Earnings Preview: TiVo Inc. - Analyst Blog

May 23 2011 - 11:27AM

Zacks

TiVo Inc. (TIVO) is scheduled to announce its

first quarter 2012 results on May 24, 2011. In the run-up to the

first quarter earnings, there are no major variations in analysts’

estimates.

Prior Quarter Recap

TiVo Inc. reported a loss of 30 cents per share in the fourth

quarter of 2011, falling short of the Zacks Consensus Estimate of a

loss of 28 cents.

Revenues decreased 18.7% year over year to $55.8 million in the

fourth quarter. However, total revenue was marginally above the

Zacks Consensus Estimate of $54.0 million. The weak year-over-year

results were primarily due to 10.2% decline in Service and 38.5%

decline in Hardware revenue in the quarter. Technology revenues

remained flat in the quarter.

Results for the quarter were negatively impacted by higher

operating expenses that escalated 35.8% on a yearly basis due to

higher R&D cost and legal expenses.

For further details please refer to: TiVo Misses, Guides

Lower

Current Quarter Expectations

Management expects a disappointing first quarter of 2012. The

guidance reflects increased litigation expense and higher R&D

costs due to increased product development and distribution

efforts. The expenses are expected to increase by roughly $7.6

million sequentially in the first quarter.

TiVo expects Service and Technology revenues to range between

$36.0 million and $38.0 million. Management expects a higher net

loss in the range of $35.0 million-$37.0 million in the first

quarter. Adjusted EBITDA is expected to be between ($25.0) million

and ($27.0) million in the first quarter of 2012.

For fiscal 2012, TiVo expects R&D spending to increase in

the range of $25.0 million to $30.0 million. Legal expenses are

expected to more than double on a year-over-year basis ($23.0

million in fiscal 2010).

Estimate Revision Trend

For the current quarter, out of the eight analysts covering

TiVo, no analyst revised estimates in the last thirty days. The

Zacks Consensus Estimate is a loss of 31 cents per share for the

quarter.

For the fiscal year 2012, one analyst raised estimates in the

last thirty days. Hence, the EPS estimate inched up from a loss of

$1.21 to $1.20.

Conclusion

Despite missing earnings expectations in the last two quarters,

TiVo posted a positive earnings surprise of 4.76% in the trailing

four quarters. Management’s disappointing outlook tends to indicate

another dismal quarter.

TiVo remains entangled in various patent lawsuits, which

involves major companies like AT&T Inc. (T),

Verizon Communications Inc. (VZ),

Microsoft Corp. (MSFT), Dish Network

Corp. (DISH) and most recently Motorola Mobility

Holdings Inc. (MMI). We believe that going forward, any

negative outcome from these various lawsuits will have a negative

impact on the shares.

Moreover, increasing legal expenses (46.0% of total operating

expenses in 2011) and increasing competition from cable and

satellite providers will hurt profitability going forward.

Additionally, TiVo has raised $150.0 million in senior notes,

which are expected to mature in 2016. Funding of intellectual

property litigations seems to be one of the primary reasons for

raising the cash. We believe that going forward, the debt issuance

might pose a significant headwind for the company given its

lackluster results and depleting cash reserves.

We have a Neutral recommendation on TiVo over the long term

driven by new partnerships with leading companies, new customer

wins, product launches and international expansion. However,

increasing legal complexities, higher operating expenses, lower

subscriber additions and additional debt remain primary headwinds

for growth, in our view.

Currently, TiVo has a Zacks #2 Rank, which translates into a Buy

rating in the short term.

DISH NETWORK CP (DISH): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

TIVO INC (TIVO): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

Zacks Investment Research

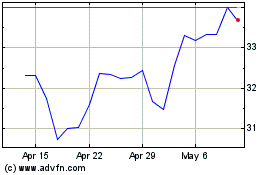

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

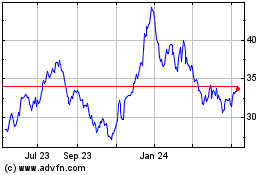

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jul 2023 to Jul 2024