TULSA, Okla., July 31 /PRNewswire-FirstCall/ -- Helmerich &

Payne, Inc. (NYSE:HP) reported record net income of $125,369,000

($1.18 per diluted share) from operating revenues of $522,517,000

for its third fiscal quarter ended June 30, 2008, compared with net

income of $115,204,000 ($1.09 per diluted share) from operating

revenues of $421,274,000 during last year's third fiscal quarter

ended June 30, 2007. Included in this year's third quarter's net

income are $0.09 per share of after-tax gains from the sale of

portfolio securities and $0.04 per share from the sale of drilling

equipment and insurance settlements, as well as a charge equivalent

to $0.07 per share (after-tax) from the in-process research and

development write-off corresponding to the previously announced

acquisition of TerraVici Drilling Solutions. Included in third

quarter net income for 2007 were gains of $0.15 per share from the

sale of portfolio securities and $0.06 per share from the sale of

drilling equipment and insurance settlements. For the nine months

ended June 30, 2008, the Company reported net income of

$335,253,000 ($3.16 per diluted share) from operating revenues of

$1,452,824,000 compared with net income of $332,851,000 ($3.17 per

diluted share) from operating revenues of $1,180,209,000 during the

nine months ended June 30, 2007. Included in net income were gains

from the sale of portfolio securities and drilling equipment, and

gains from insurance settlements of $0.21 per share for the first

nine months of fiscal 2008 and $0.60 per share for the first nine

months of fiscal 2007. Also included in the net income

corresponding to the first nine months of fiscal 2008 is the above

mentioned in-process research and development charge of $0.07 per

share. Helmerich & Payne, Inc. also announced today that, since

its last announcement in late May, it had signed 18 long-term

contracts with eight exploration and production companies to

operate 18 new FlexRigs(R)*. The names of the customers and other

terms were not disclosed. Since the beginning of this fiscal year,

the Company has announced 50 new contracts for the construction and

operation of 50 new FlexRigs under long-term contracts with firm

term durations of three years or greater. This also brings to 127,

the total number of long-term commitments for new FlexRigs that

have been announced by the Company since March, 2005. To date, 95

of the 127 new builds have been completed, with the remaining 32

scheduled for completion by the end of fiscal 2009. Upon completion

of these commitments, FlexRigs will represent over 70% of the

Company's global fleet and over 80% of its U.S. land rig fleet.

Company President and C.E.O., Hans Helmerich commented, "This past

quarter's results in our U.S. land rig operations and the

announcement of 18 more new build orders further validate the

Company's leadership in implementing new technology in the field.

We believe that as FlexRigs continue to meet and exceed

expectations in the field and bring meaningful value to our

customers with safer and lower cost wells, demand for both the

FlexRig and the organizational competence H&P delivers, will

provide more opportunities for growth in both our U.S. and

international operations." All three of the Company's drilling

segments recorded improved results compared with the previous

quarter. The Company's U.S. land rig segment operating income

increased sequentially by 11% to $159,413,000 for this year's third

quarter, from $143,740,000 during this year's second quarter. Last

year's third quarter U.S. land rig segment operating income was

$114,619,000. Segment operating income grew during the quarter as a

result of both increased average margins per rig day and growth in

total rig activity driven primarily by the Company's new build

program. Average margins for the quarter increased to $13,365 per

rig day, compared to $12,858 per rig day in the previous quarter, a

$507 per day increase. Total revenue days for the recent quarter

increased by 7% over the previous quarter as the Company's average

rig utilization remained high, totaling 96% for this year's third

quarter, compared to 94% for the previous quarter. The Company's

offshore operations reported segment operating income of

$12,013,000 for the third quarter of fiscal 2008, compared with

$3,603,000 for the second quarter of fiscal 2008 and $4,553,000 for

the third quarter of fiscal 2007. The recent commencement of

operations of two additional platform rigs in the Gulf of Mexico

and one rig offshore Trinidad helped increase average third quarter

dayrates, margins and rig utilization compared to the same

statistics in the second quarter. Total activity days in the

offshore operations during the quarter were 732, compared with 514

days during the second quarter of fiscal 2008, and 546 activity

days during the same period last year. By the end of this year's

third quarter, eight of the Company's nine platform rigs were

working. Segment operating income for the Company's international

land operations was $17,492,000 during this year's third quarter,

compared with $12,752,000 during this year's second quarter and

$28,873,000 during last year's third quarter. This year's second

quarter income included an accounting adjustment of $5.9 million

relating to the depreciation of certain assets recorded in prior

years. Average rig utilization for the third quarter of 2008 was

79%, compared with 73% for the second quarter of fiscal 2008 and

90% for the third quarter of fiscal 2007. By the end of the third

quarter, 24 of the Company's 27 international land rigs were

working. In addition, the first of seven previously announced new

international FlexRigs was completed and is currently being

mobilized to its location in Latin America. Helmerich & Payne,

Inc. is primarily a contract drilling company. As of July 31, 2008,

the Company's existing fleet included 181 U.S. land rigs, 27

international land rigs and nine offshore platform rigs. Helmerich

& Payne, Inc.'s conference call/webcast is scheduled to begin

this morning at 11:00 a.m. ET (10:00 a.m. CT) and can be accessed

at http://www.hpinc.com/ under Investors. If you are unable to

participate during the live webcast, the call will be archived on

H&P's website indicated above. Statements in this release and

information disclosed in the conference call and webcast that are

"forward-looking statements" within the meaning of the Securities

Act of 1933 and the Securities Exchange Act of 1934 are based on

current expectations and assumptions that are subject to risks and

uncertainties. For information regarding risks and uncertainties

associated with the Company's business, please refer to the "Risk

Factors" and "Management's Discussion & Analysis of Results of

Operations and Financial Condition" sections of the Company's SEC

filings, including but not limited to, its annual report on Form

10-K and quarterly reports on Form 10-Q. As a result of these

factors, Helmerich & Payne, Inc.'s actual results may differ

materially from those indicated or implied by such forward-looking

statements. *FlexRig(R) is a registered trademark of Helmerich

& Payne, Inc. HELMERICH & PAYNE, INC. Unaudited (in

thousands, except per share data) Three Months Ended Nine Months

Ended CONSOLIDATED March 31 June 30 June 30 STATEMENTS OF INCOME

2008 2008 2007 2008 2007 Operating Revenues: Drilling - U.S. Land

$365,263 $391,755 $303,514 $1,104,662 $842,559 Drilling - Offshore

29,789 47,298 29,626 104,368 94,083 Drilling - International Land

75,757 80,585 85,357 234,944 235,153 Other 2,835 2,879 2,777 8,850

8,414 473,644 522,517 421,274 1,452,824 1,180,209 Operating costs

and other: Operating costs, excluding depreciation 253,958 274,168

229,025 763,921 627,948 Depreciation 51,872 51,210 38,125 147,066

101,228 General and administrative 14,090 14,723 11,538 42,716

35,501 Research and development - 522 - 522 - In-process research

and development - 11,129 - 11,129 - Gain from involuntary

conversion of long-lived assets - (5,426) (5,900) (10,236) (11,070)

Income from asset sales (1,946) (1,616) (6,186) (4,404) (39,008)

317,974 344,710 266,602 950,714 714,599 Operating income 155,670

177,807 154,672 502,110 465,610 Other income (expense): Interest

and dividend income 1,220 1,034 962 3,369 3,240 Interest expense

(4,773) (4,651) (3,260) (14,255) (6,092) Gain on sale of investment

securities 5,476 16,388 25,298 21,994 51,812 Other 180 66 120 (370)

250 2,103 12,837 23,120 10,738 49,210 Income before income taxes

and equity in income of affiliate 157,773 190,644 177,792 512,848

514,820 Income tax provision 58,784 70,187 64,960 189,117 188,396

Equity in income of affiliate net of income taxes 3,065 4,912 2,372

11,522 6,427 NET INCOME $102,054 $125,369 $115,204 $335,253

$332,851 Earnings per common share: Basic $0.98 $1.20 $1.11 $3.22

$3.22 Diluted $0.96 $1.18 $1.09 $3.16 $3.17 Average common shares

outstanding: Basic 103,883 104,530 103,323 103,973 103,292 Diluted

106,090 106,689 105,313 106,130 104,990 HELMERICH & PAYNE, INC.

Unaudited (in thousands) CONSOLIDATED CONDENSED BALANCE SHEETS

6/30/08 9/30/07 ASSETS Cash and cash equivalents $99,018 $89,215

Other current assets 512,381 409,749 Total current assets 611,399

498,964 Investments 218,869 223,360 Net property, plant, and

equipment 2,534,931 2,152,616 Other assets 13,322 10,429 TOTAL

ASSETS $3,378,521 $2,885,369 LIABILITIES AND SHAREHOLDERS' EQUITY

Total current liabilities $272,108 $226,612 Total noncurrent

liabilities 485,241 398,241 Long-term notes payable 455,000 445,000

Total shareholders' equity 2,166,172 1,815,516 TOTAL LIABILITIES

AND SHAREHOLDERS' EQUITY $3,378,521 $2,885,369 HELMERICH &

PAYNE, INC. Unaudited (in thousands) Nine Months Ended June 30

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS 2008 2007 OPERATING

ACTIVITIES: Net income $335,253 $332,851 Depreciation 147,066

101,228 In-process research and development 11,129 - Changes in

assets and liabilities (1,077) 58,137 Gain from involuntary

conversion of long-lived assets (10,236) (11,070) Gain on sale of

assets and investment securities (26,268) (90,682) Other (12,279)

(5,065) Net cash provided by operating activities 443,588 385,399

INVESTING ACTIVITIES: Capital expenditures (509,018) (681,149)

Insurance proceeds from involuntary conversion of long-lived assets

13,926 11,070 Proceeds from sale of assets and investments 31,584

158,464 Acquisition of business, net of cash acquired (12,024) -

Net cash used in investing activities (475,532) (511,615) FINANCING

ACTIVITIES: Dividends paid (14,060) (13,971) Repurchase of common

stock - (17,621) Net increase (decrease) in bank overdraft 4,465

(11,293) Proceeds from exercise of stock options 14,267 3,277 Net

proceeds from short-term and long-term debt 12,259 201,279 Excess

tax benefit from stock-based compensation 24,816 1,254 Net cash

provided by financing activities 41,747 162,925 Net increase in

cash and cash equivalents 9,803 36,709 Cash and cash equivalents,

beginning of period 89,215 33,853 Cash and cash equivalents, end of

period $99,018 $70,562 SEGMENT REPORTING Three Months Ended Nine

Months Ended March 31 June 30 June 30 2008 2008 2007 2008 2007 (in

thousands, except days and per day amounts) U.S. LAND OPERATIONS

Revenues $365,263 $391,755 $303,514 $1,104,662 $842,559 Direct

operating expenses 181,757 187,771 157,758 535,093 417,514 General

and administrative expense 4,257 4,801 3,625 13,452 10,228

Depreciation 35,509 39,770 27,512 109,123 72,008 Segment operating

income $143,740 $159,413 $114,619 $446,994 $342,809 Revenue days

14,272 15,263 12,371 43,422 34,075 Average rig revenue per day

$24,415 $24,543 $23,401 $24,329 $23,537 Average rig expense per day

$11,557 $11,178 $11,619 $11,212 $11,063 Average rig margin per day

$12,858 $13,365 $11,782 $$13,117 $12,474 Rig utilization 94% 96%

96% 95% 97% OFFSHORE OPERATIONS Revenues $29,789 $47,298 $29,626

$104,368 $94,083 Direct operating expenses 21,918 31,166 21,748

72,295 66,595 General and administrative expense 1,114 1,276 907

3,488 3,865 Depreciation 3,154 2,843 2,418 8,855 7,885 Segment

operating income $3,603 $12,013 $4,553 $19,730 $15,738 Revenue days

514 732 546 1,706 1,656 Average rig revenue per day $41,209 $51,309

$30,263 $45,711 $33,095 Average rig expense per day $29,144 $31,181

$21,734 $29,483 $21,921 Average rig margin per day $12,065 $20,128

$8,529 $16,228 $11,174 Rig utilization 65% 89% 67% 70% 67% SEGMENT

REPORTING Three Months Ended Nine Months Ended March 31 June 30

June 30 2008 2008 2007 2008 2007 (in thousands, except days and per

day amounts) INTERNATIONAL LAND OPERATIONS Revenues $75,757 $80,585

$85,357 $234,944 $235,153 Direct operating expenses 50,129 55,093

49,166 156,004 142,530 General and administrative expense 1,300

1,182 670 3,420 2,264 Depreciation 11,576 6,818 6,648 24,120 17,538

Segment operating income $12,752 $17,492 $28,873 $51,400 $72,821

Revenue days 1,795 1,951 2,235 5,727 6,863 Average rig revenue per

day $39,695 $38,709 $34,200 $37,570 $29,583 Average rig expense per

day $25,299 $25,638 $18,246 $23,704 $16,253 Average rig margin per

day $14,396 $13,071 $15,954 $13,866 $13,330 Rig utilization 73% 79%

90% 77% 93% Operating statistics exclude the effects of offshore

management contracts, gains and losses from translation of foreign

currency transactions, and do not include reimbursements of

"out-of-pocket" expenses in revenue per day, expense per day and

margin calculations. A management contract for a customer-owned

offshore rig working in an international location was moved from

the International segment to the Offshore segment in the fourth

quarter of fiscal 2007. The amounts for Offshore and International

land segments for the three and nine months ended June 30, 2007

have been restated to reflect this change. Reimbursed amounts were

as follows: U.S. Land Operations $16,809 $17,158 $14,016 $48,244

$40,521 Offshore Operations $3,343 $4,296 $3,639 $10,501 $11,183

International Land Operations $4,505 $5,066 $8,570 $19,784 $31,550

With the growth of the drilling segments, the previously reported

Real Estate segment has become a smaller percentage of total

segment operating income. As a result, the Real Estate segment has

been included with other non-reportable business segments. The

three months ended March 31, 2008, and the three and nine months

ended June 30, 2007, have been restated to reflect this change.

Segment operating income is a non-GAAP financial measure of the

Company's performance, as it excludes general and administrative

expenses, corporate depreciation, income from asset sales and other

corporate income and expense. The Company considers segment

operating income to be an important supplemental measure of

operating performance for presenting trends in the Company's core

businesses. This measure is used by the Company to facilitate

period-to-period comparisons in operating performance of the

Company's reportable segments in the aggregate by eliminating items

that affect comparability between periods. The Company believes

that segment operating income is useful to investors because it

provides a means to evaluate the operating performance of the

segments and the Company on an ongoing basis using criteria that

are used by our internal decision makers. Additionally, it

highlights operating trends and aids analytical comparisons.

However, segment operating income has limitations and should not be

used as an alternative to operating income or loss, a performance

measure determined in accordance with GAAP, as it excludes certain

costs that may affect the Company's operating performance in future

periods. The following table reconciles segment operating income

per the information above to income before income taxes and equity

in income of affiliates as reported on the Consolidated Statements

of Income (in thousands). SEGMENT REPORTING Three Months Ended Nine

Months Ended March 31 June 30 June 30 2008 2008 2007 2008 2007

Operating Income U.S. Land $143,740 $159,413 $114,619 $446,994

$342,809 Offshore 3,603 12,013 4,553 19,730 15,738 International

Land 12,752 17,492 28,873 51,400 72,821 Other 1,301 (10,421) 1,285

(7,596) 3,713 Segment operating income $161,396 $178,497 $149,330

$510,528 $435,081 Corporate general and administrative (7,419)

(7,464) (6,336) (22,356) (19,144) Other depreciation (1,003)

(1,087) (945) (3,019) (1,994) Inter-segment elimination 750 819 537

2,317 1,589 Gain from involuntary conversion of long-lived assets -

5,426 5,900 10,236 11,070 Income from asset sales 1,946 1,616 6,186

4,404 39,008 Operating income $155,670 $177,807 $154,672 $502,110

$465,610 Other income (expense): Interest and dividend income 1,220

1,034 962 3,369 3,240 Interest expense (4,773) (4,651) (3,260)

(14,255) (6,092) Gain on sale of investment securities 5,476 16,388

25,298 21,994 51,812 Other 180 66 120 (370) 250 Total other income

(expense) 2,103 12,837 23,120 10,738 49,210 Income before income

taxes and equity in income of affiliate $157,773 $190,644 $177,792

$512,848 $514,820 DATASOURCE: Helmerich & Payne, Inc. CONTACT:

Juan Pablo Tardio, +1-918-588-5383, for Helmerich & Payne, Inc.

Web site: http://www.hpinc.com/

Copyright

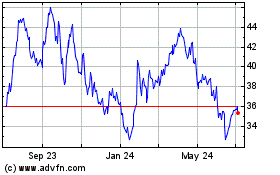

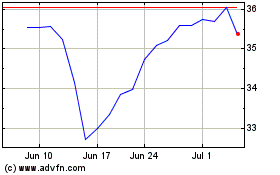

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2024 to Jun 2024

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Jun 2023 to Jun 2024