Navios Maritime Holdings Inc. Reports Financial Results for the

Fourth Quarter and Year Ended December 31, 2013

MONACO--(Marketwired - Feb 19, 2014) - Navios Maritime Holdings

Inc. (NYSE: NM)

- Revenue:

- $512.3 million for 2013; $130.6 million for Q4

- Adjusted EBITDA:

- $159.8 million for 2013; $42.0 million for Q4

- Acquired 22 vessels in 2013 and YTD 2014

- Six vessels to owned fleet; six vessels through Navios Asia;

ten vessels through Navios Europe

- Chartered-in five vessels

- Japanese built Kamsarmax vessels delivering between Q2 2015 and

Q4 2016

- Chartered for periods between seven and ten years

- Purchase option on all vessels

- Dividend of $0.06 per share for Q4 2013

Navios Maritime Holdings Inc. ("Navios Holdings" or "the

Company") (NYSE: NM), a global, vertically integrated seaborne

shipping and logistics company, today reported financial results

for the fourth quarter and year ended December 31, 2013.

Angeliki Frangou, Chairman and Chief Executive Officer, stated,

"We are pleased to report our results for the fourth quarter and

year 2013. We had solid results and reported Adjusted EBITDA

of $159.8 million and $42.0 million for the year and the quarter,

respectively. As we continue to focus on execution, we are

returning capital to our shareholders through dividend payments and

declared a $0.06 dividend for Q4 2013 representing a yield of

2.4%."

Angeliki Frangou continued, "Controlling costs was an

institutional imperative in 2013, to take advantage of any change

in the cycle. Through a number of initiatives, we materially

reduced our daily cash breakeven to an estimated $7,308 per vessel

for 2014. This low breakeven allows us to position Navios optimally

as it provides a margin of safety in a recovering market and should

provide reasonable cash flow in any event."

HIGHLIGHTS -- RECENT DEVELOPMENTS

Navios Holdings

Issuances of American Depositary Shares Representing Preferred

Stock

On January 28, 2014, Navios Holdings completed the sale

2,000,000 American Depositary Shares, each of which represents

1/100th of a share of the Company's Series G Cumulative Redeemable

Perpetual Preferred Stock, with a liquidation preference of

$2,500.00 per share, priced at $25.00 per American Depositary

Share. Dividends will be payable on the Series G Cumulative

Redeemable Perpetual Preferred Stock at a rate of 8.75% per annum

of the stated liquidation preference. The American Depositary

Shares have been approved for listing on the New York Stock

Exchange under the symbol "NMPrG." The net proceeds of

approximately $47.7 million from the offering (after deducting

underwriting discounts and estimated offering expenses) will be

used for general corporate purposes, including acquisition of

vessels.

Fleet Developments

Acquisition of Two New Building Vessels

On January 26, 2014, Navios Holdings entered into agreements to

purchase two bulk carrier vessels, one 84,000 dwt Panamax vessel

and one 180,600 dwt Capesize vessel, both to be built in Japan. The

vessels' acquisition prices are $31.8 million and $52.0 million,

respectively. Both vessels are scheduled for delivery in Q4 2015.

The vessels will be financed with debt and cash from

operations.

Chartered-in Five Vessels

In January 2014, Navios Holdings entered into agreements to

charter-in five new building Japanese Kamsarmax vessels. The

vessels are expected to be delivered between Q2 2015 and Q4 2016

and are chartered-in for periods from seven to ten years for an

average charter rate of $13,480 per day for the first year. Navios

has purchase option on all of the vessels.

Dividend Policy

On February 17, 2014, the Board of Directors declared a

quarterly cash dividend for the fourth quarter of 2013 of $0.06 per

share of common stock. The dividend is payable on March 27, 2014 to

stockholders of record as of March 20, 2014. The declaration and

payment of any further dividends remain subject to the discretion

of the Board and will depend on, among other things, Navios

Holdings' cash requirements after taking into account market

opportunities, restrictions under its credit agreements and other

debt obligations and such other factors as the Board may deem

advisable.

Navios South American Logistics Inc. ("Navios

Logistics")

On February 11, 2014, Navios Logistics entered into an agreement

for the construction of three new pushboats with a construction

price of $7.4 million each. These vessels are expected to be

delivered in the first quarter of 2015.

Navios Asia LLC ("Navios Asia")

In January, 2014, Navios Asia took delivery of the N Bonanza, a

2006-built 76,596 dwt bulk carrier vessel for a purchase price of

$17.5 million, of which $6.3 million was paid from equity

contributions and $11.3 million was financed through a loan.

Navios Maritime Partners L.P. ("Navios Partners")

In February 2014, Navios Partners completed its public offering

of 6,325,000 common units, including the full exercise of the

underwriters' overallotment option at $17.30 per unit, and raised

gross proceeds of approximately $109.4 million. The net proceeds of

this offering were approximately $104.5 million. Navios Holdings

paid $2.2 million in order to retain its 2% general partner

interest. As a result, 129,082 additional general partnership units

were issued in connection with this offering. Following this

offering Navios Holdings' owns 20.0% of Navios Partners (which

includes a 2% general partner interest).

On February 14, 2014, Navios Holdings received $7.4 million from

Navios Partners representing the cash distribution for the fourth

quarter of 2013.

Navios Maritime Acquisition Corporation ("Navios

Acquisition")

On February 14, 2014, Navios Acquisition priced its public

offering of 14,950,000 shares of its common stock, including the

full exercise of the underwriters' overallotment option at a price

of $3.85 per share, raising gross proceeds of $57.6 million. The

offering is expected to close on February 20, 2014. Following this

offering, Navios Holdings' has a 43.6% voting interest and 46.4%

economic interest in Navios Acquisition (43.1% voting and 45.8%

economic interest following the exercise of the underwriters'

overallotment option).

On January 7, 2014, Navios Holdings received $3.6 million from

Navios Acquisition representing the cash dividend for the third

quarter of 2013.

Time Charter Coverage

As of February 18, 2014, Navios Holdings has chartered-out 51.4%

and 8.8% of available days for 2014 and 2015, respectively,

equivalent to $115.4 million and $28.9 million in revenue,

respectively. The average daily charter-out rate for the core fleet

is $13,408 and $18,230 for 2014 and 2015, respectively. The average

daily charter-in rate for the active long-term charter-in vessels

for 2013 is $13,759.

The above figures do not include the fleet of Navios Logistics

and vessels servicing Contracts of Affreightment.

Fleet Profile

Navios Holdings controls a fleet of 66 vessels totaling 6.3

million dwt, of which 42 are owned and 24 are chartered-in under

long-term charters (collectively, the "Core Fleet"). Navios

Holdings currently operates 53 vessels (15 Capesize, 17 Panamax, 19

Ultra Handymax and two Handysize) totaling 5.1 million dwt. The

current average age of the operating fleet is 7.0 years.

Additionally, Navios Holdings has (i) seven newbuilding charter-in

vessels expected to be delivered at various dates through 2016;

(ii) two newbuilding owned vessels expected to be delivered in Q4

2015; and (iii) four vessels in the Navios Asia fleet expected to

be delivered in the first quarter of 2015.

Exhibit II provides certain details of the "Core Fleet" of

Navios Holdings. It does not include the fleet of Navios

Logistics.

Earnings Highlights

As of December 31, 2013

- Net Debt to Total Capitalization of 51.3%.

- Cash of $189.9 million.

Fourth Quarter 2013 and 2012 Results (in thousands of U.S.

dollars, except per share data and unless otherwise

stated):

The fourth quarter 2013 and 2012 information presented below was

derived from the unaudited condensed consolidated financial

statements for the respective periods. EBITDA, Adjusted EBITDA,

Adjusted Net Loss and Adjusted Basic Losses Per Share are non-U.S.

GAAP financial measures and should not be used in isolation or as

substitution for Navios Holdings' results.

See Exhibit I under the heading, "Disclosure of Non-GAAP

Financial Measures," for a discussion of EBITDA or Adjusted EBITDA

of Navios Holdings, on a consolidated basis, and Navios Logistics,

and a reconciliation of such measure to the most comparable measure

under U.S. GAAP.

| |

|

|

|

|

|

|

|

|

|

Three Month Period |

|

|

Three Month Period |

|

|

|

|

Ended |

|

|

Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2013 |

|

|

2012 |

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

Revenue |

|

$ |

130,586 |

|

|

$ |

128,457 |

|

|

Adjusted EBITDA (*) |

|

$ |

41,985 |

|

|

$ |

53,834 |

|

|

Adjusted Net loss (*) |

|

$ |

(18,059 |

) |

|

$ |

(1,046 |

) |

|

Adjusted Basic Losses Per Share (*) |

|

$ |

(0.18 |

) |

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

(*) |

|

Adjusted EBITDA, Adjusted Net Loss and Adjusted Basic Losses Per

Share for the three months ended December 31, 2013 exclude a $37.1

million loss on bond extinguishment and a $14.8 million loss from

Navios Acquisition. |

| |

|

|

|

|

|

Adjusted EBITDA for the three months ended December 31, 2012

excludes a $161.2 million gain from defaulted charter's

compensation and related accounts, net. |

| |

|

|

| |

|

Adjusted Net Loss and Adjusted Basic Losses

Per Share for the three months ended December 31, 2012 also exclude

the item described in the immediately preceding paragraph, and $4.1

million of accelerated amortization of intangibles. |

| |

|

|

Revenue from drybulk vessel operations for the three months

ended December 31, 2013 was $80.0 million as compared to $69.9

million for the same period during 2012. The increase in drybulk

revenue was mainly attributable to an increase in the time charter

equivalent rate ("TCE") per day by 3.8% to $13,291 per day in the

fourth quarter of 2013, as compared to $12,805 per day in the same

period of 2012; (ii) an increase in available days for owned

vessels of 453 days; and (iii) an increase in short-term charter-in

fleet available days of 473 days. This increase was partially

offset by a decrease in long-term charter-in fleet available days

of 11 days.

Revenue from the logistics business was $50.6 million for the

three months ended December 31, 2013 as compared to $58.6 million

for the same period of 2012. This decrease was mainly attributable

to a decrease in the Paraguayan liquid port's volume of products

sold mitigated by an increase in the revenues of the dry port and

the barge business.

Adjusted EBITDA of Navios Holdings for the three months ended

December 31, 2013 decreased by $11.8 million to $42.0 million as

compared to $53.8 million for the same period of 2012. The $11.8

million decrease in Adjusted EBITDA was primarily due to (i) a $1.4

million increase in direct vessel expenses (excluding the

amortization of deferred drydock and special survey costs); (ii) a

$5.9 million decrease in other income, net; (iii) a $0.5 million

increase in net income attributable to the noncontrolling interest;

and (iv) a $18.9 million decrease in equity in net earnings from

affiliated companies. This overall decrease of $26.7 million was

mitigated by a (i) a $2.1 million increase in revenue;(ii) a $12.4

million decrease in time charter, voyage and logistics business

expenses; and (iii) a $0.4 million decrease in general and

administrative expenses (excluding share-based compensation

expenses).

EBITDA of Navios Logistics was $14.3 million for the three month

period ended December 31, 2013 as compared to $10.9 million for the

same period in 2012.

Adjusted Net Loss of Navios Holdings for the three months ended

December 31, 2013 was $18.1 million as compared to $1.1 million for

the same period of 2012. The $17.0 million increase of Adjusted Net

Loss was mainly due to: (i) a decrease in Adjusted EBITDA of $11.8

million; (ii) an increase in interest income/(expense) and finance

cost, net of $2.4 million; (iii) an increase in income tax expense

of $0.7 million; (iv) an increase of $0.9 million in amortization

for deferred drydock and special survey costs; and (v) an increase

of $1.9 million in share-based compensation expense. This overall

increase was partially offset by a decrease in depreciation and

amortization of $0.7 million (excluding the accelerated

amortization of intangibles in 2012).

Year Ended December 31, 2013 and 2012 Results (in thousands of

U.S. dollars, except per share data and unless otherwise

stated):

The information for the year ended December 31, 2013 and 2012

presented below was derived from the unaudited condensed

consolidated financial statements for the respective periods.

EBITDA, Adjusted EBITDA, Adjusted Net (Loss)/Income and Adjusted

Basic Losses/(Earnings) Per Share are non-U.S. GAAP financial

measures, and should not be used in isolation or as substitution

for Navios Holdings' results.

See Exhibit I under the heading, "Disclosure of Non-GAAP

Financial Measures," for a discussion of EBITDA or Adjusted EBITDA

of Navios Holdings, on a consolidated basis, and Navios Logistics,

and a reconciliation of such measures to the most comparable

measures under U.S. GAAP.

| |

|

|

|

|

|

|

|

Year Ended |

|

Year Ended |

|

|

|

December 31, |

|

December 31, |

|

|

|

2013 |

|

2012 |

|

|

|

(unaudited) |

|

(unaudited) |

|

Revenue |

|

$ |

512,279 |

|

$ |

616,494 |

|

Adjusted EBITDA (*) |

|

$ |

159,829 |

|

$ |

237,935 |

|

Adjusted Net (Loss)/Income (*) |

|

$ |

(57,143) |

|

$ |

18,005 |

|

Adjusted Basic (Losses)/Earnings Per Share (*) |

|

$ |

(0.58) |

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

(*) |

|

Adjusted EBITDA, Adjusted Net Loss and Adjusted Basic Losses Per

Share for the year ended December 31, 2013 excludes a $37.1 million

loss on bond extinguishment and a $14.8 million loss from Navios

Acquisition. |

| |

|

|

| |

|

Adjusted EBITDA for the year ended December

31, 2012 excludes (i) a $161.2 million gain from defaulted

charter's compensation and related accounts, net (ii) a $0.3

million gain on the sale of the Navios Buena Ventura to Navios

Partners. |

| |

|

|

|

|

|

Adjusted Net Income and Adjusted Basic Earnings Per Share for the

year ended December 31, 2012 exclude items (i) and (ii) described

in the immediately preceding paragraph, and $4.1 million of

accelerated amortization of intangibles. |

| |

|

|

Revenue from drybulk vessel operations for the year ended

December 31, 2013 was $275.2 million as compared to $369.5 million

for the same period during 2012. The decrease in drybulk revenue

was mainly attributable to: (i) a decrease in the TCE per day by

33.8% to $12,029 per day in the year ended December 31, 2013

following the receipt in advance of $175.4 million due to

restructuring of credit default insurance in the fourth quarter of

2012, as compared to $18,167 per day in the same period of 2012;

and (ii) a decrease in the long-term charter-in fleet available

days of 309 days. This decrease was partially offset by an increase

in short-term charter-in fleet available days of 1,415 days and an

increase in available days for owned vessels of 669 days.

Revenue from the logistics business was $237.1 million for the

year ended December 31, 2013 as compared to $247.0 million for the

same period of 2012. This decrease was mainly attributable to

a decrease in the Paraguayan liquid port's volume of products sold.

This decrease was partially offset by an increase in (i) rates in

the dry port terminal; and (ii) rates in the cabotage fleet.

Adjusted EBITDA of Navios Holdings for the year ended December

31, 2013 decreased by $78.1 million to $159.8 million as compared

to $237.9 million for the same period of 2012. The $78.1 million

decrease in Adjusted EBITDA was primarily due to: (i) a $104.2

million decrease in revenue; (ii) a $14.1 million decrease in

equity in net earnings from affiliated companies; and (iii) a $3.7

million increase in net income attributable to the noncontrolling

interest. The overall variance of $122.0 million was mitigated by:

(i) a $7.0 million decrease in general and administrative expenses

(excluding share-based compensation expenses); (ii) a $6.0 million

decrease in direct vessel expenses (excluding the amortization of

deferred drydock and special survey costs); (iii) a $24.9 million

decrease in time charter, voyage and logistics business expenses;

and (iv) a $6.0 million increase in other income, net.

EBITDA of Navios Logistics was $56.8 million for the year ended

December 31, 2013 as compared to $48.1 million for the same period

in 2012.

Adjusted Net loss of Navios Holdings for the year ended December

31, 2013 was $57.1 million as compared to $18.0 million of income

for the same period of 2012. The decrease of Adjusted Net Income by

$75.1 million was mainly due to: (i) a decrease in Adjusted EBITDA

of $78.1 million; (ii) an increase in interest income/(expense) and

finance cost, net of $5.0 million; (iii) an increase of $2.3

million in amortization for deferred drydock and special survey

costs; and (iv) an increase of $0.3 million in share-based

compensation expense. The decrease was partially offset by: (i) a

decrease in depreciation and amortization of $6.0 million

(excluding the accelerated amortization of intangibles in 2012);

and (ii) an increase in income tax benefit of $4.6 million.

Fleet Summary Data:

The following table reflects certain key indicators indicative

of the performance of the Navios Holdings' drybulk operations

(excluding the Navios Logistics fleet) and its fleet performance

for the three and twelve month periods ended December 31, 2013 and

2012.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Month Period Ended December 31, 2013 |

|

|

Three Month Period Ended December 31, 2012 |

|

|

Year Ended December 31, 2013 |

|

|

Year Ended December 31, 2012 |

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available Days (1) |

|

|

5,389 |

|

|

|

4,474 |

|

|

|

19,364 |

|

|

|

17,589 |

|

|

Operating Days (2) |

|

|

5,370 |

|

|

|

4,391 |

|

|

|

19,062 |

|

|

|

17,273 |

|

| Fleet

Utilization (3) |

|

|

99.7 |

% |

|

|

98.2 |

% |

|

|

98.4 |

% |

|

|

98.2 |

% |

|

Equivalent Vessels (4) |

|

|

59 |

|

|

|

49 |

|

|

|

53 |

|

|

|

48 |

|

| TCE

(5) |

|

$ |

13,291 |

|

|

$ |

12,805 |

|

|

$ |

12,029 |

|

|

$ |

18,167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(1) |

|

Available days for the fleet are total calendar days the vessels

were in Navios Holdings' possession for the relevant period after

subtracting off-hire days associated with major repairs, drydocking

or special surveys. The shipping industry uses available days to

measure the number of days in a relevant period during which

vessels should be capable of generating revenues. |

|

(2) |

|

Operating days are the number of available days in the relevant

period less the aggregate number of days that the vessels are

off-hire due to any reason, including unforeseen circumstances. The

shipping industry uses operating days to measure the aggregate

number of days in a relevant period during which vessels actually

generate revenues. |

|

(3) |

|

Fleet

utilization is the percentage of time that Navios Holdings' vessels

were available for generating revenue, and is determined by

dividing the number of operating days during a relevant period by

the number of available days during that period. The shipping

industry uses fleet utilization to measure a company's efficiency

in finding suitable employment for its vessels. |

|

(4) |

|

Equivalent Vessels is defined as the total available days during a

relevant period divided by the number of days of this period. |

|

(5) |

|

TCE

is defined as voyage and time charter revenues less voyage expenses

during a relevant period divided by the number of available days

during the period. |

|

|

|

|

Conference Call:

As previously announced, Navios Holdings will host a conference

call today, February 19, 2014, at 8:30 am ET, at which time members

of senior management will provide highlights and commentary on the

financial results of the Company for the fourth quarter and year

ended December 31, 2013.

A supplemental slide presentation will be available on the

Navios Holdings website at www.navios.com under the "Investors"

section by 8:00 am ET on the day of the call.

Conference Call details: Call Date/Time: Wednesday, February 19,

2014, at 8:30 am ET Call Title: Navios Holdings Inc. Q4 2013

Financial Results Conference Call US Dial In: +1.877.480.3873

International Dial In: +1.404.665.9927

Conference ID: 3140 3509

The conference call replay will be available shortly after the

live call and remain available for one week at the following

numbers: US Replay Dial In: +1.800.585.8367

International Replay Dial In: +1.404.537.3406

Conference ID: 3140 3509

This call will be simultaneously Webcast. The Webcast will be

available on the Navios Holdings website, www.navios.com, under the

"Investors" section. The Webcast will be archived and available at

the same Web address for two weeks following the call.

About Navios Maritime Holdings Inc.

Navios Maritime Holdings Inc. (NYSE: NM) is a global, vertically

integrated seaborne shipping and logistics company focused on the

transport and transshipment of drybulk commodities including iron

ore, coal and grain. For more information about Navios Holdings

please visit our website: www.navios.com.

About Navios South American Logistics Inc.

Navios South American Logistics Inc. is one of the largest

logistics companies in the Hidrovia region of South America,

focusing on the Hidrovia region river system, the main navigable

river system in the region, and on cabotage trades along the

eastern coast of South America. Navios Logistics serves the storage

and marine transportation needs of its petroleum, agricultural and

mining customers through its port terminals, river barge and

coastal cabotage operations. For more information about Navios

Logistics please visit its website: www.navios-logistics.com.

About Navios Maritime Partners L.P.

Navios Partners (NYSE: NMM) is a publicly traded master limited

partnership which owns and operates dry cargo vessels. For more

information, please visit its website: www.navios-mlp.com.

About Navios Maritime Acquisition Corporation

Navios Acquisition (NYSE: NNA) is an owner and operator of

tanker vessels focusing in the transportation of petroleum products

(clean and dirty) and bulk liquid chemicals. For more information

about Navios Acquisition, please visit its website:

www.navios-acquisition.com.

Forward Looking Statements - Safe Harbor

This press release contains forward-looking statements (as

defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended)

concerning future events and Navios Holdings' growth strategy and

measures to implement such strategy, including expected vessel

acquisitions and entering into further time charters. Words such as

"expects," "intends," "plans," "believes," "anticipates," "hopes,"

"estimates," and variations of such words and similar expressions

are intended to identify forward-looking statements. Such

statements include comments regarding expected revenues and time

charters. Although Navios Holdings believes that the expectations

reflected in such forward-looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct. These statements involve known and unknown risks and

are based upon a number of assumptions and estimates which are

inherently subject to significant uncertainties and contingencies,

many of which are beyond the control of Navios Holdings. Actual

results may differ materially from those expressed or implied by

such forward-looking statements. Factors that could cause actual

results to differ materially include, but are not limited to

changes in the demand for drybulk vessels; competitive factors in

the market in which Navios Holdings operates; risks associated with

operations outside the United States; and other factors listed from

time to time in Navios Holdings' filings with the Securities and

Exchange Commission. Navios Holdings expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Navios Holdings' expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

| |

| EXHIBIT I |

| |

| NAVIOS MARITIME HOLDINGS INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Expressed in thousands of U.S. dollars - except share

and per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Month |

|

|

Three Month |

|

|

Year |

|

|

Year |

|

|

|

|

Period Ended |

|

|

Period Ended |

|

|

Ended |

|

|

Ended |

|

|

|

|

December 31, 2013 |

|

|

December 31, 2012 |

|

|

December 31, 2013 |

|

|

December 31, 2012 |

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

Revenue |

|

$ |

130,586 |

|

|

$ |

128,457 |

|

|

$ |

512,279 |

|

|

$ |

616,494 |

|

| Time

charter, voyage and logistics business expenses |

|

|

(53,317 |

) |

|

|

(65,774 |

) |

|

|

(244,412 |

) |

|

|

(269,279 |

) |

|

Direct vessel expenses |

|

|

(28,543 |

) |

|

|

(26,167 |

) |

|

|

(114,074 |

) |

|

|

(117,790 |

) |

|

General and administrative expenses |

|

|

(16,662 |

) |

|

|

(15,239 |

) |

|

|

(44,634 |

) |

|

|

(51,331 |

) |

|

Depreciation and amortization |

|

|

(25,158 |

) |

|

|

(29,932 |

) |

|

|

(98,124 |

) |

|

|

(108,206 |

) |

|

Interest income/(expense)and finance cost, net |

|

|

(28,361 |

) |

|

|

(25,981 |

) |

|

|

(108,506 |

) |

|

|

(103,479 |

) |

|

Gain/(loss) on derivatives |

|

|

- |

|

|

|

79 |

|

|

|

(260 |

) |

|

|

(196 |

) |

| Gain

on sale of assets |

|

|

- |

|

|

|

- |

|

|

|

18 |

|

|

|

323 |

|

| Loss

on bond and debt extinguishment |

|

|

(37,136 |

) |

|

|

- |

|

|

|

(37,136 |

) |

|

|

- |

|

| Other

(expense)/income, net |

|

|

26 |

|

|

|

167,144 |

|

|

|

5,954 |

|

|

|

161,110 |

|

|

(Loss)/income before equity in net earnings of affiliated

companies |

|

|

(58,565 |

) |

|

|

132,587 |

|

|

|

(128,895 |

) |

|

|

127,646 |

|

|

Equity in net (losses)/earnings of affiliated companies |

|

|

(10,436 |

) |

|

|

23,269 |

|

|

|

19,344 |

|

|

|

48,228 |

|

|

(Loss)/income before taxes |

|

$ |

(69,001 |

) |

|

$ |

155,856 |

|

|

$ |

(109,551 |

) |

|

$ |

175,874 |

|

|

Income tax (expense)/benefit |

|

|

(719 |

) |

|

|

(31 |

) |

|

|

4,260 |

|

|

|

(312 |

) |

| Net

(loss)/income |

|

|

(69,720 |

) |

|

|

155,825 |

|

|

|

(105,291 |

) |

|

|

175,562 |

|

| Less:

Net loss/(income) attributable to the noncontrolling interest |

|

|

(259 |

) |

|

|

286 |

|

|

|

(3,772 |

) |

|

|

(77 |

) |

| Net

(loss)/income attributable to Navios Holdings common

stockholders |

|

$ |

(69,979 |

) |

|

$ |

156,111 |

|

|

$ |

(109,063 |

) |

|

$ |

175,485 |

|

|

(Loss)/income attributable to Navios Holdings common stockholders,

basic |

|

$ |

(70,462 |

) |

|

$ |

155,684 |

|

|

$ |

(110,990 |

) |

|

$ |

173,780 |

|

|

(Loss)/income attributable to Navios Holdings common stockholders,

diluted |

|

$ |

(70,462 |

) |

|

$ |

156,111 |

|

|

$ |

(110,990 |

) |

|

$ |

175,485 |

|

| Basic

(losses)/earnings per share attributable to Navios Holdings common

stockholders |

|

$ |

(0.69 |

) |

|

$ |

1.54 |

|

|

$ |

(1.09 |

) |

|

$ |

1.72 |

|

|

Weighted average number of shares, basic |

|

|

102,010,974 |

|

|

|

101,326,887 |

|

|

|

101,854,415 |

|

|

|

101,232,720 |

|

|

Diluted (losses)/earnings per share attributable to Navios Holdings

common stockholders |

|

$ |

(0.69 |

) |

|

$ |

1.41 |

|

|

$ |

(1.09 |

) |

|

$ |

1.58 |

|

|

Weighted average number of shares, diluted |

|

|

102,010,974 |

|

|

|

111,107,512 |

|

|

|

101,854,415 |

|

|

|

111,033,758 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| NAVIOS MARITIME HOLDINGS INC. Other Financial Data |

| |

|

|

|

|

|

|

|

|

|

December 31, 2013 (unaudited) |

|

December 31, 2012 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

| Cash

and cash equivalents |

|

$ |

187,831 |

|

$ |

257,868 |

|

Restricted cash |

|

|

2,041 |

|

|

24,704 |

| Other

current assets |

|

|

150,114 |

|

|

187,995 |

|

Vessels, port terminal and other fixed assets, net |

|

|

1,808,883 |

|

|

1,746,493 |

| Other

noncurrent assets |

|

|

418,744 |

|

|

355,008 |

|

Goodwill and other intangibles |

|

|

352,000 |

|

|

369,394 |

| Total

assets |

|

$ |

2,919,613 |

|

$ |

2,941,462 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities, including current portion of long-term

debt |

|

|

149,767 |

|

|

189,376 |

|

Senior and ship mortgage notes, net of discount and including

premium |

|

|

1,293,156 |

|

|

1,034,141 |

|

Long-term debt, net of current portion |

|

|

198,832 |

|

|

290,976 |

| Other

noncurrent liabilities |

|

|

88,523 |

|

|

103,930 |

| Total

stockholders' equity |

|

|

1,189,335 |

|

|

1,323,039 |

| Total

liabilities and stockholders' equity |

|

$ |

2,919,613 |

|

$ |

2,941,462 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

Year Ended |

|

|

|

|

December 31, 2013 |

|

|

December 31, 2012 |

|

|

|

|

(unaudited) |

|

|

|

|

| Net

cash provided by operating activities |

|

$ |

57,922 |

|

|

$ |

228,644 |

|

| Net

cash (used in)/provided by investing activities |

|

$ |

(256,744 |

) |

|

$ |

12,453 |

|

| Net

cash provided by/(used in) financing activities |

|

$ |

128,785 |

|

|

$ |

(154,325 |

) |

| |

|

|

|

|

|

|

|

|

Disclosure of Non-GAAP Financial Measures EBITDA represents net

income plus interest and finance costs plus depreciation and

amortization and income taxes, if any, unless otherwise stated.

Adjusted EBITDA represents EBITDA excluding certain items as

described under "Earnings Highlights". EBITDA and Adjusted EBITDA

are "non-GAAP financial measures" and should not be considered a

substitute for net income, cash flow from operating activities and

other operations or cash flow statement data prepared in accordance

with generally accepted accounting principles in the United States

or as a measure of profitability or liquidity.

EBITDA is presented to provide additional information with

respect to the ability of Navios Holdings to satisfy its respective

obligations including debt service, capital expenditures and

working capital requirements. While EBITDA is frequently used as a

measure of operating results and the ability to meet debt service

requirements, the definition of EBITDA is used here may not be

comparable to that used by other companies due to differences in

methods of calculation.

Navios Logistics EBITDA is used to measure company's operating

performance.

The following tables provide a reconciliation of Adjusted EBITDA

of Navios Holdings and EBITDA of Navios Logistics, which in the

case of Navios Holdings is on a consolidated basis:

Navios Holdings Reconciliation of Adjusted EBITDA to Cash from

Operations

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

| Three

Months Ended |

|

2013 |

|

|

2012 |

|

| (in

thousands of U.S. dollars) |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Net

cash (used in)/provided by operating activities |

|

$ |

(21,134 |

) |

|

$ |

170,834 |

|

| Net

decrease in operating assets |

|

|

(8,683 |

) |

|

|

(15,011 |

) |

| Net

decrease in operating liabilities |

|

|

22,491 |

|

|

|

31,821 |

|

| Net

interest cost |

|

|

28,361 |

|

|

|

25,981 |

|

|

Deferred finance charges |

|

|

(1,260 |

) |

|

|

(1,554 |

) |

|

Provision for losses on accounts receivable |

|

|

(330 |

) |

|

|

(16,694 |

) |

|

Unrealized (loss)/gain on FFA derivatives and expenses related to

bond and debt extinguishment |

|

|

(12,142 |

) |

|

|

49 |

|

|

Equity in affiliates, net of dividends received |

|

|

(18,811 |

) |

|

|

13,417 |

|

|

Payments for drydock and special survey |

|

|

1,832 |

|

|

|

5,930 |

|

|

Noncontrolling interest |

|

|

(259 |

) |

|

|

286 |

|

| Gain

from defaulted charters' compensation and related accounts,

net |

|

|

- |

|

|

|

(161,225 |

) |

| Loss

on bond and debt extinguishment |

|

|

37,136 |

|

|

|

- |

|

| Other

items from affiliates |

|

|

14,784 |

|

|

|

- |

|

|

Adjusted EBITDA |

|

$ |

41,985 |

|

|

$ |

53,834 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Navios Logistics EBITDA Reconciliation to Net Income/(Loss)

|

|

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

|

Three Months Ended |

|

2013 |

|

2012 |

|

|

(in thousands of U.S. dollars) |

|

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

| Net

income/(loss) attributable to Navios Logistics shareholders |

|

$ |

315 |

|

$ |

(748 |

) |

|

Depreciation and amortization |

|

|

5,735 |

|

|

6,866 |

|

|

Amortization of deferred drydock and special survey costs |

|

|

1,264 |

|

|

312 |

|

|

Interest income/(expense) and finance cost, net |

|

|

6,351 |

|

|

4,494 |

|

|

Income tax benefit/(expense) |

|

|

642 |

|

|

(39 |

) |

|

EBITDA |

|

$ |

14,307 |

|

$ |

10,885 |

|

|

|

|

|

|

|

|

|

|

Navios Holdings Reconciliation of Adjusted EBITDA to Cash from

Operations

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

Twelve Months Ended |

|

2013 |

|

|

2012 |

|

|

(in thousands of U.S. dollars) |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Net

cash provided by operating activities |

|

$ |

57,922 |

|

|

$ |

228,644 |

|

| Net

(decrease)/increase in operating assets |

|

|

(57,792 |

) |

|

|

50,687 |

|

| Net

decrease in operating liabilities |

|

|

28,914 |

|

|

|

18,016 |

|

| Net

interest cost |

|

|

108,506 |

|

|

|

103,479 |

|

|

Deferred finance charges |

|

|

(5,384 |

) |

|

|

(6,309 |

) |

|

Provision for losses on accounts receivable |

|

|

(630 |

) |

|

|

(17,136 |

) |

|

Unrealized loss on FFA derivatives and expenses related to bond and

debt extinguishment |

|

|

(12,211 |

) |

|

|

(124 |

) |

|

Equity in affiliates, net of dividends received |

|

|

(19,781 |

) |

|

|

7,519 |

|

|

Payments for drydock and special survey |

|

|

12,119 |

|

|

|

14,461 |

|

|

Noncontrolling interest |

|

|

(3,772 |

) |

|

|

(77 |

) |

| Gain

on sale of assets |

|

|

18 |

|

|

|

- |

|

|

Gain from defaulted charters' compensation and related accounts,

net |

|

|

- |

|

|

|

(161,225 |

) |

| Loss

on bond and debt extinguishment |

|

|

37,136 |

|

|

|

- |

|

| Other

items from affiliates |

|

|

14,784 |

|

|

|

- |

|

|

Adjusted EBITDA |

|

$ |

159,829 |

|

|

$ |

237,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Navios Logistics EBITDA Reconciliation to Net Income

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

Twelve Months Ended |

|

2013 |

|

|

2012 |

|

(in thousands of U.S. dollars) |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

| Net

income attributable to Navios Logistics shareholders |

|

$ |

9,716 |

|

|

$ |

156 |

|

Depreciation and amortization |

|

|

23,354 |

|

|

|

26,940 |

|

Amortization of deferred drydock and special survey costs |

|

|

3,392 |

|

|

|

1,332 |

|

Interest income/(expense) and finance cost, net |

|

|

24,929 |

|

|

|

19,669 |

|

Income tax (expense)/benefit |

|

|

(4,554 |

) |

|

|

35 |

|

EBITDA |

|

$ |

56,837 |

|

|

$ |

48,132 |

|

|

|

|

|

|

|

|

|

| |

| |

| EXHIBIT II |

| Owned Vessels |

| |

|

|

|

|

|

|

|

|

|

Vessel Name |

|

Vessel Type |

|

Year Built |

|

Deadweight (in metric tons) |

|

Navios Serenity |

|

Handysize |

|

2011 |

|

34,690 |

|

Navios Ionian |

|

Ultra Handymax |

|

2000 |

|

52,067 |

|

Navios Horizon |

|

Ultra Handymax |

|

2001 |

|

50,346 |

|

Navios Herakles |

|

Ultra Handymax |

|

2001 |

|

52,061 |

|

Navios Achilles |

|

Ultra Handymax |

|

2001 |

|

52,063 |

|

Navios Vector |

|

Ultra Handymax |

|

2002 |

|

50,296 |

|

Navios Meridian |

|

Ultra Handymax |

|

2002 |

|

50,316 |

|

Navios Mercator |

|

Ultra Handymax |

|

2002 |

|

53,553 |

|

Navios Arc |

|

Ultra Handymax |

|

2003 |

|

53,514 |

|

Navios Hios |

|

Ultra Handymax |

|

2003 |

|

55,180 |

|

Navios Kypros |

|

Ultra Handymax |

|

2003 |

|

55,222 |

|

Navios Astra |

|

Ultra Handymax |

|

2006 |

|

53,468 |

|

Navios Ulysses |

|

Ultra Handymax |

|

2007 |

|

55,728 |

|

Navios Celestial |

|

Ultra Handymax |

|

2009 |

|

58,063 |

|

Navios Vega |

|

Ultra Handymax |

|

2009 |

|

58,792 |

|

Navios Magellan |

|

Panamax |

|

2000 |

|

74,333 |

|

Navios Star |

|

Panamax |

|

2002 |

|

76,662 |

|

Navios Northern Star |

|

Panamax |

|

2005 |

|

75,395 |

|

Navios Amitie |

|

Panamax |

|

2005 |

|

75,395 |

|

Navios Taurus |

|

Panamax |

|

2005 |

|

76,596 |

|

Navios Asteriks |

|

Panamax |

|

2005 |

|

76,801 |

|

Navios Galileo |

|

Panamax |

|

2006 |

|

76,596 |

|

Navios Avior |

|

Panamax |

|

2012 |

|

81,355 |

|

Navios Centaurus |

|

Panamax |

|

2012 |

|

81,472 |

|

Navios Stellar |

|

Capesize |

|

2009 |

|

169,001 |

|

Navios Bonavis |

|

Capesize |

|

2009 |

|

180,022 |

|

Navios Happiness |

|

Capesize |

|

2009 |

|

180,022 |

|

Navios Phoenix |

|

Capesize |

|

2009 |

|

180,242 |

|

Navios Lumen |

|

Capesize |

|

2009 |

|

180,661 |

|

Navios Antares |

|

Capesize |

|

2010 |

|

169,059 |

|

Navios Etoile |

|

Capesize |

|

2010 |

|

179,234 |

|

Navios Bonheur |

|

Capesize |

|

2010 |

|

179,259 |

|

Navios Altamira |

|

Capesize |

|

2011 |

|

179,165 |

|

Navios Azimuth |

|

Capesize |

|

2011 |

|

179,169 |

|

|

|

|

|

|

|

|

Navios Asia Fleet(3)

|

Vessel Name |

|

Vessel Type |

|

Year Built |

|

Deadweight (in metric tons) |

| N

Amalthia |

|

Panamax |

|

2006 |

|

75,318 |

| N

Bonanza |

|

Panamax |

|

2006 |

|

76,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long term Chartered-in Fleet in Operation

|

|

|

|

|

|

|

|

|

|

|

Vessel Name |

|

Vessel Type |

|

Year Built |

|

Deadweight (in metric tons) |

|

Purchase Option(1) |

|

Navios Lyra |

|

Handysize |

|

2012 |

|

34,718 |

|

Yes (2) |

|

Navios Apollon |

|

Ultra Handymax |

|

2000 |

|

52,073 |

|

No |

|

Navios Primavera |

|

Ultra Handymax |

|

2007 |

|

53,464 |

|

Yes |

|

Navios Armonia |

|

Ultra Handymax |

|

2008 |

|

55,100 |

|

No |

|

Navios Oriana |

|

Ultra Handymax |

|

2012 |

|

61,442 |

|

Yes |

|

Navios Mercury |

|

Ultra Handymax |

|

2013 |

|

61,393 |

|

Yes |

|

Navios Libra II |

|

Panamax |

|

1995 |

|

70,136 |

|

No |

|

Navios Altair |

|

Panamax |

|

2006 |

|

83,001 |

|

No |

|

Navios Esperanza |

|

Panamax |

|

2007 |

|

75,356 |

|

No |

|

Navios Marco Polo |

|

Panamax |

|

2011 |

|

80,647 |

|

Yes |

|

Navios Southern Star |

|

Panamax |

|

2013 |

|

82,224 |

|

Yes |

|

Golden Heiwa |

|

Panamax |

|

2007 |

|

76,662 |

|

No |

|

Beaufiks |

|

Capesize |

|

2004 |

|

180,310 |

|

Yes |

|

Rubena N |

|

Capesize |

|

2006 |

|

203,233 |

|

No |

| King

Ore |

|

Capesize |

|

2010 |

|

176,800 |

|

No |

|

Navios Koyo |

|

Capesize |

|

2011 |

|

181,415 |

|

Yes |

|

Navios Obeliks |

|

Capesize |

|

2012 |

|

181,415 |

|

Yes |

| |

|

|

|

|

|

|

|

|

Navios Asia Fleet to be Delivered (3)

| |

|

|

|

|

|

|

|

Vessels |

|

Vessel Type |

|

Built |

|

Estimated Delivery Date |

|

Navios TBN |

|

Panamax |

|

2007 |

|

Q1 2015 |

|

Navios TBN |

|

Panamax |

|

2007 |

|

Q1 2015 |

|

Navios TBN |

|

Panamax |

|

2007 |

|

Q1 2015 |

|

Navios TBN |

|

Panamax |

|

2007 |

|

Q1 2015 |

| |

|

|

|

|

|

|

Owned Fleet to be Delivered

| |

|

|

|

|

|

|

|

Vessels |

|

Vessel Type |

|

Delivery Date |

|

Deadweight (in metric tons) |

|

Navios TBN |

|

Panamax |

|

Q4 2015 |

|

84,000 |

|

Navios TBN |

|

Capesize |

|

Q4 2015 |

|

180,600 |

| |

|

|

|

|

|

|

Long-term Chartered-in Fleet to be Delivered

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessel |

|

Delivery |

|

Deadweight |

|

Purchase |

|

Vessels |

|

Type |

|

Date |

|

(in metric tons) |

|

Option |

|

Navios Venus |

|

Ultra Handymax |

|

Q1 2015 |

|

61,000 |

|

Yes |

|

Navios Felix |

|

Capesize |

|

Q2 2016 |

|

180,000 |

|

Yes |

|

Navios TBN |

|

Panamax |

|

Q2 2015 |

|

80,000 |

|

Yes |

|

Navios TBN |

|

Panamax |

|

Q3 2015 |

|

82,000 |

|

Yes |

|

Navios TBN |

|

Panamax |

|

Q4 2016 |

|

81,000 |

|

Yes |

|

Navios TBN |

|

Panamax |

|

Q4 2016 |

|

81,000 |

|

Yes |

|

Navios TBN |

|

Panamax |

|

Q4 2016 |

|

84,000 |

|

Yes |

| |

|

(1) |

|

Generally, Navios Holdings may exercise its purchase option after

three to five years of service. |

|

(2) |

|

Navios Holdings holds the initial 50% purchase option on the

vessel. |

|

(3) |

|

51%

ownership by Navios Holdings. |

| |

|

|

Contact: Navios Maritime Holdings Inc. +1.212.906.8643

investors@navios.com

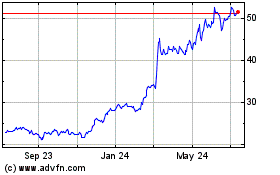

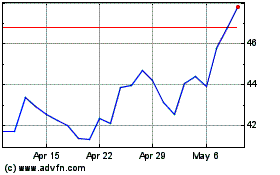

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Sep 2023 to Sep 2024