April 20, 2021 -- InvestorsHub NewsWire -- via

BENZINGA

With World Series of Golf, Inc.’s (OTC

Pink: WSGF) Vaycaychella nearing its planned Q2 launch,

WSGF stock looks attractive. Although shares have been caught in

sector weakness, a rebound could be in play as its prime asset,

Vaycaychella, gets set to potentially revolutionize the global

vacation rental real estate investment market. Since 2020, WSGF has

been putting the pieces of this innovative investment app together,

and with its final beta testing expected to conclude this month,

the App could open a world of investment opportunity to retail

investors wanting to build a global property portfolio.

Shares gained ground early Monday ahead of the company’s planned

Tuesday update. And with the company’s FY2020 Annual Report

published, which satisfies its reporting requirements, the stock

could be positioned to rally on confirmation that the App is on

schedule to hit its production launch target date. WSGF acquired

Vaycaychella last year and has committed its resources to make this

asset its primary business focus. A name change reflecting the

alternative real estate finance focus is underway.

While the premise of the App sounds simple, the configuration is

not. And that’s what makes the investment so intriguing. Targeting

a massive vacation real estate investment market, Vaycaychella is

on a mission is to expand the short-term rental ecosystem upstream

from rental Apps like Airbnb (NASDAQ: ABNB), VRBO,

and Expedia (NASDAQ: EXPE) that

match renters to landlords. Taking a different approach,

Vaycaychella matches investors with property owners and developers

through a mutually beneficial introduction that can provide each

party attractive returns.

The revenue generated through Vaycaychella could be enormous.

And that surge could cause an exponential rise in WSGF stock.

Vaycaychella In The Caribbean

WSGF management is undoubtedly optimistic about its flagship

asset. They believe that Vaycaychella will provide upwards of $100

million in revenues within its first 12-months in the market.

Although that sounds like lofty guidance, consider that investment

apps like Robinhood have reached billion-dollar valuations

in less than five years in the market.

Vaycaychella could follow in the same path, primarily through

targeting a real estate investment market opportunity that could

face little to no near-term competition. And by the time

competitors try to creep its space, Vaycaychella’s first-to-market

status could protect its market share.

Vaycaychella is already active.

Currently, it operates a portfolio of Caribbean vacation

properties serving as a pilot model to validate the sector

opportunity. The goal is to build a business around providing an

alternative financing resource that empowers entrepreneurs to

develop and expand short-term vacation property rental businesses.

Already, Vaycaychella has provided alternative financing to back

multiple short-term vacation rental properties and a boutique

hotel. Those deals provide capital to owners and attractive returns

to the investor. Thus, the agreements produce a win-win

proposition.

Better yet, the barriers to making a deal are low. In fact, in

sharp contrast to conventional property investment, Vaycaychella

facilitates agreements that require no credit checks, no income to

debt ratios, and no income verification. If an investor has

capital, a deal can be made.

Also, in a move that could create even more flexibility in

financing investment opportunities, Vaycaychella will integrate

cryptocurrency and crowdfunding functions into its platform. Most

important, though, is that Vaycaychella provides an alternative

financing fintech application as a resource for individuals that

might not be able to access a traditional mortgage. In short, the

App could be an ideal tool to finance income-producing rental

properties with potentially better terms compared to conventional

lenders.

Vaycaychella Expected To Launch In Q2

The excellent news for stock investors stock and those wanting

to use the App is that its launch is less than two months away.

Management has reiterated its plans to launch the App no later than

May of this year and possibly by the end of April.

The timing could be excellent. It’s expected that the

post-Covid-19 convergence of an increase in vacation demand and

housing supply could result in an ideal buying opportunity for the

would-be short-term vacation property owner/operator entrepreneurs.

In fact, both Airbnb and Expedia are tracking toward their

respective 52-week highs as analysts model the positive impact to

the sector from an easing pandemic.

Vaycaychella’s peer-to-peer alternative real estate investment

and fintech app could be a game-changer to the industry. At the

very least, it fills an enormous niche by targeting an investment

market that has been neglected by trading-app developers. As it

stands, it’s the only known App that targets retail investors that

provides a unique opportunity to build a property portfolio through

just a few clicks on a smart device.

Better still, the App is especially appealing because its

Peer-To-Peer (P2P) design connects short-term rental property

buyers to sellers. And, because of deal structures that allow for

fractional ownership or investment interest in multiple properties

across the world, it creates an opportunity for those that might

not have had the resources before to make a purchase on their own.

Thus, Vaycaychella brings with it the potential to create a new

breed of alternative investors.

It can also change the way deals get done. Specifically, through

its secure and feature-rich platform, Vaycaychella closes the

distance between the parties involved by making global transactions

possible through a few touches on a smart device. Perhaps the best

part of the App, though, is that it allows parties to do away with

almost every obstacle associated with traditional real estate

investment. Although some find it hard to believe, Vaycaychella is

designed to close transactions quickly and eliminate credit checks,

lengthy applications, and property surveys.

Q2 Could be Transformational

Now, with Vaycaychella’s planned launch date approaching, WSGF

stock could get a bounce. In February, shares jumped by more than

70% intraday on the news that its final beta testing had started.

This time the stakes could be even bigger.

An update following its launch could have a considerable impact

on WSGF valuation. Not only would user adoption be a key metric to

gauge its long-term potential, but details could also allow

analysts to fill in pricing models to better appraise the company

stock. And such an update could be less than three months

away.

Despite recent weakness in the stock, WSGF is likely to grab its

footing and reverse course with positive momentum ahead of

Vaycaychella’s launch. Indeed, it’s hard to gauge OTC Pink stocks,

but what is clear from trading patterns is that even the slightest

amount of buying pressure can substantially impact prices. Thus,

the recent volatility could be attributed to the overall weakness

in the broader nano-cap markets.

Putting the past two weeks of trading aside, Q2 could be

transformative for Vaycaychella and WSGF stock. And both are set up

for success, making the stock attractive to both short and

long-term investors. At current prices, the launch of Vaycaychella

is not priced into the shares. That, in and of itself, makes

investment in WSGF a timely and compelling consideration.

Disclaimers: Hawk Point Media is responsible for the

production and distribution of this content. Hawk Point Media is

not operated by a licensed broker, a dealer, or a registered

investment adviser. It should be expressly understood that under no

circumstances does any information published herein represent a

recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the business of

marketing and advertising companies for monetary compensation.

Never invest in any stock featured on our site or emails unless you

can afford to lose your entire investment. The

information made available by Hawk Point Media is not intended to

be, nor does it constitute, investment advice or recommendations.

The contributors may buy and sell securities before and after any

particular article, report and publication. In no event shall Hawk

Point Media be liable to any member, guest or third party for any

damages of any kind arising out of the use of any content or other

material published or made available by Hawk Point Media,

including, without limitation, any investment losses, lost profits,

lost opportunity, special, incidental, indirect, consequential or

punitive damages. Past performance is a poor indicator of future

performance. The information in this video, article, and in its

related newsletters, is not intended to be, nor does it constitute,

investment advice or recommendations. Hawk Point

Media strongly urges you conduct a complete and

independent investigation of the respective companies and

consideration of all pertinent risks. Readers are advised to review

SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports,

Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point Media, its

authors, contributors, or its agents, may be compensated for

preparing research, video graphics, and editorial content. As part

of that content, readers, subscribers, and website viewers, are

expected to read the full disclaimers and financial disclosures

statement that can be found by clicking HERE.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in

micro-cap and growth securities is highly speculative and carries

an extremely high degree of risk. It is possible that an investors

investment may be lost or impaired due to the speculative nature of

the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: KL Feigeles

Email: editorial@hawkpointmedia.com

City: Miami Beach

State: Florida

Country: United States

Website: https://www.greenlightstocks.com

Source - https://www.benzinga.com/pressreleases/21/04/ab20702596/with-vaycaychellas-q2-launch-imminent-world-series-of-golf-inc-s-stock-is-in-play-wsgf

Other stocks on the move -

GVSI,

WDLF and

AABB.

SOURCE: BENZINGA

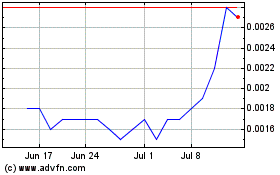

Good Vibrations Shoes (PK) (USOTC:GVSI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Good Vibrations Shoes (PK) (USOTC:GVSI)

Historical Stock Chart

From Nov 2023 to Nov 2024