UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Period March 2015 File No. 0-30720

Radius Gold Inc.

(Name of Registrant)

200 Burrard Street, Suite 650, Vancouver, British Columbia, Canada V6C 3L6

(Address of principal executive offices)

1.

Notice of Meeting and Management Information Circular

2.

Consent of Qualified Person

3.

Consent of Auditor

4.

Form of Proxy

5.

Financial Statement Request Form

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

FORM 20-F x

FORM 40-F ¨

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Form 6-K to be signed on its behalf by the undersigned, thereunto duly authorized.

Radius Gold Inc.

(Registrant)

| |

Dated: March 27, 2015

| By: /s/ Simon Ridgway

Simon Ridgway

President and Director

|

![[radiusinfocircular001.jpg]](radiusinfocircular001.jpg)

NOTICE OF MEETING

AND

MANAGEMENT PROXY CIRCULAR

WITH RESPECT TO

THE ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 23, 2015

Neither the TSX Venture Exchange Inc. nor any securities regulatory authority has in any way passed upon the merits of the Change of Business described in this circular.

![[radiusinfocircular002.jpg]](radiusinfocircular002.jpg)

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an Annual and Special Meeting (the “Meeting”) of the Shareholders of Radius Gold Inc. (the “Company”) will be held at the Company’s office, 200 Burrard Street, Suite 650, Vancouver, British Columbia on Thursday, April 23, 2015, at the hour of 10:00 a.m. (local time), for the following purposes:

(a)

to receive the financial statements of the Company for the fiscal year ended December 31, 2013, together with the report of the auditors thereon;

(b)

to appoint auditors and to authorize the Directors to fix their remuneration;

(c)

to elect Directors;

(d)

to re-approve the Company’s Stock Option Plan;

(e)

to approve an ordinary resolution, the full text of which is provided in “Particulars of Matters to be Acted Upon – Change of Business” of the accompanying Management Proxy Circular (the “Circular”), approving a change of the Company’s business from a mining issuer engaged in mineral exploration to an investment issuer engaged in investing in, and lending to, privately held and publicly traded corporations; and

(f)

to transact such further or other business as may properly come before the Meeting or any adjournment or adjournments thereof.

Shareholders who are unable to attend the Meeting are requested to complete, date, sign and mail the enclosed form of proxy in accordance with the instructions set out in the proxy and in the Circular.

DATED the 20th day of March, 2015.

BY ORDER OF THE BOARD

Simon Ridgway,

President and Chief Executive Officer

If you are a non-registered shareholder of the Company and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or by the other intermediary. Failure to do so may result in your shares not being eligible to be voted by proxy at the meeting.

MANAGEMENT PROXY CIRCULAR

TABLE OF CONTENTS

| |

INFORMATION CONTAINED IN THIS CIRCULAR

| i

|

FORWARD-LOOKING INFORMATION

| i

|

CURRENCY

| ii

|

GLOSSARY OF TERMS

| iii

|

SUMMARY

| 1

|

PROXIES

| 3

|

Solicitation and Deposit of Proxies

| 3

|

Non-Registered Holders

| 3

|

Voting of Proxies

| 4

|

Revocation of Proxies

| 4

|

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

| 4

|

EXECUTIVE COMPENSATION

| 4

|

Compensation Discussion and Analysis

| 5

|

Summary Compensation Table

| 5

|

Option-Based and Share-Based Awards to NEOs

| 6

|

Compensation to Directors

| 7

|

Option-Based and Share-Based Awards to the Directors

| 7

|

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

| 8

|

AUDIT COMMITTEE

| 9

|

CORPORATE GOVERNANCE

| 9

|

Board of Directors

| 10

|

Directorships

| 10

|

Orientation and Continuing Education

| 10

|

Ethical Business Conduct

| 10

|

Nomination of Directors

| 10

|

Compensation Committee

| 10

|

Assessments

| 10

|

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

| 11

|

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

| 11

|

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

| 11

|

PARTICULARS OF MATTERS TO BE ACTED UPON

| 11

|

Appointment and Remuneration of Auditors

| 11

|

Election of Directors

| 11

|

Bankruptcy

| 13

|

Stock Option Plan

| 13

|

Change of Business

| 14

|

Other Matters

| 16

|

INFORMATION CONCERNING THE RESULTING ISSUER

| 16

|

Corporate Structure

| 16

|

General Development of the Business

| 17

|

Description of the Securities / Dividend Policy

| 21

|

Stock Option Plan / Options to Purchase Securities

| 21

|

Selected Financial Information / Management’s Discussion and Analysis

| 22

|

Available Funds and Principal Purposes

| 23

|

Prior Sales / Stock Exchange Price

| 23

|

Directors, Officers and Promoters

| 23

|

Executive Compensation Following the Change of Business

| 27

|

Securities Subject to Escrow or Resale Restrictions

| 27

|

Legal Proceedings

| 27

|

Auditor, Transfer Agent and Registrar

| 27

|

Material Contracts

| 27

|

Risk Factors

| 27

|

INTERESTS OF EXPERT

| 31

|

OTHER MATERIAL FACTS

| 31

|

ADDITIONAL INFORMATION

| 31

|

BOARD APPROVAL

| 31

|

CERTIFICATE OF RADIUS GOLD INC

| 32

|

| |

APPENDIX “A” AUDIT COMMITTEE CHARTER

| A-1

|

APPENDIX “B” INVESTMENT POLICY

| B-1

|

APPENDIX “C” CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2012

|

C-1

|

APPENDIX “D” CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2013

|

D-1

|

APPENDIX “E” AMENDED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2014

|

E-1

|

APPENDIX “F” MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2013

|

F-1

|

APPENDIX “G” AMENDED MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2014

|

G-1

|

INFORMATION CONTAINED IN THIS CIRCULAR

The information contained in this Management Proxy Circular (the “Circular”) is given as at March 20, 2015, except where otherwise noted.

No person has been authorized to give any information or to make any representation in connection with the Change of Business (defined below) and other matters described herein other than those contained in this Circular and, if given or made, any such information or representation should be considered not to have been authorized by the Company.

This Circular does not constitute the solicitation of an offer to purchase, or the making of an offer to sell, any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation or offer is not authorized or in which the person making such solicitation or offer is not qualified to do so or to any person to whom it is unlawful to make such solicitation or offer.

Information contained in this Circular should not be construed as legal, tax or financial advice and Shareholders are urged to consult their own professional advisors in connection therewith.

The proposed transactions set out herein have not been approved or disapproved by any securities regulatory authority, nor has any securities regulatory authority passed upon the fairness or merits thereof or upon the accuracy or adequacy of the information contained in this Circular, and any representation to the contrary is unlawful.

The description in this Circular of the Investment Policy (defined below) is a summary only. Shareholders should refer to the full text of the proposed Investment Policy attached to this Circular as Appendix “B”. The final Investment Policy will be posted on the Company’s website and filed on SEDAR prior to the completion of the Change of Business.

FORWARD-LOOKING INFORMATION

Certain statements herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable Canadian securities legislation which are based on expectations, estimates and projections as at the date of this Circular or the dates of the documents incorporated herein by reference, as applicable. Such forward-looking statements or information include, but are not limited to, statements or information concerning: the timing for the implementation of the Change of Business (defined below); the completion of the Change of Business; the potential benefits of the Change of Business; statements relating to the business and future activities of the Company; the ability of the Company to continue to successfully compete in the market; requirements for additional capital and future financing; estimated uses of funds; planned activities and planned future acquisitions; and other events and conditions that may occur in the future.

Often, but not always, forward-looking statements or information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. With respect to forward-looking statements and information contained herein, numerous assumptions have been made, including among other things, the Company’s ability to satisfy the conditions required to complete the Change of Business, including obtaining the approval of the Change of Business by the Company’s shareholders and the TSXV (defined below). Although management of the Company believes that the assumptions made and the expectations represented by such statement or information are reasonable, there can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks, uncertainties and other factors include the following, among others: the failure to satisfy the requirements to complete the Change of Business, including obtaining the necessary shareholder and regulatory approvals; the speculative nature of the Company’s operations; regulatory restrictions; and defective title to mineral claims or property, as well as those factors discussed under “Risk Factors” herein.

Readers should also refer to the Company’s most recent interim and annual Management Discussion and Analysis for additional information on risks and uncertainties relating to forward-looking statements and information. Although the Company has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in the forward-looking statements or information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to reissue or update any forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

CURRENCY

All currency references herein are in Canadian dollars unless otherwise indicated.

GLOSSARY OF TERMS

In this Circular and the Notice of Meeting, the following terms shall have the respective meanings set out below, words importing the singular number shall include the plural and vice versa and words importing any gender shall include all genders.

“affiliate” means a corporation that is affiliated with another corporation because:

(a) one of them is the subsidiary of the other, or

(b) each of them is controlled by the same person.

For the purposes of the foregoing, a corporation is “controlled” by a person if:

(a) voting securities of that corporation are held, other than by way of security only, by or for the benefit of that person, and

(b) the voting securities, if voted, entitle the person to elect a majority of the directors of the corporation.

For the purposes of the foregoing, a person beneficially owns securities that are beneficially owned by:

(a) a corporation controlled by that person, or

(b) an affiliate of that Person or an affiliate of any corporation controlled by that person.

“arm’s length transaction” means, in respect of the Company, a transaction which is not carried out by or with a “related party” as that term is used in Policy 5.9 of the TSXV or a “non-arm’s length party” such as a promoter, officer, director, other insider or control person (a greater than 20% shareholder) of the Company and any associates or affiliates of any of such persons.

“BCBCA” means the Business Corporations Act (British Columbia), and the regulations thereunder, as now in effect and as they may be promulgated or amended from time to time.

“Board” means the Company’s board of directors.

“CEO” means Chief Executive Officer.

“CFO” means Chief Financial Officer.

“Change of Business” means a transaction or series of transactions which will redirect the Company’s resources and change the nature of its business from a Mining Issuer to an Investment Issuer through, for example, the acquisition of interests in other businesses which represent a material amount of the Company’s market value, assets or operations.

“Change of Business Resolution” means the ordinary resolution to be considered and, if deemed advisable, approved by Shareholders at the Meeting in respect of the Change of Business in the form set forth under “Particulars of Matters to be Acted Upon – Change of Business” in this Circular.

“Circular” means this management proxy circular, including all schedules attached hereto.

“Common Shares” means the common shares without par value in the capital of the Company.

“Company” means Radius Gold Inc., a company existing under the BCBCA.

“Effective Date” means the date upon which the Change of Business becomes effective.

“Intermediaries” means brokers, investment firms, clearing houses and similar entities that own securities on behalf of Non-Registered Holders.

“Investment Issuer” means a corporation, the shares of which are listed on the TSXV, engaged in the business of investing in the securities and assets of, or lending to, other corporations whether or not their shares are listed on the TSXV.

“Investment Policy” means the policy adopted by the Board in respect of the Resulting Issuer’s investments.

“Management” means the Company’s senior officers consisting of its CEO and CFO.

“Meeting” means the annual and special meeting of Shareholders to be held at 10:00 a.m. (Vancouver time) on Thursday, April 23, 2015 to consider, among other matters, the Change of Business, and any adjournment or postponement thereof.

“NI 52-110” means National Instrument 52-110 - Audit Committees of the Canadian securities administrators.

“NI 54-101” means National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer of the Canadian securities administrators.

“NI 58-101” means National Instrument 58-101 - Disclosure of Corporate Governance Practices of the Canadian securities administrators.

“Non-Registered Holders” means shareholders who do not hold Common Shares in their own name, and instead hold their Common Shares through a broker, bank or other nominee.

“Notice of Meeting” means the notice to Shareholders calling the Meeting, which accompanies this Circular.

“Stock Option Plan” means the stock option plan of the Company.

“Record Date” means March 17, 2015, being the date set by the Company for determining Shareholders entitled to receive notice of and vote at the Meeting.

“Registered Holders” means holders of record of Common Shares.

“Resulting Issuer” means the Company following the Change of Business.

“SEDAR” means the System for Electronic Document Analysis and Retrieval.

“Shareholders” means the Registered Holders and the Non-Registered Holders.

“TSXV” means the TSX Venture Exchange.

SUMMARY

The following is a summary of information relating to the Meeting, the Company and the Resulting Issuer (assuming completion of the Change of Business) and should be read together with the more detailed information and financial data and statements contained elsewhere in this Circular.

The Meeting

The Meeting will be held on Thursday, April 23, 2015 at the Company’s office, 200 Burrard Street, Suite 650, Vancouver, British Columbia, at 10:00 a.m. (Vancouver time). The Record Date set by the Company for determining Shareholders entitled to receive notice of and vote at the Meeting is March 17, 2015.

The Meeting is both an annual and a special meeting. At the Meeting the audited financial statements of the Company for the year ended December 31, 2013 will be presented to the Shareholders, and the Shareholders will be asked: (i) to appoint auditors and authorizing the directors to fix the auditors’ remuneration; (ii) to elect directors to hold office until the next annual meeting of the Company; and (iii) to re-approve the Stock Option Plan.

In addition, the Shareholders will be asked at the Meeting to consider and, if deemed advisable, pass the Change of Business Resolution approving the Change of Business of the Company. See “Particulars of the Matters to be Acted Upon - Change of Business” for the full text of the Change of Business Resolution. All resolutions to be passed at the Meeting require a simple majority of the vote of Shareholders voting in person or by proxy at the Meeting.

Change of Business / Stock Exchange Listing

The Company is currently a Tier 2 Mining Issuer pursuant to the policies of the TSXV. The Management and Board believe that a more appropriate allocation of the Company’s working capital and management skills involves changing the Company to an Investment Issuer, and the Company has applied to the TSXV to become a Tier 1 Investment Issuer. Following completion of the Change of Business, the Company will continue its existence as the Resulting Issuer and will be listed on the TSXV as an Investment Issuer. See “Particulars of the Matters to be Acted Upon - Change of Business”.

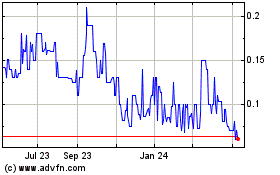

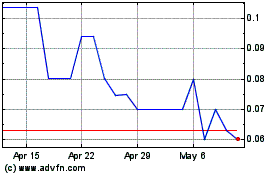

The closing price of the Company’s Common Shares on the TSXV on January 6, 2015, the day before the announcement of the Change of Business, was $0.10, and on March 20, 2015 was $0.095. The Common Shares trade under the symbol “RDU”.

Stock Exchange and Shareholder Approvals

The TSXV has conditionally accepted the Change of Business subject to the Company fulfilling all of the requirements of the TSXV’s conditional acceptance in connection with or upon completion of the Change of Business.

In order for the Change of Business to proceed, the Change of Business Resolution must be approved by an ordinary resolution passed by the Shareholders at the Meeting. The officers and directors of the Company, holding in the aggregate approximately 8.3% of the issued and outstanding Common Shares of the Company, have indicated their support for the Change of Business. See “Particulars of the Matters to be Acted Upon - Change of Business”.

Arm’s Length Transaction

The Change of Business is an arm’s length transaction. None of the directors, officers or promoters of the Company, nor any of their respective associates and affiliates, has any interest in the Change of Business (other than as Shareholders) nor will they receive any consideration from the Company in connection therewith.

Available Funds and Principal Purposes

As at February 28, 2015, the estimated working capital of the Company was approximately $9,387,000. Following completion of the Change of Business, the Resulting Issuer’s estimated consolidated working capital will be $9,187,000, which is intended to be used as follows:

| | | |

| Available for future investments in accordance with the Investment Policy (1)

| $7,837,000

|

| Estimated costs of the Change of Business

| $50,000

|

| Estimated general and administrative expenses for the next 18 months

| $1,100,000

|

| Unallocated working capital

| $200,000

|

| | $9,187,000

|

| Note:

| |

| (1)

| This amount will be available to cover any expenditures to be made by the Company on its mineral properties and any other properties the Company may acquire in the future. See “Information Concerning the Resulting Issuer - General Development of the Business - Mineral Properties” for a description of the Company’s current mineral property assets.

|

Risk Factors

Following the completion of the Change of Business, the Resulting Issuer’s business will involve investing in, and lending to, privately held and publicly traded corporations, while continuing to acquire and explore properties in the mineral resource sector. In evaluating the Change of Business, you should carefully consider, in addition to the other information contained in this Circular, the risks and uncertainties described under “Information Concerning the Resulting Issuer - Risk Factors” herein before deciding to vote in favour of the Change of Business. Some of the risk factors that will be faced by the Company or the Resulting Issuer, as the case may be, are:

·

The change of business is subject to Shareholder approval and the final approval of the TSXV.

·

Costs of the change of business.

·

No operating history as an investment issuer.

·

Risks of competition.

·

Risks of fluctuations in the value of the company and the common shares.

·

Risks related to due diligence investigations in connection with future investments.

·

Risks of investment in illiquid securities.

·

Loss of investment risk.

·

No guaranteed return risk.

·

Dividends.

·

Currency risk.

·

Commodity risk.

·

Foreign investment risks.

·

Risk of lack of diversification of investments.

·

Resource sector risks.

·

Exploration and development risks.

·

Ability to develop and operate key projects.

·

Reliance on permits and approvals from governmental authorities.

·

Environmental risks.

·

Economic and political factors.

·

Uninsurable risks.

·

Equity market risk.

·

Market disruption risks.

·

Private corporation risks.

·

Risk of dilution from possible future offerings.

·

Financing risks.

·

Stress in the global economy.

·

Dependence upon key management.

Sponsorship

The TSXV has granted the Company a waiver from the sponsorship requirements of the TSXV in respect of the Change of Business.

Recommendation of the Board

The Board has determined that the Change of Business is in the best interests of the Company. Accordingly, the Board recommends that Shareholders vote IN FAVOUR of the Change of Business Resolution.

PROXIES

This Circular is furnished in connection with the solicitation of proxies by the management of the Company for use at the Meeting and any adjournment thereof, at the time and place and for the purposes set forth in the accompanying Notice of Meeting.

Solicitation and Deposit of Proxies

While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the directors and regular employees of the Company. All costs of solicitation will be borne by the Company. The Company has arranged for Intermediaries to forward this Circular, form of proxy and other meeting documents (the “Meeting Materials”) to Non-Registered Holders of Common Shares held as of the Record Date by those Intermediaries and the Company may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

The individuals named in the accompanying form of proxy (“Proxy”) are directors or officers of the Company. A shareholder wishing to appoint some other person (who need not be a shareholder) to represent the shareholder at the Meeting has the right to do so, either by inserting such person’s name in the blank space provided in the Proxy and striking out the printed names or by completing another form of proxy. The Proxy will not be valid unless the completed, dated and signed form of proxy is received by Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, ON M5J 2Y1, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof, or is delivered to the Chairman of the Meeting prior to commencement of the Meeting or any adjournment thereof.

Non-Registered Holders

Only Registered Holders of Common Shares or the persons they appoint as their proxyholders are permitted to vote at the Meeting. In many cases, however, Common Shares beneficially owned by a Non-Registered Holder are registered either:

(a)

in the name of an Intermediary that the Non-Registered Holder deals with in respect of the shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans, or

(b)

in the name of a clearing agency, such as The Canadian Depository for Securities Limited, of which the Intermediary is a participant.

In accordance with the requirements of NI 54-101, the Company will distribute the Meeting Materials to Intermediaries and clearing agencies for onward distribution to Non-Registered Holders. The Company does not intend to pay Intermediaries to forward the Meeting Materials if the Non-Registered Holders have provided instructions to their Intermediary that they object to the Intermediary disclosing ownership information about the Non-Registered Holders. In this case, such Non-Registered Holder will not receive the Meeting Materials if the Intermediary does not assume the cost of delivery.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive Meeting Materials. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will be sent a voting instruction form which must be completed, signed and returned by the Non-Registered Holder in accordance with the Intermediary’s directions on the voting instruction form. In some cases, such Non-Registered Holders will instead be given a Proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. This form of proxy does not need to be signed by the Non-Registered Holder, but, to be used at the Meeting, needs to be properly completed and deposited with Computershare Trust Company as described under “Solicitation and Deposit of Proxies” above.

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares that they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the Proxy and insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form.

Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies, including instructions regarding when and where the voting instruction form or Proxy form is to be delivered.

Voting of Proxies

Common Shares represented by any properly executed Proxy will be voted or withheld from voting on any ballot that may be called for in accordance with the instructions given by the shareholder. In the absence of such direction, such Common Shares will be voted in favour of the matters set forth herein.

The Proxy, when properly completed and delivered and not revoked confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the Proxy to vote in accordance with their best judgment on such matters or business. As at the date hereof, the management of the Company knows of no such amendment, variation or other matter that may be come before the Meeting.

Revocation of Proxies

A Registered Shareholder who has given a Proxy may revoke it by an instrument in writing executed by the shareholder or by his attorney authorized in writing or, where the Shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered either to the registered office of the Company, 200 Burrard Street, Suite 650, Vancouver, British Columbia, V6C 3L6, at any time up to and including the last business day preceding the day of the Meeting, or if adjourned, any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or, if adjourned, any reconvening thereof or in any other manner provided by law. A Non-Registered Shareholder who wishes to revoke a Proxy or voting instruction form should carefully follow the instructions and directions on the Proxy or the voting instruction form, as applicable. A revocation of a Proxy does not affect any matter on which a vote has been taken prior to the revocation.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As at the date hereof, the Company had issued and outstanding 86,675,617 fully paid and non-assessable common shares, each share carrying the right to one vote. The Company has no other classes of voting securities.

Registered Holders of Common Shares as at the Record Date who either personally attend the Meeting or who have completed and delivered a form of proxy in the manner and subject to the provisions described above shall be entitled to vote or to have their shares voted at the Meeting.

To the knowledge of the directors and senior officers of the Company, no person or company beneficially owns, directly or indirectly, or exercises control or direction over shares carrying more than 10% of the voting rights attached to all outstanding shares of the Company.

EXECUTIVE COMPENSATION

As at December 31, 2013, three individuals were “named executive officers” of the Company within the meaning of the definition set out in National Instrument Form 51-102F6, “Statement of Executive Compensation”. As required by Form 51-102F6, the following includes disclosure of the compensation paid or payable by the Company to its named executive officers, including its Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), namely:

·

Simon Ridgway, the CEO since 2007, and the President from 2007 to December 2, 2011 and since December 13, 2012,

·

Ralph Rushton, the Vice-President, Corporate Development (and previously President) to January 1, 2014, and

·

Kevin Bales, the CFO since 2009,

(hereinafter together referred to as “NEOs”).

Compensation Discussion and Analysis

Compensation Philosophy

The Compensation Committee of the Board is responsible for ensuring that the Company has appropriate procedures for making recommendations to the Board with respect to the compensation of the Company’s executive officers and directors. The Compensation Committee consists of Mario Szotlender, Bradford Cooke and William Katzin, each of whom is an independent director. The Committee members have the necessary experience to enable them to make decisions on the suitability of the Company’s compensation policies or practices. Messrs. Szotlender and Cooke have in the past served, or currently serve, on compensation committees of other public resource or mining companies. The Board is satisfied that the composition of the Compensation Committee ensures an objective process for determining compensation.

The general philosophy of the Company’s compensation strategy is to: (a) encourage management to achieve a high level of performance and results with a view to increasing long-term shareholder value; (b) align management’s interests with the long-term interest of shareholders; (c) provide a compensation package that is commensurate with other mineral exploration companies in order to attract and retain highly qualified executives and directors; and (d) ensure that total compensation paid takes into account the Company’s overall financial position.

There are no identified risks arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company. The Company has no policy with respect to Directors and NEOs purchasing financial instruments including prepared variable forward contracts, equity swaps, collars or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the directors and NEOs. However, management is not aware of any Director or NEO having purchased such an instrument.

Elements of Compensation

The compensation to the Company’s NEOs for the fiscal year ended December 31, 2013 was comprised solely of salaries. During the fiscal year ended December 31, 2012, the Company granted incentive stock options to its NEOs. In establishing levels of cash compensation and the granting of stock options, the executive’s performance, level of expertise, and responsibilities are considered.

Incentive stock options are granted pursuant to the Company’s Stock Option Plan which is designed to encourage share ownership on the part of management, directors and employees. The Compensation Committee and the Board believe that the Stock Option Plan aligns the interests of the Company’s personnel with shareholders by linking compensation to the longer term performance of the Company’s shares. The granting of incentive stock options is a significant component of executive compensation as it allows the Company to reward each executive officer’s efforts to increase shareholder value without requiring the use of the Company’s cash reserves.

Stock options are generally granted at the time of the executive’s hiring or appointment and periodically thereafter. Stock option grants are made on the basis of the number of stock options currently held, position, overall individual performance, anticipated contribution to the Company’s future success and the individual’s ability to influence corporate and business performance. The purpose of granting such stock options is to assist the Company in compensating, attracting, retaining and motivating management, directors and employees of the Company and to closely align the personal interest of such persons to the interest of the Shareholders.

The recipients of incentive stock options and the terms of the stock options granted are determined from time to time by the Compensation Committee, who is responsible for administering the Company’s Stock Option Plan. The exercise price of the stock options granted is generally determined by the market price at the time of grant. For further information on the Stock Option Plan, please see “Particulars of Matters to be Acted Upon – Stock Option Plan” in this Circular.

Summary Compensation Table

The following summarizes all compensation paid or payable to NEOs during the nine months ended September 30, 2014 and the fiscal years ended December 31, 2013, 2012, and 2011:

| | | | | | | | | |

Name and

Principal Position

|

Period

Ended

|

Salary

|

Share-

based

Awards

|

Option-

based

Awards(1)

| Non-Equity Annual Incentive Plan Compensation

|

Pension

Value

|

All Other

Compensation

|

Total

Compensation

|

Annual

Incentive

Plans

| Long-term

Incentive

Plans

|

| | | | | | | | | |

Simon Ridgway

| 9/30/14

| $76,500(2)

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $76,500

|

CEO & President

| 2013

| $79,500(2)

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $79,500

|

| 2012

| $69,000(2)

| Nil

| $51,262

| Nil

| Nil

| Nil

| $72,000(3)

| $192,262

|

| 2011

| $60,000(2)

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $60,000

|

| | | | | | | | | |

Ralph Rushton (4)

| 9/30/14

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

|

Former VP &

| 2013

| $95,047

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $95,047

|

Former President

| 2012

| $79,804

| Nil

| $17,087

| Nil

| Nil

| Nil

| Nil

| $96,891

|

| 2011

| $40,404

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $40,404

|

| | | | | | | | | |

Kevin Bales

| 9/30/14

| $19,392

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $19,392

|

CFO

| 2013

| $24,696

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $24,696

|

| 2012

| $25,625

| Nil

| $23,922

| Nil

| Nil

| Nil

| Nil

| $49,547

|

| 2011

| $30,737

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| $30,737

|

| | | | | | | | | |

Notes

:

(1)

Amounts represent the grant date fair value of the options vested at year end which was estimated using the Black-Scholes option pricing model with the following assumptions for the 2012 fiscal year: risk-free interest rate of 1.80%, dividend yield of 0%, expected life of 10 years and a volatility factor of 89%. Option pricing models require the input of highly subjective assumptions including the expected price volatility. Changes in the subjective input assumptions can materially affect the fair value estimate, and therefore the existing models do not necessarily provide a reliable single measure of the fair value of these stock options.

(2)

Paid to Mill Street Services Ltd., a private company owned by the Ridgway Family Trust, of which Simon Ridgway is the Trustee.

(3)

Paid to Mill Street Services Ltd. in recognition of Simon Ridgway’s services in negotiating and completing the Company’s sale of its Nicaragua properties in 2012.

(4)

Ceased as Vice-President, Corporate Development on January 1, 2014.

Option-Based and Share-Based Awards to NEOs

The following sets forth the details of incentive stock options to purchase common shares of the Company and share-based awards held by NEOs as at September 30, 2014:

| | | | | | | | |

|

OPTION-BASED AWARDS

|

SHARE-BASED AWARDS

|

Name

|

No. of Securities Underlying Unexercised Options

|

Option Exercise Price

|

Option

Expiration

Date

|

Value Vested

During

the

Year

|

Value of

Unexercised

In-The-Money Options (1)

|

Value of Awards Vested During the Year

|

No. of Awards That Have Not Vested

| Market Value of Awards That Have Not

Vested

|

| | | | | | | | |

Simon Ridgway

| 200,000

| $0.29

| January 7, 2020

| N/A

| N/A

| N/A

| N/A

| N/A

|

| 220,000

| $0.69

| Sept. 23, 2020

| N/A

| N/A

| | | |

| 300,000

| $0.20

| Dec. 12, 2022

| N/A

| N/A

| | | |

| 720,000

| | | | | | | |

| | | | | | | | |

Ralph Rushton

| 200,000

| $0.29

| January 7, 2020

| N/A

| N/A

| N/A

| N/A

| N/A

|

| 100,000

| $0.69

| Sept. 23, 2020

| N/A

| N/A

| | | |

| 100,000

| $0.20

| Dec. 12, 2022

| N/A

| N/A

| | | |

| 400,000

| | | | | | | |

| | | | | | | | |

Kevin Bales

| 110,000

| $0.29

| January 7, 2020

| N/A

| N/A

| N/A

| N/A

| N/A

|

| 100,000

| $0.69

| Sept. 23, 2020

| N/A

| N/A

| | | |

| 140,000

| $0.20

| Dec. 12, 2022

| N/A

| N/A

| | | |

| 350,000

| | | | | | | |

| | | | | | | | |

Note:

(1)

Calculated using the closing price of the Company’s shares on the TSX Venture Exchange (the “TSXV”) on September 30, 2014 of $0.09 less the exercise price of any in-the-money stock options.

Compensation to Directors

The following summarizes all compensation paid or payable to the Directors who were not NEOs of the Company during the fiscal year ended December 31, 2013 and the nine months ended September 30, 2014:

| | | | | | | |

Name

|

Fees

Earned

| Share-

based

Awards

| Option-

based

Awards

| Non-Equity

Incentive Plan

Compensation

|

Pension

Value

|

All Other

Compensation

|

Total

Compensation

|

| | | | | | | |

Mario Szotlender

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

|

Bradford Cooke

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

|

William Katzin

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

| Nil

|

| | | | | | | |

Note

:

(1)

For corporate development services.

Option-Based and Share-Based Awards to the Directors

The following sets forth the details of incentive stock options to purchase common shares of the Company and share-based awards held by the Directors who were not NEOs of the Company as at September 30, 2014:

| | | | | | | |

|

OPTION-BASED AWARDS

|

SHARE-BASED AWARDS

|

Name

|

No. of Securities Underlying Unexercised Options

|

Option Exercise

Price

|

Option

Expiration

Date

|

Value Vested

During

the Year

|

Value of

Unexercised

In-The-Money Options (1)

|

No. of Shares or Units of Shares That Have Not Vested

| Market or Payout Value of Share-Based Awards That Have Not Vested

|

| | | | | | | |

Mario Szotlender

| 125,000

| $0.29

| January 7, 2020

| N/A

| N/A

| N/A

| N/A

|

| 100,000

| $0.69

| Sept. 23, 2020

| N/A

| N/A

| | |

| 175,000

| $0.20

| Dec. 12, 2022

| N/A

| N/A

| | |

| 400,000

| | | | | | |

| | | | | | | |

Bradford Cooke

| 125,000

| $0.29

| January 7, 2020

| N/A

| N/A

| N/A

| N/A

|

| 100,000

| $0.69

| Sept. 23, 2020

| N/A

| N/A

| | |

| 100,000

| $0.20

| Dec. 12, 2022

| N/A

| N/A

| | |

| 325,000

| | | | | | |

| | | | | | | |

William Katzin

| 150,000

| $0.81

| July 26, 2021

| N/A

| N/A

| N/A

| N/A

|

| 200,000

| $0.20

| Dec. 12, 2022

| N/A

| N/A

| | |

| 350,000

| | | | | | |

| | | | | | | |

Note:

(1)

Calculated using the closing price of the Company’s shares on the TSXV on September 30, 2014 of $0.09 less the exercise price of any in-the-money stock options.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The only equity compensation plan which the Company has in place is its Stock Option Plan which was previously approved by the shareholders on December 10, 2013. The Stock Option Plan has been established to provide incentive to qualified parties to increase their proprietary interest in the Company and thereby encourage their continuing association with the Company. The Stock Option Plan provides that the number of common shares of the Company issuable under the Stock Option Plan, together with all of the Company’s other previously established or proposed share compensation arrangements, may not exceed 10% of the total number of issued and outstanding common shares.

The following table sets out information regarding compensation plans under which equity securities of the Company are authorized for issuance as at December 31, 2013:

| | | |

EQUITY COMPENSATION PLAN

|

Plan Category

| (a)

No. of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

| (b)

Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| (c)

No. of Securities Remaining

Available for Future Issuance

under Equity Compensation

Plans (excluding Securities

Reflected in column (a))

|

| | | |

Equity Compensation Plan

| 4,915,000

| $0.35

| 3,752,561

|

Approved by Shareholders

| | | |

| | | |

Equity Compensation Plans Not

| Nil

| N/A

| N/A

|

Approved by Shareholders

| | | |

| | | |

Total:

| 4,915,000

| $0.35

| 3,752,561

|

AUDIT COMMITTEE

Pursuant to the provisions of National Instrument 52-110 (“NI 52-110”), the Company’s Audit Committee has adopted a written charter (the “Charter”) that sets out its mandate and responsibilities. The Charter is attached hereto as Schedule “A”. As the Company is a “venture issuer” (as defined in NI 52-110), it is relying on the exemption provided to it in Section 6.1 of NI 52-110 with respect to audit committee reporting obligations.

The Audit Committee is comprised of William Katzin, Mario Szotlender and Bradford Cooke, all of whom are “independent” and “financially literate” within the meanings given to those terms in NI 52-110. The education and experience of each audit committee member that is relevant to the performance of his responsibilities as an audit committee member is as follows:

| |

Audit Committee Member

| Education and Experience

|

William Katzin

| Mr. Katzin is a graduate of the University of Cape Town, South Africa with a Bachelor of Commerce and Law degree. He is a member of the Institute of Chartered Accountants of British Columbia. He has been a partner in private practice with a Vancouver firm of Chartered Accountants since 1986 and has experience working with resource and exploration companies. He is an audit committee member of two other publicly-traded resource companies.

|

Mario Szotlender

| Mr. Szotlender holds a degree in international relations and has successfully directed Latin American affairs for numerous private and public companies over the past 20 years. He has been involved in various mineral exploration and development joint ventures (precious metals and diamonds) in Central and South America, including heading several mineral operations in Venezuela, including Las Cristinas in the 1980’s. Mr. Szotlender consults to several private exploration companies, and is a director and/or audit committee member of several other publicly-traded resource companies.

|

Bradford Cooke

| Mr. Cooke is a professional geologist with over 30 years’ experience in the mining industry. He has participated in the discovery of several mineral deposits, and has raised over $250 million in equity and joint venture financings for resource projects since 1988. Mr. Cooke received his B.Sc. Geology (Honors) degree in 1976 and a M.Sc. Geology degree in 1984. Mr. Cooke is the CEO of Canarc Resource Corp. and Endeavour Silver Corp., both of which are listed on the Toronto Stock Exchange, and is or has been an audit committee member of other publicly-traded resource companies.

|

During the Company’s most recently completed fiscal year, the Company’s auditors performed certain non-audit services. All fees charged by the Company’s auditors during the last two fiscal years are as follows:

| | |

| 2013

| 2012

|

Audit Fees

| $84,700

| $118,250

|

Audit-Related Fees (1)

| Nil

| $ 35,500

|

Tax Fees (tax return preparation)

| $10,000

| $ 8,500

|

All Other Fees (2)

| Nil

| $ 3,000

|

| $94,700

| $165,250

|

Notes

:

(1)

The Audit-Related Fees in 2012 were in connection with IFRS services.

(2)

All Other Fees in 2012 were in connection with the Company’s spin-out transaction with Rackla Metals Inc.

CORPORATE GOVERNANCE

The Board is of the view that the Company’s corporate governance practices are appropriate and effective for the Company, given its relatively small size and limited operations. The Company’s method of corporate governance allows for the Company to operate efficiently, with appropriate checks and balances that control and monitor management and corporate functions without excessive administrative burden.

Board of Directors

The Board considers William Katzin, Mario Szotlender and Bradford Cooke to be “independent” according to the definition set out in NI 52-110. Simon Ridgway is not independent as he is an executive officer of the Company.

The independent Directors believe that their majority on the Board, their knowledge of the Company’s business, and their independence are sufficient to facilitate the functioning of the Board independently of management. The independent Directors have the discretion to meet in private in the absence of the other Directors whenever they believe it is appropriate to do so.

Directorships

The directors of the Company are also directors of one or more other reporting issuers. Please see “Information Concerning the Resulting Issuer – Directors, Officers and Promoters – Other Reporting Issuer Experience” in this Circular.

Orientation and Continuing Education

Management works to ensure that any new appointee to the Board of Directors receives the appropriate written materials to fully apprise him or her of the duties and responsibilities of a director pursuant to applicable law and policy. Each new director brings a different skill set and professional background, and with this information, the Board is able to determine what orientation to the nature and operations of the Company’s business will be necessary and relevant to each new director.

Ethical Business Conduct

The Board expects management to operate the business of the Company in a manner that enhances shareholder value and is consistent with the highest level of integrity. Management is expected to execute the Company’s business plan and to meet performance objectives and goals. In addition, the Board must comply with conflict of interest provisions in Canadian corporate law, including relevant securities regulatory instruments, in order to ensure that directors exercise independent judgment in considering transactions and agreements in respect of which a director or executive officer has a material interest.

Nomination of Directors

Given the Company’s current stage of development and size of the Board, the Board is presently of the view that it functions effectively as a committee of the whole with respect to the nomination of directors. The entire Board will assess potential nominees and take responsibility for selecting new directors. The nominees are generally the result of recruitment efforts by the Board members, including both formal and informal discussions among Board members and the CEO of the Company.

Compensation Committee

The Company has established a Compensation Committee to assist the Board in discharging its oversight responsibilities relating to compensation, including the compensation of key senior management employees of the Company. The members of the Compensation Committee are William Katzin, Mario Szotlender and Bradford Cooke, all of whom are independent directors.

The Compensation Committee’s mandate is to review and make recommendations to the Board with respect to the adequacy and form of compensation and benefits of executive officers and directors, and with respect to the Company’s Stock Option Plan and the granting of options thereunder. To carry out its duties, the Compensation Committee may retain special legal, accounting, financial or other consultants to advise the Compensation Committee at the Company’s expense, and it has the sole authority to retain and terminate any executive compensation consulting firm and to approve any such firm’s fees and other retention terms.

Assessments

The Company has not determined formal means or methods to regularly assess the Board, its committees or the individual directors with respect to their effectiveness and contributions. The Board periodically reviews its own performance and effectiveness as well as the charters of its committees. Effectiveness is subjectively measured by comparing actual corporate results with stated objectives. The contributions of an individual director are informally monitored by the other Board members, having in mind the business strengths of the individual and the purpose of originally nominating the individual to the Board.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

None of the current or former directors, executive officers, employees of the Company or its subsidiaries, the proposed nominees for election to the Board, or their respective associates or affiliates, are or have been indebted to the Company or its subsidiaries since the beginning of the last completed financial year of the Company.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, no proposed nominee for election as a director of the Company, none of the persons who have been directors or executive officers of the Company since the commencement of the Company’s last completed financial year and no associate or affiliate of any of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting other than the election of directors.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

In January 2014, Medgold Resources Corp. (“Medgold”) of 200 Burrard Street, Suite 650, Vancouver, BC V6C 3L6, a company with two common directors with the Company, granted to the Company the right for 18 months to select, based on the results of Medgold’s exploration work, one of Medgold’s Portugal properties in which the Company will be granted the option to acquire a 51% interest by spending $3.0 million in exploration and development of such property over a period of three years. The Company also invested $500,000 in a private placement financing of the Company by purchasing 5.0 million units at $0.10 per unit. Each unit consisted of one common share of Medgold and one warrant to acquire an additional Medgold share at $0.15 per share exercisable for two years. This private placement was completed in February 2014. In November 2014, the exercise price of 3.0 million of the warrants was reduced to $0.11 per share, and the Company exercised such warrants at a cost of $330,000.

Other than as disclosed above, no insider, proposed nominee for election as a director, or any associate or affiliate of the foregoing, had any material interest, direct or indirect, in any transaction or proposed transaction since January 1, 2013 which has materially affected or would materially affect the Company or its subsidiaries.

PARTICULARS OF MATTERS TO BE ACTED UPON

To the knowledge of the Board, the only matters to be brought before the Meeting are those matters set forth in the accompanying Notice of Meeting, as more particularly described as follows:

Appointment and Remuneration of Auditors

The management of the Company will recommend to the Meeting to appoint BDO Canada LLP, Chartered Accountants, as auditors of the Company for the ensuing year, and to authorize the directors to fix their remuneration. Amisano Hanson were appointed auditors of the Company as of the Company’s amalgamation date of July 1, 2004. In early 2008, BDO Canada LLP acquired Amisano Hanson and continued as the Company’s auditors.

Election of Directors

The Board of Directors presently consists of four directors and it is intended to elect four Directors at the Meeting. The persons named below will be presented for election at the Meeting as management’s nominees and the persons named in the accompanying form of proxy intend to vote for the election of these nominees. Management does not contemplate that any of these nominees will be unable to serve as a director. Each director elected will hold office until the next annual general meeting of the Company or until his successor is elected or appointed, unless his office is earlier vacated in accordance with the Articles of the Company, or with the provisions of the BCBCA.

The following table sets out the names of the nominees for election as directors, where each is ordinarily resident, all offices of the Company now held by them, their principal occupations, the period of time for which each has been a director of the Company, and the number of Common shares of the Company or any of its subsidiaries beneficially owned by each, directly or indirectly, or over which control or direction is exercised, as at the date hereof.

| | | |

Name, Position and Residency (1)

| Principal Occupation (1)

| Period as a Director (since amalgamation of the Company)

| No. of Common Shares (1)

|

Simon Ridgway (2)

CEO, President & Director

British Columbia, Canada

| CEO of the Company and Chairman of Fortuna Silver Mines Inc. (mining).

| July 1, 2004 to present

| 5,757,952

|

Mario Szotlender (2) (3)

Director

Venezuela

| Independent Consultant; Director of several public mineral exploration or mining companies.

| July 1, 2004 to present

| 1,518,781

|

Bradford Cooke (2) (3)

Director

British Columbia, Canada

| CEO of Endeavour Silver Corp. (mining); Chairman of Canarc Resource Corp. (mineral exploration).

| July 1, 2004 to present

| 150,000

|

William Katzin (2) (3)

Director

British Columbia, Canada

| Chartered Accountant; Partner of Campbell Saunders & Co.

| July 27, 2011 to present

| Nil

|

Notes:

(1)

The information as to residency, principal occupation, and shares beneficially owned is not within the knowledge of the management of the Company and has been furnished by the respective nominees.

(2)

Member of the Audit Committee.

(3)

Member of the Compensation Committee.

Corporate Cease Trade Orders

As at the date of this Circular, other than as set out below, none of the persons nominated as a director of the Company is, or within the ten years prior to the date of this Circular has been, a director or executive officer of any company, including the Company, that while that person was acting in that capacity:

(a)

was the subject of a cease trade order or similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days; or

(b)

was subject to an event that resulted, after the director ceased to be a director or executive officer of the company being the subject of a cease trade order or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or

(c)

within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Two of the proposed nominees for re-election as a director, Simon Ridgway and Mario Szotlender, are directors of a corporation that, in the past 10 years, had its registration under Section 12(g) of the Securities Exchange Act of 1934 revoked by the United States Securities and Exchange Commission (“SEC”) for failure to keep its filings with the SEC up-to-date. Upon receipt of the SEC’s notice of proposed revocation, the corporation filed a settlement agreement with the SEC consenting to the revocation as the corporation was dormant at the time. This corporation filed a registration statement with the SEC in January 2015 to re-register its common shares under Section 12(g) of the U.S. Exchange Act, which became effective in March 2015. The effectiveness of such registration statement removes the prior restrictions on market participants trading the corporation’s shares in United States markets.

Bankruptcy

To the knowledge of the Company, as at the date of this Circular, none of the persons nominated as a director of the Company has, within the ten years prior to the date of this Circular, become bankrupt or made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

Penalties or Sanctions

To the knowledge of the Company, as at the date of this Circular, none of the persons nominated as a director of the Company have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority, has entered into a settlement agreement with a securities regulatory authority or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable security holder making a decision about whether to vote for the proposed director.

Stock Option Plan

As the Company’s Stock Option Plan is a rolling stock option plan, the TSXV requires that the Stock Option Plan be approved annually by the shareholders at the Company’s annual general meeting. The material terms of the Stock Option Plan are as follows:

1.

the Stock Option Plan reserves a rolling maximum of 10% of the issued capital of the Company at the time of granting of each option, with no vesting provisions other than the vesting restrictions required by the Exchange for options granted to investor relations consultants;

2.

no more than 5% of the issued capital may be reserved for issuance to any one individual in any 12 month period;

3.

no more than 2% of the issued capital may be reserved for issuance to any Consultant (as defined by the TSXV) or to an optionee providing investor relations services in any 12 month period;

4.

the minimum exercise price of an option cannot be less than the Market Price (as defined by the TSXV) of the Company’s shares;

5.

options will be granted for a period of up to ten years;

6.

options are non-assignable and non-transferable; and

7.

there are provisions for adjustment in the number of shares issuable on exercise of options in the event of a share consolidation, split, reclassification or other relevant change in the Company’s corporate structure or capitalization.

In order to re-approve the Company’s Stock Option Plan for the ensuing year, the Shareholders will be asked at the Meeting to pass an ordinary resolution in substantially the following form:

“BE IT HEREBY RESOLVED as an ordinary resolution of the Company that:

1.

the Stock Option Plan of the Company, with terms substantially as described in the information circular of the Company dated March 20, 2015, be and is hereby ratified, confirmed and approved,

2.

the directors of the Company are hereby authorized to make any changes to the Plan which may be required in order to obtain acceptance for filing by the Exchange without requiring further approval of the Shareholders; and

3.

any one director or officer of the Company is authorized and directed, on behalf of the Company, to take all necessary steps and proceedings and to execute, deliver and file any and all declarations, agreements, documents and other instruments and do all such other acts and things (whether under corporate seal of the Company or otherwise) that may be necessary or desirable to give effect to this ordinary resolution.”

The Board believes the Stock Option Plan is fair and reasonable to the Shareholders and in the best interests of the Company. Management of the Company recommends that Shareholders vote IN FAVOUR of the foregoing resolution to re-approve the Stock Option Plan. Unless such authority is withheld, the persons named in the enclosed Proxy intend to vote in favour of the foregoing resolution.

Change of Business

In light of the current state of the mineral exploration and mining sector and given the expertise and skill sets of the members of the Board of Directors and Management, the Management and Board of the Company believe that the ideal allocation of the Company’s working capital would be within the framework of a resources-focused investment company making investments in privately held and publicly traded corporations, while maintaining a limited number of mineral projects for direct exploration activities. For those reasons, the Management and Board have proposed that the Company undergo a Change of Business from a Mining Issuer to an Investment Issuer in accordance with the rules and policies of the TSXV.

The Change of Business is an “arm’s length transaction” for the purposes of the TSXV and remains subject to TSXV approval.

Investment Policy

As required by the TSXV’s listing requirements for an Investment Issuer, the Company will adopt the Investment Policy to govern the Resulting Issuer’s investment activities. The Investment Policy will provide, among other things, the investment objectives and strategy based on the fundamental principles set out below. A complete copy of the proposed Investment Policy is attached to this Circular as Appendix “B”. The final Investment Policy will be posted on the Company’s website and filed on SEDAR prior to the completion of the Change of Business.

Investment Objectives

The Resulting Issuer’s investment objectives are to seek:

a)

a high return on investment opportunities, primarily in the natural resources sector; and

b)

to preserve capital and limit downside risk while achieving a reasonable rate of return by focusing on opportunities with attractive risk to reward profiles.

The Resulting Issuer does not anticipate the declaration of dividends to Shareholders during its initial stages and plans to reinvest the profits of its investments to further the growth and development of the Resulting Issuer’s investment portfolio.

Investment Strategy

In light of the numerous investment opportunities across the entire natural resources sector, the Resulting Issuer aims to adopt a flexible approach to investment targets without placing unnecessary limits on potential returns on its investment. This approach is demonstrated in the Resulting Issuer’s proposed investment strategy set out below.

| |

Investment Sector:

| Natural resources industry. All commodities that can be classified as natural resources may be considered for investment purposes, including, but not limited to, minerals, metals, petroleum, forestry and industries that derive their value from natural resources, such as power generation, and technologies that are used in the natural resources sector such as drilling and surveillance.

|

| |

Investment Types:

| Equity, debt, royalties, income and commodity streams, derivatives and any other investment structures or instruments that could be acquired or created.

|

| |

Commodities:

| All commodities that comprise natural resources. Such commodities may include, but are not limited to, precious metals, base metals, ferrous metals, nonferrous metals, industrial metals, non-industrial metals, agricultural minerals, industrial minerals, other minerals, oil, gas, water and forestry products.

|

| |

Jurisdictions:

| All countries are permissible depending on the risk assessment of the Board and Management at the time the investment is made and the risk-reward relationship associated with each investment in a particular jurisdiction.

|

| |

Investment Size:

| Unlimited, which may result in the Resulting Issuer holding a control position in a target corporation or possibly requiring future equity or debt financings to raise money for specific investments.

|

| |

Investment Timeline:

| Not limited.

|

| |

Investment Targets:

| Direct property investments either through outright purchase of a property or acquiring an option to earn an interest in a property, or through a derivative interest such as a royalty, stream or other derivative facility.

Investments in public or private corporations, partnership or other legal entities which own, or propose to own, natural resource assets or derivatives of natural resource assets.

Distressed situations where a change of management or other restructuring is required to realize the value of the asset.

|

| |

Investment Review:

| Will seek to maintain the ability to actively review and revisit all of investments on an ongoing basis.

|

| |

Liquidity:

| Will evaluate the liquidity of investments and seek to realize value from same in a prudent and orderly fashion.

|

Composition of Investment Portfolio

The nature and timing of the Resulting Issuer's investments will depend, in part, on available capital at any particular time and the investment opportunities identified and available to the Resulting Issuer.

Subject to the availability of capital, the Resulting Issuer intends to create a diversified portfolio of investments. The composition of its investment portfolio will vary over time depending on its assessment of a number of factors including the performance of financial markets and credit risk.

Investments

The Company’s current investments consist of:

·

2,826,394 common shares of B2Gold Corp.;

·

1,007,406 common shares of Focus Ventures Ltd.;

·

8,000,000 common shares and warrants to purchase an additional 2,000,000 common shares of Medgold Resources Corp.;

·

9,866,375 common shares of Rackla Metals Inc.; and

·

$800,000 advance to Southern Silver Exploration Corp. (“Southern Silver”), convertible, subject to approval by the shareholders of Southern Silver, into a maximum of 16,000,000 common shares of Southern Silver,

all of which are public companies. Future investments by the Resulting Issuer will not be subject to TSXV approval unless it is a non-arm’s length transaction, involves the issuance of securities by the Resulting Issuer, or involves more than 50% of the Resulting Issuer’s working capital or management time.

In order to approve the Change of Business, the Shareholders will be asked at the Meeting to pass an ordinary resolution in substantially the following form:

“BE IT HEREBY RESOLVED as an ordinary resolution that:

1.

the change of business of the Company from a “Mining Issuer” to an “Investment Issuer”, as those terms are used in the policies of the TSX Venture Exchange (“TSXV”), as more particularly described in the Company’s information circular dated March 20, 2015, be and is hereby ratified, confirmed and approved;

2.

the Company’s investment strategy and policy may be amended from time to time in order to satisfy the requirements or requests of the TSXV without requiring further approval of the shareholders of the Company; and

3.

any one director or officer of the Company is authorized and directed, on behalf of the Company, to take all necessary steps and proceedings and to execute, deliver and file any and all declarations, agreements, documents and other instruments and do all such other acts and things (whether under corporate seal of the Company or otherwise) that may be necessary or desirable to give effect to this ordinary resolution.”

The Board believes the Change of Business is in the best interests of the Company. Management of the Company recommends that Shareholders vote IN FAVOUR of the foregoing resolution to approve the Change of Business. Unless such authority is withheld, the persons named in the enclosed Proxy intend to vote in favour of the foregoing resolution.

Other Matters

Management of the Company knows of no matters to come before the Meeting other than those referred to in the Notice of Meeting accompanying this Circular. However, if any other matters properly come before the Meeting, it is the intention of the persons named in the form of proxy accompanying this Circular to vote on any such matters in accordance with their best judgment of such matters.

INFORMATION CONCERNING THE RESULTING ISSUER

The following describes the current business of the Company and the proposed business of the Resulting Issuer after completion of the Change of Business, and should be read together with (i) the audited consolidated financial statements of the Company for the fiscal years ended December 31, 2013, 2012 and 2011 (the “Annual Financial Statements”) attached as Appendix “C” and “D” to this Circular; (ii) the amended unaudited condensed interim consolidated financial statements of the Company for the nine months ended September 30, 2014 and 2013 (the “Interim Financial Statements”) attached as Appendix “E” to this Circular; (iii) the management’s discussion and analysis of the Company for the fiscal year ended December 31, 2013 (the “Annual MD&A”) attached as Appendix “F” to this Circular; and (iv) the amended management’s discussion and analysis for the nine months ended September 30, 2014 (the “Interim MD&A”) attached as Appendix “G” to this Circular; as well as other documents which are available under the Company’s profile on SEDAR at www.sedar.com.

Corporate Structure

Name and Incorporation