UPDATE: MetLife Institutional To Sell Floating-Rate Notes

March 29 2011 - 3:14PM

Dow Jones News

MetLife Institutional Funding II said it would sell a $1 billion

offering of floating-rate notes on Tuesday.

The three-year issue is expected to be sold in the

private-placement Rule 144a market later this session via sole

bookrunner Barclays Capital.

The deal was launched with a risk premium of 90 basis points

over the three month London Interbank Offered rate, directly in

line with preliminary pricing guidance.

Proceeds will be used for general corporate purposes, which

could include the repayment of outstanding debt securities.

The deal has been rated Aa3 by Moody's Investors Service and AA-

by Standard & Poor's.

-By Kellie Geressy-Nilsen; Dow Jones Newswires; 212 416-2225;

kellie.geressy@dowjones.com

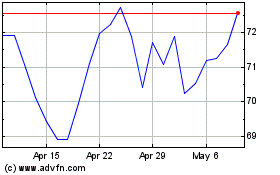

MetLife (NYSE:MET)

Historical Stock Chart

From Jun 2024 to Jul 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Jul 2023 to Jul 2024