ITT's Q1 Net Profit Falls 22%; Raises Fiscal Year Earnings Outlook

May 01 2010 - 12:37AM

Dow Jones News

ITT Corp.'s (ITT) first-quarter profit dropped 22% from a year

ago, but the company raised its earnings forecast for 2010 amid

continued improvement in its motion and flow control business.

Net income for the industrial and defense manufacturer fell to

$146 million, or 79 cents a share, from $187 million, or $1.02 a

share, a year ago, as results included a one-time gain of $54

million from a tax settlement. Excluding last year's noncash gain

and a $10 million charge this year related to the U.S. health care

reform legislation, first-quarter income from continuing operations

rose 17% over last year to $156 million, or 84 cents a share.

Revenue climbed 3% to $2.64 billion.

Wall Street analysts expected the White Plains, N.Y., company to

earn 75 cents a share on revenue of $2.51 billion.

The better-than-expected results reflect improving end-market

demand and better profit margins.

"ITT's focused execution got us off to a great start in 2010 ...

giving us confidence in raising our full-year earnings outlook,"

said Chairman and Chief Executive Steve Loranger in a written

statement.

For 2010, the company now expects to earn $4.05 a share to $4.20

a share, up from $3.90 to $4.10 forecast in February. ITT predicted

revenue will rise 4% over 2009, compared with a 3% increase

forecast earlier. For the second quarter, earnings of $1.05 a share

to $1.07 are expected, roughly flat with 2009.

After struggling last year, ITT's motion and flow control

business appears to have supplanted defense as the ITT's

best-performing business unit.

Motion and flow control, which supplies equipment and components

to the automotive, aerospace, rail and beverage industries,

reported a 96% increase in first-quarter operating profit to $55

million, as the unit's operating margin rose to 14.2% from 9.2% a

year ago. Revenue grew 26% to $387 million. ITT attributed the

increase to European auto industry contracts, a locomotive

component contract in China and beverage market share gains in

emerging markets. The company now anticipates revenue from the unit

to rise 6% this year, compared with a 1% gain predicted earlier in

the year.

In ITT's fluid technology unit, which makes pumps for

residential water plants and industrial processes, operating income

increased 32% to $91 million, while revenue grew 8% to $801

million. The improvement was driven by orders from emerging

overseas markets, the mining industry and energy sector. The

company also completed the purchase of Nova Analytics, giving ITT a

new business platform in rhw analytical instrument market. The Nova

acquisition is expected to increase revenue by 5% from a 2%

increase seen earlier.

In the defense and information solutions unit, which was the

company's best-performing business in 2009, first-quarter income

fell 11% to $146 million as revenue slipped 4% to $1.45 billion.

The company said volume declines were seen in several product

lines, including tactical radios and devices used to block radio

signals that detonate improvised explosive devices targeted at U.S.

troops in Afghanistan and Iraq. The company projects a 3% increase

in revenue from the unit this year.

ITT's stock ended Thursday's regular trading session up 3.7%, or

$1.54, at $57.97 a share.

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

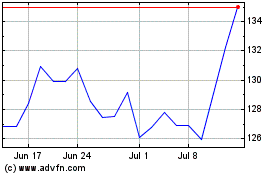

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2024 to Jul 2024

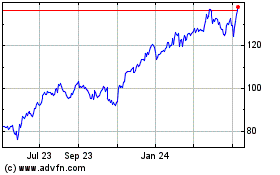

ITT (NYSE:ITT)

Historical Stock Chart

From Jul 2023 to Jul 2024