Recorded Music Revenue Hits $12 Billion in 2020 Amid Pandemic Streaming Boom

February 26 2021 - 2:00PM

Dow Jones News

By Anne Steele

Sales of recorded music grew 9.2% last year to $12.2 billion as

subscriptions to streaming services reached new highs during the

Covid-19 pandemic.

The past year marked the music industry's fifth consecutive year

of growth thanks to streaming, which accounted for 83% of total

revenue, according to a report from record company trade group the

Recording Industry Association of America. Revenue generated from

music licenses to social media and fitness apps also picked up

during the last year.

The pandemic lockdowns were momentous for at-home streaming

entertainment services in 2020. With almost no live concerts,

limited capacity at sporting events and closed movie theaters

consumers tuned into music-streaming apps, and flocked to social

apps like Instagram, and TikTok and at-home fitness apps like

Peloton, which heavily rely on music to engage users. drive

engagement.

Subscriptions to on-demand streaming services offered by Spotify

Technology SA, Apple Inc. and others grew to 75.5 million from 60.4

million in 2019, the biggest ever increase in a single year. The

streaming category, which also includes ad-supported on-demand

services, such as YouTube, Vevo and Spotify's ad-supported tier,

streaming radio services such as Pandora and SiriusXM, as well as

music licenses for streaming fitness services like Peloton,

generated $10.1 billion in 2020, up 13.4% from the previous

year.

"These services are largely music-powered -- whether it's TikTok

dances, skateboarding dreams, or Instagram people-watching, the

'most followed' lists for all these services and platforms are

overwhelmingly made up of artists and music creators," said RIAA

Chief Executive Mitch Glazier.

RIAA's data includes Peloton and Facebook, which owns Instagram,

but it doesn't include TikTok.

The music industry's fortunes started to turn around in 2016,

when the growth from streaming services began to outweigh a 15-year

decline in CD sales amid rampant online piracy. Revenue is still

below, but closing in on, its 1999 peak of $14.6 billion.

Last year, sales of physical music products were flat at $1.1

billion. Revenue from sales of vinyl -- up 29% to $626 million --

surpassed revenue from CDs for the first time since 1986, though it

still only accounted for 5.2% of overall revenue. Digital download

sales fell 18% to $674 million, and accounted for just 6% of total

revenue in 2019.

A decline in advertising revenue during the pandemic dragged on

revenue from ad-supported on-demand streaming services such as

Alphabet Inc.'s YouTube and Spotify's free service, which saw 17%

year-over-year growth to $1.2 billion. The category saw nearly 30%

growth in each of the prior three years.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 26, 2021 13:45 ET (18:45 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

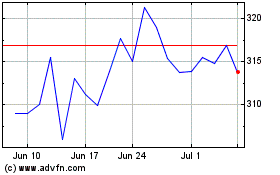

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Oct 2024 to Nov 2024

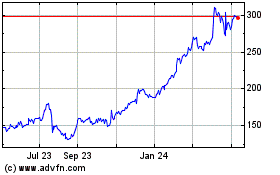

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Nov 2023 to Nov 2024