braemarseascope.com

Falconer Bryan

Falconer Bryan provides specialised marine and offshore services. It has offices

at the following locations: Australia, China, India, Indonesia, Malaysia,

Singapore, Vietnam, United Kingdom

www.falconer-bryan.com

Steege Kingston

Steege Kingston provides specialist loss adjusting and other expert services to

the energy (oil and gas), marine, power and other related industrial sectors. It

has offices in London, Houston, Singapore, Calgary and Mexico City.

www.steegekingston.com

Cory Brothers Shipping Agency

Port agency, freight forwarding and logistics services within the UK.

www.cory.co.uk

Wavespec

Marine engineering and naval architecture consultants to the shipping and

offshore markets.

www.wavespec.com

DV Howells

Pollution response service primarily in the UK for marine and rail operations.

www.dvhowells.co.uk

PRELIMINARY ANNOUNCEMENT - YEAR ENDED 29 February 2008

CHAIRMAN'S STATEMENT

This is my sixth report to Shareholders as Chairman and once again I am

delighted to announce another successful year of growth for the Group. The

financial highlights are that revenue increased by 37% from #73.8m to #101.0m,

profit before tax from continuing operations increased by 47% from #10.0m to

#14.7m and earnings per share from continuing operations rose by 53% to 48.99

pence from 32.08 pence in 2006/7. A more representative comparison of the

Group's performance is made by adjusting for an exceptional charge of #950,000

made last year, in which case adjusted pre-tax profits grew by 34% and earnings

per share by 33%.

Our staff across the World have performed well and we are grateful for their

effort and commitment which has brought about this success.

Shipbroking has thrived in shipping markets which have been both volatile and

buoyant. The demand for oil and raw materials has continued unabated attracting

further new investment in shipping. In particular this year we have benefited

from strong activity and rates in newbuilding, dry bulk and offshore chartering

though all shipbroking sections have performed well. Our forward order book has

grown again and stands at a record level.

Our Environmental division had an outstanding year, largely due to their

involvement in the clearance of the stricken container vessel off the south

coast of England, and both Cory Brothers and Wavespec performed well over the

year.

We have continued to invest part of our operating cash flows in these

businesses. In pursuing this strategy we are creating a broader and more diverse

group which can offer a wider range of services for clients. We have invested

significantly in our Technical division through the purchase of Falconer Bryan

in July 2007 for a cash consideration of #5.9m and Steege Kingston in March 2008

for a consideration which is expected to be in the range #8.0 - #8.5m dependent

on its financial performance. Falconer Bryan offers a range of engineering and

surveying services from offices across the Far East, and Steege Kingston is an

international loss-adjuster specialising in the energy market. These businesses

operate in markets that will grow and they also complement our existing

operations to create new opportunities. We have also added to our Logistics

division with the acquisition of 80 per cent of Fred. Olsen Freight Limited for

#2.0m in December 2007 and the remaining interest in Gorman Cory for #0.9m in

March 2008.

The Directors are recommending for approval at the Annual General Meeting a

final dividend of 15.00 pence per ordinary share, to be paid on 25 July 2008 to

shareholders on the register at the close of business on 27 June 2008. Together

with the 8.00p interim dividend the Company's dividend for the year is 23.0

pence (2007: 19.0 pence), a rise of 21%. The dividend is covered 2.1 times by

earnings from continuing operations.

Market conditions remain favourable for our businesses and the financial year

has begun well, so far with no adverse effect from the global credit squeeze.

Freight rates and vessel values are both firm and there is strong demand for our

services, all of which bodes well for the new year.

Sir Graham Hearne

6 May 2008

CHIEF EXECUTIVE'S REVIEW OF THE BUSINESS

Strategy

Our strategy has been, and remains, to extend the Group's activities beyond pure

shipbroking to cover other shipping related service areas where we can add value

not only for shareholders but also for our clients. To reflect the growth that

has occurred thus far, and to let clients and others more easily identify with

our overall offering, we have reorganised the Group into distinct operating

divisions: Shipbroking, Technical, Logistics and Environmental.

Operations

This year our shipbroking business has improved its financial performance

significantly at a time when the core office, departmental structure and head

count has not fundamentally changed. Some of this can be attributed to higher

freight rates but in many areas we are showing good growth in transaction

volumes which is a testament to the effectiveness of our teams. The new

financial year has started extremely well - as at 1 March 2008 we had already

concluded shipbroking business totalling in excess of US$53m deliverable over

the course of the year which is some 77% higher than the equivalent position at

1 March 2007.

Our Technical, Logistics and Environmental businesses have all been busy over

the last year and have raised their international profile considerably due to

their success in handling and winning important business. Each of these

businesses possesses specialist skills for which we expect there to be a growing

demand as the world fleet grows and both the appetite for energy and exploration

activity remain high. We have added to our skill base through selective

acquisitions and organic growth which will bring further opportunities to

increase our presence in these areas.

A review of the market and our activities during the year is set out by segment

below.

Shipbroking - Braemar Seascope

Revenues increased by 30% to #52.8m (2007: #40.5m) and operating profits were

23% higher at #13.0m (2007: #10.6m).

Shipbroking activities are undertaken under the name of Braemar Seascope from

offices in London, Aberdeen, Shanghai, Beijing, Singapore, Melbourne, Perth, and

Sarzanna, Italy, with further joint venture offices in Delhi and Mumbai.

At the beginning of our financial year - 1 March 2007 - the Baltic Dry Index,

the barometer for the dry bulk market, stood at the relatively low level of

4,818 before making steady gains until mid November when it reached its peak of

11,039, falling back to 5,615 by the end of January 2008 and finishing the

financial year at 7,613. It currently stands at 9,581. Volatility was especially

a feature of the Capesize market, which is devoted to the transportation of raw

materials particularly coal for power and steel, and iron ore for steel and is

indicative of a relatively even balance of supply and demand. In such

circumstances news or rumours of port closures, congestion or stem curtailments

can cause significant short-term fluctuations. Our dry cargo department finished

the year with record invoiced revenues, with the overseas offices all making

good contributions. We have also been active in the period charter market and

our forward book has grown substantially. In our next financial year we expect

volatility to continue and, although there will be a considerable number of

additions to the fleet, we expect the market to remain healthy, underpinned by

the burgeoning demands particularly in China and India.

Our deep sea tanker chartering department increased their involvement in both

the number of spot and time charter transactions, resulting in an increase in

revenue over last year. The Baltic Dirty Tanker Index ("BDTI") started the

financial year at 1,094 and closed at 1,151, averaging 1,122 over the year. It

currently stands at 1,701. However, on the 7 December 2007 a large single hull

crude tanker was holed by a barge whilst at anchor off South Korea resulting in

major pollution affecting the coastal environment. Charterers immediately looked

to secure only double hull tonnage putting pressure on the market. VLCC tanker

rates spiked achieving earnings as high as $300,000 per day despite the high

bunker prices. These rates filtered down to the Suezmax and Aframax sectors and

although there was a significant correction in the first quarter of 2008, the

rates remained higher than at any time in the previous year barring the peak in

December 2007 when the BDTI reached 2,279. The demand for double hull tonnage

has also accelerated various conversion programs that single hull tanker owners

had been planning for dry bulk or FPSO work. We expect that the balance between

demand, new crude carriers entering the market and conversions/scrapping to

broadly equate over the coming year.

In the smaller tanker sectors the impact of newbuildings entering the market

depressed rates. However the increase in refining and the subsequent

distribution of products in the coastal markets is expected to result in the

volume of transactions rising significantly over the next year. Volumes in the

specialist chemical markets (including petrochemical gases) have increased

resulting in charterers securing medium term contracts for 12 to 24 months.

Newbuilding tonnage delivering to this sector has accommodated the increase in

movements and rates are expected to remain steady.

LPG markets remained fairly static over the year with a surplus of large tonnage

keeping the rates at low levels although the main producers are now pricing the

product for expected increased sales from the end of 2008. LNG markets have also

stayed quiet with a number of delivered LNG carriers waiting for their planned

project work to commence. These projects had been delayed for technical and

commercial reasons and this has affected the critical supply of LNG. For a

number of these projects, transportation is now expected to commence within two

years. Once underway the surplus tonnage in both LNG and LPG sectors should be

quickly absorbed.

The performance of the sale and purchase department improved again with notable

success in placing newbuilding orders across a wide variety of high quality

shipyards. Secondhand transaction deal flow was steady and quite evenly balanced

between tankers and bulk carriers. Transaction values have been strong

reflecting the historically high prices achieved in the principal ship

categories. Another major feature was the amount of resale activity, this being

business where we are involved in transacting the onward sale of a newbuilding

contract already placed and for which our commission is generally earned on

delivery of the vessel from the yard. Demolition business is currently a less

active part of sale and purchase but we expect it to increase in the coming

years in line with the phase-out of single hull tankers, and as we enter the new

financial year we are seeing more evidence of this.

Container charter rates and vessel values remained quite firm over the year and

our container desk performed well in both the sale and purchase and chartering

markets. The arrival of substantial newbuilding tonnage will be a source of new

opportunities although charter rates and second hand prices could be lower in

the medium term if demand slows. However continuing globalisation, of which the

container market is a corner stone, underpins future prospects.

The offshore desk enjoyed a record year of growth and activity driven by the

high level of oil exploration activity. Supply vessels have been much in demand

and day rates rose to historic highs which look likely to be sustained by the

high price of oil. The increase in earnings has encouraged investment in the

industry and our team were also involved in concluding good sale and purchase

and newbuilding business.

Technical - Wavespec, Falconer Bryan and Steege Kingston

Revenues increased by 43% to #9.5m (2007: #6.6m) and operating profits were up

by 32% at #0.7m (2007: #0.5m). Falconer Bryan contributed revenues of #3.4m and

operating profits before amortisation of #0.5m in the eight months since it was

acquired. The business is headquartered in Singapore and employs 90 full time

staff from seven offices, most of which are based in the Far East. All of its

offices have been busy throughout the period working on a broad range of marine

warranty surveys, towage approvals and consulting engineering work, and this

activity shows every sign of continuing in the same vein. We are pleased with

the progress it has made as part of the Group during which a new office in

London has been established to access the insurance market.

Wavespec's revenue and operating contribution was slightly lower mainly due to a

weaker dollar, less higher margin project work and an office move to new leased

premises in Malden. However it has extended its Qatargas business to 2011 and

recently won new business for the design of new coal carrying vessels.

Steege Kingston was acquired on 3 March 2008 and has therefore not been

consolidated in the year we are now reporting on. It provides specialist loss

adjusting and other expert services to the energy (oil and gas), marine, power

and other related industrial sectors and is one of the leading international

players in the energy adjusting market, with a particularly strong reputation

and presence in the offshore/upstream sector. Its client base covers insurance

underwriters, insurance brokers as well as the insured parties in the oil and

gas industry itself. It operates from offices in London, Houston, Singapore,

Calgary and Mexico City with a total of 62 employees. In the year to 31 December

2007 it recorded consolidated revenues of #7.0 million and pre-tax profits of

#1.7 million and as at 31 December 2007 gross assets were #7.2 million and net

assets were #4.9 million including cash of #0.2 million.

The Technical division is now substantially larger as a result of the new

business additions. The combination of international offices, client bases and

skills will be a powerful business base from which to grow. The division now has

170 full time employees plus a further 70 consultant engineers acting as

supervisors in shipyards.

Logistics - Cory Brothers

Revenues increased by 19% to #27.9m (2007: #23.4m) and operating profits were up

5% at #1.0m (2007: #0.9m). Revenue growth arose primarily from liner, logistics

and forwarding business driven by sustained strong demand. In excess of 19,500

forwarding jobs were handled in the year compared with 13,200 last year.

Logistics and one-off projects continue to be the mainstay of sustainable growth

and profitability, and we are proud that Cory Logistics' success in this area

has been recognised by the industry with the awards of Lloyd's List Freight

Forwarder of the Year and Heavylift/ Project Specialist of the year for 2007.

The acquisition of 80% of Fred. Olsen Freight on 24 December 2007 is a key

strategic addition and a natural fit with Cory Logistics. It provides a range of

freight forwarding and liner agency services for a predominantly UK client base

complementing the services currently offered by Cory Logistics. It has 50

employees located mostly in Ipswich and close to the Cory Logistics offices of

Felixstowe.

Port agency is maintaining a leading position in an increasingly competitive UK

market, handling in excess of 6,000 port calls in 2007/8, an increase of 23%

over the prior year and. In April 2008 Cory was awarded the highly prestigious

BP hub agency business for the European region.

Morrison Tours, a seasonal business linked closely to the cruise industry around

the UK has added to its customer base and improved the take-up of the shore

excursions on offer with improved prospects for the coming year.

Environmental - DV Howells

DV Howells increased revenues to #10.8m from #3.2m in the previous year and

operating profits grew from #0.2m to #1.8m. Much of the growth was due to the

company's salvage support and environmental protection for the stricken

container ship off the South coast of England which had an incremental income of

over #7.9 million in the year. This work resulted in a significant increase in

man hours worked on the protection and clean up of the beaches together with the

specialist handling of the recovered containers from the ship. The Industrial

Services section of the company, which handled much of this work, also deployed

its specialist tank cleaning technology on a number of oil storage tank farms.

The 24/7 Incident Response section continued steadily performing specialist

environmental clean up including the handling of hazardous substances and spills

for ports, rail and roads from its nine bases in the UK. It also attended a

number of call outs for the Maritime and Coastguard Agency ("MCA") as part of

the contract to operate the MCA national counter pollution stockpiles.

The company's International and Specialist Services section acted as consultant

advisors in the review of various UK ports' oil spill contingency plans, as well

as assisting the Irish Coastal Authority with their emergency response and

incident management plans.

The company has grown its international involvement through a variety of

contracts including specialist consulting assignments for the International

Maritime Organisation, UK Ministry of Defence and major oil and shipping

companies, plus offshore drilling support, spill response and training, in

Africa, Europe and the Far East.

Financial Review

Income statement

Revenue and operating profits grew in all divisions - the segmental results are

shown in note 3 in this statement. Gross margins (calculated after charging

costs that are directly related to revenue) were stable at 72% and operating

margins after all operating expenses (excluding an exceptional charge in 2007)

also remained unchanged at 14%.

A reconciliation of reported profits to adjusted profits is set out in the table

below.

2007/8 2006/7

% #000 #000

Adjusted profits from continuing operations before

impairment charge and tax +34% 14,718 10,964

Impairment of Braemar Seascope Pty goodwill - (950)

-------- ------

Reported profit before tax from continuing operations +47% 14,718 10,014

-------- ------

Pence Pence

EPS from continuing operations (pre impairment charge) +33% 48.99 36.90

Impairment of goodwill - (4.82)

-------- ------

Basic EPS from continuing operations +53% 48.99 32.08

-------- ------

The average rate of exchange for conversion of US dollar income during the

financial year, after taking account of hedging, was $1.99/# (2007: $1.86/#) and

at 29 February 2008 the balance sheet rate for conversion was $1.99/# (28

February 2007: $1.97/#). If the 2007/8 shipbroking income had been translated at

the 2006/7 average exchange rate, it would have been higher by approximately

#3.7 million.

Discontinued operations

In September 2007 the bunker trading operations based in Australia ceased and

the historic net result of this activity is now shown on a single discontinued

operations line in the income statement.

Taxation

The tax rate on reported profit before tax was 32.6% (2007: 35.8%). The

underlying rate, excluding the share of net profits from joint ventures and the

effect of the impairment charge, was 33.4% (2007: 33.3%). Next year the tax rate

will benefit from the reduction in the rate of UK corporation tax to 28%.

Cash flow and acquisitions

The cash balance increased over the year by #7.0m to #21.6m (2007: #14.6m). The

Group generated operating cash flows (after tax) of #17.0m up from #6.5m in the

prior year mainly due to the increase in operating profits and an improvement in

working capital management. Out of this, #1.0m was spent on fixed assets, #4.3m

on acquisitions and #4.1m for dividend payments.

Cash expended on acquiring businesses was #7.4m, offset by #3.1m of cash in the

acquired balance sheets, in respect of Falconer Bryan (#5.9m), Fred. Olsen

Freight Limited (#1.3m) and deferred consideration (#0.2m). Subsequent to the

year end the Group paid #4.2m in respect of the purchase of Steege Kingston and

#0.9m to purchase the 59% of Gorman Cory such that it is now wholly-owned.

I would like to express my personal thanks and appreciation to all the staff

whose hard work and commitment which has contributed to our performance this

year, and with such dedicated colleagues I am confident for the continuing

success of the Group.

Alan Marsh

6 May 2008

Braemar Shipping Services PLC

Unaudited Consolidated Income statement for the year ended 29 February 2008

Year ended Year ended

29 Feb 2008 28 Feb 2007

Continuing operations Notes #'000 #'000

Revenue 3 100,964 73,831

Cost of sales (28,267) (20,658)

---------- ----------

72,697 53,173

Operating costs (58,729) (43,685)

---------- ----------

Impairment of goodwill - (950)

Operating costs excluding impairment of

goodwill (58,729) (42,735)

---------- ----------

---------- ----------

Operating profit 3 13,968 9,488

Finance income 391 335

Finance costs (11) (16)

Share of profit from joint ventures' and

associates 370 207

---------- ----------

Profit before taxation - continuing operations 14,718 10,014

Taxation (4,797) (3,585)

---------- ----------

Profit for the year - continuing operations 9,921 6,429

Profit / (loss) for the period from

discontinued operations (3) 43

---------- ----------

Profit for the year 9,918 6,472

---------- ----------

Attributable to:

Ordinary shareholders 9,772 6,367

Minority interest 146 105

---------- ----------

Profit for the year 9,918 6,472

---------- ----------

Earnings per ordinary share 5

Basic - continuing operations 48.99 p 32.08 p

Diluted - continuing operations 48.69 p 31.65 p

Basic - profit for the year 48.97 p 32.29 p

Diluted - profit for the year 48.68 p 31.87 p

Braemar Shipping Services PLC

Unaudited Consolidated Balance sheet as at 29 February 2008

As at As at

29 Feb 08 28 Feb 07

Assets #'000 #'000

Non current assets

Goodwill 25,826 22,606

Other intangible assets 2,315 1,582

Property, plant and equipment 5,820 5,478

Investments 1,890 1,538

Deferred tax assets 754 642

Other receivables 155 81

-------- --------

36,760 31,927

Current assets

Inventories 91 70

Trade and other receivables 26,784 21,750

Derivative financial instruments 107 27

Restricted cash 3,952 -

Cash and cash equivalents 21,635 14,634

-------- --------

52,569 36,481

-------- --------

Total assets 89,329 68,408

-------- --------

Liabilities

Current liabilities

Derivative financial instruments 49 -

Trade and other payables 39,540 29,011

Current tax payable 3,017 2,402

Provisions 48 294

Client monies held as escrow agent 3,952 -

-------- --------

46,606 31,707

Non-current liabilities

Deferred tax liabilities 681 283

Trade and other payables 434 -

Provisions 81 169

-------- --------

1,196 452

-------- --------

Total liabilities 47,802 32,159

-------- --------

Total assets less total liabilities 41,527 36,249

-------- --------

Equity

Share capital 2,061 2,023

Share premium 9,261 8,554

Shares to be issued (2,527) (1,047)

Other reserves 20,687 21,020

Retained earnings 11,717 5,390

-------- --------

Group shareholders' equity 41,199 35,940

Minority interest 328 309

-------- --------

Total equity 41,527 36,249

-------- --------

Braemar Shipping Services PLC

Unaudited Consolidated Cash flow statement for the year ended 29 February 2008

Year ended Year ended

29 Feb 08 28 Feb 07

Notes #'000 #'000

Cash flows from operating activities

Cash generated from operations 6 21,158 9,668

Interest received 391 335

Interest paid (11) (16)

Tax paid (4,587) (3,413)

------- -------

Net cash generated from operating activities 16,951 6,574

------- -------

Cash flows from investing activities

Dividends received from joint ventures - 263

Acquisition of subsidiaries, net of cash acquired (4,270) (1,844)

Purchase of property, plant and equipment (1,032) (654)

Proceeds from sale of property, plant and equipment 57 25

Purchase of investments (38) -

Proceeds from sale of investments 200 -

Other long term assets (74) (23)

------- -------

Net cash used in investing activities (5,157) (2,233)

------- -------

Cash flows from financing activities

Proceeds from issue of ordinary shares 745 569

Dividends paid (4,053) (3,595)

Dividends paid to minority interest (143) (100)

Purchase of own shares (1,480) (50)

Payment of principal under finance leases - (11)

------- -------

Net cash used in financing activities (4,931) (3,187)

------- -------

Increase/(decrease) in cash and cash equivalents 6,863 1,154

Cash and cash equivalents at beginning of the

period 14,634 13,567

Foreign exchange differences 138 (87)

------- -------

Cash and cash equivalents at end of the period 21,635 14,634

------- -------

Balance sheet analysis of cash and cash equivalents

Cash and cash equivalents 21,635 14,634

Short term borrowings - -

------- -------

Cash and cash equivalents at end of the period 21,635 14,634

------- -------

Braemar Shipping Services PLC

Unaudited Consolidated Statement of Changes in Total Equity for the year ended

29 February 2008

Share capital Share premium Shares to be Other reserves Retained Total Minority Total equity

issued earnings interest

#'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000

------ ------ ------ ------ ------ ------ ------ ------

Group

As at 1 March

2006 1,988 8,046 (997) 21,789 2,031 32,857 - 32,857

Cash flow

hedges

- Transfer to

net profit - - - 40 - 40 - 40

- Fair value

losses in the

period - - - 17 - 17 - 17

Exchange

differences - - - (70) - (70) - (70)

------ ------ ------ ------ ------ ------ ------ ------

Net income

recognised

directly in

equity - - - (13) - (13) - (13)

Profit for

the - - - - 6,367 6,367 105 6,472

year ------ ------ ------ ------ ------ ------ ------ ------

Total

recognised

income in the

year - - - (13) 6,367 6,354 105 6,459

------ ------ ------ ------ ------ ------ ------ ------

Acquisition - - - - - 304 304

Dividends - - - (3,595) (3,595) (100) (3,695)

paid

Issue of 35 508 - - - 543 - 543

shares

Purchase of

shares - - (50) - - (50) - (50)

Consideration

to be paid - - - (738) - (738) - (738)

Credit in

respect of

share option

schemes - - - - 309 309 - 309

Deferred tax

on items

taken - - - (18) 278 260 - 260

to equity

Transfer to - - - - - - - -

retained ------ ------ ------ ------ ------ ------ ------ ------

profit

relating to

exercised

share options

Balance at 28

February 2007 2,023 8,554 (1,047) 21,020 5,390 35,940 309 36,249

Cash flow

hedges

- Transfer to

net profit - - - (16) - (16) - (16)

- Fair value

losses in the

period - - - 107 - 107 - 107

Exchange

differences - - - 383 - 383 - 383

------ ------ ------ ------ ------ ------ ------ ------

Net income

recognised

directly in

equity - - - 474 - 474 - 474

Profit for

the - - - - 9,772 9,772 146 9,918

year ------ ------ ------ ------ ------ ------ ------ ------

Total

recognised

income in the

year - - - 474 9,772 10,246 146 10,392

------ ------ ------ ------ ------ ------ ------ ------

Acquisition - - - - - 16 16

Dividends - - - (4,053) (4,053) (143) (4,196)

paid

Issue of 38 707 - - - 745 - 745

shares

Purchase of

shares - - (1,480) - - (1,480) - (1,480)

Consideration

to be paid - - - (782) - (782) - (782)

Credit in

respect of

share option

schemes - - - - 554 554 - 554

Deferred tax

on items

taken - - - (25) 54 29 - 29

to equity

Transfer to - - - - - - - -

retained ------ ------ ------ ------ ------ ------ ------ ------

profit

relating to

exercised

share options

Balance at 29

February 2008 2,061 9,261 (2,527) 20,687 11,717 41,199 328 41,527

------ ------ ------ ------ ------ ------ ------ ------

Braemar Shipping Services PLC

Notes to the financial statements

Note 1 - General Information

The Preliminary Announcement of unaudited results for the year ended 29 February

2008 is an extract from the forthcoming 2008 Annual Report and Accounts and does

not constitute the Group's statutory accounts of 2008 nor 2007. Statutory

accounts for 2007 have been delivered to the Registrar of Companies, and those

for 2008 will be delivered following the company's Annual General Meeting. The

auditors have reported on the 2007 accounts; their report was unqualified and

did not contain statements under Sections 237(2) or (3) of the Companies Act

1985.

Note 2 - Accounting policies

Whilst the financial information included in this preliminary announcement has

been prepared in accordance with International Financial Reporting Standards

(IFRSs) adopted for use in the European Union, this announcement does not itself

contain sufficient information to comply with IFRSs. The company expects to

distribute full accounts that comply with IFRSs on 23 May 2008.

Note 3 - Segmental results

Revenue Profit for the period

2008 2007 2008 2007

#'000 #'000 #'000 #'000

Shipbroking 52,794 40,530 12,993 10,593

Logistics 27,874 23,449 953 911

Technical services 9,467 6,623 728 553

Environmental services 10,829 3,229 1,836 225

-------- -------- -------- --------

Segment revenue/ operating

profit from continuing

operations excluding 100,964 73,831 16,510 12,282

impairment

Impairment - Shipbroking - - - (950)

-------- -------- -------- --------

Segment revenue/operating

profit 100,964 73,831 16,510 11,332

after impairment -------- --------

Unallocated other costs (2,542) (1,844)

Finance income (cost)- net 380 319

Share of profit from joint

ventures' and associates 370 207

-------- --------

Profit before taxation 14,718 10,014

Taxation (4,797) (3,585)

-------- --------

Profit for the period

attributable to shareholders

from continuing operations 9,921 6,429

-------- --------

Note 4 - Dividend

The proposed final dividend of 15.00 pence per share (2007: final 12.25 pence)

takes the total dividend for the year to 23.00 pence (2007: 19.0 pence). The

cost of the final dividend will be #3.0m (2007: #2.4m) based on 20.2m shares

(which excludes shares held in the ESOP for which the dividend has been waived

and includes shares issued for Steege Kingston - see note 7) and will be charged

to equity in the 2008/9 financial year.

Braemar Shipping Services PLC

Notes to the financial statements

Note 5 - Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the year, excluding 685,014 ordinary shares held by the

employee share trust (2007:331,495) which are treated as cancelled. For diluted

earnings per share, the weighted average number of ordinary shares in issue is

adjusted to assume conversion of all dilutive ordinary shares. The Group has one

class of potential dilutive ordinary shares being those granted to employees

where the exercise price is less than the average market price of the Company's

ordinary shares during the year.

2008 2008 2008 2007 2007 2007

Continuing operations Earnings #'000s Weighted Per share Earnings #'000s Weighted Per share

average number amount pence average number amount pence

of shares of shares

Adjusted

earnings per

share 9,775 19,953,231 48.99 7,274 19,715,846 36.90

Impairment of

goodwill - - - (950) - (4.82)

------ -------- ------ ------ -------- ------

Profit for the

period

attributable

to

shareholders 9,775 19,953,231 48.99 6,324 19,715,846 32.08

Effect of

dilutive share

options - 122,061 (0.30) - 264,693 (0.43)

------ -------- ------ ------ -------- ------

Fully diluted

earnings per

share 9,775 20,075,292 48.69 6,324 19,980,539 31.65

------ -------- ------ ------ -------- ------

Total operations

Profit for the

period

attributable

to

shareholders 9,772 19,953,231 48.97 6,367 19,715,846 32.29

Effect of

dilutive share

options - 122,061 (0.29) - 264,693 (0.42)

------ -------- ------ ------ -------- ------

Fully diluted

earnings per

share 9,772 20,075,292 48.68 6,367 19,980,539 31.87

------ -------- ------ ------ -------- ------

Note 6 - Reconciliation of operating profit to net cash flow from operating

activities

2008 2007

#'000 #'000

Profit before tax for the year from continuing

operations 14,718 10,014

Profit before tax for the year from discontinued

operations (3) 62

Adjustments for:

- Depreciation 687 518

- Amortisation 452 284

- Goodwill impairment charge 114 950

- Loss / (profit) on sale of property plant and

equipment 57 (12)

- Profit on sale of investment (89) -

- Interest income (391) (335)

- Interest expense 11 16

- Share of profit of joint ventures (370) (207)

- Share based payments 554 309

Changes in working capital:

- Stocks (21) 7

- Trade and other receivables 143 (3,874)

- Trade and other payables 5,630 2,098

- Provisions (334) (162)

-------- --------

Cash generated from operations 21,158 9,668

-------- --------

Note 7 - Post balance sheet event

On 3 March 2008 the Company acquired all of the share capital of Steege Kingston

Partnership Limited. The initial consideration was #5.5 million satisfied by

cash from existing resources of #4.2 million and the issue of 306,513 new

ordinary shares in Braemar Shipping Services plc. Further consideration is due

based on a multiple of the earnings before interest and tax in each of the two

years post completion and these amounts will be settled wholly in cash. Total

consideration is expected to be in the range #8.0 million - #8.5 million and the

maximum consideration payable is capped at #12.0 million.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SSFSWWSASEDI

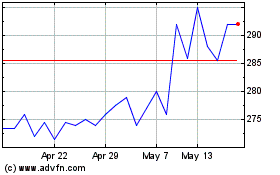

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024