HIGHLIGHTS WESTCHESTER, Ill., May 7 /PRNewswire-FirstCall/ --

TreeHouse Foods, Inc. (NYSE:THS) today reported a substantial

increase in first quarter earnings compared to last year driven by

excellent performance in its North American Retail Grocery

business. Earnings for the quarter were $0.39 per fully diluted

share compared to $0.07 per fully diluted share reported for the

first quarter of last year. On an adjusted basis, as described

below, fully-diluted earnings per share improved 20.6% to $0.41

compared to $0.34 last year. Improved gross margins across most

product categories contributed to the broadly based improvement.

The reported results for the first quarter included two unusual

items that affected year over year comparisons. The Company

reported non-recurring costs of $0.01 per share in the first

quarter of 2009 associated with the Company's closed Portland,

Oregon pickle plant. Last year the Company recorded an initial

charge of $0.24 per share when it announced the original closure

plan. The second unusual item relates to the adjustment of an

intercompany loan with E.D. Smith to reflect current exchange

rates. This non-cash adjustment lowered reported earnings by $0.01

per share in 2009 and $0.03 per share in 2008. Excluding these two

items results in adjusted earnings per share on a fully diluted

basis of $0.41 in 2009 compared to $0.34 in 2008. ITEMS AFFECTING

DILUTED EPS COMPARABILITY: Three Months Ended March 31 --------

2009 2008 ---- ---- (unaudited) Diluted EPS as reported $0.39 $0.07

Plant closing costs 0.01 0.24 Loss on intercompany note translation

0.01 0.03 ---- ---- Adjusted diluted EPS $0.41 $0.34 ===== =====

Commenting on the results, Sam K. Reed, Chairman and CEO, said, "We

finished the quarter with sales growth in local currencies, margin

improvement and lower operating costs. While our sales growth was

constrained by challenges in the food away from home industry, our

retail grocery segment in particular performed well across a broad

array of product categories. Overall, it was a very good start to

2009." Adjusted operating earnings before interest, taxes,

depreciation, amortization and unusual items (Adjusted EBITDA,

reconciled to net income, the most directly comparable GAAP

measure, appears on the attached schedule) increased 7.3% to $40.0

million in the quarter compared to $37.3 million in the same period

last year. The increase is the result of improved gross margins in

the quarter, despite lower revenues. Net sales for the first

quarter totaled $355.4 million compared to $360.6 million last

year. Excluding currency effects, sales would have increased by

2.2%. Retail grocery sales increased 5.0% despite currency

pressures as private label continues to realize share gains across

most retail categories. This increase was more then offset by

softness in the food away from home channel as consumers continue

to gravitate towards meals at home. Gross margins for the quarter

improved by 70 basis points to 20.2% compared to 19.5% last year.

The improvement was due to carry over pricing and internal

productivity gains. This was especially evidenced by pickle gross

margins that improved over 300 basis points as a result of the

category rationalization program started last year. Selling,

distribution, general and administrative expenses were $41.6

million for the quarter, a decrease of 5.4% (2.1% decrease

excluding currency effects) from $43.9 million in the first quarter

of 2008. The decrease was due to lower distribution expenses as

energy costs dropped significantly compared to the comparable

quarter last year. Other operating expense for the quarter was $0.2

million compared to $10.9 million last year. The costs in 2009

primarily reflect the ongoing maintenance costs associated with the

Company's closed Portland, Oregon pickle plant. Last year's large

expense related to the initial charge to close the plant. Interest

expense in the quarter was $4.5 million compared to $7.7 million

last year as lower debt levels due to strong operating cash flows

over the past year and lower interest rates contributed to the

decline. The Company's first quarter effective income tax rate of

37.0% was higher than last year's tax rate of 26.3% due to

significantly higher US taxable income and a reduced benefit from

intercompany interest expense due to lower Canadian exchange rates.

Net income for the quarter totaled $12.7 million compared to $2.1

million last year. Fully-diluted earnings per share for the quarter

were $0.39 per share compared to $0.07 per share last year.

Excluding unusual items, adjusted earnings per share from

continuing operations for the first quarter of 2009 would have been

$0.41, compared to last year's first quarter adjusted earnings per

share of $0.34. SEGMENT RESULTS The Company has three reportable

segments: 1. North American Retail Grocery - This segment sells

branded and private label products to customers within the United

States and Canada. These products include pickles, peppers,

relishes, condensed and ready to serve soup, broths, gravies, jams,

spreads, salad dressings, sauces, non-dairy powdered creamer,

salsa, aseptic products and baby food. 2. Food Away From Home -

This segment sells to foodservice customers, including restaurant

chains and food distribution companies, within the United States

and Canada. 3. Industrial and Export - This segment includes the

Company's co-pack business and non-dairy powdered creamer sales to

industrial customers. These customers either repackage it into

single serve packages for the food service industry or use it as an

ingredient in other food service applications. Export sales are

primarily to industrial customers. The direct operating income for

our segments is determined by deducting manufacturing costs from

net sales and deducting direct operating costs such as freight to

customers, commissions, brokerage fees as well as direct selling

and marketing expenses. General sales and administrative expenses,

including restructuring charges, are not allocated to our business

segments as these costs are managed at the corporate level. North

American Retail Grocery net sales for the first quarter increased

by 5.0% (12.1% excluding currency) to $230.7 million from $219.6

million during the same quarter last year primarily due to improved

pricing. Unit sales in the Retail channel were down 2.0% in total,

however, excluding infant feeding and the planned reduction in

pickles, unit sales were up 4.0% compared to last year. Sales of

salad dressing, salsa and sauces showed strong year over year unit

sales increases, while soup sales were up slightly from last year.

Retail sales were negatively affected by retailer inventory

reductions and the late timing of the Easter holiday. Still, we are

encouraged by market data that indicates private label share of

sales is growing in most of our food categories. Direct operating

income improved to 14.9% from 11.6% last year due to pricing, mix

changes and very positive improvements in pickle margins resulting

from last year's rationalization strategy. Food Away From Home

segment sales declined 5.9% from last year to $66.8 million as unit

volumes were negatively affected by the overall decline in the food

away from home market. Partially offsetting the unit shortfall was

higher pricing necessary to cover higher input costs compared to

last year. Despite the increase in pricing, direct operating income

fell slightly from 10.7% to 10.5% due to a shift in mix from higher

margin food distributors to lower margin national account quick

serve customers. Industrial and Export segment sales decreased

17.3% as much of this business is industrial sales to customers

that primarily repackage non dairy creamers for the food away from

home market. Sales in the quarter totaled $58.0 million compared to

$70.1 million last year. Unit sales were down 22.0%, but revenues

were partially offset by higher pricing needed to cover input

costs. OUTLOOK FOR 2009 Commenting on the outlook for 2009, Sam K.

Reed said, "We believe our strong start to the year shows good

promise for the balance of the year. Although unit growth has been

challenged by declines in the food away from home market, we are

encouraged by the unit growth we saw in our key retail grocery

product categories, especially salsa, salad dressings and sauces.

Strength in retail grocery sales should more than offset the

recession's effects on our other business units. Based on our view

that retail private label will continue to perform well, we are

raising our previously issued guidance of $1.80 to $1.85 in

adjusted earnings per share for 2009 to $1.82 to $1.87." COMPARISON

OF ADJUSTED INFORMATION TO GAAP INFORMATION The adjusted earnings

per share data contained in this press release reflect adjustments

to reported earnings per share data to eliminate the net expense or

net gain related to items identified in the above chart. This

information is provided in order to allow investors to make

meaningful comparisons of the Company's operating performance

between periods and to view the Company's business from the same

perspective as Company management. Because the Company cannot

predict the timing and amount of charges associated with

non-recurring items or facility closings and reorganizations,

management does not consider these costs when evaluating the

Company's performance, when making decisions regarding the

allocation of resources, in determining incentive compensation for

management, or in determining earnings estimates. These costs are

not recorded in any of the Company's operating segments. Adjusted

EBITDA represents net income before interest expense, income tax

expense, depreciation and amortization expense, and non-recurring

items. Adjusted EBITDA is a performance measure and liquidity

measure used by our management, and we believe is commonly reported

and widely used by investors and other interested parties, as a

measure of a company's operating performance and ability to incur

and service debt. This non-GAAP financial information is provided

as additional information for investors and is not in accordance

with or an alternative to GAAP. These non-GAAP measures may be

different from similar measures used by other companies. A full

reconciliation table between reported income from continuing

operations for the three month periods ended March 31, 2009 and

2008 calculated according to GAAP and Adjusted EBITDA is attached.

Conference Call Webcast A webcast to discuss the Company's

financial results will be held at 5:00 p.m. (Eastern Time) today

and may be accessed by visiting the "Investor Overview" page

through the "Investor Relations" menu of the Company's website at

http://www.treehousefoods.com/. About TreeHouse Foods TreeHouse is

a food manufacturer servicing primarily the retail grocery and

foodservice channels. Its products include non-dairy powdered

coffee creamer; canned soup, salad dressings and sauces; salsa and

Mexican sauces; jams and pie fillings under the E.D. Smith brand

name; pickles and related products; infant feeding products; and

other food products including aseptic sauces, refrigerated salad

dressings, and liquid non-dairy creamer. TreeHouse believes it is

the largest manufacturer of pickles and non-dairy powdered creamer

in the United States and the largest manufacturer of private label

salad dressings in the United States and Canada based on sales

volume. FORWARD LOOKING STATEMENTS This press release contains

"forward-looking statements." Forward-looking statements include

all statements that do not relate solely to historical or current

facts, and can generally be identified by the use of words such as

"may," "should," "could," "expects," "seek to," "anticipates,"

"plans," "believes," "estimates," "intends," "predicts,"

"projects," "potential" or "continue" or the negative of such terms

and other comparable terminology. These statements are only

predictions. The outcome of the events described in these

forward-looking statements is subject to known and unknown risks,

uncertainties and other factors that may cause the Company or its

industry's actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievement expressed or implied

by these forward-looking statements. TreeHouse's Form 10-K for the

year ended December 31, 2008 discusses some of the factors that

could contribute to these differences. You are cautioned not to

unduly rely on such forward-looking statements, which speak only as

of the date made, when evaluating the information presented in this

presentation. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, to reflect any change

in its expectations with regard thereto, or any other change in

events, conditions or circumstances on which any statement is

based. FINANCIAL INFORMATION TREEHOUSE FOODS, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share

data) Three Months Ended March 31 -------- 2009 2008 ---- ----

(unaudited) Net sales $355,396 $360,623 Cost of sales 283,685

290,234 ------- ------- Gross profit 71,711 70,389 Operating

expenses: Selling and distribution 25,781 28,664 General and

administrative 15,773 15,242 Other operating expense, net 242

10,922 Amortization expense 3,258 3,487 ----- ----- Total operating

expenses 45,054 58,315 ------ ------ Operating income 26,657 12,074

Other (income) expense: Interest expense 4,498 7,731 Interest

income - (20) Loss on currency exchange 2,060 1,860 Other, net

(112) (294) ----- ----- Total other expense 6,446 9,277 ----- -----

Income before income taxes 20,211 2,797 Income taxes 7,479 736

----- --- Net income $12,732 $2,061 ======= ====== Weighted average

common shares: Basic 31,547 31,204 Diluted 32,343 31,308 Net

earnings per common share: Basic $0.40 $0.07 Diluted $0.39 $0.07

Supplemental Information: ------------------------- Depreciation

and Amortization $11,448 $11,973 Expense under FAS123R, before tax

$2,900 $2,781 Segment Information: -------------------- North

American Retail Grocery Net Sales $230,682 $219,640 Direct

Operating Income $34,305 $25,492 Direct Operating Income Percent

14.9% 11.6% Food Away From Home Net Sales $66,753 $70,926 Direct

Operating Income $7,006 $7,568 Direct Operating Income Percent

10.5% 10.7% Industrial and Export Net Sales $57,961 $70,057 Direct

Operating Income $6,680 $9,603 Direct Operating Income Percent

11.5% 13.7% The following table reconciles our net income to

adjusted EBITDA for the three months ended March 31, 2009 and 2008:

TREEHOUSE FOODS, INC. RECONCILIATION OF REPORTED EARNINGS TO

ADJUSTED EBITDA (In thousands, except per share data) Three Months

Ended March 31 -------- 2009 2008 ---- ---- (unaudited) Net income

as reported $12,732 $2,061 Interest expense 4,498 7,731 Interest

income - (20) Income taxes 7,479 736 Depreciation and amortization

11,448 11,973 Stock option expense 2,900 2,781 Acquisition

integration and accounting adjustments - 83 Loss on intercompany

note translation 732 1,541 Interest rate swap mark to market (28) -

Net plant shut-down costs and asset sales of closed facilities 280

10,436 --- ------ Adjusted EBITDA $40,041 $37,322 ======= =======

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO

http://photoarchive.ap.org/ DATASOURCE: TreeHouse Foods, Inc.

CONTACT: Investor Relations of TreeHouse Foods, Inc.,

+1-708-483-1300, ext. 1331 Web Site: http://www.treehousefoods.com/

Copyright

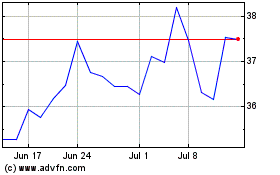

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

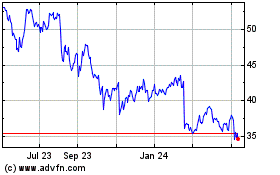

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024