0001811074

false

0001811074

2023-07-27

2023-07-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

July 27, 2023

Texas

Pacific Land Corporation

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

001-39804 |

75-0279735 |

(State or Other

Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification Number) |

1700 Pacific Avenue, Suite 2900, Dallas, Texas 75201

(Address of Principal Executive Offices, including Zip Code)

Registrant’s

telephone number, including area code: 214-969-5530

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

|

Common Stock (par value $.01 per share)

|

|

TPL |

|

New York Stock Exchange |

Item 1.01 Entry into a Material Definitive Agreement

On July 28, 2023, Texas Pacific Land Corporation

(the “Company”), a Delaware corporation, entered into a Cooperation Agreement (the “Agreement”) with Horizon Kinetics

LLC and Horizon Kinetics Asset Management LLC (together with Horizon Kinetics LLC and collectively with their affiliates, “Horizon”),

SoftVest Advisors, LLC and SoftVest, L.P. (together with SoftVest Advisors, LLC and collectively with their affiliates, “SoftVest”;

and together with Horizon, the “Investor Group”). The Company and the Investor Group are each referred to as a “party”

and collectively as the “parties.”

Pursuant to the Agreement, the Company has agreed

to, among other things, nominate Marguerite Woung-Chapman, Murray Stahl and, subject to the approval of the Company’s Nominating

and Corporate Governance Committee, Rob Roosa (the “2023 Nominees”) for election to the board of directors (the “Board”)

of the Company at the 2023 annual meeting of stockholders (the “2023 Annual Meeting”). In addition, the pre-signed letters

of resignation previously submitted by Murray Stahl and Eric Oliver will be considered withdrawn with no further effect. Further, the

Investor Group has specifically agreed to vote or cause to be voted all equity securities of the Company over which the Investor Group

has direct or indirect voting control (i) for the election of the 2023 Nominees and against any director nominee not recommended by the

Board, (ii) for the advisory vote on the Company’s executive compensation, (iii) for the ratification of the appointment by the

Board of the independent registered public accounting firm, and (iv) in accordance with the recommendation of the majority of the Board

in respect of any stockholder proposal submitted pursuant to Rule 14a-8.

In addition, pursuant to the Agreement, the June

11, 2020 stockholders’ agreement by and among the parties (the “Stockholders’ Agreement”) will terminate following

the completion of the 2023 Annual Meeting, which in no event will extend beyond December 31, 2023. Following the termination of the Stockholders’

Agreement, the Investor Group will be subject to certain standstill and non-disparagement obligations under the Agreement as long as one

of Mr. Stahl or Mr. Oliver remain on the Board.

The parties have agreed that the Agreement will

have no impact on the parties’ pending litigation in the Delaware Court of Chancery in connection with the Stockholders’ Agreement

in Texas Pacific Land Corp. v. Horizon Kinetics LLC, No. 2022-1066-JTL (Del. Ch.).

The foregoing description of the Agreement is

qualified by the full text of the Agreement, which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On July 27, 2023, David E. Barry and John R. Norris

III notified the Board that they will not stand for reelection at the 2023 Annual Meeting. Their decision not to stand for reelection

is not the result of any disagreement with the Company on any matter relating to its operations, policies or practices. Messrs. Barry

and Norris will continue to serve on the Board and their respective Board committees until the expiration of their current terms at the

2023 Annual Meeting.

Item 7.01 Regulation FD Disclosure

On August 1, 2023, the Company issued a press

release regarding the Agreement with the Investor Group, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 7.01 and

in the accompanying Exhibit 99.1 shall not be incorporated by reference into any filing of the Company, whether made before or after the

date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such

filing. The information in this Item 7.01 and the accompanying Exhibit 99.1 shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Trust has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

TEXAS PACIFIC LAND TRUST |

| |

|

| Date: August 1, 2023 |

By: |

/s/ Micheal W. Dobbs |

| |

|

Micheal W. Dobbs |

| |

|

SVP, General Counsel and Secretary |

Exhibit 10.1

Execution Version

COOPERATION AGREEMENT

This

Cooperation Agreement (this “Agreement”) is made and entered into as of July 28, 2023, by and among Texas Pacific

Land Corporation (the “Company”), on the one hand, and Horizon Kinetics LLC (“Horizon Kinetics”)

and Horizon Kinetics Asset Management LLC (together with Horizon Kinetics and collectively with their respective Affiliates, “Horizon”),

SoftVest Advisors, LLC (“SoftVest Advisors”) and SoftVest, L.P. (together with SoftVest Advisors and collectively

with their respective Affiliates, “SoftVest,” and collectively with Horizon, the “Investor Group”), on

the other hand. The Company and the Investor Group are each herein referred to as a “party” and collectively as the

“parties.”

For

other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally

bound hereby, agree as follows:

| 1. | The Board shall take all actions necessary

to nominate Marguerite Woung-Chapman, Murray Stahl and, subject to the approval of the Company’s

Nominating and Corporate Governance Committee, a person agreed upon by the parties prior

to the signing of this Agreement (collectively, the “2023 Nominees”) for

election at the 2023 annual meeting of stockholders (the “2023 Annual Meeting”).

The Board shall recommend, support and solicit proxies for the election of each of the 2023

Nominees and no other person at the 2023 Annual Meeting. |

| 2. | The pre-signed letters of resignation previously

submitted by Murray Stahl and Eric Oliver shall be considered withdrawn and no longer effective

as of the execution of this Agreement. For the avoidance of doubt, the Investor Group agrees

to vote or cause to be voted (including by proxy) all equity securities of the Company over

which the Investor Group has direct or indirect voting control (i) for the election of the

2023 Nominees and against any other director nominee not recommended by the Board, (ii) for

the advisory vote on the Company’s executive compensation, (iii) for the ratification

of the appointment by the Board of the independent registered public accounting firm, and

(iv) in accordance with the recommendation of the majority of the Board in respect of any

stockholder proposal submitted pursuant to Rule 14a- 8. |

3.

| (a) | Immediately after the Termination Date

(as defined below), and for as long as either Mr. Stahl or Mr. Oliver serves on the Board,

without the prior written consent of the Company, the Investor Group and Messrs. Stahl and

Oliver shall not, nor shall they permit any of their Representatives to, make any public

or private statement that undermines, disparages or otherwise reflects detrimentally on (i)

the Company, (ii) the Company’s current or former directors, officers or employees

in their capacity as such, (iii) the Company’s subsidiaries, or (iv) the business of

the Company or the Company’s subsidiaries or any of its or its subsidiaries’

current directors, officers or employees. |

| (b) | Immediately after the Termination Date,

and for as long as Mr. Stahl or Mr. Oliver serves on the Board, without the prior written

consent of the Investor Group, Mr. Stahl or Mr. Oliver, as the case may be, the Company shall

not, nor shall it permit any of its Representatives to, make any public or private statement

that undermines, disparages or otherwise reflects detrimentally on (i) Mr. Stahl or Horizon,

(ii) Mr. Oliver or SoftVest, (iii) Horizon or SoftVest’s current or former directors,

officers or employees in their capacity as such, (iv) Horizon or SoftVest’s subsidiaries,

or any of its current or former directors, officers or employees, or (v) the business of

Horizon or SoftVest or Horizon’s or SoftVest’s subsidiaries or any of Horizon’s

or SoftVest’s subsidiaries’ current directors, officers or employees. |

| (c) | Notwithstanding anything contained herein

or in the Stockholders’ Agreement, dated June 11, 2020, by and among the parties (as

amended from time to time, the “Stockholders’ Agreement”), to the

contrary, the restrictions contained herein and therein shall not (i) apply (A) to any Legal

Proceedings brought by the Company against the Investor Group and/or Messrs. Stahl and Oliver

or any Legal Proceedings brought by the Investor Group against the Company, (B) in any compelled

testimony or production of information in response to a Legal Requirement, or (C) to any

disclosure that such party reasonably believes, after consultation with its outside counsel,

to be legally required by applicable law, rules or regulations; or (ii) prohibit any party

from reporting what it reasonably believes, after consultation with its outside counsel,

to be violations of federal or state law or regulation to any governmental authority pursuant

to Section 21F of the Exchange Act or Rule 21F promulgated thereunder. Notwithstanding anything

to the contrary contained herein, nothing shall prohibit any party or its Representatives

from making any statements in response to the pending decision of, or any post-trial opinion

entered in connection with the litigation in the Delaware Court of Chancery captioned Texas

Pacific Land Corp. v. Horizon Kinetics LLC, No. 2022-1066-JTL (Del. Ch.). |

| 4. | Immediately after the Termination Date, and

as long as either Mr. Stahl or Mr. Oliver serves on the Board, without the prior written

consent of the Company, neither the Investor Group nor Messrs. Stahl and Oliver shall, and

shall cause their respective Affiliates and controlled Associates not to, directly or indirectly: |

(a)

(i) nominate, recommend for nomination or give notice of an intent to nominate or recommend for nomination a person for election at any

Stockholder Meeting at which directors are to be elected; (ii) initiate, encourage or participate in any solicitation of proxies in respect

of any election contest or removal contest with respect to directors; (iii) submit, initiate, make or be a proponent of any stockholder

proposal for consideration at, or bring any other business before, any Stockholder Meeting; (iv) initiate, encourage or participate in

any solicitation of proxies in respect of any stockholder proposal for consideration at, or other business brought before, any Stockholder

Meeting; or (v) initiate, encourage or participate in any “withhold” or similar campaign with respect to any Stockholder

Meeting; or

(b)

make any (i) public or private (other than to the Board) proposal with respect to or (ii) seek to encourage, advise or assist any person

in so encouraging or advising with respect to, in each case: (A) any change in the number or term of directors serving on the Board or

the filling of any vacancies on the Board, (B) any change in the capitalization, dividend or share repurchase policy of the Company,

(C) any other change in the Company’s business, operations, strategy, management, governance, corporate structure, or other affairs

or policies, (D) any Extraordinary Transaction, (E) causing a class of securities of the Company to be delisted from, or to cease to

be authorized to be quoted on, any securities exchange or (F) causing a class of equity securities of the Company to become eligible

for termination of registration pursuant to Section 12(g)(4) of the Exchange Act. Notwithstanding the foregoing, nothing herein shall

prohibit (i) Mr. Stahl or Mr. Oliver from suggesting or proposing any action whatsoever in any meeting of the Board of Directors or (ii)

Mr. Stahl or Mr. Oliver from disclosing their or the Investor Group’s vote as stockholders with respect to any Stockholder Meeting.

| 5. | All references to the “Termination Date” in the Stockholders’

Agreement and the ancillary documents thereto are hereby replaced to read “following the completion

of the 2023 annual meeting of stockholders of TPL Corp (the “Termination Date”)”,

which in no event shall extend beyond December 31, 2023. Notwithstanding the first proviso in Section

11(a) of the Stockholders’ Agreement, all of the Investor Group’s obligations under the

Stockholders’ Agreement shall terminate upon the Termination Date; provided, however,

that the termination thereof shall not limit the rights or remedies of the parties to enforce their

respective rights under the Stockholders’ Agreement in accordance therewith with respect to any

breaches of the Stockholders’ Agreement, whether alleged or not, that occurred prior to the Termination

Date. |

6.

| (a) | No later than two Business Days following

the date of this Agreement, the Company shall file with the SEC a Current Report on Form

8-K reporting its entry into this Agreement, disclosing applicable items to conform to its

obligations hereunder and appending this Agreement as an exhibit thereto (the “Form

8-K”). The Form 8-K shall be consistent with the terms of this Agreement. The Company

shall provide the members of the Investor Group and their Representatives with a reasonable

opportunity to review and comment on the Form 8-K prior to it being filed with the SEC and

consider in good faith any comments of the Investor Group and their Representatives. |

| (b) | No later than two Business Days following

the date of this Agreement, Horizon shall file with the SEC amendments to its Schedule 13D

filing, in compliance with Section 13 of the Exchange Act, reporting its entry into this

Agreement, disclosing applicable items to conform to its obligations hereunder and including

the terms of this Agreement and including this Agreement as an exhibit thereto (the “Schedule

13D Amendment”). The Schedule 13D Amendment shall be consistent with the terms

of this Agreement. Horizon shall provide the Company and its Representatives with a reasonable

opportunity to review its Schedule 13D Amendment prior to its being filed with the SEC and

consider in good faith any comments of the Company and its Representatives. |

| 7. | Each party shall be responsible for its own costs and expenses in connection

with the negotiation and execution of this Agreement. This Agreement shall be binding upon, inure to

the benefit of, and be enforceable by and against the permitted successors and assigns of each party. |

| 8. | As used in this Agreement: |

(i)

the terms “Affiliate” and “Associate” (and any plurals thereof) have the meanings ascribed to such

terms under Rule 12b-2 promulgated by the SEC under the Exchange Act and shall include all persons or entities that are or become Affiliates

or Associates of any applicable person or entity referred to in this Agreement; provided, however, that the term “Associate”

shall refer only to Associates controlled by the Company or the members of the Investor Group, as applicable; provided, further that,

for purposes of this Agreement, the members of the Investor Group shall not be Affiliates or Associates of the Company, and the Company

shall not be an Affiliate or Associate of the members of the Investor Group;

(ii)

the terms “person,” “proxy” and “solicitation” (and any plurals thereof) have

the meanings ascribed to such terms under the Exchange Act and the rules and regulations promulgated thereunder; provided, however,

that the meaning of “solicitation” shall be without regard to the exclusions set forth in Rules 14a- 1(l)(2)(iv) and 14a-2

under the Exchange Act;

(iii)

the term “Business Day” means any day that is not a Saturday, Sunday or other day on which commercial banks in the

State of Delaware are authorized or obligated to be closed by applicable law;

(iv)

the term “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated

thereunder;

(v)

the term “Extraordinary Transaction” means any tender offer, exchange offer, share exchange, merger, consolidation,

acquisition, business combination, sale, recapitalization, restructuring, or other matters involving a corporate transaction that require

a stockholder vote;

(vi)

the term “Representatives” means (A) a person’s Affiliates and Associates and (B) its and their respective trustees,

directors, officers, employees, partners, members, managers, consultants, legal or other advisors, agents and other representatives acting

in a capacity on behalf of, in concert with or at the direction of such person or its Affiliates or Associates;

(vii)

the term “SEC” means the U.S. Securities and Exchange Commission; and

(viii)

the term “Stockholder Meeting” means each annual or special meeting, or any action by written consent in lieu

thereof, of stockholders of the Company and any adjournment, postponement, rescheduling or continuation thereof.

| 9. | All notices, demands and other communications to be given or delivered

under or by reason of the provisions of this Agreement shall be in writing and shall be deemed to have

been given (a) when delivered by hand, with written confirmation of receipt; (b) upon sending if sent

by electronic mail to the electronic mail addresses below, with confirmation of receipt from the receiving

party by electronic mail; (c) one Business Day after being sent by a nationally recognized overnight

carrier to the addresses set forth below; or (d) when actually delivered if sent by any other method

that results in delivery, with written confirmation of receipt: |

If to the Company:

Texas Pacific Land Corporation

1700 Pacific Avenue, Suite 2900

Dallas, TX 75201

Attn: Micheal Dobbs

Email: mdobbs@texaspacific.com

with mandatory copies (which shall not constitute

notice) to:

Sidley Austin LLP

1000 Louisiana Street, Suite 5900

Houston, TX 77002

Attn: George J. Vlahakos

Email: gvlahakos@sidley.com

If to the Investor Group:

Horizon Kinetics LLC

470 Park Avenue South

New York, NY 10016

Attn: Jay Kesslen

Email: jkesslen@horizonkinetics.com

| 10. | The parties reserve all rights under the Stockholders’ Agreement

and the ancillary documents related thereto for any breaches thereof, whether alleged or not, that

occurred prior to the execution of this Agreement. For the avoidance of doubt, this Agreement shall

have no impact on the parties’ pending litigation in the Delaware Court of Chancery in connection

with the Stockholder’s Agreement in Texas Pacific Land Corp. v. Horizon Kinetics LLC, No. 2022-

1066-JTL (Del. Ch.), and no party may directly or indirectly suggest otherwise, including to the Delaware

Court of Chancery or any other court. |

| 11. | This Agreement, and any disputes arising out of or related to the Agreement

(whether for breach of contract, tortious conduct or otherwise) shall be governed by, and construed

in accordance with, the laws of the State of Delaware, without regard to conflict of laws principles

that would require the application of laws of another jurisdiction. The parties agree that exclusive

jurisdiction and venue for any legal proceeding arising out of or related to this Agreement shall exclusively

lie in the Court of Chancery of the State of Delaware, or if such court does not have subject matter

jurisdiction, the Superior Court of the State of Delaware or, if jurisdiction is vested exclusively

in the federal courts of the United States, the federal courts of the United States sitting in the

State of Delaware. Each party waives any objection it may now or hereafter have to the laying of venue

of any such legal proceeding and irrevocably submits to personal jurisdiction in any such court in

any legal proceeding and hereby further irrevocably and unconditionally waives and agrees not to please

or claim in any court that any such legal proceeding brought in any such court has been brought in

any inconvenient forum. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN

ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT. |

| 12. | Each party to this Agreement acknowledges and agrees that each of the

other parties would be irreparably injured by an actual breach of this Agreement by another party or

its Representatives and that monetary remedies may be inadequate to protect either party against any

actual or threatened breach or continuation of any breach of this Agreement. Without prejudice to any

other rights and remedies otherwise available to the parties under this Agreement, each party shall

be entitled to equitable relief by way of injunction or otherwise and specific performance of the provisions

hereof upon satisfying the requirements to obtain such relief without the necessity of posting a bond

or other security, if another party or any of its Representatives breach or threaten to breach any

provision of this Agreement. Such remedy shall not be deemed to be the exclusive remedy for a breach

of this Agreement, but shall be in addition to all other remedies available at law or equity to the

non-breaching party. |

| 13. | This Agreement may be executed in one or more textually identical counterparts,

each of which shall be deemed an original, but all of which together shall constitute one and the same

agreement. Signatures to this Agreement transmitted by facsimile transmission, by electronic mail in

“portable document format” (“.pdf”) form, or by any other electronic means

intended to preserve the original graphic and pictorial appearance of a document, shall have the same

effect as physical delivery of the paper document bearing the original signature. |

[Signature Pages Follow]

IN WITNESS WHEREOF, each

of the parties has executed this Agreement, or caused the same to be executed by its duly authorized representative, as of the date first

above written.

| |

TEXAS PACIFIC LAND CORPORATION |

| |

|

| |

By: |

|

| |

Name: |

Micheal W. Dobbs |

| |

Title: |

Senior Vice President, Secretary and General Counsel |

| |

Horizon Kinetics LLC |

| |

|

| |

By: |

|

| |

Name: |

Murray Stahl |

| |

Title: |

CEO |

| |

|

| |

|

| |

Horizon Kinetics Asset Management |

| |

|

| |

By: |

|

| |

Name: |

Murray Stahl |

| |

Title: |

CEO |

| Agreed and acknowledge |

|

| |

|

|

|

| Murray Stahl |

|

SIGNATURE

PAGE TO ADDENDUM TO STOCKHOLDERS' AGREEMENT

| |

SoftVest Advisors, LLC |

| |

|

| |

By: |

|

| |

Name: |

Eric Oliver |

| |

Title: |

Managing Director |

| |

|

| |

SoftVest, L.P. |

| |

|

| |

By: SoftVest GP I, LLC as general partner |

| |

|

| |

By: |

|

| |

Name: |

Eric Oliver |

| |

Title: |

Managing Director |

| Agreed and acknowledge |

|

| |

|

|

|

| Eric L. Oliver |

|

Exhibit 99.1

Texas Pacific Land Corporation Announces Board

Refreshment

Will nominate two new independent directors

with relevant experience and expertise in energy, land and royalty management and executive leadership at the 2023 Annual Meeting

David E. Barry and John R. Norris III will retire

from the Board at the 2023 Annual Meeting

Company enters into a Cooperation Agreement

with Horizon Kinetics and SoftVest

DALLAS, AUGUST 1, 2023 – Texas Pacific Land Corporation

(NYSE: TPL) (the “Company” or “TPL”) today announced its slate of director nominees for election to the Company’s

board of directors (the “Board”) at the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”).

The Company will nominate two new independent directors, Marguerite

Woung-Chapman and Robert Roosa, in addition to current director, Murray Stahl. The current directors and co-chairs of the Board, David

E. Barry and John R. Norris III, have announced their intention to retire at the 2023 Annual Meeting and will not stand for reelection.

The Board intends to announce new Board leadership following the 2023 Annual Meeting.

TPL’s new independent director nominees bring a strong and relevant

mix of skills and experiences, as well as proven track records of value creation, which the Board believes will enhance its oversight

of TPL’s strategy and performance:

| · | Ms. Woung-Chapman has extensive energy sector executive experience, having worked at and with oil and gas companies for more

than 30 years. Ms. Woung-Chapman currently serves as a member of the Board of Directors of Chord Energy (NASDAQ: CHRD) and Summit Midstream

Partners (NYSE: SMLP). She previously served as Senior Vice President, General Counsel and Corporate Secretary of Energy XXI Gulf Coast,

Inc. |

| · | Mr. Roosa brings deep oil and gas financial and executive experience to the Board and is currently Partner and Chief Executive

Officer of Brigham Royalties, LLC. He was previously the Chief Executive Officer and a Director of Brigham Minerals, Inc., a public minerals

company, from 2017 to 2022. |

“We thank David and John for their dedication and years of service

to TPL and its shareholders, during which time they helped oversee substantial growth and value creation. We wish them all the best,"

said General Donald Cook, TPL director and chairperson of the Nominating and Governance Committee. “The Board looks forward to welcoming

Marguerite and Robert. We believe the Company and its shareholders will benefit greatly from their relevant experience and expertise as

we continue to execute TPL’s strategy and drive value for our shareholders.”

In connection with the Board changes, TPL has entered into a Cooperation

Agreement (the “Cooperation Agreement”) with Horizon Kinetics LLC, SoftVest, L.P. and their affiliated funds (collectively,

the “Investor Group”), which includes, among other things, certain voting commitments and standstill and non-disparagement

provisions. The Cooperation Agreement will be filed on Form 8-K with the Securities and Exchange Commission. The Cooperation Agreement

has no impact on the litigation pending in Delaware Chancery Court between TPL and the Investor Group.

Evercore is serving as financial advisor to TPL, Sidley Austin LLP

is serving as legal advisor to TPL and Spotlight Advisors, LLC is serving as strategic advisor to TPL.

About Marguerite Woung-Chapman

Ms. Woung-Chapman currently serves as a member of the Board of Directors

of Chord Energy (NASDAQ: CHRD) and Summit Midstream Partners (NYSE: SMLP). In 2018, Ms. Woung-Chapman served as Senior Vice President,

General Counsel and Corporate Secretary of Energy XXI Gulf Coast, Inc., a NASDAQ-listed independent exploration and production company

that was engaged in the development, exploitation and acquisition of oil and natural gas properties in the U.S. Gulf Coast region. Prior

to that, from 2012 to 2017, Ms. Woung-Chapman served in various capacities at EP Energy Corporation, a private company that subsequently

became an NYSE-listed independent oil and gas exploration and production company, including, among others, Senior Vice President, Land

Administration, General Counsel and Corporate Secretary. Ms. Woung-Chapman began her career as a corporate attorney with El Paso Corporation

(including its predecessors) and served in various capacities of increasing responsibility during her tenure from 1991 until 2012, including,

among others, Vice President, Legal Shared Services, Corporate Secretary and Chief Governance Officer. She has a B.S. in Linguistics from

Georgetown University and a J.D. from the Georgetown University Law Center.

About Robert Roosa

Robert M. Roosa is Partner and Chief Executive Officer of Brigham Royalties,

LLC and previously served as the Chief Executive Officer since 2017 and director of Brigham Minerals since 2018 until it was acquired

by Sitio Royalties Corporation in 2022. Mr. Roosa served as the President of Anthem Ventures, LLC, a family office, and assisted Mr. Brigham

with a number of family ventures between January 2012 and January 2017. Mr. Roosa served various roles, including Director of Finance

and Investor Relations, while at Brigham Exploration from 2006 until its sale to Statoil in December of 2011. From 2000 to 2006, Mr. Roosa

held a series of positions at Exxon Mobil Corporation, an oil and gas company, in the Corporate Treasurer’s Department. Prior to

2000, Mr. Roosa worked for Cooper Industries, an electrical products manufacturing company, in its Corporate Controllers and Audit Groups

and with the accounting firm Deloitte & Touche LLP in its audit function. Mr. Roosa graduated from Southern Methodist University with

a Master of Business Administration and from the University of Texas at Austin with a Bachelor of Business Administration.

About Texas Pacific Land Corporation

Texas Pacific Land Corporation is one of the largest landowners in

the State of Texas with approximately 874,000 acres of land in West Texas, with the majority of its ownership concentrated in the Permian

Basin. The Company is not an oil and gas producer, but its surface and royalty ownership provide revenue opportunities throughout the

life cycle of a well. These revenue opportunities include fixed fee payments for use of our land, revenue for sales of materials (caliche)

used in the construction of infrastructure, providing sourced water and/or treated produced water, revenue from our oil and gas royalty

interests, and revenues related to saltwater disposal on our land. The Company also generates revenue from pipeline, power line and utility

easements, commercial leases and temporary permits related to a variety of land uses including midstream infrastructure projects and hydrocarbon

processing facilities.

Contacts

Investors:

TPL Investor Relations

IR@texaspacific.com

Media:

Paul Caminiti / Nicholas Leasure

Reevemark

(212) 433-4600

TeamTPL@reevemark.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

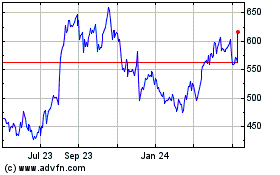

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Apr 2024 to May 2024

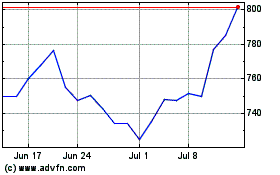

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From May 2023 to May 2024