- Current report filing (8-K)

September 02 2011 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 2, 2011

HEALTHCARE REALTY TRUST INCORPORATED

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

MARYLAND

|

|

001-11852

|

|

62-1507028

|

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer

Identification No.)

|

3310 West End Ave. Suite 700 Nashville, Tennessee 37203

(Address of principal executive offices) (Zip Code)

(615) 269-8175

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (

see

General

Instruction A.2. below):

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01 Other Events

Update on At-the-Market Equity Issuances

Since December 2008, Healthcare Realty Trust Incorporated (the “Company”) has had in place an

at-the-market equity offering program to sell shares of its common stock from time to time in

at-the-market sales transactions.

|

|

•

|

|

At June 30, 2011, the Company had 76,467,850 shares outstanding.

|

|

|

|

|

•

|

|

Between June 30, 2011 and July 31, 2011, the Company sold 1,360,900 shares of common

stock, generating approximately $27.7 million in net proceeds.

|

|

|

|

|

•

|

|

From August 1 to 31, 2011, the Company sold zero shares of common stock under its

at-the-market equity offering program.

|

|

|

|

|

•

|

|

Were the Company to issue no additional shares during the third quarter, the

weighted average outstanding shares for the third quarter would be

approximately 77.5

million.

|

|

|

|

|

•

|

|

The Company will consider issuing additional shares through its at-the-market equity

offering program, depending on the cost of issuing such shares relative to the Company’s

investing activities.

|

Update on Richmond Portfolio Acquisition

As disclosed in the Company’s Form 10-Q for the period ended June 30, 2011, the

Company entered into an agreement on June 29, 2011 to purchase a portfolio of eight outpatient

buildings in Richmond, Virginia for total consideration of approximately $173.5 million, including

prepaid ground rent of $12.8 million and debt assumption of approximately $58.4 million.

|

|

•

|

|

On June 30, 2011, the Company acquired one of the eight

buildings for cash consideration

of approximately $34.8 million, including prepaid ground rent of approximately $2.9

million.

|

|

|

|

|

•

|

|

On August 4, 2011, the Company acquired two of the eight

buildings for total

consideration of approximately $75.8 million, including prepaid ground rent of

approximately $5.8 million and debt assumption of approximately $30.8 million.

|

|

|

|

|

•

|

|

On August 31, 2011, the Company acquired one of the

eight buildings for total

consideration of approximately $15.4 million, including prepaid ground rent of

approximately $1.4 million and debt assumption of approximately $7.0 million.

|

|

|

|

|

•

|

|

The Company expects that the acquisitions of the remaining four buildings will occur in

a series of closings through the end of the third quarter of 2011, subject to customary

closing conditions. Total consideration for the four buildings is approximately $47.5

million, including prepaid ground rent of approximately $2.7 million and debt assumption of

$20.6 million, or net cash consideration of approximately $26.8 million.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HEALTHCARE REALTY TRUST INCORPORATED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Scott W. Holmes

|

|

|

|

|

|

Scott W. Holmes

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

Date: September 2, 2011

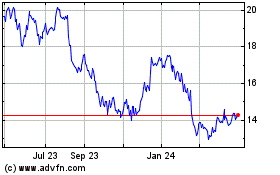

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Dec 2024 to Jan 2025

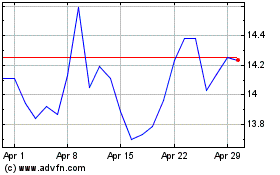

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Jan 2024 to Jan 2025