Eaton Partners Serves as Exclusive Global Placement Agent to Solum Partners

April 27 2023 - 8:30AM

Eaton Partners (“Eaton”), one of the largest placement agents and

financial advisory firms and a wholly owned subsidiary of Stifel

Financial Corp. (NYSE: SF), is pleased to announce that it served

as exclusive global placement agent for Solum Partners (“Solum”)

and its Solum Partners Fund II, L.P. (“Fund II”). The Fund closed

oversubscribed with approximately $850 million in capital

commitments.

Solum is a leading alternative asset manager

investing in the food and agriculture industry utilizing a proven,

hands-on approach anchored in the deep industry knowledge of its

team. Solum focuses on forming strong local partnerships with the

objective of achieving operational excellence and continuous

improvement across all of its portfolio companies.

“As the global agriculture and food production

industry continues to evolve, businesses have needed to adapt and

meaningfully scale operations to keep pace,” said Uli Flores, Head

of Real Assets at Eaton Partners. “Solum’s approach to the food and

agriculture sector is highly differentiated, which allowed us to

secure a diverse, yet like-minded, investor base, and we are proud

to have been a part of the outstanding fundraising efforts.”

“We appreciate the work of Eaton Partners and

are encouraged by the strong demand and enthusiasm shown by our

investors, especially when considering the current geopolitical and

macroeconomic landscape,” noted Colin Butterfield, CEO of Solum

Partners. “Through our unique owner-operator approach, we are proud

to partner with farmers and industry leaders to not only provide

capital but also foster operational improvements and leverage

vertical integration to ensure they are positioned for continued

and accelerated success. It is a privilege to be entrusted with

this capital, and we look forward to continuing to identify and

manage sustainable food and agriculture assets in the pursuit of

attractive risk-adjusted returns.”

Fund II is the second vehicle managed by Solum

Partners since its spinout from Harvard Management Company in

October 2020. The firm has approximately $2 billion of assets under

management.

About Eaton PartnersEaton

Partners, is one of the world’s largest capital placement agents

and fund advisory firms, having raised more than $130 billion for

over 175 highly differentiated alternative investment funds and

offerings. Eaton Partners is a division of Stifel, Nicolaus &

Company, Incorporated, Member SIPC and NYSE. For more information,

please visit https://eaton-partners.com/.

About Stifel Stifel Financial

Corp. (NYSE: SF) is a financial services holding company

headquartered in St. Louis, Missouri, that conducts its banking,

securities, and financial services business through several wholly

owned subsidiaries. Stifel’s broker-dealer clients are served in

the United States through Stifel, Nicolaus & Company,

Incorporated, including its Eaton Partners business division;

Keefe, Bruyette & Woods, Inc.; Miller Buckfire & Co., LLC;

and Stifel Independent Advisors, LLC. The Company’s broker-dealer

affiliates provide securities brokerage, investment banking,

trading, investment advisory, and related financial services to

individual investors, professional money managers, businesses, and

municipalities. Stifel Bank and Stifel Bank & Trust offer a

full range of consumer and commercial lending solutions. Stifel

Trust Company, N.A. and Stifel Trust Company Delaware, N.A. offer

trust and related services. To learn more about Stifel, please

visit the Company’s website at www.stifel.com. For global

disclosures, please visit

https://www.stifel.com/investor-relations/press-releases.

About Solum PartnersSolum

Partners, headquartered in Boston, Massachusetts, manages

approximately $2 billion in assets within the agriculture and food

production industry as of March 31, 2023. The firm utilizes its

hands-on approach and industry knowledge to enhance the value of

its investments and deliver attractive risk-adjusted returns for

investors. The firm’s strategy is driven by a focus on strong

partnerships, operational excellence, and continuous improvement

and is underpinned by a comprehensive approach to ESG. For more

information, please visit https://solumpartners.com/ or

contact ir@solumpartners.com.

Media Contact Neil Shapiro, +1 (212) 271-3447

shapiron@stifel.com

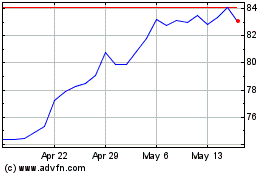

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Mar 2024 to Apr 2024

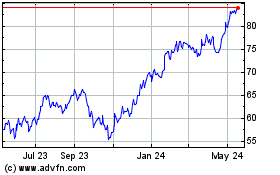

Stifel Financial (NYSE:SF)

Historical Stock Chart

From Apr 2023 to Apr 2024