Macerich Announces Fourth Quarter Results SANTA MONICA, Calif.,

Feb. 10 /PRNewswire-FirstCall/ -- The Macerich Company today

announced results of operations for the quarter and year ended

December 31, 2003 which included net income to common stockholders

for the three months ended December 31, 2003 of $25.5 million, or

$.44 per share-diluted compared to net income of $33.2 million or

$.75 per share-diluted for the three months ended December 31,

2002. Net income in the quarter ended December 31,2002 was

positively impacted by net gain on sales of consolidated assets of

$12.0 million or $.18 per share compared to $.00 per share gain on

sales of consolidated assets in the quarter ended December 31,

2003. Net income to common stockholders for the year ended December

31, 2003 was $113.2 million or $2.09 per share-diluted compared to

$61.0 million or $1.62 per share-diluted for the year ended

December 31, 2002. Funds from operations ("FFO") per share --

diluted for the quarter ended December 31, 2003 was $1.04 compared

to $1.05 for the comparable period in 2002 and FFO per

share-diluted for the year ended December 31, 2003 increased to

$3.58 compared to $3.06 for the comparable period in 2002. A

reconciliation of net income to FFO is included in the financial

highlights section of this press release. Highlights included: *

During the fourth quarter, Macerich signed 340,000 square feet of

specialty store leases at average initial rents of $37.34 per

square foot. First yearrents on mall and freestanding store leases

signed during the quarter were 18% higher than expiring rents on a

comparable space basis. * Total same center tenant sales for the

quarter ended December 31, 2003 were up 2.6% compared to the fourth

quarter of 2002, comparable tenant sales were up 1.8% over the

quarter ended December 31, 2002. * In November, the quarterly

dividend was increased 7% from $.57 to $.61 per share. Macerich has

increased its dividend each year since becoming a public company in

1994. * Portfolio occupancy remained high at 93.3%, up from 92.9%

at September 30, 2003, and down from 93.9% at December 31, 2002. *

On December 18, 2003 Macerich closed on the acquisition of Biltmore

Fashion Park in Phoenix, Arizona. * On January 30, 2004 Macerich

closed on the acquisition of Inland Center in San Bernardino,

California. FFO per share -- diluted was $1.04 compared to $1.05

per share for the quarter ended December 31,2002 and $3.58 and

$3.06 for the years ended December 31, 2003 and 2002 respectively,

after reflecting the recent accounting rule changes and the FFO

definition discussed below. In compliance with the Securities and

Exchange Commission's Regulation G relating to non- GAAP financial

measures, the Company has revised its FFO definition as of January

1, 2003 and for all prior periods presented, to include gain or

loss on sales of peripheral land and the impact on rental revenue

resulting from the acquisition of acquired below market leases in

accordance with SFAS No. 141. The Company's revised definition is

in accordance with the definition provided by the National

Association of Real Estate Investment Trusts ("NAREIT"). The

Company has also restated 2002 FFO to reflect the write-off of

technology investments. Furthermore, effective January 1, 2003 and

for all prior periods presented, loss on early extinguishment of

debt is no longer considered to be an extraordinary item under GAAP

and accordingly is included in FFO. The impact of these changes is

identified below: All amounts per share For the 3 months ended: For

the year ended: December 31: December 31: 2003 2002 2003 2002

FFO-diluted per share : $1.04 $1.05 $3.58 $3.06 Reflected in

FFO/share is the impact of: Loss onearly extinguishments of debt

$.00 ($.04) $.00 ($.06) Write-off of technology investments $.00

$.00 $.00 ($.21) Impact of SFAS 141 $.03 $.03 $.07 $.03 Gain on

peripheral land sales $.00 $.00 $.02 $.04 Commenting on results,

Arthur Coppola, President and Chief Executive Officer of Macerich

stated, "Excluding the impact of thetemporary bridge financing on

the Westcor acquisition which increased our leverage for the third

quarter and part of the fourth quarter of 2002, the FFO growth per

share was approximately 4% for the quarter. This growth rate also

reflects the negativeearnings impact of decreasing our floating

rate debt from 38% of total debt at October 1, 2002 down to 21% at

December 31, 2003. During the quarter we saw the continuation of

strong releasing spreads and good leasing activity. In addition, we

made tremendous progress on our balance sheet and have reduced our

floating rate debt exposure considerably. During the quarter we

were also able to bring Arizona's two major fashion malls, Biltmore

Fashion Park, acquired in December, and Scottsdale Fashion Square,

which is only five miles away from Biltmore, under common ownership

and create even greater opportunities. " Acquisition Activity On

December 18, 2003, Macerich closed on the purchase of Biltmore

Fashion Park in Phoenix, Arizona. Macy's and Saks Fifth Avenue

anchor Biltmore. The center's annual tenant sales per square foot

were $479. The $158.5 million purchase price included the

assumption of $77.4 million of debt, the issuance of 705,636

partnership units of The Macerich Partnership L.P. and $51 million

in cash. Leading specialty retailers in the center include Tommy

Bahama, Allen-Edmonds, Polo by Ralph Lauren, Gucci, Escada, Stuart

Weitzman, Cole-Hahn, Cartier and Elizabeth Arden Salon. Biltmore is

owned in a 50/50 partnership with an institutional partner. On

January 30, 2003, Macerich, in a 50/50 joint venture with a private

investment company, acquired Inland Center, a 1 million square foot

super-regional mall in San Bernardino, California. The purchase

price was $63.3 million and concurrently with the acquisition the

joint venture placed a $54 million fixed rate loan on the property

bearing interest at 4.63%. The mall shop tenants at Inland are

averaging $440 per square foot in annual sales. Sears,

Robinson-May, Macy'sand Gottschalks anchor the mall. Redevelopment

and Development Activity At Queens Center, the redevelopment and

expansion continue. The project will increase the size of the

center from 620,000 square feet to approximately one million square

feet. Completion is planned in phases starting in the second

quarter 2004 with stabilization expected in 2005. Leasing activity

has been strong with over 88% of the total shop expansion space

already leased or committed, including 93% for the phase one space.

Construction continues at Scottsdale 101, a 600,000 square foot

power center in North Phoenix. The power center is being built in

phases through 2004. Circuit City, Borders and Bed Bath and Beyond

recently opened. Progress also continues at La Encantada, a 258,000

square foot specialty center in Tucson, Arizona, which will feature

Adrienne Vittadini, Ann Taylor, Apple Computer, Cache, Pottery

Barn, Tommy Bahama and Williams-Sonoma. This project is planned to

open in phases through 2004. At Sommersville Town Center in

Antioch, California a new 105,000 square foot Macy's store is under

construction and expected to open in the fall of 2004. Nordstrom

announced plans to open a 144,000 square foot store at The Oaks

Mall in Thousand Oaks, California. This store opening is planned in

conjunction with an expansion of the existing mall tentatively

scheduled to open in 2007. Financing Activity In November, the

Company closed on the refinancing of a $180 million floating rate

loan on FlatIron Crossing. The loan was paid off and refinanced

with a $200 million, fixed rate 10-year loan bearing interest at

5.23%. Also, the Company has reached agreement on an $85 million,

5-year fixed rate loan with an interest rate of 4.63% on Northridge

Mall. The rate on the loan is locked and this financing is expected

to close in April 2004. Loan proceeds are expected to pay down the

Company's unsecured floating rate debt. In addition, in connection

with the Company's $250 million unsecured term loan, aninterest

rate swap agreement was entered into to fix the interest rate at

4.45% from November 2003 to October 13, 2005. Earnings Guidance The

Company is reaffirming its previously issued year 2004 FFO per

share guidance and revising its EPS guidance in the following

ranges: Range per share: Fully Diluted EPS $1.79..........$1.89

Plus: Real Estate Depreciation and Amortization

$2.09..........$2.09 Less: impact of preferred shares (not dilutive

to EPS) ($.10).........($.10) Less: Gain on Sale of Assets

$.00...........$.00 Fully Diluted FFO per share

$3.78..........$3.88 Plus: Interest Expense per share

$2.60..........$2.60 Plus: Non real estate depreciation, income

taxes and ground rent expense per share $.17...........$.17 EBITDA

per share $6.55..........$6.65 Less: management company expenses,

REIT General and administrative expenses and EBITDA of

non-comparable centers ($.83).........($.83) Same center EBITDA per

share $5.72..........$5.82 The guidance is based on management's

current view of the current market conditions in the regional mall

business. Due to the uncertainty in the timing and economics of

acquisitions and dispositions, the guidanceranges do not include

any potential property acquisitions or dispositions other than

those that have closed through January 31, 2004. The Company is not

able to assess at this time the potential impact of such exclusions

on future EPS and FFO. FFO does not include gains or losses on

sales of depreciated operating assets. The Macerich Company is a

fully integrated self-managed and self- administered real estate

investment trust, which focuses on the acquisition, leasing,

management, development andredevelopment of regional malls

throughout the United States. The Company is the sole general

partner and owns an 82% ownership interest in The Macerich

Partnership, L.P. Macerich now owns approximately 60 million square

feet of gross leaseable area consisting primarily of interests in

59 regional malls. Additional information about The Macerich

Company can be obtained from the Company's web site at

http://www.macerich.com/ Investor Conference Call The Company will

provide an online Web simulcast and rebroadcast of its quarterly

earnings conference call. The call will be available on The

Macerich Company's website at http://www.macerich.com/ and through

CBN at http://www.fulldisclosure.com/. The call begins today,

February 10, 2004 at 10:30 AM Pacific Time. To listen to the call,

please go to any of these web sites at least 15 minutes prior to

the call in order to register and download audio software if

needed. An online replay at http://www.macerich.com/ will be

available for one year after the call. Note: This release contains

statements that constitute forward-looking statements. Stockholders

are cautioned that any such forward-looking statements are not

guarantees of future performance and involve risks, uncertainties

and other factors that may cause actual results, performance or

achievements of the Company to vary materially from those

anticipated, expected or projected. Such factors include, among

others, general industry, economic and business conditions, which

will, among other things, affect demand for retail space or retail

goods, availability and creditworthiness of current and prospective

tenants, tenant bankruptcies, lease rates and terms, interest rate

fluctuations, availability and cost of financing and operating

expenses; adverse changes in the real estate markets including,

among other things, competition from other companies, retail

formats and technology, risks of real estate development and

redevelopment, acquisitions and dispositions; governmental actions

and initiatives; environmental and safety requirements; and

terrorist activities which could adversely affect all of the above

factors. The reader is directed to the Company's various filings

with the Securities and Exchange Commission, for a discussionof

such risks and uncertainties. (See attached tables) THE MACERICH

COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE

AMOUNTS) Results before Impact of Results after SFAS 144 (f) SFAS

144 (f) SFAS 144 (f) Results of Operations: For the For the For the

Three Months Three Months Three Months Ended December 31 Ended

December 31 Ended December 31 Unaudited Unaudited 2003 2002 2003

2002 2003 2002 Minimum Rents (e) 81,068 74,372 (9) (2,086) 81,059

72,286 Percentage Rents 7,958 6,943 (26) 7,958 6,917 Tenant

Recoveries 43,535 36,109 (383) 43,535 35,726 Other Income 5,575

3,898 (1) 5,575 3,897 Total Revenues 138,136 121,322 (9) (2,496)

138,127 118,826 Shopping center and operating expenses (c) 49,455

40,486 14 (977) 49,469 39,509 Depreciation and amortization 35,176

23,608 (463) 35,176 23,145 General, administrative and other

expenses (c) 1,892 2,875 1,892 2,875 Interest expense 33,665 36,520

(151) 33,665 36,369 Loss on early extinguishments of debt 29 2,734

29 2,734 Gain (loss) on sale or writedown of assets (117) 12,044 88

(12,150) (29) (106) Pro rata income (loss) of unconsolidated

entities (c) 16,038 22,094 16,038 22,094 Income (loss) of the

Operating Partnership from continuing operations 33,840 49,237 65

(13,055) 33,905 36,182 Discontinued Operations: Gain (loss) on sale

of asset -- -- (88) 12,150 (88) 12,150 Income from discontinued

operations -- -- 23 905 23 905 Income before minority interests

33,840 49,237 -- -- 33,840 49,237 Income allocated to minority

interests 5,994 10,825 -- -- 5,994 10,825 Net income before

preferred dividends 27,846 38,412 -- -- 27,846 38,412 Dividends

earned by preferred stockholders (a) 2,357 5,195 -- -- 2,357 5,195

Net income to common stockholders 25,489 33,217 -- -- 25,489 33,217

Average # of shares outstanding - basic 57,745 42,077 57,745 42,077

Average shares outstanding, - basic, assuming full conversion of OP

Units (d) 71,324 55,793 71,324 55,793 Average shares outstanding -

diluted for FFO (d) 75,491 68,642 75,491 68,642 Per share income -

diluted before discontinued operations -- -- 0.44 0.56 Net income

per share - basic 0.44 0.79 0.44 0.79 Net income per share -

diluted 0.44 0.75 0.44 0.75 Dividend declared per share 0.61 0.57

0.61 0.57 Funds from operations "FFO" (b) (d)- basic 75,963 65,099

75,963 65,099 Funds from operations "FFO" (a) (b)(d) - diluted

78,320 72,354 78,320 72,354 FFO per share - basic (b)(d) 1.07 1.17

1.07 1.17 FFO per share - diluted (a)(b)(d) 1.04 1.05 1.04 1.05

Results before Impact of Results after SFAS 144 (f) SFAS 144 (f)

SFAS 144 (f) Results of Operations: For the Year For the Year For

the Year Ended Ended Ended December 31 December 31 December 31

Unaudited Unaudited 2003 2002 2003 2002 2003 2002 Minimum Rents (e)

297,606 234,617 (2,119) (5,864) 295,487 228,753 Percentage Rents

12,999 11,193 (48) 12,999 11,145 Tenant Recoveries 160,114 121,547

(345) (973) 159,769 120,574 Other Income 17,808 12,062 (59) (34)

17,749 12,028 Total Revenues (e) 488,527 379,419 (2,523) (6,919)

486,004 372,500 Shopping center and operating expenses ( c) 172,515

130,339 (834) (3,259) 171,681 127,080 Depreciation and amortization

109,028 78,837 (333) (1,271) 108,695 77,566 General, administrative

and other expenses (c) 10,724 7,435 10,724 7,435 Interest expense

132,512 122,934 (320) 132,512 122,614 Loss on early extinguishments

of debt 155 3,605 155 3,605 Gain on sale or writedown of assets

34,451 22,253 (22,031) (26,073) 12,420 (3,820) Pro rata income of

unconsolidated entities (c) 58,897 43,049 58,897 43,049 Income

(loss) of the Operating Partnership from continuing operations

156,941 101,571 (23,387) (28,142) 133,554 73,429 Discontinued

Operations: Gain on sale of asset -- -- 22,031 26,073 22,031 26,073

Income from discontinued operations -- -- 1,356 2,069 1,356 2,069

Income before minority interest 156,941 101,571 -- -- 156,941

101,571 Income allocated to minority interests 28,907 20,189 -- --

28,907 20,189 Net income before preferred dividends 128,034 81,382

-- -- 128,034 81,382 Dividends earned by preferred stockholders (a)

14,816 20,417 -- -- 14,816 20,417 Net income to common stockholders

113,218 60,965 -- -- 113,218 60,965 Average # of shares outstanding

- basic 53,669 37,348 53,669 37,348 Average shares outstanding, -

basic, assuming full conversion of OP Units (d) 67,332 49,611

67,332 49,611 Average shares outstanding - diluted for FFO (d)

75,198 63,015 75,198 63,015 Per share income - diluted before

discontinued operations 1.78 1.06 Net income per share - basic 2.11

1.63 2.11 1.63 Net income per share - diluted 2.09 1.62 2.09 1.62

Dividend declared per share 2.32 2.22 2.32 2.22 Funds from

operations "FFO" (b) (d)- basic 254,316 164,916 254,316 164,916

Funds from operations "FFO" (a) (b) (d) - diluted 269,132 194,643

269,132 194,643 FFO per share - basic (b) (d) 3.78 3.32 3.78 3.32

FFO per share - diluted (a) (b) (d) 3.58 3.06 3.58 3.06 (a) The

Company issued $161,400 of convertible debentures in June and July,

1997. The debentures were convertible into common shares at a

conversion price of $31.125 per share. Thedebentures were paid off

in full in December 2002. On February 25, 1998, the Company sold

$100,000 of convertible preferred stock and on June 16, 1998

another $150,000 of convertible preferred stock was issued. The

convertible preferred shares can be converted on a 1 for 1 basis

for common stock. These preferred shares are assumed converted for

purposes of net income per share for 2003 and are not assumed

converted for purposes of net income per share for 2002 as it would

be antidilutive to that calculation. On September 9, 2003, 5.487

million shares of Series B convertible preferred stock were

converted into common shares. The weighted average preferred shares

outstanding are assumed converted for purposes of FFO per diluted

share as they are dilutive to that calculation for all periods

presented. (b) The Company uses FFO in addition to net income to

report its operating and financial results and considers FFO a

supplemental measure for the real estate industry and a supplement

to Generally Accepted Accounting Principles (GAAP) measures. NAREIT

defines FFO as net income (loss) (computed in accordance with

GAAP), excluding gains (or losses) from extraordinary items and

sales of depreciated operating properties, plus real estate related

depreciation and amortization and after adjustments for

unconsolidated partnerships and joint ventures. Adjustments for

unconsolidated partnerships and joint ventures are calculated to

reflect FFO on the same basis. FFO is useful to investors in

comparing operating and financial results between periods. This is

especially true since FFO excludes real estate depreciation and

amortization, as the Company believes real estate values fluctuate

based on market conditions rather than depreciating in value

ratably on a straight-line basis over time. FFO does not represent

cash flow from operations as defined by GAAP, should not be

considered as an alternative to net income as defined by GAAP and

is not indicative of cash available to fund all cash flow needs.

FFO as presented may not be comparable to similarly titled measures

reported by other real estate investment trusts. Effective January

1, 2003, gains or losses on sale of peripheral land and the impact

of SFAS 141 have been included in FFO. The inclusion of gains on

sales of peripheral land increasedFFO for the three and twelve

months ended December 31, 2003 by $190 and $1,441, respectively, or

by $.00 per share and $.02 per share, respectively. During the

three and twelve months ended December 31, 2002, there were ($121)

and $2,531, respectively, of outparcel sales or $.00 and $.04 per

share respectively. FFO for the quarter and year ended December 31,

2002 have been restated to reflect the Company's share of

impairment of technology assets and losses on debt-related

transactions previously reported as extraordinary items under GAAP,

reducing FFO by a net $2,734, or $.04 per share during the quarter

ended December 31, 2002 and $16,871 or $.27 per share for the year

ended December 31, 2002. FFO has also been restated to include gain

on land sales, including joint ventures at prorata, which increased

FFO by $0 for the quarter and $2.5 million or $.04 per share for

the year ended December 31, 2002. (c) Thisincludes, using the

equity method of accounting, the Company's prorata share of the

equity in income or loss of its unconsolidated joint ventures for

all periods presented and for Macerich Management Company through

June 2003. Effective July 1, 2003, the Company has consolidated

Macerich Management Company. Certain reclassifications have been

made in the 2002 financial highlights to conform to the 2003

financial highlights presentation. (d) The Company has operating

partnership units ("OP units"). Each OP unit may be converted into

a share of Company stock. Conversion of the OP units has been

assumed for purposes of calculating the FFO per share and the

weighted average number of shares outstanding. Due to an equity

issuance in November, 2002, calculation of the annual 2002 FFO per

share using the weighted average number of shares outstanding

during the year does not equal the sum of the actual FFO per share

calculated by quarter. The sum of the quarterly results is

reflected above. (e) Effective October 1, 2002, the Company adopted

SFAS No. 141, Business Combinations, which requires companies that

have acquired assets subsequent to June 2001 to reflect the

discounted net present value of market rents in excess of rents in

place at the date of acquisition as a deferred credit to be

amortized into income over the average remaining life of the

acquired leases. The FFO accretion from amortizing the net present

value of the excess of market rent in excess of in place rents for

the three and twelve months ending December 31, 2003 was

approximately $.03 per share and $.07 per share, respectively.

Additionally, the impact on FFO for the three and twelve months

ending December 31, 2002 was $.03 per share. In accordance with the

NAREIT definition of FFO, the impact of this accounting treatment

is included in FFO. Also, as a result of SFAS141, during the fourth

quarter of 2003, an additional $9.5 million of depreciation and

amortization has been reflected based on a reclassification of the

purchase price of recent acquisitions between buildings and into

the valueof in-place leases, tenant improvements and lease

commissions in accordance with independent third party evaluations

and recent guidance regarding the SFAS 141 calculation methodology.

(f) In October 2001, the FASB issued SFAS No. 144, "Accounting for

the Impairment or Disposal of Long-Lived Assets" ("SFAS 144"). SFAS

144 addresses financial accounting and reporting for the impairment

or disposal of long-lived assets. The Company adopted SFAS 144 on

January 1, 2002. The Company sold Boulder Plaza on March 19, 2002

and in accordance with SFAS 144 the results of Boulder Plaza for

the periods from January 1, 2002 to March 19, 2002 have been

reclassified into "discontinued operations" on the consolidated

statements of operations. Additionally, the Company sold its 67%

interest in Paradise Village Gateway on January 2, 2003 (acquired

in July 2002), and the loss on sale of $0.2 million has been

reclassified to discontinuedoperations. The Company sold Bristol

Center on August 4, 2003, and the results for the period January 1,

2002 to December 31, 2002 and for the period January 1, 2003 to

August 4, 2003 have been reclassified to discontinued

operations.The sale of Bristol Center resulted in a gain on sale of

asset of $22.2 million. Dec 31 Dec 31 Summarized Balance Sheet

Information 2003 2002 (UNAUDITED) Cash and cash equivalents $47,160

$53,559 Investment in real estate, net (i) $3,317,055 $2,842,177

Investments in unconsolidated entities (j) $577,396 $617,205 Total

Assets $4,121,802 $3,662,080 Mortgage and notes payable $2,682,599

$2,291,908 Dec 31 Dec 31 Additional financial data as of: 2003 2002

Occupancy of centers (g) 93.30% 93.90% Comparable quarter change in

same center sales (g) (h) 2.60% 0.90% Additional financial data for

the twelve months ended: Acquisitions of property and equipment -

including joint ventures prorata $339,997 $1,661,227 Redevelopment

and expansions of centers - including joint ventures prorata

$183,896 $65,184 Renovations of centers - including joint ventures

at prorata $24,468 $6,860 Tenant allowances- including joint

ventures at prorata $12,043 $16,010 Deferred leasing costs -

including joint ventures at prorata $18,486 $16,512 (g) excludes

redevelopment properties-Crossroads Mall- Boulder, and Parklane

Mall. (h) includes mall and freestanding stores. (i) includes

construction in process on wholly owned assets of $268,810 at

December 31, 2003 and $133,536 at December 31, 2002. (j) the

Company's prorata share of construction in process on

unconsolidated entities of $16,510 at December 31, 2003 and $16,147

atDecember 31, 2002. PRORATA SHARE OF JOINT For the Three Months

For the Year VENTURES Ended December 31 Ended December 31 Unaudited

Unaudited (Unaudited) (All amounts (All amounts in thousands) in

thousands) 2003 2002 2003 2002 Revenues: Minimum rents $40,407

$45,565 $158,061 $137,059 Percentage rents 4,625 4,351 8,163 7,138

Tenant recoveries 16,881 17,627 66,886 55,130 Management fee (c) --

2,758 5,250 9,646 Other 1,438 1,598 4,820 3,735 Total revenues

63,351 71,899 243,180 212,708 Expenses: Shopping center expenses

21,077 20,113 78,70264,581 Interest expense 14,739 14,330 57,049

50,116 Management company expense (c) 3,247 3,013 9,411

Depreciation and amortization 11,493 11,98845,674 37,530 Total

operating expenses 47,309 49,678 184,438 161,638 Gain (loss) on

sale or writedown of assets (4) (127) 155 (8,021) Net income 16,038

22,094 58,897 43,049 RECONCILIATION OF NET INCOME For the Three

Months For the Year TO FFO (b)(e) Ended December 31 Ended December

31 (All amounts (All amounts in thousands) in thousands)

(UNAUDITED) (UNAUDITED) 2003 2002 2003 2002 Net income - available

to common stockholders $25,489 $33,217 $113,218 $60,965 Adjustments

to reconcile net income to FFO- basic Minority interest 5,994

10,825 28,907 20,189 (Gain ) loss on saleof wholly owned assets 117

(12,044) (34,451) (22,253) plus gain on land sales - consolidated

assets 195 -- 1,054 128 less impairment writedown of consolidated

assets -- -- -- (3,029) (Gain) loss on sale or write-down of assets

from unconsolidated entities (pro rata share) 4 127 (155) 8,021

plus gain on land sales - unconsolidated assets (5) (121) 387 2,403

less impairment writedown of unconsolidated assets -- -- --

(10,237) Depreciation and amortization on wholly owned centers

35,176 23,608 109,028 78,837 Depreciation and amortization on joint

ventures and from the management companies (pro rata) 11,493 11,815

45,674 37,355 Less: depreciation on personal property and

amortization of loan costs and interest rate caps (2,500) (2,328)

(9,346) (7,463) Total FFO - basic 75,963 65,099 254,316 164,916

Additional adjustment to arrive at FFO - diluted Interest expense

and amortization of loan costs on the debentures -- 2,060 -- 9,310

Preferred stock dividends earned 2,357 5,195 14,816 20,417 Effect

of employee/director stock incentive plans FFO - diluted 78,320

72,354 269,132 194,643 THE MACERICH COMPANY RECONCILIATION OF For

the Three Months For the Year NET INCOME TO EBITDA Ended December

31 Ended December 31 (All amounts in thousands) (All amounts in

thousands) (UNAUDITED) (UNAUDITED) 2003 2002 2003 2002 Net income -

available to common stockholders 25,489 33,217 113,218 60,965

Interest expense 33,665 36,520 132,512 122,934 Interest expense -

unconsolidated entities (pro rata) 14,739 14,330 57,049 50,116

Depreciation and amortization - wholly-owned centers 35,176 23,608

109,028 78,837 Depreciation and amortization - unconsolidated

entities (pro rata) 11,493 11,988 45,674 37,530 Minority interest

5,994 10,825 28,907 20,189 Loss on early extinguishments of debt 29

2,734 155 3,605 Loss (gain) on sale of assets - wholly-owned

centers 117 (12,044) (34,451) (22,253) Loss (gain) on sale of

assets - unconsolidated entities (pro rata) 4 127 (155) 8,021

Preferred dividends 2,357 5,195 14,816 20,417 EBITDA (k) $129,063

$126,500 $466,753 $380,361 THE MACERICH COMPANY RECONCILIATION OF

EBITDA TO SAME CENTERS - NET OPERATING INCOME ("NOI") For the Three

Months For the Year Ended December 31 Ended December 31 (All

amounts in thousands) (All amounts in thousands) (UNAUDITED)

(UNAUDITED) 2003 2002 2003 2002 EBITDA (k) $129,063 $126,500

$466,753 $380,361 Add: REIT general and administrative expenses

1,892 2,875 10,724 7,435 Management Company expenses 1,872 922

7,550 5,295 EBITDA of non-comparable centers (15,148) (13,181)

(142,292) (56,943) SAME CENTERS - Net operating income ("NOI") (l)

$117,679 $117,116 $342,735 $336,148 (k) EBITDA represents earnings

before interest, income taxes, depreciation, amortization, minority

interest, extraordinary items, gain (loss) on sale of assets and

preferred dividends and includes joint ventures at their pro rata

share. Management considers EBITDA to be an appropriate

supplemental measure to net income because it helps investors

understand the ability of the Company to incur and service debt and

make capital expenditures. EBITDA should not be construed as an

alternative to operating income as an indicator of the Company's

operating performance, or to cash flows from operating activities

(as determined in accordance with GAAP) or as a measure

ofliquidity. EBITDA, as presented, may not be comparable to

similarly titled measurements reported by other companies. (l) The

Company presents same-center NOI because the Company believes it is

useful for investors to evaluate the operating performance of

comparable centers. Same-center NOI is calculated using total

EBITDA and subtracting out EBITDA from non-comparable centers and

eliminating the management companies and the Company's general and

administrative expenses. DATASOURCE: Macerich Company CONTACT:

Press, Arthur Coppola, President and Chief Executive Officer, or

Thomas E. O'Hern, Executive Vice President and Chief Financial

Officer, both of Macerich Company, +1-310-394-6000 Web site:

http://www.macerich.com/

Copyright

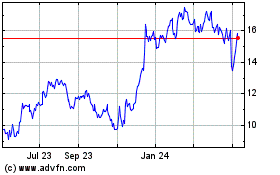

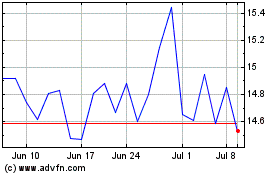

Macerich (NYSE:MAC)

Historical Stock Chart

From May 2024 to Jun 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2023 to Jun 2024