Macerich and Alaska Permanent Fund Corporation Partner to Acquire Shops at North Bridge

January 10 2008 - 2:59PM

PR Newswire (US)

Acquisition Gives Macerich Premier Magnificent Mile Address in

Chicago SANTA MONICA, Calif., Jan. 10 /PRNewswire-FirstCall/ -- The

Macerich Partnership, L.P., the operating partnership of

Macerich(R) (NYSE:MAC), and the Alaska Permanent Fund Corporation

(APFC) today announced the acquisition of one of Chicago's

mixed-use retail jewels -- The Shops at North Bridge -- created by

Chicago real estate developer, The John Buck Company. The joint

acquisition was arranged by Dallas-based L&B Realty Advisors,

LLP (L&B), one of the nation's largest commercial real estate

investment management organizations. Located on Chicago's famed

Michigan Avenue and producing annual small shop tenant (spaces

10,000 square feet or less) sales of $839 per square foot, The

Shops at North Bridge property aligns with Macerich's strategic

focus on high-quality retail real estate in the country's most

powerful markets. "A clear point of differentiation for Macerich is

our focus on cultivating the very best properties in optimal,

high-performing markets throughout the country," said Macerich

Chief Investment Officer Edward C. Coppola. "Within our national

portfolio, we have a dominant presence in many of the nation's top

markets -- including Los Angeles, metropolitan New York, Phoenix,

the San Francisco Bay Area, and Washington, D.C. The Shops at North

Bridge gives us an opportunity to enter Chicago with what we

believe is the best retail location in this desirable market.

"We're very confident that Macerich will continue our vision for

this world-class asset," said John O'Donnell, President and Chief

Operating Officer, The John Buck Company. "This acquisition also is

an opportunity for Macerich and L&B to expand their partnership

with Alaska Permanent Fund Corporation, which operates with a real

estate investment philosophy that mirrors both firms' focus on the

best properties in the best markets," Coppola continued. This is

the second joint venture for the two entities: Macerich and APFC

co-own another of the country's top-performing regional shopping

centers, Tysons Corner Center in the Capital Region's affluent

Fairfax County. "Adding The Shops at North Bridge to our portfolio

of real estate assets was an opportunity for us to partner with

Macerich, again, in owning and managing an exceptional piece of

real estate in a market with exceptional attributes," commented

Michael Burns, APFC's Chief Executive Officer. "This acquisition is

the perfect complement to our partnership with Macerich." "It is a

rare opportunity for our client, APFC, to gain an asset of this

pre-eminence while broadening their strategic relationship with

Macerich and L&B," said L&B's Director of Acquisitions,

Bernadette Mussell. The Shops at North Bridge is a

680,933-square-foot mixed-use retail development anchoring the

south end of Chicago's primary retail district known as "The

Magnificent Mile." In addition to the four-level shopping center,

the transaction includes two parking garages with a combined 1,200

spaces and 133,615 square feet of office space immediately west of

the center. The Shops at North Bridge is home to one of the top

five performing Nordstrom Department Stores in the country.

Currently at an occupancy level of 94.9%, The Nordstrom-anchored

Shops at North Bridge features approximately 50 specialty retailers

and 20 restaurants. Five hotels, including the luxurious Conrad

Hotel and the historic Intercontinental Chicago Hotel, complement

the retail development. Considered one of the country's top retail

and tourism magnets, Chicago is projected to be the

seventh-fastest-growing city in the country. Macerich and APFC

acquired the property from a partnership comprised of The John Buck

Company, the Morgan Stanley real estate funds and Westfield Group

for $515 million. Macerich and APFC assumed the $205 million

balance of the existing loan at an interest rate of 4.67% maturing

in July 2009. The acquisition of The Shops at North Bridge caps a

year in which Macerich completed the most new development and

redevelopment projects in the company's history, including the

first phase openings of two ground-up regional shopping centers in

Arizona and two significant expansions in Arizona and New Jersey.

In all, Macerich opened six redevelopment and new development

projects in 2007. Over the past 12 months L&B began targeting

opportunities in Chicago due to its status as a global market. In

addition to North Bridge, other investments include The Pinnacle

Retail, The Shops at The Fordham, both on Wabash Street two blocks

from North Bridge, and a to-be-developed multifamily high-rise

across from River North's highly visible Merchandise Mart on Kinzie

Street. Macerich is a fully integrated self-managed and

self-administered real estate investment trust, which focuses on

the acquisition, leasing, management, development and redevelopment

of regional malls throughout the United States. The company is the

sole general partner and owns an 85% ownership interest in The

Macerich Partnership, L.P. Macerich now owns approximately 76

million square feet of gross leaseable area consisting primarily of

interests in 71 regional malls. Additional information about

Macerich can be obtained from the Company's Web site at

http://www.macerich.com/. The Alaska Permanent Fund was created by

referendum in 1976 to save a portion of the state's oil revenue for

the future. The Fund is currently worth approximately $39 billion.

In 1980, the Alaska State Legislature created the Alaska Permanent

Fund Corporation to manage the investments of the Permanent Fund

outside of the State Treasury. The Fund is invested in a diverse

portfolio of assets, including U.S. and non-U.S. fixed income

securities, equities and real estate, as well as infrastructure,

absolute return and private equity investments. A portion of the

Permanent Fund earnings are distributed to eligible Alaskans, and

these dividends have ranged from $331 in 1984 to $1964 in 2000. In

the fall of 2007 dividends of $1,654 were paid to more than 600,000

Alaskans. L&B provides real estate advisory and management

services to institutional investors and individual clients,

including: portfolio management, acquisitions, asset management,

construction services, and property management. The company manages

a portfolio of more than 19 million square feet of office, retail,

medical, industrial and multifamily properties valued at $3.6

billion. Note: This release contains statements that constitute

forward-looking statements. Stockholders are cautioned that any

such forward-looking statements are not guarantees of future

performance and involve risks, uncertainties and other factors that

may cause actual results, performance or achievements of the

Company to vary materially from those anticipated, expected or

projected. Such factors include, among others, general industry,

economic and business conditions, which will, among other things,

affect demand for retail space or retail goods, availability and

creditworthiness of current and prospective tenants, anchor or

tenant bankruptcies, closures, mergers or consolidations, lease

rates and terms, interest rate fluctuations, availability and cost

of financing and operating expenses; adverse changes in the real

estate markets including, among other things, competition from

other companies, retail formats and technology, risks of real

estate development and redevelopment, acquisitions and

dispositions; governmental actions and initiatives (including

legislative and regulatory changes); environmental and safety

requirements; and terrorist activities which could adversely affect

all of the above factors. The reader is directed to the Company's

various filings with the Securities and Exchange Commission,

including the Annual Report on Form 10-K for the year ended

December 31, 2006, for a discussion of such risks and uncertainties

which discussion is incorporated by reference. DATASOURCE: Macerich

CONTACT: Edward C. Coppola, chief investment officer or Thomas

O'Hern, executive vice president and chief financial officer,

+1-310-394-6000, or media, Anita Walker, +1-602-953-6550, all of

Macerich; or John O'Donnell, president, chief operating officer of

The John Buck Company, +1-312-441-4113 Web site:

http://www.macerich.com/

Copyright

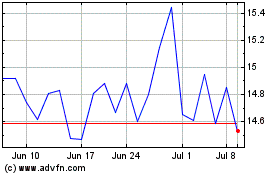

Macerich (NYSE:MAC)

Historical Stock Chart

From May 2024 to Jun 2024

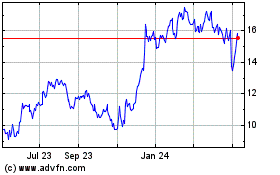

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2023 to Jun 2024