Hersha Hospitality Trust Announces Dividends; Modifies Common Dividend Policy

May 06 2009 - 4:56PM

Business Wire

Hersha Hospitality Trust (NYSE: HT), owner of select service and

upscale hotels in major metropolitan markets, today announced that

its Board of Trustees declared a cash dividend of $0.50 per Series

A Preferred Share for the second quarter ending June 30, 2009. The

preferred share dividend is payable July 15, 2009 to holders of

record as of July 1, 2009.

The Board of Trustees also declared quarterly cash dividends of

$0.05 per Common Share and per Limited Partnership unit for the

second quarter ending June 30, 2009. The common share dividend and

limited partnership unit distribution are payable on July 15, 2009

to shareholders and unitholders of record on June 30, 2009.

Ashish Parikh, Hersha�s Chief Financial Officer, stated, �The

decision by our Board to reduce the dividend is in response to, and

comes after thorough analysis of, the difficult and unprecedented

operating environment in the lodging industry, coupled with capital

markets that remain constrained. This decision was considered at

length because of the Company�s ten year track record of never

having cut our dividend since our initial public offering in

1999.�

�The Company believes the reduction to be prudent and in the

best interest of shareholders at this time to preserve liquidity

and maintain financial flexibility given the continued lack of

visibility on the length and severity of the current economic

downturn. As fundamentals improve and the markets stabilize our

Board is committed to re-evaluating the dividend each quarter. The

dividend policy should result in cash preservation for the Company

of approximately $30 million over the next twelve months, which

will further strengthen our liquidity and balance sheet position,�

concluded, Mr. Parikh.

The new dividend rate on common shares represents an annualized

yield of 5.6% based on the closing price of Hersha�s stock on May

6, 2009.

Future distributions, if any, will be at the discretion of the

Company�s Board of Trustees and will depend on the Company�s actual

cash flow, financial condition, capital requirements, the annual

distribution requirements under the REIT provisions of the Internal

Revenue Code and such other factors as we may deem relevant. The

Company�s ability to make distributions will depend on its receipt

of distributions from its operating partnership and lease payments

from our lessees with respect to the hotels. The Company relies on

the profitability and cashflows of its hotels to generate

sufficient cash flow for distributions.

About Hersha Hospitality Trust

Hersha Hospitality Trust is a self-advised real estate

investment trust, which owns interests in 77 hotels, totaling 9,707

rooms, primarily along the Northeast Corridor from Boston to

Washington D.C. The Company also owns hotels in Northern California

and Scottsdale, Arizona. Hersha focuses on high quality, upscale

hotels in high barrier to entry markets. More information on the

Company and its portfolio of hotels is available on Hersha's Web

site at http://www.hersha.com.

Forward Looking Statement

Certain matters within this press release are discussed using

forward-looking language as specified in the Private Securities

Litigation Reform Act of 1995, and, as such, may involve known and

unknown risks, uncertainties and other factors that may cause the

actual results or performance to differ from those projected in the

forward-looking statement. For a description of these factors,

please review the information under the heading �Risk Factors�

included in our Annual Report on Form 10-K for the year ended

December 31, 2008, filed with the Securities Exchange

Commission.

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Jun 2024 to Jul 2024

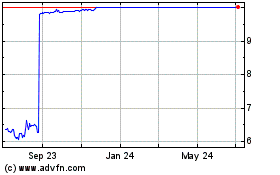

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Jul 2023 to Jul 2024