SANTA MONICA, Calif., Aug. 2 /PRNewswire-FirstCall/ -- The Macerich

Company (NYSE:MAC) today announced results of operations for the

quarter ended June 30, 2007 which included total funds from

operations ("FFO") diluted of $100.7 million or $1.04 per share, up

8.2% compared to $.96 per share- diluted for the quarter ended June

30, 2006. For the six months ended June 30, 2007, FFO-diluted was

$177.1 million compared to $175.4 million for the six months ended

June 30, 2006. Net income available to common stockholders for the

quarter ended June 30, 2007 was $13.4 million or $.19 per share-

diluted compared to $25.7 million or $.36 per share-diluted for the

quarter ended June 30, 2006. For the six months ended June 30,

2007, net income was $16.0 million compared to $33.1 million for

the six months ended June 30, 2006. The Company's definition of FFO

is in accordance with the definition provided by the National

Association of Real Estate Investment Trusts ("NAREIT"). A

reconciliation of net income to FFO and net income per common

share-diluted ("EPS") to FFO per share-diluted is included in the

financial tables accompanying this press release. Recent

Highlights: -- During the quarter, Macerich signed 343,000 square

feet of specialty store leases at average initial rents of $43.71

per square foot. Starting base rent on new lease signings was 26.2%

higher than the expiring base rent. -- Mall tenant annual sales per

square foot for the year ended June 30, 2007 was $458 compared to

$433 at June 30, 2006. -- Portfolio occupancy at June 30, 2007 was

93.2% compared to 92.1% at June 30, 2006. On a same center basis,

occupancy was 93.2% at June 30, 2007 compared to 92.8% at June 30,

2006. -- FFO per share-diluted increased 8.2% compared to the

second quarter of 2006. Contributing to this increase was same

center net operating income growth of 3.4%. Commenting on results,

Arthur Coppola, president and chief executive officer of Macerich

stated, "The quarter reflected continuing strong fundamentals with

occupancy gains, strong releasing spreads and solid same center

growth in net operating income. In addition, we continue to

strengthen our balance sheet with the recent refinancing of

Scottsdale Fashion Square which contributed to a further reduction

in our floating rate debt. We continue to make excellent progress

on our significant pipeline of developments and redevelopments

which we expect will fuel earnings growth in the years to come."

Redevelopment and Development Activity SanTan Village, a 1.2

million square foot regional shopping center on 120 acres, will be

the first regional shopping center developed in the fast- growing

area of Gilbert, Arizona and the first regional mall opened in the

Phoenix metroplex since the opening of Chandler Fashion Center in

2001. Currently 90% committed, the first phase of the open-air

shopping center, including approximately 100 specialty retailers

and Dillard's, is scheduled to open in October, 2007. Remaining

retail phases are slated to open in 2008. Phase I of The Promenade

at Casa Grande, a 1 million square foot, 120 acre regional shopping

center in fast growing Pinal County, Arizona, is 90% committed and

scheduled to open in November, 2007. The first phase features

mini-anchors, restaurants and shops. Bed, Bath & Beyond,

Claire's, Cost Plus World Market, Fashion Bug, Olive Garden, Mimi's

Cafe and Sports Authority will join the existing line up which

includes Dillard's, JCPenney, Target, Kohl's and Harkins Theaters.

Phase II is scheduled to open spring 2008. At Flagstaff Mall, in

Flagstaff, Arizona the first phase of the 287,000 square foot power

center addition is scheduled for a fall 2007 opening. Home Depot

will anchor The Marketplace and will open with first-to-market

retailers including Shoe Pavilion, Marshall's, Best Buy, Old Navy,

Linens 'n Things, Cost Plus World Market and Petco. At Freehold

Raceway Mall in Freehold, New Jersey, construction continues on the

110,000 square foot lifestyle expansion which is slated to open in

November, 2007. The project is 85% committed. New retailers include

Borders, The Cheesecake Factory, P.F. Chang's, Jared and The

Territory Ahead. New retailers joining the existing 1.6 million

square foot regional shopping center, which is undergoing an

interior renovation, include Ruehl, Robot Galaxy, Solstice,

Charlotte Russe, Amuse and Pro Image. Scottsdale Fashion Square,

the 2 million square foot luxury flagship, is undergoing a $130

million redevelopment and expansion. Phase I of the expansion is

expected to begin fall 2007 with the demolition of the vacant

anchor space, acquired from Federated, and an adjacent parking

structure. A 65,000 square foot, first-to-market Barneys New York,

will anchor additional 100,000-square-feet of new shop space slated

to open fall 2009. Construction continues on the combined

redevelopment, expansion and interior renovation of The Oaks, an

upscale 1.1 million square foot super- regional shopping center in

California's affluent Thousand Oaks. The project is expected to be

completed in fall 2008. The market's first Nordstrom department

store is under construction. At Estrella Falls, plans continue

moving forward. Infrastructure improvements are underway and the

site plan approval process for the regional shopping center is

anticipated to be completed in fall 2007. The adjacent power center

is expected to open in phases beginning in 2008. Regional shopping

center retailers announced to date include Coach, Chico's, White

House/Black Market and Industrial Ride Shop; announced power center

retailers include Bashas', Staples, Shoe Pavilion and Razmataz. The

mall is projected to open in phases beginning in 2009. Financing

Activity In July, a $550 million refinancing of Scottsdale Fashion

Square was completed. The loan bears interest at a 5.66% fixed rate

with a seven year term. The Company used its prorata share of

excess proceeds, $162 million, to pay down its line of credit which

reduced floating rate debt as a percentage of total outstanding

indebtedness to under 6%. The Macerich Company is a fully

integrated self-managed and self- administered real estate

investment trust, which focuses on the acquisition, leasing,

management, development and redevelopment of regional malls

throughout the United States. The Company is the sole general

partner and owns an 85% ownership interest in The Macerich

Partnership, L.P. Macerich now owns approximately 77 million square

feet of gross leaseable area consisting primarily of interests in

73 regional malls. Additional information about The Macerich

Company can be obtained from the Company's web site at

http://www.macerich.com/. Investor Conference Call The Company will

provide an online Web simulcast and rebroadcast of its quarterly

earnings conference call. The call will be available on The

Macerich Company's website at http://www.macerich.com/ and through

CCBN at http://www.earnings.com/. The call begins today, August 2,

2007 at 10:30 AM Pacific Time. To listen to the call, please go to

either of these web sites at least 15 minutes prior to the call in

order to register and download audio software as needed. An online

replay at http://www.macerich.com/ will be available for one year

after the call. Note: This release contains statements that

constitute forward-looking statements. Stockholders are cautioned

that any such forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and other

factors that may cause actual results, performance or achievements

of the Company to vary materially from those anticipated, expected

or projected. Such factors include, among others, general industry,

economic and business conditions, which will, among other things,

affect demand for retail space or retail goods, availability and

creditworthiness of current and prospective tenants, anchor or

tenant bankruptcies, closures, mergers or consolidations, lease

rates and terms, interest rate fluctuations, availability and cost

of financing and operating expenses; adverse changes in the real

estate markets including, among other things, competition from

other companies, retail formats and technology, risks of real

estate development and redevelopment, acquisitions and

dispositions; governmental actions and initiatives (including

legislative and regulatory changes); environmental and safety

requirements; and terrorist activities which could adversely affect

all of the above factors. The reader is directed to the Company's

various filings with the Securities and Exchange Commission,

including the Annual Report on Form 10-K for the year ended

December 31, 2006, for a discussion of such risks and

uncertainties, which discussion is incorporated herein by

reference. THE MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS) Results before Impact of Results after

SFAS 144 (e) SFAS 144 (e) SFAS 144 (e) Results of For the Three For

the Three For the Three Operations: Months Ended Months Ended

Months Ended June 30, June 30, June 30, Unaudited Unaudited 2007

2006 2007 2006 2007 2006 Minimum rents $125,921 $127,483 ($20)

($10,892) $125,901 $116,591 Percentage rents 2,922 2,754 (60) (208)

2,862 2,546 Tenant recoveries 67,995 65,932 144 (5,307) 68,139

60,625 Management Companies' revenues 9,599 7,369 - - 9,599 7,369

Other income 9,352 6,341 (65) (381) 9,287 5,960 Total revenues

215,789 209,879 (1) (16,788) 215,788 193,091 Shopping center and

operating expenses 69,172 70,151 (398) (6,153) 68,774 63,998

Management Companies' operating expenses 18,519 12,125 - - 18,519

12,125 Income tax (benefit) expense (787) 218 - - (787) 218

Depreciation and amortization 60,404 59,411 - (3,401) 60,404 56,010

REIT general and administrative expenses 4,412 3,292 - - 4,412

3,292 Interest expense 62,226 71,188 35 (3,040) 62,261 68,148 Loss

on early extinguishment of debt - - - - - - Gain (loss)on sale or

writedown of assets 1,183 62,961 1,096 (62,961) 2,279 - Equity in

income of unconsolidated joint ventures (c) 18,997 17,861 - -

18,997 17,861 Minority interests in consolidated joint ventures

(55) (37,904) 28 37,363 (27) (541) Income (loss) from continuing

operations 21,968 36,412 1,486 (29,792) 23,454 6,620 Discontinued

Operations: (Loss) gain on sale of assets - - (1,124) 25,952

(1,124) 25,952 (Loss) income from discontinued operations - - (362)

3,840 (362) 3,840 Income before minority interests of OP 21,968

36,412 - - 21,968 36,412 Income allocated to minority interests of

OP 2,398 4,770 - - 2,398 4,770 Net income before preferred

dividends 19,570 31,642 - - 19,570 31,642 Preferred dividends and

distributions (a) 6,122 5,970 - - 6,122 5,970 Net income to common

stockholders $13,448 $25,672 $0 $0 $13,448 $25,672 Average number

of shares outstanding - basic 71,528 71,458 71,528 71,458 Average

shares outstanding, assuming full conversion of OP Units (d) 84,552

85,023 84,552 85,023 Average shares outstanding - diluted for FFO

(a) (d) 96,701 88,650 96,701 88,650 Per share income - diluted

before discontinued operations - - $0.21 $0.01 Net income per

share-basic $0.19 $0.36 $0.19 $0.36 Net income per share- diluted

(a) $0.19 $0.36 $0.19 $0.36 Dividend declared per share $0.71 $0.68

$0.71 $0.68 Funds from operations "FFO" (b)(d)- basic $89,409

$82,860 $89,409 $82,860 Funds from operations "FFO" (a)(b) (d) -

diluted $100,696 $85,327 $100,696 $85,327 FFO per share - basic(b)

(d) $1.06 $0.98 $1.06 $0.98 FFO per share - diluted(a)(b)(d) $1.04

$0.96 $1.04 $0.96 Results before Impact of Results after SFAS 144

(e) SFAS 144 (e) SFAS 144 (e) Results of For the Six For the Six

For the Six Operations: Months Ended Months Ended Months Ended June

30, June 30, June 30, Unaudited Unaudited 2007 2006 2007 2006 2007

2006 Minimum rents $249,913 $261,069 ($30) ($22,390) $249,883

$238,679 Percentage rents 6,706 5,720 (79) (804) 6,627 4,916 Tenant

recoveries 135,778 133,338 15 (10,370) 135,793 122,968 Management

Companies' revenues 18,353 14,626 - - 18,353 14,626 Other income

16,946 13,289 (146) (697) 16,800 12,592 Total revenues 427,696

428,042 (240) (34,261) 427,456 393,781 Shopping center and

operating expenses 137,851 138,278 (456) (12,436) 137,395 125,842

Management Companies' operating expenses 36,274 26,839 - - 36,274

26,839 Income tax (benefit) expense (907) (315) - - (907) (315)

Depreciation and amortization 117,492 122,951 2 (7,530) 117,494

115,421 REIT general and administrative expenses 9,785 6,990 - -

9,785 6,990 Interest expense 129,781 143,153 35 (6,224) 129,816

136,929 Loss on early extinguishment of debt 877 1,782 - - 877

1,782 Gain (loss)on sale or writedown of assets 2,646 62,460 1,385

(62,961) 4,031 (501) Equity in income of unconsolidated joint

ventures(c) 33,480 38,877 - - 33,480 38,877 Minority interests in

consolidated joint ventures (1,546) (38,407) 30 37,403 (1,516)

(1,004) Income (loss) from continuing operations 31,123 51,294

1,594 (33,629) 32,717 17,665 Discontinued Operations: (Loss) gain

on sale of assets - - (1,413) 25,952 (1,413) 25,952 (Loss) income

from discontinued operations - - (181) 7,677 (181) 7,677 Income

before minority interests of OP 31,123 51,294 - - 31,123 51,294

Income allocated to minority interests of OP 2,865 6,230 - - 2,865

6,230 Net income before preferred dividends 28,258 45,064 - -

28,258 45,064 Preferred dividends and distributions(a) 12,244

11,939 - - 12,244 11,939 Net income to common stockholders $16,014

$33,125 $0 $0 $16,014 $33,125 Average number of shares outstanding

- basic 71,597 70,152 71,597 70,152 Average shares outstanding,

assuming full conversion of OP Units (d) 84,792 83,807 84,792

83,807 Average shares outstanding - diluted for FFO (a) (d) 88,419

87,434 88,419 87,434 Per share income - diluted before discontinued

operations - - $0.24 $0.07 Net income per share-basic $0.22 $0.47

$0.22 $0.47 Net income per share - diluted (a) $0.22 $0.47 $0.22

$0.47 Dividend declared per share $1.42 $1.36 $1.42 $1.36 Funds

from operations "FFO" (b)(d) - basic $171,900 $170,504 $171,900

$170,504 Funds from operations "FFO" (a)(b) (d) - diluted $177,051

$175,437 $177,051 $175,437 FFO per share - basic(b) (d) $2.04 $2.04

$2.04 $2.04 FFO per share - diluted (a) (b) (d) $2.00 $2.01 $2.00

$2.01 (a) On February 25, 1998, the Company sold $100,000 of

convertible preferred stock representing 3.627 million shares. The

convertible preferred shares can be converted on a 1 for 1 basis

for common stock. These preferred shares are not assumed converted

for purposes of net income per share - diluted for 2007 and 2006 as

they would be antidilutive to those calculations. The weighted

average preferred shares outstanding are assumed converted for

purposes of FFO per share - diluted as they are dilutive to those

calculations for all periods presented. On April 25, 2005, in

connection with the acquisition of Wilmorite Holdings, L.P. and its

affiliates, the Company issued as part of the consideration

participating and non-participating convertible preferred units in

MACWH, LP. These preferred units are not assumed converted for

purposes of net income per share - diluted and FFO per share -

diluted for 2007 and 2006 as they would be antidilutive to those

calculations. On March 16, 2007, the Company issued $950 million of

convertible senior notes. These notes are not assumed converted for

purposes of net income per share - diluted for 2007 as they would

be antidilutive to the calculation. These notes are assumed

converted for purposes of FFO per share - diluted for the three

months ended June 30, 2007 as they are dilutive to the calculation.

(b) The Company uses FFO in addition to net income to report its

operating and financial results and considers FFO and FFO-diluted

as supplemental measures for the real estate industry and a

supplement to Generally Accepted Accounting Principles (GAAP)

measures. NAREIT defines FFO as net income (loss) (computed in

accordance with GAAP), excluding gains (or losses) from

extraordinary items and sales of depreciated operating properties,

plus real estate related depreciation and amortization and after

adjustments for unconsolidated partnerships and joint ventures.

Adjustments for unconsolidated partnerships and joint ventures are

calculated to reflect FFO on the same basis. FFO and FFO on a fully

diluted basis are useful to investors in comparing operating and

financial results between periods. This is especially true since

FFO excludes real estate depreciation and amortization, as the

Company believes real estate values fluctuate based on market

conditions rather than depreciating in value ratably on a

straight-line basis over time. FFO on a fully diluted basis is one

of the measures investors find most useful in measuring the

dilutive impact of outstanding convertible securities. FFO does not

represent cash flow from operations as defined by GAAP, should not

be considered as an alternative to net income as defined by GAAP

and is not indicative of cash available to fund all cash flow

needs. FFO as presented may not be comparable to similarly titled

measures reported by other real estate investment trusts. Effective

January 1, 2003, gains or losses on sale of undepreciated assets

and the impact of SFAS 141 have been included in FFO. The inclusion

of gains on sales of undepreciated assets (decreased) increased FFO

for the three and six months ended June 30, 2007 and 2006 by $(0.2)

million, $0.7 million, $3.5 million and $3.6 million, respectively,

or by $.00 per share, $0.01 per share, $0.04 per share and $.04 per

share, respectively. Additionally, SFAS 141 increased FFO for the

three and six months ended June 30, 2007 and 2006 by $3.5 million,

$7.5 million, $4.3 million and $8.9 million, respectively, or by

$.04 per share, $0.08 per share, $0.05 per share and $0.10 per

share, respectively. (c) This includes, using the equity method of

accounting, the Company's prorata share of the equity in income or

loss of its unconsolidated joint ventures for all periods

presented. (d) The Macerich Partnership, LP (the "Operating

Partnership" or the "OP") has operating partnership units ("OP

units"). Each OP unit can be converted into a share of Company

stock. Conversion of the OP units not owned by the Company has been

assumed for purposes of calculating the FFO per share and the

weighted average number of shares outstanding. The computation of

average shares for FFO - diluted includes the effect of outstanding

stock options and restricted stock using the treasury method and

assumes conversion of MACWH, LP preferred and common units to the

extent they are dilutive to the calculation. For the three and six

months ended June 30, 2007 and 2006, the MACWH, LP preferred units

were antidilutive to FFO. (e) In October 2001, the FASB issued SFAS

No. 144, "Accounting for the Impairment or Disposal of Long-Lived

Assets" ("SFAS 144"). SFAS 144 addresses financial accounting and

reporting for the impairment or disposal of long-lived assets. The

Company adopted SFAS 144 on January 1, 2002. The Company has

classified the results of operations for all of the below

dispositions to discontinued operations. On June 9, 2006,

Scottsdale 101 in Arizona was sold. The sale of this property

resulted in a gain on sale in 2006, at the Company's prorata share,

of $25.8 million. On July 13, 2006, Park Lane Mall in Nevada was

sold. The sale of this property resulted in a gain on sale of $5.9

million in 2006. On July 27, 2006, Greeley Mall in Colorado and

Holiday Village in Montana were sold. The sale of these properties

resulted in gains on sale of $21.3 million and $7.4 million,

respectively, in 2006. On August 11, 2006, Great Falls Marketplace

in Montana was sold. The sale of this property resulted in a gain

on sale of $11.8 million in 2006. On December 29, 2006, Citadel

Mall in Colorado Springs, Colorado, Crossroads Malls in Oklahoma

City, Oklahoma and Northwest Arkansas Mall in Fayetteville,

Arkansas were sold. The sale of these properties resulted in a

total gain on sale of $132.7 million in 2006. June 30, December 31,

Summarized Balance Sheet Information 2007 2006 (UNAUDITED) Cash and

cash equivalents $49,034 $269,435 Investment in real estate, net

(h) $5,914,882 $5,755,283 Investments in unconsolidated entities

(i) $987,021 $1,010,380 Total assets $7,498,814 $7,562,163 Mortgage

and notes payable $5,123,549 $4,993,879 Pro rata share of debt on

unconsolidated entities $1,665,475 $1,664,447 Total common shares

outstanding: 71,642 71,568 Total preferred shares outstanding:

3,627 3,627 Total partnership/preferred units outstanding: 15,687

16,342 June 30, June 30, Additional financial data as of: 2007 2006

(UNAUDITED) Occupancy of centers (f) 93.20% 92.10% Comparable

quarter change in same center sales (f) (g) 1.21% 4.40% Additional

financial data for the six months ended: Acquisitions of property

and equipment - including joint ventures at pro rata $5,216

$265,455 Redevelopment and expansions of centers - including joint

ventures at pro rata $248,353 $80,864 Renovations of

centers-including joint ventures at pro rata $19,778 $26,070 Tenant

allowances- including joint ventures at pro rata $13,515 $13,624

Deferred leasing costs- including joint ventures at pro rata

$15,406 $13,606 (f) excludes redevelopment properties (Santan

Village Phase 2, Santa Monica Place, The Oaks, Twenty Ninth Street

and Westside Pavilion Adjacent) (g) includes mall and freestanding

stores. (h) includes construction in process on wholly owned assets

of $455,552 at June 30, 2007 and $294,115 at December 31, 2006. (i)

the Company's pro rata share of construction in process on

unconsolidated entities of $51,996 at June 30, 2007 and $45,268 at

December 31, 2006. For the Three Months For the Six Months PRORATA

SHARE OF Ended June 30, Ended June 30, JOINT VENTURES (UNAUDITED)

(UNAUDITED) (All amounts in (All amounts in thousands) thousands)

2007 2006 2007 2006 Revenues: Minimum rents $61,985 $59,100

$123,875 $117,470 Percentage rents 1,938 1,894 4,225 4,522 Tenant

recoveries 28,602 26,403 57,791 54,006 Other 3,291 3,139 5,954

6,676 Total revenues 95,816 90,536 191,845 182,674 Expenses:

Shopping center expenses 32,807 29,286 63,395 60,444 Interest

expense 23,751 23,292 48,068 42,753 Depreciation and amortization

20,696 20,585 45,084 41,164 Total operating expenses 77,254 73,163

156,547 144,361 Gain (loss) on sale of assets 362 244 (2,020) 244

Equity in income of joint ventures 73 244 202 320 Net income

$18,997 $17,861 $33,480 $38,877 For the Three Months For the Six

Months RECONCILIATION OF NET Ended June 30, Ended June 30, INCOME

TO FFO (b)(e) (UNAUDITED) (UNAUDITED) (All amounts in (All amounts

in thousands) thousands) 2007 2006 2007 2006 Net income - available

to common stockholders $13,448 $25,672 $16,014 $33,125 Adjustments

to reconcile net income to FFO - basic Minority interest in OP

2,398 4,770 2,865 6,230 Gain on sale of consolidated assets (1,183)

(62,961) (2,646) (62,460) plus (loss) gain on undepreciated asset

sales - consolidated assets (542) 3,255 339 3,376 plus minority

interest share of (loss) gain on sale of consolidated joint

ventures (488) 37,008 348 37,008 (Gain) loss on sale of assets from

unconsolidated entities (pro rata share) (362) (244) 2,020 (244)

plus gain on undepreciated asset sales - unconsolidated entities

(pro rata share) 350 244 350 244 Depreciation and amortization on

consolidated assets 60,404 59,411 117,492 122,951 Less depreciation

and amortization allocable to minority interests on consolidated

joint ventures (1,332) (1,247) (2,326) (3,222) Depreciation and

amortization on joint ventures (pro rata) 20,696 20,585 45,084

41,164 Less: depreciation on personal property and amortization of

loan costs and interest rate caps (3,980) (3,633) (7,640) (7,668)

Total FFO - basic 89,409 82,860 171,900 170,504 Additional

adjustment to arrive at FFO - diluted Preferred stock dividends

earned 2,575 2,467 5,151 4,933 Convertible debt - interest expense

8,712 - - - Total FFO - diluted $100,696 $85,327 $177,051 $175,437

For the Three Months For the Six Months Ended June 30, Ended June

30, (UNAUDITED) (UNAUDITED) Reconciliation of EPS to FFO per

diluted share: 2007 2006 2007 2006 Earnings per share - Diluted

$0.19 $0.36 $0.22 $0.47 Per share impact of depreciation and

amortization of real estate $0.90 $0.89 $1.80 $1.83 Per share

impact of gain on sale of depreciated assets ($0.03) ($0.26)

($0.01) ($0.27) Per share impact of preferred stock not dilutive to

EPS ($0.02) ($0.03) ($0.01) ($0.02) Fully Diluted FFO per share

$1.04 $0.96 $2.00 $2.01 THE MACERICH COMPANY For the Three Months

For the Six Months RECONCILIATION OF NET Ended June 30, Ended June

30, INCOME TO EBITDA (UNAUDITED) (UNAUDITED) (All amounts in (All

amounts in thousands) thousands) 2007 2006 2007 2006 Net income -

available to common stockholders $13,448 $25,672 $16,014 $33,125

Interest expense 62,226 71,188 129,781 143,153 Interest expense -

unconsolidated entities (pro rata) 23,751 23,292 48,068 42,753

Depreciation and amortization - consolidated assets 60,404 59,411

117,492 122,951 Depreciation and amortization - unconsolidated

entities (pro rata) 20,696 20,585 45,084 41,164 Minority interest

2,398 4,770 2,865 6,230 Less: Interest expense and depreciation and

amortization allocable to minority interests on consolidated joint

ventures (1,766) (2,060) (3,201) (4,927) Loss on early

extinguishment of debt - - 877 1,782 Gain on sale of assets -

consolidated assets (1,183) (62,961) (2,646) (62,460) Loss (gain)

on sale of assets - unconsolidated entities (pro rata) (362) (244)

2,020 (244) Add: Minority interest share of (loss) gain on sale of

consolidated joint ventures (488) 37,008 348 37,008 Income tax

(benefit) expense (787) 218 (907) (315) Preferred dividends 6,122

5,970 12,244 11,939 EBITDA (j) $184,459 $182,849 $368,039 $372,159

THE MACERICH COMPANY RECONCILIATION OF EBITDA TO SAME CENTERS - NET

OPERATING INCOME ("NOI") For the Three Months For the Six Months

Ended June 30, Ended June 30, (UNAUDITED) (UNAUDITED) (All amounts

in (All amounts in thousands) thousands) 2007 2006 2007 2006 EBITDA

(j) $184,459 $182,849 $368,039 $372,159 Add: REIT general and

administrative expenses 4,412 3,292 9,785 6,990 Management

Companies' revenues (c) (9,599) (7,369) (18,353) (14,626)

Management Companies' operating expenses (c) 18,519 12,125 36,274

26,839 Lease termination income of comparable centers (2,134)

(1,796) (5,531) (10,365) EBITDA of non-comparable centers (20,724)

(19,910) (40,799) (40,415) SAME CENTERS - Net operating income

("NOI") (k) $174,933 $169,191 $349,415 $340,582 (j) EBITDA

represents earnings before interest, income taxes, depreciation,

amortization, minority interest, extraordinary items, gain (loss)

on sale of assets and preferred dividends and includes joint

ventures at their pro rata share. Management considers EBITDA to be

an appropriate supplemental measure to net income because it helps

investors understand the ability of the Company to incur and

service debt and make capital expenditures. EBITDA should not be

construed as an alternative to operating income as an indicator of

the Company's operating performance, or to cash flows from

operating activities (as determined in accordance with GAAP) or as

a measure of liquidity. EBITDA, as presented, may not be comparable

to similarly titled measurements reported by other companies. (k)

The Company presents same-center NOI because the Company believes

it is useful for investors to evaluate the operating performance of

comparable centers. Same-center NOI is calculated using total

EBITDA and subtracting out EBITDA from non-comparable centers and

eliminating the management companies and the Company's general and

administrative expenses. DATASOURCE: The Macerich Company CONTACT:

Arthur Coppola, President and Chief Executive Officer, or Thomas E.

O'Hern, Executive Vice President and Chief Financial Officer, both

of The Macerich Company, +1-310-394-6000 Web site:

http://www.macerich.com/

Copyright

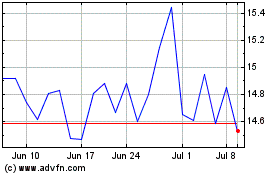

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

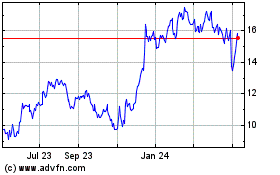

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024