UPDATE: Bank Regulators Order 14 Lenders To Overhaul Foreclosure Practices

April 13 2011 - 2:35PM

Dow Jones News

Major U.S. banks and thrifts filed foreclosures with improper

documentation and lacked sufficient staff to properly handle

distressed borrowers, federal bank regulators said Wednesday as

they ordered lenders to overhaul their foreclosure processes.

The orders for 14 institutions issued by the Office of the

Comptroller of the Currency, Federal Reserve and Office of Thrift

Supervision followed a probe of the mortgage servicing abuses that

erupted into view last fall. The orders did not include fines for

the industry, though the Federal Reserve said it "plans to announce

monetary penalties."

"These deficiencies represent significant and pervasive

compliance failures and unsafe and unsound practices at these

institutions," the Fed said in a statement. Regulators also

required two outsourcing companies to change their practices.

Still, Democratic lawmakers and some state attorneys general

have advocated a tougher response, including a much larger effort

to write down the value of loans for troubled homeowners. But

Republicans at the state and federal level reject that approach,

calling it an overly broad response to the foreclosure-document

problems.

Acting Comptroller of the Currency John Walsh said in a

statement that the agreements "will not only fix the problems we

found in foreclosure processing, but will also correct failures in

governance and the loan modification process and address financial

harm to borrowers."

Earlier in the day, J.P. Morgan Chase & Co. (JPM) Chief

Executive Jamie Dimon said he expects banks to eventually pay

fines, adding that resolving the issue "will be good for

everybody." As a result of the orders, J.P. Morgan expects banks'

costs for mortgage servicing will result in $1.1 billion in

additional staffing and legal costs.

The orders were issued to the nation's four largest banks--Bank

of America Corp. (BAC), Wells Fargo & Co. (WFC) J.P. Morgan and

Citigroup Inc. (C).

Citi said in a statement that the company is "committed to

working with our regulators to further strengthen our programs in

these areas and meeting these new requirements by the

implementation deadlines." Wells Fargo called the orders an

"unprecedented measure and a tough message to take, but it will

make mortgage servicing practices better across the board." Bank of

America did not immediately comment.

Also receiving orders were Ally Financial Inc., HSBC Holdings

PLC (HBC, HSBA.LN, 0005.HK), MetLife Inc. (MET), PNC Financial

Services Group Inc. (PNC), SunTrust Banks Inc. (STI), U.S. Bancorp

(USB), Aurora Bank, EverBank, OneWest Bank and Sovereign Bank.

MetLife said in a statement that it "either has implemented, or

is in the process of implementing, many of these standards."

The orders found that the banks filed foreclosure documents in

courts around the country that included assertions that bank

employees could not personally verify. Banks also filed documents

that weren't properly notarized, did not ensure that mortgage

documents were transferred properly, failed to have adequate staff

for the foreclosure process and didn't properly oversee outside

firms that handled foreclosures, the regulators found.

The orders, however, are likely to come under fire for leaving

too much discretion in the hands of banks. They require each to

hire an independent consultant to evaluate whether they improperly

foreclosed on any homeowners and require each company to establish

their own process to consider whether to compensate borrowers who

have been harmed.

Regulators did not reach a definitive conclusion on whether

borrowers had improperly lost their homes, according to a person

familiar with the matter.

Last week, a group of consumer advocates objected to that idea

in a letter to the bank regulators, arguing that doing so would

"permit the perpetrators of these recognized illegalities to create

their own process for fixing the problems in the future."

Rep. Elijah Cummings (D., Md.) the top Democrat on the House

Oversight and Government Reform Committee, had called on the

Comptroller's office to postpone the orders, writing in a letter

Tuesday that the then-pending action was "insufficient to curb the

serious and chronic misconduct allegedly engaged in against

homeowners and mortgage investors."

The bank regulators also announced actions against two

outsourcing companies Lender Processing Services Inc. and Mortgage

Electronic Registration Systems, or MERS. The Fed said those

actions " address significant compliance failures and unsafe and

unsound practices" at both companies.

Reston, Va.-based MERS said in a statement that it is "already

actively implementing changes that tighten corporate governance,

improve internal controls and address quality assurance issues"

identified in the review.

MERS runs a database that allows banks to package loans into

securities that can be sold without being recorded in local county

courthouses, reducing costs for banks. Critics of the company have

raised concerns over whether notes were properly assigned or

tracked within the electronic system.

-By Alan Zibel, Dow Jones Newswires; 202-862-9263;

alan.zibel@dowjones.com

--Matthias Rieker contributed to this article.

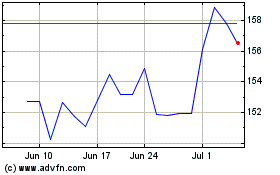

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

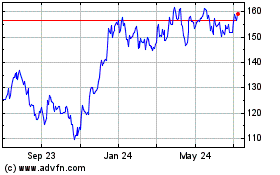

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Jul 2023 to Jul 2024