SANTA MONICA, Calif., Aug. 7 /PRNewswire-FirstCall/ -- The Macerich

Company (NYSE:MAC) today announced results of operations for the

quarter ended June 30, 2008 which included total funds from

operations ("FFO") diluted of $103.2 million or $1.16 per diluted

share, up 11.5% compared to $1.04 per diluted share for the quarter

ended June 30, 2007. For the six months ended June 30, 2008,

FFO-diluted was $199.2 million compared to $177.1 million for the

six months ended June 30, 2007. Net income available to common

stockholders for the quarter ended June 30, 2008 was $18.8 million

or $.25 per share-diluted compared to $10.9 million or $.15 per

share-diluted for the quarter ended June 30, 2007. For the six

months ended June 30, 2008, net income available to common

stockholders was $114.4 million or $1.55 per share- diluted

compared to $14.4 million or $.20 per share-diluted for the six

months ended June 30, 2007. The Company's definition of FFO is in

accordance with the definition provided by the National Association

of Real Estate Investment Trusts ("NAREIT"). A reconciliation of

net income to FFO and net income per common share-diluted ("EPS")

to FFO per share-diluted is included in the financial tables

accompanying this press release. Recent Highlights: * During the

quarter, Macerich signed 370,000 square feet of specialty store

leases (up 7.9% from the second quarter of 2007) with average

initial rents of $45.51 per square foot. Starting base rent on new

lease signings was 26.5% higher than the expiring base rent. * Mall

tenant sales per square foot for the trailing twelve month period

increased to $468 for the quarter ended June 30, 2008 compared to

$458 for the quarter ended June 30, 2007. * Portfolio occupancy at

June 30, 2008 was 92.9% compared to 93.2% at June 30, 2007. On a

same center basis, occupancy was 92.8% at June 30, 2008 compared to

93.1% at June 30, 2007. * Same center net operating income for the

quarter was up 3.35% compared to the same period in 2007. * FFO per

share-diluted increased 11.5% compared to the second quarter of

2007. * Since May, the Company has closed on over $1.0 billion in

financings. Those six financing transactions have generated

proceeds in excess of the maturing loans of over $600 million.

Commenting on results, Arthur Coppola president and chief executive

officer of Macerich stated, "In light of the economy, we are

pleased with the continuing strong fundamentals with occupancy

levels near 93%, strong releasing spreads and solid same center

growth in net operating income. In addition, we had a tremendous

amount of financing activity which generated substantial liquidity

and further strengthened our balance sheet. The majority of our

redevelopment effort is on The Oaks and Santa Monica Place, both of

which saw significant progress during the quarter." Redevelopment

and Development Activity The expansion of The Oaks, a 1.1 million

square-foot super regional mall in Thousand Oaks, California,

continues on schedule toward a multi-phased opening beginning with

a 138,000-square-foot Nordstrom Department Store slated to open on

September 5, 2008. New additions to the center's interior retail

lineup include the first-to-markets Bare Escentuals, Fruits and

Passions, kate spade, Marciano and Teavana. Construction on the

two-level, open-air retail, dining and entertainment venue,

anchored by Muvico Entertainment, Devon Seafood Grill, Ruth Chris's

Steakhouse and Lazy Dog Cafe and a complete interior renovation

continues toward a phased opening beginning Fall 2008. On July 15,

Macerich announced plans for a new 122,000-square-foot Nordstrom

that will debut as an additional anchor for Santa Monica Place, a

regional shopping center under redevelopment in affluent Santa

Monica, California. Nordstrom will replace a vacant anchor space

acquired as a result of the Federated merger. Projected to re-open

in Fall 2009, construction on the project is well underway and the

roof has been removed, setting the stage for the center's

transformation into a sophisticated, urban, open-air environment.

Vertical construction of an approximately 160,000-square-foot

luxury wing expansion at Scottsdale Fashion Square is underway and

on schedule for a projected opening of phase-I of the project in

Fall 2009. Anchored by a first- to-market 60,000-square-foot

Barneys New York, the expansion will introduce up to 100,000 square

feet of luxury shops and restaurants on Scottsdale Road. New

retailers inside the center include A/X Armani Exchange, Bare

Escentuals, Bottega Veneta, Metropark, Puma and Socrati. On July

15, plans were announced to expand the existing Nordstrom footprint

at Broadway Plaza, the Company's high-performing asset in Walnut

Creek, California. Previously announced was the addition of luxury

department store Neiman-Marcus. The entitlement process for the new

anchor addition is anticipated to be complete in late 2008.

Broadway Plaza is a 697,984-square- foot open-air regional shopping

center in the East Bay/San Francisco area. Financing Activity

Subsequent to the first quarter, the Company has closed on six

transactions with its pro rata share of the financings being $1.045

billion which generated excess proceeds above the prior loans of

over $600 million. The excess proceeds were used to pay down the

Company's line of credit. On May 6, 2008, the Company closed on a

$100 million financing of The Mall of Victor Valley, a regional

mall in Victorville, California, at an initial rate of 4.32%. Some

of the loan proceeds paid off the former loan of approximately $51

million with an interest rate of 5.25%. This floating rate loan has

an initial term of three years extendable to five years. On June 5,

2008, Westside Pavilion, a 740,000 square foot regional mall in Los

Angeles was refinanced with a new $175 million five year loan with

an initial interest rate of 4.45%. Some of the loan proceeds paid

off the former loan of $91.6 million with an interest rate of

6.74%. On June 13, 2008, the Company closed on a $150 million loan

on the recently opened SanTan Village regional shopping center. The

floating rate loan has an initial three year term, extendable to

five years. The initial funding was approximately $117 million at

an initial interest rate of 4.73%. Approximately $33 million of

additional proceeds will be distributed as the remaining

construction costs are incurred. On July 10, 2008, a $170 million,

6.76% seven year fixed rate loan was placed on Fresno Fashion Fair,

a super regional mall in Fresno, California. A portion of the

proceeds were used to pay off the previous loan of $63.1 million

bearing interest at 6.52%. On July 11, 2008, the Company placed a

$300 million combination construction -- permanent loan on The

Oaks, a super regional mall in Thousand Oaks, California. The

initial funding was $220 million at an interest rate of 4.29%.

Approximately $48 million of additional proceeds will be

distributed upon completion of the construction and another $30

million upon stabilization. This floating rate loan has an initial

term of three years. Additionally, on July 31, 2008, the Company

closed on a $150 million, seven year, 6.11% fixed interest rate

loan secured by Broadway Plaza. A portion of the proceeds were used

to pay off the current loan of $59 million (with a 6.68% interest

rate). The Company owns 50% of this joint venture. Upon completion

of these financings, the Company has less than $100 million of

remaining maturities for 2008. The Macerich Company is a fully

integrated self-managed and self-administered real estate

investment trust, which focuses on the acquisition, leasing,

management, development and redevelopment of regional malls

throughout the United States. The Company is the sole general

partner and owns an 86% ownership interest in The Macerich

Partnership, L.P. Macerich now owns approximately 77 million square

feet of gross leaseable area consisting primarily of interests in

72 regional malls. Additional information about The Macerich

Company can be obtained from the Company's web site at

http://www.macerich.com/. Investor Conference Call The Company will

provide an online Web simulcast and rebroadcast of its quarterly

earnings conference call. The call will be available on The

Macerich Company's website at http://www.macerich.com/ (Investing

section) and through CCBN at http://www.earnings.com/. The call

begins today, August 7, 2008 at 10:30 AM Pacific Time. To listen to

the call, please go to any of these web sites at least 15 minutes

prior to the call in order to register and download audio software

if needed. An online replay at http://www.macerich.com/ (Investing

section) will be available for one year after the call. The Company

will publish a supplemental financial information package which

will be available at http://www.macerich.com/ in the Investing

Section. It will also be furnished to the SEC as part of a Current

Report on Form 8-K. Note: This release contains statements that

constitute forward-looking statements. Stockholders are cautioned

that any such forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and other

factors that may cause actual results, performance or achievements

of the Company to vary materially from those anticipated, expected

or projected. Such factors include, among others, general industry,

economic and business conditions, which will, among other things,

affect demand for retail space or retail goods, availability and

creditworthiness of current and prospective tenants, anchor or

tenant bankruptcies, closures, mergers or consolidations, lease

rates and terms, interest rate fluctuations, availability and cost

of financing and operating expenses; adverse changes in the real

estate markets including, among other things, competition from

other companies, retail formats and technology, risks of real

estate development and redevelopment, acquisitions and

dispositions; governmental actions and initiatives (including

legislative and regulatory changes); environmental and safety

requirements; and terrorist activities which could adversely affect

all of the above factors. The reader is directed to the Company's

various filings with the Securities and Exchange Commission,

including the Annual Report on Form 10-K/A for the year ended

December 31, 2007, for a discussion of such risks and

uncertainties, which discussion is incorporated herein by

reference. The Company does not intend, and undertakes no

obligation, to update any forward-looking information to reflect

events or circumstances after the date of this release or to

reflect the occurrence of unanticipated events. (See attached

tables) THE MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS) Results of Operations: Results before

Impact of Results after SFAS 144 (e) SFAS 144 (e) SFAS 144 (e) For

the Three For the Three For the Three Months Ended Months Ended

Months Ended June 30, June 30, June 30, Unaudited Unaudited 2008

2007 2008 2007 2008 2007 Minimum rents $130,673 $125,920 ($7,069)

($11,136) $123,604 $114,784 Percentage rents 2,954 2,919 - (81)

2,954 2,838 Tenant recoveries 67,067 67,995 (1,421) (7,345) 65,646

60,650 Management Companies' revenues 10,382 9,599 - - 10,382 9,599

Other income 6,775 9,356 (64) (2,903) 6,711 6,453 Total revenues

$217,851 $215,789 ( $8,554) ($21,465) $209,297 $194,324 Shopping

center and operating expenses 69,354 69,172 (2,099) (7,299) 67,255

61,873 Management Companies' operating expenses 20,529 18,519 - -

20,529 18,519 Income tax benefit (689) (787) - - (689) (787)

Depreciation and amortization 57,772 59,291 (961) (5,638) 56,811

53,653 REIT general and administrative expenses 4,135 4,412 - -

4,135 4,412 Interest expense 68,506 62,226 - (3,500) 68,506 58,726

Gain on sale or disposition of assets 376 1,183 113 1,096 489 2,279

Equity in income of unconsolidated joint ventures (c) 24,946 18,997

- - 24,946 18,997 Minority interests in consolidated joint ventures

(879) (3,602) 1 3,685 (878) 83 Income from continuing operations

22,687 19,534 (5,380) (247) 17,307 19,287 Discontinued Operations:

Loss on sale or disposition of assets - - (113) (1,124) (113)

(1,124) Income from discontinued operations - - 5,493 1,371 5,493

1,371 Income before minority interests of OP 22,687 19,534 - -

22,687 19,534 Income allocated to minority interests of OP 3,058

1,940 - - 3,058 1,940 Net income before preferred dividends 19,629

17,594 - - 19,629 17,594 Preferred dividends (a) 835 2,575 - - 835

2,575 Adjustment of minority interest due to redemption value -

4,119 - - - 4,119 Net income to common stockholders 18,794 10,900 -

- 18,794 10,900 Average number of shares outstanding - basic 73,780

71,528 73,780 71,528 Average shares outstanding, assuming full

conversion of OP Units (d) (e) 86,781 84,552 86,781 84,552 Average

shares outstanding - Funds From Operations ("FFO") - diluted (a)

(d) (e) 88,633 96,701 88,633 96,701 Per share income - diluted

before discontinued operations - - $0.19 $0.20 Net income per

share-basic $0.25 $0.15 $0.25 $0.15 Net income per share - diluted

(a) (e) $0.25 $0.15 $0.25 $0.15 Dividend declared per share $0.80

$0.71 $0.80 $0.71 FFO - basic (b) (d) $102,345 $89,409 $102,345

$89,409 FFO - diluted (a) (b) (d) (e) $103,180 $100,696 $103,180

$100,696 FFO per share - basic (b) (d) $1.19 $1.06 $1.19 $1.06 FFO

per share - diluted (a) (b) (d) (e) $1.16 $1.04 $1.16 $1.04 Results

of Operations: Results before Impact of Results after SFAS 144 (e)

SFAS 144 (e) SFAS 144 (e) For the Six For the Six For the Six

Months Ended Months Ended Months Ended June 30, June 30, June 30,

Unaudited Unaudited 2008 2007 2008 2007 2008 2007 Minimum rents

$262,760 $249,913 ($13,325) ($22,169) $249,435 $227,744 Percentage

rents 5,658 6,706 - (204) 5,658 6,502 Tenant recoveries 134,898

135,778 (2,863) (14,263) 132,035 121,515 Management Companies'

revenues 20,073 18,353 - - 20,073 18,353 Other income 13,388 16,946

(348) (3,938) 13,040 13,008 Total revenues $436,777 $427,696

($16,536) ($40,574) $420,241 $387,122 Shopping center and operating

expenses 140,307 137,849 (4,135) (13,960) 136,172 123,889

Management Companies' operating expenses 38,872 36,274 - - 38,872

36,274 Income tax benefit (388) (907) - - (388) (907) Depreciation

and amortization 118,901 115,267 (1,383) (10,235) 117,518 105,032

REIT general and administrative expenses 8,538 9,785 - - 8,538

9,785 Interest expense 139,333 129,781 - (7,035) 139,333 122,746

Loss on early extinguishment of debt - 877 - - - 877 Gain on sale

or disposition of assets 100,313 2,646 (99,150) 1,385 1,163 4,031

Equity in income of unconsolidated joint ventures (c) 47,244 33,480

- - 47,244 33,480 Minority interests in consolidated joint ventures

(1,404) (8,640) - 7,505 (1,404) (1,135) Income from continuing

operations 137,367 26,256 (110,168) (454) 27,199 25,802

Discontinued Operations: Gain (loss) on sale or disposition of

assets - - 99,150 (1,413) 99,150 (1,413) Income from discontinued

operations - - 11,018 1,867 11,018 1,867 Income before minority

interests of OP 137,367 26,256 - - 137,367 26,256 Income allocated

to minority interests of OP 19,656 2,578 - - 19,656 2,578 Net

income before preferred dividends 117,711 23,678 - - 117,711 23,678

Preferred dividends (a) 3,289 5,150 - - 3,289 5,150 Adjustment of

minority interest due to redemption value - 4,119 - - - 4,119 Net

income to common stockholders 114,422 14,409 - - 114,422 14,409

Average number of shares outstanding - basic 73,061 71,597 73,061

71,597 Average shares outstanding, assuming full conversion of OP

Units (d) (e) 88,465 84,792 88,465 84,792 Average shares

outstanding - FFO - diluted (a) (d) (e) 88,465 88,419 88,465 88,419

Per share income - diluted before discontinued operations - - $0.31

$0.25 Net income per share - basic $1.57 $0.20 $1.57 $0.20 Net

income per share - diluted (a) (e) $1.55 $0.20 $1.55 $0.20 Dividend

declared per share $1.60 $1.42 $1.60 $1.42 FFO - basic (b) (d)

$195,902 $171,902 $195,902 $171,902 FFO - diluted (a) (b) (d) (e)

$199,191 $177,052 $199,191 $177,052 FFO per share - basic (b) (d)

$2.29 $2.03 $2.29 $2.03 FFO per share - diluted (a) (b) (d) (e)

$2.25 $2.00 $2.25 $2.00 THE MACERICH COMPANY FINANCIAL HIGHLIGHTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) (a) On February 25, 1998,

the Company sold $100 million of convertible preferred stock

representing 3.627 million shares. The convertible preferred shares

can be converted on a 1 for 1 basis for common stock. The preferred

shares outstanding were assumed converted for purposes of net

income per share - diluted for the six months ended June 30, 2008.

The preferred shares outstanding were not assumed converted for the

three months ended June 30, 2008 and for all periods presented for

2007 as they would be antidilutive to the calculation. The weighted

average preferred shares outstanding are assumed converted for

purposes of FFO per share - diluted as they are dilutive to those

calculations for all periods presented. On October 18, 2007,

560,000 shares of convertible preferred stock were converted to

common shares. Additionally, on May 6, 2008 and May 8, 2008,

684,000 and 1,338,860 shares of convertible preferred stock were

converted to common shares, respectively. (b) The Company uses FFO

in addition to net income to report its operating and financial

results and considers FFO and FFO-diluted as supplemental measures

for the real estate industry and a supplement to Generally Accepted

Accounting Principles (GAAP) measures. NAREIT defines FFO as net

income (loss) (computed in accordance with GAAP), excluding gains

(or losses) from extraordinary items and sales of depreciated

operating properties, plus real estate related depreciation and

amortization and after adjustments for unconsolidated partnerships

and joint ventures. Adjustments for unconsolidated partnerships and

joint ventures are calculated to reflect FFO on the same basis. FFO

and FFO on a fully diluted basis are useful to investors in

comparing operating and financial results between periods. This is

especially true since FFO excludes real estate depreciation and

amortization, as the Company believes real estate values fluctuate

based on market conditions rather than depreciating in value

ratably on a straight-line basis over time. FFO on a fully diluted

basis is one of the measures investors find most useful in

measuring the dilutive impact of outstanding convertible

securities. FFO does not represent cash flow from operations as

defined by GAAP, should not be considered as an alternative to net

income as defined by GAAP and is not indicative of cash available

to fund all cash flow needs. FFO as presented may not be comparable

to similarly titled measures reported by other real estate

investment trusts. Effective January 1, 2003, gains or losses on

sales of undepreciated assets and the impact of SFAS 141 have been

included in FFO. The inclusion of gains on sales of undepreciated

assets increased FFO for the three and six months ended June 30,

2008 and 2007 by $1.4 million, $3.0 million, $(0.2) million and

$0.7 million, respectively, or by $.01 per share, $0.03 per share,

$0.00 per share and $.01 per share, respectively. Additionally,

SFAS 141 increased FFO for the three and six months ended June 30,

2008 and 2007 by $3.9 million and $8.5 million, $3.5 million and

$7.5 million, respectively, or by $.04 per share, $0.10 per share,

$0.04 per share and $0.08 per share, respectively. (c) This

includes, using the equity method of accounting, the Company's

prorata share of the equity in income or loss of its unconsolidated

joint ventures for all periods presented. (d) The Macerich

Partnership, LP (the "Operating Partnership" or the "OP") has

operating partnership units ("OP units"). Each OP unit can be

converted into a share of Company common stock. Conversion of the

OP units not owned by the Company has been assumed for purposes of

calculating the FFO per share and the weighted average number of

shares outstanding. The computation of average shares for FFO -

diluted includes the effect of share and unit-based compensation

plans and convertible senior notes using the treasury stock method.

It also assumes conversion of MACWH, LP preferred and common units

to the extent they are dilutive to the calculation. For the three

and six months ended June 30, 2008 and 2007, the MACWH, LP

preferred units were antidilutive to FFO. (e) In October 2001, the

FASB issued SFAS No. 144, "Accounting for the Impairment or

Disposal of Long-Lived Assets" ("SFAS 144"). SFAS 144 addresses

financial accounting and reporting for the impairment or disposal

of long-lived assets. The Company adopted SFAS 144 on January 1,

2002. On December 17, 2007, the Company, as part of a

sale/leaseback transaction involving Mervyn's sites, identified

certain locations available for sale. The Company has classified

the results of operations from these sites as discontinued

operations. On April 25, 2005, in connection with the acquisition

of Wilmorite Holdings, L.P. and its affiliates, the Company issued

as part of the consideration participating and non-participating

convertible preferred units in MACWH, LP. The participating units

are not assumed converted for purposes of net income per share and

FFO - diluted per share for all periods presented as they would be

antidilutive to the calculation. On January 1, 2008, a subsidiary

of the Company, at the election of the holders, redeemed

approximately 3.4 million participating convertible preferred units

in exchange for the distribution of the interests in the entity

which held that portion of the Wilmorite portfolio that consisted

of Eastview Mall, Greece Ridge Center, Marketplace Mall and

Pittsford Plaza ("Rochester Properties"). This exchange is referred

to as the "Rochester Redemption." As a result of the Rochester

Redemption , the Company has classified the results of operations

from the Rochester Properties to discontinued operations and

recorded a gain of $99.3 million for the period ended March 31,

2008. THE MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS) Pro rata share of joint ventures: For the

Three Months For the Six Months Ended June 30, Ended June 30,

Unaudited Unaudited 2008 2007 2008 2007 Revenues: Minimum rents

$67,124 $61,985 $133,434 $123,875 Percentage rents 2,143 1,938

4,405 4,225 Tenant recoveries 31,452 28,602 64,048 57,791 Other

9,851 3,291 14,009 5,954 Total revenues $110,570 $95,816 $215,896

$191,845 Expenses: Shopping center expenses 35,988 32,807 71,913

63,395 Interest expense 25,668 23,751 51,927 48,068 Depreciation

and amortization 25,755 20,696 48,034 45,084 Total operating

expenses 87,411 77,254 171,874 156,547 Gain (loss) on sale of

assets 1,604 362 2,923 (2,020) Equity in income of joint ventures

183 73 299 202 Net income $24,946 $18,997 $47,244 $33,480

Reconciliation of Net Income to FFO (b): For the Three Months For

the Six Months Ended June 30, Ended June 30, Unaudited Unaudited

2008 2007 2008 2007 Net income - available to common stockholders

$18,794 $10,900 $114,422 $14,409 Adjustments to reconcile net

income to FFO - basic Minority interest in OP 3,058 1,940 19,656

2,578 Gain on sale or disposition of consolidated assets (376)

(1,183) (100,313) (2,646) Adjustment of minority interest due to

redemption value - 4,119 - 4,119 plus gain on undepreciated asset

sales - consolidated assets 241 (542) 574 339 plus minority

interest share of gain on sale of consolidated joint ventures 248

(488) 589 348 (Gain) loss on sale of assets from unconsolidated

entities (pro rata share) (1,604) (362) (2,923) 2,020 plus gain on

undepreciated asset sales - unconsolidated entities (pro rata

share) 1,116 350 2,436 350 plus minority interest share of gain on

sale of unconsolidated entities 487 - 487 - Depreciation and

amortization on consolidated assets (f) 57,772 59,291 118,901

115,267 Less depreciation and amortization allocable to minority

interests on consolidated joint ventures (788) (1,332) (1,361)

(2,326) Depreciation and amortization on joint ventures (pro rata)

(f) 25,755 20,696 48,034 45,084 Less: depreciation on personal

property and amortization of loan costs (f) (2,358) (3,980) (4,600)

(7,640) Total FFO - basic 102,345 89,409 195,902 171,902 Additional

adjustment to arrive at FFO - diluted Preferred stock dividends

earned 835 2,575 3,289 5,150 Convertible debt - interest expense -

8,712 - - Total FFO - diluted $103,180 $100,696 $199,191 $177,052

(f) In 2008, amortization of loan costs is included in interest

expense. Reconciliation of EPS to FFO per diluted share: For the

Three Months For the Six Months Ended June 30, Ended June 30,

Unaudited Unaudited 2008 2007 2008 2007 Earnings per share -

diluted $0.25 $0.15 $1.55 $0.20 Per share impact of depreciation

and amortization of real estate 0.92 0.88 1.88 1.77 Per share

impact of (gain) loss on sale or disposition of depreciated assets

0.00 (0.03) (1.16) (0.01) Per share impact of preferred stock not

dilutive to EPS (0.01) (0.01) (0.02) (0.01) Per share impact of

adjustment of minority interest due to redemption value - 0.05 -

0.05 FFO per share - diluted $1.16 $1.04 $2.25 $2.00 THE MACERICH

COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE

AMOUNTS) Reconciliation of Net Income to EBITDA: For the Three

Months For the Six Months Ended June 30, Ended June 30, Unaudited

Unaudited 2008 2007 2008 2007 Net income - available to common

stockholders $18,794 $10,900 $114,422 $14,409 Interest expense

68,506 62,226 139,333 129,781 Interest expense - unconsolidated

entities (pro rata) 25,668 23,751 51,927 48,068 Depreciation and

amortization - consolidated assets 57,772 59,291 118,901 115,267

Depreciation and amortization - unconsolidated entities (pro rata)

25,755 20,696 48,034 45,084 Minority interest 3,058 1,940 19,656

2,578 Adjustment of minority interest due to redemption value -

4,119 - 4,119 Less: Interest expense and depreciation and

amortization allocable to minority interests on consolidated joint

ventures (1,191) (1,766) (1,950) (3,201) Loss on early

extinguishment of debt - - - 877 Gain on sale or disposition of

assets - consolidated assets (376) (1,183) (100,313) (2,646) (Gain)

loss on sale of assets - unconsolidated entities (pro rata) (1,604)

(362) (2,923) 2,020 Add: Minority interest share of gain on sale of

consolidated joint ventures 248 (488) 589 348 Add: Minority

interest share of gain on sale of unconsolidated entities 487 - 487

- Income tax benefit (689) (787) (388) (907) Distributions on

preferred units 264 3,547 540 7,094 Preferred dividends 835 2,575

3,289 5,150 EBITDA (g) $197,527 $184,459 $391,604 $368,041

Reconciliation of EBITDA to Same Centers - Net Operating Income

("NOI"): For the Three Months For the Six Months Ended June 30,

Ended June 30, Unaudited Unaudited 2008 2007 2008 2007 EBITDA (g)

$197,527 $184,459 $391,604 $368,041 Add: REIT general and

administrative expenses 4,135 4,412 8,538 9,785 Management

Companies' revenues (10,382) (9,599) (20,073) (18,353) Management

Companies' operating expenses 20,529 18,519 38,872 36,274 Lease

termination income of comparable centers (2,264) (2,130) (4,787)

(5,483) EBITDA of non- comparable centers (38,607) (30,256)

(71,110) (57,949) Same Centers - NOI (h) $170,938 $165,405 $343,044

$332,315 (g) EBITDA represents earnings before interest, income

taxes, depreciation, amortization, minority interest, extraordinary

items, gain (loss) on sale of assets and preferred dividends and

includes joint ventures at their pro rata share. Management

considers EBITDA to be an appropriate supplemental measure to net

income because it helps investors understand the ability of the

Company to incur and service debt and make capital expenditures.

EBITDA should not be construed as an alternative to operating

income as an indicator of the Company's operating performance, or

to cash flows from operating activities (as determined in

accordance with GAAP) or as a measure of liquidity. EBITDA, as

presented, may not be comparable to similarly titled measurements

reported by other companies. (h) The Company presents same-center

NOI because the Company believes it is useful for investors to

evaluate the operating performance of comparable centers.

Same-center NOI is calculated using total EBITDA and subtracting

out EBITDA from non-comparable centers and eliminating the

management companies and the Company's general and administrative

expenses. Same center NOI excludes the impact of straight-line and

SFAS 141 adjustments to minimum rents. DATASOURCE: The Macerich

Company CONTACT: Arthur Coppola, President and Chief Executive

Officer, or Thomas E. O'Hern, Executive Vice President and Chief

Financial Officer, both of The Macerich Company, +1-310-394-6000

Web site: http://www.macerich.com/

Copyright

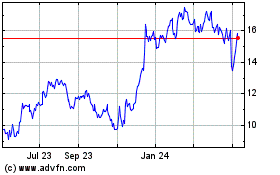

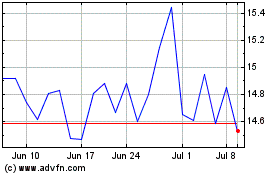

Macerich (NYSE:MAC)

Historical Stock Chart

From May 2024 to Jun 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2023 to Jun 2024