SANTA MONICA, Calif., Nov. 3 /PRNewswire-FirstCall/ -- The Macerich

Company (NYSE:MAC) today announced results of operations for the

quarter ended September 30, 2006 which included net income

available to common stockholders of $47.0 million or $.66 per

share-diluted compared to $4.1 million or $.07 per share-diluted

for the quarter ended September 30, 2005. For the nine months ended

September 30, 2006, net income increased to $80.1 million compared

to $28.9 million for the nine months ended September 30, 2005.

Funds from operations ("FFO") diluted was $86.6 million or $.98 per

share compared to $81.1 million or $1.04 per share for the quarter

ended September 30, 2005. For the nine months ended September 30,

2006, FFO-diluted was $262.0 million compared to $234.1 million for

the nine months ended September 30, 2005. The Company's definition

of FFO is in accordance with the definition provided by the

National Association of Real Estate Investment Trusts ("NAREIT"). A

reconciliation of net income to FFO and net income per common

share-diluted ("EPS") to FFO per share-diluted is included in the

financial tables accompanying this press release. Recent

Highlights: * During the quarter, Macerich signed 326,000 square

feet of specialty store leases at average initial rents of $40.88

per square foot. Starting base rent on new lease signings was 23.7%

higher than the expiring base rent. * Total same center tenant

sales, for the quarter ended September 30, 2006, were up 5.3%

compared to sales for the quarter ended September 30, 2005. *

Portfolio occupancy at September 30, 2006 was 93.0% compared to

93.4% at September 30, 2005. On a same center basis, occupancy was

93.0% at September 30, 2006 compared to 93.6% at September 30,

2005. * During the third quarter, Great Falls Marketplace, Greeley

Mall, Holiday Village Mall, and Parklane Mall were sold for a

combined sale price of approximately $132 million. The Macerich

total gain on sale of these assets recognized during the quarter

was in excess of $46 million. Commenting on results, Arthur Coppola

president and chief executive officer of Macerich stated, "The

quarter was highlighted by continued strong core operations.

Occupancy remained high, leasing spreads were excellent and mall

tenant sales growth continued at a healthy level. In addition

during the quarter we were active in selling non-core assets and

improving our balance sheet. The ultimate use of the sale proceeds

will be for our upcoming developments and redevelopments which is a

very effective recycling of our capital. The strengthening of our

balance sheet leaves us well positioned to take advantage of the

pipeline of development and redevelopment opportunities in our

existing portfolio." Redevelopment and Development Activity The

grand opening of the first phase of Twenty-Ninth Street, an 805,000

square foot shopping district in Boulder, Colorado, took place on

October 13. The balance of the project is scheduled for completion

in the summer 2007. Phase I of the project is 87% leased with

another 7% of the space in negotiation. Tenants include Ann Taylor

Loft, Apple, Bath and Body Works, Borders, California Pizza

Kitchen, Century Theatres, Coldwater Creek, Home Depot, J. Jill,

Macy's, Muttropolis, Puma, Purple Martini, Victoria's Secret and

Wild Oats Market. The grand re-opening of Carmel Plaza took place

on October 21. The center underwent an $11 million renovation which

included the reconfiguring of a former department store space. New

high-profile luxury tenants include San Francisco based Wilkes

Bashford, Tiffany & Co., Cos Bar and Anthropologie. On November

1, we received City Council approval for our application to add up

to four or five mixed use towers of up to 165 feet at Biltmore

Fashion Park. Biltmore Fashion Park is an established luxury

destination for first-to-market, high-end and luxury tenants in the

metropolitan Phoenix market. The mixed use towers are planned to be

built over time based upon demand. In Thousand Oaks, California,

the planning commission voted on October 23 to approve the first

comprehensive renovation and expansion plan of The Oaks Mall since

it was first opened in 1978. The expansion will add 230,000 square

feet of building area to the approximately 1 million square feet of

space that currently exists. Construction is projected to start in

January 2007. The expansion, including a new 144,000 square foot

Nordstrom is scheduled to open at the center in fall 2008. At

Westside Pavilion in Los Angeles, construction continues on the

redevelopment of the western portion of the center that will

include a 12 screen, state of the art Landmark Theatre, a Barnes

& Noble and restaurants. The estimated completion of the

redevelopment is fall 2007. In February, construction began on the

SanTan Village regional shopping center in Gilbert, Arizona. The

center is an outdoor open air streetscape project planned to

contain in excess of 1.2 million square feet on 120 acres. The

center is currently 70% leased and will be anchored by Dillard's,

Harkins Theatres and will contain a lifestyle shopping district

featuring retail, office and restaurants. Additional tenants

include American Eagle Outfitters, Ann Taylor Loft, Borders,

Charlotte Russe, Chico's, Coldwater Creek, J. Jill, Lucy, Pac Sun

and Soma. The project is scheduled to open in phases starting in

the fall of 2007, with the retail phases expected to be completed

by late 2008. Asset Sales Macerich continued its strategy of

selling non-core assets with the third quarter sales of Great Falls

Marketplace, Greeley Mall, Holiday Village Mall and Parklane Mall.

The aggregate total purchase price was approximately $132 million.

The gain on the sale of these four assets was in excess of $46

million. These centers totaled 1.0 million square feet and averaged

$239 per square foot in annual tenant sales. Financing Activity In

July, the Company's line of credit was upsized from $1.0 billion to

$1.5 billion. The borrowing spread was reduced by .25% to 1.15%

over LIBOR at the current leverage level. The maturity was extended

from July 2007 to April 2010. In September, Macerich swapped $400

million of the line to a fixed rate of 5.08% plus the applicable

line of credit borrowing spread. In July, a $61 million, 6.26%

fixed rate, 10-year loan was placed on Crossroads Mall. The loan

proceeds were used primarily to pay-down floating rate debt.

Primarily as a result of the above transactions and the application

of the asset sale proceeds to reduce the line of credit

indebtedness, the percentage of unhedged floating rate debt to

total debt was reduced to 18.65%. Macerich is a fully integrated

self-managed and self-administered real estate investment trust,

which focuses on the acquisition, leasing, management, development

and redevelopment of regional malls throughout the United States.

The Company is the sole general partner and owns an 84% ownership

interest in The Macerich Partnership, L.P. Macerich now owns

approximately 79 million square feet of gross leaseable area

consisting primarily of interests in 73 regional malls. Additional

information about The Macerich Company can be obtained from the

Company's web site at http://www.macerich.com/. Investor Conference

Call The Company will provide an online Web simulcast and

rebroadcast of its quarterly earnings conference call. The call

will be available on The Macerich Company's website at

http://www.macerich.com/ and through CCBN at

http://www.earnings.com/. The call begins today, November 3, 2006

at 10:30 AM Pacific Time. To listen to the call, please go to

either of these web sites at least 15 minutes prior to the call in

order to register and download audio software if needed. An online

replay at http://www.macerich.com/ will be available for one year

after the call. The Company will publish a supplemental financial

information package which will be available at

http://www.macerich.com/ in the Investing Section. It will also be

furnished to the SEC as part of a Current Report on Form 8-K. Note:

This release contains statements that constitute forward-looking

statements. Stockholders are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks, uncertainties and other factors that may cause

actual results, performance or achievements of the Company to vary

materially from those anticipated, expected or projected. Such

factors include, among others, general industry, economic and

business conditions, which will, among other things, affect demand

for retail space or retail goods, availability and creditworthiness

of current and prospective tenants, anchor or tenant bankruptcies,

closures, mergers or consolidations, lease rates and terms,

interest rate fluctuations, availability and cost of financing and

operating expenses; adverse changes in the real estate markets

including, among other things, competition from other companies,

retail formats and technology, risks of real estate development and

redevelopment, acquisitions and dispositions; governmental actions

and initiatives (including legislative and regulatory changes);

environmental and safety requirements; and terrorist activities

which could adversely affect all of the above factors. The reader

is directed to the Company's various filings with the Securities

and Exchange Commission, including the Annual Report on Form 10-K

for the year ended December 31, 2005, for a discussion of such

risks and uncertainties, which discussion is incorporated herein by

reference. (See attached tables) THE MACERICH COMPANY FINANCIAL

HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) Results before

Impact of SFAS 144 (e) SFAS 144 (e) For the For the Three Months

Three Months Ended Ended September 30, September 30, Unaudited

Results of Operations: 2006 2005 2006 2005 Minimum rents $123,314

$124,738 ($895) ($4,737) Percentage rents 4,880 5,291 (14) 13

Tenant recoveries 67,541 65,645 (186) (1,585) Management Companies'

revenues 8,023 6,921 -- -- Other income 9,469 5,505 (26) (201)

Total revenues 213,227 208,100 (1,121) (6,510) Shopping center and

operating expenses 71,553 70,824 (595) (2,553) Management

Companies' operating expenses 14,455 12,914 -- -- Income tax

expense < benefit > 535 (1,166) -- -- Depreciation and

amortization 56,120 57,941 (277) (1,730) General, administrative

and other expenses 2,551 3,420 -- -- Interest expense 70,272 71,354

(117) (1,294) Loss on early extinguishment of debt 29 -- -- -- Gain

(loss) on sale or writedown of assets 46,560 10 (46,022) -- Pro

rata income (loss) of unconsolidated entities (c) 18,490 18,831 --

-- Minority interests in consolidated joint ventures (694) 90 (176)

(168) Income (loss) from continuing operations 62,068 11,744

(46,330) (1,101) Discontinued Operations: Gain (loss) on sale of

asset -- -- 46,214 -- Income from discontinued operations -- -- 116

1,101 Income before minority interests of OP 62,068 11,744 -- --

Income allocated to minority interests of OP 8,901 1,406 -- -- Net

income before preferred dividends 53,167 10,338 -- -- Preferred

dividends and distributions (a) 6,199 6,274 -- -- Net income to

common stockholders $46,968 $4,064 $0 $0 Average number of shares

outstanding - basic 71,479 59,247 Average shares outstanding,

assuming full conversion of OP Units (d) 85,021 73,660 Average

shares outstanding - diluted for FFO (d) 88,648 77,633 Per share

income - diluted before discontinued operations -- -- Net income

per share - basic $0.66 $0.07 Net income per share - diluted (a)

$0.66 $0.07 Dividend declared per share $0.68 $0.65 Funds from

operations "FFO" (b)(d) - basic $84,020 $78,264 Funds from

operations "FFO" (a)(b)(d) - diluted $86,595 $81,090 FFO per share-

basic (b)(d) $0.99 $1.07 FFO per share- diluted (a)(b)(d) $0.98

$1.04 Results after SFAS 144 (e) For the Three Months Ended

September 30, Unaudited Results of Operations: 2006 2005 Minimum

rents $122,419 $120,001 Percentage rents 4,866 5,304 Tenant

recoveries 67,355 64,060 Management Companies' revenues 8,023 6,921

Other income 9,443 5,304 Total revenues 212,106 201,590 Shopping

center and operating expenses 70,958 68,271 Management Companies'

operating expenses 14,455 12,914 Income tax expense < benefit

> 535 (1,166) Depreciation and amortization 55,843 56,211

General, administrative and other expenses 2,551 3,420 Interest

expense 70,155 70,060 Loss on early extinguishment of debt 29 --

Gain (loss) on sale or writedown of assets 538 10 Pro rata income

(loss) of unconsolidated entities (c) 18,490 18,831 Minority

interests in consolidated joint ventures (870) (78) Income (loss)

from continuing operations 15,738 10,643 Discontinued Operations:

Gain (loss) on sale of asset 46,214 -- Income from discontinued

operations 116 1,101 Income before minority interests of OP 62,068

11,744 Income allocated to minority interests of OP 8,901 1,406 Net

income before preferred dividends 53,167 10,338 Preferred dividends

and distributions (a) 6,199 6,274 Net income to common stockholders

$46,968 $4,064 Average number of shares outstanding - basic 71,479

59,247 Average shares outstanding, assuming full conversion of OP

Units (d) 85,021 73,660 Average shares outstanding - diluted for

FFO (d) 88,648 77,633 Per share income - diluted before

discontinued operations $0.12 $0.06 Net income per share - basic

$0.66 $0.07 Net income per share - diluted (a) $0.66 $0.07 Dividend

declared per share $0.68 $0.65 Funds from operations "FFO" (b)(d)-

basic $84,020 $78,264 Funds from operations "FFO" (a)(b)(d) -

diluted $86,595 $81,090 FFO per share - basic (b)(d) $0.99 $1.07

FFO per share - diluted (a)(b)(d) $0.98 $1.04 THE MACERICH COMPANY

FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Results before Impact of SFAS 144 (e) SFAS 144 (e) For the For the

Nine Months Nine Months Ended Ended September 30, September 30,

Unaudited Results of Operations: 2006 2005 2006 2005 Minimum rents

$384,383 $335,391 ($10,314) ($14,376) Percentage rents 10,601

11,164 (248) (431) Tenant recoveries 200,879 169,811 (3,954)

(5,179) Management Companies' revenues 22,650 18,362 -- -- Other

income 22,756 16,684 (349) (517) Total revenues 641,269 551,412

(14,865) (20,503) Shopping center and operating expenses 209,831

179,169 (6,125) (7,964) Management Companies' operating expenses

41,295 37,291 -- -- Income tax expense (benefit) 219 (2,205) -- --

Depreciation and amortization 179,071 149,767 (3,097) (4,851)

General, administrative and other expenses 9,540 9,937 -- --

Interest expense 213,426 175,636 (2,253) (3,501) Loss on early

extinguishment of debt 1,811 -- -- -- Gain (loss) on sale or

writedown of assets 109,020 1,474 (108,983) (297) Pro rata income

(loss) of unconsolidated entities (c) 57,367 46,416 -- -- Minority

interests in consolidated joint ventures (39,101) (471) 37,229

(173) Income (loss) from continuing operations 113,362 49,236

(75,144) (4,657) Discontinued Operations: Gain (loss) on sale of

asset -- -- 72,167 297 Income from discontinued operations -- --

2,977 4,360 Income before minority interests of OP 113,362 49,236

-- -- Income allocated to minority interests of OP 15,131 7,085 --

-- Net income before preferred dividends 98,231 42,151 -- --

Preferred dividends and distributions (a) 18,139 13,197 -- -- Net

income to common stockholders $80,092 $28,954 $0 $0 Average number

of shares outstanding - basic 70,587 59,073 Average shares

outstanding, assuming full conversion of OP Units (d) 84,216 73,522

Average shares outstanding - diluted for FFO (d) 87,843 77,349 Per

share income - diluted before discontinued operations -- -- Net

income per share - basic $1.13 $0.49 Net income per share - diluted

(a) $1.13 $0.49 Dividend declared per share $2.04 $1.95 Funds from

operations "FFO" (b)(d) - basic $254,523 $226,569 Funds from

operations "FFO" (a)(b)(d) - diluted $262,031 $234,110 FFO per

share - basic (b)(d) 3.03 $3.10 FFO per share- diluted (a)(b)(d)

$2.98 $3.03 Results after SFAS 144 (e) For the Nine Months Ended

September 30, Unaudited Results of Operations: 2006 2005 Minimum

rents $374,069 $321,015 Percentage rents 10,353 10,733 Tenant

recoveries 196,925 164,632 Management Companies' revenues 22,650

18,362 Other income 22,407 16,167 Total revenues 626,404 530,909

Shopping center and operating expenses 203,706 171,205 Management

Companies' operating expenses 41,295 37,291 Income tax expense

(benefit) 219 (2,205) Depreciation and amortization 175,974 144,916

General, administrative and other expenses 9,540 9,937 Interest

expense 211,173 172,135 Loss on early extinguishment of debt 1,811

-- Gain (loss) on sale or writedown of assets 37 1,177 Pro rata

income (loss) of unconsolidated entities (c) 57,367 46,416 Minority

interests in consolidated joint ventures (1,872) (644) Income

(loss) from continuing operations 38,218 44,579 Discontinued

Operations: Gain (loss) on sale of asset 72,167 297 Income from

discontinued operations 2,977 4,360 Income before minority

interests of OP 113,362 49,236 Income allocated to minority

interests of OP 15,131 7,085 Net income before preferred dividends

98,231 42,151 Preferred dividends and distributions (a) 18,139

13,197 Net income to common stockholders $80,092 $28,954 Average

number of shares outstanding - basic 70,587 59,073 Average shares

outstanding, assuming full conversion of OP Units (d) 84,216 73,522

Average shares outstanding - diluted for FFO (d) 87,843 77,349 Per

share income - diluted before discontinued operations $0.24 $0.43

Net income per share - basic $1.13 $0.49 Net income per share -

diluted (a) $1.13 $0.49 Dividend declared per share $2.04 $1.95

Funds from operations "FFO" (b)(d) - basic $254,523 $226,569 Funds

from operations "FFO" (a)(b)(d) - diluted $262,031 $234,110 FFO per

share - basic (b)(d) $3.03 $3.10 FFO per share - diluted (a)(b)(d)

$2.98 $3.03 (a) On February 25, 1998, the Company sold $100,000 of

convertible preferred stock representing 3.627 million shares. The

convertible preferred shares can be converted on a 1 for 1 basis

for common stock. These preferred shares are not assumed converted

for purposes of net income per share - diluted for 2006 and 2005 as

they would be antidilutive to those calculations. The weighted

average preferred shares outstanding are assumed converted for

purposes of FFO per diluted share as they are dilutive to that

calculation for all periods presented. (b) The Company uses FFO in

addition to net income to report its operating and financial

results and considers FFO and FFO-diluted as supplemental measures

for the real estate industry and a supplement to Generally Accepted

Accounting Principles (GAAP) measures. NAREIT defines FFO as net

income (loss) (computed in accordance with GAAP), excluding gains

(or losses) from extraordinary items and sales of depreciated

operating properties, plus real estate related depreciation and

amortization and after adjustments for unconsolidated partnerships

and joint ventures. Adjustments for unconsolidated partnerships and

joint ventures are calculated to reflect FFO on the same basis. FFO

and FFO on a fully diluted basis are useful to investors in

comparing operating and financial results between periods. This is

especially true since FFO excludes real estate depreciation and

amortization, as the Company believes real estate values fluctuate

based on market conditions rather than depreciating in value

ratably on a straight-line basis over time. FFO on a fully diluted

basis is one of the measures investors find most useful in

measuring the dilutive impact of outstanding convertible

securities. FFO does not represent cash flow from operations as

defined by GAAP, should not be considered as an alternative to net

income as defined by GAAP and is not indicative of cash available

to fund all cash flow needs. FFO as presented may not be comparable

to similarly titled measures reported by other real estate

investment trusts. Effective January 1, 2003, gains or losses on

sale of undepreciated assets and the impact of SFAS 141 have been

included in FFO. The inclusion of gains on sales of undepreciated

assets increased FFO for the three and nine months ended September

30, 2006 and 2005 by $2.3 million, $6.0 million, $1.3 million and

$3.2 million, respectively, or by $.03 per share, $.07 per share,

$.02 per share and $.04 per share, respectively. Additionally, SFAS

141 increased FFO for the three and nine months ended September 30,

2006 and 2005 by $4.0 million, $12.9 million, $4.8 million and

$10.9 million, respectively or by $.04 per share, $.15 per share,

$.06 per share and $.14 per share, respectively. (c) This includes,

using the equity method of accounting, the Company's prorata share

of the equity in income or loss of its unconsolidated joint

ventures for all periods presented. (d) The Macerich Partnership,

LP (the "Operating Partnership" or the "OP") has operating

partnership units ("OP units"). Each OP unit can be converted into

a share of Company stock. Conversion of the OP units not owned by

the Company has been assumed for purposes of calculating the FFO

per share and the weighted average number of shares outstanding.

The computation of average shares for FFO - diluted includes the

effect of outstanding stock options and restricted stock using the

treasury method. Also assumes conversion of MACWH, LP units to the

extent they are dilutive to the calculation. For the three and nine

months ended September 30, 2006 and 2005, the MACWH, LP units were

antidilutive to FFO. (e) In October 2001, the FASB issued SFAS No.

144, "Accounting for the Impairment or Disposal of Long-Lived

Assets" ("SFAS 144"). SFAS 144 addresses financial accounting and

reporting for the impairment or disposal of long-lived assets. The

Company adopted SFAS 144 on January 1, 2002. On January 5, 2005,

the Company sold Arizona Lifestyle Galleries. The sale of this

property resulted in a gain on sale of $0.3 million. On June 9,

2006, Scottsdale 101 in Arizona was sold. The sale of this property

resulted in a gain on sale, at the Company's prorata share, of

$25.8 million. Additionally, the Company reclassified the results

of operations for the three and nine months ended September 30,

2006 and 2005 to discontinued operations. On July 13, 2006,

Parklane Mall in Nevada was sold. The sale of this property

resulted in a gain on sale of $5.9 million. The Company

reclassified the results of operations for the three and nine

months ended September 30, 2006 and 2005 to discontinued

operations. On July 27, 2006, Greeley Mall in Colorado and Holiday

Village in Montana were sold. The sale of these properties resulted

in gains on sale of $21.3 million and $7.3 million, respectively.

The Company reclassified the results of operations for the three

and nine months ended September 30, 2006 and 2005 to discontinued

operations. On August 11, 2006, Great Falls Marketplace in Montana

was sold. The sale of this property resulted in a gain on sale of

$11.9 million. The Company reclassified the results of operations

for the three and nine months ended September 30, 2006 and 2005 to

discontinued operations. September 30, Dec 31, Summarized Balance

Sheet Information 2006 2005 (UNAUDITED) Cash and cash equivalents

$62,047 $155,113 Investment in real estate, net (h) $5,675,959

$5,438,496 Investments in unconsolidated entities (i) $1,001,051

$1,075,621 Total Assets $7,280,523 $7,178,944 Mortgage and notes

payable $4,852,636 $5,424,730 Pro rata share of debt on

unconsolidated entities $1,644,727 $1,438,960 Total common shares

outstanding at quarter end: 71,482 59,942 Total preferred shares

outstanding at quarter end: 3,627 3,627 Total partnership/preferred

units outstanding at quarter end: 16,387 16,647 September 30,

September 30, Additional financial data as of: 2006 2005 Occupancy

of centers (f) 93.00% 93.40% Comparable quarter change in same

center sales (f) (g) 5.30% 7.00% Additional financial data for the

nine months ended: Acquisitions of property and equipment -

including joint ventures at prorata $359,213 $2,476,820

Redevelopment and expansions of centers - including joint ventures

at prorata $141,039 $114,648 Renovations of centers - including

joint ventures at prorata $44,546 $44,916 Tenant allowances -

including joint ventures at prorata $28,794 $22,074 Deferred

leasing costs - including joint ventures at prorata $20,473 $19,939

(f) excludes redevelopment properties. (g) includes mall and

freestanding stores. (h) includes construction in process on wholly

owned assets of $295,852 at September 30, 2006 and $162,157 at

December 31, 2005. (i) the Company's prorata share of construction

in process on unconsolidated entities of $148,800 at September 30,

2006 and $98,180 at December 31, 2005. PRORATA SHARE OF For the

Three Months For the Nine Months JOINT VENTURES Ended September 30,

Ended September 30, (UNAUDITED) (UNAUDITED) (All amounts in (All

amounts in (Unaudited) thousands) thousands) 2006 2005 2006 2005

Revenues: Minimum rents $59,760 $54,310 $177,230 $150,130

Percentage rents 2,784 2,391 7,306 5,942 Tenant recoveries 28,674

23,909 82,680 65,846 Other 3,931 2,910 10,607 8,665 Total revenues

95,149 83,520 277,823 230,583 Expenses: Shopping center expenses

32,425 28,818 92,869 77,067 Interest expense 23,507 16,823 66,260

54,128 Depreciation and amortization 21,045 20,495 62,209 55,243

Total operating expenses 76,977 66,136 221,338 186,438 Gain on sale

or writedown of assets 1 1,321 245 1,861 Equity in income of joint

ventures 317 126 637 410 Net income $18,490 $18,831 $57,367 $46,416

RECONCILIATION OF For the Three Months For the Nine Months NET

INCOME TO Ended September 30, Ended September 30, FFO (b)(e)

(UNAUDITED) (UNAUDITED) (All amounts in (All amounts in thousands)

thousands) 2006 2005 2006 2005 Net income - available to common

stockholders $46,968 $4,064 $80,092 $28,954 Adjustments to

reconcile net income to FFO - basic Minority interest in OP 8,901

1,406 15,131 7,085 (Gain ) loss on sale of consolidated assets

(46,560) (10) (109,020) (1,474) plus gain on undepreciated asset

sales - consolidated assets 2,339 -- 5,715 1,307 plus minority

interest share of gain on sale of consolidated joint ventures (192)

-- 36,816 -- (Gain) loss on sale of assets from unconsolidated

entities (pro rata share) (1) (1,321) (245) (1,861) plus gain on

undepreciated asset sales - unconsolidated assets -- 1,323 244

1,867 Depreciation and amortization on consolidated assets 56,120

57,941 179,071 149,767 Less depreciation and amortization allocable

to minority interests on consolidated joint ventures (1,128)

(1,787) (4,351) (3,612) Depreciation and amortization on joint

ventures (pro rata) 21,045 20,495 62,209 55,243 Less: depreciation

on personal property and amortization of loan costs and interest

rate caps (3,472) (3,847) (11,139) (10,707) Total FFO - basic

84,020 78,264 254,523 226,569 Additional adjustment to arrive at

FFO - diluted Preferred stock dividends earned 2,575 2,503 7,508

7,218 Non-participating preferred units - dividends 323 323

Participating preferred units - dividends n/a - antidilutive n/a -

antidilutive FFO - diluted 86,595 81,090 262,031 234,110 For the

Three Months For the Nine Months Ended September 30, Ended

September 30, (UNAUDITED) (UNAUDITED) (All amounts in (All amounts

in Reconciliation of EPS thousands) thousands) to FFO per diluted

share: 2006 2005 2006 2005 Earnings per share $0.66 $0.07 $1.13

$0.49 Per share impact of depreciation and amortization real estate

$0.86 $0.99 $2.69 $2.60 Per share impact of gain on sale of

depreciated assets ($0.52) $0.00 ($0.79) $0.00 Per share impact of

preferred stock not dilutive to EPS ($0.02) ($0.02) ($0.05) ($0.06)

Fully Diluted FFO per share $0.98 $1.04 $2.98 $3.03 THE MACERICH

COMPANY RECONCILIATION OF For the Three Months For the Nine Months

NET INCOME TO EBITDA Ended September 30, Ended September 30,

(UNAUDITED) (UNAUDITED) (All amounts in (All amounts in thousands)

thousands) 2006 2005 2006 2005 Net income - available to common

stockholders $46,968 $4,064 $80,092 $28,954 Interest expense 70,272

71,354 213,426 175,636 Interest expense - unconsolidated entities

(pro rata) 23,507 16,823 66,260 54,128 Depreciation and

amortization - consolidated assets 56,120 57,941 179,071 149,767

Depreciation and amortization - unconsolidated entities (pro rata)

21,045 20,495 62,209 55,243 Minority interest 8,901 1,406 15,131

7,085 Less: Interest expense and depreciation and amortization

allocable to minority interests on consolidated joint ventures

(1,264) (2,559) (6,191) (5,163) Loss on early extinguishment of

debt 29 -- 1,811 -- Loss on early extinguishment of debt -

unconsolidated entities (pro rata) -- 7 -- 7 Loss (gain) on sale of

assets - consolidated assets (46,560) (10) (109,020) (1,474) Loss

(gain) on sale of assets - unconsolidated entities (pro rata) (1)

(1,321) (245) (1,861) Add: Minority interest share of gain on sale

of consolidated joint ventures (192) -- 36,816 -- Income tax

expense (benefit) 535 (1,166) 219 (2,205) Preferred dividends 6,199

6,274 18,139 13,197 EBITDA (j) $185,559 $173,308 $557,718 $473,314

THE MACERICH COMPANY RECONCILIATION OF EBITDA TO SAME CENTERS - NET

OPERATING INCOME ("NOI") For the Three Months For the Nine Months

Ended September 30, Ended September 30, (UNAUDITED) (UNAUDITED)

(All amounts in (All amounts in thousands) thousands) 2006 2005

2006 2005 EBITDA (j) $185,559 $173,308 $557,718 $473,314 Add: REIT

general and administrative expenses 2,551 3,420 9,540 9,937

Management Companies' revenues (c) (8,023) (6,921) (22,650)

(18,362) Management Companies' operating expenses (c) 14,455 12,914

41,295 37,291 EBITDA of non- comparable centers (13,017) (5,898)

(120,501) (55,679) SAME CENTERS - Net operating income ("NOI")(k)

$181,525 $176,823 $465,402 $446,501 (j) EBITDA represents earnings

before interest, income taxes, depreciation, amortization, minority

interest, extraordinary items, gain (loss) on sale of assets and

preferred dividends and includes joint ventures at their pro rata

share. Management considers EBITDA to be an appropriate

supplemental measure to net income because it helps investors

understand the ability of the Company to incur and service debt and

make capital expenditures. EBITDA should not be construed as an

alternative to operating income as an indicator of the Company's

operating performance, or to cash flows from operating activities

(as determined in accordance with GAAP) or as a measure of

liquidity. EBITDA, as presented, may not be comparable to similarly

titled measurements reported by other companies. (k) The Company

presents same-center NOI because the Company believes it is useful

for investors to evaluate the operating performance of comparable

centers. Same-center NOI is calculated using total EBITDA and

subtracting out EBITDA from non-comparable centers and eliminating

the management companies and the Company's general and

administrative expenses. DATASOURCE: Macerich Company CONTACT:

Arthur Coppola, President and Chief Executive Officer, or Thomas E.

O'Hern, Executive Vice President and Chief Financial Officer, both

of The Macerich Company, +1-310-394-6000 Web site:

http://www.macerich.com/

Copyright

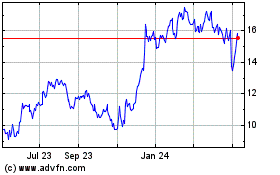

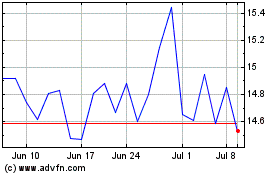

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024