UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|X| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal year ended December 31, 2008

or

|_| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from ________________ to ___________________________

Commission file number 000-20936

Jade Art Group, Inc.

(Exact name of registrant as specified in its charter)

Nevada 71-1021813

State or other jurisdiction of (I.R.S. Employer Identification No.)

incorporation or organization

|

#35, Baita Zhong Road,

Yujiang County, Jiangxi Province, P.R. of China 335200

(Address of principal executive offices) (Zip Code)

(646) 200-6328

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

------------------- -----------------------------------------

None

|

Securities registered pursuant to section 12(g) of the Act:

Title of each class Name of each exchange on which registered

------------------- -----------------------------------------

None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. Yes |_| No |X|

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes |_| No |X|

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes |X| No |_|

Indicate by check mark whether the registrant has submitted electronically and

posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T ( 229.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes |_| No |_|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K (ss. 229.405 of this chapter) is not contained herein, and

will not be contained, to the best of registrant's knowledge, in definitive

proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K |_|

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of "large accelerated filer," "accelerated filer," and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer |_| Accelerated filer |_|

Non-accelerated filer |X| Smaller reporting company |_|

Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes |_| No |X|

As of June 30, 2008, the aggregate market value of the common stock of the

registrant held by non-affiliates (excluding shares held by directors, officers

and others holding more than 10% of the outstanding shares of the class) was

$86,177,687.9 based upon a closing sale price of $1.85 on the Over the Counter

Bulletin Board.

As of May 18, 2009, the registrant had outstanding 79,980,000 shares of common

stock.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

Item 1. Business 2

Item 1A. Risk Factors 18

Item 2. Properties 19

Item 3. Legal Proceedings 19

Item 4. Submission of Matters to a Vote of Security Holders 19

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities 20

Item 6. Selected Financial and Other Data 22

Item 7. Management's Discussion and Analysis of Financial Condition and

Results of Operations 22

Item 7A. Quantitative and Qualitative Disclosures About Market Risk 28

Item 8. Financial Statements and Supplementary Data 28

Item 9. Changes in and Disagreements With Accountants on Accounting and

Financial Disclosure 58

Item 9A. Controls and Procedures 58

Item 9B. Other Information 59

PART III

Item 10. Directors, Executive Officers and Corporate Governance 59

Item 11. Executive Compensation 62

Item 12. Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters 66

Item 13. Certain Relationships and Related Transactions, and

Director Independence 67

Item 14. Principal Accounting Fees and Services 68

PART IV

Item 15. Exhibits and Financial Statement Schedules 70

Signatures 72

|

Item 1. Business.

Introduction

Jade Art Group, Inc. is a seller and distributor in China of raw jade,

ranging in uses from decorative construction material for both the commercial

and residential markets to high-end jewelry. For more than 30 years, the

Company's business consisted of manufacturing and selling hand and

machine-carved wood products, such as furniture, architectural accents and

Buddhist figurines in China. Commencing in 2007, we experienced a reduction of

revenue from our woodcarving business, which largely resulted from increased

competition. As a result, we decided to dispose of our wood products business

and to enter the business of raw jade sales and distribution, which management

believed presented a better long-term growth potential. On January 11, 2008, we

formed a new wholly-owned Chinese subsidiary, JiangXi SheTai Jade Industrial

Company Limited, to engage in the sale and distribution of raw jade throughout

China. Our goal is to meet China's increasing demand for jade and to eventually

vertically integrate our raw jade distribution activities with jade processing,

carving, polishing, and, at a later date, retail sales.

The Company currently operates in one segment.

Our Corporate History

The financial statements presented are those of Jade Art Group, Inc.

(formerly Vella Productions, Inc.) ("the Company") which was incorporated under

the laws of the State of Nevada on September 30, 2005.

On October 1, 2007, Vella Productions Inc., the former registrant, entered

into an agreement and plan of merger with its wholly-owned subsidiary, VLLA

Merger Sub, Inc., and each of Guoxi Holding Limited ("GHL"), Hua-Cai Song,

Fu-Lan Chen, Mei-Ling Chen, Chen-Qing Luo, Mei-Qing Zhang, Song-Mao Cai,

Shenzhen Hua Yin Guaranty & Investment Company Limited, Top Good International

Limited, Total Giant Group Limited, Total Shine Group Limited, Sure Believe

Enterprises Limited, Think Big Trading Limited, Huge Step Enterprises Limited

and Billion Hero Investments Limited (the "Merger Agreement").

Pursuant to the Merger Agreement, GHL merged with VLLA Merger Sub, Inc,

with GHL as the surviving entity. As a result of the Merger Transaction, GHL

became a wholly-owned subsidiary of the Registrant, which, in turn, made the

Registrant the indirect owner of the operating company subsidiary of GHL,

Jiangxi XiDa (formerly known as Jiangxi Xi Cheong Lacquer, Inc.). Under the

Merger Agreement, in exchange of surrendering their shares in GHL, the GHL

Shareholders received an aggregate of (i) 68,900,000 newly-issued shares of the

Registrant's common stock, par value $.001 per share (the "Common Stock") and

(ii) $14,334,500, in the form of promissory notes payable on or before the first

year anniversary of the Merger Transaction. Consideration was to be distributed

pro ratably among the GHL Shareholders in accordance with their respective

ownership interests in GHL immediately before the completion of the Merger

Transaction.

The acquisition has been accounted for as a recapitalization and,

accordingly, these financial statements represent historical operations of

Jiangxi XiDa and the capital structure of the former Vella Productions, Inc.

-2-

On November 8, 2007, the Company amended and restated its articles of

incorporation to reflect Jade Art Group, Inc. as its new corporate name and,

shortly thereafter, commenced operations as a distributor and seller of raw jade

sourced from the SheTai Jade Mine owned by Wulateqianqi XiKai Mining Co., Ltd.

("XiKai Mining").

The Company's Exclusive Distribution Agreement with XiKai Mining

On January 17, 2008, the Company entered into an Exclusive Distribution

Rights Agreement (the "Exchange Agreement") with XiKai Mining. Under the

Exchange Agreement, XiKai Mining committed to sell to the Company 90% of the raw

jade material produced from its SheTai Jade mine, located in Wulateqianqi,

China, for a period of 50 years (the "Exclusive Rights"). In exchange for these

Exclusive Rights, the Company agreed to pay XiKai Mining RMB 60 million

(approximately $8.7 million) by March 31, 2009 and, to transfer to XiKai Mining

100% of our ownership interest in all of the Company's woodcarving operations,

which were contained in Jiangxi XiDa. This transfer of Jiangxi XiDa was made on

February 20, 2008.

XiKai Mining is the Company's sole source for raw jade. Under the Exchange

Agreement, the price for the raw jade material has been set for the first five

years at RMB 2000 (approximately $285) per metric ton, and is subsequently

subject to renegotiation every five years with adjustments not to exceed 10%. A

chart summarizing the material terms of the Exchange Agreement is set forth

below:

Parties to the Agreement: (a) GHL and its wholly owned subsidiary Jiangxi

SheTai Jade Industrial Co., Ltd. ("STJ")

(b) XiKai Mining

Exclusive Commitment: XiKai Mining committed to sell to the Company

up to 90% of the raw jade material produced in

the SheTai Jade mine

Term of Agreement: 50 years

Cost of Agreement: The Company agreed to pay to XiKai Mining RMB

60 million (approximately $8.8 million on the

date of the agreement) by 3/31/09. This amount

was paid on 3/1/08. The Company also agreed to

transfer to XiKai Mining 100% ownership of the

wholly owned Jiangxi XiDa Wooden Carving

Lacquerware Co., Ltd. The transfer was

completed on 2/20/08 and the agreement was

finalized on 3/10/08.

Commitment to Purchase: If the Company so requests, XiKai Mining

committed to provide 40,000 tons of annual jade

production.

Minimum Obligation The Company is not obligated to purchase any

specified amount of jade.

Average Cost / Ton: The Company's average cost will not exceed RMB

2,000 per ton (approximately $285 on the date

of the Exchange Agreement). This cost will be

renegotiated every five years with a maximum

increase, in any, of 10% on each adjustment.

Failure to Perform: XiKai Mining must pay to the Company RMB 18,000

(approximately $2,500 at the date of the

Exchange Agreement) for each ton below 40,000

ordered by the Company but not delivered.

|

-3-

Miscellaneous Terms: o XiKai Mining may not sell the remaining

10% of SheTai output at less than the agreed

upon price with the Company.

o The Exchange Agreement may only be

terminated by the consent of the Company and

XiKai.

o The agreement is subject to the laws of

the People's Republic of China ("PRC"),

where any dispute will be resolved through

arbitration.

|

Jade from the SheTai Mine

The SheTai Jade mine commenced operation in 2002 and is estimated to have

an annual operating capacity of approximately 40,000 tons by 2009. It has one of

the largest jade reserves in China. According to a survey report issued by the

Inner Mongolia Geological Institution, the mine has proven and probable reserves

of approximately six million tons. The SheTai Jade mine's reserves are unique,

in that they include some of the oldest (formed approximately 1.8 billion - 2.4

billion years ago) jade ore found in China and are considered to be of the

highest quality in terms of rigidity and relative size of its pieces.

There are two types of jade: nephrite and jadeite. Jadeite's rarity,

higher degree of hardness and vivid colors have made it better known and more

expensive than nephrite. The SheTai Jade mine, in the mountain ranges of Inner

Mongolia, China, contains the jadeite variety of jade. The jade from the SheTai

mine is stainless, non-corrosive, non-weathering and does not fade. In addition,

SheTai Jade is abrasion resistant, smooth and highly reflective. The green is

pure and the gems are translucent, with a glassy luster. SheTai Jade is as hard

as quartz, with a degree of hardness between 7.1 and 7.3 on the Mohs scale,

which is much higher than that of most jade. As a result of such

characteristics, SheTai Jade has a broad spectrum of applications, ranging from

commercial and residential construction, and decorative jade artwork to

intricately carved jade jewelry.

SheTai Jade Mine is located in Inner Mongolia, China's northern border

autonomous region. The location of the SheTai Jade mine is noted by the tan

shading in the map below. The star on the map denotes the capital, Beijing.

[GRAPHIC OMITTED]

-4-

Uses for SheTai Jade

Jade has varied applications, ranging from jewelry to construction and

furniture manufacturing. Asians and, predominantly, the Chinese have a long

history of jade usage in jewelry and craftwork. The Chinese tradition of using

jade and the belief that jade protects its owners from evil has made it a

popular stone. Thus, jade is not merely valued as a commodity, but also as a

good luck charm for its owner. Jade's popularity has led to considerable demand

and has helped in commanding high prices.

Our jade has a wide range of applications due to its unique

characteristics, broadening the potential customer base of the Company. Raw jade

has the following four major applications:

o As construction material such as tiles, mosaic, and cobblestone;

o In making sculptures and large-scale statues like Buddha figures,

garden architecture, political leaders and corporate founder

statues;

o In furniture and home furnishings such as lamps, countertops and

kitchenware;

o In jewelry items (In spite of jewelry being the most common use of

jade, the volume demanded in this segment is not substantial

compared to potential commercial applications. The quantity required

in jewelry markets is also highly cyclical. However, delicate

artwork and jewelry command higher margins, which compensates for

lower unit volumes.)

Raw jade, which is used in furniture and construction materials, costs

around $3 per kilogram, while the purest form, used most commonly in jewelry

after considerable processing, is as expensive as $85-$100 per gram. The stone's

pricing is mainly dependent on factors like purity, color, hardness, clarity and

rarity of particular genres of the stone.

The Company is promoting the usage of its SheTai brand jade in the

construction of high-end hotel, temples, restaurants, government and corporate

buildings as well as in home decor. The Company is also positioning SheTai Jade

as an alternative for marble and granite.

Customers of the Company

We commenced the distribution and sale of raw jade in January 2008. During

the quarter ended March 31, 2008, we entered into five contracts for the sale of

raw jade to customers in China. During the quarter ended June 30, 2008, the

Company entered into one additional contract with an existing customer. The

total value of these contracts is estimated to be $42 million. Each contract

obligated the customer to purchase a specified amount of raw jade within a

specified amount of time ranging from six to twelve months. We have not entered

into any new contracts since June 30, 2008.

The Company began shipments on February 1, 2008 and had distributed 9,330

tons as of December 31, 2008. As of the filing of this report, four of our six

contracts have been completed in full. Contracts with QuanZhou TianXia HuiCui

Jade Company Ltd. ("QZTX") for the purchase of 1,260 tons of raw jade and Putian

Licheng Qiyushengshi Co. ("QYSB") for the purchase of 2,490 tons of raw jade

remain outstanding. However, as a result of the adverse impact of the downturn

in the Chinese economy on these customers, the Company has informally agreed to

extend the period in which the customers must fulfill their purchase obligations

to a date to be mutually agreed upon in the future.

-5-

These contracts have been negotiated with sub-distributors and processors

who in turn sell jade to the artisans responsible for crafting the final

products. There are approximately 150,000 jade-carving factories in China. The

province in which our customer, QZTX, operates is home to over 1,000 large jade

carving and processing factories, generating over $1.5 billion in annual

production. PuTian City, home to our customer, QYSB, contains 1,000 jade and

jewelry companies with annual production of $2 billion.

Our major customers include the following:

Percentage of

Customer Revenues in 2008

-------- ----------------

Shenzhen Hongda Artcraft Co. 23%

Quanzhou Tianxia Huicui Jade Co. 21%

Suzhou Cuiping Jade Co. 21%

Putian Licheng Qiyushengshi Co. 18%

|

All of our sales of SheTai Jade to date are to customers located in China.

However, the Company intends to solicit customers elsewhere in Asia.

The Company's Jade Distribution Agreements

Our contracts require customers to purchase specified amounts raw jade

over periods ranging from six months to one year at times which are at the

discretion of the customer. Xikai Mining mines the raw jade and prepares it for

pick-up by the Company's customers at a warehouse which Xikai Mining maintains

near its She Tai Jade mine. The customer is responsible for the shipment of the

jade, including the cost of shipment.

The customers inspect the jade after delivery and make a determination as

to whether to accept such jade. Jade can only be returned to the Company in the

event that there are issues related to its quality. No customer has ever

returned jade to the Company due to quality issues or any other reasons.

Our contracts for the sale of raw jade generally provide that the Company

will receive 30% of the contracted value of the order before shipment. The

balance is then due after shipment, within 10 days after customer's inspection

and acceptance of the jade. However, the Company's customers generally have,

instead, paid the balance within 45 days after shipment.

The table below summarizes details regarding the Company's contracts with

the following customers (i) GuangFuGuoXiang Jade ("GFGX"), (ii) YangZhou GuoCui

Jade ("YZGC"); (iii) ShenZhen HongDa Craftwork Ltd. ("SZHD"), (iv) QuanZhou

TianXiaHuiCui Jade Company Ltd. ("QZTX"), and (v) Putian Licheng Qiyushengshi

Co. ("QYSB").

Business and Marketing Strategy

The Company currently employs sales personnel to market its jade to

potential customers throughout China. We market our jade based on its excellent

quality and special characteristics which allow it to be used for varied

purposes including as construction materials.

Competition

The Chinese jade industry is spread among a large number of companies

including Zheng Dong Jade Co., Xin Jiang Lao Shan, He Tian Jade Co. and Leung

Jade Co., Ltd. The industry is highly fragmented and consists of mostly private

companies, making detailed information difficult to uncover. We also compete

generally with distributors of other construction materials and gemstones

throughout China.

-6-

We compete directly with other distributors of jade on the basis of

quality and price. We compete with distributors of other materials on the basis

of the unique characteristics of SheTai jade (e.g. color, hardness, durability

and beauty) and also on price.

Order Backlog

We do not maintain any inventory. XiKai Mining maintains an inventory of

raw jade in its warehouse and fills our orders promptly after receipt.

Accordingly we do not have an order backlog.

Seasonality

The Company is generally not affected by seasonality. The only seasonal

affect on our business could be a delay of shipments from the SheTai Mine in the

winter if the road leading from the mine becomes inoperable due to extremely

heavy snow.

Intellectual Property

Except for certain trade secrets and unregistered trade names, the Company

currently has no trademarks, copyrights, patents or other intellectual property.

Research and Development

The Company has incurred no costs related to research and development over

the last three years.

Employees

The Company has approximately 38 full time employees, including 29 who

work in sales and 4 in administration. We believe that relations with our

employees are good.

-7-

1A. Risk Factors.

The following are risks associated with our Company and business

operations. If any of these risks were to develop into actual events, our

business, financial condition or results of operations could be materially

adversely affected and the trading price of our common stock could decline

significantly. Our business activities are subject to various risks and

uncertainties, including the following:

Risk Related to the Company Business and Industry

Senior management has not operated in any aspect of the jade industry before,

and there is no guarantee that we will be able to do so successfully.

Our senior management has no operating history on which an evaluation of

our business and prospects in the jade industry can be made. Accordingly, the

likelihood of our success must be considered in the light of the problems,

expenses, difficulties, complications and delays frequently encountered by

companies in early stages of development. Such risks generally include, but are

not necessarily limited to, the failure to develop or profitably exploit markets

for the sale of the jade; the failure of our current supplier to supply adequate

quantities of jade to allow us to operate profitably notwithstanding our

agreement; the failure to raise sufficient funds to acquire businesses we may

identify to facilitate obtaining new suppliers of jade production, or to

actually acquire any such businesses which we may so identify for which we may

have raised sufficient funds, or to successfully integrate any such business

which we may actually acquire; the failure to anticipate and adapt to developing

markets and/or to new governmental regulations or domestic or foreign trade

restrictions; the failure to successfully compete against current or new

competitors in the markets in which we compete; the rejection of our products by

our customers; and the failure to successfully complete any of our business

goals on a timely basis.

Our cash flow depends heavily on the market price for jade.

The cash flow and profitability of our current operations are

significantly affected by the market price of jade that is affected by numerous

factors beyond our control. Specifically, the prices for jade may be affected by

the type and amount of commercial and residential construction in the People's

Republic of China (PRC) and elsewhere, for which construction jade such as ours

is used; and the prices for gem quality jade depend on market demand, which is

also beyond our control. Factors that could cause such volatility include, among

other things: conditions or trends in the mining industries and governmental

regulations that affect such industries; changes in the market valuations of

other companies against whom we compete; general market and economic conditions

domestically and worldwide; general trade restrictions imposed by various

countries; and political events, including actions by the PRC government which

could delay shipment of our products and could have a materially adverse effect

on our operating results and financial condition, as well as international

reaction to political and economic events and developments in the PRC.

Changes in consumer preferences could reduce the demand for jade.

Although demand and prices for jade have been relatively strong in recent

years, we are unable to predict future demand and prices, and cannot provide any

assurance that current levels of demand and prices will continue or that any

future increases in demand or price can be sustained. Any change in the

preferences of consumers could reduce the demand for jade. Failure to anticipate

and respond to changes in consumer preferences and demands could lead to, among

other things, customer dissatisfaction, failure to attract demand for our jade,

loss of contracts with our third party distributors and lower profit margins.

-8-

The economic downturn in China could continue to reduce demand for our product.

The Chinese economy has experienced a slowing growth rate due to a number

of factors, including but not limited to instability in the global financial

markets, the appreciation of the RMB, and economic and monetary policies adopted

by the Chinese government aimed at preventing overheating of the Chinese economy

and inflation. We have been affected by the economic downturn and continue to be

affected. The use of jade is a luxury product that is not a necessity. In the

current economic downturn, people are less willing to purchase luxuries such as

products made of jade. Consequently, the demand for our product has suffered and

will continue to suffer. We cannot predict how long the downturn will last, the

timing of any subsequent recovery, or how much of an impact the downturn will

have on our business and operating results.

In 2008, we depended on revenues from six customers, and any loss, cancellation,

reduction, or interruption in these relationships could harm our business.

In 2008, we derived all of our revenue from only six customers. Of the six

customer contracts, four have been completed in full. We are not certain as to

when or how much jade the remaining two customers will require. If sales to such

customers were terminated or significantly reduced, our revenues and net income

could significantly decline. Our success will depend on our continued ability to

develop and manage relationships with our customers. Any adverse change in our

relationship with our customers may have a material adverse effect on our

business. Although we are attempting to expand our customer base, we expect that

our customer concentration will not change significantly in the near future. We

cannot be sure that we will be able to retain our customers or that we will be

able to attract additional customers or that our customers will continue to buy

our products in the same amounts as in prior years. The loss of one or more of

our customers, any reduction or interruption in sales to these customers, our

inability to successfully develop relationships with additional customers or

future price concessions that we may have to make could significantly harm our

business.

We face significant actual and potential competition for our products.

We must compete in a market with companies that have significantly greater

experience and history in the jade industry, have resources greater than ours

and have established business relationships and distribution channels better

developed than ours. We will compete with numerous jade suppliers worldwide,

many of whom possess substantially greater financial and other resources than

us, including experience and the ability to leverage economies of scale and to

sell products competitive with ours at a price more attractive to our

purchasers, and who have established reputations in the markets in which we will

compete. There can be no assurance that our products could compete effectively

with such competitors.

We also compete with other stone distributors, including distributors of

granite, marble, limestone, travertine and other natural stones. Additionally,

we compete with manufacturers of so-called "engineered stone" as well as

manufacturers of other building materials like concrete, aluminum, glass, wood

and other materials. We compete with providers of these materials on the basis

of price, availability of supply, end-user preference for certain colors,

patterns or textures, and other factors.

-9-

We currently rely on a single jade supplier for our raw jade, and we may lose

sales if our supplier fails to meet our needs.

We have a distribution agreement with XiKai Mining whereby it has agreed

to sell to us 90% of the jade it produces from its SheTai Jade Mine which

represents our sole source of jade. There can be no assurance that we will be

able to find other supplies should that become necessary, and there can be no

guarantee that it will not become necessary.

We may not be able to enforce our agreement with XiKai Mining.

We are wholly dependent on XiKai Mining for our jade. There is no

guarantee that XiKai Mining will choose to continue to honor its agreement or

that we would be able to enforce our agreement in the Chinese courts if it were

necessary to do so. Even if the courts are available to us, the costs of

litigation could be substantial and the results uncertain.

Our supplier could be unable to meet our needs.

There can be no assurance that XiKai Mining will be able to continue to

successfully produce and distribute to us sufficient jade to enable us to

realize anticipated profits. Even if XiKai Mining desires to meet our needs it

could be unable to do so because of events beyond its control, including, but

not limited to: geological events, such as an earthquake, that disrupts or makes

temporarily or permanently impossible the continued exploitation of XiKai

Mining's mines; a loss of necessary government permits or unanticipated adverse

governmental regulation of jade production; labor unrest; equipment failures,

accidents and work injuries, a deterioration in the quality of the jade at

XiKai's mine or economic events that result in XiKai Mining's inability to mine

or supply jade.

The mine is concentrated in one geographic region, which could cause it to be

impacted by regional events.

The jade that we distribute is located exclusively in the She Tai Jade

Mine in Inner Mongolia. Because of this geographic concentration, local or

regional events, such as natural disasters, may increase costs, reduce

availability of equipment or supplies, reduce demand or limit production. As a

result, any such event may impact our gross profit from our jade.

We will face strong competition from other companies should we ever need or

desire to establish a new or additional supplier of jade.

We may need or otherwise desire to replace and/or expand our supplies

through the negotiation of new agreements with XiKai Mining and/or other

producers. There can be no assurance that we will be able to negotiate any such

agreement, or that if we do we will be able to negotiate such an agreement on

terms that are favorable to us, or even if we do negotiate favorable terms that

any such agreement will not also be subject to the same risks as our current

agreement with XiKai Mining described elsewhere herein. In addition, there is a

limited supply of desirable mining lands available in the PRC and elsewhere

where exploration, mining and/or production activities may be conducted. Because

we could face strong competition from other companies for favorable distribution

agreements with companies that mine and supply raw jade, some of whom may be

able to leverage greater economies in negotiating distribution arrangements than

we are, we may be unable to adequately replace or supplement the desired supply

arrangement that we currently have with XiKai Mining.

The mining industry in the PRC also has drawbacks that the mining industry does

not have within the United States.

The mining industry in the PRC also has drawbacks that the mining industry

does not have within the United States. For instance:

-10-

In China, insurance coverage is a relatively new concept compared to that

of the United States and for certain aspects of a business operation insurance

coverage is restricted or expensive. Workers' compensation for employees in the

PRC may be unavailable or, if available, insufficient to adequately cover such

employees.

The environmental laws and regulations in the PRC set various standards

regulating certain aspects of health and environmental quality, including, in

some cases, the obligation to rehabilitate current and former facilities and

locations where operations are or were conducted.

Violation of such standards could result in a temporary or permanent

restriction by the PRC of the mining operations of XiKai Mining and could

negatively impact our business.

Our expanding operations risk.

We may not be able to manage our expanding operations effectively. We

anticipate significant continued expansion of this business as we address market

opportunities and growth in our customer base. To manage the potential growth of

our operations and personnel, we will need to improve operational and financial

systems, procedures and controls, and expand, train and manage our growing

employee base. We cannot assure you that our current and planned personnel,

systems, procedures and controls will be adequate to support our future

operations. There can be no assurance that new management will be able to

properly manage the direction of our Company or that any intended change in our

business focus will be successful. If our management fails to properly manage

and direct our Company, our Company may be forced to scale back or abandon our

existing operations, which could cause the value of our shares to decline.

We may be unsuccessful in any future strategy to acquire complementary

businesses or expand into carving, processing, and retail sale of jade.

Our potential business strategy in the future includes expanding our

business capabilities through both internal growth and the acquisition of

complementary businesses related to the carving processing and retail sale of

jade. We may be unable to find additional complementary businesses to acquire or

we may be unable to enter into additional agreements in order to expand our

current business.

Completion of future acquisitions also would expose us to potential risks,

including risks associated with:

o the assimilation of new operations, technologies and personnel;

o unforeseen or hidden liabilities;

o the diversion of resources from our existing businesses;

o the inability to generate sufficient revenue to offset the costs and

expenses of acquisitions; and

o the potential loss of, or harm to relationships with, employees,

customers and suppliers as a result of the integration of new

businesses.

Our brand and reputation may be harmed by counterfeit jade products.

The jade markets in China and elsewhere in Asia are tainted by counterfeit

products, the presence of which has the potential to create a negative impact on

the price of raw jade. Any counterfeit jade products could damage the SheTai

Jade brand and could adversely impact the perception of customers of jade.

-11-

Estimates of our future revenues and operating results are subject to inherent

uncertainties.

Our short operating history and the rapidly changing nature of the markets

in which we compete make it difficult to accurately predict our revenues and

operating results. Furthermore, our revenues and operating results may fluctuate

in the future due to a number of factors, including the following:

o the introduction of competitive products by different or new

competitors;

o reduced demand for raw jade;

o increased or uneven expenses, whether related to sales and

marketing, product development or administration;

o deferral of recognition of our revenue in accordance with applicable

accounting principles due to the time required to complete projects;

and

o costs related to the expansion of the Company's business into

related activities whether through acquisition or otherwise.

Due to these factors, predictions may not be achieved, either because expected

revenues do not occur or because they occur at lower prices or on terms that are

less favorable to us. In addition, these factors increase the chances that our

results could be lower than the expectations of investors and analysts. If so,

the market price of our stock would likely decline.

Risks related to doing business in China.

Adverse changes in economic and political policies of government of the

PRC could have a material adverse effect on the overall economic growth of PRC,

which could adversely affect our business. Because our operations are all

located outside of the United States and are subject to Chinese laws, any change

of Chinese laws may adversely affect our business and results of operations.

As all of our existing operations are located in the PRC, this exposes us

to risks, such as exchange controls and currency restrictions, currency

fluctuations and devaluations, changes in local economic conditions, changes in

Chinese laws and regulations, exposure to possible expropriation or other

Chinese government actions, and unsettled political conditions. These factors

may have a material adverse effect on our business, results of operations and

financial condition.

The PRC's economy differs from the economies of most developed countries

in many respects, including with respect to the amount of government

involvement, level of development, growth rate, control of foreign exchange and

allocation of resources. While the PRC's economy has experienced significant

growth in the past 20 years, growth has been uneven across different regions and

among various economic sectors of China. The government of the PRC has

implemented various measures to encourage economic development and guide the

allocation of resources. Some of these measures benefit the overall PRC economy,

but may also have a negative effect on us. For example, our financial condition

and results of operations may be adversely affected by government control over

capital investments or changes in tax regulations that are applicable to us.

Since early 2004, the PRC government has implemented certain measures to control

the pace of economic growth. Such measures may cause a decrease in the level of

economic activity in China, which in turn could adversely affect our results of

operations and financial condition.

-12-

We face risks associated with currency exchange rate fluctuation, any adverse

fluctuation may adversely affect our anticipated operating margins.

Although we are incorporated in the United States, all of our current

revenues are in Chinese currency. Conducting business in currencies other than

US dollars subjects us to fluctuations in currency exchange rates that could

have a negative impact on our operating results reported in US dollars.

Fluctuations in the value of the US dollar relative to the Renminbi could impact

our revenue, cost of revenues and operating margins. Historically, we have not

engaged in exchange rate hedging activities. Although we may implement hedging

strategies to mitigate this risk, these strategies may not eliminate our

exposure to foreign exchange rate fluctuations and involve costs and risks of

our own, such as ongoing management time and expertise, external costs to

implement the strategy and potential accounting implications.

The Chinese legal and judicial system may negatively impact foreign investors.

In 1982, the National People's Congress amended the Constitution of China

to authorize foreign investment and guarantee the "lawful rights and interests"

of foreign investors in China. However, China's system of laws is not yet

comprehensive. The legal and judicial systems in China are still rudimentary,

and enforcement of existing laws is inconsistent. Many judges in China lack the

depth of legal training and experience that would be expected of a judge in a

more developed country. Because the Chinese judiciary is relatively

inexperienced in enforcing the laws that do exist, anticipation of judicial

decision-making is more uncertain than would be expected in a more developed

country. It may be impossible to obtain swift and equitable enforcement of laws

that do exist, or to obtain enforcement of the judgment of one court by a court

of another jurisdiction. China's legal system is based on written statutes; a

decision by one judge does not set a legal precedent that is required to be

followed by judges in other cases. In addition, the interpretation of Chinese

laws may be varied to reflect domestic political changes. The promulgation of

new laws, changes to existing laws and the pre-emption of local regulations by

national laws may adversely affect foreign investors. However, the trend of

legislation over the last 20 years has significantly enhanced the protection of

foreign investment and allowed for more control by foreign parties of their

investments in Chinese enterprises. There can be no assurance that a change in

leadership, social or political disruption, or unforeseen circumstances

affecting China's political, economic or social life, will not affect the

Chinese government's ability to continue to support and pursue these reforms.

Such a shift could have a material adverse effect on the Company's business and

prospects.

The practical effect of the PRC legal system on our business operations in

China can be viewed from two separate but intertwined considerations. First, as

a matter of substantive law, the Foreign Invested Enterprise laws provide

significant protection from government interference. In addition, these laws

guarantee the full enjoyment of the benefits of corporate articles and contracts

to Foreign Invested Enterprise participants. These laws, however, do impose

standards concerning corporate formation and governance, which are not

qualitatively different from the general corporation laws of the several states.

Similarly, the PRC accounting laws mandate accounting practices, which are not

consistent with U.S. Generally Accepted Accounting Principles. China's

accounting laws require that an annual "statutory audit" be performed in

accordance with PRC accounting standards and that the books of account of

Foreign Invested Enterprises are maintained in accordance with Chinese

accounting laws. Article 14 of the PRC Wholly Foreign-Owned Enterprise Law

requires a Wholly Foreign-Owned Enterprise to submit certain periodic fiscal

reports and statements to designate financial and tax authorities, at the risk

of business license revocation. Second, while the enforcement of substantive

rights may appear less clear than United States procedures, the Foreign Invested

Enterprises and Wholly Foreign-Owned Enterprises are Chinese registered

companies, which enjoy the same status as other Chinese registered companies in

business-to-business dispute resolution. Therefore, as a practical matter,

although no assurances can be given, the Chinese legal infrastructure, while

different in operation from its United States counterpart, should not present

any significant impediment to the operation of Foreign Invested Enterprises.

-13-

Because most of our directors and officers reside outside of the United States,

it may be difficult for you to enforce your rights against them or enforce U.S.

court judgments against them.

All but one of our directors and officers reside outside of the United

States and all of our assets are located outside of the United States. It may

therefore be difficult for investors in the United States to enforce their legal

rights, to effect service of process upon our directors or officers or to

enforce judgments of United States courts predicated upon civil liabilities and

criminal penalties of our directors and officers under United States Federal

securities laws. Further, it is unclear if extradition treaties now in effect

between the United States and the PRC would permit effective enforcement of

criminal penalties of the United States Federal securities laws.

Economic reform issues.

Although the Chinese government owns the majority of productive assets in

China, during the past several years the government has implemented economic

reform measures that emphasize decentralization and encourage private economic

activity. Because these economic reform measures may be inconsistent or

ineffectual, there are no assurances that:

o Our Company will be able to capitalize on economic reforms;

o The Chinese government will continue its pursuit of economic reform

policies;

o The economic policies, even if pursued, will be successful;

o Economic policies will not be significantly altered from time to

time; and

o Business operations in China will not become subject to the risk of

nationalization.

Since 1979, the Chinese government has reformed its economic systems.

Because many reforms are unprecedented or experimental, they are expected to be

refined and improved. Other political, economic and social factors, such as

political changes, changes in the rates of economic growth, unemployment or

inflation, or in the disparities in per capita wealth between regions within

China, could lead to further readjustment of the reform measures. This refining

and readjustment process may negatively affect our operations.

Over the last few years, China's economy has registered a high growth

rate. Recently, there have been indications that rates of inflation have

increased. In response, the Chinese government recently has taken measures to

curb this excessively expansive economy. These measures have included

devaluations of the Chinese currency, the Renminbi (RMB), restrictions on the

availability of domestic credit, reducing the purchasing capability of certain

of its customers, and limited re-centralization of the approval process for

purchases of some foreign products. These austerity measures alone may not

succeed in slowing down the economy's excessive expansion or control inflation,

and may result in future dislocations in the Chinese economy. The Chinese

government may adopt additional measures to further combat inflation, including

the establishment of freezes or restraints on certain projects or markets.

-14-

To date, reforms to China's economic system have not adversely impacted

our operations and are not expected to adversely impact operations in the

foreseeable future; however, there can be no assurance that the reforms to

China's economic system will continue or that we will not be adversely affected

by changes in China's political, economic, and social conditions and by changes

in policies of the Chinese government, such as changes in laws and regulations,

measures which may be introduced to control inflation, changes in the rate or

method of taxation, imposition of additional restrictions on currency conversion

and remittance abroad, and reduction in tariff protection and other import

restrictions

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and

any determination that we violated the Foreign Corrupt Practices Act could have

a material adverse effect on our business.

We are subject to the United States Foreign Corrupt Practices Act, or the

FCPA, and other laws that prohibit improper payments or offers of payments to

foreign governments and their officials and political parties by U.S. persons

and issuers as defined by the statute for the purpose of obtaining or retaining

business. We have operations, agreements with third parties and make sales in

China, which is known to experience corruption. Our activities in China create

the risk of unauthorized payments or offers of payments by one of the employees,

consultants, sales agents or distributors of our company or the companies in

which we invest may engage that could be in violation of various laws including

the FCPA, even though these parties are not always subject to our control. It is

our policy to implement safeguards to discourage these practices by our

employees. However, our existing safeguards and any future improvements may

prove to be less than effective, and the employees, consultants, sales agents or

distributors of our company or the companies in which we invest may engage in

conduct for which we might be held responsible. Violations of the FCPA may

result in severe criminal or civil sanctions, and we may be subject to other

liabilities, which could negatively affect our business, operating results and

financial condition. In addition, the government may seek to hold us liable for

successor liability FCPA violations committed by companies in which we invest or

that we acquire.

Risks Related to the Company.

The relative lack of public company experience of our management team may put us

at a competitive disadvantage.

Our management team lacks public company experience, which could impair

our ability to comply with legal and regulatory requirements such as those

imposed by Sarbanes-Oxley Act of 2002. Certain individuals who now constitute

our senior management have never had responsibility for managing a publicly

traded company. Such responsibilities include complying with federal securities

laws and making required disclosures on a timely basis. Our senior management

may not be able to implement programs and policies in an effective and timely

manner that adequately respond to such increased legal, regulatory compliance

and reporting requirements. Our failure to comply with all applicable

requirements could lead to the imposition of fines and penalties and distract

our management from attending to the growth of our business.

We will continue to incur significant increased costs as a result of operating

as a public company, and management will be required to devote substantial time

to compliance requirements.

As a public company we incur significant legal, accounting and other

expenses under the Sarbanes-Oxley Act of 2002, together with rules implemented

by the Securities and Exchange Commission and applicable market regulators.

These rules impose various requirements on public companies, including requiring

-15-

certain corporate governance practices. Our management and other personnel will

need to devote a substantial amount of time to these compliance requirements.

Moreover, these rules and regulations will increase our legal and financial

compliance costs and will make some activities more time-consuming and costly.

In addition, the Sarbanes-Oxley Act requires, among other things, that we

maintain effective internal controls for financial reporting and disclosure

controls and procedures. In particular, we must perform system and process

evaluations and testing of our internal controls over financial reporting to

allow management and our independent registered public accounting firm to report

on the effectiveness of our internal controls over financial reporting, as

required by Section 404 of the Sarbanes-Oxley Act. Such testing, or the

subsequent testing by our independent registered public accounting firm, may

reveal deficiencies in our internal controls over financial reporting that are

deemed to be material weaknesses. Compliance with Section 404 may require that

we incur substantial accounting expenses and expend significant management

efforts. If we are not able to comply with the requirements of Section 404 in a

timely manner, or if our accountants later identify deficiencies in our internal

controls over financial reporting that are deemed to be material weaknesses, the

market price of our common stock could decline and we could be subject to

sanctions or investigations by the Commission or other applicable regulatory

authorities.

Insiders have substantial control over us, and they could delay or prevent a

change in our corporate control even if our other stockholders want it to occur.

Our executive officers, directors, and principal stockholders who hold 5%

or more of the outstanding common stock and their affiliates beneficially owned

as of December 31, 2008, in the aggregate, approximately 53% of our outstanding

common stock. These stockholders will be able to exercise significant control

over all matters requiring stockholder approval, including the election of

directors and approval of significant corporate transactions. This could delay

or prevent an outside party from acquiring or merging with us even if our other

stockholders wanted it to occur.

We depend on key personnel and have no key man insurance.

We depend on our key management and other personnel. Our future success

depends to a significant extent upon the continued service of our executive

officers and other key management and on our ability to continue to attract,

retain and motivate executive and other key employees, including those in

managerial and sales positions. The loss of the services of one or more of our

key employees or our failure to attract, retain and motivate qualified personnel

could have a material adverse effect on our business, financial condition and

results of operations. Although most of these personnel are founders and

stockholders, there can be no assurance that we can be successful in retaining

them. We do not have key man insurance.

Our Executives do not speak any English and may have different perspectives on

business situations based on differences between Chinese and American culture.

Our management is comprised of individuals born and raised in the PRC who

do not speak English. As a result of differences in culture, educational

background and business experiences, our management may analyze, evaluate and

present business opportunities and results of operations differently from the

way they are analyzed, evaluated and presented by management teams of public

companies in Europe and the United States. In addition, our management has very

limited skills in English. Consequently, it is possible that our management team

will emphasize or fail to emphasize aspects of our business that might

customarily be emphasized in a different manner by comparable public companies

from different geographical and political areas.

-16-

Risks Related to the Common Stock

There is a limited public market for the common stock.

There is currently a limited public market for our common stock. Holders

of our common stock may, therefore, have difficulty selling their common stock,

should they decide to do so. In addition, there can be no assurances that such

markets will continue or that any shares of common stock, which may be

purchased, may be sold without incurring a loss. Any such market price of the

common stock may not necessarily bear any relationship to our book value,

assets, past operating results, financial condition or any other established

criteria of value, and may not be indicative of the market price for the common

stock in the future. Further, our market price for the common stock may be

volatile depending on a number of factors, including business performance,

industry dynamics, and news announcements or changes in general economic

conditions.

We may issue shares of our capital stock or debt securities to complete an

acquisition, which would reduce the equity interest of our stockholders or

subject our company to risks upon default

We may issue our securities to acquire companies or assets. Most likely,

we will issue additional shares of our common stock or preferred stock, or both,

to complete acquisitions. If we issue additional shares of our common stock or

shares of our preferred stock, the equity interest of our existing stockholders

may be reduced significantly, and the market price of our common stock may

decrease. The shares of preferred stock we issue are likely to provide holders

with dividend, liquidation and voting rights, and may include participation

rights, senior to, and more favorable than, the rights and powers of holders of

our common stock. If we issue debt securities as part of an acquisition, and we

are unable to generate sufficient operating revenues to pay the principal amount

and accrued interest on that debt, we may be forced to sell all or a significant

portion of our assets to satisfy our debt service obligations, unless we are

able to refinance or negotiate an extension of our payment obligation.

Future sales of our common stock, or the perception that such sales could occur,

could have an adverse effect on the market price of our common stock.

We have approximately 79,980,000 shares of our common stock outstanding.

There are a limited number of holders of our common stock. Future sales of our

common stock, pursuant to a registration statement or Rule 144 under the

Securities Act, or the perception that such sales could occur, could have an

adverse effect on the market price of our common stock. Any attempt to sell a

substantial number of our shares could severely depress the market price of our

common stock. As noted above, we may use our capital stock in the future to

finance acquisitions and to compensate employees and management, which would

further dilute the interests of our existing shareholders and could also depress

the trading price of our common stock.

The common stock may be deemed penny stock with a limited trading market.

Our common stock is currently listed for trading in the Over-The-Counter

Bulletin Board, owned and operated by FINRA, Inc. (formerly NASD, Inc.) which is

generally considered to be less efficient than the NASDAQ market or other

national exchanges, and which may cause difficulty in conducting trades and

difficulty in obtaining future financing. Further, our securities are subject to

the "penny stock rules" adopted pursuant to Section 15 (g) of the Securities

Exchange Act of 1934, as amended (the "Exchange Act"). The penny stock rules

apply to non-NASDAQ companies whose common stock trades at less than $5.00 per

-17-

share or which have tangible net worth of less than $5,000,000 ($2,000,000 if

the company has been operating for three or more years). Such rules require,

among other things, that brokers who trade "penny stock": to persons other than

"established customers" complete certain documentation, make suitability

inquiries of investors and provide investors with certain information concerning

trading in the security, including a risk disclosure document and quote

information under certain circumstances. Many brokers have decided not to trade

"penny stock" because of the requirements of the penny stock rules and, as a

result, the number of broker-dealers willing to act as market makers in such

securities is limited. In the event that we remain subject to the "penny stock

rules" for any significant period, there may develop an adverse impact on the

market, if any, for our securities. Because our securities are subject to the

"penny stock rules" investors will find it more difficult to dispose of our

securities.

Further, for companies whose securities are traded in the Over-The-Counter

Market, it is more difficult: (i) to obtain accurate quotations; (ii) to obtain

coverage for significant news events because major wire services, such as the

Dow Jones News Service, generally do not publish press releases about such

companies, and (iii) to obtain needed capital.

We have not and do not anticipate paying any dividends on our common stock;

because of this our securities could face devaluation in the market.

We have paid no dividends on our common stock to date and it is not

anticipated that any dividends will be paid to holders of our common stock in

the foreseeable future. While our dividend policy will be based on the operating

results and capital needs of the business, it is anticipated that any earnings

will be retained to finance our future expansion and for the implementation of

our business plan. Additionally, current regulations in China would permit our

operating company in China to pay dividends to us only out of its accumulated

distributable profits, if any, determined in accordance with Chinese accounting

standards and regulations. In addition, our operating company in China will be

required to set aside at least 10% (up to an aggregate amount equal to half of

its registered capital) of its accumulated profits each year. Such reserve

account may not be distributed as cash dividends. In addition, if our operating

company in China incurs debt on its own behalf in the future, the instruments

governing the debt may restrict its ability to pay dividends or make other

payments to us. Lack of a dividend can further affect the market value of our

common stock, and could significantly affect the value of any investment in us.

Risks related to financial reports and estimates.

We are subject to critical accounting policies and actual results may vary

from our estimates. We follow generally accepted accounting principles in the

United States in preparing our financial statements. As part of this work, we

must make many estimates and judgments concerning future events. These affect

the value of the assets and liabilities, contingent assets and liabilities, and

revenue and expenses reported in our financial statements. We believe that these

estimates and judgments are reasonable, and we make them in accordance with our

accounting policies based on information available at the time. However, actual

results could differ from our estimates, and this could require us to record

adjustments to expenses or revenues that could be material to our financial

position and results of operations in the future.

Item 1A. Unresolved Staff Comments

The Company had no unresolved Securities and Exchange Commission staff

comments as of December 31, 2008.

-18-

Item 2. Properties

On December 10, 2007, the Company entered into a lease agreement with

GuoXi Group for office space located at Yujiang City of Jiangxi Province. The

lease has a term of two years and requires monthly payments of RMB 20,000

(approximately $2,900).

The Company does not own any real property. Management believes that the

Company's facilities are adequate to meet its current needs and should continue

to be adequate for the foreseeable future.

Item 3. Legal Proceedings

The Company is not a party to any legal proceedings as of the date of this

filing.

Item 4. Submission of Matters to a vote of Security Holders

There were no matters submitted to a vote of the security holders of the

Company through the solicitation of proxies or otherwise during the fourth

quarter of the year ended December 31, 2008.

-19-

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities.

Market for Our Common Stock

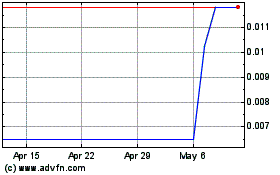

Our common stock is traded in the over-the-counter market (the OTC

Bulletin Board). On May 14, 2008, Jade Art Group Inc. has been informed by

NASDAQ that its ticker symbol was being changed from JADG to JADA, effective as

of the open of business on May 15, 2008.

On May 15, 2008, a reverse stock split of the Company's issued and

outstanding common stock on a one (1) for three (3) basis became effective.

The Company declared a three-for-one (3:1)forward stock split, in the

nature of a share dividend, with respect to the shares of our common stock

issued and outstanding at the close of business on December 28, 2007.

The prices set forth below reflect the quarterly high and low bid price

information for shares of our common stock for the periods indicated.

High Low

---- ---

2008

First Quarter $2.60 $0.60

Second Quarter $4.00 $0.50

Third Quarter $5.25 $1.80

Fourth Quarter $2.97 $0.25

2007

Fourth Quarter $2.50 $1.02

|

Holders

As of December 31, 2008, our common stock was held of record by 306

stockholders.

Dividend Policy

We have never paid cash dividends on our common stock. We currently intend

to retain and use any future earnings for the development and expansion of our

business and do not anticipate paying any cash dividends in the forseeable

future.

Equity Compensation Plans

The Company does not currently have any equity compensation plans.

Performance Graph

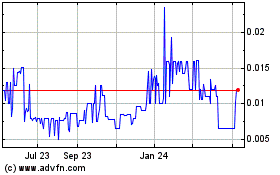

The graph compares the yearly cumulative total shareholder return on the

Company's Common Stock with the yearly cumulative total return of (a) the NASDAQ

Market and (b) a peer group of companies that have a market capitalization

similar to that of the Company.

-20-

The Company does not believe that it can reasonably identify a peer group

of companies, on an industry or line-of-business basis, for the purpose of

developing a comparative performance index. While the Company is aware that some

other publicly-traded companies market products in similar lines-of-business,

none of these other companies distribute raw jade. Moreover, some of these other

companies that engage in the Company's line-of-business do so through divisions

or subsidiaries that are not publicly-traded. Furthermore, many of these other

companies are substantially more highly capitalized than the Company. For these

reasons, any such comparison would not, in the opinion of the Company, provide a

meaningful index of comparative performance.

The comparisons in the graph below are based on historical data and are

not indicative of, or intended to forecast, the possible future performance of

the Company's Common Stock.

[GRAPHIC OMITTED]

COMPARISON OF CUMULATIVE TOTAL RETURN OF ONE OR MORE

COMPANIES, PEER GROUPS, INDUSTRY INDEXES AND/OR BROAD MARKETS

------------------------ FISCAL YEAR ENDING ----------------------

COMPANY/INDEX/MARKET 10/23/2007 12/31/2007 12/31/2008

Jade Art Group, Inc. 100.00 250.00 255.26

Peer Group Index 100.00 52.52 25.92

NASDAQ Market Index 100.00 92.83 54.78

|

Purchases of Equity Securities by the Company and Affiliated Purchasers

During the fiscal year ended December 31, 2008, neither the Company nor

any affiliated purchasers purchased any shares of our common stock.

-21-

Item 6. Selected Financial Data.

The selected financial information for each of the two years ended

December 31, 2008 and 2007 has been derived from, and should be read in

conjunction with, our audited consolidated financial statements and other

financial information presented elsewhere herein. Capitalized terms are as

defined and described in the consolidated financial statements or elsewhere

herein.

Year Ended December 31,

2008 2007

------------- ------------

Sales $ 30,537,079 $ --

Cost of sales -5,225,273 --

------------- ------------

Gross profit 25,311,806 --

Operating expenses:

Selling, general and administrative expenses -2,806,341 --

------------

Operating income 22,505,465 --

Other income (expenses):

Interest expense -421,507 --

Interest income 132,087 --

Loss on forgiveness of debt -132,087

------------- ------------

Income before taxes from continuing operations 22,083,958

Income tax expense -6,693,841 --

------------- ------------

Net income from continuing operations 15,390,117 --

Discontinued operations, net of tax

Income from woodcarving operations, net of tax 96,751 764,906

Gain from transfer of woodcarving operations,

net of tax 55,322,615 --

Net income from discontinued operations 55,419,366 764,906

------------- ------------

Net Income $ 70,809,483 $ 764,906

============= ============

Earnings Per Share:

Basic $ 0.88 $ 0.01

============= ============

Diluted $ 0.88 $ 0.01

============= ============

Weighted-average Common Shares Outstanding

Basic 79,980,000 76,058,432

Diluted 80,665,131 76,058,432

============= ============

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results

of Operation.

Special Note Regarding Forward Looking Information

This report contains forward-looking statements that reflect management's

current views and expectations with respect to our business, strategies, future

results and events, and financial performance. All statements made in this

report other than statements of historical fact, including statements that

address operating performance, events or developments that management expects or

anticipates will or may occur in the future, including statements related to

future reserves, cash flows, revenues, profitability, adequacy of funds from

operations, statements expressing general optimism about future operating

results and non-historical information, are forward-looking statements. In

-22-

particular, the words "believe," "expect," "intend," "anticipate," "estimate,"

"plan," "may," "will," variations of such words and similar expressions identify

forward-looking statements, but are not the exclusive means of identifying such

statements and their absence does not mean that the statement is not

forward-looking. Readers should not place undue reliance on forward-looking

statements which are based on management's current expectations and projections

about future events, are not guarantees of future performance, are subject to

risks, uncertainties and assumptions. Our actual results, performance or

achievements could differ materially from the results expressed in, or implied

by, these forward-looking statements. Factors that could cause or contribute to

such differences include those discussed in this report, particularly under the

caption "Risk Factors." Except as required under the federal securities laws, we

do not undertake any obligation to update the forward-looking statements in this

report.

Critical Accounting Policies and Estimates

The following discussion and analysis of financial condition and results

of operations are based upon the Company's consolidated financial statements,

which have been prepared in conformity with accounting principles generally

accepted in the United States of America. The Company's significant accounting

policies are more fully described in Note 1 of the Notes to Consolidated

Financial Statements. Certain accounting estimates are particularly important to

the understanding of the Company's financial position and results of operations

and require the application of significant judgment by the Company's management

or can be materially affected by changes from period to period in economic

factors or conditions that are outside the control of management. The Company's

management uses their judgment to determine the appropriate assumptions to be

used in the determination of certain estimates. Those estimates are based on

historical operations, future business plans and projected financial results,

the terms of existing contracts, the observance of trends in the industry,

information provided by customers and information available from other outside

sources, as appropriate. The following discusses the Company's critical

accounting policies and estimates.

Accounting Method

The consolidated financial statements are prepared using the accrual

method of accounting. The Company changed its fiscal year-end from July 31 to

December 31 in fiscal year 2007.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of

the Company and its wholly-owned subsidiaries. All significant inter-company

transactions and balances have been eliminated on consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting

principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. The Company bases its estimates on

historical experience and on various other assumptions that are believed to be

reasonable under the circumstances. Actual results could differ from those

estimates.

Foreign Currency Translation

The Company's functional currency is the Chinese Yuan Renminbi ("RMB"),

and reporting currency is the United States Dollar. The financial statements of

the Company are translated to United States Dollars in accordance with SFAS

No.52 "Foreign Currency Translation". Monetary assets and liabilities

denominated in foreign currencies are translated using the exchange rate

prevailing at the balance sheet date. Transactions affecting the Company's

revenue and expense accounts are translated using an average exchange rate

during the period presented. Gains and losses arising on translation or

settlement of foreign currency denominated transactions or balances are included

in the determination of income. Foreign currency transactions are primarily

undertaken in RMB. Foreign Currency Translation Adjustments are included in

Other Comprehensive Income and disclosed as a separate category of Stockholders'

Equity.

Accounts Receivable and Notes Receivable

The Company extends unsecured credit to its customers in the ordinary

course of business but mitigates the associated risks by performing credit

checks and actively pursuing past due accounts. An allowance for doubtful

accounts is established and recorded based on management's assessment of the

credit history with the customer and current relationships with them.

The Company makes provision for bad debts based on an assessment of the

recoverability of accounts receivable. Specific provisions are applied to

related-party receivables and third-party receivables where events or changes in

circumstances indicate that the balances may not be collectible. However, due to

the Company's experience in the sale and distribution of raw jade in 2008, and

the nature of the Company's business, management did not expect any