Lithia Motors, Inc. (NYSE:LAD) today announced that third quarter

2006 sales increased 3% to $880.4 million as compared to $858.9

million in the same period last year. New vehicle sales increased

1%, used vehicle sales increased 6%, finance/insurance sales

increased 5% and parts/service sales increased 12%. Third quarter

2006 net income from continuing operations was $12.8 million as

compared to $18.1 million in the third quarter of 2005. Diluted

earnings per share from continuing operations, including the $0.03

effect of accounting for equity compensation under FAS123-R, were

$0.60. Third quarter 2006 earnings per share from continuing

operations, excluding the effect of accounting for equity

compensation under FAS123-R, were $0.63 as compared to $0.85 in the

same period last year. Sid DeBoer, Lithia�s Chairman and CEO,

commented, �Recently Lithia reached a milestone of 100 stores over

a period of 10 years as a public company. We are excited about this

achievement, although we are only just beginning to realize some of

the growth and operating opportunities that lay ahead of us.� �Our

third quarter revenues were up 3% compared to last year�s third

quarter. Although this is due to acquisitions, it is still

noteworthy considering the very difficult comparison with the third

quarter of last year where we saw exceptionally strong sales driven

by effective employee pricing. Incentives were not as effective in

the third quarter this year.� �While total revenues were up, third

quarter earnings were down year over year due to a combination of

factors; high inventory levels and higher interest rates impacted

our bottom line by approximately 12 cents per share for the

quarter. This excludes inventories from acquisitions over the prior

year. We also experienced increased costs resulting from

company-wide operational initiatives in the quarter. We estimate

expenses for all these new initiatives to be in the range of seven

to eight cents per share for the full-year 2006. Additionally, for

most of September, we were unable to sell the majority of our Dodge

RAM light duty pickups, one of our core products, due to a �sell

hold� from the manufacturer that is related to a safety restraint

system in these vehicles.� �Total same store sales declined 3.5%

against a backdrop of 9.1% growth in the third quarter of last

year. New vehicle inventories remained above historical average

levels at the end of September, but are down $230 million

sequentially from the second quarter. We expect them to continue to

decline by year-end. Fuel costs have declined recently and that

should benefit consumer sentiment and help increase truck sales.

Interest rates have risen steadily for the last two years and with

interest rates currently steady, floorplan interest costs should

stop increasing in the year ahead,� concluded Mr. DeBoer. For the

nine-month period ending September 30, 2006, total sales increased

9% to $2.48 billion from $2.27 billion in the same period last

year. New vehicle sales increased 10%, used vehicle sales increased

9%, finance/insurance sales increased 12%, and parts/service sales

increased 12%. For the first nine months, Lithia�s net income from

continuing operations was $35.1 million as compared to $41.7

million in the first nine months of 2005. Diluted earnings per

share from continuing operations, including the $0.09 effect of

accounting for equity compensation under FAS123-R, were $1.65. For

the first nine months of 2006 earnings per share from continuing

operations, excluding the affect of accounting for equity

compensation under FAS123-R, were $1.74 as compared to $1.98 in the

same period last year. Jeffrey B. DeBoer, Senior Vice President and

CFO added, �In the past four months we have completed four

acquisitions: a Chrysler store in Ukiah, California; two stores in

Grand Forks, North Dakota with a combination of import and domestic

brands; and more recently, BMW and Porsche stores in Seaside,

California and BMW and Mercedes Benz stores in Des Moines, Iowa.

These more recent acquisitions have provided a good demonstration

of our continuing brand diversification efforts. Year to date we

have completed acquisitions with approximately $390 million in

annualized revenues, and we plan on continuing our normal

acquisition pace in 2007.� "Our guidance for the full-year 2006 and

2007 is included in the table below. For the full-year 2007 we are

giving guidance for a flat year as a number of key items are

material to the year ahead. Company health and benefit plan costs

will be increasing, negatively impacting earnings by 10 to 12 cents

per share. We will also continue with our special operational

projects and initiatives which include: Office Automation; Lithia�s

Store Management System; Human Development Systems and our Assured

Used Vehicle Program. Long-term we expect these projects to reduce

the company�s SG&A expense and allow the stores to focus more

on customers which will help drive long-term sales growth. We also

expect that in the coming year, our domestic product mix will

continue to negatively impact earnings, however, we believe that

the restructurings now underway at the domestic manufacturers along

with changes in mix and product improvements will help us in the

future.� �We are excited about the start up of our first

independent used vehicle retail outlets in 2007. Start up costs for

this initiative will impact earnings by approximately 10 cents per

share. Once established, we expect that each independent used

vehicle store will reach monthly operational profitability within

12 months of opening,� concluded Jeffrey B. DeBoer. Guidance

Guidance Earnings per Share FY 2006 FY 2007 -------------

------------- From Continuing Operations: $1.95 - $1.99 $1.90 -

$2.10 The company currently has a 1,000,000 share repurchase

program in place. Prior to the beginning of�2006, 60,231 shares had

been purchased. In the past few months the company purchased

196,600 shares, leaving 743,169 shares still available for

repurchase under the program. Conference Call Information Lithia

Motors will be providing more detailed information on the results

for the third quarter 2006 in its conference call scheduled for 2

p.m. PT today. The call can be accessed live by calling

973-633-1010. To listen to a live webcast or hear a replay, log-on

to: www.lithia.com � go to Investor Relations � and click on the

Live Webcast icon. About Lithia Lithia Motors, Inc. is a Fortune

700 and Russell 2000 Company. Lithia sells 26 brands of new

vehicles at 102 stores which are located in 42 markets within 15

states. Internet sales are centralized at www.Lithia.com. Lithia

also sells used vehicles; arranges finance, warranty, and credit

insurance contracts; and provides vehicle parts, maintenance, and

repair services at all of its locations. Lithia retailed 103,333

new and used vehicles and had $2.9 billion in total revenue in

2005. Forward Looking Statements This press release includes

forward looking statements within the meaning of the �Safe-Harbor�

provisions of the Private Securities Litigation Reform Act of 1995,

which management believes are a benefit to shareholders. These

statements are necessarily subject to risk and uncertainty and

actual results could differ materially due to certain risk factors,

including without limitation economic conditions, acquisition risk

factors and others set forth from time to time in the company�s

filings with the SEC. Specific risks in this press release include

items which impact earnings, anticipated revenues of recently

acquired and projected new store acquisitions, anticipated

profitability of independent used vehicle stores and projected

full-year 2006 and 2007 earnings per share guidance. Additional

Information For additional information on Lithia Motors, contact

the Investor Relations Department: (541) 776-6591 or log-on to:

www.lithia.com � go to Investor Relations LITHIA MOTORS, INC. (In

Thousands except per share and unit data) Unaudited Three Months

Ended September 30, $Increase %Increase 2006 2005 (Decrease)

(Decrease) New Vehicle Sales $515,059 $510,541 $4,518 0.9% Used

Vehicle Sales 239,387 226,518 12,869 5.7 Finance & Insurance

33,982 32,462 1,520 4.7 Service, Body & Parts Sales 90,108

80,786 9,322 11.5 Fleet & Other Revenues 1,836 8,548 (6,712)

(78.5) -------- -------- -------- ------- Total Revenues 880,372

858,855 21,517 2.5 Cost of Sales 733,116 717,591 15,525 2.2

-------- -------- -------- ------- Gross Profit 147,256 141,264

5,992 4.2 SG&A Expense 109,122 98,588 10,534 10.7

Depreciation/Amortization 4,411 3,624 787 21.7 -------- --------

-------- ------- Income from Operations 33,723 39,052 (5,329)

(13.6) Flooring Interest Expense (10,027) (5,534) 4,493 81.2 Other

Interest Expense (3,819) (3,037) 782 25.7 Other Income, net 188 186

2 1.1 -------- -------- -------- ------- Income from continuing

operations before income taxes 20,065 30,667 (10,602) (34.6) Income

Tax Expense (7,289) (12,551) (5,262) (41.9) Income Tax Rate 36.3%

40.9% -------- -------- -------- ------- Income from continuing

ops. 12,776 18,116 (5,340) (29.5) Income (Loss) from discontinued

operations, net of income taxes (81) (484) (403) (83.3) Net Income

$12,695 $17,632 ($4,937) (28.0)% ========= ======== =======

======== Diluted Net Income per share: Continuing Operations $0.63

$0.85 $(0.22) (25.9)% Effects of FAS123-R (0.03) - Diluted Net

Income per share after effect of FAS123-R: $0.60 $0.85 (0.25)

(29.4)% Discontinued Operations - (0.02) -------- -------- --------

------- Net Income per share $0.60 $0.83 (0.23) (27.7)% =========

======== ======= ======== Diluted Shares Outstanding 22,128 21,882

246 1.1% Increase Increase Unit Sales: 2006 2005 (Decrease)

(Decrease) New Vehicle 18,829 18,682 147 0.8% Used - Retail Vehicle

11,925 12,057 (132) (1.1) Used - Wholesale 7,686 7,091 595 8.4

Total Units Sold 38,440 37,830 610 1.6 LITHIA MOTORS, INC. Three

Months Ended September 30, $Increase % Increase Average Selling

Price: 2006 2005 (Decrease) (Decrease) ---------------------- ----

---- ---------- --------- New Vehicle $27,355 $27,328 $27 0.1% Used

- Retail Vehicle 16,223 15,502 721 4.7 Used - Wholesale 5,976 5,586

390 7.0 Key Financial Data: ------------------- Gross Profit Margin

16.7% 16.4% SG&A as a % of Gross Profit 74.1% 69.8% Operating

Margin 3.8% 4.5% Pre-Tax Margin 2.3% 3.6% Gross Margin/Profit Data

2006 2005 ------------------------ ---- ---- New Vehicle Retail

7.7% 7.7% Used Vehicle Retail 14.5% 15.8% Used Vehicle Wholesale

0.9% 1.7% Service, Body & Parts 49.8% 48.1% New Retail Gross

Profit/Unit $2,101 $2,112 Used Retail Gross Profit/Unit $2,348

$2,448 Used Wholesale Gross Profit/Unit $56 $93 Finance &

Insurance/ Retail Unit $1,105 $1,056 Same Store Data 2006 2005

--------------- ---- ---- New Vehicle Retail Sales (5.8)% 9.3% Used

Vehicle Sales (includes Wholesale) (1.0)% 10.2% Total Vehicle Sales

(excludes fleet) (4.4)% 9.6% Finance & Insurance Sales (2.6)%

8.5% Service, Body & Parts Sales 3.6% 4.9% Total Sales

(Excluding Fleet) (3.5)% 9.1% Total Gross Profit (Excluding Fleet)

(3.5)% 7.0% LITHIA MOTORS, INC. (In Thousands except per share and

unit data) Unaudited Nine Months Ended September 30, $Increase %

Increase 2006 2005 (Decrease) (Decrease) New Vehicle Sales

$1,438,930 $1,308,535 $130,395 10.0% Used Vehicle Sales 679,374

624,609 54,765 8.8 Finance & Insurance 94,312 84,282 10,030

11.9 Service, Body & Parts Sales 258,317 230,468 27,849 12.1

Fleet & Other Revenues 4,105 20,716 (16,611) (80.2) ---------

--------- -------- ------- Total Revenues 2,475,038 2,268,610

206,428 9.1 Cost of Sales 2,052,776 1,882,869 169,907 9.0 ---------

--------- -------- ------- Gross Profit 422,262 385,741 36,521 9.5

SG&A Expense 317,375 281,043 36,332 12.9 Depreciation/

Amortization 12,669 10,418 2,251 21.6 --------- --------- --------

------- Income from Operations 92,218 94,280 (2,062) (2.2) Flooring

Interest Expense (25,573) (16,636) 8,937 53.7 Other Interest

Expense (10,791) (8,878) 1,913 21.5 Other Income, net 930 718 212

29.5 --------- --------- -------- ------- Income from continuing

operations before income taxes 56,784 69,484 (12,700) (18.3) Income

Tax Expense (21,662) (27,787) (6,125) (22.0) Income Tax Rate 38.1%

40.0% --------- --------- -------- ------- Net Income from

continuing ops. 35,122 41,697 (6,575) (15.8)% Income (Loss) from

discontinued operations, net of income taxes (1,452) (1,400) 52 3.7

Net Income $33,670 $40,297 ($6,627) (16.4)% ========= =========

======== ======= Diluted Net Income per share: Continuing

Operations $1.74 $1.98 $(0.24) (12.1)% Effects of FAS123-R (0.09) -

Diluted Net Income per share after effect of FAS123-R: $1.65 $1.98

(0.33) (16.7)% Discontinued Operations (0.06) (0.07) ---------

--------- -------- ------- Net Income per share $1.59 $1.91 (0.32)

(16.8)% ========= ========= ======== ======= Diluted Shares

Outstanding 22,120 21,765 355 1.6% Increase Increase Unit Sales:

2006 2005 (Decrease) (Decrease) ----------- ------ ------ ---------

--------- New Vehicle 52,346 47,147 5,199 11.0% Used - Retail

Vehicle 34,543 33,478 1,065 3.2 Used - Wholesale 19,537 18,338

1,199 6.5 Total Units Sold 106,426 98,963 7,463 7.5 LITHIA MOTORS,

INC. Nine Months Ended September 30, $Increase % Increase Average

Selling Price: 2006 2005 (Decrease) (Decrease)

---------------------- New Vehicle $27,489 $27,754 ($265) (1.0)%

Used - Retail Vehicle 16,220 15,469 751 4.9 Used - Wholesale 6,095

5,821 274 4.7 Key Financial Data: ------------------- Gross Profit

Margin 17.1% 17.0% SG&A as a % of Gross Profit 75.2% 72.9%

Operating Margin 3.7% 4.2% Pre-Tax Margin 2.3% 3.1% Gross

Margin/Profit Data 2006 2005 ------------------------ ---- ---- New

Vehicle Retail 7.6% 7.9% Used Vehicle Retail 15.2% 15.7% Used

Vehicle Wholesale 2.8% 3.2% Service, Body & Parts 49.7% 48.7%

New Retail Gross Profit/ Unit $2,098 $2,193 Used Retail Gross

Profit/ Unit $2,469 $2,430 Used Wholesale Gross Profit/ Unit $168

$188 Finance & Insurance/ Retail Unit $1,085 $1,045 Same Store

Data 2006 2005 --------------- ---- ---- New Vehicle Retail Sales

3.1% 3.3% Used Vehicle Sales (includes Wholesale) 2.7% 4.2% Total

Vehicle Sales (excludes fleet) 2.9% 3.6% Finance & Insurance

Sales 4.8% 3.6% Service, Body & Parts Sales 5.4% 2.3% Total

Sales (Excluding Fleet) 3.3% 3.5% Total Gross Profit (Excluding

Fleet) 2.5% 4.0% LITHIA MOTORS, INC. Balance Sheet Highlights

(Dollars in Thousands) September 30, 2006 December 31, 2005

Unaudited ------------------ ----------------- Cash & Cash

Equivalents $41,329 $48,566 Trade Receivables(a) 99,935 106,443

Inventory 652,071 606,047 Assets Held for Sale - 27,411 Other

Current Assets 13,971 15,781 -------- -------- Total Current Assets

807,306 804,248 Real Estate, net 293,904 255,372 Equipment &

Leases, net 86,135 77,805 Goodwill, net 277,717 260,899 Other

Assets 63,817 54,390 -------- -------- Total Assets $1,528,879

$1,452,714 ========== ========== Floorplan Notes Payable $537,557

$530,452 Liabilities held for sale - 22,388 Other Current

Liabilities 117,745 95,560 -------- -------- Total Current

Liabilities 655,302 648,400 Used Vehicle Flooring 71,000 - Real

Estate Debt 161,195 154,046 Other Long-Term Debt 92,473 136,505

Other Liabilities 57,802 54,130 -------- -------- Total Liabilities

1,037,772 993,081 -------- -------- Shareholders' Equity 491,107

459,633 -------- -------- Total Liabilities & Shareholders'

Equity $1,528,879 $1,452,714 ========== ========== ______________

(a) Includes contracts-in-transit of $49,181 and $52,453 at

September 30, 2006 and December 31, 2005 respectively. Other

Balance Sheet Data (Dollars in Thousands except per share data)

Current Ratio 1.2x 1.2x LT Debt/Total Cap. (Excludes Used -Vehicle

Flooring and Real Estate) 16% 23% Working Capital $152,004 $155,848

Book Value per Basic Share $25.20 $23.97 Lithia Motors, Inc.

(NYSE:LAD) today announced that third quarter 2006 sales increased

3% to $880.4 million as compared to $858.9 million in the same

period last year. New vehicle sales increased 1%, used vehicle

sales increased 6%, finance/insurance sales increased 5% and

parts/service sales increased 12%. Third quarter 2006 net income

from continuing operations was $12.8 million as compared to $18.1

million in the third quarter of 2005. Diluted earnings per share

from continuing operations, including the $0.03 effect of

accounting for equity compensation under FAS123-R, were $0.60.

Third quarter 2006 earnings per share from continuing operations,

excluding the effect of accounting for equity compensation under

FAS123-R, were $0.63 as compared to $0.85 in the same period last

year. Sid DeBoer, Lithia's Chairman and CEO, commented, "Recently

Lithia reached a milestone of 100 stores over a period of 10 years

as a public company. We are excited about this achievement,

although we are only just beginning to realize some of the growth

and operating opportunities that lay ahead of us." "Our third

quarter revenues were up 3% compared to last year's third quarter.

Although this is due to acquisitions, it is still noteworthy

considering the very difficult comparison with the third quarter of

last year where we saw exceptionally strong sales driven by

effective employee pricing. Incentives were not as effective in the

third quarter this year." "While total revenues were up, third

quarter earnings were down year over year due to a combination of

factors; high inventory levels and higher interest rates impacted

our bottom line by approximately 12 cents per share for the

quarter. This excludes inventories from acquisitions over the prior

year. We also experienced increased costs resulting from

company-wide operational initiatives in the quarter. We estimate

expenses for all these new initiatives to be in the range of seven

to eight cents per share for the full-year 2006. Additionally, for

most of September, we were unable to sell the majority of our Dodge

RAM light duty pickups, one of our core products, due to a "sell

hold" from the manufacturer that is related to a safety restraint

system in these vehicles." "Total same store sales declined 3.5%

against a backdrop of 9.1% growth in the third quarter of last

year. New vehicle inventories remained above historical average

levels at the end of September, but are down $230 million

sequentially from the second quarter. We expect them to continue to

decline by year-end. Fuel costs have declined recently and that

should benefit consumer sentiment and help increase truck sales.

Interest rates have risen steadily for the last two years and with

interest rates currently steady, floorplan interest costs should

stop increasing in the year ahead," concluded Mr. DeBoer. For the

nine-month period ending September 30, 2006, total sales increased

9% to $2.48 billion from $2.27 billion in the same period last

year. New vehicle sales increased 10%, used vehicle sales increased

9%, finance/insurance sales increased 12%, and parts/service sales

increased 12%. For the first nine months, Lithia's net income from

continuing operations was $35.1 million as compared to $41.7

million in the first nine months of 2005. Diluted earnings per

share from continuing operations, including the $0.09 effect of

accounting for equity compensation under FAS123-R, were $1.65. For

the first nine months of 2006 earnings per share from continuing

operations, excluding the affect of accounting for equity

compensation under FAS123-R, were $1.74 as compared to $1.98 in the

same period last year. Jeffrey B. DeBoer, Senior Vice President and

CFO added, "In the past four months we have completed four

acquisitions: a Chrysler store in Ukiah, California; two stores in

Grand Forks, North Dakota with a combination of import and domestic

brands; and more recently, BMW and Porsche stores in Seaside,

California and BMW and Mercedes Benz stores in Des Moines, Iowa.

These more recent acquisitions have provided a good demonstration

of our continuing brand diversification efforts. Year to date we

have completed acquisitions with approximately $390 million in

annualized revenues, and we plan on continuing our normal

acquisition pace in 2007." "Our guidance for the full-year 2006 and

2007 is included in the table below. For the full-year 2007 we are

giving guidance for a flat year as a number of key items are

material to the year ahead. Company health and benefit plan costs

will be increasing, negatively impacting earnings by 10 to 12 cents

per share. We will also continue with our special operational

projects and initiatives which include: Office Automation; Lithia's

Store Management System; Human Development Systems and our Assured

Used Vehicle Program. Long-term we expect these projects to reduce

the company's SG&A expense and allow the stores to focus more

on customers which will help drive long-term sales growth. We also

expect that in the coming year, our domestic product mix will

continue to negatively impact earnings, however, we believe that

the restructurings now underway at the domestic manufacturers along

with changes in mix and product improvements will help us in the

future." "We are excited about the start up of our first

independent used vehicle retail outlets in 2007. Start up costs for

this initiative will impact earnings by approximately 10 cents per

share. Once established, we expect that each independent used

vehicle store will reach monthly operational profitability within

12 months of opening," concluded Jeffrey B. DeBoer. -0- *T Guidance

Guidance Earnings per Share FY 2006 FY 2007 -------------

------------- From Continuing Operations: $1.95 - $1.99 $1.90 -

$2.10 *T The company currently has a 1,000,000 share repurchase

program in place. Prior to the beginning of 2006, 60,231 shares had

been purchased. In the past few months the company purchased

196,600 shares, leaving 743,169 shares still available for

repurchase under the program. Conference Call Information Lithia

Motors will be providing more detailed information on the results

for the third quarter 2006 in its conference call scheduled for 2

p.m. PT today. The call can be accessed live by calling

973-633-1010. To listen to a live webcast or hear a replay, log-on

to: www.lithia.com - go to Investor Relations - and click on the

Live Webcast icon. About Lithia Lithia Motors, Inc. is a Fortune

700 and Russell 2000 Company. Lithia sells 26 brands of new

vehicles at 102 stores which are located in 42 markets within 15

states. Internet sales are centralized at www.Lithia.com. Lithia

also sells used vehicles; arranges finance, warranty, and credit

insurance contracts; and provides vehicle parts, maintenance, and

repair services at all of its locations. Lithia retailed 103,333

new and used vehicles and had $2.9 billion in total revenue in

2005. Forward Looking Statements This press release includes

forward looking statements within the meaning of the "Safe-Harbor"

provisions of the Private Securities Litigation Reform Act of 1995,

which management believes are a benefit to shareholders. These

statements are necessarily subject to risk and uncertainty and

actual results could differ materially due to certain risk factors,

including without limitation economic conditions, acquisition risk

factors and others set forth from time to time in the company's

filings with the SEC. Specific risks in this press release include

items which impact earnings, anticipated revenues of recently

acquired and projected new store acquisitions, anticipated

profitability of independent used vehicle stores and projected

full-year 2006 and 2007 earnings per share guidance. Additional

Information For additional information on Lithia Motors, contact

the Investor Relations Department: (541) 776-6591 or log-on to:

www.lithia.com - go to Investor Relations -0- *T LITHIA MOTORS,

INC. (In Thousands except per share and unit data) Unaudited Three

Months Ended September 30, $Increase %Increase 2006 2005 (Decrease)

(Decrease) New Vehicle Sales $515,059 $510,541 $4,518 0.9% Used

Vehicle Sales 239,387 226,518 12,869 5.7 Finance & Insurance

33,982 32,462 1,520 4.7 Service, Body & Parts Sales 90,108

80,786 9,322 11.5 Fleet & Other Revenues 1,836 8,548 (6,712)

(78.5) -------- -------- -------- ------- Total Revenues 880,372

858,855 21,517 2.5 Cost of Sales 733,116 717,591 15,525 2.2

-------- -------- -------- ------- Gross Profit 147,256 141,264

5,992 4.2 SG&A Expense 109,122 98,588 10,534 10.7

Depreciation/Amortization 4,411 3,624 787 21.7 -------- --------

-------- ------- Income from Operations 33,723 39,052 (5,329)

(13.6) Flooring Interest Expense (10,027) (5,534) 4,493 81.2 Other

Interest Expense (3,819) (3,037) 782 25.7 Other Income, net 188 186

2 1.1 -------- -------- -------- ------- Income from continuing

operations before income taxes 20,065 30,667 (10,602) (34.6) Income

Tax Expense (7,289) (12,551) (5,262) (41.9) Income Tax Rate 36.3%

40.9% -------- -------- -------- ------- Income from continuing

ops. 12,776 18,116 (5,340) (29.5) Income (Loss) from discontinued

operations, net of income taxes (81) (484) (403) (83.3) Net Income

$12,695 $17,632 ($4,937) (28.0)% ========= ======== =======

======== Diluted Net Income per share: Continuing Operations $0.63

$0.85 $(0.22) (25.9)% Effects of FAS123-R (0.03) - Diluted Net

Income per share after effect of FAS123-R: $0.60 $0.85 (0.25)

(29.4)% Discontinued Operations - (0.02) -------- -------- --------

------- Net Income per share $0.60 $0.83 (0.23) (27.7)% =========

======== ======= ======== Diluted Shares Outstanding 22,128 21,882

246 1.1% Increase Increase Unit Sales: 2006 2005 (Decrease)

(Decrease) New Vehicle 18,829 18,682 147 0.8% Used - Retail Vehicle

11,925 12,057 (132) (1.1) Used - Wholesale 7,686 7,091 595 8.4

Total Units Sold 38,440 37,830 610 1.6 *T -0- *T LITHIA MOTORS,

INC. Three Months Ended September 30, $Increase % Increase Average

Selling Price: 2006 2005 (Decrease) (Decrease)

---------------------- ---- ---- ---------- --------- New Vehicle

$27,355 $27,328 $27 0.1% Used - Retail Vehicle 16,223 15,502 721

4.7 Used - Wholesale 5,976 5,586 390 7.0 Key Financial Data:

------------------- Gross Profit Margin 16.7% 16.4% SG&A as a %

of Gross Profit 74.1% 69.8% Operating Margin 3.8% 4.5% Pre-Tax

Margin 2.3% 3.6% Gross Margin/Profit Data 2006 2005

------------------------ ---- ---- New Vehicle Retail 7.7% 7.7%

Used Vehicle Retail 14.5% 15.8% Used Vehicle Wholesale 0.9% 1.7%

Service, Body & Parts 49.8% 48.1% New Retail Gross Profit/Unit

$2,101 $2,112 Used Retail Gross Profit/Unit $2,348 $2,448 Used

Wholesale Gross Profit/Unit $56 $93 Finance & Insurance/ Retail

Unit $1,105 $1,056 Same Store Data 2006 2005 --------------- ----

---- New Vehicle Retail Sales (5.8)% 9.3% Used Vehicle Sales

(includes Wholesale) (1.0)% 10.2% Total Vehicle Sales (excludes

fleet) (4.4)% 9.6% Finance & Insurance Sales (2.6)% 8.5%

Service, Body & Parts Sales 3.6% 4.9% Total Sales (Excluding

Fleet) (3.5)% 9.1% Total Gross Profit (Excluding Fleet) (3.5)% 7.0%

*T -0- *T LITHIA MOTORS, INC. (In Thousands except per share and

unit data) Unaudited Nine Months Ended September 30, $Increase %

Increase 2006 2005 (Decrease) (Decrease) New Vehicle Sales

$1,438,930 $1,308,535 $130,395 10.0% Used Vehicle Sales 679,374

624,609 54,765 8.8 Finance & Insurance 94,312 84,282 10,030

11.9 Service, Body & Parts Sales 258,317 230,468 27,849 12.1

Fleet & Other Revenues 4,105 20,716 (16,611) (80.2) ---------

--------- -------- ------- Total Revenues 2,475,038 2,268,610

206,428 9.1 Cost of Sales 2,052,776 1,882,869 169,907 9.0 ---------

--------- -------- ------- Gross Profit 422,262 385,741 36,521 9.5

SG&A Expense 317,375 281,043 36,332 12.9 Depreciation/

Amortization 12,669 10,418 2,251 21.6 --------- --------- --------

------- Income from Operations 92,218 94,280 (2,062) (2.2) Flooring

Interest Expense (25,573) (16,636) 8,937 53.7 Other Interest

Expense (10,791) (8,878) 1,913 21.5 Other Income, net 930 718 212

29.5 --------- --------- -------- ------- Income from continuing

operations before income taxes 56,784 69,484 (12,700) (18.3) Income

Tax Expense (21,662) (27,787) (6,125) (22.0) Income Tax Rate 38.1%

40.0% --------- --------- -------- ------- Net Income from

continuing ops. 35,122 41,697 (6,575) (15.8)% Income (Loss) from

discontinued operations, net of income taxes (1,452) (1,400) 52 3.7

Net Income $33,670 $40,297 ($6,627) (16.4)% ========= =========

======== ======= Diluted Net Income per share: Continuing

Operations $1.74 $1.98 $(0.24) (12.1)% Effects of FAS123-R (0.09) -

Diluted Net Income per share after effect of FAS123-R: $1.65 $1.98

(0.33) (16.7)% Discontinued Operations (0.06) (0.07) ---------

--------- -------- ------- Net Income per share $1.59 $1.91 (0.32)

(16.8)% ========= ========= ======== ======= Diluted Shares

Outstanding 22,120 21,765 355 1.6% Increase Increase Unit Sales:

2006 2005 (Decrease) (Decrease) ----------- ------ ------ ---------

--------- New Vehicle 52,346 47,147 5,199 11.0% Used - Retail

Vehicle 34,543 33,478 1,065 3.2 Used - Wholesale 19,537 18,338

1,199 6.5 Total Units Sold 106,426 98,963 7,463 7.5 *T -0- *T

LITHIA MOTORS, INC. Nine Months Ended September 30, $Increase %

Increase Average Selling Price: 2006 2005 (Decrease) (Decrease)

---------------------- New Vehicle $27,489 $27,754 ($265) (1.0)%

Used - Retail Vehicle 16,220 15,469 751 4.9 Used - Wholesale 6,095

5,821 274 4.7 Key Financial Data: ------------------- Gross Profit

Margin 17.1% 17.0% SG&A as a % of Gross Profit 75.2% 72.9%

Operating Margin 3.7% 4.2% Pre-Tax Margin 2.3% 3.1% Gross

Margin/Profit Data 2006 2005 ------------------------ ---- ---- New

Vehicle Retail 7.6% 7.9% Used Vehicle Retail 15.2% 15.7% Used

Vehicle Wholesale 2.8% 3.2% Service, Body & Parts 49.7% 48.7%

New Retail Gross Profit/ Unit $2,098 $2,193 Used Retail Gross

Profit/ Unit $2,469 $2,430 Used Wholesale Gross Profit/ Unit $168

$188 Finance & Insurance/ Retail Unit $1,085 $1,045 Same Store

Data 2006 2005 --------------- ---- ---- New Vehicle Retail Sales

3.1% 3.3% Used Vehicle Sales (includes Wholesale) 2.7% 4.2% Total

Vehicle Sales (excludes fleet) 2.9% 3.6% Finance & Insurance

Sales 4.8% 3.6% Service, Body & Parts Sales 5.4% 2.3% Total

Sales (Excluding Fleet) 3.3% 3.5% Total Gross Profit (Excluding

Fleet) 2.5% 4.0% *T -0- *T LITHIA MOTORS, INC. Balance Sheet

Highlights (Dollars in Thousands) September 30, 2006 December 31,

2005 Unaudited ------------------ ----------------- Cash & Cash

Equivalents $41,329 $48,566 Trade Receivables(a) 99,935 106,443

Inventory 652,071 606,047 Assets Held for Sale - 27,411 Other

Current Assets 13,971 15,781 -------- -------- Total Current Assets

807,306 804,248 Real Estate, net 293,904 255,372 Equipment &

Leases, net 86,135 77,805 Goodwill, net 277,717 260,899 Other

Assets 63,817 54,390 -------- -------- Total Assets $1,528,879

$1,452,714 ========== ========== Floorplan Notes Payable $537,557

$530,452 Liabilities held for sale - 22,388 Other Current

Liabilities 117,745 95,560 -------- -------- Total Current

Liabilities 655,302 648,400 Used Vehicle Flooring 71,000 - Real

Estate Debt 161,195 154,046 Other Long-Term Debt 92,473 136,505

Other Liabilities 57,802 54,130 -------- -------- Total Liabilities

1,037,772 993,081 -------- -------- Shareholders' Equity 491,107

459,633 -------- -------- Total Liabilities & Shareholders'

Equity $1,528,879 $1,452,714 ========== ========== ______________

(a) Includes contracts-in-transit of $49,181 and $52,453 at

September 30, 2006 and December 31, 2005 respectively. Other

Balance Sheet Data (Dollars in Thousands except per share data)

Current Ratio 1.2x 1.2x LT Debt/Total Cap. (Excludes Used -Vehicle

Flooring and Real Estate) 16% 23% Working Capital $152,004 $155,848

Book Value per Basic Share $25.20 $23.97 *T

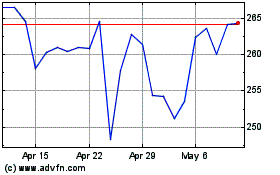

Lithia Motors (NYSE:LAD)

Historical Stock Chart

From Jun 2024 to Jul 2024

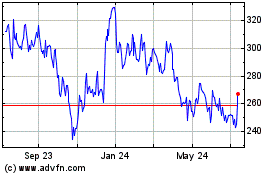

Lithia Motors (NYSE:LAD)

Historical Stock Chart

From Jul 2023 to Jul 2024