Macerich Announces 2004 Results SANTA MONICA, Calif., Feb. 10

/PRNewswire-FirstCall/ -- The Macerich Company (NYSE:MAC) today

announced results of operations for the quarter and year ended

December 31, 2004 which included funds from operations ("FFO") per

share - diluted increasing 12% to $1.16 compared to $1.04 for the

quarter ended December 31, 2003 and $3.90 for the year ended

December 31, 2004, a 9% increase compared to $3.58 for 2003. Net

income available to common stockholders for the quarter ended

December 31, 2004 was $30.0 million or $.51 per share-diluted

("EPS") compared to $25.5 million or $.44 per share- diluted for

the quarter ended December 31, 2003. For the year ended December

31, 2004 net income was $82.5 million or $1.40 per share-diluted

compared to $113.2 million or $2.09 per share-diluted for the year

ended December 31, 2003. Net income for the year ended December 31,

2003 was positively impacted by net gain on sales of consolidated

assets of $34.5 million or $.46 per share-diluted compared to a net

gain on asset sales of $8 million or $.11 per share-diluted for the

year ended December 31, 2004. A reconciliation of net income to FFO

and net income per common share-diluted ("EPS") to FFO per

share-diluted is included in the financial highlights section of

this press release. The Company's definition of FFO is in

accordance with the definition provided by the National Association

of Real Estate Investment Trusts ("NAREIT"). Recent highlights: *

During the quarter, Macerich signed 208,000 square feet of

specialty store leases at average initial rents of $38.92 per

square foot. First year rents on mall and freestanding store leases

signed during the quarter were 34% higher than average expiring

rents. * Total same center tenant sales, for the quarter ended

December 31, 2004, were up 4.2% compared to sales levels for the

quarter ended December 31, 2003. Total same center tenant sales for

the year were up 5.9% compared to 2003. Total portfolio mall store

sales per square foot were $391 during 2004 compared to $361 for

2003. * Portfolio occupancy at December 31, 2004 was 92.5% compared

to 93.3% at December 31, 2003. * Growth in same center net

operating income for the quarter was 3.96% compared to the quarter

ended December 31, 2003. * The grand opening of the $275 million

expansion of Queens Center took place in November. Occupancy of the

expanded center was 96% at year end. * The Company announced an

agreement to acquire the Wilmorite Company for $2.33 billion.

Commenting on results and recent events, Arthur Coppola, President

and Chief Executive Officer of Macerich stated, "The quarter was

highlighted by continued strong leasing activity including very

positive releasing spreads and solid growth in same center net

operating income." Redevelopment and Development Activity At Queens

Center, the multi-phased $275 million redevelopment and expansion

had its grand opening the weekend of November 19th. The project

increased the size of the center from 620,000 square feet to

approximately one million square feet. During the course of the

last 12 months, 109 new or expanded stores have opened at Queens

Center. New tenants recently opened include Banana Republic,

Godiva, Guess, Coach, Aldo Shoes, Club Monaco, Benetton, American

Eagle Outfitters, Bostonian, Urban Outfitters, Applebee's Neighbor

Bar & Grill, GNC and Queens Diner. Tenants who have recently

expanded their presence at Queens Center include, The Gap, H &

M, Victoria's Secret and Forever 21. At Washington Square in

suburban Portland the Company is proceeding with an expansion

project which consists of the addition of 80,000 square feet of

shop space. The expansion is underway with substantial completion

earmarked for the fourth quarter of 2005. The development of San

Tan Village progresses. The 500 acre master planned Gilbert project

will unfold during several phases of development which will be

driven by market and retailers' needs. Upon full completion, San

Tan Village will represent 3,000,000 square feet of retail space.

Phase I, featuring a 29 acre full service power center, will open a

Wal-Mart in 2005 followed by a Sam's Club later in the year. Phase

II represents an additional 308,000 square feet of gross leaseable

area. Leases have been signed with OfficeMax, Jo-Ann Superstore,

Bed Bath & Beyond, Marshall's and DSW Designer Shoes

representing 157,000 square feet. Phase II is projected to open

September 2005. The regional shopping center component of San Tan

Village sits on 120 acres representing 1.3 million square feet. The

center's multi-faceted design will incorporate quality elements

from other retail formats including the successful traditional

enclosed mall anchored by Dillard's and May Co.'s Robinsons-May, an

open-air lifestyle center and an 18-screen Harkins Theatre

entertainment district. Infrastructure improvements are underway.

The entertainment district could open as early as 2006 followed by

a projected fall 2007 opening for the majority of the balance of

the center. Acquisitions The acquisition of Fiesta Mall closed in

November. The acquisition of Fiesta solidified Macerich's dominance

in the Phoenix market. Fiesta is a 1,000,000 square foot super

regional mall. It is anchored by Dillard's, Macy, Sears and

Robinsons-May. The mall's shops have annual sales per square foot

of $362. The purchase price was $135 million. Shortly after closing

the Company placed a 10 year $84 million fixed rate loan at 4.87%.

On December 23, 2004 the Company announced that it had signed a

definitive agreement to acquire Wilmorite Properties, Inc. and

Wilmorite Holdings L.P. ("Wilmorite"). The total purchase price

will be approximately $2.33 billion, including the assumption of

approximately $882 million of existing debt at an average interest

rate of 6.43% and the issuance of convertible preferred units and

common units totaling an estimated $320 million. Approximately $210

million of the convertible preferred units can be redeemed, subject

to certain conditions, for that portion of the Wilmorite portfolio

generally located in the greater Rochester area. The balance of the

consideration to Wilmorite's equity holders will be paid in cash.

This transaction has been approved by each company's Board of

Directors, subject to customary closing conditions. A

majority-in-interest of the limited partners of Wilmorite Holdings

L.P. and of the stockholders of its general partner, Wilmorite

Properties, Inc., have also approved this acquisition. It is

currently anticipated that this transaction will be completed in

March, 2005. Wilmorite's existing portfolio includes interests in

11 regional malls and two open-air community centers, with 13.4

million square feet of space located in Connecticut, New York, New

Jersey, Kentucky and Virginia. Approximately 5 million square feet

of gross leaseable area is located at three premier regional malls:

Tysons Corner Center in McLean, Virginia, Freehold Raceway Mall in

Freehold, New Jersey and Danbury Fair Mall in Danbury, Connecticut.

The average tenant sales per square foot, for these three centers,

is in excess of $525. The total portfolio average of mall store

annual sales per square foot is $403. On a pro forma basis

reflecting this acquisition, Macerich will own 75 regional malls

with total portfolio square footage increasing to approximately

76.4 million square feet. Earnings Guidance At this time management

is not modifying the previously provided guidance for 2005. The EPS

and FFO per share guidance will be readdressed after the closing of

the Wilmorite transaction discussed above. The Macerich Company is

a fully integrated self-managed and self-administered real estate

investment trust, which focuses on the acquisition, leasing,

management, development and redevelopment of regional malls

throughout the United States. The Company is the sole general

partner and owns an 81% ownership interest in The Macerich

Partnership, L.P. Macerich now owns approximately 63 million square

feet of gross leaseable area consisting primarily of interests in

64 regional malls. Additional information about The Macerich

Company can be obtained from the Company's web site at

http://www.macerich.com/ Investor Conference Call The Company will

provide an online Web simulcast and rebroadcast of its quarterly

earnings conference call. The call will be available on The

Macerich Company's website at http://www.macerich.com/ and through

CCBN at http://www.fulldisclosure.com/. The call begins today,

February 10 at 12:30 PM Pacific Time. To listen to the call, please

go to any of these web sites at least 15 minutes prior to the call

in order to register and download audio software if needed. An

online replay at http://www.macerich.com/ will be available for one

year after the call. Note: This release contains statements that

constitute forward-looking statements. Stockholders are cautioned

that any such forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and other

factors that may cause actual results, performance or achievements

of the Company to vary materially from those anticipated, expected

or projected. Such factors include, among others, general industry,

economic and business conditions, which will, among other things,

affect demand for retail space or retail goods, availability and

creditworthiness of current and prospective tenants, anchor or

tenant bankruptcies, closures, mergers or consolidations, lease

rates and terms, interest rate fluctuations, availability and cost

of financing and operating expenses; adverse changes in the real

estate markets including, among other things, competition from

other companies, retail formats and technology, risks of real

estate development and redevelopment, acquisitions and

dispositions; governmental actions and initiatives (including

legislative and regulatory changes); environmental and safety

requirements; and terrorist activities which could adversely affect

all of the above factors. The reader is directed to the Company's

various filings with the Securities and Exchange Commission, for a

discussion of such risks and uncertainties. (See attached tables)

THE MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER

SHARE AMOUNTS) Results before Impact of Results after SFAS 144 (f)

SFAS 144 (f) SFAS 144 (f) Results of For the Three For the Three

For the Three Operations: Months Ended Months Ended Months Ended

December 31 December 31 December 31 Unaudited Unaudited 2004 2003

2004 2003 2004 2003 Minimum Rents (e) 100,181 82,790 (2,625)

(3,787) 97,556 79,003 Percentage Rents 10,071 7,958 (348) (370)

9,723 7,588 Tenant Recoveries 43,792 43,271 (969) (1,451) 42,823

41,820 Management Companies (c) 6,128 5,414 -- -- 6,128 5,414 Other

Income 6,876 5,598 (101) (71) 6,775 5,527 Total Revenues 167,048

145,031 (4,043) (5,679) 163,005 139,352 Shopping center and

operating expenses 50,659 45,235 (1,626) (1,544) 49,033 43,691

Management Companies' operating expenses (c) 13,617 9,837 -- --

13,617 9,837 Depreciation and amortization 41,126 36,303 (951)

(2,259) 40,175 34,044 General, administrative and other expenses

(c) 2,993 1,740 2,993 1,740 Interest expense 40,787 34,418 53 (608)

40,840 33,810 Loss on early extinguishment of debt -- 29 -- 15 --

44 Gain (loss) on sale or writedown of assets 7,048 (117) (6,822)

85 226 (32) Pro rata income (loss) of unconsolidated entities (c)

14,631 16,489 -- -- 14,631 16,489 Income (loss) of the Operating

Partnership from continuing operations 39,545 33,841 (8,341)

(1,198) 31,204 32,643 Discontinued Operations: Gain (loss) on sale

of asset -- -- 6,822 (85) 6,822 (85) Income from discontinued

operations -- -- 1,519 1,283 1,519 1,283 Income before minority

interests 39,545 33,841 -- -- 39,545 33,841 Income allocated to

minority interests 7,220 5,994 -- -- 7,220 5,994 Net income before

preferred dividends 32,325 27,847 -- -- 32,325 27,847 Dividends

earned by preferred stockholders (a) 2,358 2,357 -- -- 2,358 2,357

Net income to common stockholders 29,967 25,490 -- -- 29,967 25,490

Average number of shares outstanding - basic 58,772 57,745 58,772

57,745 Average shares outstanding, - basic, assuming full

conversion of OP Units (d) 72,914 71,324 72,914 71,324 Average

shares outstanding - diluted for FFO (d) 76,928 75,491 76,928

75,491 Per share income - diluted before discontinued operations --

-- 0.40 0.42 Net income per share - basic 0.51 0.44 0.51 0.44 Net

income per share - diluted 0.51 0.44 0.51 0.44 Dividend declared

per share 0.65 0.61 0.65 0.61 Funds from operations "FFO" (b) (d) -

basic 87,198 75,964 87,198 75,964 Funds from operations "FFO" (a)

(b) (d) - diluted 89,556 78,321 89,556 78,321 FFO per share - basic

(b) (d) 1.20 1.07 1.20 1.07 FFO per share - diluted (a) (b) (d)

1.16 1.04 1.16 1.04 percentage change 12.21% Results before Impact

of Results after SFAS 144 (f) SFAS 144 (f) SFAS 144 (f) Results of

For the Year For the Year For the Year Operations: Ended Ended

Ended December 31 December 31 December 31 Unaudited Unaudited 2004

2003 2004 2003 2004 2003 Minimum Rents (e) 340,282 300,578 (10,593)

(14,280) 329,689 286,298 Percentage Rents 18,236 12,999 (582) (572)

17,654 12,427 Tenant Recoveries 163,827 158,600 (4,822) (5,904)

159,005 152,696 Management Companies (c) 21,751 14,630 -- -- 21,751

14,630 Other Income 19,642 17,830 (473) (304) 19,169 17,526 Total

Revenues (e) 563,738 504,637 (16,470) (21,060) 547,268 483,577

Shopping center and operating expenses 171,375 157,852 (6,392)

(6,527) 164,983 151,325 Management Companies' operating expenses

(c) 38,298 31,587 -- -- 38,298 31,587 Depreciation and amortization

146,383 110,156 (4,287) (5,236) 142,096 104,920 General,

administrative and other expenses (c) 11,077 8,482 11,077 8,482

Interest expense 146,382 133,265 (55) (2,558) 146,327 130,707 Loss

on early extinguishment of debt 1,642 155 -- 15 1,642 170 Gain

(loss) on sale or writedown of assets 8,041 34,451 (7,114) (22,031)

927 12,420 Pro rata income of unconsolidated entities (c) 54,881

59,348 -- -- 54,881 59,348 Income (loss) of the Operating

Partnership from continuing operations 111,503 156,939 (12,850)

(28,785) 98,653 128,154 Discontinued Operations: Gain on sale of

asset -- -- 7,114 22,031 7,114 22,031 Income from discontinued

operations -- -- 5,736 6,754 5,736 6,754 Income before minority

interest 111,503 156,939 -- -- 111,503 156,939 Income allocated to

minority interests 19,870 28,907 -- -- 19,870 28,907 Net income

before preferred dividends 91,633 128,032 -- -- 91,633 128,032

Dividends earned by preferred stockholders (a) 9,140 14,816 -- --

9,140 14,816 Net income to common stockholders 82,493 113,216 -- --

82,493 113,216 Average number of shares outstanding - basic 58,537

53,669 58,537 53,669 Average shares outstanding, - basic, assuming

full conversion of OP Units (d) 72,715 67,332 72,715 67,332 Average

shares outstanding - diluted for FFO (d) 76,727 75,198 76,727

75,198 Per share income - diluted before discontinued operations

1.22 1.71 Net income per share - basic 1.41 2.11 1.41 2.11 Net

income per share - diluted 1.40 2.09 1.40 2.09 Dividend declared

per share 2.48 2.32 2.48 2.32 Funds from operations "FFO" (b) (d) -

basic 290,032 254,315 290,032 254,315 Funds from operations "FFO"

(a) (b) (d) - diluted 299,172 269,131 299,172 269,131 FFO per share

- basic (b) (d) 3.99 3.78 3.99 3.78 FFO per share - diluted (a) (b)

(d) 3.90 3.58 3.90 3.58 percentage change 8.95% (a) On February 25,

1998, the Company sold $100,000 of convertible preferred stock and

on June 16, 1998 another $150,000 of convertible preferred stock

was issued. The convertible preferred shares can be converted on a

1 for 1 basis for common stock. These preferred shares are assumed

converted for purposes of net income per share for 2003 and are not

assumed converted for purposes of net income per share for 2004 as

it would be antidilutive to those calculations. On September 9,

2003, 5.487 million shares of Series B convertible preferred stock

were converted into common shares. The weighted average preferred

shares outstanding are assumed converted for purposes of FFO per

diluted share as they are dilutive to that calculation for all

periods presented. (b) The Company uses FFO in addition to net

income to report its operating and financial results and considers

FFO and FFO-diluted as supplemental measures for the real estate

industry and a supplement to Generally Accepted Accounting

Principles (GAAP) measures. NAREIT defines FFO as net income (loss)

(computed in accordance with GAAP), excluding gains (or losses)

from extraordinary items and sales of depreciated operating

properties, plus real estate related depreciation and amortization

and after adjustments for unconsolidated partnerships and joint

ventures. Adjustments for unconsolidated partnerships and joint

ventures are calculated to reflect FFO on the same basis. FFO and

FFO on a fully diluted basis are useful to investors in comparing

operating and financial results between periods. This is especially

true since FFO excludes real estate depreciation and amortization,

as the Company believes real estate values fluctuate based on

market conditions rather than depreciating in value ratably on a

straight-line basis over time. FFO on a fully diluted basis is one

of the measures investors find most useful in measuring the

dilutive impact of outstanding convertible securities. FFO does not

represent cash flow from operations as defined by GAAP, should not

be considered as an alternative to net income as defined by GAAP

and is not indicative of cash available to fund all cash flow

needs. FFO as presented may not be comparable to similarly titled

measures reported by other real estate investment trusts. Effective

January 1, 2003, gains or losses on sale of peripheral land and the

impact of SFAS 141 have been included in FFO. The inclusion of

gains on sales of peripheral land increased FFO for the three and

twelve months ended December 31, 2004 by $1,448 and $4,403

respectively, or by $.02 per share and $.06 per share,

respectively. Additionally, the impact of SFAS No. 141 increased

FFO for the three and twelve months ended December 31, 2004 by $3.4

million and $11.3 million, respectively, or by $.04 per share and

approximately $.15 per share, respectively. The inclusion of gains

on sales of peripheral land increased FFO for the three and twelve

months ended December 31, 2003 by $189 and $1,441, respectively, or

by approximately $.00 per share and $.02 per share, respectively.

Additionally, the impact of SFAS 141 increased FFO for the three

and twelve months ended December 31, 2003 by $2.1 million and $5.6

million, respectively, or by $.03 per share and $.075 per share,

respectively. The Company adopted SFAS No. 141 (see Note (e) below)

effective October 1, 2002. (c) This includes, using the equity

method of accounting, the Company's prorata share of the equity in

income or loss of its unconsolidated joint ventures for all periods

presented and for Macerich Management Company through June 2003.

Effective July 1, 2003, the Company has consolidated Macerich

Management Company. Certain reclassifications have been made in the

2003 financial highlights to conform to the 2004 financial

highlights presentation. (d) The Company has operating partnership

units ("OP units"). Each OP unit can be converted into a share of

Company stock. Conversion of the OP units has been assumed for

purposes of calculating the FFO per share and the weighted average

number of shares outstanding. (e) Effective October 1, 2002, the

Company adopted SFAS No. 141, Business Combinations, which requires

companies that have acquired assets subsequent to June 2001 to

reflect the discounted net present value of market rents in excess

of rents in place at the date of acquisition as a deferred credit

to be amortized into income over the average remaining life of the

acquired leases. The impact on diluted EPS for the three and twelve

months ended December 31, 2004 was approximately $.05 and $.15 per

share, respectively. The impact on diluted EPS for the three and

twelve months ending December 31, 2003 was approximately $.03 per

share and $.07 per share, respectively. In accordance with the

NAREIT definition of FFO, the impact of this accounting treatment

is included in FFO. (f) In October 2001, the FASB issued SFAS No.

144, "Accounting for the Impairment or Disposal of Long-Lived

Assets" ("SFAS 144"). SFAS 144 addresses financial accounting and

reporting for the impairment or disposal of long-lived assets. The

Company adopted SFAS 144 on January 1, 2002. The Company sold its

67% interest in Paradise Village Gateway on January 2, 2003

(acquired in July 2002), and the loss on sale of $0.2 million has

been reclassified to discontinued operations. Additionally, the

Company sold Bristol Center on August 4, 2003, and the results for

the period January 1, 2003 to December 31, 2003 have been

reclassified to discontinued operations. The sale of Bristol Center

resulted in a gain on sale of asset of $22.2 million. On December

17, 2004, the Company sold Westbar and the results for the twelve

months ending December 31, 2004 and 2003 have been reclassified to

discontinued operations. The sale of Westbar resulted in a gain on

sale of $6.8 million. Additionally, the results of Crossroads Mall

in Oklahoma for the twelve months ending December 31, 2004 and 2003

have been reclassified to discontinued operations as the Company

has identified this asset for disposition. THE MACERICH COMPANY

FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Summarized Balance Sheet Dec 31 Dec 31 Information 2004 2003

(UNAUDITED) Cash and cash equivalents $72,114 $47,160 Investment in

real estate, net (i) $3,574,553 $3,186,725 Investments in

unconsolidated entities (j) $618,523 $577,908 Total Assets

$4,637,096 $4,145,593 Mortgage and notes payable $3,230,120

$2,682,599 Pro rata share of debt on unconsolidated entities

$1,147,268 $1,046,042 Dec 31 Dec 31 Additional financial data as

of: 2004 2003 Occupancy of centers (g) consolidated assets 92.60%

92.80% unconsolidated assets 92.40% 93.80% Total portfolio 92.50%

93.30% Comparable quarter change in same center sales (g) (h)

consolidated assets 2.90% 0.20% unconsolidated assets 5.20% 4.80%

Total portfolio 4.20% 2.60% Sales per square foot (h): consolidated

assets $368 $350 unconsolidated assets $414 $372 Total portfolio

$391 $361 Additional financial data for the twelve months ended:

Acquisitions of property and equipment - including joint ventures

prorata $342,235 $339,997 Redevelopment and expansions of centers -

including joint ventures prorata $145,888 $183,896 Renovations of

centers - including joint ventures at prorata $31,286 $24,468

Tenant allowances - including joint ventures at prorata $21,361

$12,043 Deferred leasing costs - including joint ventures at

prorata $20,488 $18,486 (g) excludes redevelopment properties --

29th Street Center, Parklane Mall, Santa Monica Place (h) includes

mall and freestanding stores. (i) includes construction in process

on wholly owned assets of $88,228 at December 31, 2004 and $268,810

at December 31, 2003. (j) the Company's prorata share of

construction in process on unconsolidated entities of $32,047 at

December 31, 2004 and $16,510 at December 31, 2003. For the Three

Months For the Year PRORATA SHARE OF JOINT Ended December 31 Ended

December 31 VENTURES (UNAUDITED) (UNAUDITED) (All amounts in (All

amounts in (Unaudited) thousands) thousands) 2004 2003 2004 2003

Revenues: Minimum rents $45,805 $39,793 $174,591 $157,445

Percentage rents 7,074 4,625 11,528 8,163 Tenant recoveries 19,525

16,828 75,524 66,833 Management fee (c) -- -- -- 5,250 Other 2,146

1,428 6,917 4,810 Total revenues 74,550 62,674 268,560 242,501

Expenses: Shopping center expenses 24,658 20,837 91,894 78,459

Interest expense 15,594 14,392 63,550 56,703 Management company

expense (c) -- -- -- 3,013 Depreciation and amortization 20,072

10,952 61,060 45,133 Total operating expenses 60,324 46,181 216,504

183,308 (Loss) on early extinguishment of debt (367) -- (528) --

Gain (loss) on sale or writedown of assets 772 (4) 3,353 155 Net

income 14,631 16,489 54,881 59,348 THE MACERICH COMPANY FINANCIAL

HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) RECONCILIATION

OF For the Three Months For the Year NET INCOME TO FFO (b)(e) Ended

December 31 Ended December 31 (UNAUDITED) (UNAUDITED) (All amounts

in (All amounts in thousands) thousands) 2004 2003 2004 2003 Net

income - available to common stockholders $29,967 $25,490 $82,493

$113,216 Adjustments to reconcile net income to FFO - basic

Minority interest 7,220 5,994 19,870 28,907 (Gain) loss on sale of

wholly owned assets (7,048) 117 (8,041) (34,451) plus gain on land

sales - consolidated assets 600 195 939 1,054 less impairment

writedown of consolidated assets -- -- -- -- (Gain) loss on sale or

write-down of assets from unconsolidated entities (pro rata share)

(772) 4 (3,353) (155) plus gain on land sales - unconsolidated

assets 849 (5) 3,464 387 less impairment writedown of

unconsolidated assets -- -- -- -- Depreciation and amortization on

consolidated assets 41,126 36,303 146,383 110,156 Less depreciation

allocated to minority interests (1,555) (586) (1,555) (586)

Depreciation and amortization on joint ventures and from the

management companies (pro rata) 20,072 10,952 61,060 45,133 Less:

depreciation on personal property and amortization of loan costs

and interest rate caps (3,261) (2,500) (11,228) (9,346) Total FFO -

basic 87,198 75,964 290,032 254,315 Additional adjustment to arrive

at FFO - diluted Preferred stock dividends earned 2,358 2,357 9,140

14,816 Effect of employee/director stock incentive plans -- -- --

-- FFO - diluted 89,556 78,321 299,172 269,131 For the Three Months

For the Year Ended December 31 Ended December 31 (UNAUDITED)

(UNAUDITED) (All amounts in (All amounts in thousands) thousands)

Reconciliation of EPS to FFO per diluted share: 2004 2003 2004 2003

Earnings per share $0.51 $0.44 $1.40 $2.09 Per share impact of

depreciation and amortization real estate $0.77 $0.61 $2.68 $1.93

Per share impact of gain on sale of depreciated assets ($0.09)

$0.00 ($0.10) ($0.44) Per share impact of preferred stock not

dilutive to EPS ($0.03) ($0.01) ($0.08) $0.00 Fully Diluted FFO per

share $1.16 $1.04 $3.90 $3.58 THE MACERICH COMPANY For the Three

Months For the Year RECONCILIATION OF Ended December 31 Ended

December 31 NET INCOME TO EBITDA (UNAUDITED) (UNAUDITED) (All

amounts in (All amounts in thousands) thousands) 2004 2003 2004

2003 Net income - available to common stockholders 29,967 25,490

82,493 113,216 Interest expense 40,787 34,418 146,382 133,265 Less

interest expense allocated to minority interests (480) (406) (480)

(406) Interest expense - unconsolidated entities (pro rata) 15,594

14,392 63,550 56,703 Depreciation and amortization - wholly- owned

centers 41,126 36,303 146,383 110,156 Less depreciation allocated

to minority interests (1,555) (586) (1,555) (586) Depreciation and

amortization - unconsolidated entities (pro rata) 20,072 10,952

61,060 45,133 Minority interest 7,220 5,994 19,870 28,907 Loss on

early extinguishment of debt -- 29 1,642 155 Loss on early

extinguishment of debt - unconsolidated entities 367 -- 528 -- Loss

(gain) on sale of assets - wholly-owned centers (7,048) 117 (8,041)

(34,451) Loss (gain) on sale of assets - unconsolidated entities

(pro rata) (772) 4 (3,353) (155) Preferred dividends 2,358 2,357

9,140 14,816 EBITDA (k) $147,636 $129,064 $517,619 $466,753 THE

MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER

SHARE AMOUNTS) THE MACERICH COMPANY RECONCILIATION OF EBITDA TO

SAME CENTERS - NET OPERATING INCOME ("NOI") For the Three Months

For the Year Ended December 31 Ended December 31 (UNAUDITED)

(UNAUDITED) (All amounts in (All amounts in thousands) thousands)

2004 2003 2004 2003 EBITDA (k) $147,636 $129,064 $517,619 $466,753

Add: REIT general and administrative expenses 2,993 1,740 11,077

8,482 Management Companies' revenues (c) (6,128) (5,414) (21,751)

(14,630) Management Companies' operating expenses (c) 13,617 9,837

38,298 30,038 EBITDA of non- comparable centers (29,472) (11,481)

(89,150) (45,505) SAME CENTERS - Net operating income ("NOI") (l)

$128,646 $123,746 $456,093 $445,138 (k) EBITDA represents earnings

before interest, income taxes, depreciation, amortization, minority

interest, extraordinary items, gain (loss) on sale of assets and

preferred dividends and includes joint ventures at their pro rata

share. Management considers EBITDA to be an appropriate

supplemental measure to net income because it helps investors

understand the ability of the Company to incur and service debt and

make capital expenditures. EBITDA should not be construed as an

alternative to operating income as an indicator of the Company's

operating performance, or to cash flows from operating activities

(as determined in accordance with GAAP) or as a measure of

liquidity. EBITDA, as presented, may not be comparable to similarly

titled measurements reported by other companies. (l) The Company

presents same-center NOI because the Company believes it is useful

for investors to evaluate the operating performance of comparable

centers. Same-center NOI is calculated using total EBITDA and

subtracting out EBITDA from non-comparable centers and eliminating

the management companies and the Company's general and

administrative expenses. DATASOURCE: The Macerich Company CONTACT:

Arthur Coppola, President and Chief Executive Officer, or Thomas E.

O'Hern, Executive Vice President and Chief Financial Officer, of

The Macerich Company, +1-310-394-6000 Web site:

http://www.macerich.com/

Copyright

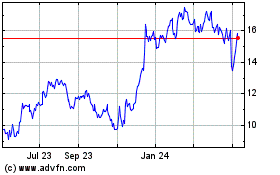

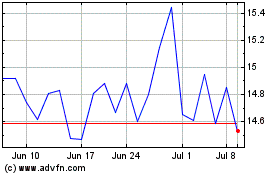

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024