UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Period August 2015 File No. 0-30720

Radius Gold Inc.

(Name of Registrant)

200 Burrard Street, Suite 650, Vancouver, British Columbia, Canada V6C 3L6

(Address of principal executive offices)

1.

Interim Financial Statements for the Period Ended June 30, 2015

2.

Management Discussion and Analysis

3.

Certification of CEO

4.

Certification of CFO

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

FORM 20-F x

FORM 40-F ¨

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Form 6-K to be signed on its behalf by the undersigned, thereunto duly authorized.

Radius Gold Inc.

(Registrant)

| |

Dated: September 1, 2015

| By: /s/ Simon Ridgway

Simon Ridgway

President and Director

|

![[radiusq22015fs001.jpg]](radiusq22015fs001.jpg)

(An Exploration Stage Company)

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2015

(Unaudited – Prepared by Management)

(Expressed in Canadian Dollars)

NOTICE OF NO AUDITOR REVIEW OF

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

In accordance with National Instrument 51-102 of the Canadian Securities Administrators, the Company discloses that its external auditors have not reviewed the unaudited condensed interim consolidated financial statements for the six months ended June 30, 2015. These financial statements have been prepared by management and approved by the Audit Committee and the Board of Directors of the Company.

RADIUS GOLD INC.

(An Exploration Stage Company)

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

(Expressed in Canadian Dollars)

| | |

As at:

| June 30,

| December 31,

|

| 2015

| 2014

|

| | |

ASSETS

| | |

| |

|

Current assets

| | |

Cash and cash equivalents (Note 6)

| $ 190,249

| $ 1,238,372

|

Available-for-sale investments (Note 7)

| 6,024,681

| 5,561,555

|

Advances and other receivables (Note 10)

| 539,013

| 867,837

|

Taxes receivable

| 16,563

| 10,881

|

Due from related party (Note 13)

| 32,412

| -

|

Prepaid expenses and deposits (Note 13)

| 42,017

| 72,277

|

Total current assets

| 6,844,935

| 7,750,922

|

| | |

Non-current assets

| | |

Long-term deposits (Note 13)

| 143,464

| 143,464

|

Property and equipment (Note 8)

| 95,753

| 114,271

|

Exploration and evaluation assets (Note 10)

| 1,814,695

| 563,391

|

Investment in associates (Note 9)

| 386,001

| 473,001

|

Total non-current assets

| 2,439,913

| 1,294,127

|

| | |

TOTAL ASSETS

| $ 9,284,848

| $ 9,045,049

|

| | |

LIABILITIES AND SHAREHOLDERS' EQUITY

| | |

| | |

Current liabilities

| | |

Accounts payable and accrued liabilities (Note 13)

| $ 222,660

| $ 121,590

|

Total liabilities

| 222,660

| 121,590

|

| | |

Shareholders' equity

| | |

Share capital (Note 11)

| 56,592,613

| 56,592,613

|

Other equity reserve

| 6,636,658

| 6,636,658

|

Deficit

| (54,252,265)

| (54,506,920)

|

Accumulated other comprehensive income

| 85,182

| 201,108

|

Total shareholders' equity

| 9,062,188

| 8,923,459

|

| | |

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

| $ 9,284,848

| $ 9,045,049

|

APPROVED ON BEHALF OF THE BOARD OF DIRECTORS AND AUTHORIZED FOR ISSUE ON AUGUST 28, 2015 BY:

| | | | |

“Simon Ridgway”

| , Director

| | “William Katzin”

| , Director

|

Simon Ridgway

| | | William Katzin

| |

The accompanying notes form an integral part of these condensed interim consolidated financial statements

RADIUS GOLD INC.

(An Exploration Stage Company)

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(Expressed in Canadian Dollars)

| | | | |

| Three months ended June 30,

| Six months ended June 30,

|

| 2015

| 2014

| 2015

| 2014

|

| | | | |

EXPLORATION EXPENDITURES

| $ 189,627

| $ 212,066

| $ 316,862

| $ 310,613

|

| | | | |

GENERAL AND ADMINISTRATIVE EXPENSES

| | | | |

Amortization

| 9,241

| 10,264

| 18,518

| 20,397

|

Legal and audit fees

| 100,171

| 16,547

| 154,969

| 16,547

|

Management fees (Note 13)

| 25,500

| 25,500

| 51,000

| 51,000

|

Office and miscellaneous (Note 13)

| 39,568

| 44,206

| 92,828

| 106,953

|

Property investigations (Note 13)

| 5,339

| 16,675

| 24,996

| 84,049

|

Public relations (Note 13)

| 12,364

| 1,064

| 24,763

| 3,268

|

Salaries and benefits (Note 13)

| 37,519

| 25,415

| 79,961

| 45,179

|

Transfer agent and regulatory fees (Note 13)

| 9,643

| 2,951

| 27,785

| 11,366

|

Travel and accommodation (Note 13)

| 2,371

| 8,108

| 14,811

| 19,905

|

| 241,716

| 150,730

| 489,631

| 358,664

|

| | | | |

Loss before other income (expenses)

| (431,343)

| (362,796)

| (806,493)

| (669,277)

|

| | | | |

OTHER INCOME (EXPENSES)

| | | | |

Mineral property royalty income, net (Note 10)

| 487,833

| -

| 487,833

| -

|

Share of post-tax losses of associates (Note 9)

| (31,000)

| -

| (87,000)

| -

|

Gain on loan conversion (Note 10)

| -

| -

| 180,000

| -

|

Foreign currency exchange gain (loss)

| 13,951

| (4,431)

| 21,179

| (282)

|

Gain on sale of available-for-sale investments

| 18,465

| -

| 18,465

| 1,289,708

|

Impairment on available-for-sale investments

| -

| -

| (28,264)

| -

|

Gain from mineral property option agreements

(Note 10)

| -

| -

| 60,661

| -

|

Investment income

| 412

| 11,985

| 17,241

| 15,903

|

Recovery of receivable (Note 10)

| -

| -

| 423,055

| -

|

Write off of exploration and evaluation costs

(Note 10)

| -

| -

| (32,022)

| -

|

Net income (loss) for the period

| $ 58,318

| $ (355,242)

| $ 254,655

| $ 636,052

|

| | | | |

Other comprehensive income (loss)

| | | | |

Items that may be reclassified subsequently to profit or loss:

| | | | |

Fair value gains (losses) on available-for-sale

investments (Note 7)

| (91,185)

| 101,014

| (115,926)

| 2,466,028

|

Total comprehensive income (loss)

| $ (32,867)

| $ (254,228)

| $ 138,729

| $ 3,102,080

|

| | | | |

Basic and diluted income (loss) per share

| $0.00

| $(0.00)

| $0.00

| $0.01

|

|

|

|

|

|

Weighted average number of

common shares outstanding

| 86,675,617

| 86,675,617

| 86,675,617

| 86,675,617

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements

RADIUS GOLD INC.

(An Exploration Stage Company)

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

For the six months ended June 30, 2015 and 2014

(Expressed in Canadian Dollars)

| | | | | | |

| Number of

common

shares

| Share capital

| Other equity

reserve

| Accumulated

other

comprehensive

income (loss)

| Deficit

| Total

|

| | | | | | |

Balance, December 31, 2013

| 86,675,617

| $ 56,592,613

| $ 6,636,658

| $ 1,124,511

| $ (53,137,013)

| $ 11,216,769

|

Income for the period

| -

| -

| -

| -

| 636,052

| 636,052

|

Available-for-sale investments

| -

| -

| -

| 2,466,029

| -

| 2,466,029

|

Balance, June 30, 2014

| 86,675,617

| 56,592,613

| 6,636,658

| 3,590,540

| (52,500,961)

| 14,318,850

|

Loss for the period

| -

| -

| -

| -

| (2,005,959)

| (2,005,959)

|

Available-for-sale investments

| -

| -

| -

| (3,389,432)

| -

| (3,389,432)

|

Balance, December 31, 2014

| 86,675,617

| 56,592,613

| 6,636,658

| 201,108

| (54,506,920)

| 8,923,459

|

Income for the period

| -

| -

| -

| -

| 254,655

| 254,655

|

Available-for-sale investments

| -

| -

| -

| (115,926)

| -

| (115,926)

|

Balance, June 30, 2015

| 86,675,617

| $ 56,592,613

| $ 6,636,658

| $ 85,182

| $ (54,252,265)

| $ 9,062,188

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements

RADIUS GOLD INC.

(An Exploration Stage Company)

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Expressed in Canadian Dollars)

| | | | |

| Three months ended June 30,

| Six months ended June 30,

|

| 2015

| 2014

| 2015

| 2014

|

| | | | |

Cash provided by (used in):

| | | | |

| | | | |

OPERATING ACTIVITIES

| |

| | |

Net income (loss) for the period

| $ 58,318

| $ (355,242)

| $ 254,655

| $ 636,052

|

Items not involving cash:

| | | | |

Amortization

| 9,241

| 10,264

| 18,518

| 20,397

|

Gain from mineral property option agreements

| -

| -

| (60,661)

| -

|

Recovery of receivable

| -

| -

| (423,055)

| -

|

Write off of exploration and evaluation costs

| -

| -

| 32,022

| -

|

Impairment of available-for-sale investments

| -

| -

| 28,264

| -

|

Gain on sale of available-for-sale investments

| (18,465)

| -

| (18,465)

| (1,289,708)

|

Gain on loan conversion

| -

| -

| (180,000)

| -

|

Share of post-tax losses of associates

| 31,000

| -

| 87,000

| -

|

| 80,094

| (344,978)

| (261,722)

| (633,259)

|

Changes in non-cash working capital items:

| | | | |

Advances and other receivables

| (483,497)

| (1,712)

| 28,824

| (382)

|

Taxes receivable

| (4,212)

| 776

| (5,682)

| 9

|

Prepaid expenses and deposits

| 1,442

| 15,491

| 30,260

| 38,856

|

Due from related parties

| 355,526

| 5,640

| (32,412)

| 33,817

|

Accounts payable and accrued liabilities

| 68,622

| (3,083)

| 101,070

| 5,258

|

Cash provided by (used in) operating activities

| 17,975

| (327,866)

| (139,662)

| (555,701)

|

| | | | |

INVESTING ACTIVITIES

| | | | |

Recovery of receivable

| -

| -

| 423,055

| -

|

Purchase of marketable securities and

investments

| (366,200)

| -

| (366,200)

| (450,000)

|

Expenditures on exploration and evaluation

asset acquisition costs

| (1,259,505)

| (62,151)

| (1,283,326)

| (62,151)

|

Proceeds from mineral property option

agreements

| -

| -

| 60,661

| -

|

Proceeds from sale of available-for-sale

investments

| 257,349

| -

| 257,349

| 3,350,858

|

Purchase of property and equipment

| -

| (2,749)

| -

| (2,749)

|

Cash provided by (used for) investing activities

| (1,368,356)

| (64,900)

| (908,461)

| 2,835,958

|

| | | | |

Increase (decrease) in cash and cash equivalents

| (1,350,381)

| (392,766)

| (1,048,123)

| 2,280,257

|

| | | | |

Cash and cash equivalents, beginning of period

| 1,540,630

| 4,233,811

| 1,238,372

| 1,560,788

|

|

|

|

|

|

Cash and cash equivalents, end of period

| $ 190,249

| $ 3,841,045

| $ 190,249

| $ 3,841,045

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

1.

CORPORATE INFORMATION

Radius Gold Inc. (the “Company”) was formed by the amalgamation of Radius Explorations Ltd. and PilaGold Inc. effective on July 1, 2004.

The Company is a public company incorporated and domiciled in British Columbia, Canada and is engaged in acquisition and exploration of mineral properties, and investment in companies which hold mineral property interests. The address of the Company’s head office is 650 – 200 Burrard Street, Vancouver, BC, Canada V6C 3L6.

In April 2015, the Company received approval from its shareholders and the TSX Venture Exchange (the “TSXV”) for the change of its business from that of a mineral exploration issuer to an investment issuer. Effective April 30, 2015, the Company’s shares commenced trading on the TSXV as a Tier 1 Investment Issuer. There were no changes in the Company’s management, board of directors, trading symbol or CUSIP number as a result of the change in business.

2.

BASIS OF PREPARATION

Statement of Compliance

These condensed interim consolidated financial statements are prepared in accordance with International Accounting Standard (“IAS”) 34 Interim Financial Reporting under International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”). These condensed interim consolidated financial statements follow the same accounting policies and methods of application as the most recent annual financial statements of the Company. These condensed interim consolidated financial statements do not contain all of the information required for full annual financial statements. Accordingly, these condensed interim consolidated financial statements should be read in conjunction with the Company’s most recent annual financial statements, which were prepared in accordance with IFRS as issued by the IASB.

Basis of Measurement

These condensed interim consolidated financial statements have been prepared on the historical cost basis as modified by any revaluation of available for sale financial assets.

The condensed interim consolidated financial statements are presented in Canadian dollars (“CDN”), which is also the Company’s functional currency.

The preparation of financial statements in compliance with IFRS requires management to make certain critical accounting estimates. It also requires management to exercise judgment in applying the Company’s accounting policies. The areas involving a higher degree of judgment of complexity, or areas where assumptions and estimates are significant to the financial statements are disclosed in Note 5.

Nature of Operations

These financial statements have been presented on the basis that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

Basis of Consolidation

These condensed interim consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. A wholly owned subsidiary is an entity in which the Company has control, directly or indirectly, where control is defined as the power to govern the financial and operating policies of an enterprise so as to obtain benefits from its activities. All material intercompany transactions and balances have been eliminated on consolidation. Subsidiaries are deconsolidated from the date control ceases.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

2.

BASIS OF PREPARATION – (cont’d)

Basis of Consolidation – (cont’d)

Details of the Company’s principal subsidiaries at June 30, 2015 are as follows:

| | | | |

| Name

| Place of Incorporation

| Interest %

| Principal Activity

|

| Minerales Sierra Pacifico S.A.

| Guatemala

| 100%

| Exploration company

|

| Radius Gold (U.S.) Inc.

| Nevada, USA

| 100%

| Exploration company

|

| Geometales Del Norte-Geonorte

| Mexico

| 100%

| Exploration company

|

| Radius (Cayman) Inc.

| Cayman Islands

| 100%

| Holding company

|

3.

NEW ACCOUNTING POLICY

Revenue Recognition

Royalty revenue is recognized based upon amounts contractually due pursuant to the underlying royalty agreement. Specifically, revenue is recognized in accordance with the terms of the underlying royalty agreement subject to (i) the pervasive evidence of the existence of the arrangements; (ii) the risks and rewards having been transferred; (iii) the royalty is reasonably determinable; and (iv) the collectability of the royalty being reasonably assured. Royalty revenue may be subject to adjustment upon final settlement of estimated metal prices, weights, and assays. Adjustments recorded upon final settlement are offset against revenue when incurred.

4.

STANDARDS, AMENDMENTS AND INTERPRETATIONS NOT YET EFFECTIVE

The following new standard has been issued by the IASB but is not yet effective:

IFRS 9 Financial Instruments

IFRS 9 is part of the IASB's wider project to replace IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 retains but simplifies the mixed measurement model and establishes two primary measurement categories for financial assets: amortized cost and fair value. The basis of classification depends on the entity's business model and the contractual cash flow characteristics of the financial asset. In response to delays to the completion of the remaining phases of the project, the IASB issued amendments to IFRS 9 and has indefinitely postponed the adoption of this standard. The amendments also provided relief from the requirement to restate comparative financial statements for the effects of applying IFRS 9. IFRS 9 is effective for annual periods beginning on or after January 1, 2018. The Company is in the process of evaluating the impact of the new standard.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

5.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The Company makes estimates and assumptions about the future that affect the reported amounts of assets and liabilities. Estimates and judgments are continually evaluated based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. In the future, actual experience may differ from these estimates and assumptions.

The effect of a change in an accounting estimate is recognized prospectively by including it in comprehensive income in the period of the change, if the change affects that period only, or in the period of the change and future periods, if the change affects both.

The key areas of judgment applied in the preparation of the condensed interim consolidated financial statements that could result in a material adjustment to the carrying amounts of assets and liabilities are as follows:

a)

Where the Company holds the largest shareholding in an investment and has the power to exercise significant influence through common officers and board members, such an investment is treated as an associate. The Company may be able to exercise significant influence over Rackla Metals Inc. (“Rackla”) and Medgold Resources Corp (“Medgold”);

b)

The determination of when an investment is impaired requires significant judgment. In making this judgment, the Company evaluates, amongst other things, the duration and extent to which the fair value of the investment is less that its original cost at each reporting period;

c)

Although the Company has taken steps to verify title to mineral properties in which it has an interest, these procedures do not guarantee the Company’s title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects; and

d)

The application of the Company’s accounting policy for exploration and evaluation expenditure requires judgment in determining whether it is likely that future economic benefits will flow to the Company.

If, after exploration and evaluation expenditure is capitalized, information becomes available suggesting that the carrying amount of an exploration and evaluation asset may exceed its recoverable amount, the Company carries out an impairment test at the cash generating unit or group of cash generating units level in the year the new information becomes available.

The key estimate applied in the preparation of the condensed interim consolidated financial statements that could result in a material adjustment to the carrying amounts of assets and liabilities are as follows:

a)

The Company is subject to income tax in several jurisdictions and significant judgment is required in determining the provision for income taxes. During the ordinary course of business, there are transactions and calculations for which the ultimate tax determination is uncertain. As a result, the company recognizes tax liabilities based on estimates of whether additional taxes and interest will be due. These tax liabilities are recognized when, despite the company's belief that its tax return positions are supportable, the company believes that certain positions are likely to be challenged and may not be fully sustained upon review by tax authorities. The company believes that its accruals for tax liabilities are adequate for all open audit years based on its assessment of many factors including past experience and interpretations of tax law. This assessment relies on estimates and assumptions and may involve a series of complex judgments about future events. To the extent that the final tax outcome of these matters is different than the amounts recorded, such differences will impact income tax expense in the period in which such determination is made.

6.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents are held for the purpose of meeting short-term cash commitments rather than for investment or other purposes. The Company does not hold any deposits with maturities of greater than three months from the date of acquisition. Cash at banks and on hand earns interest at floating rates based on daily bank deposit rates.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

7.

AVAILABLE-FOR-SALE INVESTMENTS

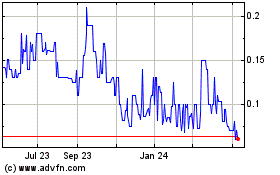

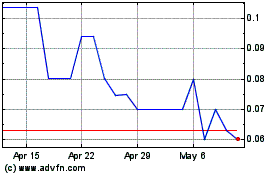

Available-for-sale investments are recorded at fair value. As of June 30, 2015, available-for-sale investments consisted of 2,700,000 (December 31, 2014: 2,826,394) common shares of B2Gold Corp. (“B2Gold”), 2,838,406 (December 31, 2014: 1,007,406) common shares of Focus Ventures Ltd. (“Focus”), and 6,000,000 (December 31, 2014: Nil) common shares of Southern Silver Exploration Corp. (“Southern Silver”), all of which are public companies.

During the period ended June 30, 2015, the Company completed the following transactions:

i)

Received 6,000,000 common shares of Southern Silver with a fair value of $480,000, of which $300,000 satisfied part of a loan repaid by Southern Silver and $180,000 was recorded as a fair value gain (Note 10).

ii)

Purchased 1,831,000 units of a Focus private placement at a cost of $366,200. Each unit consists of one common share of Focus and one full share purchase warrant, each full warrant entitling the Company to purchase one additional common share of Focus at $0.265 until June 2, 2017. If the closing price of Focus’ shares exceeds $0.40 for a period of 10 consecutive trading days, Focus may accelerate the expiry of the warrants by giving notice in writing to the Company, and in such case, the warrants will expire on the 30th day after the date on which such notice is given. The Focus share purchase warrants are not tradable on an exchange.

iii)

Sold 126,394 common shares of B2Gold for net proceeds of $257,349 and recorded a gain on sale of available-for-sale investments of $18,465.

Subsequent to June 30, 2015, the Company sold an additional 110,000 B2Gold shares for net proceeds of $159,648.

During the year ended December 31, 2014, the Company acquired 5,000,000 common shares and 5,000,000 share purchase warrants in Medgold by way of a private placement at a cost of $500,000, with such instruments being classified as available-for-sale investments upon initial recognition. Each Medgold warrant entitles the Company to purchase an additional common share exercisable for two years at a price of $0.15. The Medgold share purchase warrants are not tradable on an exchange.

During the year ended December 31, 2014, the Company determined that the decline in value of Medgold shares was significant and, accordingly, recorded an impairment of $300,000. Also during the year ended December 31, 2014, the exercise price for 3,000,000 of the Medgold warrants was reduced from $0.15 to $0.11 per share, for the one tranche, and the Company exercised the 3,000,000 warrants at a cost of $330,000. As a result of the Company’s holding in Medgold increasing from 14.4% to 19.1% upon the exercise of these warrants on November 4, 2014, the Company may be able to exercise significant influence over Medgold and the investment in Medgold was reclassified as an investment in associate (Note 9).

The Company originally received 4,815,894 B2Gold shares on August 10, 2012, pursuant to the disposal of a mineral property. The Company is entitled to sell a maximum of 10% of the original number of B2Gold shares within any 30-day period without encumbrance. If the Company wishes to exceed this limitation, there may be a delay of up to 15 days before the selling of the shares can be completed. During the year ended December 31, 2014, the Company sold 1,057,000 B2Gold shares for proceeds of $3,350,858 and recorded a gain on sale of available-for-sale investments of $1,289,708. During the period ended June 30, 2015, an impairment charge of $28,264 (year ended December 31, 2014: $141,320) was charged against the B2Gold shares due the fair value of the shares being less than the adjusted cost base.

As at June 30, 2015, the fair value based on quoted market prices of the available-for-sale investments was $6,024,681 (December 31, 2014: $5,561,555). An unrealized loss of $115,926 was recorded in other comprehensive income during the period ended June 30, 2015 (2014: unrealized gain of $2,466,028) of which an unrealized loss of $180,000 related to Southern Silver shares and unrealized gains of $54,000 and $10,074 related to B2Gold and Focus shares, respectively.

The fair value of quoted securities is based on published market prices.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

7.

AVAILABLE-FOR-SALE INVESTMENTS – (cont’d)

| | | | | | |

|

| B2Gold

| Focus

| Southern Silver

| Medgold(1)

| Total

|

| Balance, December 31, 2013

| $ 8,465,799

| $ 221,629

| $ -

| $ -

| $ 8,687,428

|

| Acquisition of shares

| -

| -

| -

| 500,000

| 500,000

|

| Disposition of shares

| (2,061,150)

| -

| -

| -

| (2,061,150)

|

| Impairment adjustment

| (141,320)

| -

| -

| (300,000)

| (441,320)

|

| Reclassification as investment in

associate (Note 9)

| -

| -

| -

| (200,000)

| (200,000)

|

| Net change in fair value recorded

in other comprehensive income

| (893,181)

| (30,222)

| -

| -

| (923,403)

|

| Balance, December 31, 2014

| 5,370,148

| 191,407

| -

| -

| 5,561,555

|

| Acquisition of shares

| -

| 366,200

| 480,000

| -

| 846,200

|

| Disposition of shares

| (238,884)

| -

| -

| -

| (238,884)

|

| Impairment adjustment

| (28,264)

| -

| -

| -

| (28,264)

|

| Net change in fair value recorded

in other comprehensive income

| 54,000

| 10,047

| (180,000)

| -

| (115,926)

|

| Balance, June 30, 2015

| $ 5,157,000

| $ 567,681

| $ 300,000

| $ -

| $ 6,024,681

|

| |

| (1)

The Company also holds 8,000,000 free trading common shares of Medgold with a fair value of $1,200,000 as of June 30, 2015 but the investment was reclassified from an available-for-sale investment to an investment in associate during the year ended December 31, 2014 (Note 9).

|

The Company also holds 9,866,376 free trading common shares of Rackla with a fair value of $147,996 as of June 30, 2015 (December 31, 2014: $147,996) but they are recorded as an investment in associate (Note 9).

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

8.

PROPERTY AND EQUIPMENT

| | | | | | | | |

|

| Leasehold

improvements

| Trucks

| Computer

equipment

| Furniture and

equipment

| Geophysical

equipment

| Field

equipment

| Total

|

| Cost

| | | | | | | |

| Balance, December 31, 2013

| $ 59,004

| $ 215,638

| $ 249,319

| $ 62,656

| $ 83,594

| $ 2,480

| $ 672,691

|

| Additions

| 3,758

| -

| 2,749

| -

| -

| -

| 6,507

|

| Balance, December 31, 2014

| 62,762

| 215,638

| 252,068

| 62,656

| 83,594

| 2,480

| 679,198

|

| Additions

| -

| -

| -

| -

| -

| -

| -

|

| Balance, June 30, 2015

| $ 62,762

| $ 215,638

| $ 252,068

| $ 62,656

| $ 83,594

| $ 2,480

| $ 679,198

|

| | | | | | | | |

| Accumulated amortization

| | | | | | | |

| Balance, December 31, 2013

| $ 30,767

| $ 185,582

| $ 206,704

| $ 36,675

| $ 58,104

| $ 1,757

| $ 519,589

|

| Charge for period

| 5,300

| 10,655

| 15,674

| 8,394

| 5,098

| 217

| 45,338

|

| Balance, December 31, 2014

| 36,067

| 196,237

| 222,378

| 45,069

| 63,202

| 1,974

| 564,927

|

| Charge for period

| 3,150

| 6,008

| 5,386

| 1,859

| 2,039

| 76

| 18,518

|

| Balance, June 30, 2015

| $ 39,217

| $ 202,245

| $ 227,764

| $ 46,928

| $ 65,241

| $ 2,050

| $ 583,445

|

| Carrying amounts

|

|

|

|

|

|

|

|

| At December 31, 2014

| $ 26,695

| $ 19,401

| $ 29,690

| $ 17,587

| $ 20,392

| $ 506

| $ 114,271

|

| At June 30, 2015

| $ 23,545

| $ 13,393

| $ 24,304

| $ 15,728

| $ 18,353

| $ 430

| $ 95,753

|

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

9.

INVESTMENT IN ASSOCIATES

Medgold

As at June 30, 2015, the Company held 8,000,000 (December 31, 2014: 8,000,000) common shares of Medgold, representing 17.1% of Medgold’s outstanding common shares. On November 4, 2014, the Company acquired 3,000,000 common shares of Medgold by way of exercising 3,000,000 share purchase warrants at a cost of $330,000, bringing the Company’s total holdings in Medgold to 8,000,000 common shares, representing an increase from 14.4% to 19.1% of Medgold’s outstanding common shares at that time. Upon this transaction, Medgold met the definition of an associate and therefore reclassified its holdings in Medgold from an available-for-sale investment to investment in associate and has been equity accounted for in the condensed interim consolidated financial statements. During the period ended June 30, 2015, the Company’s total holdings of Medgold decreased from 19.1% to 17.1% as a result of an increase in the issued capital of Medgold. As at June 30, 2015, the Company held 2,000,000 (December 31, 2014: 2,000,000) share purchase warrants to purchase common shares of Medgold. Each Medgold warrant entitles the Company to purchase an additional common share exercisable for two years at a price of $0.15. The Medgold share purchase warrants are not tradable on an exchange.

Subsequent to June 30, 2015, the Company purchased in the market an additional 40,000 common shares of Medgold for a net purchase price of $4,085.

The following table shows the continuity of the Company’s interest in Medgold for the period from November 4, 2014 to June 30, 2015:

| | |

| Available-for-sale investment reclassified as investment in associate on

November 4, 2014

| $ 200,000

|

| Increase in investment

| 330,000

|

| Less: share of losses in associate

| (57,000)

|

| Balance, December 31, 2014

| 473,000

|

| Less: share of losses in associate

| (87,000)

|

| Balance, June 30, 2015

| $ 386,000

|

The financial statement balances of Medgold are as follows:

| | | |

|

| June 30,

2015

| December 31,

2014

|

| Total current assets

| $ 146,690

| $ 543,200

|

| Total assets

| 1,161,914

| 1,407,082

|

| Total current liabilities

| 329,182

| 561,853

|

| Total liabilities

| 563,585

| 766,309

|

| Net loss

| 507,101

| 2,048,113

|

At June 30, 2015, the fair value of the 8,000,000 common shares of Medgold was $1,200,000 (December 31, 2014: $560,000).

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

9.

INVESTMENT IN ASSOCIATES – (cont’d)

Rackla

As at June 30, 2015, the Company held 9,866,376 (December 31, 2014: 9,866,376) common shares of Rackla, representing 19.5% of Rackla’s outstanding common shares.

Rackla meets the definition of an associate and has been equity accounted for in the condensed interim consolidated financial statements.

The Company’s carrying value in Rackla as at June 30, 2015 and December 31, 2014 was a nominal amount of $1. Since the Company’s share of losses in Rackla exceeded its interest during the year ended December 31, 2013, the Company has discontinued recognizing its share of further losses. The cumulative unrecognized share of losses for the associate is $579,982.

The financial statement balances of Rackla are as follows:

| | | |

|

| June 30,

2015

| December 31,

2014

|

| Total current assets

| $ 47,224

| $ 59,064

|

| Total assets

| 195,980

| 209,044

|

| Total liabilities

| 158,871

| 102,550

|

| Net loss

| 66,385

| 1,081,000

|

At June 30, 2015, the fair value of the 9,866,376 common shares of Rackla was $147,996 (December 31, 2014: $147,996).

10.

EXPLORATION AND EVALUATION ASSETS

| | | | | | |

| Acquisition costs

| Peru

| Guatemala

| Mexico

| United States

| Total

|

| Balance, December 31, 2013

| $ -

| $ 531,369

| $ -

| $ -

| $ 531,369

|

| Additions

| -

| -

| -

| 118,775

| 118,775

|

| Write-off acquisition costs

| -

| -

| -

| (86,753)

| (86,753)

|

| Balance, December 31, 2014

| -

| 531,369

| -

| 32,022

| 563,391

|

| Additions

| 1,259,505

| -

| 23,821

| -

| 1,283,326

|

| Write-off acquisition costs

| -

| -

| -

| (32,022)

| (32,022)

|

| Balance, June 30, 2015

| $ 1,259,505

| $ 531,369

| $ 23,821

| $ -

| $ 1,814,695

|

Title to mineral properties involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyancing history, characteristic of many mineral properties. The Company has investigated title to all of its mineral properties and, to the best of its knowledge, title to all of its properties are in good standing.

Details of the Company’s mineral property interests are disclosed in full in the consolidated financial statements for the year ended December 31, 2014. Significant exploration and evaluation asset transactions that have occurred since December 31, 2014 are as follows:

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

10.

EXPLORATION AND EVALUATION ASSETS – (cont’d)

Peru

Bayovar 12 Project Net Smelter Royalty

In April 2015, the Company purchased from Focus a production royalty equivalent to 2% of Focus’s 70% interest in future phosphate production from the Bayovar 12 project located in the Sechura district of northern Peru. The purchase price for the royalty was $1,259,505 (US$1,000,000). Focus will have the right for 12 months to buy back one-half of the royalty for US$1.0 million. Should the Company decide at any time in the future to sell the royalty, Focus will retain a first right of refusal. The Company and Focus have two common directors.

Mexico

i)

Margarita Silver Project

In March 2015, the Company acquired an option to earn a 100% interest in the Margarita Silver Project located in the State of Chihuahua, Mexico. The Project consists of two mining exploration licenses comprising a total of 125 hectares. The Company can earn the 100% interest in the project by making cash payments to the property owners, two private Mexico corporations, totalling US$3,000,000 over a period of five years following issuance of a drill permit for the Project, of which a cash payment of $23,821 (US$20,000) was made upon execution of the agreement. If the option is exercised by the Company, the property owners will be entitled to a 0.5% NSR royalty. The Company may re-purchase the royalty at any time for US$500,000.

ii)

Cerro Las Minitas Property / Loan to Southern Silver

In November 2014, the Company loaned $800,000 to Southern Silver in order to fund Southern Silver’s final option payment to acquire the Cerro Las Minitas mineral claims in Mexico. In consideration of the loan, Southern Silver granted to the Company an exclusive option for 120 days to settle the terms of a business arrangement for the Company to acquire either a direct or indirect interest in the Cerro Las Minitas claims, whereby the Company would participate in the continued exploration and development of the property. Security for the loan consisted of an option to earn a 100% interest in the Cerro Las Minitas claims.

At the election of the Company, the loan could be converted into common shares of Southern Silver at a rate of $0.05 per share. The loan was repayable on demand, provided that the Company shall not demand payment for a period of one year. Interest was payable annually at 8% per annum, and the Company was restricted from holding more than 19.9% of the then issued and outstanding shares of Southern Silver if opting to receive shares of Southern Silver as repayment, unless approval of the shareholders of Southern Silver was obtained.

During the period ended June 30, 2015, the Company decided to not pursue obtaining an interest in the Cerro Las Minitas claims and on March 17, 2015 the Company elected to have $300,000 of the loan converted to 6,000,000 common shares of Southern Silver, and the remaining loan principal balance of $500,000 plus $21,742 in interest was paid to the Company in full satisfaction of the repayment of the loan. On conversion of the loan, a fair value gain of $180,000 was recognized on the Southern Silver shares held.

iii)

Tlacolula Property

The Company owns a 100% interest in the Tlacolula Property which consists of one granted exploration concession covering 12,642 hectares.

By an agreement signed in September 2009 and subsequently amended in December 2012 and then again on November 10, 2014, the Company granted to Fortuna the option to earn a 60% interest in the Tlacolula Property by spending US$2 million on exploration of the Property and making staged payments totaling US$300,000 cash (US$200,000 received) and US$250,000 (US$150,000 received) in common stock no later than January 31, 2017. During the period ended June 30, 2015, the Company received US$50,000 in cash from Fortuna pursuant to the November 10, 2014 amending agreement. The Company and Fortuna have two common directors.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

10.

EXPLORATION AND EVALUATION ASSETS – (cont’d)

Guatemala

Tambor Project

In August 2012, the Company sold its interest in its subsidiary, Exploraciones Mineras de Guatemala S.A., which holds the Tambor gold project, to KCA, giving KCA a 100% interest in the project. As consideration, KCA agreed to repay approximately US$400,000 owing to the Company (US$100,000 paid upon signing and approximately US$300,000 to be paid once KCA has commenced shipment of gold produced from the property). Also upon commercial production, KCA agreed to make quarterly payments to the Company based on the then price of gold and the number of ounces produced from the property.

In 2012 and 2013, due to the uncertainty at that time of receiving future production payments from KCA, the Company wrote-off receivable balances totaling $440,505 and had not recognized a contingent gain on potential royalty payments. During the period ended June 30, 2015, as a result of commercial production having commenced in late 2014, KCA paid to the Company US$341,063 as settlement for the outstanding receivable balance and a recovery of $423,055 was recognized. For the period ended June 30, 2015, the Company has recognized $487,833 in net royalty income with a corresponding receivable from KCA.

Idaho - USA

i)

Blue Hill Gold Property

In 2014, the Company entered into an agreement with Otis Gold Corp (“Otis”) for the right to acquire a 70% interest in the Blue Hill Gold Property, subject to a 2.5% net smelter return royalty, which consists of 36 federal lode mining claims located on federal land comprising 295 hectares and one Idaho State lease comprising 33 hectares in the Cassia County, Idaho. The option could be exercised by making cash payments to Otis totaling US$525,000 (US$30,000 paid) and incurring exploration expenditures on the property totaling US$5,000,000, over a period of four years. During the period ended June 30, 2015, the Company decided to terminate the agreement and acquisition costs totaling $32,022 were written off.

ii)

Mineral Property

In 2014, the Company entered into an agreement with Merrill Palmer to lease a 100% interest in the Mineral Property which consists of a series of federal mining claims in the Mineral Mining District, Washington County, Idaho. The lease of 100% of the Mineral Property (subject to a 3.0% net smelter return royalty) was for up to 99 years which the Company could keep in good standing by making annual advance royalty payments to Mr. Palmer of US$50,000 for the first year (paid) and increasing US$10,000 each subsequent year, for a total of US$1,100,000 over the first ten years. Also during 2014, the Company staked an additional 47 claims at a cost of $32,174, which claims were registered in the name of Mr. Palmer and added as part of the Mineral Property. During the period ended June 30, 2015, the Company decided to terminate the lease, and relinquished all rights to the leased and staked claims. As at December 31, 2014, all acquisition costs totaling $86,753 were written off.

Portugal

Medgold Strategic Alliance

On January 8, 2014, the Company entered into a strategic alliance agreement with Medgold whereby the Company had the right to option one of Medgold’s properties in Portugal. For a period of eighteen months, the Company had the right to select one of the Medgold’s Portuguese properties in which the Company would be granted the option to earn a 51% interest by spending $3,000,000 on exploration and development of that property. Subsequent to June 30, 2015, the Company’s right to option one of Medgold’s properties expired.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

11.

SHARE CAPITAL AND RESERVES

a)

Common Shares

The Company is authorized to issue an unlimited number of common shares without par value.

There was no share capital activity during the periods ended June 30, 2015 and 2014.

b)

Share Purchase Warrants

There was no share purchase warrant activity during the periods ended June 30, 2015 and 2014 and as at June 30, 2015, no share purchase warrants were outstanding.

c)

Nature and Purpose of Equity and Reserves

The reserves recorded in equity on the Company’s balance sheet include ‘Other equity reserve’, ‘Deficit’ and ‘Accumulated Other Comprehensive Loss/Income’.

Other equity reserve is used to recognize the value of stock option grants and share purchase warrants prior to exercise. The value of stock option and share purchase warrants that are forfeited or expire unexercised is not removed from other equity reserve.

Deficit is used to record the Company’s change in deficit from earnings from period to period.

Accumulated other comprehensive loss/income comprises an available-for-sale reserve. This reserve is used to recognize fair value changes on available-for-sale investments.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

12.

SHARE-BASED PAYMENTS

a)

Option Plan Details

The Company has a formal stock option plan in accordance with the policies of the TSX Venture Exchange (“TSX-V”) under which it is authorized to grant options up to 10% of its outstanding shares to officers, directors, employees and consultants. The exercise price of each option is not less than the closing market price of the Company’s stock on the trading day prior to the date of grant. Options granted to investor relations personnel vest in accordance with TSX-V regulation. The options are for a maximum term of ten years.

The following is a summary of changes in options for the period ended June 30, 2015:

| | | | | | | | | |

| | | | | During the period

| | |

| Grant date

| Expiry date

| Exercise price

| Opening balance

| Granted

| Exercised

| Forfeited / expired

| Closing balance

| Vested and exercisable

|

| Jan 08, 2010

| Jan 07, 2020

| $0.29

| 1,570,000

| -

| -

| -

| 1,570,000

| 1,570,000

|

| May 26, 2010

| May 25, 2020

| $0.36

| 100,000

| -

| -

| -

| 100,000

| 100,000

|

| Sep 24, 2010

| Sep 23, 2020

| $0.69

| 820,000

| -

| -

| -

| 820,000

| 820,000

|

| Jul 27, 2011

| Jul 26, 2021

| $0.81

| 150,000

| -

| -

| -

| 150,000

| 150,000

|

| Dec 13, 2012

| Dec 12, 2022

| $0.20

| 2,135,000

| -

| -

| -

| 2,135,000

| 2,135,000

|

| | | | 4,775,000

| -

| -

| -

| 4,775,000

| 4,775,000

|

| Weighted average exercise price

| $0.34

| -

| -

| -

| $0.34

| $0.34

|

b)

Fair Value of Options Issued During the Period

There were no options granted during the period ended June 30, 2015.

The weighted average remaining contractual life of the options outstanding at June 30, 2015 is 6.02 years.

Options Issued to Employees

The fair value at grant date is determined using a Black-Scholes option pricing model that takes into account the exercise price, the term of the option, the impact of dilution, the share price at grant date, the expected price volatility of the underlying share, the expected dividend yield and the risk free interest rate for the term of the option.

Options Issued to Non-Employees

Options issued to non-employees are measured based on the fair value of the goods or services received, at the date of receiving those goods or services. If the fair value of the goods or services received cannot be estimated reliably, the options are measured by determining the fair value of the options granted using the Black-Scholes option pricing model.

The expected volatility is based on the historical volatility (based on the remaining life of the options), adjusted for any expected changes to future volatility due to publicly available information. The risk free rate of return is the yield on a zero-coupon Canadian Treasury Bill of a term consistent with the assumed option life. The expected average option term is the average expected period to exercise, based on the historical activity patterns for each individually vesting tranche.

Option pricing models require the input of highly subjective assumptions, including the expected price volatility. Changes in these assumptions can materially affect the fair value estimate and, therefore, the existing models do not necessarily provide a reliable single measure of the fair value of the Company’s stock options.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

12.

SHARE-BASED PAYMENTS – (cont’d)

c)

Expenses Arising from Share-based Payment Transactions

There were no expenses arising from share-based payment transactions recognized during the periods ended June 30, 2015 and 2014 as part of share-based compensation expense.

As of June 30, 2015 there was no amount (December 31, 2014: $Nil) of total unrecognized compensation cost related to unvested share-based compensation awards.

d)

Amounts Capitalized Arising from Share-based Payment Transactions

There were no expenses arising from the share-based payment transactions that were capitalized during the periods ended June 30, 2015 and 2014 as part of exploration and evaluation asset acquisition costs.

13.

RELATED PARTY TRANSACTIONS

The Company had transactions during the periods ended June 30, 2015 and 2014 with related parties who consisted of directors, officers and the following companies with common directors:

| | |

| Related party

| Nature of transactions

|

| Mill Street Services Ltd. (“Mill Street”)

| Management fees

|

| Gold Group Management Inc. (“Gold Group”)

| Shared general and administrative expenses

|

| Fortuna

| Shared general and administrative expenses

|

| Focus

| Investment and shared general and administrative expenses

|

| Medgold (Associate)

| Investment and shared general and administrative expenses

|

In addition to related party transactions disclosed elsewhere in the condensed interim consolidated financial statements, the Company incurred the following expenditures charged by non-key management officers and companies which have common directors with the Company in the periods ended June 30, 2015 and 2014:

| | | | | |

| | Three months ended June 30,

| Six months ended June 30,

|

|

| 2015

| 2014

| 2015

| 2014

|

| Expenses:

| | | | |

| Salaries and benefits

| $ 5,440

| $ 3,717

| $ 12,693

| $ 5,077

|

| Mineral property costs:

| | | | |

| Salaries and benefits

| 909

| 2,388

| 909

| 4,021

|

|

| $ 6,349

| $ 6,105

| $ 13,602

| $ 9,098

|

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

13.

RELATED PARTY TRANSACTIONS – (cont’d)

The Company reimburses Gold Group, a company controlled by the Chief Executive Officer of the Company, for shared administrative costs and other business related expenses paid by Gold Group on behalf of the Company. During the periods ended June 30, 2015 and 2014, the Company reimbursed Gold Group the following:

| | | | | |

| | Three months ended June 30,

| Six months ended June 30,

|

|

| 2015

| 2014

| 2015

| 2014

|

| General and administrative expenses:

| | | | |

| Office and miscellaneous

| $ 12,703

| $ 10,800

| $ 20,622

| $ 19,754

|

| Public relations

| 152

| 529

| 926

| 1,189

|

| Property investigations

| -

| -

| 1,587

| -

|

| Salaries and benefits

| 31,730

| 21,969

| 64,709

| 39,250

|

| Transfer agent and

regulatory fees

| 1,923

| 1,679

| 1,923

| 3,179

|

| Travel and accommodation

| 1,935

| 1,994

| 9,695

| 8,037

|

|

| $ 48,443

| $ 36,971

| $ 99,462

| $ 71,409

|

Salary and benefits costs for the periods ended June 30, 2015 and 2014 include those for the Chief Financial Officer and Corporate Secretary.

These transactions are in the normal course of operations and are measured at the fair value of the services rendered.

Long-term deposits include an amount of $60,000 (December 31, 2014: $60,000) paid to Gold Group as a deposit on the shared office and administrative services agreement that became effective July 1, 2012.

The amount due from related party consists of $32,412 (December 31, 2014: $Nil) due from Medgold, a company with a common director with the Company. The amount owing from Medgold arose from shared administrative costs. This amount was unsecured, non-interest bearing and are due on demand.

Accounts payable and accrued liabilities include $49,682 (December 31, 2014: $34,297) payable to Gold Group for shared administrative costs.

Key management compensation

Key management personnel are persons responsible for planning, directing and controlling the activities of an entity, and include certain directors and officers. Key management compensation comprises:

| | | | | |

| | Three months ended June 30,

| Six months ended June 30,

|

|

| 2015

| 2014

| 2015

| 2014

|

| Management fees

| $ 25,500

| $ 25,500

| $ 51,000

| $ 51,000

|

| Salaries, benefits and fees

| 8,709

| 7,933

| 16,042

| 12,975

|

|

| $ 34,209

| $ 33,433

| $ 67,042

| $ 63,975

|

There were no share-based payments to key management personnel or directors not specified as key management personnel during the periods ended June 30, 2015 and 2014.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

14.

SEGMENTED INFORMATION

Operating segments are defined as components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker, or decision-making group, in deciding how to allocate resources and in assessing performance. All of the Company’s operations are within the mining sector relating to precious metals exploration. Due to the geographic and political diversity, the Company’s exploration operations are decentralized whereby exploration managers are responsible for business results and regional corporate offices provide support to the exploration programs in addressing local and regional issues. The Company’s operations are therefore segmented on a district basis. The Company’s assets are located in Canada, USA, Guatemala, Nicaragua, Mexico and Caymans. Details of identifiable assets by geographic segments are as follows:

| | | | | | | |

Period ended June 30, 2015

| Canada

| USA

| Guatemala

| Nicaragua

| Mexico

| Other

| Consolidated

|

Exploration expenditures

| $ -

| $ 38,821

| $ 59,914

| $ 4,213

| $ 213,914

| $ -

| $ 316,862

|

Exploration and evaluation

assets written off

| -

| 32,022

| -

| -

| -

| -

| 32,022

|

Gain on sale of available-for-sale

investments

| 18,465

| -

| -

| -

| -

| -

| 18,465

|

Mineral property royalty income

| -

| -

| -

| -

| -

| 487,833

| 487,833

|

Investment income

| 17,241

| -

| -

| -

| -

| -

| 17,241

|

Amortization

| 11,209

| -

| 7,309

| -

| -

| -

| 18,518

|

Net income (loss)

| 227,048

| (38,821)

| (173,400)

| (11,480)

| (159,677)

| 410,985

| 254,655

|

Capital expenditures*

| -

| -

| -

| -

| 23,821

| 1,259,505

| 1,283,326

|

| | | | | | | |

Period ended June 30, 2014

| Canada

| USA

| Guatemala

| Nicaragua

| Mexico

| Caymans

| Consolidated

|

Exploration expenditures

| $ -

| $ 130,178

| $ 71,173

| $ 4,729

| $ 104,533

| $ -

| $ 310,613

|

Gain on sale of available-for-sale

investments

| 1,289,708

| -

| -

| -

| -

| -

| 1,289,708

|

Investment income

| 15,903

| -

| -

| -

| -

| -

| 15,903

|

Amortization

| 13,037

| -

| 7,011

| 349

| -

| -

| 20,397

|

Profit/(loss) before income taxes

| 957,576

| (130,178)

| (60,833)

| (807)

| (109,968)

| (19,738)

| 636,052

|

Capital expenditures*

| 2,749

| 62,151

| -

| -

| -

| -

| 64,900

|

|

*Capital expenditures consists of additions of property and equipment and exploration and evaluation assets

|

| | | | | | |

As at June 30, 2015

| Canada

| Guatemala

| Nicaragua

| Mexico

| Other

| Consolidated

|

Total current assets

| $ 6,056,577

| $ 13,651

| $ 2,798

| $ 27,325

| $ 744,584

| $ 6,844,935

|

Total non-current assets

| 611,179

| 545,408

| -

| 23,821

| 1,259,505

| 2,439,913

|

Total assets

| $ 6,667,756

| $ 559,059

| $ 2,798

| $ 51,146

| $2,004,089

| $ 9,284,848

|

Total liabilities

| $ 218,663

| $ 343

| $ 37

| $ 3,617

| $ -

| $ 222,660

|

| | | | | | | |

As at December 31, 2014

| Canada

| USA

| Guatemala

| Nicaragua

| Mexico

| Other

| Consolidated

|

Total current assets

| $ 7,430,559

| $ -

| $ 12,298

| $ 8,003

| $ 33,908

| $ 266,154

| $ 7,750,922

|

Total non-current assets

| 709,801

| 32,022

| 552,717

| (413)

| -

| -

| 1,294,127

|

Total assets

| $ 8,140,360

| $ 32,022

| $ 565,015

| $ 7,590

| $ 33,908

| $ 266,154

| $ 9,045,049

|

Total liabilities

| $ 111,963

| $ -

| $ 2,933

| $ 1,208

| $ 5,486

| $ -

| $ 121,590

|

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

15.

FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

The Company is exposed to the following financial risks:

·

Market Risk

·

Credit Risk

·

Liquidity Risk

In common with all other businesses, the Company is exposed to risks that arise from its use of financial instruments. This note describes the Company’s objectives, policies and processes for managing those risks and the methods used to measure them. Further quantitative information in respect of these risks is presented throughout these financial statements.

General Objectives, Policies and Processes

The Board of Directors has overall responsibility for the determination of the Company’s risk management objectives and policies and, whilst retaining ultimate responsibility for them, it has delegated the authority for designing and operating processes that ensure the effective implementation of the objectives and policies to the Company’s finance function. The Board of Directors receive periodic reports through which it reviews the effectiveness of the processes put in place and the appropriateness of the objectives and policies it sets.

The overall objective of the Board is to set policies that seek to reduce risk as far as possible without unduly affecting the Company’s competitiveness and flexibility. Further details regarding these policies are set out below.

a)

Market Risk

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market prices. Market prices are comprised of three types of risk: foreign currency risk, interest rate risk, and equity price risk.

Foreign Currency Risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Company is exposed to fluctuations in foreign currencies through its operations in foreign countries. The Company monitors this exposure, but has no hedge positions. As at June 30, 2015, cash totalling $58,172 (December 31, 2014: $97,995) was held in US dollars, $535 (December 31, 2014: $680) in Nicaragua Cordoba, $Nil (December 31, 2014: $99) in Guatemala Quetzal, $664 (December 31, 2014: $1,254) in Mexican Pesos and $88 (December 31, 2014: $84) in Peruvian Sols. Based on the above net exposures at June 30, 2015, a 10% depreciation or appreciation of the above currencies against the Canadian dollar would approximately result in a $6,000 increase or decrease in the Company’s after tax net earnings.

Interest Rate Risk

Interest rate risk is the risk that future cash flows will fluctuate as a result of changes in market interest rates. The Company does not have any borrowings. Interest rate risk is limited to potential decreases on the interest rate offered on cash held with chartered Canadian financial institutions. The Company considers this risk to be limited as it holds no assets or liabilities subject to variable rates of interest.

Equity Price Risk

Equity price risk is the uncertainty associated with the valuation of assets arising from changes in equity markets. The Company’s available-for-sale investments are exposed to significant equity price risk due to the potentially volatile and speculative nature of the businesses in which the investments are held. The available-for-sale investments held in B2Gold, Focus, and Southern Silver are monitored by the Board with decisions on sale taken by Management. A 10% decrease in fair value of the shares would result in an approximate $602,000 decrease in equity.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

15.

FINANCIAL INSTRUMENTS AND RISK MANAGEMENT – (cont’d)

b)

Credit Risk

Credit risk is the risk of an unexpected loss if a customer or third party to a financial instrument fails to meet its contractual obligations. The Company’s credit risk is primarily attributable to its cash and cash equivalents, available-for-sale investments and advances and other receivables. The Company limits exposure to credit risk by maintaining its cash and cash equivalents with large financial institutions. The Company does not have cash and cash equivalents or available-for-sale investments that are invested in asset based commercial paper. For advances and other receivables, the Company estimates, on a continuing basis, the probable losses and provides a provision for losses based on the estimated realizable value.

c)

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company’s approach to managing liquidity risk is to provide reasonable assurance that it will have sufficient funds to meet liabilities when due. The Company manages its liquidity risk by forecasting cash flows required by operations and anticipated investing and financing activities. At June 30, 2015, the Company had working capital of $6.6 million (December 31, 2014: $7.6 million) available to apply against short-term business requirements. All of the Company’s financial liabilities have contractual maturities of less than 45 days and are subject to normal trade terms.

Determination of Fair value

Fair values have been determined for measurement and/or disclosure purposes based on the following methods. When applicable, further information about the assumptions made in determining fair values is disclosed in the notes specific to that asset or liability.

Management considers that due to their short-term nature the carrying amounts of financial assets and financial liabilities, which include cash, due from related parties, advances and other receivables, deposits, accounts payables and accrued liabilities, and due to related parties are assumed to approximate their fair values.

The fair value investments in associates are detailed in the following table:

| | | |

| | June 30, 2015

| June 30, 2015

|

| | Book value

| Fair value

|

| Financial assets

| | |

| Shares held in Rackla and recorded as investment in associate (Note 9)

| $ 1

| $ 147,996

|

| Shares held in Medgold and recorded as investment in associate (Note 9)

| $ 386,000

| $ 1,200,000

|

Fair Value Hierarchy

Financial instruments that are measured subsequent to initial recognition at fair value are grouped in Levels 1 to 3 based on the degree to which the fair value is observable:

| | | |

| Level 1

| | Unadjusted quoted prices in active markets for identical assets or liabilities;

|

| Level 2

| | Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (i.e., as prices) or indirectly (i.e., derived from prices); and

|

| Level 3

| | Inputs for the asset or liability that are not based on observable market data (unobservable inputs).

|

The available-for-sale investments for B2Gold, Focus, and Southern Silver are based on quoted prices and are therefore considered to be Level 1.

Radius Gold Inc.

(An Exploration Stage Company)

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the six months ended June 30, 2015

(Expressed in Canadian Dollars)

16.

CAPITAL MANAGEMENT

The Company’s objectives when managing capital are to safeguard the Company’s ability to continue as a going concern in order to advance its mineral properties and to acquire new investments. In order to facilitate the management of its capital requirements, the Company prepares periodic budgets that are updated as necessary. The Company manages its capital structure and makes adjustments to it to effectively support its business activities. The properties in which the Company currently holds are in the exploration stage; as such the Company is dependent on external financing to fund its activities. In order to carry out the planned exploration and possible acquisitions and to pay for general administrative costs, the Company will spend its existing working capital and raise additional amounts as needed. The Company will continue to assess new properties and investments, and seek to acquire an interest in additional properties and investments if it feels there is sufficient geologic or economic potential and if it has adequate financial resources to do so.

Management reviews its capital management approach on an ongoing basis and believes that this approach, given the relative size of the Company, is reasonable. The Company monitors its cash and cash equivalents, available-for-sale investments, common shares, warrants and stock options as capital. There were no changes in the Company’s approach to capital management during the period ended June 30, 2015. The Company’s investment policy is to hold cash in interest bearing bank accounts, which pay comparable interest rates to highly liquid short-term interest bearing investments with maturities of one year or less and which can be liquidated at any time without penalties. Neither the Company nor any of its subsidiaries is subject to externally imposed capital requirements and does not have exposure to asset-backed commercial paper or similar products. The Company expects its current capital resources to be sufficient to carry out its planned exploration programs and operating costs for the next twelve months.

![[radiusq22015mda001.jpg]](radiusq22015mda001.jpg)

(the “Company”)

MANAGEMENT’S DISCUSSION AND ANALYSIS

Second Quarter Report – June 30, 2015

General

This Management’s Discussion and Analysis (“MD&A”) supplements, but does not form part of, the unaudited condensed interim consolidated financial statements of the Company for the six months ended June 30, 2015. The following information, prepared as of August 28, 2015, should be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements for six months ended June 30, 2015 and the related notes contained therein. The Company reports its financial position, results of operations and cash flows in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). In addition, the following should be read in conjunction with the Consolidated Financial Statements of the Company for the year ended December 31, 2014 and the related MD&A. All amounts are expressed in Canadian dollars unless otherwise indicated. The June 30, 2015 financial statements have not been reviewed by the Company’s auditors.

The Company’s public filings, including its most recent unaudited and audited financial statements can be reviewed on the SEDAR website (www.sedar.com).

Forward Looking Information

This MD&A contains certain statements which constitute forward-looking information within the meaning of applicable Canadian securities legislation (“Forward-looking Statements”). All statements included herein, other than statements of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this MD&A include, without limitation, statements relating to:

·

the Company’s planned exploration activities for its mineral properties;

·

the Company’s anticipated receipt of royalty payments from the Tambor Project;

·

the intended use of proceeds received from past and possible future financing activities;

·

the sufficiency of the Company’s cash position and its ability to raise, if needed, equity capital or access debt facilities; and

·

maturities of the Company’s financial liabilities or other contractual commitments.

Often, but not always, these Forward-looking Statements can be identified by the use of words such as “anticipates”, “believes”, “plans”, “estimates”, “expects”, “forecasts”, “scheduled”, “targets”, “possible”, “strategy”, “potential”, “intends”, “advance”, “goal”, “objective”, “projects”, “budget”, “calculates” or statements that events, “will”, “may”, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and factors include, among others:

·

risks associated with mineral exploration activities, and investing in companies which conduct mineral exploration and development activities;

·

due diligence investigations on potential investments not identifying all relevant facts;

·

inability to dispose of illiquid securities;

·

receipt of royalty payments from the Tambor Project;

·

fluctuations in commodity prices;

·

fluctuations in foreign exchange rates and interest rates;

·

credit and liquidity risks;

·